Intangible assets accounting card: form NMA-1

Being a primary document, an intangible asset registration card is drawn up upon receipt of an object. The standard form approved by Goskomstat is universal and until recently was mandatory, but since 2013 business entities have been allowed to develop their own documents, maintaining all the necessary details. Note that the intangible asset form - 1 is very convenient; it was developed by analogy with the asset accounting card, and companies use it, including additional sections only when they are necessary due to the specifics of production.

Sample filling

To avoid mistakes and fill out the intangible asset form correctly, you should pay attention to the example of filling out the card. The name of the company that owns the intangible assets should be indicated on the front side. You also need to indicate the name of the unit that accepted the object. Further actions: you must enter the date corresponding to the date when the form was filled out, as well as the number.

On the front side of the card you must enter the name of the asset (intangible). The table columns contain the following data:

- name of the relevant division (structural);

- type of activity carried out;

- accounting (accounting) number;

- when conducting analytics - the corresponding accounting code;

- the amount of all relevant financial expenses in the process of acquiring assets;

- if there is a certain period of the asset, it must be indicated;

- depreciation is determined depending on the type of accrual;

- the rate of such depreciation is determined according to the chosen method;

- indication of an account reflecting depreciation charges every thirty days;

- the date when exactly the existing asset was taken into account;

- an indication of how the asset was received;

- indication of the date and number of documents regarding the right to a particular asset.

Attention! After the asset leaves the company, it is necessary to fill out all remaining lines in the existing form. At the same time, the document on the platform of which the asset is transferred is noted. You will need to indicate the reason why this asset was lost. If a sale takes place, the amount of funds that went into the company's treasury should be indicated.

To fill out the back of the intangible asset card, you need to pay attention to the sample, which will be the best way to prevent the most serious mistakes. On this side, it is necessary to briefly describe the asset, provide data such as position, surname, first name and patronymic of the citizen who fills out the form. You must also indicate the exact date, month and year of its completion.

https://youtu.be/ertOAVVGjlc

Post Views: 887

Filling out form No. NMA-1

Drawing up a document is a simple operation, but there are rules that guide it:

Each registration card is assigned a registration number in the line “Card No.”, the date of drawing up the document and the acceptance certificate, the full name of the company, OKPO code, as well as the division (shop/department) where the facility is operated are indicated. However, based on the intangibility of property, it is usually used in the activities of an entire enterprise, for example, a brand or trademark of a company, and then there is no need to fill out the line “Structural unit”.

For enterprises using a coding system, the transaction code for the receipt of the asset is entered on the card, and then the date and number of the corresponding document are specified. Subsequently, information is entered about the type of activity for which the asset was acquired, the department responsible for operating the asset, and the balance sheet account (subaccount) in which it will be recorded.

All object parameters are indicated:

- the initial cost, which consists of the costs of purchasing and bringing it to usable formats;

- the period required for full depreciation of property (SPI). Often, SPI is determined by expert means, since a special classifier has not been created, and the specifics of these assets are not always amenable to traditional methods of calculating depreciation. For intangible assets whose useful life is not determined, depreciation rates are set for ten years;

- depreciation rate in % or estimated rate;

- monthly depreciation amount;

- an account in which accrued depreciation amounts are accumulated.

For objects for which depreciation is not accrued (for example, received under donation agreements), dashes are placed in the corresponding columns.

The column “Acquisition method” provides information on how the company acquired the assets. Column 12 “Registration document” contains information about the document confirming the right to use intangible assets.

The last block of the table is devoted to information about the disposal/relocation of an object: document number and date, reason for disposal, amount from the sale of the object.

In the lower right corner of the form, in the “Depreciation amount” detail, the amount of monthly deductions is indicated.

The reverse side of the card is devoted to a brief description of the main qualities of the object.

https://youtu.be/cmgZIMxMFSU

Login to the site

Features of filling out primary documents for accounting for intangible assets

According to the Accounting Regulations “Accounting for Intangible Assets” PBU 14/2000, approved by Order of the Ministry of Finance of the Russian Federation dated October 16, 2000 No. 91n, intangible assets for accounting purposes include:

- the exclusive right of the patent holder to an invention, industrial design, utility model;

- exclusive copyright for computer programs, databases;

- property right of the author or other copyright holder to the topology of integrated circuits;

- the exclusive right of the owner to a trademark and service mark, the name of the place of origin of goods;

- the exclusive right of the patent holder to selection achievements.

