Home / Labor Law / Labor Code / Work experience

Back

Published: 08/29/2018

Reading time: 9 min

0

8825

In order to calculate the duration of a person’s labor or other socially useful activity—his work experience—it is necessary to have documents confirming this activity. The main one is the citizen’s work book, in which the employer had to record the dates of hiring and dismissal.

If any periods of work are not recorded in it, the person must find any other supporting documents: extracts from orders, archival certificates, employment contracts.

- Manual calculation using a work book

- Online calculator

- Northern work experience

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

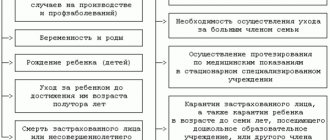

What is included in the length of service and how to calculate the periods?

How to calculate the length of service for calculating a pension?

Let's look at an example of a calculation.

https://youtu.be/eO_M2NoPeDg

Example No. 1

Condition: according to the work book, citizen Sergeev worked in the following periods:

- 17.09.1956 – 04.06.1957;

- 18.03.1960 – 08.07.1977;

- 08.01.1978 – 27.12.1978;

- 15.06.1981 – 13.09.1987;

- 07.03.1988 – 21.10.1991;

Additional length of service includes military service during the period: 06/07/1957 – 06/18/1959.

So, to calculate it you need to do the following:

- Let's sum up all the start dates of the work periods (we do it in a column, dot under the dot): 09/17/1956 03/18/1960 01/08/1978 06/15/1981 03/07/1988 06/07/1957 72.28.11820 (answer received).

- Let's sum up the end dates of work periods: 06/04/1957 07/08/1977 12/27/1978 09/13/1987 10/21/1991 06/18/1959 91.50.11849 (response received)

- What is deducted from length of service when calculating a pension? We subtract the first from the received answer in the second action 91.50.11849 72.28.11820 19.22.29 or 30 years 10 months 19 days (answer received)

- In the last action, we add one more day for each dismissal from work (the army does not count). In our case there are five of them.

Total: during his life, citizen Sergeev earned 30 years, 10 months and 24 days.

Using this method, you can do the calculation yourself. In the case considered, there was only one additional addition condition, but there are many others, which were mentioned above.

The entire period that a person works for the benefit of society is usually calculated by law according to two indicators: the total number of working years or the quality of the duties performed (they can be calculated depending on the type of work performed).

The periods included in the total length of service are taken into account in this calculation according to their actual calendar duration by summation (clauses 3–4 of Article 30 of Law No. 173-FZ of December 17, 2001). However, there are a number of exceptions, according to which the corresponding intervals are taken into account in an increased amount. For example, for both options for determining the total length of service for a full year, the time worked during a full season in seasonal industries is taken.

In calculating the length of service under clause 4 of Art. 30 of the Law of December 17, 2001 No. 173-FZ additionally increases the time:

- work in the Far North, in areas equivalent to it, in the zone of the Chernobyl accident - 1.5 times;

- conscript service in the army, work in leper colonies, anti-plague institutions, work during the Second World War (except for areas of occupation), living in besieged Leningrad, being in a concentration camp - 2 times;

- participation in hostilities and service in the zone of the Chernobyl accident, treatment of war injuries, work in besieged Leningrad, unjustified detention in places of detention - 3 times.

The right to choose a calculation formula and, accordingly, to evaluate the total length of service is reserved by law to the insured person. However, in practice, such a calculation is made by the Pension Fund based on the documents it has, choosing from 2 options the most profitable for the pensioner.

The length of service is assessed in years, months and days. In this case, 30 calendar days are taken for a full month, and 12 months for a year (clause 47 of the Government of the Russian Federation Resolution No. 1015 of October 2, 2014 and clause 35 of the previous Government Resolution of the Russian Federation dated July 24, 2002 No. 555).

The basic principle of calculation in all cases is the summation of time periods of a person’s work activity, which are documented. In the absence of a work record or inaccurate or incomplete information contained in it, the length of service can be confirmed by other documents:

- written employment contracts;

- certificates issued by the employer or government agency;

- extracts from orders;

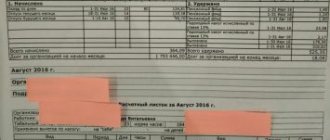

- personal accounts or salary slips.

