Non-insurance periods for sick leave and the formula for accounting for them in 2020 are one of the most common questions among accountants of private and public enterprises. This is due to the control of the Russian government over the correct reimbursement of financial compensation to employees undergoing treatment, as well as a large number of nuances in accounting for such periods.

What does it include?

The main thing here is Federal Law No. 400, or to be more precise, Article 12 of this law.

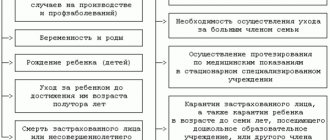

According to this document, non-insurance periods include:

- The period of removal from office in accordance with the Procedural and Criminal Code. Even if the citizen was later rehabilitated, points are no longer awarded.

- Operational search activities.

- Residence abroad of spouses of those who work as diplomats and ambassadors.

- Care provided for disabled people of group 1, minor children or persons over 80 years of age.

- Detention, even for unjustified reasons.

- Receiving unemployment benefits, participating in paid public works. Relocation periods according to civil service requirements.

- The care of one parent for the children until each reaches one and a half years of age.

- A period of temporary disability during which compulsory social insurance benefits were paid.

- Military and other service with equal values.

https://youtu.be/dc4PMfHhBj0

Rules for filling out sick leave

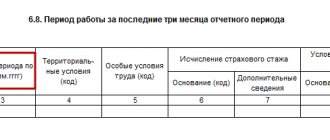

To indicate the non-insurance period, a separate column is provided on the certificate of incapacity for work. This information is entered by an authorized representative of the employer. Entries are made in accordance with the general rules:

- in cells, starting from the first, without going beyond the boundaries;

- black ink;

- in block letters or by printing on special devices.

In the designated cells indicate the number of years and months of military service. The countdown has been going on since 2007.

Non-insurance periods on sick leave - what is it?

Usually this refers to periods when a citizen served in the following structures:

- FSIN.

- FSKN.

- Ministry of Emergency Situations.

- Ministry of Internal Affairs

- RF Armed Forces.

Service in the RF Armed Forces means any type of service - both urgent conscription and contract. During this time, no fees are paid for the citizen.

Moreover, any type of activity must have documentary evidence. This rule applies equally to all structures listed above.

The following are most often used as identification documents:

- Certificates from government agencies.

- Labor contracts.

- Work books.

- Military IDs.

The manager himself must obtain confirmation that during the specified time period the citizen associated his activities with one of these structures. If there is no evidence in writing, then the periods are simply removed from the insurance record. Because of this, temporary disability benefits are smaller.

How to calculate your pension: what the Pension Fund won’t tell you

A new pension system began to take shape in the USSR back in 1990. During this time, it went through a series of reforms, the intricacies of which are almost impossible to understand. But we succeeded!

Now the Pension Fund independently converts and calculates pensions for all periods of work - sometimes with a large error. Complex formulas and schemes did not make this mechanism transparent and clear even for the fund’s employees themselves, who prefer to read out excerpts from the federal law on pensions when answering all questions. We will figure out how to monitor the work of the Pension Fund and prevent several years from accidentally disappearing from your work experience, and several thousand rubles from your pension itself.

Experience

the

fact that seniority is the total number of years worked.

The Russian Pension Fund considered that this definition was too simple and understandable, and canceled it. Now officially this term is used only in relation to people who have work experience before the beginning of 2002. Everyone else is already accumulating insurance experience

.

Essentially, this is the same thing, but there is a difference - the length of service takes into account the years of activity, and the insurance record takes into account the years in which the employer transferred insurance contributions to the Pension Fund. In this new model, the size of the pension does not depend on the number of years worked, but on the amount of payments to the fund. It is worth considering that to receive an insurance pension you need to have a minimum insurance period. It is currently 9 years and will reach a high of 15 years by 2024.

Minimum insurance period to receive a non-minimum pension

| Year | Experience |

| 2018 | 9 |

| 2019 | 10 |

| 2020 | 11 |

| 2021 | 12 |

| 2022 | 13 |

| 2023 | 14 |

| 2024 | 15 |

If your insurance period is shorter, you can only count on an old-age social pension, the amount of which is much lower - 5,180 rubles per month in 2020. Experience includes not only work activity, but also the so-called non-insurance periods - the time when payments to the Pension Fund are not made, but the years are still counted and in some cases points are added: military service, caring for a child, a disabled person or an older person 80 years old, period of receiving unemployment benefits and temporary disability. You can learn more about how many points and for what merits you can receive from our previous material.

