Government duty

State duty is a sum of money collected by specially authorized institutions (courts, notary offices, police, registry offices, financial system authorities, etc.) for performing actions in the interests of organizations and individuals and issuing documents of legal significance (consideration of claims , complaints, certification of contracts, wills and powers of attorney, civil registration, state registration of a legal entity, securities prospectus, etc.).

And in modern conditions, the collection of state duties is regulated by Chapter 25.3 of the Tax Code of Russia and is defined as a fee levied on organizations and individuals when applying to state bodies, local governments, other bodies and (or) officials who are authorized in accordance with legislative acts of the Russian Federation, legislative acts of the constituent entities of the Russian Federation and regulatory legal acts of local governments, for the performance of legally significant actions in relation to these persons provided for by the Tax Code, with the exception of actions performed by consular offices of the Russian Federation. In this case, the issuance of documents (their duplicates) is equated to legally significant actions, and the issuance of copies of documents is not recognized as such.

State duty is included in the Russian tax system, so it can be considered a type of tax payment. The similarity with taxes lies in the obligatory payment to the budget, in the extension of the general conditions of establishment to it, involving the determination of the payer and all six elements of taxation listed in Art. 17 Tax Code. The difference between state duties and taxes is that they are targeted and reimbursable.

Being a federal tax, state duty is obligatory for payment throughout Russia. Duty amounts, in accordance with Articles 50, 56, 61,611 and 612 of the Budget Code, are credited at a rate of 100% to the revenues of the federal budget, budgets of the constituent entities of the Federation and local budgets.

State duty payers

Payers of the state duty are organizations, including foreign ones, and individuals (citizens of Russia, foreign citizens and stateless persons) if they:

- apply for the performance of legally significant actions provided for in Chapter 25.3 of the Tax Code;

- act as defendants in courts of general jurisdiction, arbitration courts or in cases considered by magistrates, and if the court decision is not made in their favor and the plaintiff is exempt from paying state fees.

If several payers who are not entitled to benefits apply to perform a legally significant action at the same time, the state duty is paid by the payers in equal shares. If among the persons who simultaneously applied for the commission of a legally significant action there are persons exempt from paying the state duty, the amount of the latter is reduced in proportion to the number of persons exempt from paying it. The remaining amount of the state duty is paid by persons who are not exempt from paying it.

The object of the state duty is the services of state bodies, local governments, other authorized bodies and officials. The Tax Code establishes a closed list of objects for collecting duties, consisting of 230 types of legally significant actions that can be combined into four groups (Table 20).

Characteristics of state duties. Table 20

Requests, petitions and complaints submitted to the Constitutional Court (5 types, Art. 33323)

Claims and other statements and complaints filed with arbitration courts (13 types, Art. 33321)

Claims and other statements and complaints filed with courts of general jurisdiction and magistrates (14 types, Art. 33319)

State registration of acts of civil status (7 types, Art. 33326)

State registration of a computer program, database and integrated circuit topology (7 types, Art. 33330)

State registration of legal entities, individual entrepreneurs and other state registration (126 types, Art. 33333)

Issuance of documents related to the acquisition (renunciation) of citizenship, entry (exit) from Russia (26 types, Art. 33328)

Implementation of federal assay supervision (6 types, Art. 33331)

From December 29, 2010, the fee is not charged if changes are made to the issued document aimed at correcting errors made by the body or official that issued the document when performing a legally significant action.

The tax base of the state duty is either the service itself for performing a legally significant action, or the price of the claim.

Tax period determined by Art. 55 of the Tax Code, in relation to state duty, as a rule, is absent, which is explained by the deadlines for its payment established by the Code.

The deadline for payment of the duty usually requires its payment in advance, i.e. before the commission of a legally significant action. However, there are two exceptions to this rule, when the duty is levied in a subsequent manner and when it can be said about the tax period, namely:

The proportional duty on property documents can be differentiated depending on the degree of relationship. In a progressive state duty, the rate increases as the tax base increases (the amount in claims of a property nature, forming a complex progression).

The size of the proportional (progressive) state duty may be further limited by minimum and maximum limits. Sometimes the amount of the state duty additionally takes into account the unit of volume (page-by-page certification of documents). Since the object of state duty is 230 types of legally significant actions, we will give only some examples of state duty rates.

Tax benefits when paying state duty

For the payment of state duties to the budget, Chapter 25.3 of the Tax Code establishes about 90 benefits, which are set out in Articles 333.35 - 333.39 and which are classified both in terms of legally significant actions performed, and depending on the category of payers and forms of actions performed. At the same time, the authorities of the constituent entities of the Federation and municipalities are not given the right to establish additional benefits.

Benefits can be : conditional (living with the testator on the day of death) and unconditional; partial (50% for disabled people of groups 1 and 2 for notarial acts) and full.