Intangible assets also take into account the business reputation of the organization and organizational expenses (expenses associated with the formation of a legal entity, recognized in accordance with the constituent documents as part of the contribution of participants (founders) to the authorized (share) capital of the organization).

To account for all types of intangible assets received for use by the organization, an intangible assets accounting card is used (form No. NMA-1).

An intangible asset accounting card is kept in the accounting department for each object.

The form is filled out in one copy based on the document for posting, acceptance and transfer (movement) of intangible assets and other documentation.

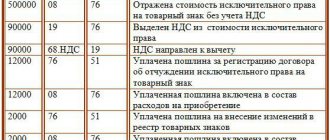

Let's look at filling out an intangible asset accounting card using a conditional example.

Example

On June 22, 2002, Zoya LLC (OKPO code for a conditional example 07318675) acquired the exclusive right of the patent holder to an industrial design from the patent holder ZAO Integral.

Zoya LLC began producing products based on the acquired industrial design in July 2002. The capitalization of the intangible asset object was formalized by Acceptance Certificate No. 43 dated June 22, 2002.

The cost of purchasing and processing this product amounted to 1,000,000 rubles. (excluding VAT).

The card was filled out by accountant Ivanova O.V.

Let's fill out the form card No. NMA-1 according to the example data.

Each document is assigned a serial number, which is indicated in the line “Card No. __”.

In our example, the card number is “7”

In the line “Organization” the full name of the organization is indicated.

In our example, LLC Zoya.

Further on the same line, in the corresponding column, the organization code according to OKPO is indicated, which is assigned to the organization by the statistics department immediately after its registration.

In our example, in the “OKPO code” column we write the code “07318675”.

The line “Structural unit” indicates the full name of the structural unit where the object is used. If an intangible asset is used for the activities of the organization as a whole (for example, a trademark or organizational expenses), then this line is not filled in.

In our example we set “Sewing shop”.

In the “Date of Compilation” column, the date the card was filled out is indicated.

In our example, “22 06.02”.

In the column “Operation type code” the code of the business transaction for the acquisition of intangible assets or their transfer is entered. Note that the code is affixed if the organization uses a coding system.

In our example, we put a dash, since Zoya LLC does not use a coding system.

In the column “Document for capitalization” the date and number of the document that was used to document the capitalization operation of an intangible asset are entered, respectively.

In our example:

"Date" - "June 22, 2002"

"Number" - "43".

The next three lines of the form are highlighted for entering information about the full name and purpose of the intangible asset item

In our example, “Patent for an industrial design of a garment “Women’s Jacket” (the entry in this example is conditional).

In column 1 “Structural unit” write down the name or code numbers (if the organization uses a coding system) of the structural unit of the organization to which the intangible asset is transferred.

In our example, “sewing workshop”.

Column 2 “Type of activity” indicates the type of activity for which the intangible asset is used

In our example, “tailoring”.

In column 3 “Account, subaccount” indicate the account on the debit of which the object of intangible assets is capitalized

In our example "04"

In column 4 “Analytical accounting code” the analytical accounting code is entered if the organization uses the appropriate coding system. If there is no code in the column, a dash is inserted.

In our example, the coding system is not used, so we put a dash in column 4.

Column 5 “Original (book) cost” indicates the initial cost, which consists of the sum of the actual costs of acquisition, production and costs of bringing intangible assets to the state in which they are suitable for use for the intended purposes, excluding VAT

In our example “1000000=00”.

Column 6 “Useful life” indicates the period during which intangible assets will be amortized. It can be determined expertly or on the basis of documents confirming the transfer of an intangible asset.

For intangible assets for which it is impossible to determine the useful life, depreciation rates are established for ten years (but not more than the life of the organization).

In our example, the useful life is 10 years, this period is established in the patent for an industrial design. Therefore, in column 6 we write “10”.

Column 7 “Amount of accrued depreciation” indicates the amount of depreciation, which is calculated monthly according to rates calculated based on the original cost and useful life.

Amortization of intangible assets is calculated regardless of the organization's performance in the reporting period

In our example “8333–33” (1000000x10%/12=8333–33)

In column 8 “Depreciation rate, % or estimated rate” the depreciation rate is entered, which is calculated based on the established useful life.

In our example, “10%” (100%/10 years).

Column 9 “Code of account and object of analytical accounting (for attributing depreciation of intangible assets)” must contain a cost account to which the amounts of actually accrued depreciation will be written off.

In our example "20"

If depreciation is not provided for intangible assets (for example, for objects received under a gift agreement), then dashes are added in columns 7 - 9.