Soviet and post-Soviet experience

Now people who worked before the collapse of the Soviet Union in 1991 are retiring. During this time, the pension system has undergone major changes - the process of calculating and calculating pensions has changed dramatically several times. The size of payments today depends solely on the number of points accumulated in the account. Although the system is the same, the way points are calculated differs depending on when you received your experience. Three periods can be distinguished: before 2002, from 2002 to 2014 and from 2020 to the present.

Calculation of length of service and pension until 2002

To understand how much pension you earned before 2002, you need to invest several hours of your time. It is very difficult to understand this system, especially for pensioners. Excessive trust in the Pension Fund can cost money - lawsuits against the Pension Fund demanding a revision of the pension amount are becoming common practice. But if you dare to take this step, you will have to start by calculating two coefficients.

Experience coefficient

(SC)

- your work experience is converted into this parameter. It is relatively easy to calculate. To do this, you need to know how many years you worked before 2002.

For men, it is calculated as follows: if your experience before 2002 is greater than or equal to 25 years, then use the formula:

SC = 0.55 + 0.01 x (experience - 25).

If you are less than 25 years old, then you don’t have to count anything - your SC = 0.55.

For women, the formula is slightly different. If the experience is greater than or equal to 20 years, we take a similar, but slightly modified formula:

SC = 0.55 + 0.01 x (experience - 20).

If less than 20 years, then again the coefficient is already approved for you - SC = 0.55.

Nobody knows where these numbers come from. But the value of this coefficient is legally limited. It cannot exceed 0,75

. If suddenly it turns out to be higher, automatically lower it to this level.

For example, Sergei has been working since 1981. Thus, his work experience as of January 1, 2002 is 20 years and 6 months (according to the rules of the Pension Fund of Russia, we round up to 20, contrary to mathematical rules). If you yourself don’t remember when you started work, all this data is written down in a certificate, which you can request on the State Services website, or see in your personal account. Since Sergey’s experience is less than 25 years, his experience coefficient is equal to 0,55

.

Average monthly salary coefficient (AMS) —

the ratio of your average monthly salary (SA) for the period 2000-2001 (or average monthly salary for any five years of continuous service) to the average salary in the country for the same period (SA). The formula looks like this:

KSZ = ZR / ZP.

Most likely, you do not remember your average monthly salary for the period 2000-2001 - the data can again be found in the certificate in paragraph 2.1. The average salary in the country at that time was 1,494.5 rubles

.

If you want to calculate salary for some other five-year period. You can use the calculator here. It also automatically calculates the average salary in the country for the period you select based on open data.

So, we calculate the KSZ for Sergei. To do this, we divide his average monthly earnings 2887,94

rubles from the certificate for the average salary in the country

is 1494.5

rubles.

We get - 1.93

.

The Pension Fund of Russia again, for unknown reasons, limits the maximum coefficient threshold to 1,2.

A good salary did not help Sergei - as a result, his

CV = 1.2.

Convert to rubles

Then, according to the formulas, the two coefficients are converted into rubles to calculate the estimated pension (RP) until 2002.

Let's return to the experience coefficient. If you have more than 0.55 (men whose experience before 2002 was greater than or equal to 25 years, for women more than or equal to 20 years), then take the formula:

RP = (SK x KSZ x 1671) - 450.

It is impossible to understand where these numbers in the formula come from. From the text of the Federal Law it follows that 1671 is the average salary in the country for the period from July 1 to September 30, 2001, established by the Government. Why exactly this period is taken into account - we do not presume to speculate. 450 is the amount of the basic part of the labor pension established by law as of January 1, 2002. For the sake of calculation, it is better for you to simply take these numbers as given.

If the result obtained after multiplication is in parentheses (SC x KSZ x 1671)

less than 660 rubles (the minimum calculated pension amount), then, according to Federal Law No. 173, the calculated pension is automatically equal to

210 rubles after deducting that very “basic part” of 450 rubles.

Don't ask why.

If the experience coefficient is 0,55

, then the formula becomes more complicated.

for men:

RP = (SK x KSZ x 1671 - 450) x (Experience until 2002 / 25)

for women:

RP = (SK x KSZ x 1671 - 450) x (Experience until 2002/20)

If the product (SK x KSZ x 1671)

again less than 660 rubles, then the formula changes.

for men:

RP = 210 x (Experience until 2002/25)

for women:

RP = 210 x (Experience until 2002/20)

Let's look at the example of Sergei. His experience coefficient was equal to 0,55

, salary coefficient

1.2

and

20

years of experience.