State bodies and organizations fully financed from the budget and cultural institutions are exempt from paying state duty. The following categories of individuals are exempt from paying all types of state duties: Heroes of the Soviet Union, Heroes of the Russian Federation and full holders of the Order of Glory; participants and disabled people of the Great Patriotic War.

Benefits are also established depending on the forms of actions performed. In particular, plaintiffs in claims for the recovery of wages (monetary support) and other claims arising from labor relations, as well as in claims for the recovery of benefits, are exempt from paying fees in cases considered in courts of general jurisdiction and by magistrates; public organizations of disabled people acting as plaintiffs and defendants; The plaintiffs are disabled people of groups I and II.

Due to their large number, a complete presentation of all benefits is not possible within the framework of a textbook, therefore, if necessary, you should refer to the above-mentioned Articles 333.35 - 333.39 of the Tax Code.

The state duty is paid at the place of commission of a legally significant action in cash or non-cash form. The non-cash form of payment is confirmed by a payment order with a note from the bank or the relevant territorial body of the Federal Treasury (another body that opens and maintains accounts), including one that makes payments in electronic form, about its execution. The cash form of payment of the state duty is confirmed either by a receipt of the established form issued to the payer by the bank, or by a receipt issued to the payer by an official or the cash desk of the body to which the payment was made.

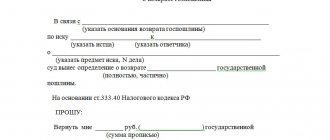

Article 333.40 of the Tax Code provides for the grounds and procedure for the return or offset of paid state duty. In particular, the paid duty must be returned to the payer in part or in full in the following cases:

When concluding a settlement agreement before the arbitration court makes a decision, 50% of the amount of the state duty paid by him must be returned to the plaintiff. This provision does not apply if the settlement agreement is concluded in the process of executing a judicial act of the arbitration court.

The Tax Code also provides for certain cases when the paid state duty is not returned to the payer. In particular, the paid state fee is not subject to refund if the defendant voluntarily satisfies the plaintiff’s demands after the latter applies to the arbitration court and a ruling is made to accept the statement of claim for proceedings, as well as when the settlement agreement is approved by a court of general jurisdiction.

The state fee paid for the state registration of marriage, divorce, name change, corrections and changes in civil status records is also non-refundable if the state registration of the corresponding civil status act was not subsequently carried out or corrections were not made and changes in civil registration.

The state fee paid for state registration of rights, restrictions (encumbrances) of rights to real estate, transactions with it is not refundable in the event of refusal of state registration. In case of termination of the state registration of the right, restriction (encumbrance) of the right to real estate, transaction with it, on the basis of relevant statements of the parties to the agreement, half of the paid state duty is returned. Refund of an overpaid or collected amount of state duty is made upon the payer’s application, which is submitted to the body (official) authorized to perform legally significant actions for which the state duty was paid (collected). If the state fee is refundable in full, original payment documents are attached to the application, but if it is partially refundable, copies of payment documents are attached.

The decision to return to the payer the overpaid (collected) amount of state duty is made by the body (official) carrying out the actions for which the state duty was paid (collected).

The refund of the overpaid (collected) amount of state duty is carried out by the Federal Treasury.

An application for the return of an overpaid (collected) amount of state duty in cases heard in courts, as well as by justices of the peace, is submitted by the payer to the tax authority at the location of the court in which the case was heard. An application for the return of an overpaid (collected) amount of state duty may be submitted within three years from the date of payment of the specified amount. Refund of the overpaid (collected) amount of state duty is made within one month from the date of filing the specified application for refund.

The payer of the state duty also has the right to offset the overpaid (collected) amount of the state duty against the amount of the state duty payable for performing a similar action. The offset is made upon the payer’s application submitted to the authorized body (official) to which he applied to perform a legally significant action. An application for offset of the amount of overpaid (collected) state duty may be filed within three years from the date of the relevant court decision on the return of the state duty from the budget or from the date of payment of this amount to the budget.

Refunds or credits for overpaid (collected) amounts of state duty are made in the manner established by Chapter 12 of the Tax Code.

According to the Tax Code, the state duty payer is given the right to receive a deferment or installment payment at the request of an interested person within the period established by paragraph 1 of Article 64 of the Code. At the same time, interest is not accrued on the amount of state duty in respect of which a deferment or installment plan has been granted for the entire period for which the deferment or installment plan has been granted.

Tax authorities check the correctness of calculation and payment of state duty in state notary offices, civil registry offices and other bodies, organizations that carry out actions in relation to payers, for the implementation of which a state duty is charged. Moreover, all these bodies and organizations are obliged, in the manner established by the Ministry of Finance of the Russian Federation, to submit information to the tax authorities about the legally significant actions they have performed.

BCC for payment of state duty in 2018-2019

State duty is a fee levied on applications to state bodies, local government bodies, other bodies and or to officials who are authorized in accordance with the legislative acts of the Russian Federation, legislative acts of the constituent entities of the Russian Federation and normative legal acts of local government bodies, for the commission in relation to these persons carry out legally significant actions provided for in this chapter, with the exception of actions performed by consular offices of the Russian Federation.

