In this article I will not touch upon the issues of increasing VAT. In fact, with this tax, many other issues arise that freelancers who decide to form an individual entrepreneur need to be aware of. First, I will give a little theoretical information, and then we will look at practical questions and problems that an individual entrepreneur may have.

What is VAT?

VAT is a value added tax. It “sits” in all goods and services produced by companies and individual entrepreneurs on the general taxation system (OSNO). From January 1, 2020, the tax will be 20% (previously it was 18%).

For example, if a supermarket sells you a pack of paper for 240 rubles, then 40 rubles in this price is the amount of VAT, and the supermarket must transfer this VAT to the state. The supermarket also has the right to reduce the amount of VAT paid by the amount of tax that was “sat” in the bundle of paper that the supermarket bought from the supplier.

Let's look at how VAT is reduced. If a supermarket bought a pack of paper for 210 rubles (including VAT 35 rubles) and sold it for 240 rubles (including VAT 40 rubles), then in reality it will transfer 5 rubles to the state. VAT (40 rubles – 35 rubles = 5 rubles).

Due to VAT, which is included in expenses, companies can reduce the amount of VAT they need to pay to the state. If VAT is not included in the expenses, the company cannot reduce the amount of VAT that it will have to pay to the state.

Now let's move on to analyzing practical situations.

←

→

sergey888 (2006-11-24 14:34) [0] VAT - value added tax.

Why is it calculated from the FULL cost of the goods? those. If a store bought a product for 100 rubles, increased it by 30% and sells it for 130 rubles, then VAT should be 20% of 30 rubles. and it's only 5 rubles. It turns out that the seller must pay VAT in the amount of 6 rubles, and not 26 rubles. I think that no one would hide from such a tax... ← →

Kurdl (2006-11-24 14:43) [1]

So what? It’s not called “Tax from

added value"!

You're not outraged by why the road tax is not collected on asphalt? ← →

alien1769 (2006-11-24 14:45) [2]

Naive.

This is what the state's income and public sector salaries are based on. ← →

VICTOR_ (2006-11-24 14:48) [3]

There should be a tax credit on arrival so that this situation does not arise.

Then the tax is really calculated on value added ← →

sniknik (2006-11-24 14:48) [4]

There was a time when a battle was shown in the Duma on this issue, the difference between turnover tax and profit tax was discussed (the question, for example, is why in the states 39% of profit tax is normal, but in our country only 20% of turnover is too much? 20 is less! ;o ). looked like a good comedy...

As for VAT, you need to see an accountant, it’s tricky, part of it is returned at the shown costs (if you can show it at all) and some other nonsense, it’s very confusing... that’s why we hold accountants in high esteem, if you know all the intricacies you can pay less... you don’t know, you’ll give everything and still have to stay.

a simple and understandable system (such as GAAP) is unprofitable for some. ← →

StriderMan (2006-11-24 14:49) [5]

it is not clear why the consumer

.

IMHO this is anti-advertising if the price is indicated without VAT. ← →

Curdle (2006-11-24 14:55) [6]

> sniknik © (24.11.06 14:48) [4] > there was a time when a battle was shown in the Duma about this, the difference > between turnover tax and profit tax was discussed (question > for example, why is it normal for 39% profit tax in the states , > but we only have 20% of turnover, is that much? 20 is less! ;o).

Why does the law “On Civil Liability of Owners

Vehicle”, is the policy issued for the vehicle and not for the owner? Because lawmaking is done by senile people! At least they should call it something else, otherwise it’s funny right away!

Because lawmaking is done by senile people! At least they should call it something else, otherwise it’s funny right away!

← →

calm (2006-11-24 14:56) [7]

> VAT - value added tax. > Why...

It’s even funnier with the unified social tax and income tax on wages.

Clear double taxation. And if you consider that staff salaries are included in the price of the goods and are accordingly subject to VAT, then it’s triple. ← →

Curdle (2006-11-24 15:00) [8]

But I still remember in the Soviet Union there was a tax on childlessness (perhaps it was officially called something longer).

But we called it even shorter: “Egg Tax” (because for some reason we collected it only from childless males). ← →

sergey888 (2006-11-24 15:28) [9]

It’s not called “Value Added Tax”!

What is the difference?

← →

saxon (2006-11-24 15:29) [10]

Deleted by moderator

← →

Anatoly Podgoretsky (2006-11-24 16:24) [11]

> sergey888 (24.11.2006 15:28:09) [9]

A simple difference, if there is added value, then get tax.

And in the second case, only from the difference between price and added value. ← →

sergey888 (2006-11-24 16:44) [12]

And in the second case, only from the difference between price and added value.

Those. If VAT stands for Tax on

Added Value, then the tax is taken from the FULL cost, and if the Tax

is

ON Value Added, then only from the DIFFERENCE between the purchase and sale prices?

← →

Anatoly Podgoretsky (2006-11-24 16:50) [13]

> sergey888 (24.11.2006 16:44:12) [12]

Yeah

← →

oldman (2006-11-24 17:06) [14]

But too lazy to open the Tax Code of the Russian Federation, Section VIII, Chapter 21?

Read carefully. And don’t ask such questions later. ← →

Alchemist (2006-11-24 17:16) [15]

> [14] oldman © (24.11.06 17:06) > But too lazy to open the Tax Code of the Russian Federation, section VIII, chapter > 21? > Read thoughtfully. > And don’t ask similar questions later.

Well, I opened it at one time, read it for a long time and thoughtfully - I didn’t understand a damn thing...

← →

oldman (2006-11-24 17:17) [16]

> Alchemist © (24.11.06 17:16) [15] > well, I discovered it at one time, read it for a long time and thoughtfully - nothing > I didn’t understand...

Well, whose problem is this?