First, we calculate the product in brackets (0.55 × 1.2 × 1671) = 1102.86.

Since it is greater than 660, we subtract 450 from it. We get -

652.86 x (20/25) = 522.288

. This is the pension he collected over 20 years of work until 2002. Not much, right?

Valorization amount (SV)

Since in Soviet and early post-Soviet times, before the advent of the compulsory pension insurance system, people did not make monthly contributions from each salary in the amount of 22%, many pensioners simply physically did not have time to accumulate an insurance pension. Therefore, in 2010, everyone who had work experience before 2002 received a 10% increase in the pension already “earned” by that time. Those who worked during Soviet times before 1991 also received an additional increase - 1% for each year of experience. This valorization (that’s what this supplement is officially called) applies to everyone and even those who are just planning to retire.

For example, Sergei will retire in 2020. He worked for 37 years, ten of which were until 1991. The amount of his pension as of January 1, 2002 (we have already calculated it - 522,288

ruble) will be increased by 10% and by another 1% for each calendar year of “Soviet” service - a total of 10%. Only the full year is taken into account in the calculation. That is, if he worked for 20 years and 6 months, the length of service will still be rounded up to 20 years.

On paper the percentages look impressive. In fact, the government “supplement” is rather a mockery.

The formula for calculating the premium is as follows:

SV = RP x (0.1+0.01 x length of service before 1991)

If there is no experience before 1991, then simply multiply RP x 0.1.

Sergey will receive an additional payment as a reward for his Soviet and post-Soviet work: 522.288 x (0.1 + 0.01×10) = 104.457 rubles

.

And the total amount of his insurance pension (SP)

for 20 years of work experience will thus be

SP = SV + RP, that is, 626.7 rubles.

Indexing

This pension was indexed annually from 2002 to the end of 2014, until the Pension Fund of Russia switched to a point system. The value of the conversion index for these years was 5,6148

. Every year the Government adopted a resolution setting out the annual indexation amount. This number is the product of all indices for this period. Thus, our insurance pension (SP) increased by 5.6148 times. In general, you can use this calculator - it will automatically calculate how many rubles your pension has increased.

Let's calculate Sergei's pension for the first 20 years of work, taking into account indexation in 2014 - 626,7×5,6148.

We will receive

3518.8

rubles.

To convert the amount into points, you need to use their “cost” at the time of 2020, that is, 64.1 rubles.

By dividing our indexed pension by the cost of one point, we can calculate their number.

In the case of Sergei - 3518.8 / 64.1 = 54.9 points.

It is this figure that should be reflected in his personal account for the period before 2002 - on the website it appears under the name IPC - individual personal coefficient (obviously, the word “points” is again too simple for the Pension Fund).

Calculation of length of service and pensions from 2002 to 2014

In 2002, the Russian pension system was reformed again. Among other things, an insurance pension appeared. Accounting for length of service and pension savings was fully automated.

In the personal account of the insured person on the Pension Fund of the Russian Federation website, in the table “Information on periods of employment, insurance contributions for the formation of an insurance pension from January 1, 2002,” the amounts of insurance contributions accrued to the citizen are indicated for each year, starting from 2002 to 2014.

This money is converted into points by the Pension Fund itself. The mechanism, as usual, is not simple and not very transparent. Here a new value appears in the formula - survival age (Tdozh)

.

We assume that T here, as in physics, denotes time. By optimistic federal pension law standards, the average time you'll live after retirement is 228 months, or 19 years. Here the data contradicts Rosstat statistics. They estimate that the average survival age is 12.5 years. We would like to note that, unlike length of service, there is no differentiation depending on gender, although the average age of life of men and women in Russia is very different. But why take this into account? Your entire pension capital (PC) -

the total amount of insurance contributions, already taking into account the indexation from paragraph 2.4 in the certificate - is divided by this period.

That is, the amount of insurance pension (SP)

earned by you for the period from 2002 to 2014 is calculated as the ratio

SP = PC / Train.

Sergei’s certificate says that his pension capital for these 12 years is equal to 1 139 433,55

rubles

We calculate how much monthly pension he earned during this time. To do this, we divide his total capital by 228 months - the survival period. We get - 4997.51 rubles

.

To find out the points, we divide our insurance pension by the “cost” of a point at the time of 2020 - 64.1 rubles per piece.

