OGRN is the main state registration number of the record of the creation of a legal entity. persons or records of the first submission in accordance with the Federal Law of the Russian Federation “On State Registration of Legal Entities” of data on legal entities. a person who was registered before the entry into force of this Law.

Is there a OGRN of an individual entrepreneur (IP) or is it assigned only to legal entities?

Yes, there is, and it’s called OGRNIP (main state registration number of an individual entrepreneur).

OGRNIP is assigned by the tax office when an individual undergoes the procedure of state registration as an individual entrepreneur or an entry about an individual entrepreneur is made in the Unified State Register of Individual Entrepreneurs (USRIP).

OGRNIP is assigned only once!

There are also GRNs - these are state registration numbers. These numbers are issued when any changes are made to the register of individual entrepreneurs. This happens when, for example, a new passport has been received. Each state registration number also has its own date, and they indicate exactly the specific date of making changes to the data in the Unified State Register of Individual Entrepreneurs. The date of issue of the OGRNIP is considered to be the date of the first entry in the Unified State Register of Individual Entrepreneurs, that is, the date of issue of the first OGRNIP upon registration of an individual entrepreneur.

Certificate OGRNIP

After assigning a main state number to an individual entrepreneur, he receives a certificate of state registration of an individual entrepreneur or, in other words, a certificate of OGRNIP.

Where can I get OGRNIP?

You can obtain a OGRN as an individual entrepreneur at the interdistrict tax office where the individual entrepreneur is registered.

Decoding OGRNIP

The registration number of the entry that is entered into the Unified State Register of Individual Entrepreneurs consists of 15 characters. They are arranged in a certain sequence: S G G K K N N X X X X X X X

Each of the 15 characters of OGRNIP is deciphered as follows: C (1st character) - state registration number in the entry to the main state registration number of the individual entrepreneur.

YY (2nd to 3rd digit) - the last two digits of the year, this is the sign of entry into the state register.

KK (4th, 5th characters) - according to the list of subjects of the Russian Federation, serial number, which is established by Article 65 of the Constitution of the Russian Federation. NN (6th and 7th digits) - code number of the interdistrict tax inspectorate that issued the OGRN to a legal entity. ХХХХХХХ (from the 8th to the 14th digit) - the entry number that is entered in the state register during the year. H (15th digit) is a check number, which is the low-order digit of the remainder of dividing the previous 14-digit number by 13.

So deciphering OGRNIP is not so difficult, but how can you check its correctness?

Checking OGRNIP

To check the ORGNIP for correctness, you need to use the following algorithm:

- First, we divide the 14-digit number obtained by discarding the last 15th digit in the OGRNIP being checked by 13.

- From the resulting number in step 1, discard the remainder and multiply by 13.

- We subtract from the number obtained in step 1 the number we received in step 2.

- We check the received figure with the check number (15 digits) of the OGRNIP being checked. If the numbers match, then the OGRNIP being checked is correct; if not, it is incorrect.

Example of checking OGRNIP

Let's say you need to check OGRNIP 304500116000157

- 30450011600015/13=2342308584616,5;

- 2342308584616*13=30450011600008;

- 30450011600015-30450011600008=7;

- Since the resulting figure coincides with the verification number, the OGRNIP being verified is correct.

How can I find out the OGRNIP in order to decipher the numbers in the number or check for correctness? Very simple.

Step-by-step instruction

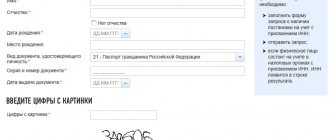

In 2020, the easiest way to find out the registration number is to check the TIN online. To do this you will need to perform several steps:

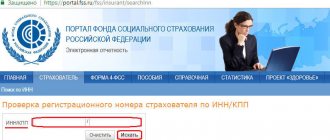

- go to the official website of the Pension Fund;

- at the top the user will be asked to select the region of registration of the legal entity;

- A link “Contacts and addresses” will appear just below. Below it there will be a link “Branch”, which will open a new page;

- on the new page there will be a link with the department’s email address;

