What are intangible assets?

Intangible assets are non-current assets; unlike fixed assets, they do not have a physical form and are the result of intellectual activity.

In accounting, the concept of intangible assets is discussed in detail in PBU 14/2007; this provision regulates all activities related to intangible assets.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Intangible assets include: (click to expand)

- Exclusive right to an invention, industrial design, utility model.

- Exclusive copyright for computer programs, databases.

- Property rights to topologies of integrated circuits.

- Exclusive right to a trademark, company name, commercial designations.

- Exclusive right to selection achievements.

- Business reputation of the organization (Civil Code).

- Know-how (Tax Code).

Patent received from the founders of debit and credit

Take into account exclusive rights to intellectual property as part of intangible assets if the following conditions are simultaneously met:

- the organization is the holder of exclusive rights to the object;

- exclusive rights are registered;

- the organization does not plan to sell (transfer) exclusive rights;

- an object of intellectual property is used in the production of products (works, services) or for management needs;

- the use of the object can bring economic benefits (income);

- the period of use of the intellectual property exceeds 12 months.

Such requirements are established by paragraph 3 of Article 257 of the Tax Code of the Russian Federation.

Expenses for the acquisition (receipt) of exclusive rights to intellectual property worth more than 40,000 rubles.

Accounting for intangible assets (receipt)

Purchase of intangible assets (entries, example):

In accounting there is account 04 “Intangible assets”. Also, as in the case of fixed assets, intangible assets are accounted for at their original cost plus additional costs minus VAT. Moreover, since 2008, VAT has not been levied on the exclusive right to inventions, industrial designs, computer programs, databases, topologies of integrated circuits, know-how, and utility models. Additional costs may include payment of various duties, payment for the services of any intermediary organizations, payment for consulting and information services and other costs associated with the purchase of an intangible asset.

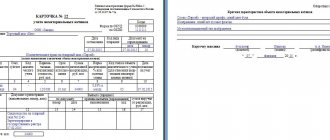

The primary documents for accounting for intangible assets are the Intangible Asset Accounting Card-1, and a transfer acceptance certificate is also drawn up.

Postings when purchasing an intangible asset:

| Debit | Credit | Operation name |

| 60 (76) | 51 | The cost of intangible assets has been paid |

| 08 | 60 (76) | The cost of the purchased intangible asset is taken into account |

| 19 | 60 (76) | VAT allocated |

| 08 | 60 (76) | All costs for the acquisition of intangible assets are taken into account |

| 04 | 08 | Intangible asset accepted for accounting |

Let's look at an example of how accounting is kept when purchasing an intangible asset, and what entries are made.

Example of purchasing an intangible asset:

Firm 1 bought the exclusive right to the invention from firm 2. The patent assignment agreement was registered with Rospatent with a fee of 2,400 rubles. The cost of the patent is 59,000 rubles.

In this example, the accounting entries will include the following:

| Sum | Debit | Credit | Operation name |

| 59000 | 60 | 51 | Patent cost paid |

| 59000 | 08 | 60 | The cost of the purchased patent is taken into account |

| 2400 | 08 | 60 | Duty payment included |

| 61400 | 04 | 08 | Intangible asset accepted for accounting |

Creation of an intangible asset (entry, example):

Intangible assets are considered created if they are received:

- As a result of the performance of official duties or for a specific assignment of the employer

- From outsiders under a concluded creation agreement.

Postings when creating intangible assets are similar to the previous case of purchase, only additional costs include payment for the services of employees of third-party organizations involved in the creation of intangible assets, payment for the labor of in-house specialists involved in the creation of intangible assets, deductions for social needs, costs of maintaining research equipment and other fixed assets involved in the creation of intangible assets, as well as accrued depreciation on them.

Example:

The research bureau developed a new engine, conducted successful tests, and sent an application for a patent to Rospatent.

Expenses:

- wages of employees 30,000;

- insurance premiums 7800;

- material costs 10,000;

- state duty 2000;

- examination fee 990.

The patent was received for 5 years.