← →

MsGuns (2006-11-24 17:20) [17]

VAT has been “communized” from the West, where this type of tax was introduced to combat OVERproduction and today is used mainly as a “trough” for those “admitted” to it, i.e.

for banal embezzlement ← →

kaif (2006-11-24 17:22) [18]

The idea of the method of calculating VAT itself is clear, although absurd. If a company bought a product for 118 rubles, then it “contains” 18 rubles of VAT. That is, the company, having purchased the goods, has already “paid VAT” in the amount of 18 rubles. Further, if a company sold this product (the simplest case), say, for 177 rubles = 100 + 18 + 50 + 9, then the “price with VAT” includes 18 + 9 VAT, which it already “owes to the budget.” If at the end of the month from the figures that she “owed to the budget” (18+9) we subtract the figures that she “paid” (18), then we would get exactly the Value Added Tax or, if you prefer, the Value Added Tax - so which is not the name at all.

The problem with VAT is this. The method of its “fundamental calculation” does not take into account the fact that “purchased 18 rubles” VAT (see the first operation) can be interpreted in any way. Let’s say the company from which your company bought goods for 118 rubles did not pay anything to the budget when it was supposed to pay its VAT. And it is assumed that everyone follows the law properly and only in this case your 18 rubles paid by that person are equivalent to what they “eventually” ended up in the budget. And if that company did not pay or its supplier did not pay or its supplier did not pay, then the Tax Office may refuse to credit your company with these 18 rubles, citing the fact that they did not reach the budget

.

And then your company will pay all 27 rubles instead of 9 rubles. The state apparently believes that some companies are responsible for the affairs of others and this is the ideal legal field for business

.

That is, it’s kind of a dog’s business for business not to get involved or catch those who don’t pay taxes, and not at all for the State in the person of the Tax Service. That is, the Tax Service can take bribes from those who do not pay VAT, and not recognize

it as input VAT for those who are trying to work on whitewash, for example, for export. VAT refunds for each transaction are considered for 180 days and refusal is possible for any minor reason. Even if someone 5th in the supply chain did not pay “real money to the budget” for something. So the budget does not suffer, the swindlers are happy and the tax authorities have their own personal income.

In general, the very method of calculating VAT ultimately (in numbers) is nothing more than a tax on the delta in price

. That is, an idiotic mechanical way of calculating what is essentially an additional income tax. That's all.

And the existing idiotic method of calculating

and payment/refund instead of a simple

calculation

(from the delta) is equivalent to a forced interest-free loan in the amount of 18% of turnover, which the State imposed on all businesses in the country.

I'm not even talking about all the little tricks and dirty tricks prescribed in each new “procedure for calculating and paying VAT”, leading to headaches, financial losses and abuses on the part of the Tax Service.

For example, the same idiotic “VAT on advance payment”. ← →

sergey888 (2006-11-24 17:29) [19]

kaif © (24.11.06 17:22) [18]

Holy shit.

← →

kaif (2006-11-24 17:43) [20]

It's just that payments are easier to control than profits. That is why VAT exists in Russia. It's just easy to charge

.

And often you can avoid paying “input VAT” (purchased) or even not recognize

at all. If Russia had normal financial accounting, in which companies published their annual reports, as they do all over the world, except for Latin American countries, then VAT would not have such a meaning. And his rate would be lower. And they would charge it in a simpler, symmetrical and natural way.

Do you want a simple diagram of how to run VAT “in the opposite direction”? Let's say your company makes children's toys from foam or prints children's literature. You purchase paralon or paper “including VAT”, and sell products “VAT exempt”. As a result, the state owes you VAT. Ideally, it is obliged to pay it. But in practice everything turns out to be much more complicated. If you do not prove that the manufacturers or importers of the paralon paid VAT, then it may well not be returned to you. However, you do not have any authority to “check” anything.

For example, if the exporter’s tax office (VAT rate for export = 0) discovers a product that was imported under a customs declaration that does not exist, then VAT will not be returned at all. However, if the exporter himself tries to ask the customs office what declarations this or that company has for this or that product, he will simply be sent to hell, because it is a trade secret.

It turns out that the business is responsible for matters that it does not control

before authorities that do not

want

or

cannot

.

The state is constantly trying to create systems (databases on customs declaration, etc.) in which it could not return VAT instead of creating a situation in which a business could act in a normal legal framework and bear responsibility only for those events which he is able to influence.

The government is always only interested in “how much VAT is collected” and is never interested in “how exactly it was collected.”

If someone came up with some kind of “interesting lever” that would allow them to simply steal some more VAT from some companies into the budget, then they will only be praised. And this will be justified by the fact that some companies themselves steal VAT. Well, it kind of turned out bash to bash. If a swindler stole VAT from the state, and it then managed to steal the same VAT from an honest business, then this is the Triumph of Law and Justice. ← →

sergey888 (2006-11-24 18:02) [21]

Now it’s clear why we are not considered a developed country, but are classified as 3rd world countries...

← →

Layner (2006-11-24 18:09) [22]

... Another important note: VAT in accounting is either accrued or allocated to the cost of purchased / sold goods.

← →

Suslik (2006-11-24 18:40) [23]

Don’t take this as PR - this is part of the hype of my product. 2Author. The point is well stated - this is a classic example of a tax. ——————————————————

The theoretical essence of VAT

The object of value added tax is the turnover of sales of products (goods, works, services). This tax is indirect, i.e. is paid not by the seller, but by the buyer in the form of a premium to the selling price. In this case, the amount of tax payable to the budget by a given enterprise is determined as the difference between the amounts of tax received by the enterprise from buyers of its products and the amounts of tax paid by the enterprise itself when purchasing material resources (works, services).

A legitimate question arises: why is this tax called value added tax? The fact is that the cost of production of any enterprise can theoretically be divided into the following three elements:

· material and equivalent costs; · wages (including unified social tax); · profit.

The value added by a given enterprise is understood as the difference between the cost of the product produced by the enterprise and the cost of the material resources expended, or the sum of profit and labor costs.

