What is the FSS pilot project - direct payments

The pilot project assumes that the payment of temporary disability benefits from the Social Insurance Fund is made directly to their recipients, bypassing employers. This program has been in effect since 2011, and is called “Direct Payments”.

According to the plan, this project is designed for the period until December 31, 2019. However, this year amendments were adopted that extended it until 2020.

The main goal of this project is to speed up the employee’s receipt of disability benefits, and to relieve employers of the burden of paying these benefits to their employees. By the beginning of 2019, 39 regions are participating in this project, and this year it is planned that 20 more regions will join them in two stages.

Attention! When an insured event occurs, the employee is issued a certificate of incapacity for work by the medical institution. He presents it to his employer, who within five days must fill out an application based on it and, after signing it, send it to the Social Insurance Fund. Further payments are made directly by the Social Insurance Fund, and not by the employer.

If the number of employees is more than 25 people, then the application must be sent in the electronic register via telecommunication channels.

Within 10 days, the territorial bodies of the Social Insurance Fund review the received documents, and if properly completed, the employee will be directly paid funds to pay for sick leave at the expense of social insurance. It is carried out by transferring funds to the employee’s card, or through a postal transfer.

Attention! If the employer has closed its activities, or its location is unknown, then the employee can apply for payment to the social insurance authorities independently, submitting all the documents they need.

Features of the project “Direct Payments” of benefits.

Before the pilot project was introduced, employing organizations independently calculated benefits and then paid them. Payments largely depended on the financial position of the company. If she experienced difficulties, then this was reflected in the citizens receiving benefits.

In turn, “Direct Payments” changed this algorithm. Now benefits are paid directly from the Insurance Fund to persons insured under OSS. And employers transfer contributions in full, without reducing them by the amount of benefits paid. This sequence was approved by the 294th Government Resolution dated April 21, 2011.

Initially, only two regions were covered by the project, but starting in 2021, direct benefit payments will extend to the entire territory of the Russian Federation. The implementation of the program is aimed at increasing the level of social protection of the population, creating transparency in matters of payments and assignments of benefits, as well as leveling costs, reducing the time for their calculation and processing.

In accordance with the pilot project, employing companies adhere to the following algorithm of actions:

1. They do not independently calculate or transfer social benefits to employees. The FSS is vested with these obligations;

2. It is necessary to inform employees about:

- Changed procedure for transferring benefits;

- Acceptable methods of receiving payments with the need to issue a bank card, personal account and provide accurate information about the place of residence and official registration;

- Terms of payment of social benefits.

3. Insurance premiums are paid according to their accruals in full;

4. Documents for the corresponding categories of benefits are accepted from personnel. And then this information is sent to the Foundation;

5. The policyholder pays at his own expense:

- Weekends for caring for disabled children, provided additionally (reimbursed by the territorial Social Insurance Fund);

- Costs of measures to prevent injuries at work (reimbursed by the territorial Social Insurance Fund);

- Burial (reimbursed by the territorial Social Insurance Fund);

- The first three days of sick leave.

6. When filling out the 4FSS form, information on the calculation of contributions and benefits is not entered.

What payments does the FSS compensate?

According to general rules, an employee has the right to receive the following payments from the insurance fund:

- Payment under a certificate of incapacity for work for days exceeding three days paid by the employer. If the certificate of incapacity for work is a continuation of another sick leave

- A benefit for a certificate of incapacity for work, which is fully paid for from the Social Insurance Fund (for example, sick leave for child care).

- Maternity benefit.

- A one-time payment for registering a pregnant woman in the early stages.

- One-time payment upon the birth of a child.

- Payment for child care until he reaches one and a half years old.

You might be interested in:

Non-payment of wages: what the law says, payment terms, employee actions, employer liability

The procedure for processing benefits and other payments using the Social Insurance Fund portal

It is possible to apply for benefits through the FSS website. The start page contains a special section “Personal Account”. It can be used by policyholders, insured persons and ITU employees.

The medical institution fills out the sick leave form electronically. The form contains information that is indicated in the paper version . After registering the document, the company specialist fills out its sections through a special option service. Next, a special register is formed and sent to the fund.