Online accounting Changes since the year. Subscribe to our newsletter. KBK for state duties in the year table March 15, Accountants Club. Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free! Moscow, Novodmitrovskaya st. Personal data processing policy.

Good to know! You can purchase a license for the BukhSoft Online accounting program from rubles per month in which always up-to-date forms and forms, automatic filling, generation of reports with verification before sending to funds and inspections. More information about the program Any questions?

Call us: 8 free or request a call back. All primary items are in the Purchase Accounting register without manual entry! Details for paying state duty. The article contains details about the payment order fields, as well as free reference books and useful links. Amount of state duty. The amount of the state duty is determined by the Tax Code, since the state duty is a tax payment. The article contains a large table on payment amounts, as well as free reference books on payments and settlements.

Payment of state duty by legal entities to the budget per year. Let's look at the types and procedures for companies to pay state fees each year. We will also provide useful documents and services that will help you manage your budget. State duty for registration of property rights in the year: payment, amounts, KBK details. Let's consider who, when and in what amounts pays the state duty for registering property rights in a year.

Here are samples of the necessary documents that can be downloaded. Calculation and payment of state fees to the arbitration court per year. Applicants are required to pay a state fee to the arbitration court. Exceptions are provided only in certain cases. Let's consider the procedure for paying and calculating state duty in a year. New duty for Russians: important details State duty on a license: what they will charge for 6. Driver's license: duty is not a problem Business registration: simplification from October 1.

How much will the real estate tax be when purchasing multiple premises? Login to programs. Personal discounts, gifts and free services when ordering a call back. Electronic reporting Features Tariffs.

Opportunities Tariffs. New in the year. Accounting and tax changes Changes for the accountant since the year. Changes in VAT since the year. Production calendar Changes in labor legislation Innovations for small businesses How to confirm the main type of activity. Current reporting period. New VAT return for the 3rd quarter of the year: form and completion. Deadline for submitting calculations for insurance premiums for the 3rd quarter of the year.

Calculation of insurance premiums for 9 months of the year. Calculation of insurance premiums for the 3rd quarter of the year: sample filling. Unified simplified tax return for the 3rd quarter of the year: form, sample completion, due date. SZV-M for August of the year: due date, form and form. Deadline for paying VAT for the 3rd quarter of the year. Declaration on UTII for the 3rd quarter of the year: download form. Income tax return for 9 months of the year. Deadlines for payment of income tax for the 3rd quarter of the year.

A new form for calculating property tax advances for the 3rd quarter of the year. Deadlines for submitting UTII reports for the 3rd quarter of the year. Form 4-FSS for 9 months of the year: sample filling and due date. Deadlines for submitting reports for the 3rd quarter of the year: table. Advance payment under the simplified tax system for the 3rd quarter of the year: payment deadline. Advances on property tax for the 3rd quarter of the year: due date and payment. Advance payments for income tax for the 3rd quarter of the year. Program for sending reports via the Internet.

Legal basis. Tax Code Civil Code. Poll of the week. Do you need financial analysis as an accountant? No, this is an extra headache. Yes, this is part of the accountant's job. We are in social networks. To download the file, please register. I have a password. Password has been sent to your email Enter.

Enter email Wrong login or password. Incorrect password. Enter password. This is my first time here. They allow you to get to know you and receive information about your user experience. This is necessary to improve the site. By visiting the site and providing your information, you allow us to provide it to third party partners. If you agree, continue to use the site.

If not, set special settings in your browser or contact technical support. Additional Information. I give my consent to the processing of my personal data. These documents will help you pay your budget correctly and on time. Download for free:. We suggest considering the topic: “State fee for registering an LLC in a year - amount and payment procedure” with comments from professionals.

We tried to explain everything in understandable languages and fully cover the topic. Read the article carefully and if you have any questions, you can ask them in the comments or directly to the consultant on duty. Good legislative news, gentlemen entrepreneurs!

The price of such a signature varies among different certification centers. When contacting state authorities, self-government or any officials with a request for any action that is significant from the point of view of the law, an individual or legal entity must pay a special fee - a state duty.

Unfortunately, these fees have increased significantly this year for almost all types of services. For an entrepreneur, a state fee is needed to pay for such government actions:. For individuals, the state duty has a fixed value established at the state level. To calculate the state duty, you can use a variety of online calculators: the developers claim that they are regularly updated due to changes in the Tax Code.

In order for funds transferred as a state fee to be counted, they must go to the budget of the desired administrator - one or another government body, most often the Federal Tax Service. The budget classification code - KBK, entered in the payment order field, is responsible for the distribution of transferred funds. The BCC depends on the purpose of this or that state duty that the entrepreneur is going to pay. Institutions are often faced with the need to pay state fees.

