Payment of sick leave in 2020: calculation

The certificate of incapacity for work is submitted by the citizen at the place of work no later than six months after the date of its “closure”. The employer checks this document for authenticity and correctness. Then he is obliged to accrue and pay his employee, usually within a month, the corresponding allowance.

A sick leave is an official document issued in case of illness, and payment for work is carried out by the enterprise. Also, a certificate of incapacity for work can be issued to healthy people if they are caring for sick relatives, or to women in case of pregnancy and childbirth. Prescribed by a doctor for up to 15 days. If it is necessary to obtain this document for a longer period, a person must undergo a special medical commission.

Calculation of sick leave for part-time work in 2020

Sick leave benefits are understood as payments made by the employer in favor of a temporarily disabled employee, and such payments are due only to officially employed citizens who have consulted a doctor and issued a sick leave certificate.

To qualify for sickness benefits, self-employed people, as well as lawyers, notaries, farmers and members of northern indigenous peoples, must make payments to the Social Insurance Fund themselves.

Calculation of sick leave in 2020 for part-time work

If an employee is assigned part-time work, then the minimum amount of average daily earnings must be adjusted in proportion to the length of working time. And at what point should this be done - before it is compared with the actual average daily earnings or after? As of the date of signing for publication of the last issue of the journal, specialists of the Federal Social Insurance Fund of the Russian Federation believed that it is not possible to adjust the minimum wage when calculating the minimum average daily earnings for an employee who is assigned part-time work follows.

Of course, the right to compensation for payments from social insurance is given only by a genuine sick leave certificate, filled out in accordance with all the rules for its registration. Let us remind you that medical workers of institutions with an appropriate license for medical activities, as well as for some additional services in the field of medicine, have the right to issue sick leave. The document must indicate the name of the institution that issued it. In addition, the date of issue of the sheet, the patient’s full name, his date of birth and the reason for temporary disability are required, which is indicated by a special code, the decoding of which is given on the back of the sick leave sheet.

Calculation of average earnings for sick leave

- The benefit is calculated based on actual earnings (no matter how employees work, how many days they spent, how many hours).

- Earnings for the billing period are divided by the same 730, but the average employee’s earnings should not be less than the minimum wage!

If after calculations you end up with amounts less than the minimum wage, then you still need to take the minimum wage. The average daily earnings, calculated from the minimum wage, decreases in proportion to the length of working hours.

Accrual of sick leave during the transition period

Situations with “rolling” sick leave are possible - when the sick leave was opened at the end of 2020 (the minimum wage is 11,280 rubles), and closed already in 2020 (with the new minimum wage of 12,130 rubles).

In this case, the minimum wage in force on the day began . The only exception: sick leave from the minimum wage in 2020 will have to be recalculated if it was calculated for an employee with less than 6 months of experience (clause 20 of the Decree of the Government of the Russian Federation of June 15, 2007 No. 375, part 6 of article 7 of Law 255-FZ). Days falling within the period of validity of the new minimum wage are subject to recalculation. That is, days from 01/01/2020.

KEEP IN MIND

If the employee’s work experience is more than six months, benefits (including for employment and labor) calculated from the minimum wage, days of incapacity for work for which fall during the transition period, are not recalculated .

Calculation of sick leave in 2020: examples of calculation in a new way

Amount of earnings for previous years: 2020 – 346,000 rubles, 2020 – 511,000 rubles. These values do not exceed the maximum values determined in each year, in 2020 - 755,000 rubles, in 2020 - 815,000 rubles. It follows that the employee’s actual earnings will be used to determine benefits.

Once you have all the specified information in your hands, you can use the online sick leave calculator in 2020. This step will allow you to make calculations with minimal time and without errors.

We recommend reading: Khmao subsidies for the purchase of housing

How to calculate the amount of sick leave for part-time work and what determines the amount of payments

Persons who are absent from work due to illness are entitled to sick leave benefits for each day from the opening of the sick leave until they return to work. The amount of this benefit depends on the citizen’s earnings over the last two years, the cost of living and the region of residence.

Previously unemployed citizen M. got a job at the enterprise on December 1, 2020, then was on sick leave from September 1 to September 18 inclusive. On the date of opening of the sick leave, M.’s working day lasted 5 hours instead of the 8 hours required at this rate by agreement with the employer.

Calculation of sick leave in 2020 with examples

A separate category are women who were previously on maternity leave. They have the opportunity to independently choose the period that will be considered reporting for determining benefits. Experts advise taking the time when income was maximum.