After clicking the button, recipients of the subsidy are redirected to the State Services portal. Therefore, you need to have an account on this resource. Next, the SNILS number and password are entered, and the citizen’s actions are confirmed. The person returns to the fund’s website again, where a personal account opens.

The insured person can track all subsidies and monetary transactions through his personal account on the FSS website, use the calculator, and make a request. However, he will not be able to submit papers on his own initiative. This option is allowed in some regions when a citizen uses the State Services portal.

What documents are drawn up and how can they be submitted?

to submit documentation for a specific type of payment within six months :

- from the moment of recovery or official recognition as disabled - for a subsidy that compensates for lost income during the period of temporary disability;

- from the date of completion of maternity leave - compensation for sick leave in connection with maternity;

- from the date of birth of the newborn - one-time assistance after birth;

- from the moment the baby turns one and a half years old - for care maintenance.

The employee brings documents to the employer. Employees of the personnel department and accounting department process them and send them to the fund within 5 days. FSS specialists, in turn, credit the money before the end of 10 days.

Each type of benefit has its own list of documents. In all cases, an application is written in a special form.

Package of documents for payment in connection with temporary disability:

- sick leave;

- copy of ID.

To receive maternity leave:

- sick leave due to maternity;

- a certificate from the doctor of the medical institution recording the fact that observation began before the 12th week of pregnancy;

- copy of the passport.

A one-time benefit on the occasion of the birth of a newborn is accrued after submitting:

- registry office certificates;

- birth certificate;

- information from the place of employment of the second spouse that compensation was not accrued to him;

- decisions of the guardianship authorities if the newborn is adopted.

Monthly maintenance for up to one and a half years is assigned on the basis of:

- copies of the order on parental leave;

- documents about the birth of the child and previous children;

- papers on taking a minor into custody;

- information from the employer of the second parent that he was not assigned maintenance;

- copy of the passport.

https://youtu.be/GLNq0IQTgkk

What documents need to be submitted

The list of documents that the employer needs to provide to the Social Insurance Fund depends on the reason for paying benefits:

- Regular sick leave for illness: Application in the form “Appendix 1”;

- Certificate of incapacity for work;

- Accident report – if sick leave was issued as a result of an industrial accident.

Attention! If the Social Insurance Fund has reasons for a justified refusal to pay benefits, this decision is communicated to the employee within 2 days from the date of its adoption.

- Maternity benefit: Application in the form “Appendix 1”;

- Certificate of incapacity for work;

- Certificate of registration in early consultation (if available);

- Application in the form “Appendix 1”;

- Application in the form “Appendix 1”;

- Application in the form “Appendix 1”;

- Application in the form “Appendix 7”;

- Application in the form “Appendix 6”;

- Application in the form “Appendix 8”;

Issues related to the transition to direct payments of social benefits to employees from the Social Insurance Fund of the Russian Federation

The final transition of all Russian regions to direct payments from the Social Insurance Fund will be completed in 2020, and from January 1, 2021, amendments to the federal law on social insurance will come into force, enshrining the principle of direct payments.

However, employers will not be able to completely get rid of the hassle of social payments to employees.

What types of benefits are paid under the direct payment system?

- Payments of insurance coverage directly from the Social Insurance Fund of the Russian Federation concern the following benefits:

- for temporary disability (including due to an accident at work and (or) occupational disease);

- a one-time benefit for women registered in medical institutions in the early stages of pregnancy;

- for pregnancy and childbirth;

- lump sum benefit for the birth of a child;

- monthly child care allowance;

- payment of leave (in addition to annual paid leave) to the insured person injured at work.

- The employer retains obligations to assign and pay the following social benefits:

- temporary disability benefits for the first 3 days of the employee’s illness;

- payment for 4 additional days of care for disabled children;

- social benefit for the funeral of a deceased employee.

The employer pays the temporary disability benefit for the first 3 days of an employee’s illness on sick leave to the employee entirely at his own expense, but the employer pays for 4 additional days of caring for disabled children and a social benefit for the funeral of a deceased employee, and then reimburses for account of funds of the Federal Social Insurance Fund of the Russian Federation. In this case, the offset principle does not apply!

