What is a penalty

Penalties for taxes and contributions are penalties for late or incomplete (partial) payment of taxes or contributions.

We can say that this is a type of penalty for failure to fulfill obligations to pay taxes; they are also charged for failure to pay utility bills or alimony, supplies under the contract. But in this article we are interested in tax penalties; their purpose, calculation and payment are regulated in Art. 75 of the Tax Code of the Russian Federation. Tax payments have strict deadlines. If the deadlines are violated, the tax service charges penalties, which will increase until the tax is paid in full. To stop the growth of penalties, pay your taxes or fees as soon as possible. The penalty is a percentage of the unpaid amount, and is accrued for each day of late payment. To calculate them, you need to know the key rate of the Central Bank at the time of the violation.

If the advance payment under the usn is paid less

In this case, one should take into account the legal position of the Plenum of the Supreme Arbitration Court of the Russian Federation, expressed in paragraph 14 of Resolution No. 57 of July 30, 2013

“On some issues arising when arbitration courts apply part one of the Tax Code of the Russian Federation”

: penalties for failure to pay advance tax payments on time are subject to calculation until the date of their actual payment or, in case of non-payment, until the due date for payment of the relevant tax. If, at the end of the tax period, the amount of the calculated tax turned out to be less than the amount of advance payments due during this tax period, the courts must proceed from the fact that penalties accrued for non-payment of these advance payments are subject to a proportionate reduction.

See also letter of the Ministry of Finance of Russia dated August 16, 2013 N 03-02-08/33518.

Advances during the year and minimum tax: we optimize the tax burden under the simplified tax system

The procedure for filling out a tax return under the simplified tax system provides that the minimum tax payable for the year is reduced by the amount of calculated advance payments.

Therefore, it does not matter whether the advance payments were paid or not, the minimum tax can be reduced on them. The main thing is that advance payments are accrued, that is, reflected in the declaration.

In other words, at the end of the year you need to transfer to the budget the difference between the calculated minimum tax and the calculated advances. However, this does not mean that you can avoid making advance payments at all during the year. The debt for them will remain with the taxpayer. Let's show this with an example. Condition: The organization at the end of 2020

the following indicators were obtained: - accrued advance payment based on the results of the first quarter - 10,000 rubles; - accrued advance payment based on the results of the half-year - 25,000 rubles.

How tax accounting is carried out under the simplified tax system for individual entrepreneurs

Entrepreneurial activity requires knowledge of laws. When and how to file a tax return to avoid possible non-payment of taxes? Each individual entrepreneur who uses the simplified taxation system is required to submit a declaration to the tax authorities by April 30. This must be done every year.

It is mandatory to register books of income and expenses, which reflect the accounting of business activities. It is necessary to register the accounting book at the beginning of each year with the Federal Tax Service. Individual entrepreneurs using the simplified tax system are exempt from accounting, but, following the tax code, must keep strict records of income, expenses, and other objects of taxation, as established by law (Article 346.24).

How to properly keep track of income and expenses? Entrepreneurs are required to fully reflect in the accounting book all existing income, expenses, and other business activities.

All data must be reliable and recorded. In each reporting period, an entrepreneur is obliged to reflect in the accounting book the property status and results of his activities as an entrepreneur. All business procedures are accompanied by supporting documents.

Accounting must be kept for each individual item. The expense column must reflect the accounting of all fixed assets, that is, the property that is depreciable (Chapter 25 of the Tax Code). Such property includes objects that are used to acquire income. Their operational period is more than a year, and the cost is more than 20 thousand rubles.

Is an advance an income under the simplified tax system, and the return of an advance an expense?

One of the significant features that distinguishes the simplified tax system from the conventional taxation system is the recognition of income using the cash method, that is, upon receipt of money into the taxpayer’s account or cash register.

In this regard, the question often arises whether an advance is income under the simplified tax system.