Postings in this example:

| Sum | Debit | Credit | Operation name |

| 30000 | 08 | 70 | Employees' salaries taken into account |

| 7800 | 08 | 69 | UST allocated |

| 10000 | 08 | 10 | Material costs taken into account |

| 2000 | 60 | 51 | State duty paid |

| 990 | 60 | 51 | The examination fee has been paid |

| 2000 | 08 | 60 | Payment of state duty is taken into account |

| 990 | 08 | 60 | Payment of the fee for conducting the examination is taken into account |

| 50790 | 04 | 08 | Intangible asset accepted for accounting |

In this example, it is worth noting that this is how the accounting for intangible assets will look like in accounting, in tax accounting in accordance with Art. 257 of the Tax Code, taxes paid are not taken into account as costs when creating intangible assets.

We will discuss tax accounting in more detail later in the corresponding section of this site.

Receipt of an intangible asset in the form of a contribution to the authorized capital (posting):

If intangible assets are received by an enterprise as a contribution to the authorized capital, then remember account 75 and make the following entries:

D08 K75 - The cost of intangible assets is taken into account,

D04 K08 - Intangible asset accepted for accounting.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Individual entrepreneur on a patent and maintaining a book of income

merchant; each sheet of the book is stitched and has a number; the amounts of funds received and the dates of transactions, their names are entered in the columns; on the final page - an indication of the total number of sheets, etc. You need to understand that the entrepreneur uses the book under a certain patent, which the tax authority issued for a specific period and for a specific type of activity. There are two acceptable ways to maintain a book of income on a patent:

- on paper sheets in the form of a bound book; in electronic form.

If you chose the first option, then after the patent ceases to be valid or the tax period ends, the merchant is obliged to submit this register to the Federal Tax Service, where it will be checked. If we are talking about the electronic version, then they work with special files on the computer, where the individual entrepreneur types information about income. Under the same conditions as in the first case, it is necessary

The director of our company (who is also its sole founder) filed a patent for an invention for one of his companies five years ago.

Since this company does not operate, the director decided to transfer the patent

Without registration, such an agreement will be invalid (clause 50 of the resolution of the Plenum of the Supreme Court of the Russian Federation No. 5, Plenum of the Supreme Arbitration Court of the Russian Federation No. 29 of March 26, 2009

“On some issues that arose in connection with the entry into force of part four of the Civil Code of the Russian Federation”

). From the Rules for state registration of agreements on the disposal of the exclusive right to an invention, approved by Decree of the Government of the Russian Federation of December 24, 2008 N 1020, it follows that there are no obstacles to the registration of an agreement on the gratuitous transfer of exclusive rights to a patent between commercial organizations.

Thus, if an agreement on the transfer of a patent is registered with Rospatent, from the moment of its registration your company is the holder of exclusive rights to the patent, and this right must be reflected in accounting.

Amortization of intangible assets

depreciation of fixed assets

- Using account 05, on which depreciation is accumulated monthly. In this case, the entries for depreciation of intangible assets will look like this: D20 (44) K05 .

- By reducing the initial cost, when depreciation is written off directly from account 04, posting D20 (44) K04 .

Read more about the features of calculating depreciation of intangible assets in this article. Intangible assets can be revalued periodically to ensure that their accounting value corresponds to current reality. Read more about the revaluation of intangible assets here.

Interest-free loan from the LLC founder

According to legislative standards, a citizen who is the founder of an organization is obliged to replenish its current account with an amount equal to the authorized capital of the LLC within 4 months. Its value is determined by the company’s constituent documentation.

If the activity of a business entity has recently begun, then the funds in the account may be needed for settlement transactions. For example, transferring earnings to employees, fulfilling financial obligations to contractors, paying obligatory payments, purchasing raw materials and equipment, and so on. A business entity may not have enough available money to cover all expenses. In this case, the founder can provide a loan to his company without charging interest.