It turns out that each enterprise transfers to the budget the amount of tax on the value added by it. At the same time, the actual payer of the tax is the final consumer, i.e. one who uses acquired values for personal consumption, and not for resale or production of new goods. Let us explain this with a simple example.

Let there be a Peasant, a Miller, a Baker and a Final Consumer. The peasant grew grain and sold it to the Miller for 100 rubles. The Miller paid for this grain at the price of the Peasant, but at the same time, according to the current legislation, he added 20% value added tax to it, i.e. 20 rub. Let us assume that in the production of grain the Peasant spent only his own labor, without incurring any material costs. Then he must transfer all these 20 rubles. to their rightful owner - the state.

The Miller makes flour from the grain and sells it to the Baker at a price of 300 rubles. plus 60 rub. value added tax. After this, Melnik gives the state 40 rubles, i.e. the difference received is 60 rubles. and paid 20 rubles. Note that this is exactly 20% of the value he added in the amount of 200 rubles. (300-100).

The baker bakes bread from the resulting flour and sells it to the End Consumer for 720 rubles, of which 600 is the price, and 120 is value added tax. As a result, the Baker must give 60 rubles to the state. (120-60), or 20% of the value added by him in the amount of 300 rubles.

As a result, the state receives 20+40+60 = 120 rubles. Who bore these costs? Of course, not the manufacturers. Each of them only listed the tax amounts received from its buyer, minus similar amounts paid by it. The entire tax amount (120 rubles) was paid by the End Consumer.

The considered example clearly illustrates the theoretical essence of value added tax. But a deeper analysis reveals its “cunning” as an indirect tax, that is, seemingly neutral in relation to the manufacturer.

Firstly, the introduction or increase of VAT leads to an unconditional rise in the price of goods for the final buyer, which causes a reduction in demand, first in the consumer market, and then in the markets for production resources. As a result, the interests of each manufacturer are affected.

Secondly, in order to produce products, you must first buy material resources. Therefore, VAT is paid first and only then is it received. Consequently, a pause occurs, which means an additional burden on the financial resources of the enterprise. Let's imagine that in the example discussed above, the Peasant sells grain in the fall, and the Miller will produce flour from it only in the spring. In fact, this will mean that by paying an extra 20 rubles out of your pocket. At the time of purchase, Melnik provided a loan to the state for six months.

This point is clearly visible in this program. For example, in the first and second months of the game course, you buy equipment and raw materials, paying an additional 20% value added tax. These expenses will be reimbursed to you, at best, in the fourth month after the sale of the first product. However, it is in the first three months, before the start of sales, that you especially need funds, and, most likely, you will be forced to take out a bank loan.

Concluding the general description of VAT, it should be noted that this tax is also the most complex and time-consuming for accounting.

Unlike other taxes, which are calculated once at the end of the reporting period, accounting actions for VAT have to be performed constantly, when registering each transaction related to the sale or acquisition of material assets (work, services). It is therefore no coincidence that the official form of calculation of value added tax is called a tax return. Here, tax liabilities for VAT that have already arisen by the end of the reporting period are declared. No accounting entries are made based on the declaration. ← →

Suslik (2006-11-24 18:42) [24]

PS This help is from a program 4 years ago - something might be outdated.

But the essence remains. ← →

kaif (2006-11-24 18:57) [25]

Suslik © (24.11.06 18:40) [23]

Well written.

Let's add to this a whole list of deceits.

1. If the Peasant needed money in order to feed his family in the process of growing grain and the bank refused the Peasant a loan or the Peasant was not satisfied with the draconian interest rate on the loan, then the Peasant can ask the Miller for an advance for future grain under an agreement. However, having received an advance from Melnik, the Peasant, according to current Russian legislation, is obliged

immediately pay VAT on the entire advance amount.

And the Miller has no right

to offset this VAT as paid until he receives the grain in kind and capitalizes it. Although no one has yet produced any grain. And everyone already owes the state. Only because the State is vigilantly ensuring that Melnik does not replace the functions of the bank. Otherwise, the bank will not be able to charge its draconian interest rate, and business participants will simply start lending to each other (which, by the way, is allowed in other countries).

2. If the End Consumer never buys the grain and it rots in the bins, the state will not refund the VAT to anyone. In the same way, it will not return VAT to the Baker if the Buyer does not want to buy his buns, having decided to go on the Kremlin diet, and the buns will have to be written off and thrown away.

There are still many deceits.

Everything is against business. And not a single one is in favor. ← →

Elephant_ (2006-11-24 19:01) [26]

> sniknik © (24.11.06 14:48) [4] if you know all the details you can pay less...

Yeah, then you’ll keep Mishane company on the bunk - a scheme for optimizing tax deductions.

and I don’t care that everything seems to be according to the law. want to pay less? Then we go to you! ← →

Suslik (2006-11-24 19:04) [27]

> [25] kaif © (24.11.06 18:57)

> There are many more deceits.

Everything is against business. And not a single one > - in favor. I can’t say anything personally about the advances received. My father wrote this text (he is the author of the program). Now he is involved in accounting support for several large organizations. I periodically hear about these advances received - it really seems like some kind of nonsense.

On the other hand (please don’t think of me as a scoundrel), these nasty things feed crowds of booze developers. programs.

PS.

Another nasty thing that I know about (I’ve read the legislation myself) is what number to capitalize the replacement SF received. Either the current number of the reporting period, or the real number - the difference is that in one case a multimillion-dollar debt arises for several months (suspended penalties), or it does not arise. ← →

Alchemist (2006-11-24 19:04) [28]

>kaif, Gopher

Thank you, everything is clear and accessible.

If only someone, out of the kindness of their hearts, would tell us about the simplified taxation system... ← →

Suslik (2006-11-24 19:05) [29]

> If only someone, out of the kindness of their hearts, would tell us about the simplified > taxation system...

what I don’t know, I don’t know.

sorry. ← →

kaif (2006-11-24 19:13) [30]

VAT rates in different countries, for those interested:

https://en.wikipedia.org/wiki/Value_added_tax

The first figure is standard VAT, the second is reduced. I advise you to pay attention to Japan, Singapore and Malaysia.