On the one hand, advance payment is not directly mentioned in Art. 346.15 and 346.17 of the Tax Code of the Russian Federation, dedicated to the recognition of income under the simplified tax system. In paragraph 1 of Art. 346.17 the wording “Receipt of funds” was used. On the other hand, an advance payment - unlike, for example, a deposit - is not mentioned in the list of income not included in the tax base under the cash method (Article 251 of the Tax Code of the Russian Federation). In addition, the advance is exactly the same cash flow as the subsequent payment.

The position of the regulatory authorities is as follows: advances under the simplified tax system form the basis of the tax (reporting) period in which they were received. It is reflected, for example, in the letter of the Ministry of Finance of the Russian Federation dated July 6, 2012 No. 03-11-11/204.

As for the return of advances, in paragraph 1 of Art. 346.17 of the Tax Code of the Russian Federation states that the return of an advance under the simplified tax system - income minus expenses reduces the base of the tax (reporting) period in which it was made.

Thus, to avoid disputes with tax authorities and litigation, it is better to include advances in the tax base for the period in which they are received.

Who calculates the penalty

If a taxpayer or employer fails to remit taxes or contributions on time, he or she will be assessed penalties. To pay penalties, you will have to wait for a request from the Federal Tax Service, which itself must establish the fact of non-payment and charge penalties.

If a taxpayer sees a tax arrears and plans to close it, he must act in the following order:

- calculate the amount of penalties yourself;

- pay the amount of arrears and penalties;

- submit an updated declaration.

In this case, the taxpayer will avoid a fine (see paragraph 1 and paragraph 4 of Article 81 of the Tax Code of the Russian Federation). If you first send an update and only then pay the arrears and penalties, the tax office will impose a fine.

How to submit an individual entrepreneur declaration to the simplified tax system

Drawing up and submitting tax reporting to the Federal Tax Service is a legal responsibility of any entrepreneurs and organizations. Failure to submit or delivery within the established time frame can lead to unpleasant consequences for the individual entrepreneur. There is an administrative penalty for such violations - a fine for late submission of a declaration under the simplified tax system in the amounts established by the state.

The law of the Russian Federation establishes that tax returns must be drawn up strictly according to the form and submitted to the tax authorities at the end of each reporting period: a year, 9 months, half a year or quarter. There are also strict rules and clear reporting dates for different situations and types of taxpayers.

- All organizations working under the simplified tax system must draw up a declaration exactly following the form established by the Federal Tax Service of Russia in order No. ММВ-7-3/352 dated 07/04/2014.

- All declarations are submitted to a specific branch of the Federal Tax Service: either at the place of residence of the individual entrepreneur or at the registration address of the organization.

- All reports are submitted for the reporting period once a year. The last day for accepting a declaration for legal entities is March 31, and for individual entrepreneurs - April 30.

- If a company or entrepreneur that used the simplified tax system has stopped working, they are required to submit a declaration by the 25th of the next month after the termination of activity.

- If the right to use the simplified tax code is lost, reporting must be submitted no later than the 25th day of the month following the last reporting period on the simplified tax system.

Even with clear deadlines, sometimes non-submission occurs. For failure to submit on time in accordance with the taxation system under the simplified tax system in 2020, punishment is expected. So, violation of filing deadlines or failure to submit reports at all entails a fine, and if the debt is already quite significant, then this fine can greatly hit the organization’s budget.

If an organization or individual entrepreneur still does not submit a declaration on time, he may be subject to sanctions or a fine for failure to submit the declaration. In 2018, the penalty amount was 5% for each month of delay, up to a maximum of 30%.

It turns out that, having been overdue for six months, you will need to pay an impressive amount, which is not very good for enterprises and individual entrepreneurs, especially for individual entrepreneurs, because all responsibility will fall on one person. And for an LLC, payments will be simplified by the availability of capital and the possibility of holding the relevant employees accountable.

The fine is invoiced only when the company submits a declaration that is already overdue. Indeed, if the reporting is not submitted on time, the declaration submitted later will be fined, these are the rules.

