The legislative framework

The guarantee of social security in case of illness or caring for a sick family member is reflected in the Constitution of the Russian Federation and in Art. 183 Labor Code of the Russian Federation. More specific provisions are contained in the acts:

- Federal Law No. 165-FZ dated July 16, 1999 reveals the basics of social insurance;

- Federal Law of December 29, 2006 N 255-FZ - mandatory social insurance of citizens, basic principles for calculating payments for illness and in connection with maternity;

- Resolution No. 375 of June 15, 2007 includes rules on special cases of accruals, coefficients for individual areas;

- Federal Law No. 125-FZ of July 24, 1998 regulates relations with the employer in case of accidents;

- Order of the Ministry of Health and Social Development dated 02/06/2007 N 91 contains the rules for determining length of service;

- Order of the Ministry of Health and Social Development dated June 29, 2011 N 624n approves the rules on certificates of incapacity for work.

Taxes and Law

Accounting and posting of temporary disability benefits, sick leave 2012 The organization's expenses for the payment of temporary disability benefits for the first two days of incapacity can be taken into account as part of expenses for ordinary activities (clause 5 of the Accounting Regulations “Organization Expenses” PBU 10/ 99 , approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n).

Based on the Instructions for the application of the Chart of Accounts for accounting the financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, to summarize information on settlements with employees of the organization for wages (for all types of wages, bonuses, benefits and other payments ) account 70 “Settlements with personnel for wages” is intended. The benefit accrued at the expense of the organization’s funds is reflected in the debit of the production cost account (for example, account 20 “Main production”) in correspondence with the credit of account 70. The accrual of temporary disability benefits at the expense of the Federal Social Insurance Fund of the Russian Federation is reflected in the specified account in correspondence with debit account 69 “Calculations for social insurance and security”, subaccount 69-1 “Calculations for social insurance”. Personal income tax (NDFL) calculation of benefits for temporary disability The amount of benefits for temporary disability is the employee’s income and is subject to personal income tax (clause 1 of article 210, clause 1 of article 217 of the Tax Code of the Russian Federation). The organization is a tax agent and is obliged to calculate the amount of personal income tax at a rate of 13%, withhold it when paying income to the employee and pay it to the budget (clause 1 of article 224, clauses 1, 4 of article 226 of the Tax Code of the Russian Federation). The date of actual receipt of income in this case is the date of its payment (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation, see also Resolution of the Eighteenth Arbitration Court of Appeal dated May 31, 2010 No. 18AP-3890/2010 in case No. A47-9420/2009 ). Consequently, temporary disability benefits form the tax base for personal income tax for this employee in January 2011. Obviously, the employee’s income this month, formed from wages for less than half a month and the amount of temporary disability benefits, will not exceed 40,000 rubles. Therefore, based on paragraphs. 3 clause 1, clause 3 art. 218 of the Tax Code of the Russian Federation, an employee has the right to receive a standard tax deduction in the amount of 400 rubles. subject to submission of a corresponding application to the organization. Note that, according to the explanation of the Ministry of Finance of Russia, given in Letter No. 03-05-01-04/105 dated April 27, 2006, it is not necessary for such an application to be submitted by the taxpayer annually. Until a taxpayer's right to one or another standard tax deduction changes, an “unlimited” application is possible, which will be the basis for the application of standard tax deductions for several years <*>.

The date of actual receipt of income in this case is the date of its payment (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation, see also Resolution of the Eighteenth Arbitration Court of Appeal dated May 31, 2010 No. 18AP-3890/2010 in case No. A47-9420/2009 ). Consequently, temporary disability benefits form the tax base for personal income tax for this employee in January 2011. Obviously, the employee’s income this month, formed from wages for less than half a month and the amount of temporary disability benefits, will not exceed 40,000 rubles. Insurance contributions calculation of benefits for temporary disability The amount of benefits for temporary disability does not accrue insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, compulsory social insurance against accidents at work and occupational diseases (clause 1, part 1, article 9 of Federal Law No. 212-FZ, subclause 1, clause 1, article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against accidents at work and occupational diseases"). Corporate income tax calculation of benefits for temporary disability For profit tax purposes, an organization's expenses for paying benefits for the first two days of an employee's incapacity for work are classified as other expenses associated with production and (or) sales (clause 48.1, clause 1, article 264 of the Tax Code of the Russian Federation) . Accounting entries (correspondence of accounts) calculation of temporary disability benefits when accruing sick leave 2012