There VAT is 5%

In the USA there is no VAT at all. There are sales taxes, which, IMHO, is much more reasonable and simpler.

List of countries: —————————— Austria 20% 12% or 10% Belgium 21% 12% or 6% Cyprus 15% 5% Czech Republic 19% 5% Denmark 25% Estonia 18% 5% Finland 22 % 17% or 8% France 19.6% 5.5% or 2.1% Germany 16% (2007:19%) 7% Greece 19% 8% or 4% (reduced by 30% to 13%, 6% and 3% on islands) Hungary 20% 15% or 5% Ireland 21% 13.5%, 4.8% or 0% Italy 20% 10%, 6%, or 4% Latvia 18% 5% Lithuania 18% 9% or 5% Luxembourg 15% 12%, 9%, 6%, or 3% Malta 18% 5% Netherlands 19% 6% Poland 22% 7%, 3% or 0% Portugal 21% 12% or 5% Slovakia 19% Slovenia 20% 8.5% Spain 16% 7 % or 4% Sweden 25% 12% or 6% United Kingdom 17.5% 5% or 0% [edit] Non-EU countries Country Rate Standard Reduced Argentina 21% 10.5% or 0% Australia 10% 0% Bosnia and Herzegovina 17% Bulgaria 20% Canada 6% or 14%1 4.5% Chile 19% People's Republic of China2 17% 6% or 3% Croatia 22% 0% Dominican Republic 6% 12% or 0% Ecuador 12% El Salvador 13% Guyana 16% 0% Iceland 24.5% 14%3 India4 12.5% 4%, 1%, or 0% Israel 15.5%5 Japan 5% Kazakhstan 15% Lebanon 10% Moldova 20% 5% Republic of Macedonia 18% 5% Malaysia6 5% Mexico 15% 0% New Zealand 12.5% Norway 25% 13% or 8% Paraguay 10% 5% Peru 19% Philippines 12%7 Romania 19% 9% Russia 18% 10% or 0% Serbia 18% 8% or 0% Singapore 5% 8 South Africa 14% 0% Republic of Korea 10% Sri Lanka 15% Switzerland 7.6% 3.6% or 2.4% Thailand 7% Turkey 18% 8% or 1% Ukraine 20% 0% Venezuela 16% 8%

← →

kaif (2006-11-24 19:28) [31]

The simplification was invented in particular in order to steal more VAT from the population. In fact, it is not entirely correct to say that VAT is paid by the End Buyer. In theory, VAT should be returned

. For example: citizens do not pay VAT on telephones, air tickets, etc. And companies pay. Since it is “supposed” that companies should then “read it” as input, since they use it for production.

It’s not that the simplified version doesn’t pay VAT. She just pays him. She has no right to take

. That is, a simplified person does not have the right to write on the invoice “including VAT so much.”

As a result, the company that bought something from the simplified tax system can no longer count this VAT as input. This is a super cunning thing that allows you to steal even more money from your business into your budget. That is, a certain individual private enterprise, for example, “Vasya Pupkin Software” bought licensed Windows with VAT, of course. Then this private entrepreneur installed these Windows on computers, which it assembled from parts that it also bought with VAT, of course. Then this private entrepreneur decided to sell these computers to a company (a normal one, not a simplified one). The company refused. Why? Because private entrepreneur “Vasya Pupkin Software” cannot write in the invoice “Cost of the computer, including VAT.” And the company will not be able to offset this actually purchased

VAT as formally purchased by her.

Therefore, Vasya Pupkin Software will sell these computers to the public. And the population is generally not aware that there is some kind of VAT. Because it was always stolen from him. Since neither an individual entrepreneur nor an LLC has the right to write “including VAT as much” on cash receipts. Although if they had written it, it would seem that there would have been an option to include it in the personal tax return. I cannot say for sure - the ends of this legislation are tangled and lost in the abyss of general lawlessness.

But at a minimum, an individual could demand that VAT be returned (!!!) to him at the border when he exports, for example, this computer abroad.

That's for sure. But thanks to the existence of simplification - fig. Even if exported abroad, he can no longer demand anything to be returned. Because with simplification, “VAT accounting is not carried out.”

I wonder, but if they “didn’t keep records” at the box office, what would that mean? Why is there no money there?

Evilness sits on wickedness and drives with wickedness.

← →

Suslik (2006-11-24 19:29) [32]

The whole nasty thing about VAT is that this garbage takes up 50 percent of all transactions.

If I look at our system, almost every transaction contains VAT. There would be no need to pay once a quarter. ← →

Suslik (2006-11-24 19:32) [33]

> [31] kaif © (24.11.06 19:28)

Yes... I feel you are deeply “in the subject” - such hatred for this matter.

I don’t like it (VAT) either. Now it’s better - you can read it after shipment. But before, it was all about pay - it was nonsense. First the chairs, and you’ll count the VAT when the payment arrives. Chairs are coming in batches, payments are also in pieces - the devil will break his leg. I’m really afraid of my SFs, because... This is not a block within the system, but a topic for a separate accounting system. Here. ← →

kaif (2006-11-24 19:41) [34]

2 Suslik © (24.11.06 19:29) [32]

I once configured something like a “standard configuration” in Allegro. The need for strict VAT accounting in it led to at least doubling the number of codes. Moreover, the lion’s share went to the “Purchase Book” and “Sales Book” - there are no more idiotic documents for automation. Moreover, the law contradicts itself in a number of cases (from the programmer’s point of view). That is, there are very real situations that “cannot happen” according to the law. Not because they are illegal, but because it will be unclear what to write in the purchase book. Take the typical cases of “many payments - one delivery”. And the law says that invoice numbers are repeated

in the Book they cannot.