The minimum fine for late filing of a declaration is 1,000 rubles. This can happen if, due to a delay in submitting the declaration, the individual entrepreneur nevertheless provided a zero declaration after the deadline, meaning that the activity was not actually carried out, and therefore there is nothing to take tax from.

A situation may also occur when the responsible employee is also fined for late delivery. This happens in cases where the delay was caused by the employee himself and only in an LLC; an individual entrepreneur cannot receive such penalties for late dispatch.

In some situations, it happens that the company not only did not submit a declaration, but also did not pay taxes (various prepayments, contributions and advance payments under the simplified tax system also apply to such cases). Then a fine is imposed for late payment of tax or a fine for non-payment of tax according to the simplified tax system, if only the contributions have not been paid.

Responsibility for late payment of tax under the simplified tax system is much more serious than for late submission of a document. Here the punishment for non-payment will be much more serious - up to and including criminal liability for evasion or falsification of official papers.

Also, in addition to fines, the Federal Tax Service may decide to block the company’s current accounts if the delay in submitting the declaration exceeds 10 working days. In such cases, the actual activities of the organization are sharply slowed down due to frozen funds, accordingly forcing the enterprise to quickly prepare and submit reports.

The need to pay advance payments on a simplified taxation system

The need to pay advance payments is established by paragraphs 3 and 4 of Article 346.21 of the Tax Code of the Russian Federation. Advance payments must be paid at the end of each reporting period. The deadlines for payment of advance payments are specified in Article 346.21 of the Tax Code of the Russian Federation and are shown in the table using the example of 2020.

| Reporting period | Due date |

| 1st quarter 2020 | no later than April 25, 2020 |

| half year 2020 | no later than July 25, 2020 |

| 9 months of 2020 | no later than October 25, 2020 |

Read also the article ⇒ Can an individual entrepreneur issue an invoice using the simplified tax system?

Why penalties are charged on the simplified basis (and how they are calculated)

The first day for accrual of penalties is considered to be the next day after the deadline for payment of taxes or contributions. Officials have differences regarding the last day for calculating penalties.

The Federal Tax Service clarified that penalties stop accruing the next day after payment, which means the day of payment is included in the calculation of penalties. However, there is a letter from the Ministry of Finance stating that there is no need to charge penalties for the day the arrears are paid. This letter was not sent to tax authorities for mandatory application, so you can be guided by these explanations at your own peril and risk.

If the amount of penalties per day is small, it is safer to include the day of payment in the calculation of penalties. If the amount is large, be prepared to have to defend your actions in court. In addition, the taxpayer can make a written request to clarify the calculation procedure from the Ministry of Finance in order to rely on the official response in the calculations.

The reasons (and principles for calculating) penalties on the simplified tax system are generally the same as if any other tax was paid instead of the simplified tax system. It does not matter how the payment to the budget is calculated: penalties under the simplified tax system - income minus expenses - in 2018-2019 are calculated similarly to the simplified tax system - income.

We invite you to read: Arrest for failure to pay a traffic fine

1. Accrued in case of delay in payment of tax (advance) to the budget.

The tax is considered to be paid in arrears if, by the end of the day on which the deadline for its payment expires, the business entity has not generated a payment order to transfer the tax through its current account or bank cash desk.

You can find out about the deadlines for paying taxes under the simplified tax system here.

2. Calculated for each day of delay - until the tax debt is repaid.

Penalties should not be confused with a fine - a fixed penalty in the amount of 20-40% of the amount of unpaid tax. A fine is assessed on the basis of Art. 122 of the Tax Code of the Russian Federation.

Let's take a closer look at the specifics of calculating penalties on the simplified tax system - income minus expenses - and the simplified tax system - income - in more detail.

Formula and example of calculating an advance payment using the simplified tax system of 6%

To determine the amount of AP to be paid, you need to subtract the above expenses and the AP amounts for the previous period (periods) from the calculated amount.