Also, at the expense of the Federal Social Insurance Fund of the Russian Federation, the employer can be reimbursed for the costs of financing preventive measures to reduce occupational injuries.

Thus, if we take as an example the most common insurance case for temporary disability due to an employee’s illness, the employee will receive his temporary disability benefit in 2 stages:

- for the first 3 days of illness - from the employer,

- for other days - from the Social Insurance Fund to your bank account or by postal transfer.

What does the abolition of the offset principle mean for an employer?

For employers, the abolition of the offset principle means that insurance contributions for compulsory social insurance of employees in case of temporary disability and in connection with maternity, as well as insurance against industrial accidents and occupational diseases, are no longer reduced by them by the amount of expenses incurred for the payment of social benefits, and are paid to the Social Insurance Fund of the Russian Federation in full, i.e. 100%.

What are the responsibilities of the employer when directly paying benefits from the Social Insurance Fund of the Russian Federation?

The employer’s obligation is to transfer the necessary documents and information regarding the insured event to the Social Insurance Fund of the Russian Federation within 5 calendar days.

To do this, the employer creates a package of documents on paper or an electronic register with the necessary documents and information for the assignment, calculation and transfer of benefits.

Electronic registers of information in the established form, certified by the electronic signature of the employer, are submitted by employers whose average number of employees for the previous billing period is over 25 people, as well as newly created (including during reorganization) organizations whose number of employees exceeds this limit.

For small and micro enterprises with a workforce of 25 people or less, as well as newly created (including during reorganization) organizations with a specified number of individuals, they have the right to submit to the Federal Social Insurance Fund of the Russian Federation applications and documents on paper with an inventory of the established form or an electronic register.

Are there any time limits for the submission of documents by the employee and the employer to receive benefits?

The employee himself can apply to the employer for benefits no later than 6 months from the date of termination of the insured event,

- For example:

- for a one-time benefit at the birth of a child - no later than 6 months from the date of birth of the child,

- for child care - no later than 6 months from the date the child reaches the age of one and a half years.

The employer, as mentioned above, within 5 calendar days from the date of receipt of documents and applications from the employee is obliged to transfer them or an electronic register of information to the appropriate branch of the Federal Social Insurance Fund of the Russian Federation.

The Fund has another 10 calendar days to make a decision and transfer the payment to the employee.

Can an employee independently submit documents for the payment of his benefits to the territorial body of the Federal Social Insurance Fund of the Russian Federation?

As a general rule, no. Only through the employer.

If the employer is active (not liquidated), then the employee cannot independently apply to the FSS of the Russian Federation, but he has the right, on behalf of the employer, to transfer paper documents to the territorial body of the FSS of the Russian Federation, as well as fill out and sign all the necessary documents if he has a power of attorney from his employer.

But if the employer has ceased its activities at the time the employee applies for benefits (liquidated in accordance with the procedure established by law) or it is impossible to establish the location of the employer and there is a corresponding order from the bailiff, then the employee can directly apply to the Fund branch to receive benefits by submitting the necessary documents and an application for payment of the corresponding benefit.

Does the employer need to contact the Federal Social Insurance Fund of the Russian Federation if the employee’s incapacity for work lasted only 3 days?

If the employee’s incapacity for work lasts 3 days, then the employer does not need to contact the Social Insurance Fund of the Russian Federation, since the Social Insurance Fund of the Russian Federation does not pay benefits for the first three days. By law, this is the exclusive responsibility of the employer.

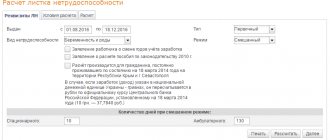

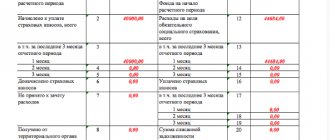

How to process and reflect the accrual of benefits on a payroll payroll?

In the payroll and payslips, the employer reflects only the temporary disability benefit for the first three days of the employee’s illness, since it is assigned and paid from the employer’s own funds, without compensation from the Social Insurance Fund of the Russian Federation.