The base limit for insurance premiums in 2020 is 815 thousand. But if monthly earnings are less than the minimum wage, then 12 minimum wages are considered for one calendar year, respectively, 24 minimum wages for two. Based on the average daily earnings, we find the amount of the daily benefit:

Examples of calculating sick leave taking into account the minimum wage, coefficients, and part-time work

When and how should this rule be applied? 1 - If there was no income at all. In this case, calculate the benefit based on the amount of the “minimum wage”. 2 - If the employee had income in the period required for calculation. In order to determine whether it is worth applying the instructions of paragraph 1.1 of the fourteenth article, make two calculations:

We remember that the amount of benefits is directly dependent on the employee’s length of service. Even if the benefit is calculated using the “minimum wage”, still take into account your employee’s insurance record. However, there are also some subtleties that must be taken into account when calculating. But let's look at specific examples

Sick leave for part-time work

But the regulation on the specifics of the procedure for calculating benefits for temporary disability (Resolution of the Government of the Russian Federation dated June 15, 2007 No. 375, as amended on March 25, 2013) states: clause 16. If the insured person is assigned part-time working hours (part-time work week, part-time working day) average daily earnings are determined in the same manner as provided for in these Regulations.

Thus, the wages of employees who work part-time are less than those of those employees who have a normal working day (week). This means that sick leave will also be paid in a smaller amount in the future.

Part time

where M is the minimum wage, RK is the regional coefficient (increment), H is the duration of the shift (in hours), P is the duration of a full shift at a given rate. If an employee works part-time, regardless of the length of the working day, then instead of the multiplier (B/P), the fractional part of the rate is substituted into the formula, for example, when working part-time, the multiplier is 0.5.

Example. Calculation of temporary disability benefits for a part-time employee

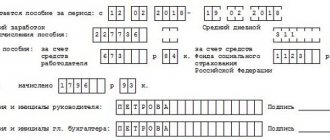

A sample of filling out sick leave from the minimum wage by an employer in Russia in 2020 makes it possible to exclude the entry of inaccurate or erroneous data and thereby influence the calculation of required payments.

In the line “TIN of the disabled person,” indicate the employee’s identification number, if he has one. If a person does not have a TIN, do not fill out this line. In the “SNILS” line, write down the insurance number of the employee’s individual personal account, which is indicated in his state pension insurance certificate.

The procedure for filling out a sick leave sheet line by line The registration number and subordination code are indicated in accordance with the notice of registration as an insurer issued to the employer by the territorial body of the Federal Social Insurance Fund of Russia.

Sick leave for part-time work

Externally, the 2020 sick leave certificate looks like this: When you receive the sick leave certificate in your hands, you need to check it very carefully for typos and errors. It’s better to redo everything on the spot than to come back later for a duplicate from your company’s accounting department (which will refuse to accept it).

- If the employee’s earnings are more than the minimum wage, then we calculate the benefit based on the employee’s earnings without applying the part-time factor;

- If the employee’s earnings are less than or equal to the minimum wage, then we calculate the benefit based on the minimum wage using the part-time coefficient. If in such a situation the benefit is calculated based on the full minimum wage, then the Social Insurance Fund will refuse to reimburse expenses during the inspection. Most courts adhere to the same position. But there is also an opposite decision, in which the court proceeds from the fact that if an employee is assigned a part-time working schedule (part-time work week, part-time work day), then the average daily earnings are determined in the same way as in the case when the employee has normal working hours and works full time

Sick leave for child care

Child care is not paid in cases where the caregiver does not need time off from work. Such cases include: paid leave, maternity leave for pregnancy and childbirth or to care for a child under 3 years of age, leave without pay.

If inpatient treatment is necessary, a certificate of incapacity for work is opened by the attending physician in the hospital. A family member receives sick leave only if they are constantly with the minor. In both cases, the following documents will be required to open.

Birth allowance if you have earnings and experience

If at the time of going on maternity leave the employee had both earnings and length of service, then the shortened working day will not affect the procedure for calculating benefits. This is due to the fact that maternity benefits in this case are calculated from average earnings, and it is not tied to the length of the working day.

If you have length of service and payments under an employment contract (GPC agreement), the benefit is calculated according to the formula:

SDZ x DO

Where:

SDZ - average daily earnings, which is calculated for the 2 years preceding the year of maternity leave;

DO - days of maternity leave (140, 156, 194).