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| Temporary disability benefits accrued at the expense of the organization (721.71 x 2) | 20 | 70 | 1 443,42 | Certificate of incapacity for work, Payroll |

| Temporary disability benefits were accrued at the expense of the Federal Social Insurance Fund of the Russian Federation (18,042.75 - 1,443.42) | 69-1 | 70 | 16 599,33 | Certificate of incapacity for work, Payroll |

| Personal income tax withheld <*> ((18,042.75 - 400) x 13%) | 70 | 68 | 2 294 | Tax card |

| Paid temporary disability benefits minus withheld personal income tax (18,042.75 - 2294) | 70 | 50 | 15 748,75 | Payroll |

Conditions for accrual and payment

Benefits are addressed to citizens of the Russian Federation and foreigners subject to a number of conditions:

- persons work under employment agreements;

- occupy positions of state or municipal employees;

- are members of the industrial cooperation system or religious ministers;

- serve their sentences with paid labor.

Employers monthly transfer insurance contributions to the Social Insurance Fund, accrued on employee earnings.

Important! The amount of benefits directly depends on the official salary. Amounts received “in an envelope” do not contribute to an increase in social benefits.

Individual entrepreneurs, lawyers, notaries and some other categories can count on help if they voluntarily pay insurance premiums for themselves.

Payments are calculated and issued upon presentation of sick leave. The legislator stipulates the impossibility of receiving wages during the period of incapacity, that is, simultaneously with benefits.

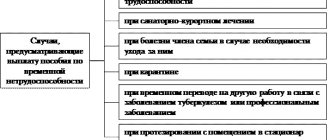

Release from duties occurs:

- for diseases and injuries;

- when caring for a sick family member;

- with being quarantined, including with a child under 7 years old;

- for prosthetics;

- when continuing treatment in a sanatorium after hospitalization.

Reimbursement of expenses from the Social Insurance Fund

In order to fully reimburse the funds paid to the employee for temporary disability, the accountant needs to collect the following package of documents and send it to the Social Insurance Fund:

- statement;

- calculation with posting;

- a copy of the employment contract with the employee;

- LN (according to the established image).

Application for payment to the Social Insurance Fund

After accepting all documents, FSS employees conduct an inspection and determine the amount of compensation to the employer for the benefit paid.

Reduced amount or denial of benefits

Payments can be made by the policyholder based on the minimum wage for the following reasons:

- failure to comply with doctor’s instructions, including failure to appear for an appointment, will result in the calculation of a reduced benefit from the date of the violation;

- illness or injury resulting from any type of intoxication - for the entire period of incapacity.

Refusal to accrue due to the following reasons:

- intentional infliction of harm to health (including attempted suicide). The fact must be proven in court;

- the onset of illness in connection with the commission of a crime intentionally by a person.

For some periods social guarantees are not provided:

- releasing an employee from performing his duties (except for vacation);

- suspension from work with no accrual of insurance premiums;

- arrest, forensic examination;

- downtime that began before going on sick leave.

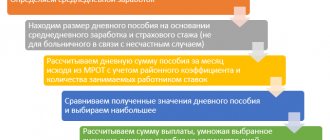

The procedure and algorithm for calculating the amount

The calculation of the due amount depends on indicators such as length of service, average salary and period of incapacity.

Work experience

The duration of work activity determines the payment standard. The period includes all work experience during which employers or the individual themselves paid contributions to the Social Insurance Fund. The length of service is recorded by a work book, and in its absence:

- employment contracts;

- orders;

- pay slips.

Important! Part-time work does not imply summing up the terms of activity at different places of employment. The coincidence of periods leads to a person's choice of which one should be taken into account.

Average earnings

When calculating the indicator, the total earnings for the 2 years preceding the year of incapacity for work are used. All types of accruals from which insurance premiums are paid to the Social Insurance Fund are taken into account, among them:

- time-based, piece-rate payment;

- bonuses, allowances, additional payments;

- vacation pay, business trips.

Important! If during the previous two years the employee was on maternity leave or there were few contributory payments, the employee has the right to choose another pair of years in order to receive more social support.

For new employment, income amounts are taken into account based on a certificate from the previous employer, which includes information about periods of activity and sick leave, and wages. The data form is fixed by Order of the Ministry of Labor dated April 30, 2013 N 182n.