The founders can deposit the required amount of money into the company's current account. To do this, you will need to draw up an agreement for an interest-free loan and provide it to the employees of the banking organization where the account is opened. There is also the possibility of depositing the required amount into the cash desk of a business entity. In the future, when the financial situation improves, the loan amount can be repaid.

Free financial assistance from the founder

As at the time of the emergence of accounting itself in the now distant Middle Ages, today strict adherence to all the rules for conducting financial transactions and recording them on paper in sufficient quantities streamlines not only monetary, legal, but also moral and ethical relations between partners who are co-founders of entities entrepreneurial activity.

Thus, the provision of financial assistance on an irrevocable basis can be carried out in several ways - a contribution to the authorized capital, a loan or a contribution to property. All these procedures must be properly reflected in the accounting registers.

Postings of the received loan from the founder

The situation when the founder provides funds as a loan with interest is recorded by the following entry: Dt 66 (67) – Kt 50 (51).

The percentages are recorded by posting: Dt 91.2 – Kt 66 (67).

Interest is accounted for in the subaccount for accounts 66 (or 67).

If the founder has drawn up a loan agreement to pay the debt of a legal entity, then the following accounting entries are formed: Dt 60 – Kt 66. This procedure does not contradict legal norms, but contributes to the emergence of problems when paying VAT.

If the money lent is not subject to interest, then the entries in the accounting system remain the same. But the absence of interest is necessarily indicated in the agreement for the provision of borrowed funds.

A business entity can pay off existing debt with money or goods produced. In this case, the proceeds from the sale of goods to pay off the debt are recorded: Dt 76 – Kt 91. The sale of goods is accompanied by the accrual of VAT: Dt 90.3 – Kt 68.02. To offset the debt, a posting is created: Dt 66 – Kt 76.

Two options for accounting for listed dividends

Income from participation in other legal entities is included in accounting as other income. For correct accounting, it is necessary to draw up an entry not when the dividends are transferred, but much earlier - on the date of the decision on the distribution of net profit. At this point, a dual approach arises to reflecting dividends due, since their amount before transferring to the current account is not precisely known, but it is necessary to reflect them.

Let a net profit of 100,000 rubles be distributed in favor of the company. We will assume that the tax on this income (we multiplied the total amount of dividends by the income tax rate for dividends of 13%) is 13,000 rubles.

Let us further consider the entries when dividends are received, that is, entries for the accrual of dividends in accounting on the date of the decision on the distribution of net profit, entries for the receipt of dividends to the current account and entries for accounting for income tax on dividends using PBU 18/02 in the context of two the options we are considering.

How to prepare accounting entries for a loan from the founder

- The loan is not subject to taxes if the participant's share remains more than 50 percent.

- The loan allows you to save the company’s money (increased rates) and the employer’s precious time on collecting documentation, since there is no need to contact the bank.

- The loan gives a chance to rehabilitate unprofitable enterprises.

- A copy of the organization's Charter;

- Economic justification for the purposes of the loan;

- Decision of the general meeting of LLC participants and shareholders to approve the loan;

- Consent to the processing of personal data for an individual;

- Documentary confirmation that the general meeting of participants is the sole executive body;

- Duplicates of documents on the appointment of a chief (manager).

Taxation of dividends received from another legal entity

An organization may own part of other legal entities: shares in an LLC or shares in a JSC. Ideally, such participation should bring income to the company in the form of dividends. Dividends are part of the net profit of an enterprise, distributed among its participants, usually in accordance with their shares.

The procedure for determining the timing and methods, as well as the accrual and transfer of dividends to participants and shareholders in LLCs and JSCs is prescribed in the relevant federal laws.

Dividends due to the company are reduced by the amount of tax, which is calculated as follows:

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

An organization that distributes its net profit among participants (shareholders) is obliged to calculate and pay tax to the budget on these amounts, as stated in paragraph 3 of Art. 275 Tax Code of the Russian Federation. In other words, she is a tax agent. It does not matter whether the dividend payer applies any special tax regime. It also does not matter what special tax regime the recipient has. Tax on dividends must be calculated and paid in any case.