Funds from the Social Insurance Fund of the Russian Federation received by an employee from the Social Insurance Fund of the Russian Federation do not appear in the employer’s records.

Direct payments of benefits and personal income tax

In the 2-NDFL certificate, the employer no longer indicates the amount of benefits paid to the employee from the Social Insurance Fund of the Russian Federation.

However, in accordance with paragraph 1 of Article 217 of the Tax Code of the Russian Federation, benefits for temporary disability (including benefits for caring for a sick child) are subject to personal income tax.

The Federal Social Insurance Fund of the Russian Federation withholds and transfers personal income tax from the amount of temporary disability benefits and issues income certificates to recipients of benefits in Form 2-NDFL.

Thus, if an employee, for example, was ill for a long time and persistently, then he will receive disability benefits from the Social Insurance Fund of the Russian Federation minus personal income tax, and he will be able to confirm his income during his illness with a certificate in form 2-NDFL, for which he will have to apply not to the employer , and to the territorial body of the FSS of the Russian Federation.

Personal income tax is not levied on the amount of benefits for women who are registered with medical institutions in the early stages of pregnancy, for pregnancy and childbirth, in connection with the birth of a child and for caring for him.

✦ Memo on direct payments from the Social Insurance Fund of the Russian Federation for the employer

✦ Memo on direct payments from the Social Insurance Fund of the Russian Federation for an employee

Pilot project regions

- Altai region

- Amur region

- Astrakhan region

- Belgorod region

- Bryansk region

- Vologda Region

- Karachay-Cherkess Republic

- Nizhny Novgorod Region

- Kurgan region

- Novgorod region

- Novosibirsk region

- Tambov Region

- Khabarovsk region

- Republic of Crimea and the city of Sevastopol

- Republic of Tatarstan

- Rostov region

- Samara Region

- The Republic of Mordovia

- Kaliningrad region

- Kaluga region

- Lipetsk region

- Ulyanovsk region

- Republic of Adygea

- Altai Republic

- The Republic of Buryatia

- Republic of Kalmykia

- Primorsky Krai

- Magadan Region

- Omsk region

- Oryol Region

- Tomsk region

- Jewish Autonomous Region

- Kabardino-Balkarian Republic

- Republic of Karelia

- Republic of North Ossetia-Alania

- Tyva Republic

- Kostroma region

- Kursk region

- The Republic of Ingushetia

- Mari El Republic

- The Republic of Khakassia

- Kamchatka Krai

- Vladimir region

- Pskov region

- Smolensk region

- Nenets Autonomous Okrug

- Chukotka Autonomous Okrug

- Arhangelsk region

- Voronezh region

- Ivanovo region

- Murmansk region

- Penza region

- Ryazan Oblast

- Sakhalin region

- Tula region

- Komi Republic

- The Republic of Sakha (Yakutia)

- Udmurt republic

- Kirov region

- Kemerovo region

- Orenburg region

- Saratov region

- Tver region

- Irkutsk region

- Chechen Republic

- Chuvash Republic

- Yamalo-Nenets Autonomous Okrug

From July 1, 2020, the pilot project regions will also include:

- Republic of Bashkortostan

- The Republic of Dagestan

- Krasnoyarsk region

- Stavropol region

- Volgograd region

- Leningrad region

- Tyumen region

- Yaroslavl region

Benefits of direct payments

In the future, government agencies plan to transfer all regions to this mechanism, when the Social Insurance Fund calculates and issues benefits to temporarily disabled citizens independently.

This system has the following advantages:

- funds are transferred in full;

- the amount of payments is guaranteed to the applicant without taking into account the financial condition of the organization where he was officially employed and carried out professional activities;

- convenient ways to receive;

- absence of difficulties in communicating with the manager regarding the accuracy of amounts and accounting calculations;

- When applying to the Social Insurance Fund, a person is guaranteed the transfer of the due benefit in 100% of cases, provided that the package of necessary papers is collected in full, and the data contained in it confirms the fact of incapacity for work.

IMPORTANT! The applicant is entitled to funds only if he made contributions to the Social Insurance Fund, that is, he officially worked in the organization, and the employer sent monthly amounts for each employee.