Basic features of the change

Revaluation of intangible assets (IIA) is a right, not a debt of an enterprise. For this reason, it becomes an integral part of the accounting policy of a particular enterprise. The right to carry out the procedure is stipulated in paragraph 17 of the Accounting Regulations “Accounting for Intangible Assets”, established by Order of the Ministry of Finance No. 153n dated December 27, 2007. Revaluation can only be carried out by commercial entities. Non-profit entities do not have revaluation rights.

The procedure in question is voluntary.

If a decision is made to implement it, it must be stated in the accounting policy; in addition, this document indicates the regularity of the procedure.

When determining the frequency of revaluation, you need to focus on regulations. In particular, the procedure can be carried out no more than once a year. That is, the company can approve the revaluation once a year, once every two, three, four years.

Revaluation can be carried out both in relation to all intangible assets and in relation to homogeneous groups. The accounting policy must specify the composition of assets that will be revalued, as well as the criteria for combining intangible assets into groups. The same document requires specifying the revaluation method. In particular, this is a direct recalculation of the residual value. Recalculation is carried out based on market value. To obtain information about the current market price, these sources can be used:

- Information on prices for the same assets.

- Prices shown in trade directories.

- Costs indicated in the media and specialized magazines.

- Assessment by BTI or an independent appraiser.

The accounting policy must indicate the securities on the basis of which the revaluation is carried out. It is also required to attach papers confirming the fact of the procedure and securing the results. They are developed by the company itself.

The results of the change in value will not be included in the balance sheet of the current reporting year. However, they must be included in the balance sheet at the beginning of the next period. They must be disclosed using an explanatory note. The need for an explanatory note is established by paragraph 20 of PBU 14/2007. The amount of revaluation is included in additional capital. The additional valuation corresponding to the amount of depreciation of the asset for previous periods is taken into account in the “Retained Earnings” account. The depreciation of the asset is recorded in the Retained Earnings account.

Receipt of intangible assets via barter

Situation: how to determine the initial tax value of an intangible asset received through barter (exchange agreement) in tax accounting?

Chapter 25 of the Tax Code of the Russian Federation does not contain special methods for determining the initial value of intangible assets received through barter (exchange agreement). Therefore, determine the initial cost of such intangible assets based on the actual costs associated with their receipt (clause 3 of Article 257 of the Tax Code of the Russian Federation). Such expenses in this situation are the tax cost of acquiring goods sold under an exchange agreement.

An example of how an intangible asset received under barter (exchange agreement) is reflected in accounting and taxation. The organization applies a general taxation system

In February, Alfa CJSC entered into an exchange agreement with Torgovaya LLC. According to the agreement, Alpha transfers goods to Hermes in exchange for an object of intangible assets - exclusive rights to an invention (patent). Under the terms of the contract, the goods exchanged and the intangible asset are recognized as equivalent. The cost of the transaction is 48,380 rubles. (including VAT 18% - 7380 rubles). The cost of the goods exchanged is 40,000 rubles. The exchange of property occurred simultaneously with the conclusion of the contract.

Under the terms of the transaction, the goods exchanged are valued at 41,000 rubles. (excluding VAT).

In accounting, the initial cost of an intangible asset received under an exchange agreement was determined by the accountant based on the sale price of goods transferred in exchange for the intangible asset (clause 14 of PBU 14/2007).

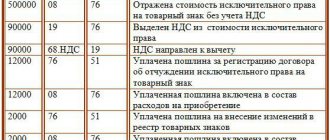

The following entries were made in Alpha's accounting:

Debit 62 Credit 90-1 – 48,380 rub. – revenue from the sale of goods is reflected equal to the cost of the patent for the invention;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 7380 rubles. – VAT is charged on proceeds from the sale of goods;

Debit 90-2 Credit 41 – 40,000 rub. – the cost of transferred goods is written off;

Debit 08 Credit 60 – 41,000 rub. (RUB 48,380 – RUB 7,380) – a patent for an invention has been capitalized at a cost equal to the price of the goods transferred in exchange (less VAT);

Debit 19 Credit 60 – 7380 rub. – the amount of VAT indicated in the Hermes invoice is reflected;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 7380 rub. – accepted for VAT deduction;

Debit 04 Credit 08 – 41,000 rub. – an intangible asset is accepted for accounting (after registration of the agreement with Rospatent);

Debit 60 Credit 62 – 48,380 rub. – the debts of the parties under the exchange agreement are offset.