The difference for different types of length of service is that when calculating benefits, insurance periods of time are taken as a basis, where breaks do not matter, and when calculating a pension, the length of service for a lifetime. If you want to calculate your length of service yourself, without using a work experience calculator work book online, use the following algorithm (clause 21 of the Calculation Rules, Letter of the Social Insurance Fund dated October 30, 2012 No. 15-03-09/12-3065P):

- We count the number of full calendar years for the period of interest;

- we count the number of full calendar months that are not included in full years;

- calculate the number of days remaining;

- we convert days into months based on 30 days in one month; we discard what doesn’t fit;

- convert months to years based on 12 months per year;

- We count the total number of years and the remaining number of months.

As you can see, the calculation is quite labor-intensive, so it’s quite difficult to do this without a special program.

Calculating length of service for sick leave: main points

As mentioned above, to calculate sick leave payments, you need to take into account only those periods of the employee’s work for which payments were made to the relevant insurance funds. In particular, the periods of work for:

- contract agreements;

- work book;

- employment contracts;

- individual entrepreneurship;

- public service.

In addition, when calculating the insurance period, contract service in the army and compulsory military service cannot be excluded.

An example of calculating length of service (according to a work book):

- We take all periods of work according to labor dates, starting from hiring to dismissal;

- we add them up, counting days, months and years separately;

- Now we need to convert days into months, and months into years.

For example, the amount of insurance experience according to the work book turned out to be 8 years 14 months 35 days. We convert months into years, we get: 1 year and two months, we do the same with days, as a result we have: 1 month 5 days. Now we add everything up and have the following result: 8 years 1 year 2 months 1 month 5 days = 9 years 3 months and 5 days.

For your information! There is no need to include time spent studying at a university or other professional educational institutions in the calculation of sick pay.

When calculating length of service, only those periods of work are taken into account when the employer contributed all due payments to extra-budgetary funds for the employee.

https://www.youtube.com/watch?v=ytpolicyandsafetyru

Attention! If at the same time an employee worked in two places at once, then to calculate the length of service for sick leave you need to take only one of them.

Why is it important to know the total insurance experience? The fact is that the percentage of payment from the salary of a sick employee directly depends on it.

How to calculate work experience using a work book

To calculate the time spent on work in a particular place, or rather its total value, does not require much knowledge and time.

Today this work can be done using various programs and Internet sites.

You need to start the process with preparing documents. These include:

- employment history;

- labor contract;

- collective agreement.

You take the dates when you started working in a particular place, as well as the end dates of your work, enter them into calculation programs and get the result online.

To make a full calculation of the total working time for an employee, you need to have only one document or a copy of it - a work book. There and only there the actual time worked at a particular enterprise is reflected. The entire count can be carried out either manually (with direct human participation) or by machine (only a special computer program takes part).

The system by which the entire length of service of an employee is calculated is called the calendar system. This calculation system implies the presence of some important factors, taking into account which you can successfully and without errors calculate the required and correct length of service:

- Each month worked must be counted as 30 days;

- The annual work period is 12 months;

- All individual indicators of different work intervals must be written out from the work book;

- Any period of work is carefully calculated by summing up the years, months and days of work at a particular enterprise;

- To combine all calculations, the amounts are added together.

It will also be important in the calculation that when summing up different periods of time, an employee will need to subtract one day from each dismissal from his place of work or service.

It is equal to the difference between the sums of the start and end dates of each period of the employee’s activity.

Accordingly, to calculate it, you need to subtract the amount calculated for hiring and the amount for dismissing the employee from each place of work.

The entire length of service for calculating the certificate of incapacity for work is calculated only on the basis of legislative documents developed specifically for these purposes.

To calculate it, you only need to provide your work book or a copy of it to the person involved in the calculations.

https://youtu.be/rc294B7K6Dg

An important rule when calculating! It must be remembered that length of service should not be equal to insurance coverage. These concepts are far from each other and are calculated differently.

For the calculation, in addition to the main period of the employee’s entire activity, other years included in the list of those included in the length of service are taken. These include:

- Military service;

- The employee’s presence in any educational institutions, regardless of what type of education he receives (the entire course of educational institutions attended and supported by documents is considered);

- Maternity leave (caring for a child up to 1.5 years old).

For general calculations of length of service, it will be necessary to attach the employee’s insurance length to all other indicators. All calculated number of days must be converted into an annual equivalent.

If there is no date in the work book entries, in such cases only a 14-day period of time is taken, no more or less.