APu = APr − V − APpr,

where B is the sum of all deductions.

Example

Individual entrepreneur Ivanov I. I., working in Moscow, has switched to the simplified tax system, the “income” object, since 2020.

For 9 months of 2020, his income amounted to 4 million rubles.

The rate for the “income” object in Moscow is set at 6%.

The amounts of contributions for compulsory insurance for 9 months amounted to 150,000 rubles, in addition, Ivanov I.I. paid a trade fee in the amount of 80,000 rubles.

Ivanov I.I. paid AP for 3 months in the amount of 10,000 rubles. and for 6 months in the amount of 12,000 rubles. Let us determine the amount of the entrepreneur's AP due for payment for 9 months.

Tax base B = 4 million rubles.

Estimated advance amount Ap = 4 million rubles. × 6% = 240,000 rub.

Deductions B = 240,000 rub. × 0.5 + 80,000 rub. = 200,000 rub.

Since the amount of insurance premiums paid (150,000 rubles) amounted to more than 50% of the calculated amount of the accident, only 120,000 rubles are accepted for deduction for this type of expense. (RUB 240,000 × 0.5).

Amount to be paid:

APu = 240,000 rub. − 200,000 rub. − 10,000 rub. − 12,000 rub. = 18,000 rub.

Fine for non-payment of advance payments usn

Current as of: May 10, 2020

Any taxpayer who fails to pay taxes on time may be subject to tax liability, including an individual entrepreneur. The main punishment for non-payment of taxes by an individual entrepreneur, like any other taxpayer, is a monetary penalty, i.e. a fine (clause 2 of Article 114 of the Tax Code of the Russian Federation).

- 20% of the unpaid tax amount if the offense was committed without intent;

- 40% of the unpaid tax amount in case of intentional commission of an offense.

This is a general norm of the Tax Code of the Russian Federation, applied to all unpaid taxes of an entrepreneur, which he must pay as a taxpayer in accordance with his taxation regime.

Every entrepreneur who has employees must withhold and transfer to the budget personal income tax on income paid to them (as well as on income paid to individuals who are not individual entrepreneurs with whom civil contracts have been concluded). In other words, fulfill the duties of a tax agent (clause 1 of Article 226 of the Tax Code of the Russian Federation).

Naturally, the Tax Code of the Russian Federation specifies tax fines for individual entrepreneurs for failure to fulfill these obligations. If an entrepreneur did not withhold personal income tax from such income and did not transfer it to the budget, or withheld and did not transfer it, then he will be subject to a fine of 20% of the amount subject to withholding and/or transfer (Article 123 of the Tax Code of the Russian Federation).

Tax authorities have recently regularly received information about the date of withholding and transfer of personal income tax from forms 6-NDFL. But inspectors can make a decision to prosecute and impose a fine on the employer only based on the results of reviewing the tax audit materials (Letter of the Federal Tax Service dated January 20, 2017 N BS-4-11/864).

Let us note that the Tax Code of the Russian Federation also establishes other offenses, the commission of which by an entrepreneur will entail the imposition of a fine.

In certain cases, an individual entrepreneur may be held criminally liable for non-payment of taxes. But an entrepreneur can be accused of tax evasion in accordance with the Criminal Code of the Russian Federation only if they fail to pay them on a large or especially large scale (Article 198 of the Criminal Code of the Russian Federation).

A penalty is a type of sanctions provided for the presence of a delay in tax payment or for the fact that payment has not been made in full. In addition, it is relied upon if errors were made in the declaration, which led to a reduction in the amount of tax and the formation of a debt to the budget.

It is calculated in accordance with the procedure established by Article 75 of the Tax Code: from the day immediately following the deadline for paying tax.