In tax accounting, a patent for an invention was taken into account at the original cost of 41,000 rubles. on the basis of an agreement with Hermes, taking into account the transaction price.

Preparing for revaluation

Reassessment involves preparation. It consists of checking the presence of assets that will be revalued. The corresponding rule is given in Order of the Ministry of Finance No. 91 of October 13, 2003. The decision to conduct a revaluation is supported by an administrative document. It is necessary to draw up a list of assets with which work will be carried out. The list includes the following information about assets:

- Name.

- Date of purchase.

- The date on which the object was accepted for accounting.

If the asset is not purchased, but created by the company itself, you need to indicate the date of construction.

Carrying out revaluation

The change in value is carried out using the residual value recalculation method. Recalculation rules are not specified in the PBU. As part of the procedure, it is necessary to bring the residual value to the market price. For this reason, it is necessary to reestimate both the initial cost of assets and the amount of depreciation. During the procedure, the conversion factor is established. It represents the ratio of market value and residual price. Both the initial cost of intangible assets and depreciation are multiplied by the coefficient.

IMPORTANT! The results of the revaluation must be stated in the reporting.

Accounting for intangible assets with an indefinite useful life

As a general rule under IAS 38, an intangible asset with an indeterminable useful life is not subject to amortization.

However, according to International Standard IAS 36 “Impairment of Assets”, an organization is required to test an intangible asset with an indeterminable useful life for impairment by comparing its recoverable amount and its carrying amount annually and if there is an indication that the intangible asset may be impaired.

However, the Standard specifies that the useful life of a non-depreciable intangible asset must be reviewed in each period to determine whether events and circumstances continue to support the assessment that the asset has an indeterminate useful life. If the answer is negative, the change in the useful life classification to “determinable” is subject to accounting as a change in accounting estimate in accordance with International Standard IAS 8 “Accounting Policies, Changes in Accounting Estimates and Errors.”

A change in the classification of the useful life of an intangible asset from indeterminable to determinable (finite) may indicate impairment of the asset.

As a result, an entity must test the asset for impairment by comparing its recoverable amount to its carrying amount and recognize any excess of its carrying amount over its recoverable amount as an impairment loss. In this case, IAS 36 Impairment of Assets applies.

Accounting for revaluation of intangible assets

A change in intangible assets implies either an additional valuation (increase in value) or a writedown (decrease in value).

Additional valuation of intangible assets

Additional valuation is carried out if the market value of the intangible asset is greater than the initial value. If the asset was not previously discounted, the amount of the revaluation must be included in additional capital (account 83). If it was marked down, the additional valuation must be reflected in account 91. The excess of the additional valuation over the amount of the markdown is recorded in account 83.

Example

In December 2020, the firm revalued the trademark. The initial cost was 300,000 rubles. Depreciation amounted to 1,000,000 rubles. The residual value was 200,000 rubles (depreciation must be subtracted from the initial cost). The market value is 500,000 rubles.

The coefficient of change in value is 1.5 (the initial price is divided by the residual price).

The recalculated cost of the objects will be 450,000 rubles (300,000 * 1.5).

The amount of the additional assessment is 150,000 rubles (450,000 – 300,000).

The new depreciation amount will be 150,000 rubles (100,000 * 1.5).

Additional accrued depreciation is equal to RUB 50,000.

The following postings are made:

- DT04 KT83. Increase in the initial value of assets.

- DT83 KT05. Additional valuation for depreciation.

The value of assets must be recorded in the balance sheet for 2016 (line 1110).