And in each line you need to indicate the number of the Invoice and the Payment Order for which it was paid

.

Accordingly, the programmer finds himself in a complete dead end. And not just a programmer. Since there is no payment order for the purchased goods yet (this seems to have been fixed now), it was impossible to offset

the input VAT at all.

And so on. Perhaps some programmers are fed by this state of affairs, but they personally rob me. Since I can’t write crooked programs with 10 entities instead of 2. Porograms. in which, in addition to the concepts of “Delivery” and “Payment”, a number of interesting concepts arise such as “Delivery, paid to such and such an extent and provided with documents from such and such dates, which, thanks to the presence of all these attributes, can finally become a line in the purchase book “or even “an advance that does not yet have delivery, but which needs to draw some fictitious Invoice with a number so that it has something to enter in the appropriate column of the Purchase Book.” If you read the legislation surrounding VAT, you might think that it was written not just by illiterate, but also by insane deutats, who are not logical in their heads. ← →

kaif (2006-11-24 19:46) [35]

2 Suslik © (24.11.06 19:32) [33]

Absolutely definitely noticed. Moreover, the customer wants “everything to be edited retroactively” and entered at random.

This is a somersault for a programmer, but not the kind of somersault that one could be proud of and brag about, but one that there is nothing to feel but shame.

Everything is crooked and incompetent - in strict accordance with the Current Legislation. Moreover, tomorrow one giftless and crooked thing will need to be replaced with another giftless and crooked one. For example, it turns out that VAT on advance payments for international transactions was abolished (apparently so as not to embarrass yourself in front of Europe), but for domestic transactions they were left in place (the money does not interfere with the budget and, most importantly, it does not stink). ← →

Anatoly Podgoretsky (2006-11-24 19:50) [36]

> Alchemist (11/24/2006 05:16:15 PM) [15]

He is a villain, he knew where to send

← →

Suslik (2006-11-24 19:50) [37]

> Perhaps some programmers are fed by this state of affairs, > but they personally rob me. Since I cannot write crooked programs, > in which there are 10 entities instead of 2.

your truth: programs are really crooked. The worst thing is that sometimes it’s not clear what to do - there are simply no experts. or rather, there is - we have an audit firm in particular. auditors are not stupid people - but everyone speaks differently when it comes to the interpretation of the law :(.

That’s why our policy is to do things as perversely as possible, so that any accountant can realize his personal preferences regarding VAT.

Regarding the same rules for accounting for replacement SFs, we were forced to make 4 dates instead of one... But you can take into account whatever you want - our system allows this. ← →

kaif (2006-11-24 20:02) [38]

And the real horror is that all warehouse accounting in Russia had to switch to lot accounting (a crooked type of batch accounting occurs without distinguishing the specific location where the batch is stored).

In the USA, you can keep track of the cost of goods sold using LIFO, FIFO or average cost. In Russia it is possible to conduct only BATCH IN THE SENSE BY LOTS. And this is no longer possible. That is, it is supposedly possible by law. But here are the numbers

Should Cargo Customs Declarations (CCD) be included in Invoices? And without them, you have broken the law. So, be kind enough to also keep records of customs declarations, in addition to accounting for VAT, which no one fucking needs and can be calculated much easier with the help of accounting entries (it is enough to cancel some idiotic and unnecessary Books and eliminate some types of State deceit) And these same customs declarations are still needed and separate virtual storage if real goods are mixed in the warehouse. In general - complete darkness. And from scratch.

All this ends with one thing - the division of accounting into real (for oneself) and fake

(for the tax office).

And not a single one in public. And what is needed is a public one. So that the very “investment climate” that so many people rave about will arise. ← →

Suslik (2006-11-24 20:04) [39]

> [38] kaif © (24.11.06 20:02)

> BATCH IN THE MEANING OF LOTS

This is called SKE - the cost of each unit.

← →

Petr V. Abramov (2006-11-24 21:14) [40]

> i.e. If a store bought a product for 100 rubles, increased it by 30% and sells it for > 130 rubles, then VAT should be 20% of 30 rubles. and it's only 5 rubles. I didn’t read the whole thread, maybe I’ll repeat myself. I bought the product for 100 rubles with VAT included 16.66666 rubles. sold for 130 rubles owes 21.66666 rubles VAT

21.66666 RUR - 16.6666 RUR = 5 RUR, as I wanted. PS but it's a toad to pay them

https://youtu.be/DTDXeNJq-98

Forgot to switch to “simplified” - you will end up subject to VAT

As a rule, when registering as an individual entrepreneur, freelancers switch to a simplified tax regime with payment of 6% of the income received. VAT is not paid on simplified products. However, to switch to a simplified tax system, you need to submit a special notification to the tax authorities . If you do not submit a notification, you will not be able to apply the simplified taxation regime, which means you will automatically remain in the general regime, in which you need to pay VAT (let me remind you, the tax rate from 2020 is 20%).

Therefore, when registering an individual entrepreneur, immediately submit a notification about the application of the simplified taxation regime.

Classification of income in tax accounting

The concept of “income” in accounting and tax accounting is defined almost identically. For profit tax purposes, income is recognized as economic benefit in cash or in kind, taken into account if it is possible to evaluate it and to the extent that such benefit can be estimated.

Neither PBU 9/99 nor the Tax Code of the Russian Federation provides an explanation of the concept of “economic benefit”. This term is contained in the Concept of Accounting in the Market Economy of the Russian Federation, approved by the Methodological Council on Accounting under the Ministry of Finance of the Russian Federation and the Presidential Council of the Institute of Professional Accountants of the Russian Federation on December 29, 1997. In accordance with paragraph 7.2.1 of the Concept, future economic benefits represent the potential ability of property to directly or indirectly contribute to the flow of cash into the organization. An asset is considered to provide future economic benefits to the entity when it can be:

- used separately or in combination with another asset in the process of production of products, works, services intended for sale;

- exchanged for another asset;

- used to pay off an obligation;

- distributed among the owners of the organization.