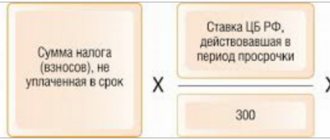

The penalty is calculated by multiplying the amount of the unpaid advance payment by the number of days of delay and 1/300 of the refinancing rate valid during the period of delay. Accrual occurs for each overdue day, including holidays and weekends.

In addition to penalties, there is also the concept of a fine, which is due for the fact that the declaration was not submitted within the required period. The fine is 1/20 of the amount of untransferred tax, but less than 1000 rubles.

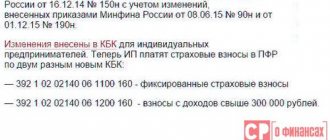

Kbk and sizes

Penalty on income is paid according to BCC 182 1 0500 110. This BCC has been used since 2020. If the taxpayer has chosen not income as the object, but income minus expenses, then the code used when paying the penalty will be as follows: 182 1 0500 110.

For 2020, a single BCC is provided, which is used for paying the simplified tax system both if the object is income minus expenses, and when paying the minimum tax. This code looks like this: 182 1 0500 110.

When making calculations for these taxes, the use of previously existing BCCs is not provided.

Inspectors can charge penalties only on those advance payments whose amount is no more than the minimum tax. This norm is specified in the Letter of the Ministry of Finance dated February 24, 2020.

If there is a delay in advance payments, penalties are calculated based on 1/300 of the Central Bank rate for each day following the day when the funds should have been paid to the state budget. However, if the amount of tax at the end of the year does not reach the advances, then tax officials have the right to calculate penalties only for those advances that do not exceed the annual amount.

True, in practice, a number of enterprises that have chosen a simplified taxation system pay not the usual, but a minimum tax of 1% of their income. In this case, it is not entirely clear how the penalty can be calculated if the minimum tax is less.

The above-mentioned Letter from the Ministry of Finance states that calculation of penalties is possible only on advances that do not exceed the minimum tax. For example, if, in fact, based on the results of each reporting period, the payment of 50,000 rubles is due, and the amount of the minimum tax is 10,000 rubles, then it is from the last amount that the penalty will be calculated.

For each month of delay due to failure to submit a declaration, a penalty of 5% is expected. When calculating it, the amount of the annual simplified tax is taken as the basis. The minimum fine threshold for both individual entrepreneurs and enterprises is 1000 rubles.

You can expect a fine of this amount if there is zero reporting. If the delay in filing a declaration exceeds six months, then the tax authorities have the right to apply a maximum fine of 30% of the tax amount.

A tax penalty is issued after a desk audit of the declaration has been carried out. At the same time, based on its results, an additional simplified tax may be charged, which will need to be paid. Accordingly, the fine will be calculated based on the amounts calculated by the inspector.

It should be borne in mind that it will not be possible to avoid a fine by not submitting a declaration and hoping that the camera will not be carried out. After the 10-day period has passed since the deadline for filing the declaration has passed (for individual entrepreneurs - May 4, and for individuals - March 31), the inspectorate will block all accounts.

In this case, the payer simply will have no other option but to submit a declaration. In addition to tax liability, a delay in submitting reports can also result in administrative ones. The judicial authority, based on an application from the tax service, may impose a fine of 300-500 rubles on an entrepreneur, manager or chief accountant.

The obligation of any organization, even if there is no activity, is to submit quarterly reports to the tax authorities. The law provides for sanctions against those who do not submit reports on time. So, if the period of delay does not exceed 180 days, then a 5% penalty is charged for each overdue month of the amount that should have been paid in the form of tax.

A zero declaration is also not a reason for exemption from penalties. In this case, the fine is charged in the minimum amount, which, according to Article 119 of the Tax Code, is equal to 100 rubles.

We invite you to read: Which organizations can apply the simplified tax system?

If there is a delay exceeding 180 days, then the legislation provides for a more serious fine equal to 30% of the tax amount and another 10% for each overdue month following the 181st day.

Moreover, for such situations the minimum amount of the fine is not regulated, so if a zero declaration is presented within 180 days, no fine should be imposed.