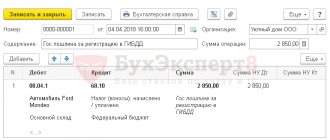

If the state fee was paid in cash, then the accounting department must have documents confirming that the fee was paid from the funds of the institution.

To what budget should I pay the state duty?

Articles on the topic

". Which budget should the state duty be credited to—the federal budget or the budget of a constituent entity of the Russian Federation? « A.A. Nikolaev, St. Petersburg

It all depends on the reasons for its payment. If the fee is paid in connection with the consideration of a case in arbitration, the Constitutional or Supreme Court, as well as for the state registration of a legal entity (including state registration of changes made to the constituent documents), the state fee is credited to the federal budget. Crediting is made at the location of the bank that accepted the payment. In other cases, the state duty is credited to the budget revenue of the constituent entity of the Russian Federation. Crediting is also carried out at the location of the bank that accepted the payment.

Budget classification codes (BCC) state fees for registering an LLC and obtaining a copy of the charter

When paying the state fee for registering an LLC and receiving a copy of the charter, you must indicate the following budget classification codes:

- 182 10800 110 — State duty for state registration of a legal entity, individuals as individual entrepreneurs, changes made to their constituent documents of a legal entity, for state registration of liquidation of a legal entity and other legally significant actions.

Name of payment: state fee for registration of a legal entity LLC.

- 182 11300 130 — Fee for providing information contained in the Unified State Register of Legal Entities and in the Unified State Register of Individual Entrepreneurs

Name of payment: for providing a copy of the charter.

You can pay the state fee for registering an LLC or obtaining a copy of the charter online, as well as print a receipt with all the necessary details for paying the fee through a bank using the service. The service automatically enters the necessary details depending on the method of submitting documents you have chosen and the reason for applying, so you do not need to look for the information yourself.

Paying state fees using eregistrator.ru is a great way to save your time!

What is state duty?

A state duty (or “state duty”) is a fee levied on citizens or legal entities when applying to government agencies to perform any legally significant actions. Note that these legally significant actions are listed by law; each of them has its own state duty - it and only this is the payment for the action required by the citizen or organization.

The state duty is established and regulated by Chapter 25.3 of the Tax Code of the Russian Federation. It refers to federal taxes, that is, regional authorities do not have the right at their level to establish any rules regarding state duties.

Payment order for payment of state duty - sample 2020 - 2020

> > > August 26, 2020 All story materials Payment order for state duty - sample 2020-2020 can help in paying this fee.

What is state duty? Who should pay it and why?

What are the features of filling out a payment form for state duty?

We will consider the answers to these and other questions in the material below.

We have also prepared for you a sample of filling out a payment form for payment of state duty and will provide it below. Documents and forms will help you: Ask on our forum how to correctly transfer money to various “official” structures. For example, you can clarify how to fill out a payment form to pay a fine. State duty is a federal tax established by the Tax Code of the Russian Federation (Chapter 25.3 of the Tax Code of the Russian Federation).

It is paid in case of contacting various bodies (state, municipal, etc.) for the commission of certain legally significant actions.

The type of BCC you indicate in the payment depends on what action is required.

For convenience, we will present the main types of actions for which a duty is paid in a table and immediately present the BCC for payment. Legally significant action Amount of state duty (for 2020–2020) BCC for state duty

- State registration of individual entrepreneurs.

- Liquidation of individual entrepreneurs

- State registration of a legal entity.

- Liquidation of an organization, etc.

- Amendments to the constituent documents.

4,000 rub. 800 rub. 800 rub. 800 rub. 160 rub.

182 1 0800 110

- State registration of rights to real estate, their restrictions (encumbrances) and transactions with it, with some exceptions

22,000 rub. - for organizations. 2,000 rub.

— for “physicists” 321 1 0800 110

- Registration of vehicles and issuance of documents for them

From 350 to 1,600 rubles.

188 1 0800 110 Court fees, including:

- At

- When applying to arbitration courts.

Payers

Payers of state duties can be any person - both legal and natural. We become a duty payer when:

- we apply for the performance of legally significant actions to the bodies authorized to carry them out;

- We act as defendants in courts (at any level), where the decision is not made in our favor, and the plaintiff in the case is exempt from paying state fees.

The simplest example: paying a fee when filing an application for marriage or divorce at the registry office, when receiving a copy of a birth certificate, etc.

State duty to court.

Select the desired item.

And on behalf of the document submitter (plaintiff, applicant). The presented calculator is used:

- for calculating state duty in regional, regional, republican courts, in the Supreme Court of the Russian Federation

- to calculate the amount of fees for consideration of cases considered by magistrates

- to calculate the amount of fees for consideration of cases considered by district (city) courts

In 2020, the amount of the state duty to the court has not changed.

When filing claims, starting from January 1, 2020, the state duty must be paid according to the specified

What is the state duty paid for?