If the intangible asset was discounted in previous periods, the postings will be as follows:

- DT04 KT91/1. The amount of revaluation of an asset corresponding to the size of the previous depreciation.

- DT91/2 KT05. The amount of revaluation of depreciation corresponding to the previous depreciation.

- DT04 KT83. The amount of the revaluation is in excess of the size of the previous markdown.

- DT83 KT05. The amount of additional assessment of depreciation charges is greater than the amount of the previous markdown.

The new value in this case will also be recorded on the balance sheet on line 1110.

Asset depreciation

Asset depreciation is carried out if the market price of intangible assets is less than the one at which the object is recorded. It is carried out according to the same scheme as for revaluation: a coefficient is determined and the initial cost is multiplied by it. If the asset was not undervalued in previous periods, the markdown is taken into account in account 91 (subaccount 2 “Other expenses”). If an additional valuation was carried out, the amount is recorded on account 83. If the amount of the markdown exceeds the size of the previous additional valuation, the difference is recorded on account 91-2.

If the asset was not previously undervalued, these entries are made:

- DT91/2 KT04. Reducing the initial value of assets.

- DT05 KT91/1. Markdown of depreciation payments.

If revaluation was carried out previously, the following postings are made:

- DT83 KT04. The amount of asset depreciation corresponding to the amount of the previous revaluation.

- DT05 KT83. The amount of depreciation depreciation on an asset corresponding to the amount of revaluation.

- DT91/2 KT04. The amount of the object's markdown in excess of the previous revaluation.

- DT05 KT91/1. The amount of depreciation markdown in excess of the previous revaluation.

The new value of assets is recorded on the balance sheet (line 1110).

Capital contribution

If an intangible asset was received as a contribution to the authorized capital, the procedure for forming its initial value depends on who the founder is (Russian or foreign organization, citizen of Russia or a foreign state).

If an intangible asset was received as a contribution to the authorized capital from a Russian organization, then its initial value in the tax accounting of the receiving party will be equal to the residual value of the object in the tax accounting of the transferring party. The residual value of an intangible asset can be confirmed by extracts (copies) from tax registers. If the receiving party does not have such documents and cannot confirm the residual value of the received intangible asset, then accept such an asset with zero initial cost in tax accounting.

The transferor's expenses associated with the transfer of property increase the initial cost of the intangible asset only if they are indicated as a contribution to the authorized capital in the constituent documents.

Such rules are established in paragraph 3 of subparagraph 2 of paragraph 1 of Article 277 of the Tax Code of the Russian Federation.

If a foreign organization or citizen (of Russia or another state) contributes an intangible asset to the authorized capital, then also accept it in tax accounting at the residual value of the transferring party. In this case, determine the value of the property based on documents confirming that the founder incurred expenses for the acquisition (creation) of the asset. If the asset has already been used, then determine its value taking into account depreciation (wear and tear) accrued according to the rules of that foreign state. In any case, the value of an intangible asset cannot be more than the market price confirmed by an independent appraiser.

An independent appraiser must evaluate the intangible asset according to the rules of the country of which the transferor is a resident (citizen). If there is no institution of independent appraisers on the territory of the state of which the foreign founder is a resident, the value of the property can be confirmed by an independent appraiser from another state. In this case, an independent appraiser can be a full member of any foreign association of professional appraisers, making his decision in accordance with the International Valuation Standards. Such an association could be, for example, the American Society of Appraisers. If the appraiser confirms his membership in the association of professional appraisers, his appraisal may be accepted to confirm the value of an intangible asset contributed to the authorized capital of a Russian organization.

This procedure follows from the provisions of paragraph 4 of subparagraph 2 of paragraph 1 of Article 277 of the Tax Code of the Russian Federation. Similar clarifications are contained in letters of the Ministry of Finance of Russia dated September 8, 2008 No. 03-03-06/1/513, dated September 12, 2007 No. 03-03-07/17, dated August 14, 2007 No. 03-03- 05/219.