For profit tax purposes, income from leasing property and granting rights to intellectual property for use can be taken into account both as part of income from sales and as part of non-operating income. At the same time, in accounting, income from participation in the authorized capitals of other organizations can be taken into account either as part of income from ordinary activities, if this is the subject of the organization’s activities, or as part of other income, when participation in the authorized capitals of other organizations is not the subject of the organization’s activities. For profit tax purposes, income from participation in the authorized capital of other organizations is classified as non-operating income of the organization.

Thus, the list of income from ordinary activities in accounting and income from sales for profit tax purposes can be formed in the same way, with the exception of income from participation in the authorized capitals of other organizations.

Non-operating income for profit tax purposes includes income that is not recognized as income from sales. The list of non-operating income is quite large. Nevertheless, the wording given in Article 250 of the Tax Code of the Russian Federation, that “non-operating income of a taxpayer is recognized, in particular, income ...”, allows us to conclude that the list remains open. We should not forget that not all funds and property received by an organization can be recognized as its income for tax accounting purposes (Article 251 of the Tax Code of the Russian Federation contains a closed list of income that is not taken into account when determining the tax base for income tax).

The list of income not taken into account when determining the tax base is much broader than the list of income not recognized as income in accounting. This leads to the fact that some income will be taken into account when determining accounting profit, but will not be taken into account when determining the tax base for income tax. In such a situation, you should be guided by PBU 18/02, approved by Order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n, which establishes the procedure for reflecting and accounting for differences arising between accounting and tax accounting data.

In contracts with clients, be sure to stipulate that your services are not subject to VAT.

If you apply the simplified taxation system, then be sure to:

- In contracts with customers, indicate that: “ The cost of services under this agreement is XX rubles YY kopecks, VAT is not assessed, since the Contractor uses a simplified taxation system

.

Sometimes lawyers require additional registration “ based on Chapter 26.2 of the Tax Code of the Russian Federation

.” - In the invoice that you issue to the client, in the column with the amount in words, be sure to indicate: “VAT is not subject to.”

- Make sure that in payment orders the payment purpose says: “Payment on invoice to such and such, not subject to VAT” or “Without VAT.”

- In the acceptance certificates, be sure to indicate in the amount column in words that the amount is “not subject to VAT.”

Results

Account 90 is necessary to collect data on income and expenses for activities that the company considers normal for itself. Income is recorded on the credit side of the account, and expenses are recorded on the debit side. The company can independently enter subaccounts to the 90th account - depending on business conditions and the accounting data used.

Accountants, especially beginners, cannot always understand which income is normal for a company and which is other. As a result, it is not completely clear which account (90 or 91) the revenue should be reflected in in each specific case. Let's look at it in order.

Income received by the organization, according to the norms of accounting legislation, is divided into income from ordinary activities and other income. Organizations are given the right to independently qualify income, taking into account their nature, conditions of receipt, as well as the direction of the organization’s activities.

Commercial organizations that are legal entities must generate information about income, guided by the Accounting Regulations “Income of the Organization” PBU 9/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n (hereinafter referred to as PBU 9/99).

The income of an organization in accordance with paragraph 2 of PBU 9/99 is recognized as an increase in economic benefits as a result of the receipt of assets (cash, other property) and (or) repayment of liabilities, leading to an increase in the capital of this organization. Meanwhile, not all funds and property received by an organization can be recognized as income of the organization. Contributions from participants (owners of property) are not recognized as income of the organization. In accordance with paragraph 3 of PBU 9/99, receipts from other legal entities and individuals are not recognized as income of the organization:

- amounts of VAT, excise taxes, export duties and other similar mandatory payments;

- under commission agreements, agency and other similar agreements in favor of the principal, principal and the like;

- in advance payment for products, goods, works, services;

- advances in payment for products, goods, works, services;

- deposit;

- as collateral, if the agreement provides for the transfer of the pledged property to the pledgee;

- in repayment of a loan granted to the borrower.

Paragraph 4 of PBU 9/99 provides a classification of income, according to which the income received by the organization is divided into income from ordinary activities and other income. The organization must provide for the chosen procedure for recognizing income in the order on accounting policies for accounting purposes. Other income also includes extraordinary income, that is, income received as a result of emergency situations. The criteria for classifying receipts as income from ordinary activities are determined by the organization independently and are fixed in the company’s accounting policies. As a rule, income from ordinary activities is recognized as income received by an organization from its main type of business. If there are several types of activities, the threshold of materiality of “ordinary” income in the total volume of income received by the organization is traditionally used as a criterion for recognizing income from ordinary activities.

The materiality criterion used by the organization to classify income is also fixed in the accounting policy (usually 5%).

In essence, income from ordinary activities of an organization is revenue from the sale of products, goods, performance of work, and provision of services.

Accordingly, all other receipts other than revenue, including those arising as a consequence of extraordinary circumstances of the organization’s economic activities, are considered other income.

What to do if the client mistakenly transferred the amount including VAT?

Sometimes clients, when paying for freelancers' services, mistakenly allocate VAT in the payment order and the amount with VAT allocated comes to your account. This could be a problem .

Although by law you are not a VAT payer, being on a simplified basis, if a payment arrives in your account where VAT is allocated, the tax office may ask you to pay VAT. After all, this tax is highlighted in the payment order. And although in practice you can fight off such demands, you can waste a lot of time.

If a client mistakenly allocated VAT in a payment to you:

- Ask the client

to send

a payment clarification letter

through his bank . In this letter, the client must write that in such and such a payment order (the payment order number and date are indicated) VAT was erroneously allocated. The correct purpose of the payment is considered to be such and such (VAT is not assessed). In a few days, a letter confirming payment will be sent to your bank, from where it will be forwarded to you. - Sometimes clients refuse to send a letter about payment clarification through their bank, because... this service may cost money. Then ask the client for a letter on company letterhead or a scan of such a letter with the signature and seal of the customer. If the tax office asks for information about why you didn’t pay VAT, you can show them a letter from the customer.