Column 10 “Date of registration” indicates the date of recording the intangible asset on the organization’s balance sheet (that is, the date of drawing up the transfer and acceptance certificate)

In our example, “June 22, 2002.”

Column 11 “Acquisition method” provides information on how the organization acquired intangible assets.

Intangible assets can be acquired by an organization in various ways, for example

- contributed by the founders (owners) of the organization on account of their contributions to the authorized capital of the organization,

- received free of charge,

- acquired by the organization in the course of its activities under a coolie sale agreement or in exchange for other property,

- production in-house, etc.

Thus, in column 11, depending on the method of obtaining intangible assets, you can write accordingly:

- capital contribution,

- free receipt,

- purchase for a fee,

- acquisition in exchange for other property,

- manufacturing.

In our example, in this column we write “purchase for a fee.”

Column 12 “Registration document (name, number, date)” contains information about the document registering the organization’s right to use an intangible asset.

In our example, “certificate No. 0879115 dated 12.09.01”

In the next five columns of the table from 13 to 17, information about the disposal or transfer of an intangible asset is entered.

Column 13 “Number” contains the number of the document according to which the movement (disposal) occurred.

Column 14 “Date” must contain the date of the document specified in column 13 of this table.

Columns 15 and 16 reflect the reason for the disposal (movement) of intangible assets.

In column 15 “Name” indicate the name of the reasons for disposal or relocation (for example, the reason for disposal may be obsolescence).

In column 16 “Reason code” the corresponding code is entered. This column is filled in if the organization uses coding of reasons for disposal of fixed assets. Otherwise, a dash is placed in this column.

In column 17 “Amount of proceeds from sales, rub. cop.,” records the amount received by the organization from the sale of this intangible asset.

In our example, these columns are not filled in yet.

Under the considered part of the table, the attribute “Amount of depreciation, rub.” is provided. kopecks,” which indicates the amount of depreciation, which is calculated monthly at rates calculated based on the original cost and useful life of the intangible asset.

In our example “8333–33”.

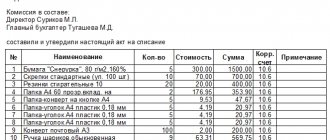

On the reverse side of the card a brief description of the intangible asset is given.

In the section “Brief description of the object of intangible assets,” only the main indicators of the object are recorded, excluding duplication of data from the technical documentation available in the organization for this object.

In our example, “The industrial design of a women’s jacket is intended for use in the production of garments.”

After filling out the intangible assets accounting card, in the line “Card filled out,” the accountant who filled out the card indicates his position, signs, writes his last name and initials (signature transcript), as well as the date of completion, day, month (in words) and year.

In our example: The card was filled out by accountant Ivanova O.V.

June 22, 2002.

Alexey Romanenko based on materials from https://www.dist-cons.ru/

Possible mistakes

Loan costs should not be included in the initial cost of the asset. This may include:

- costs of attracting specialists (both internal and external);

- price of materials;

- depreciation of environmental protection;

- patent fees.

But not loans or credits.

If a company has acquired software, and its copyright holder is another organization, then such an asset cannot be registered in the intangible assets accounting card. This only occurs if the exclusive rights to that specific software product or license are transferred.

You should not issue an intangible registration certificate (NMA-1) for the rental service of any program. These cases are noted only on the off-balance sheet account according to the agreement number, which stipulates the relationship of the copyright holder with the user.

Intangible asset registration card: sample filling and form

We will briefly describe the procedure for filling out an intangible asset card using a unified form, and also give an example of how to fill it out.

Form No. NMA-1 is kept in the accounting department for each object in one copy on the basis of documents for capitalization, movement of intangible assets and other documentation. In the section “Brief description of the object of intangible assets,” only the main indicators of the object are recorded in order to eliminate duplication of data from the technical documentation for the object of intangible assets.

NMA-1 cards in RTF format can be found here

Let's give an example of filling out form No. NMA-1 in relation to an advertising video produced for an organization by a third-party supplier and not depreciated due to the fact that the useful life cannot be reliably determined.

The legislative framework

The document was adopted by Resolution of the State Statistics Committee No. 71a of October 30, 1997. There is a footnote to this effect in the paper itself in the upper right corner (it also states that the card has been assigned the interindustry form NMA-1).

In 2013, all forms of primary documents became recommendations. For this reason, when creating a document, deviations from the given forms are allowed. Each such change must be justified and documented. The form remains in use due to the conservatism of the organizers of enterprises, as well as because of its informativeness and convenience.