Sick days

The period of release from work duties coincides with the period on the certificate of incapacity for work. There are some features:

- when undergoing further treatment in a sanatorium, financial support from the state is provided no more than 24 days in advance;

- assignment of disability is accompanied by benefits for 4 consecutive months, but not more than 5 months a year;

- patients with tuberculosis are entitled to payment until they regain their ability to work or have their disability group revised;

- care for a 7-year-old child is subject to payment only for 60 days a year, in some cases - up to 90 days;

- in case of illness of children 7-15 years old, the duration of sick leave is up to 15 days, in total for a year - up to 45 days;

- caring for a child with a disability - up to 120 days a year;

- in other cases - up to 7 days in a row, up to 30 days a year.

Calculation rules

The amount of temporary disability benefits depends on length of service:

- with up to 5 years of work experience - 60% of the average salary;

- 5-8 years - 80%;

- from 8 years - 100%.

Average earnings have limitations:

- the minimum monthly amount must correspond to the level of the minimum wage, from 01/01/2020 - 12,130 rubles. The case is provided for with less than half a year of experience;

- the maximum income for the 2 previous years is limited by law: in 2020, the results of 2020 and 2020 are taken into account - 755,000 and 815,000, respectively, for a total of 1,570,000 rubles.

Directly related to the calculation is the concept of average daily earnings - the result of dividing the total amount of wages by 730. For 2020, income per day is:

- from 11280 x 24 / 730 = 370.85 rubles (based on the minimum wage);

- up to (755000 + 815000) / 730 = 2150.68 rubles (limitation of the upper limit of annual earnings).

Important! The minimum wage current at the time of illness is taken into account for the calculation.

The final payment amount is the product of the number of sick days and average daily income.

Temporary disability benefit

In case of temporary disability, the employer pays the employee temporary disability benefits in accordance with current legislation. The amount of benefits for temporary disability and the conditions for their payment are established by federal law (Article 183 of the Labor Code of the Russian Federation).

Federal Law No. 202-FZ of December 29, 2004 (hereinafter referred to as Law No. 202-FZ) came into force on January 1, 2005 (Article 17).

According to paragraph 1 of Article 8 of Law No. 202-FZ, in 2005, temporary disability benefits (with the exception of industrial accidents and occupational diseases) are paid to the insured for the first two days of temporary disability at the expense of the employer, and from the third day - at the expense of the Social Insurance Fund RF. It should be taken into account that this procedure is used only in the case of illness and injury, including domestic injury, of the employee himself (letter of the Federal Social Insurance Fund of the Russian Federation dated January 18, 2005 No. 02-18/07-306).

Temporary disability benefits are fully paid from the funds of the Federal Social Insurance Fund of the Russian Federation in the following cases:

- due to the need to care for a sick child or family member;

- during quarantine;

- also in other cases established by law, when the disability is not directly related to the illness of the employee himself;

- in connection with an accident at work and occupational disease;

- maternity leave.

As for organizations and individual entrepreneurs using special tax regimes (USN, UTII, Unified Agricultural Tax), the procedure for paying temporary disability benefits for them remains the same. Let us remind you that at the expense of the Social Insurance Fund of the Russian Federation, a benefit is paid in the amount of 1 minimum wage (now it is 720 rubles) for a full calendar month, and the rest is paid at the expense of the employer.

Paragraph 2 of Article 8 of Law No. 202-FZ provides that the maximum amount of temporary disability benefits for a full calendar month cannot exceed 12,480 rubles (before January 1, 2005 - 11,700 rubles).

In addition, Article 7 of Law No. 202-FZ extended the validity of Article 8 of Federal Law No. 166-FZ of December 8, 2003. Thus, the calculation of the amount of temporary disability benefits in 2005 is made in accordance with paragraph 1 of Article 8 of the Federal Law of December 8, 2003 No. 166-FZ based on average earnings calculated in the manner established by Article 139 of the Labor Code of the Russian Federation and the Regulations on the specifics of the procedure for calculating average earnings fees approved by Decree of the Government of the Russian Federation dated April 11, 2003 No. 213 (hereinafter referred to as the Regulations).

Article 8 of Federal Law No. 166-FZ of December 8, 2003 states that temporary disability benefits are calculated from the average earnings of the employee at his main place of work for the last 12 calendar months preceding the month of the onset of disability.

In accordance with paragraph 2 of the Regulations, for calculating average earnings, all types of payments provided for by the remuneration system that are used in the organization are taken into account, regardless of the sources of these payments.

According to paragraph 8 of the Regulations, in all cases, except for the use of summarized recording of working hours, the average daily earnings are used to determine average earnings.

Average daily earnings are calculated by dividing the amount of wages actually accrued for the billing period by the number of days actually worked during this period.

Consider the following example.