Average daily earnings are calculated using the formula:

(ZP1 + ZP2): 730

Where:

ZP1 - salary for the first year preceding the year of maternity leave;

ZP2 - salary for the second year preceding the year of maternity leave;

730 — number of days in billing years. If one of them is a leap year, 731 days are taken into account. From these, exclude the days when the employee was on maternity leave, maternity leave, sick leave, or was released from work while maintaining her salary.

The calculated SDZ must be compared with the limit established for the year in which the calculation is made. SDZ limit is the maximum value of average daily earnings that can be taken into account when calculating benefits. It is determined based on the maximum base for insurance contributions to the Social Insurance Fund for each year involved in the calculation. In 2020, the SDZ limit is 2,301.37 (815,000 + 865,000): 730. More information about the procedure for calculating SDZ can be found here.

Calculation of sick leave and benefits when setting part-time work

Unfortunately, the FSS employees are right. As a general rule, the average daily earnings are determined by dividing the total amount of earnings accrued for the billing period by 730 days (part 3 of article 14 of the Law of December 29, 2006 No. 255-FZ and paragraph 15 of the regulation approved by the Decree of the Government of the Russian Federation dated June 15, 2007 No. 375). At the same time, this rule is also applied to calculate the average daily earnings of employees who are assigned part-time work (clause 16 of the regulation approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375). In a situation where, according to the results of the calculation, the average earnings for a full calendar month are lower than the minimum wage established on the day the illness began, such earnings are taken to be equal to the minimum wage. In this case, the value of the minimum wage must be reduced in proportion to the working hours of such an employee. This rule applies only to those employees who, on the day the sick leave was opened, had a part-time working regime established (Part 1.1 of Article 14 of the Law of December 29, 2006 No. 255-FZ). In your case, the employee carries out work and receives wages based on the actual time worked.

We recommend reading: Rights of registered adult children when dividing an apartment in Belarus

Insurance experience 45 years. Salary + RK + SN = 15,300. According to the time sheet, he works 2-3 hours a day. Salary is calculated in proportion to the standard hours/days for a 40-hour work week. Earnings for the accounting years amounted to 92,560.80. That when calculating the daily average - 126.80 rubles, i.e. less than the minimum average salary from the minimum wage - 182.60 rubles. Accordingly, the accruals amounted to RUB 3,725.04. (3067.68 at the expense of the Social Insurance Fund, 657.36 at the expense of the employer). The Social Insurance Fund asks to recalculate sick leave (as a percentage), since the employee works 2-3 hours a day, not 8 hours. The employment contract simply states the salary, the regional coefficient and the Northern bonus. Clarify please. Our employee is registered at full rate, not 1/2 rate; his full rate is indicated in the employment contract. But the working day varies due to professional needs - from 2 to 4 hours, instead of 8 hours (according to standard working hours)

How to fill out a sick leave certificate if your average earnings are less than the minimum wage

If an employee is assigned a part-time working schedule, a similar indicator is determined in proportion to the employee’s working hours according to the formula (Part 1.1 of Article 14 of Law No. 255-FZ of December 29, 2006):

What minimum wage should average earnings be compared to in 2020?

The accountant checked the amount received with the current minimum wage. The minimum wage per day is 367 rubles. (RUB 11,163 x 24: 730). This is more than the received value. Therefore, benefits must be calculated based on the minimum wage.

If the patient has a small average income or no income at all (if there is no average income), start calculating sickness benefits from this formula (clause 15.3 of the Regulations approved by Government Decree No. 375 of June 15, 2007):

- in March, the possible maximum is 306.1 rubles, the average value is higher than the maximum, so the maximum for this month is taken for payment and the total amount is 9489.1 rubles. (RUB 306.1 x 31 days);

- in April the possible maximum is 316.3 rubles, the average value falls within this maximum, so the amount payable for this month is 9359.1 rubles. (RUB 311.97 x 30 days);

- in May the picture is similar to March, the amount payable for the fifth month of 2020 is 9489.1 rubles;

- in June - as in April, the amount payable for this month is 9359.1 rubles;

- in July the picture is similar to March and May, but the payment is calculated not based on the full number of days in the month (31), but only for the 18 days attributable to vacation. The total amount is 5509.80 rubles. (RUB 306.1 x 18 days).

- in May and July 2020 – 11,163 rubles. : 31 days = 360.10 rub.;

- June 2020 – RUB 11,163 : 30 days = 372.1 rub.