The state duty is paid for the performance by state bodies of legally significant actions in relation to the citizen or organization that applied for these actions.

Legally significant actions where you are required to pay a state fee are listed in the Tax Code.

For example, the state fee must be paid:

The specifics of paying state duty, depending on the type of legally significant actions performed, the category of payers, or other circumstances, are established by Articles 333.20, 333.22, 333.25, 333.27, 333.29, 333.32 and 333.34 of the Tax Code of the Russian Federation.

Where to pay the fee

Yes, I already had an unsuccessful experience in this regard, I looked through the Code of Civil Procedure and nowhere did I find an indication that a state duty is attached to the supervisory complaint and, accordingly, the supervisor returned the complaint. Now we want to submit supervision again and we want to submit a petition for deferment of payment of the state duty, this is where I stalled)))))) Where is this petition submitted? Section 333.20. Peculiarities of paying state fees when applying to courts of general jurisdiction and magistrates

It has already been discussed that the Code of Civil Procedure does not require that a fee payment receipt be attached to supervision, despite the fact that the Tax Code requires payment of it. If you still want to attach it just in case, the details are usually indicated on the website or on stands in the city court premises.

Payment procedure and terms. Refund of state duty

In most cases, the state fee is paid before a legally significant action is performed. The Tax Code specifies the following deadlines for payment of duties:

The specifics of paying state duty for taking actions to develop state policy and legal regulation in the field of production, processing and circulation of precious metals and precious stones are established in Article 333.32 of the Tax Code of the Russian Federation.

The state duty is paid at the place of commission of a legally significant action in cash or non-cash form. Document confirming payment:

Foreign organizations, foreign citizens and stateless persons pay state fees in accordance with the general procedure.

Deferment or installment payment of state duty is granted at the request of an interested person for a period of up to one year. Interest is not charged in case of installments.

The paid state duty can be returned in the following cases:

The fee paid for marriage or divorce and other actions of the registry office cannot be returned. Also, the fee paid for state registration of rights to real estate and transactions with it is not refunded in the event of refusal of state registration.

To return the amount of the state duty, you must, within 3 years from the date of payment, submit an application to the state body that performs the actions for which this duty was paid. A receipt confirming payment must be attached to the application. The overpaid amount must be returned within 1 month.

Please pay attention!

The state fee is not paid if changes to the document are caused by an error made through the fault of the body or official who issued the document.

Courts of general jurisdiction, justices of the peace, arbitration courts, the Constitutional Court of the Russian Federation and constitutional (statutory) courts of constituent entities of the Russian Federation are given the right to exempt the payer from paying state duty, based on his property status.

The state duty for issuing a driver's license, registration documents and state registration plates for vehicles, passports, as well as for state registration of rights to real estate is not paid by citizens living in the territory of the Republic of Crimea and the federal city of Sevastopol.

"On state duty"

“On the procedure for the return of overpaid (collected) amounts of state duty”

Kbk state duty awarded by the court

Hello, in this article we will try to answer the question "".

You can also consult with lawyers online for free directly on the website.

The section contains all the responses of government bodies, which are posted on the “Open Dialogue” portal of the Electronic Government of the Republic of Kazakhstan.

Everyone knows how prices have risen and how taxes have risen.

Suddenly this also affected divorce proceedings, so now you simply cannot afford to get a divorce in 2020?

The state fee is charged regardless of the method of divorce. A receipt for payment of the fee is a required document attached to the divorce petition. Contents: Checkpoint - reason code for setting.

This is an individual nine-digit number assigned to the bank by the Federal Tax Service. The code is assigned simultaneously with the TIN when registering the bank as a taxpayer. The state fee to a court of general jurisdiction must be paid at the time the initiator of the proceedings submits an application (if the plaintiff does not belong to a preferential group of citizens).

These funds are classified as legal costs. Details for payment can be found on the information board of that court.

This data is also available on the websites of judicial authorities, and most of them even have special services that will help you calculate the fee and generate a receipt. Calculation of the state fee in court can be done by visiting the website of the judicial authority where they plan to file a claim. Most courts post convenient calculators on their official Internet pages to determine the cost of state fees.

Bank details are a necessary condition for making transfers to accounts.

These should not be confused with account details, but they are also important. In 2020, Sberbank of Russia OJSC was renamed into Sberbank of Russia PJSC at the direction of the Central Bank, but this did not affect its details.

Next, we will consider the components of the details and their meaning.

Through the registry office when submitting an application unilaterally (if the second spouse is recognized as incompetent, dead or missing, if he is sentenced to serve a prison sentence).

Republican State Institution “Department of State Revenue for the District named after.

State duty amounts

The amounts of state duty are established by the Tax Code for each type of legally significant action; they also depend on the category of payers. All sizes are established in articles 333.19, 333.21, 333.23, 333.24, 333.26, 333.28, 333.30, 333.31, 333.32, 333.32.1, 333.32.2, 333.33 of the Tax Code of the Russian Federation.