- look at the 3 digits after the @ sign in the email address. This will be the branch registration number. Citizens can also find out the number in the Pension Fund of the Russian Federation from the document of the organization in the selected region by reading the letter of the Pension Fund of the Russian Federation No. AK-15-26/6863. There will be a table listing all the codes of Russian regions. On the left side of each one you need to add a 0 to get the first 3 digits of the area code. Using this code, the full registration number is searched for on the Pension Fund website using the TIN;

- remember or copy 3 numbers. Go to the bottom of the page and find the site map. There will be a link to “Electronic Services”, and then to the user’s personal account;

- Several lines will appear where you need to enter the code found earlier. The user fills in only the first field, the rest remain empty. Then click the “Login” button;

- A new page will open and a graphic block will appear on the right asking you to remember your personal registration number. Click on the picture;

- enter the TIN of the legal entity;

- enter a picture to verify the user;

- Click on the option “Find reg. number in the Pension Fund of Russia."

How to find out OGRNIP

You can order information from the local state statistics department, where the OGRN number of the individual entrepreneur is contained in the extract from the statistical register. We immediately warn you that ordering an OGRNIP extract is not free.

You can also find out the entry number of the individual entrepreneur in the register in the extract from the Unified State Register of Individual Entrepreneurs. It is from these documents that the entrepreneur learns his OGRNIP. Based on the extract, if necessary, you can find out the OGRNIP by TIN ,

for example, check a specific entrepreneur-counterparty, etc.

Extract from the Unified State Register of Individual Entrepreneurs

p>The extract from the Unified State Register of Individual Entrepreneurs includes information about the individual entrepreneur as of the date of the last changes. Therefore, in accordance with the law of the Russian Federation, in an extract from the Unified State Register of Individual Entrepreneurs you can obtain the following information: - Full name, - OGRNIP, - INN, - citizenship, - place of residence in the Russian Federation, - date of state registration as an individual entrepreneur, and the data of this document confirming the fact of entry in the Unified State Register of Entrepreneurs, records of the specified state registration, - method and date of termination by an individual of activities as an individual entrepreneur - information about the types of activities, - information about licenses received by the individual entrepreneur, - information about changes in information contained in the state register - date of registration, registration number , name of the body that registered the individual entrepreneur - registered before 01.01. 2004

ipinform.ru

As an employer

When an entrepreneur receives the status of an employer and signs an agreement with an employee, he must contact the Pension Fund and undergo an additional registration procedure.

The pension fund requires a standard package of documents:

- a copy of the employee’s passport and TIN;

- a copy of the entrepreneur’s passport and TIN;

- an employment contract signed by both parties;

- a copy of the USRIP document;

- a copy of the citizen insurance certificate;

- a copy of the registration statement of an individual entrepreneur.

The list of documents may change, so it is recommended to call your local Pension Fund office in advance.

Registration of an entrepreneur without hired employees occurs automatically after receiving a unique number; citizen participation is not required. If the employer has already registered an employee for work, he must once again approach the Pension Fund and receive a new status, which the tax office will then find out about.

Registration of an individual entrepreneur in 2020 includes obtaining a registration number, with the help of which executive services recognize the organization.

The state carefully monitors individual entrepreneurs’ compliance with all rules, requirements, laws and regulations that are related to the registration of their business and payments to the budget.

https://www.youtube.com/watch?v=S4dzsjM948U

For failure to comply with their obligations, the entrepreneur will receive an administrative fine, and persistent violators will have their accounts blocked.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Where can I get OGRNIP

There are situations when a registration number may be urgently needed if an individual entrepreneur has lost his number or there is no certificate of its assignment, or if you need to find out the registration number of a counterparty.

1. If the registration of an individual entrepreneur is carried out for the first time , then the future individual entrepreneur needs to appear at the Federal Tax Service at the place of registration and write an application for registration as an individual entrepreneur. Have with you:

- passport and its photocopy;

- a receipt from the bank confirming payment of the state fee for registering an individual entrepreneur (800 rubles);

- You may also need a notarized power of attorney - if the documents are not submitted by the applicant himself;

- a certificate of no criminal record - if you work in the field of education or raising children;

- notification of the choice of tax regime in two copies (otherwise you will have to work for OSNO);

- for foreign citizens - a copy of the work permit, a copy of the residence permit and a notarized translation of the passport;

- for minors - notarized permission from parents to conduct business activities.