Data for filling out sick leave if average earnings are less than the minimum wage 2020

This formula calculates the cost of one working day. To calculate the BL benefit, you need to multiply the resulting number by the actual number of days of incapacity. In addition, it is necessary to introduce a correction factor depending on the length of total work experience:

- violation by the insured person without good reason during the period of temporary disability of the regime prescribed by the attending physician;

- failure of the insured person to appear without good reason at the appointed time for a medical examination or for a medical and social examination;

- illness or injury resulting from alcohol, drug, toxic intoxication or actions related to such intoxication.

A sample of filling out a sick leave certificate from the minimum wage, taking into account the regional coefficient: Useful video Read about the rules for filling out a sick leave certificate by an employer here: Conclusions Correctly filling out a sick leave certificate is the responsibility of the employee’s employer. In each organization, the role of the employee filling out the sick leave certificate lies either with the accountant or with the head of the human resources department. The employer should carefully consider all recommendations and rules for document execution in order to avoid unpleasant consequences, including when calculating payments from the minimum wage.

Minimum wage for calculating sick leave in 2020

Is it necessary to pay sick leave benefits to an external part-time employee if she is caring for a child under 3 years old at her main place of employment? It is necessary if she also worked in this company for 2 years preceding the illness. The nature of employment at the basic rate does not matter. Question No. 4. An employee has been employed at the company for 2 months in his main position and part-time. How can I pay him for sick leave? If the worker has submitted a certificate f. 182n from the previous place of work, then according to her data, if he did not work anywhere for the previous 2 years - from the minimum wage. Payments to a part-time worker are not taken into account. Question No. 5. How to determine length of service when calculating sick leave benefits for an external part-time worker? You need to ask the employee to provide a copy of the employment record from the main place of employment.

This is interesting: 330 31 01 1 what sleep

For part-time work, the size of the sick leave benefit is reduced in proportion to the rate only if the benefit is calculated based on the minimum wage. If the average monthly income for the last 2 years of work is higher than the minimum wage, then hospital payments will not depend on the size of the rate.

Sick leave for part-time work: procedure for calculating benefits

In the case under consideration, the average earnings were 90.17 rubles. Also part 1.1 art. 14 of Law N 255-FZ establishes that if the insured person did not have earnings during the periods specified in Part 1 of this article, and also if the average earnings calculated for these periods, calculated for a full calendar month, are lower the minimum wage established by federal law on the day of the insured event, the average earnings, on the basis of which benefits for temporary disability, maternity, and monthly child care benefits are calculated, are taken equal to the minimum wage established by federal law on the day occurrence of an insured event.

Calculation of sick leave for part-time work. Employee rate 0.25, 2 hours of work per day. Sick leave from 01/21/2011 to 01/25/2011. The total income in 2009 was 29,750 rubles, in 2010 it was 36,076.21. Consequently, the average daily earnings is 90.17, which is less than the average daily wage calculated on the basis of the minimum wage without taking into account part-time work, but more than the average daily earnings calculated taking into account part-time work, 142.36 and 35.59, respectively.

Part-time work: calculation of sick leave benefits

Next, you need to make an entry in the accounting records to reflect the amount of the additional payment: debit 69, subaccount “Settlements with the Federal Social Insurance Fund of the Russian Federation,” credit 70. Let us recall that additional payment of temporary disability benefits is subject to personal income tax. That is, tax must be withheld from the additional payment amount.

The amount of the minimum average daily earnings is 106.77 rubles. (RUB 4,330 x 0.75 x 24 months: 730). It is more than the amount of average daily earnings (106.77 rubles > 106.16 rubles), so we apply the norm of Part 1.1 of Art. 14 of Law N 255-FZ and further calculation of benefits is based on this amount.

Calculation of sick leave: changes in 2020, examples of calculation according to the new rule

For sick leave in 2020, this is 1473.00 (718.00+755.00) thousand rubles. That is, the average daily salary cannot be more than 2020 rubles 81 kopecks. If the estimated earnings are higher, the value determined by the maximum amounts is applied.

This will affect the amount of disability benefits, which are calculated when the employee has a very small salary, or there is no information about the salary for the two previous years. This is due to the fact that instead of paying the employee, in these cases the minimum wage is applied.

We recommend reading: Does a Mother of Many Children Have the Right to a Shortened Working Day?

Part-time sick leave

Company employees performing internal part-time duties will only need one certificate . The document is drawn up and sent to the organization’s accounting department. The length of service is summarized for two places of work, and the certificate of incapacity for work is paid based on the total length of service and average earnings for the two previous years.