Example

In January 2005, the employee was on sick leave for 10 working days due to illness. The employee's salary is 10,000 rubles. The employee does not receive any other payments other than wages in the amount of salary. All working days for the period from 01/01/2004 to 12/31/2004 were fully worked by this employee. The employee's continuous work experience is more than six years.

In this case, settlements with the employee on a certificate of incapacity for work must be reflected in accounting as follows.

First, let's determine the average daily earnings, which in the situation under consideration will be equal to 478.08 rubles. (RUB 10,000 x 12 months) / 251 days, where 251 days. - the number of working days in the billing period (from 01/01/2004 to 31/12/2004) with a five-day working week).

Further, the amount of daily temporary disability benefits depends on continuous work experience. The employee's continuous work experience is more than six years. This means that the employee must be paid 80%* of the average daily earnings, that is:

RUB 382.46 (RUB 478.08 x 80%)

Note:

* Maternity benefits are paid in the amount of average earnings, regardless of the length of continuous work experience, taking into account the maximum amount of benefits (letter of the Federal Social Insurance Fund of the Russian Federation dated January 12, 2005 No. 02-18/07-81).

The maximum amount of daily benefits that an organization can pay from the funds of the Russian Federal Social Insurance Fund is equal to:

RUB 12,480 : 15 days = 832 rub.,

where 15 days is the number of working days in January 2005.

RUB 382.46 less than 832 rub.

Therefore, temporary disability benefits are paid to the employee based on actual earnings.

Next, we will determine the average employee’s earnings, which is determined by multiplying the average daily earnings by the number of days (working, calendar) in the period subject to payment (clause 8 of the Regulations). Then the total amount of temporary disability benefits due to the employee is RUB 4,780.80. (RUB 478.08 x 10 days).

Moreover, the amount of temporary disability benefits for two days that the employer must pay is 956.16 rubles. (RUB 478.08 x 2 days). The amount of temporary disability benefits at the expense of the Federal Social Insurance Fund of the Russian Federation is 3,824.64 rubles. (RUB 478.08 x 8 days).

Calculation example

Let's look at the input data:

- the employee provided the accounting department with sick leave for 10 days;

- 6 years of experience - payment standard 80%;

- earnings for 2020 - 770,000 rubles, for 2020 - 805,000.

Calculation order:

- the income limit for 2020 is 755,000, used in the calculation;

- a similar limit for 2020 is 815,000, the employee received less, we take into account 805,000 rubles;

- P = (755000+805000) / 730 * 80% * 10 = 17095.89 rubles - the amount to be issued to the person.

Help for calculations

The Ministry of Health obliges the policyholder to attach a document containing the calculation of benefits to the sick leave certificate. After the accounting department receives the certificate of incapacity for work, a certificate is drawn up to confirm the correctness of the amount determined to be issued. It includes initial data, results broken down by payment sources.

The compiled document can be edited on general terms, indicating the position and decoding of the person making the amendment, endorsing the changes with his signature and date with the inscription “Believe the corrected one.”

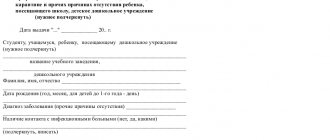

Procedure for completing the form

The legislator has not introduced a standard form of calculation. The policyholder has the right to develop it independently, reflecting this fact in the accounting policy. But it is recommended to indicate such basic details as:

- name of the employer, its registration number in the Social Insurance Fund;

- the name of the insured, his work experience;

- duration of sick leave;

- salary for 2 years;

- order of calculations, total;

- signature of the person who prepared the certificate.

The form for calculating temporary disability benefits can be downloaded for free from the link. A sample form is also available.

Personal income tax on sick leave

The amount paid to the employee for the period of temporary disability is included in income subject to personal income tax in accordance with subparagraph 7 of paragraph 1 of Article 208 and paragraph 1 of Article 217 of the Tax Code of the Russian Federation. Personal income tax is withheld upon actual payment of benefits to an employee by an organization acting as a tax agent (clause 4 of Article 226 of the Tax Code of the Russian Federation) and is reflected by an entry in the debit of account 70 “Settlements with personnel for wages” in correspondence with the credit of account 68 “Tax settlements” and fees."

Taking into account the above, we will reflect transactions for the payment of temporary disability benefits.

Debit 69 Credit 70 - 3,824.64 rubles, temporary disability benefits were accrued at the expense of the Federal Social Insurance Fund of the Russian Federation (4,780.80 - 956.16); Debit 44 (20, 26) Credit 70 - 956.16, temporary disability benefits accrued at the expense of the employer for 2 days; Debit 70 Credit 68 - 622 rubles, personal income tax is withheld from the benefit amount (4,780.8 x 13%); Debit 50 Credit 70 - 4,158.80 rubles, payment of temporary disability benefits was made.