The specifics of paying state duty on various grounds are regulated by Articles 333.20, 333.22, 333.25, 333.27, 333.29, 333.34 of the Tax Code of the Russian Federation.

From January 1, 2020, the amount of state duty for bankruptcy proceedings for an individual will depend on the status of the applicant. For an individual, its amount will be 300 rubles, for a legal entity - 6,000 rubles. These changes are provided for in the new edition of paragraphs. 5 p. 1 art. 333.21 of the Tax Code of the Russian Federation, which were introduced by Federal Law of November 30, 2016 N 407-FZ. Previously, when filing an application to declare a debtor insolvent, both organizations and citizens must pay a state fee of 6,000 rubles, but since 2020, citizens pay an amount 20 times less than legal entities for the bankruptcy procedure.

“On amendments to Article 333.21 of Part Two of the Tax Code of the Russian Federation”

What is a state duty awarded by a court?

Contents 01/05/2020 What is a state duty awarded by a court is indicated in the articles of the Tax Code of the Russian Federation (Chapter 25.3).

This is a mandatory deduction of a fixed amount ordered by the competent judge hearing the dispute.

In its order, the court indicates the amount of the fee, the timing of its payment, as well as the person in respect of whom the amount is awarded.

Enforcement control falls on the shoulders of the Federal Bailiff Service of the Russian Federation.

According to Article 333.16 of the Tax Code of the Russian Federation, state duty is a mandatory deduction made by individuals and legal entities submitting a request to state or municipal authorities, judicial organizations, and officials for the execution of legal actions.

In practice, grounds for demanding payment arise in cases where the judge grants the plaintiff’s request. According to the provisions of the Code on Enforcement Proceedings, the statement of claim is accepted only after the plaintiff has paid the state fee.

If, as a result of resolving the conflict, the claim is fully satisfied, then the state fee is compensated by the defendant.

The difficulty lies in the fact that some types of claims are considered without the participation of the defendant - writ proceedings. After the decision enters into legal force, the judge prepares a court order to collect state fees from the defendant. The cost of the order is 200 rubles (for individuals), 4000 for organizations.

The original order is sent to the FSSP for further collection of funds.

Along with the notification, the competent bailiff sends the debtor a copy of the court order. The contents of the document indicate within the framework of which enforcement proceedings the money is collected. This will allow the citizen to become familiar with the legality of the grounds for claiming funds. The further procedure will be as follows: Personal appeal to the FSSP.

This is necessary in order to confirm that the writ of execution was sent by the FSSP service and is not the result of the work of fraudsters.

Enrollment

100% of the state duty is credited to the budget of the constituent entities of the Russian Federation:

100% of the state duty is credited to the settlement budget:

100% of the state duty is credited to municipal budgets:

The budgets of city districts and municipal districts, federal cities of Moscow, St. Petersburg and Sevastopol are subject to crediting the state duty for the provision of licenses for the retail sale of alcoholic beverages issued by local governments at a rate of 100 percent.

In other cases, the state duty in full (100%) is credited to the federal budget.

State duty payment 2020

And when filling out the fields, fill out the main positions as follows: Payer status, field 101 – “01”; Taxpayer INN and KPP, fields 60 and 102 – TIN and KPP of the organization; Payer, field 8 – name of the organization; Payment order, field 21 – “5 ";Code, field 22 – “0”; KBK, field 104 – KBK state duties; Basis of payment, field 106: – “0”; Tax period, field 107 – “0”; Document number, field 108 – “0”; Document date, field 109 – “0” Purpose of payment, field 24 – text explanation.

No. 107n “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation.” Filling out stage Explanation Number of payment order Indicates the serial number of the document Date of payment order Indicates the date in the format DD.MM.YYYY Type of payment “Urgent” - in this case, the transfer of funds will be carried out by means of an urgent transfer.

State duty

State duty is a sum of money determined by law that is subject to payment to the budget for applying to government bodies at various levels.

The Tax Code of the Russian Federation contains fundamental provisions regulating the grounds and procedure for paying state duty, and also determines its size for each specific case of application to a particular body of a particular category of payers, and also provides for cases of exemption from its payment.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

State duty what budget level

WTO negotiator M. Yu. Medvedkov, although not a natural Finn, followed the same path. After going through a series of unsuccessful iterations -

“WTO hid from me, // Saying with an indifferent look: // Bear, I don’t love you!”

, - M. Yu. Medvedkov decided to attract her with charms, to ignite love with magic.

Turning to gadgets and nanotechnology, with a bright thought he comprehended the terrible secret of nature and finally achieved the desired effect.

“And suddenly sits in front of me // A decrepit, gray-haired old woman... // With a hump, with a shaking head, // A picture of sad disrepair”

, while “...All the witchcraft // Completely came true, unfortunately.