- Sometimes clients say: “send us the erroneous payment back, and we will transfer you a new payment without allocating VAT.” This won't fix the situation . Since you have already received a payment with allocated VAT, the tax office may have questions even if you send such a payment back.

Therefore, you must receive a letter confirming payment. This situation cannot be left unattended.

Other income in accounting

The list of other income is given in paragraph 7 of PBU 9/99 and is open. Other income is:

- receipts related to the provision of the organization’s assets for temporary use for a fee;

- receipts related to the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property;

- proceeds related to participation in the authorized capitals of other organizations (including interest and other income on securities);

- profit received as a result of joint activities;

- proceeds from the sale of fixed assets and other assets other than cash (except foreign currency), products, goods;

- interest received for providing the organization's funds for use, as well as interest for the bank's use of funds held in the organization's account with this bank;

- fines, penalties, penalties for violation of contract terms;

- assets received free of charge, including under a gift agreement;

- proceeds to compensate for losses caused to the organization;

- profit of previous years identified in the reporting year;

- amounts of accounts payable and depositors for which the statute of limitations has expired;

- exchange differences;

- the amount of revaluation of assets;

- Other income.

The chart of accounts for accounting the financial and economic activities of organizations and the Instructions for its application, approved by the Order of the Ministry of Finance of Russia dated October 31. 2000 No. 94n, account 91 “Other income and expenses” is intended to summarize information on other income and expenses of the reporting period.

It is recommended to open the following sub-accounts for account 91 “Other income and expenses”:

- 91–1 “Other income”;

- 91–2 “Other expenses”;

- 91–9 “Balance of other income and expenses.”

Receipts of assets recognized as other income are recorded in subaccount 91–1 “Other income”. Subaccount 91–9 is intended to identify the balance of other income and expenses for the reporting month.

Accounting for account 91 is carried out as follows. Cumulatively during the reporting year, entries are made in subaccounts 91–1 and 91–2. Each month the balance of other income and expenses is determined by comparing the turnover in the debit of subaccount 91–2 and the credit of subaccount 91–1, which is then written off from subaccount 91–9 to account 99 “Profits and losses”. That is, account 91 does not have a balance at the reporting date.

At the end of the reporting year, subaccounts opened to account 91 “Other income and expenses,” with the exception of subaccount 91–9, are closed with internal entries to subaccount 91–9. For account 91, analytical accounting should be kept for each type of other income and expenses in such a way that it is possible to identify the financial result for each operation.

The order in which other income is recognized in the accounting records of an organization is stated in paragraph 16 of PBU 9/99. If all five established conditions for revenue recognition are met, other revenues are recognized in accounting in the following order:

- proceeds from the sale of fixed assets and other assets other than cash (except foreign currency), products, goods, as well as interest received for providing the organization’s funds for use, and income from participation in the authorized capital of other organizations (when this is not the subject of activities of the organization). In this case, for accounting purposes, interest is accrued for each expired reporting period in accordance with the terms of the agreement;

- fines, penalties, penalties for violation of the terms of contracts, as well as compensation for losses caused to the organization - in the reporting period in which the court made a decision to collect them or they were recognized as a debtor;

- the amount of accounts payable and depository debt for which the limitation period has expired - in the reporting period in which the limitation period has expired;

- the amount of revaluation of assets - in the reporting period to which the date as of which the revaluation was made relates;

- other receipts - as they are formed (identified).

Let's look at some examples of income classified by PBU 9/99 as other income. Example. The organization has entered into a lease agreement under which it leases equipment it owns for a period of 1 month. Providing property for rent is not the main activity of the organization. Rental cost - 36,580 rubles, including VAT 18% - 5,580 rubles. The specified amount is transferred to the organization's bank account upon expiration of the lease term. The organization conducts settlements with the tenant on account 76 “Settlements with various debtors and creditors”.

— Debit 76 Credit 91–1 “Other income” — 36,580 rubles. — rent accrued;

- Debit 91–2 “Other expenses” Credit 68 “Calculations for taxes and fees”, subaccount “Calculations for VAT” - 5580 rubles. — the amount of VAT on rent has been accrued;

— Debit 51 “Current accounts” Credit 76–36,580 rub. — the rent amount has been credited to the bank account.

Example. A VAT payer organization sells a car in November. The contractual cost of the car is 172,280 rubles, including VAT 18% - 26,280 rubles. The initial cost of the car is 336,960 rubles.

The useful life established by the organization when accepting the vehicle for registration is 5 years, the actual service life until the moment of sale is 3 years.

Depreciation was calculated using the linear method, the amount of accrued depreciation was RUB 202,176. The residual value of the car is RUB 134,784.

- Debit 76 “Settlements with various debtors and creditors” Credit 91–1 “Other income” - 172,280 rubles. — the buyer’s debt for the sold car is taken into account;

— Debit 91–2 “Other expenses” Credit 68 “Calculations for taxes and fees” — RUB 26,280. — VAT is charged on the sales amount;

— Debit 01–2 “Disposal of fixed assets” Credit 01–1 “Fixed assets in the organization” — RUB 336,960. — the disposal of the car as a result of sale is reflected;

— Debit 02 “Depreciation of fixed assets” Credit 01–2 “Disposal of fixed assets” — 202,176 rubles. — the amount of depreciation accrued during the operation of the vehicle is written off;

— Debit 91–2 “Other expenses” Credit 01–2 “Disposal of fixed assets” — 134,784 rubles. — the residual value of the sold car is written off;

- Debit 51 “Settlements” Credit 76 “Settlements with various debtors and creditors” (62 “Settlements with buyers and customers”) - 172,280 rubles. — funds have been received from the buyer;

— Debit 91–9 “Balance of other income and expenses” Credit 99 “Profits and losses” — 11,216 rubles. — profit from the sale of the car is reflected.