As a result, he has

77.96

.

Together with the points for the period before 2002 - 77.96 + 54.9

(if you have already lost touch with reality - we counted them higher) the result is

132.86 points

.

Pension calculation after 2020

The amount of insurance contributions to the Pension Fund, as in the last chapter, is automatically converted into points or IPC. You can find them again in the help or in your personal account. In the three years after 2015, Sergei gained a few more points. In total it turned out - 157,942

.

Now let's calculate how much it will be in rubles. In 2020, one point is equal to 81,49

rubles We remember that Sergey still continues to work, and the “cost” of the IPC increases every year. The final payment will be made when he retires. If the law on raising the retirement age is adopted, then it will have a few more years left - so this is just an interim result.

If you served in the army, were on maternity leave, or had other “non-insurance periods” in your life, this should also be taken into account in the certificate - check.

To do this, to calculate the amount of pension, the total amount of points 157,942

multiply by

81.49

and get

12,870.7

rubles.

Plus, don’t forget about the fixed payment

, which is added to this amount and indexed annually.

Now it is equal to 4982.9

rubles.

Over 35 years

, Sergei earned himself a pension in the amount of

12,870.7 + 4982.9 = 17,853.6.

Compared to the average payments in the country, it’s not even that bad, but if he lives in Moscow, then his pension differs slightly from the minimum - 17.5 thousand.

Sergei has no problems with experience, but often you have to prove that you really worked. And this is not easy.

Patch holes in experience

The main document confirming the length of service and place of work, on the basis of which the calculation is made in the Pension Fund of Russia, is the work book. If there are not enough entries in it or they are made with an error (wrong dates, missing letters in the name), then the length of service can be confirmed with a certificate from the employer. If the company is already closed, you need to provide a certificate from the archive. In Moscow, a complete list of archives can be found here; for other cities and regions, you can use the website of the Federal Archival Agency.

Sometimes it happens that the work book was lost, and a request to the archive did not help in any way - the company may not have deposited any documents. There is also a way out of this situation: establishing the insurance period based on testimony. At the same time, witnesses must have documents confirming their work activity.

All the most important things are in our Telegram

Do you have interesting news from your region? Send them to our telegram bot.

Read us in Yandex.News.

If you find an error, please select a piece of text and press Ctrl+Enter.

Additional nuances

If the same time is associated with several places that are being counted, only one is chosen. To do this, the citizen draws up a written application. Breaks in work for calculating sick leave are practically irrelevant.

Any confirmation documents must include the following information:

- Work period.

- Description of the position.

- Address where duties were performed.

- Date of birth of the employee.

- FULL NAME.

- Number and date of issue.

The papers are usually transferred to the accounting department. Or another regulatory authority.

If the exact date is not indicated in the documents, then the countdown starts from the 15th. The average amount of compensation for temporary disability depends on the length of service during previous periods. The higher it is, the larger the payments. The highest rates are among those who, even with non-insurance periods, have worked for 5 years or more.

In any case, 100% will be paid to women who had maternity leave.

The more non-insurance periods, the lower the final amount of compensation will be.

Opening sick leave becomes an important point if your vacation coincides with illness. Without documents, it is impossible to confirm temporary disability. The validity of the documents begins from the first day of contacting doctors. And it doesn’t end until the issue itself is finally resolved.

Payment for sheets involves the following procedure:

- Calculate average earnings per day. We need to take the base for the previous two years, divide by the number 720.

- Next, calculate how much insurance experience you have.

- Benefits are being accrued, in a maximum of 10 days.

More about the concept

In 2007, the legislation related to the procedure for reimbursement of funds for certificates of incapacity for work underwent some changes. In particular, this applies to working time, which is taken into account when deducting the percentage of compensation from daily income. Previously, the total length of service was taken into account, but since the beginning of 2007, insurance experience began to be taken as a basis.

What is insurance and non-insurance experience? The insurance period is all periods of official fulfillment of official obligations at public and private enterprises, from the income received from which deductions were made in favor of the Social Insurance Fund . There are types of activities that exclude mandatory payments to the Social Insurance Fund. These types of employment can be divided into two groups:

- which are not taken into account when compensating for temporary disability (not indicated in the hospital document);

- those that are taken into account in the insurance period and constitute the non-insurance period on the sick leave.

Unpaid periods include:

- availability of official unpaid leave lasting more than two weeks throughout the calendar year;

- maternity leave;

- temporary suspension from performance of official duties due to the fault of the employee himself.