// Burned with a new passion for the Russian Federation // This gray-haired deity.” Since there was nowhere to run, and it seemed like the money had already been spent, and it was a pity for the long work, the protocol on accession to the WTO was ratified, spitting.

The concept of state duty

State duty is a payment to the budget collected from the payer in cases of appeal to government agencies, including local government or to officials who are empowered to perform actions of a legally significant nature in favor of the applicant.

The exception is cases of application to the country's consular offices.

Here you can learn more about the procedure for obtaining a new international passport.

Payer means:

In fact, duty payment cases can be divided:

You can learn more about the procedure for filing a cassation appeal from this article.

Filling out the cbk for state duties step by step instructions

When contacting state authorities, self-government or any officials with a request for any action that is significant from the point of view of the law, an individual or legal entity must pay a special fee - state duty . Unfortunately, in 2020, these fees have increased significantly for almost all types of services.

- KBK - 18810807141011000110 “State duty for state registration of vehicles...”. KBK is entered automatically from the Taxes and Contributions directory ;

- OKTMO code is the code of the territory in which the Organization is registered. The value is filled in automatically from the Organization directory ;

- Payer status - 08 - payer-legal entity, individual entrepreneur paying other payments : the state duty for registering a car is a duty not administered by the tax authorities;

- UIN - since the UIN can only be specified from the information of tax notices or requests for payment of tax (penalties, fines);

- Basis of payment — ;

- Taxable period — ;

- Document Number — ;

- Document date - , because these fields are not filled in when transferring the state duty for vehicle registration (clause 4 of Appendix No. 2, approved by Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n).

State duty amount

Depending on the basis for paying the state duty, it can be fixed - a specific amount in monetary terms is determined, or it can be calculated on an individual basis, since only a percentage of, for example, material claims stated in the claim is legally defined.

You can learn more about the procedure for dividing marital property in more detail here.

Thus, the state fee in court for claims of a non-property nature, or property, but not requiring assessment, is determined for an individual in the amount of 100 rubles, for a legal entity - 2000 rubles.

For cases of special proceedings, applications for divorce, challenging acts of government agencies, etc. the amount is also determined in hard monetary terms.

For example, a claim for an amount up to 10,000 rubles is subject to a duty of 4%, but not less than 200 rubles.

On an individual basis, a state duty calculator will help you with your calculations, which takes into account not only the size and type of legal claims, but also the specifics of the instance (Supreme Court, Constitutional Court, arbitration or general courts) taking into account the current provisions of the Tax Code of the Russian Federation.

In addition to the general rule that provides for payment of the fee, at the legislative level there are cases of exemption from it for certain categories of entities, or cases that do not require payment of the fee at all .

State duty is paid to the budget

The procedure for paying the state duty should be carried out in the fourth place, based on the fact that the state duty is a federal fee, which is paid by the parties, under which payments are made to the budget along with extra-budgetary funds.

Business is an exchange of benefits for money. What use are you? The answer to this question determines the type of business you run. There are no cases when a novice entrepreneur starts building a business in an area unknown to him and achieves success. This work is “available to everyone” (janitor, security guard, etc.), and the benefits (read “business”) from each person are strictly individual. Business begins when you can do something better, faster, cheaper than others for the end consumer (without intermediaries). Having money (start-up capital) can help purchase equipment, but some types of business do not require anything other than the competence of the entrepreneur himself. Maximize your benefits and the money will follow.

Details for paying state duty

Taking into account the fact that the details for paying the state duty are individual for each specific region and the body empowered to perform legally significant actions in favor of payers , you can obtain the desired details in two ways:

The Ministry of Finance introduced new BCCs for 2020

What are KBK codes? The budget classification of the Russian Federation is a grouping of income, expenses and sources of financing budget deficits of the country's budget system, used for the preparation of budget reporting, ensuring the comparability of budget indicators. This is why there are unified budget classification codes (KBK). The use of unified budget classification codes makes it possible to form a basis for monitoring the movement of budget funds and factor analysis of budget items, which simplifies the integration of estimates and budgets into common consolidated documents.

The Ministry of Finance of the Russian Federation has made changes to the procedure for applying budget classification codes (BCC) for 2020; the corresponding order was published on the official legal information portal. Thus, organizations should be prepared to use new BCCs in 2020, which are necessary to make the appropriate payments, because the responsibility for correctly indicating budget classification codes lies with the payer.

State duty payment locations

Payment is made at any bank branch in cash or non-cash form.

Based on the payment results, the payer must have either a receipt or a payment order, depending on the chosen payment method.

A number of bodies may independently collect payment ; in this case, an official of the body must also issue a receipt in the established form to the payer.

If this is not done, the action will be refused and the package of documents will be returned, which will require a second application.

What is the state duty for an extract from the Unified State Register of Legal Entities, its cost and details for payment

To carry out certain actions, organizations, for example, when applying for a loan from a bank or when going to court, sometimes need information from the Register of Legal Entities. This service is paid, i.e.

a state duty is provided for an extract from the Unified State Register of Legal Entities (Unified State Register of Legal Entities). The necessary information is located at the Federal Tax Service, which is why it is ordered there.