In order to correctly calculate a certificate of incapacity for work in the absence of an employee immediately after he is hired, it is necessary to indicate not the average salary in all calculations, but only its minimum value allowed by law.

All calculations must be made strictly in accordance with current legislation and excluding any errors; for this, everything can be checked and recalculated several times. Otherwise, the employee may go to court with a claim for incorrect calculation of the day or year of service. And he will have every right to do so.

The following order must be followed when a problem is solved using this scheme:

- Writing down all the dates when the citizen was hired. It is better to write in columns, then it will be easier to calculate.

- Opposite the first column are the dates when the dismissal took place.

- For each month of work, months and years must be individually determined.

- The resulting results are added up, the final unit of measurement is days.

- The total result is determined in the form of full months and years. The easiest way to calculate your experience is online. The formula remains relevant in 2018.

Work experience consists not only of standard work record entries, but also other periods of time:

- Care for disabled people of the first group and disabled children, people over 80 years old.

- Stay in places of deprivation of liberty, if a verdict of not guilty is subsequently rendered.

- Socially useful work.

- Periods of moving to destinations from the workplace. Including if you attended an institute for this purpose.

- Periods of time for which unemployment benefits and temporary disability were issued.

- Leave to care for a child after his birth.

- Army, service in internal affairs bodies. Online work experience is determined taking into account all indicators. The same rules apply for 2020.

A work book is a document that is issued by almost every citizen. What to do if the status of an individual entrepreneur was issued for some time? Everything will be counted taking into account the following rules.

Such information cannot be entered into work books. But length of service is taken into account when determining the pension. It is enough to take a certificate stating that labor activity was carried out over a specific period of time. In this case, a minimum of 15 years is required to receive the minimum amounts. Northern experience is a different matter.

There is no prohibition in the legislation of the Russian Federation on part-time work or the issuance of two or more work books for one citizen. But creating a second copy of the document is not a mandatory action. When calculating, in any case, standard calendar days are used. Only one general entry is taken into account; the calculator does not consider others.

Sick leave is paid depending on how much time a particular citizen has worked.

- 60% of the average remuneration for work - if the length of service is from six months to 5 years.

- 80% of the average salary - if the experience is from 5 to 8 years.

- 100% - for 8 years or longer. Data is current as of September 2020.

If harmful and dangerous conditions were present, then the citizen receives so-called special experience; the certificate of incapacity for work also takes this into account.

The calculation is carried out in accordance with Federal Law No. 400-FZ dated December 28, 2013 “On insurance pensions”.

Previously, the concept of “work experience” was used, but since 2002 the clarified term “insurance period” has been used. It includes periods of deduction of funds from the employee’s salary to the Pension Fund of the Russian Federation, as well as others that the employee was able to justify. Thus, the insurance period represents the duration of working periods and other activities during which contributions for an employee are deducted to the Pension Fund of the Russian Federation.

When calculating (using an online calculator or manually, it doesn’t matter), the employer must adhere to the established requirements:

- Maintaining calendar order. The dates that are included in the work book (for individual entrepreneurs - in the tax return) are taken into account. If two or more periods coincide, the most profitable one is taken into account.

- Citizenship of the Russian Federation. If a person has the right to payment under the laws of a foreign state and there is no correlation with the norms of the Russian Federation, the period will not be taken into account in the calculation.

- Farming. Citizens working on private farms who are farmers will be able to include the time of such activity in their length of service, subject to contributions to the funds.

- Activities for an individual - subject to the implementation of activities under an agreement and payment of fees.

- Copyright agreement - subject to deduction of contributions to the funds.

- No retroactive effect. This means that if previously the period was included in the length of service, if the legislation changes, it may be included in the insurance period.

Work experience is the total duration of employment of an individual, taking into account official activities with all employers. In this case, periods of unofficial employment are not taken into account. Calculating length of service in a work book is important for:

- Definitions of insurance experience - for the purpose of calculating benefits for temporary disability (Article 7 of Law No. 255-FZ of December 29, 2006). The gradation is set at a level from 60% to 100% depending on the duration of work of the insured person.

- Definitions of total length of service - used to establish a citizen’s rights to pension payments (Article 2 of Law No. 166-FZ of December 15, 2001). All periods of employment of a citizen are included in the calculation.