Example. The lender organization provided the borrower organization with a cash loan in the amount of RUB 326,000 on July 1, 2020. for a period of 1 month. The interest rate under the loan agreement is 14% per annum. The terms of the loan agreement stipulate that interest under the agreement is paid simultaneously with the repayment of the loan amount.

In the accounting records of the lending organization, operations for granting a loan and calculating interest will be reflected as follows:

In July 2020:

- Debit 58–3 “Loans provided” Credit 51 “Current accounts” - 326,000 - funds provided under the loan agreement are reflected as part of financial investments;

- Debit 76, subaccount “Calculations for interest due”, Credit 91–1 “Other income” - 3876.27 rubles. — interest accrued due for July 2020 ((RUB 326,000 x 14%) / 365 days x 31 days).

In August 2020:

- Debit 51 “Account settlements” Credit 76 “Settlements with various debtors and creditors”, subaccount “Calculations for interest due” - 3876.27 rubles. — interest received under the loan agreement;

- Debit 51 “Current accounts” Credit 58–3 “Loans provided” - RUB 326,000. - the loan amount is returned.

The client asks to allocate VAT in the contract, and you are on a simplified basis. What to do?

There are cases when clients ask to highlight VAT in a contract or invoice, or to issue them an invoice with VAT. Their interest is clear - they want to “write off” part of the VAT that they need to pay to the state.

Remember, this is very serious: if you use the simplified tax regime, then you do not have the right to issue an invoice. Also, you do not have the right to allocate VAT in contracts, invoices, acts, no matter how the customer asks you to do so.

You can answer such requests: I use a simplified taxation regime and do not have the right to issue an invoice or allocate VAT. They will leave you alone.

Can an individual entrepreneur allocate VAT on payments to other companies?

If you are on a simplified account, then when they pay you, the payment slips should say “VAT not subject to.” When you pay for someone's services or goods that are subject to VAT, you must highlight this VAT in the purpose of the payment.

For example, when you pay for contextual advertising services in Direct, Direct issues you an invoice indicating that the invoice amount is, for example, 1200 rubles. 00 kopecks, including VAT – 200 rubles. 00 kopecks. Accordingly, when you fill out the payment slip, you will also write in the payment purpose that you are transferring 1,200 rubles. 00 kopecks, including VAT – 200 rubles. 00 kop. This will not be your VAT, but the tax paid by Yandex .

I hope that I was able to clarify some practical issues related to VAT tax. If you have any questions, ask them in the comments. I'll try to answer everyone.

Question of the week: revenue in form No. 2: without VAT or with VAT

Question: How is revenue reflected in Form No. 2: without VAT or with VAT?

I inform you the following:

In the Financial Results Report, the amount of revenue is indicated excluding VAT and excise taxes (clause 3 of PBU 9/99, note 5 in Appendix No. 1 to Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

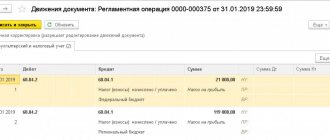

In line 2110, show revenue for the year excluding VAT. It is equal to the difference between the credit turnover in subaccount 90-1 and the debit turnover in subaccount 90-3.

A selection of documents from ConsultantPlus Systems:

Document 1

In the Financial Results Report, the amount of revenue is indicated excluding VAT and excise taxes (clause 3 of PBU 9/99, note 5 in Appendix No. 1 to Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

Tax Guide. Practical guide to annual financial statements - 2020 {ConsultantPlus}

Document 2

How to fill out an income statement for 2020

The standard report form has been approved by the Ministry of Finance. In the report, provide data for 2020 and 2020. Show expenses and losses in brackets. For lines for which you do not have data, put dashes. So, all LLCs will have dashes in lines 2900 and 2910.

In line 2110, show revenue for the year excluding VAT. It is equal to the difference between the credit turnover in subaccount 90-1 and the debit turnover in subaccount 90-3. On line 2120, indicate the debit turnover for subaccount 90-2.

The gross profit or loss on line 2100 is the difference between lines 2110 and 2120.

In line 2210, indicate the debit turnover for the “Sales expenses” subaccount or another similar subaccount to account 90. In line 2220 - for the “Administrative expenses” subaccount.

Sales profit on line 2200 is line 2100 reduced by lines 2210 and 2220.

In line 2310, indicate the credit turnover under the “Dividends” sub-account to account 91, in line 2320 - under the “Interest receivable” sub-account. In line 2330 - debit turnover for the “Interest payable” subaccount.

Other expenses and income in lines 2350 and 2340 are any expenses and income from account 91, except interest, dividends and VAT.

Line 2300 “Profit (loss) before tax” is the profit or loss from sales from line 2200, adjusted for income and expenses from lines 2310 - 2350.

To line 2410, transfer the amount from line 180 of sheet 02 of the annual income tax return.

In line 2421, show the turnover for the subaccounts “PNA” and “PNA” to account 99. If PNA is greater than PNA, indicate the value in parentheses, if vice versa, without parentheses.

In line 2430 there will be the difference between credit and debit turnover on account 77. Indicate a positive result in parentheses, a negative result without parentheses.

In line 2450, indicate the difference between debit and credit turnover on account 09. Indicate a positive result without parentheses, a negative result in parentheses.

In line 2460, show in a collapsed manner other income and expenses that are immediately attributed to account 99, for example, penalties and interest on taxes.

To calculate net profit in line 2400, adjust the profit or loss before tax from line 2300 to the values of lines 2410, 2430, 2450 and 2460. To check, compare the amount from line 2400 with the turnover on account 99 in correspondence with account 84 - they should be equal.

Data for lines 2510 and 2520 are usually not available, so the total financial result on line 2500 is equal to the net income or loss on line 2400.

{Typical situation: How to fill out a financial performance report for 2020 (Glavnaya Kniga Publishing House, 2019) {ConsultantPlus}}