The terms of the above types of work not only do not provide for mandatory payments to the Social Insurance Fund budget, but will also not be considered when determining the percentage of daily compensation. But they will be included in the total length of service without fail.

When will refusal of payment for disability be legal?

In some situations, there is no payment for disability. usually due to the following situations:

- If the disease appeared during the validity of another document. For example, related to caring for a child or a sick relative.

- When problems arose during a vacation at your own expense.

- When illness coincided with maternity leave.

- When applying for sick leave. Then you can count on compensation in just a couple of days. This also applies if problems arose immediately after completion of training.

The main thing is to fill out all the cells on the sheet without going beyond the boundaries. Start with the first available free space. Use only black ink and block letters, even when filling out by hand. Or you can use modern technology.

Typically, information on non-insurance periods is filled out only by employers or their authorized representatives. It is important to prepare supporting documents correctly. The main requirement is that it can be seen that the information is related specifically to a specific citizen.

Entries in the work book must also comply with the rules and requirements of the law. The condition applies to any securities that continued to be valid for a specific period of time.

What should you pay attention to?

What to do if an error was made when filling out?

Letter No. 14-03-11/15-11575 of the Federal Social Insurance Fund of the Russian Federation dated September 30, 2011 explains what to do if an error was made when filling out a sick leave certificate.

According to the text of the Letter, if there are technical defects in the form filled out by hand (in other words, an error or typo), there is no need to reissue the form.

At the same time, it is impossible to refuse to assign and pay benefits if there are errors on the form.

The above rule applies only if all entries on the sheet are clearly legible and readable.

So, non-insurance periods include periods of labor activity in the Ministry of Internal Affairs, the Federal Drug Control Service, the Federal Penitentiary Service and other government agencies, as well as the period of military service or contract service in the army. Only service in the relevant structures starting from January 1, 2007 is recognized as non-insurance periods.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- Regions - 8 (800) 222-69-48

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Sick leave

Design features

Filling out a sick leave certificate is carried out in the same way as when drawing up a regular temporary disability document.

Standard algorithm:

- filling out the form by an employee;

- filling out the form by the medical institution;

- approval of sick leave in the accounting and personnel department of the organization.

Based on the legislation of the Russian Federation, for each employee with whom the enterprise has an employment agreement, it must calculate insurance premiums and transfer them to extra-budgetary funds. The period of mandatory payments is the insured value - the amount of the expected payment. The Social Insurance Fund keeps records of all payments made by the employer.

Regarding non-insurance compensation, the temporary disability form provides a separate column for proper accounting. The length of service is calculated on the basis of Russian legislation (it is necessary to constantly monitor the updating of standards and Federal Law costs). At a certain point in time, non-insurance intervals include military service and other performance of public debt.

Non-insurance period or periods are reflected in the form of temporary disability associated with military service (under contract or conscription) and other service provided for by the law of the Russian Federation.

Filling out the form

Based on the norms of current legislation, when filling out the temporary disability form in the insurance period section, you should indicate:

- The full number of months and years during which contributions were made to the extra-budgetary fund.

- Time spent serving in the army or fulfilling a duty to the state is a “non-insured event” line.

- It must be taken into account that the exact time of service in the army or the Ministry of Internal Affairs should be indicated. If the service took place before 2007, then the “insurance period” column is provided for it.

To determine the cumulative period upon the onset of temporary disability, temporary non-insurance period is of great importance. They have a huge impact on the amount of sick leave benefits reimbursed by the accounting department at the place of official work. In this case, all payments are made by the FSS. Consequently, the insurance period has the following time restrictions.

For the Russian Federation in 2020, the following frequency was provided:

| 8 years | The employee is guaranteed a full amount of compensation from the average wage. |

| 5-8 years | Only 80% is due. |

| 6 – 60 months | Refund in the amount of 60%. |

Citizens of a foreign state who are officially employed, as well as residents of Russia, have the full right to accrue insurance time, provided that the enterprise has made contributions to off-budget official funds.

For certain countries, there are some exceptions in which it is permissible to use the work experience that a non-resident had. What does it mean - this period of time will be used when calculating on the territory of Russia.

The main document when determining the general guard is the work book. This is a mandatory form that contains all the necessary information regarding the employment of an individual. Therefore, if a citizen wants to receive not only sick leave payments, but also prove his length of service when applying for a pension, its safety should be ensured. It is problematic to confirm your right based on certificates.

buhuchetpro.ru