In accordance with Art. 66 of the Labor Code, the calculation of length of service according to the work book is carried out on the basis of existing records of employment, transfers and dismissals. According to the explanations of the employees of the Pension Fund of the Russian Federation, other documents can be used for confirmation - archival certificates, orders, contracts, etc.

To answer the question of how to calculate length of service using a work book, you should first of all remember that the total length of service is all periods of employment of a citizen, and the insurance period is only those in which contributions to the Pension Fund were transferred from the employee’s remuneration. Taking into account the above and in accordance with clause 1 of Order No. 91 of 02/06/07, the following periods must be included in the insurance period:

- Employment under labor contracts.

- Employment in municipal or state service.

- Other employment, for periods of which insurance premiums are transferred from the employee’s salary.

- Periods of military service exceeding 6 months.

- Duration of training in secondary and higher educational structures.

- Periods for receiving unemployment payments.

- Periods of maternity leave.

- Days of illness.

- Write down all dates of admission to work places in one column.

- Enter the dates of dismissal in the column opposite.

- After determining the intervals, it is necessary to calculate the duration of employment for each employer separately.

- Then summarize the results.

Main types

All experience is divided into several categories:

- General;

- Insurance;

- Continuous;

- Work experience provided for under special conditions.

The concept of total length of service is no longer as relevant an indicator as it was, for example, a few years ago. The total can be understood as the sum of all years worked by an employee. This concept comes into force from the moment the employee retires or when calculating sick leave.

Insurance is considered to be the total number of years worked by an employee and who necessarily paid all mandatory insurance contributions during the period of his activity at the enterprise or organization.

Continuous means time actually worked for one or more employers. This concept is used when calculating many benefits or other financial charges for an employee.

The last type is the type of calculation of the employee’s time indicator, after which he has the right to early retirement.

Calculator for calculating length of service according to a work book

To make the calculation correctly, you will need a document confirming employment. This is usually a work book. However, during the period of activity there could be cases when the employer did not make pension contributions to the Fund. In this case, the Pension Fund does not take into account the period when there were no receipts of funds (Article 10, paragraph 1 of Federal Law No. 173). An additional condition for calculation is the fact that the citizen’s workplace must be located on the territory of the Russian Federation.

To calculate length of service you will need to perform the following steps:

- If you have a work book, enter the dates of admission and dismissal from work in the empty fields.

- Indicate the number of years spent serving in the Armed Forces.

- Select the number of children you had to care for during maternity leave. For one small citizen, the length of service is accrued within 1.5 years.

- Click the “Calculate” button.

The resulting period can be compared with data from the Pension Fund. The information is indicated on the first sheet of information about the status of the individual account of a citizen of the Russian Federation. You can obtain it from the Fund by personal visit or electronically through the State Services portal.

https://youtu.be/_whoVIKdI84

ATTENTION! If a citizen did not work under a contract, but was listed as an individual entrepreneur, the years for calculation can be taken in tax returns.

Enter the data into the calculator according to your work record and click - Calculate.

Currently, this is a truly convenient and accessible resource for everyone.

Its undoubted advantages are:

- simplicity;

- lack of special knowledge;

- counting speed;

- automatic operating mode.

All the user needs to do is enter the data known to him in special fields, and then click on the “Calculate” button. Next, the calculator will do everything itself and provide the finished result.

You can use any calculator by entering “Online experience calculator” in the search bar. Information about it can be found on the first pages of search engine results. You can also use the sites listed above.

An online calculator will simplify the calculation process, thanks to this solution there is less chance of making mistakes. Every 30 days are converted into a full month automatically. 12 months also instantly become a year.

The programs are applied using the following scheme, which allows you to calculate length of service:

- Day, month and year - the format in which the days of hiring and dismissal are entered. There are corresponding columns for this on the website. You need to rely on your work record book and other proof documents. Data is entered manually, or a special calendar form is used. Now many programs work automatically.

- Other periods of work experience that are not included in the book are also included in the program.

- The calculation button is located on the right side of the columns. You need to click on it.

- The reset button is used if a site visitor made a mistake when entering any information. After this, the data corresponding to reality is entered again. All that remains is to calculate the length of service.

There is a special program for calculating length of service using a work book - these are so-called online calculators. They serve to calculate the duration of activity, taking into account the time of incapacity for work according to the work book. You must enter data carefully to avoid calculation errors.

Let's look at step by step how to use our online work history calculator.

Step 1. In the “Date of hire” field, from the drop-down calendar, select (in accordance with the work book data) the required date, month, year.