Three working days after submitting the application, you will be able to pick up the Unified State Register of Entrepreneurs (USRIP) entry sheet, which will indicate everything about the individual entrepreneur, including the registration number.

2. If you have already been registered as an individual entrepreneur , but for some reason you do not have a registration number, write an application to the Federal Tax Service at your place of registration for the issuance of a sheet from the Unified State Register of Individual Entrepreneurs. You will receive the document within three working days.

3. To find out the registration number of the counterparty , go to the official website of the Federal Tax Service and indicate his full name and the region in which he is registered. You can also search if you know the TIN.

The concept of OGRN and interpretation of the OGRN code

Often people use abbreviated versions of concepts or abbreviations in their vocabulary, unaware of the exact interpretation and meaning. The widespread, and so familiar to everyone, abbreviation OGRN can be attributed to this category.

The abbreviated name OGRN is literally revealed: the main state registration number. That is, in meaning, this concept itself means the serial number of the record regarding the registration of a legal entity, or the very first provision of the necessary data about a newly formed legal entity, which was recorded before the time the Draft Law “On State Registration of Legal Entities” came into full force.

OGRN has a standard form of a number of thirteen digits, which is intended for mandatory registration of registered legal entities in the annals of the Unified State Register (USRLE).

Each OGRN has its own specific ordered structure:

- The initial character is the same in all numbers, it is equal to one and determines the code or sign of the OGRN.

- The next two digits of the number contain information about the final two digits of the year in which the entry was made in the state register.

- The next two digits of the number reflect the code of the region of Russia according to the official regional list, which is recorded in Article 65 of the Constitution of the Russian Federation.

- Next in the number is a series of seven digits , which reflects the official serial number of this entry from the beginning of the year.

- Finally, the final digit in the number is the test code of the state number for this registration; a control number that is logically obtained by dividing the entire previous twelve-digit number of a given number by eleven. In cases where the remainder of this division is ten, the control number is written as zero.

The issuance of certificates with main state registration numbers is the responsibility of the tax office, which is located directly at the place of registration of a private entrepreneur or organization.

For an enterprise, the notorious state registration number (OGRN) is an important source of information, with which you can obtain more extensive data about the legal entity itself, for example, from public sources.

This information may be as follows:

- Who is the direct founder of the organization, who is the director;

- Is this registered company active for a given period of time;

- Legal address (that is, the actual place of registration) of this company.

What is a registration number in the Pension Fund of Russia

This is a number that identifies a businessman in the Pension Fund of the Russian Federation. It is assigned to the entrepreneur at the time the person is registered with the territorial branch of the Pension Fund. After entering information about the new company into the register, the tax office will transfer the data to the Pension Fund.

Entrepreneur registration information

The fund registers the entrepreneur and assigns him a registration number. A notification is sent to the citizen’s address; in real life, the document is often delayed for several weeks. SNILS and businessman registration number are the individual numbers of the taxpayer and the recipient.

It is important to know that an entrepreneur does not have to register with the Pension Fund of the Russian Federation himself. This rule applies to companies with workers hired by the manager or without personnel.

For your information! Since 2020, registration of individual entrepreneurs has been simplified: the inspectorate receives a notification from the tax office about the emergence of a new legal entity.

Individual tax number

Does the individual entrepreneur have a OGRN and TIN? We have already decided on the first one. Let's try to figure out the second one.

Since 1997, TIN began to be provided to individual entrepreneurs. Today, all business entities and individuals have this number. For the latter, however, there is a caveat that they may not receive it. But if this person has registered as an individual entrepreneur, then a TIN becomes necessary for him. But at the same time, it is necessary to take into account that if, before registering as an individual entrepreneur, an individual already had this number, then he will now take on the role of an economic entity.

What is this IP code for? Like any legal entity, an entrepreneur must provide the tax office with accounting and financial statements, which must indicate the TIN, as well as the OGRNIP.