- Calculation of average earnings for the previous two years . To do this, the employee is required to submit certificates of his salary for the specified period.

- Average daily earnings are calculated by dividing the total salary by the number of days - 730.

- The amount of the benefit is determined. The resulting figure is multiplied by the number of days of incapacity.

- The amount received is multiplied by a percentage of income , depending on the insurance period.

Calculation of sick leave in 2020 in a new way: example of calculation

- work under an employment contract;

- state civil or municipal service;

- military and other service specified in the Law of February 12, 1993 No. 4468-1;

- periods of other activities during which the employee was subject to compulsory social insurance in case of temporary disability and in connection with maternity.

The calculation period for paying sick leave is two calendar years that precede the year of onset of the illness or other insured event. The duration of the billing period is always 730 days; do not exclude any days from the calculation. This is stated in parts 1 and 3 of Article 14 of the Law of December 29, 2006 No. 255-FZ.

Filling out a sick leave sample from minimum wage 60

Now it is recommended for legal entities to use the status “01”, and individual entrepreneurs – “09”. A tax specialist talks about how to include prizes, financial assistance, as well as wages and vacation pay paid at the end of December in the 6-NDFL calculation. From 01/01/2020, insurance premiums in case of temporary disability and in connection with maternity must be paid to the Federal Tax Service. And for reimbursement of benefits, as before, you must contact the Social Insurance Fund. If the employee had no earnings during the billing period, the benefit must be calculated based on the minimum wage established on the date of onset of disability.

However, there are several exceptions, a complete list of which is contained in paragraph 1 of Article 9 No. 255-FZ of December 29, 2006. if the length of service is less than 5 years, then the amount of sick leave benefits is 60% of average earnings; if the employee’s length of service varies from 5 to 8 years, then the amount of sick leave is 80% of average earnings; if the length of service exceeds 8 years, the amount of sick leave is 100% of average earnings. To quickly calculate sick leave, you can use the free online calculator developed by the Kontur.Accounting service.

Features of paying sick leave to a part-time worker

An employee working in different places is also not insured against temporary disability and has the right to compensation for it. The key point that determines the possibility of obtaining it from an “additional” employer is the length of service at a given workplace. Until 2011, the basic figure was 1 year; after this date, the mandatory insurance “seniority” was increased to 2 years.

Zarechnaya A.S. She has been working at her main place of work for 8 years, while for several years she has been working part-time for different employers. Over the past two years, her salary in her main job is 50 thousand rubles/month, and in her part-time job she received 10 thousand rubles/month. from the employer for whom she worked the previous year, and 8 thousand rubles/month. from another with whom she collaborated the year before. This year she was ill for 10 days. Let's calculate the payments due to her.

How will sick leave be calculated from the minimum wage in 2020?

For cases where an employee works part-time, a general formula is used with the minimum wage indicator for sick leave in 2020. Then the resulting value is multiplied by a special coefficient. It represents the proportion of hours actually worked over the entire working period.

- the calculated percentage is set as 100 if the employee’s insurance experience is more than 8 years;

- the calculated percentage for sick leave is set as 80 if the employee’s work experience is 5-8 years;

- 60% is used for calculation if the employee’s length of service is less than 5 years.

Calculation of sick leave in 2020 for part-time work

The only difference is this. When working full time, sick leave is calculated from the minimum wage if earnings for the 2 previous years are less than 24 times the minimum wage. For sick leave opened from 05/01/2020 to 12/31/2020, this is 267,912 rubles. (RUB 11,163 x 24), and open from 01/01/2020 - RUB 270,720. (RUB 11,280 x 24). If working part-time, this value must be reduced in proportion to the working time. So, for a person who works 4 hours a day instead of 8, from 01/01/2020, sick leave is counted from the minimum wage if you earn less than 135,360 rubles. (RUB 270,720 / 8 hours x 4 hours) Letter from the Social Insurance Fund dated November 16, 2015 N 02-09-14/15-19990.

110,000 rub. must be compared with the minimum wage in proportion to Potapov’s working time. This is 108,288 rubles. (RUB 270,720 / 5 days x 2 days), which is less than actual earnings for the billing period. Therefore, the benefit must be calculated from 110,000 rubles.

07 Jun 2020 etolaw 2283

Share this post

- Related Posts

- How much does it cost in Moscow for on-site Marriage Registration in Moscow

- The ambulance did not issue a certificate

- Chernobyl land tax benefits

- How Old Should Your First Child Be to Receive Maternity Capital?