Step 2. In the “Date of dismissal from work” field, select the required date, month, year from the drop-down calendar.

Step 3. If you work for more than one employer, or have other time to be included in the calculation, select the “Add period” field.

Step 4. From the drop-down calendar, again select the desired dates in the “Date of hiring” and “Date of leaving work” fields (which periods should be included in the calculation are listed below).

Step 5. Click the "Calculate" field.

In the “Result” position you will see the total of the calculation in years, months and days. The values calculated by the work record calculator can be copied and saved.

You can also write it yourself in an editor, such as Excel, or use other software available on the Internet.

Calculation of pensions using the new formula calculator online

In order to calculate the insurance period manually, you must:

- Convert every 30 days to 1 month.

- 12 months is equivalent to one year.

- The years add up.

Important!

The date of dismissal of the employee must be included in the insurance period.

The online calculator will help the accountant count all work time, up to one day, for sick leave, and the employee can easily check these calculations of length of service. Similarly, a calculator for calculating length of service based on a work book will help in determining the length of work until the day the employee goes on maternity leave. The convenience is that you can calculate the length of service, both as a whole and separately for different periods, for any length of time.

So, let’s figure out how to calculate length of service using a work book: a calculator will help you! To begin with, let’s choose any period when the employee worked. If a person continues to work, then as the end day of the period of time, you need to indicate not the date of dismissal, but the date preceding the day the illness occurred (the day you went on maternity leave).

If necessary, you can click the “ADD PERIOD” button and enter other dates. Then the work record calculator summarizes the time intervals.

When all the necessary time periods have been added, you can click the “CALCULATE” button

Thus, we figured out how to calculate the length of service from a work book using an online tool.

Influencing factors

After the reform, the IPC - Individual Pension Coefficient - was added to the influencing factors for calculating pensions. It is quite simple to calculate it by entering your salary before deduction of personal income tax into the form on the website. In another way, IPCs are called pension points. They affect old-age insurance benefits, which are calculated by multiplying points by the price of one point in a given year and summing these values.

Conditions for receiving old age benefits:

- Availability of retirement age: from 55 years old for women and from 60 years old for men.

- A certain number of years of experience in paying insurance premiums. From 2024 this figure will reach 15 years.

- Minimum number of pension points: 30.

Important: the number of points per year is limited. In 2020 it is 9.13, and in 2021 it is 10 for citizens who do not have pension savings. Otherwise, other figures appear: up to 6.25% in 2021.

It is worth remembering: the state regularly indexes the insurance pension, while the funded pension is in a non-state pension fund or management company, depending on the citizen’s wishes, and is not subject to indexation. Verified funds invest these funds in financially profitable projects, increasing the client’s income. If the programs turn out to be failures, then the client can only hope for the amount that he had already contributed earlier.

The PFR pension calculator allows you to calculate your future pension online and form your opinion on how to ensure your old age with dignity. It is not suitable for military personnel and law enforcement officers who do not have employment experience in civilian areas.

All calculations are approximate, the exact figure will be obtained after applying for cash benefits, when all pension rights and benefits will be calculated in each case. To simplify the calculations, some factors are assumed to be constant, taking into account that the person retiring will receive it in the current year.

Persons who worked in the Far North, caring for certain categories of citizens, have the right to increased coefficients for calculating benefits.

Self-employed citizens must annually transfer 1% of the amount of at least 300,000 rubles to compulsory pension insurance.

A small questionnaire is presented on the official website of the Pension Fund. You must specify:

- floor;

- year of birth;

- number of years of conscription service;

- number of planned children;

- duration of care for certain categories of citizens;

- the period after reaching retirement age during which a person refuses to pay cash benefits;

- official salary;

- type of work: self-employed or hired worker;

- seniority.

After entering all the data, you need to click the “Calculate” button.

On the page with the calculator there is also a column where you can calculate the number of pension points that can be received in 2020, taking into account wages before deduction of personal income tax (NDFL).

What is included in the insurance period

Usually, for the calculation, notes in the work book about the hiring and dismissal of the employee are accepted. The period of caring for a child who has reached 1.5 years of age is not included in the insurance period. If during maternity leave the parent worked under a contract, no work experience is accrued in addition to the vacation.