Duration

The period of absence from work coincides with the periods specified in the sick leave certificate. To avoid errors, it is advisable to indicate in the certificate not only the start and end dates of temporary disability, but also the number of days of downtime.

Electronic sick leave certificates are becoming increasingly common. Their benefit is to reduce the number of filing errors that can cause problems in receiving benefits. Instead of the usual form, the medical institution issues a memo with the sheet number and treatment period.

Documentation and payment procedure

To apply for benefits, the employee must provide a document confirming the reason for deviation from official duties. According to Order No. 624 of June 29, 2011, the Ministry of Health approved a unified standard for drawing up a document confirming temporary disability.

Order No. 624 dated June 29, 2011

For the official release of an employee from his official duties due to illness, only personal documents drawn up in accordance with all the rules are accepted. The accounting department only accepts a document that clearly indicates the period of beginning and end of disability, as well as the reason (a code is written, not a diagnosis).

Payment source

The first 3 days of illness are paid at the expense of the employer, the rest of the period is paid from the Social Insurance Fund.

The issuance of funds to a sick employee is reflected in settlements with the Social Insurance Fund: with an increase in benefits, the obligation to pay contributions to the Fund decreases, which is recorded in the reporting.

Since 2011, the Direct Payments project has been operating in test mode. In 2020, more than 50 regions of the Russian Federation will be involved in it. It consists of transferring funds from the Social Insurance Fund directly to the insured:

- the policyholder pays for only 3 days of illness; he does not have to withdraw the rest of the money from circulation;

- payment of insurance premiums is carried out as usual and is not reduced;

- the funds received by the patient from the Fund are not indicated in the reporting;

- the transfer is carried out on the basis of documents provided by the employee at the place of work, and from there to the Social Insurance Fund.

Recognition of sick leave expenses

Based on paragraph 2 of PBU 10/99 “Expenses of the organization” (approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n), the amount of the benefit is not an expense in accounting, since it is paid from the funds of the Social Insurance Fund of the Russian Federation. For the same reason, the specified benefit amount is not taken into account for profit tax purposes. As for the payment of benefits at the expense of the employer, in accounting the amount of the benefit should be included as a cost, and when taxing profits, the following should be taken into account.

Changes that allow the costs of paying for the first two days of an employee’s illness at the expense of the employer to be taken into account as expenses that reduce the taxable base for income tax were introduced by Federal Law No. 204-FZ of December 29, 2004. This law supplements paragraph 1 of Article 264 “Other expenses associated with production and (or) sales” of the Tax Code of the Russian Federation with the subparagraphs necessary for accounting for such expenses.

So, according to subclause 48.1 of clause 1 of Article 264 of the Tax Code of the Russian Federation, the employer’s expenses for the payment of temporary disability benefits due to illness or injury (except for industrial accidents and occupational diseases) for the first two days of the employee’s incapacity for work in accordance with the legislation of the Russian Federation in the part not covered by insurance payments made to employees by insurance organizations that have licenses issued in accordance with the legislation of the Russian Federation to carry out the relevant type of activity, under agreements with employers in favor of employees in the event of their temporary disability due to illness or injury (with the exception of industrial accidents and occupational diseases) for the first two days of incapacity for work are taken into account as other expenses associated with production and sales.

Subclause 48.1 of clause 1 of Article 264 of the Tax Code of the Russian Federation applies to legal relations that arose from January 1, 2005 (Federal Law of December 29, 2004 No. 204-FZ).

Let's sum it up

Temporary disability benefits are received by any officially employed employee. Eligibility is confirmed by a sick leave certificate from a medical institution. Payments are calculated based on length of service, average income and period of illness.

Previous

For patientsFeatures of obtaining a medical report in form 001-GS/u

Next

For patients Concept and list of basic principles of health care, mechanism for their implementation

In what cases are sick leave paid?

Temporary disability benefits are paid in the following cases:

- illness or injury (including in connection with abortion surgery or in vitro fertilization);

- prosthetics for medical reasons in a hospital specialized institution;

- follow-up treatment in sanatorium-resort organizations located in Russia, immediately after the provision of medical care in a hospital setting;

- caring for a sick family member;

- quarantine of an employee, as well as quarantine of a child under 7 years of age attending a preschool educational organization, or another family member recognized as incompetent.