What it is

The registration code of entrepreneurs is assigned by the Pension Fund and consists of 12 digits, which indicate:

| First 3 digits | indicate the place of registration in Russia of the entrepreneur. This is different from the insurance number that the IRS uses. |

| Next 3 digits | indicate the area of the city where the case was opened |

| Last 6 digits | indicate a unique code |

When registering a business with the Pension Fund, the entrepreneur will be required to obtain a compulsory insurance policy.

Regardless of the chosen method, the entrepreneur will receive an insurance policy, which must be presented in the following cases: in the emergency department, public hospitals and clinics.

If an individual entrepreneur has employees, they are also required to obtain insurance from any insurer; the choice is not limited.

The difference between OGRN and OGRNIP

As we have already found out, a potential answer to the question “Does the individual entrepreneur have a OGRN?” - “Yes,” but it is necessary to clarify that it is called OGRNIP. What are the fundamental differences between them?

OGRN includes 13 digits, and OGRNIP - 15. The first is used when registering such business entities as legal entities, and the second - such as individual entrepreneurs.

This is where the difference between them ends.

What can you find out from OGRNIP

The main purpose of the OGRNIP is to be used for official purposes by the tax inspectorate and statistical authorities. What can be learned from the OGRNIP for an entrepreneur and other interested parties:

- Basic clarifying information about the individual entrepreneur.

- TIN, which was not indicated in the details or was indicated with errors.

- Information about the presence of a potential counterparty or partner on the blacklists of the Federal Tax Service will help reduce risks for business.

- Entrepreneur’s rating on various specialized resources, history of participation in tenders, etc.

- All identification codes assigned to the private entrepreneur and other information about him. Including the OGRNIP, you can request the full name of its owner, citizenship, date of registration as an individual entrepreneur, current licenses, information about the termination of his activities.

In general, the OGRNIP code allows you to obtain important information that can be used to check a potential counterparty and partner, or to obtain additional missing information about him. All data that can be obtained using the identifier is completely current and reliable, since it is provided directly from state registers, updated quarterly. Knowing the number can significantly reduce business risks and simplify interaction with counterparties.

A REFUND

Money for the “vypiska-nalog.com” report can be returned in full.

The money is returned based on a detailed and substantiated claim.

If you want to make a return, you will need to do the following:

- Write an application in free form and send it to: [email protected]

- In the application, be sure to indicate the reason why you believe that the service was not provided in full

- Also indicate in the application the desired method of returning funds, indicating all the details necessary to make the payment.

The application is reviewed within 1 – 2 working days. The funds will be returned to you within 1 to 3 business days.

ABOUT THE VIPISKA-NALOG.COM PROJECT

The service was developed in accordance with paragraph 1 of Article 7 of the Federal Law of August 8, 2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”, providing for the provision of information contained in the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs about a specific legal entity/individual entrepreneur in electronic form document.

The service provides an opportunity for interested parties to obtain information from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs about a specific legal entity/individual entrepreneur in the form of an extract from the relevant register/certificate in the form of an electronic document signed with an enhanced qualified electronic signature.

To receive an extract/certificate, the applicant's electronic signature key certificate (SKP) is not required. The extract/certificate is provided no later than the day following the day of registration of the request. The generated extract/certificate can be downloaded within five days. The extract/certificate is generated in PDF format

Attention! Based on the provisions of paragraphs 1 and 3 of Article 6 of the Federal Law of April 6, 2011 No. 63-FZ “On Electronic Signature”, an extract/certificate of the requested information in electronic form, signed with an enhanced qualified electronic signature, is equivalent to an extract/certificate of the requested information on paper. , signed with the handwritten signature of an official of the tax authority and certified by the seal of the tax authority.

How to find OGRNIP by TIN or last name

- send a request to receive an extract from the Unified State Register of Individual Entrepreneurs (the tax service will process the request within 7 days, if necessary earlier, you will have to pay extra);

- open an electronic database on the Internet, enter your TIN or last name, send a request;

- attract third parties who have access to detailed government information without data and pay the appropriate fee for the service.

If you open the electronic database, you can get only a minimum of information about the individual entrepreneur, and to find out the registry. IP number and other details, you will have to pay a little.

Which type of leasing is more profitable for individual entrepreneurs: we’ll tell you in our review.