In addition to the summarized performance indicators of the employee who constantly paid insurance premiums, it should include:

- Any type of activity by an employee located both in Russia and abroad (and who paid mandatory insurance contributions);

- Any military service;

- Receiving mandatory benefits while on sick leave;

- The period of raising each child born in the family up to 1.5 years of age (the total stay should not exceed three years);

- The time when a person received disability benefits and participated in paid work of a public nature;

- Time of detention or exile which was subsequently unjustified or illegal.

- Time to care for a disabled person of group 1, care for a disabled child or a person over 80 years of age;

- Service under contract and all the time of residence at the time of service (but not more than 5 years);

- Time spent living abroad related to work at a consulate or any other diplomatic or political relationship (the duration of such service and residence should not exceed 5 years).

All of the above periods can be counted towards the length of service provided that there is public order work.

To independently calculate your work experience using a work book online, you need to know which periods can be included in it.

The current legislation gives a specific answer to this question: the duration of labor activity during which contributions to the Pension Fund of the Russian Federation were made (work under a contract, state civil or municipal service, activity in the form of individual entrepreneurs).

Not only periods of actual work activity, but also others are subject to inclusion in the length of service:

- military service (including activities that are equivalent to it);

- period of illness and receipt of social security benefits;

- a woman is on maternity leave;

- the time of being registered with the employment service as unemployed, including the period of paid public work, as well as moving to another place of residence for employment in the direction of the employment authorities;

- time spent in custody in case of unjustified prosecution or serving a sentence;

- time of care for each child up to one and a half years old (for one of the parents) - in total no more than 6 years;

- time spent caring for a person who is a disabled person of the first group, or an elderly person over 80 years of age;

- for wives of military personnel and diplomats - the time of accompanying spouses in the absence of employment opportunities (no more than 5 years).

In order to calculate not only the working time for pensions, but also for vacations, the following information is used:

- number of days actually worked;

- weekends, holidays;

- the length of time during which the employee retains his job (child care, vacation, sick leave);

- time of moving to get a job in another area in the direction of the state employment service;

- unjustified arrest and detention;

- forced absences;

- the duration of paid public work in the direction of the employment service, i.e. the need to work at an enterprise in the direction of government agencies.

The concept of experience

Working or insurance (the concept was introduced at the end of 2001) experience is understood as the total period during which a citizen officially carried out labor activities.

Those. In total, all episodes recorded in the work book are taken into account. Unofficial part-time work is not taken into account, regardless of its duration. This is due to the fact that an employee who is not registered in an organization in accordance with the Labor Code of the Russian Federation does not make systematic contributions to the Pension Fund and does not pay taxes.

Regarding maternity leave

Employment without official documents is not taken into account. The work book is used to calculate the following parameters:

- General fears. experience. This is important when assigning benefits for temporary disability. The citizen is paid from 60 to 100% of the total salary. The final figures are determined by how long the total duration of the period was, the flogging of labor was organized. The industry doesn't matter.

- General ordinary experience. It is necessary to understand what rights a citizen has regarding pension payments. All periods of significance are included in the calculation. The Far North is no exception.

Maternity leave is a continuous rest period of 140 days associated with pregnancy and childbirth. According to current legislation, this period of time is included in the length of service. The same applies to leave to care for a child until he reaches the age of one and a half years. But here legislators have created a certain restriction - the vacation should not exceed 4.5 years. Anything that goes beyond these limits is not subject to accounting. The pension is calculated without them.

If the length of service exceeds the norms, regulatory authorities will raise questions. At the same time, the Russian pension system does not take into account payments received in foreign countries. The length of service also includes periods associated with running a personal subsidiary plot and participating in any commercial associations. The same applies to work performed on the basis of a contract of employment. It is easy to calculate it based on contracts.

Why know the exact numbers?

Reliable information about time worked is used when calculating:

- pension* for length of service;

- days of vacation (annual labor and maternity leave) and related payments**;

- payment of sick leave**.

*In order to earn the minimum pension, you must be officially employed for at least 5 years.

**Continuous employment in the organization where the citizen is employed at the time of payment is taken into account.

Also, work experience (including continuous) is taken into account by many banks when considering a loan application.

If the duration of the insurance period is calculated incorrectly, this will result in erroneously generated amounts of social benefits.

For example, for working years of 8 years and above, the amount of benefits for caring for a sick child will be 100% of the average daily wage. If you do not take into account any period, then this figure can drop to 60% - this is how much is accrued for working activities of up to 5 years.