The necessary information can also be obtained from the intermediary organization MFC (multifunctional center).

Features of document issuance

In order to obtain information from the Unified State Register of Legal Entities, an application is filled out. It states:

- tax authority number;

- information about the legal entity or individual who needed the document;

- contact phone number;

- procedure and deadline for receiving the document;

- information about the organization of interest;

- number of statements required.

A document confirming that the payment for the extract from the Unified State Register of Legal Entities has been paid is also attached.

Basic moments

The state fee must be paid before completing the application.

In 2020, the form of an extract from the Unified State Register of Legal Entities looks the same as in 2017, and contains the following information:

- name of the legal entity;

- actual and legal address;

- date of opening of the organization;

- TIN, OGRN and KPP;

- information about managers and founders;

- availability of a license;

- Kind of activity;

- are there branches, etc.

Any interested person who has an electronic digital signature can order an extract.

The tax office must provide information within 5 working days or within 1 day if the order is urgent. The date of issue of the statement must be indicated, because it may be valid for a limited period, which depends on the purpose of the document. For example, a document intended for going to court is valid for 30 calendar days.

KBK

If an application is submitted to the MFC, the KBK will be 18211301020018000130, and to the Federal Tax Service - 18211301020016000130, i.e. differs by one digit.

Amount of state duty and payment methods

If an extract on paper is required, certified by a signature and official seal, then a state fee is paid.

Its size is established by clause 1 of the Decree of the Government of the Russian Federation No. 462 of May 19, 2014 and is 200 rubles.

This is if the customer agrees to wait 5 working days. If you need an urgent extract from the Unified State Register of Legal Entities, you will have to pay 400 rubles.

The state fee is the same for everyone. When ordering several documents, funds are paid for each copy.

The information provided in the extract has been freely available since 2014. They can be found on the tax authority website and printed. There is no state fee for receiving information electronically, but in this case not all data about the organization is provided.

The funds received from the provision of this service are sent to the state budget, therefore they are called state duty. At the same time, Resolution No. 462 states that this is a fee for providing information from the Unified State Register of Legal Entities. Whatever this type of depositing money into someone else’s account is called, the main thing is to do it correctly.

Payment details

You can pay for receiving information from the Unified State Register of Legal Entities in several ways:

- In cash with a receipt.

- By non-cash transfer, in which a payment order is generated, which is certified by the bank.

- Through a special service of the tax authority “Payment of state duty”. Money is transferred instantly online.

The last method is good because the details are filled in automatically. In other cases, information about the Federal Tax Service to which the funds will be transferred must be clarified. To obtain the required information, you need to contact the tax office or find it on the organization’s website. Information can also be found at the MFC.

Details required to pay the state fee for information from the Unified State Register of Legal Entities:

- TIN/KPP;

- OKTMO;

- BIC;

- Account number;

- KBK;

- Bank of recipient.

The purpose of the payment is also indicated.

Receipt for payment

After specifying all the details, a receipt is generated. It can be filled out and paid at any bank branch. A sample form can be found on the “Payment of state duty” website. The MFC can also provide information.

The receipt is a necessary document when filling out an application for an extract from the Unified State Register of Legal Entities.

Extract from the Unified State Register of Legal Entities

A document containing information from the register of legal entities is necessary when conducting the affairs of an enterprise. It confirms information about the organization and shows its current status. The state fee for providing an extract from the Unified State Register of Legal Entities is a prerequisite for its issuance.

Below is a video about how to obtain an electronic version of the document on the tax website:

Related posts:

- KBK UTII 2017 KBK for payment of the single tax on imputed income (UTII) Table of all KBK by “imputation” Current...

- KBK simplified tax system 2013 KBK for payment of simplified taxation system income (6%) KBK for payment of simplified taxation tax income (6 percent) TAX KBK Unified...

- KBK simplified tax system 15 KBK income under the simplified tax system in 2020 Which KBK under the simplified tax system to apply in 2017? What KBK...

- KBK for profit Income tax: KBK-2019 Current as of: March 15, 2019. In field 104 of the organization’s payment order for...

KBK for an application for pricing and amendments to existing tariffs

Pricing is an integral part of a business that specializes in retail and wholesale trade. According to Art. 105.19 of the Tax Code of the Russian Federation Federal Law No. 146 of July 31, 1998 (as amended on December 27, 2018), entrepreneurs and organizations do not have the right to set tariffs freely. The price consists of several factors, and the final figure is regulated by the tax legislation of the Russian Federation. Thus, in order to set a price, a citizen must obtain appropriate permission.

To pay the state duty for the formation of the tariff or changes in the latter, the Ministry of Finance updated the BCC for 2018–2019: 182 1 08 07320 01 1000 110