At the same time, the Federal Tax Service, despite having the right to collect penalties and fines, may well not do this. In most cases, especially for first and minor violations, the tax service does not resort to penalties. Therefore, it makes sense to pay penalties and fines only after they have already been assigned.

In accounting, penalties and fines should be reflected in account 99. As for tax accounting, the amount of fines and penalties that were accrued does not affect the calculation of income tax.

In tax legislation, the concepts of penalties and fines are clearly distinguished. Penalties are understood as a certain amount of money that must be transferred to the budget by a company that has not fulfilled its tax obligations on time.

A fine is a type of tax sanction to be collected from an enterprise that has committed a tax violation.

For accounting purposes, it is possible to combine penalties for late payment of taxes and fines for tax offenses into a general category of accounting items called tax sanctions.

This approach does not contradict the objectives of accounting related to providing complete and reliable data regarding the functioning of the enterprise, as well as the key principles of its management, that is, rationality and the prerogative of content over form.

Funds accrued in the form of tax sanctions do not participate in the formation of a conditional income tax expense. Therefore, in accounting, these funds are reflected in account 99 “Profit and Loss”, which also corresponds with 68 and 69 accounts intended for recording calculations for taxes and fees and social insurance and social security, respectively.

To ensure analytical accounting of tax sanctions to the 68th and 69th accounts, it is recommended to open sub-accounts related to taxes in connection with which sanctions arose.

Penalties are assigned and calculated by the tax authorities, but everyone who has committed a fine would like to know in advance what the amount of penalties will be. This can be done based on the figures specified in regulatory documents, but this requires constant monitoring of changes in legislation.

Advance payments under the simplified tax system “income”

In order to calculate advance payments under the simplified tax system - income, you first need to determine the tax base. For a given object of taxation, it is equal to the amount of income of the taxpayer, determined taking into account the requirements of Art. 346.15 and 346.17 Tax Code of the Russian Federation:

B = D.

Then the AP amount is determined for a given tax base:

Apr = B × C,

Where:

Apr - estimated amount of advance payment;

C is the tax rate.

For the object “income”, the tax rate can range from 1 to 6%, depending on the decision of the legislative bodies of a particular region (clause 1 of Article 346.20 of the Tax Code of the Russian Federation).

In addition, for first-time registered individual entrepreneurs there are tax holidays until 2020. During the holidays, these entrepreneurs working in the production, social or scientific spheres or providing household services to the population can use a 0% rate for two years.

Next, from the calculated amount of the AP, the taxpayer can deduct the following types of expenses (clauses 3.1 and 8 of Article 346.21 of the Tax Code of the Russian Federation):

- Contributions for compulsory insurance. In this case, both payments for employees and fixed contributions for oneself are taken into account for individual entrepreneurs who do not have employees.

- Payment of sick leave benefits at the expense of the employer.

- Insurance premiums under contracts concluded in favor of employees in the event of their disability.

- Trade fee paid.

Important! Using the costs specified in paragraphs. 1–3, the amount of AP under the simplified tax system can be reduced by no more than 50%. If a trading fee is deducted, there is no such limitation. Also an exception are individual entrepreneurs who do not make payments to individuals and pay contributions for themselves. These contributions also reduce the amount of the AP in full.

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

How to calculate (and pay) penalties online

If the organization is overdue for 31 days or more, calculate the penalties as follows:

- First, we calculate penalties for the first 30 days of delay: Amount of arrears * (Key rate of the Central Bank of the Russian Federation for the period of violation / 300) * 30

- Then we calculate penalties for subsequent days of delay: Amount of arrears * (Key rate of the Central Bank of the Russian Federation for the period of violation / 150) * Number of days of delay from 31 days

- Let's sum both values.

Calculate penalties using our free calculator. Calculations will take less than a minute.

4.7 average out of 26 ratings

Fine individual entrepreneur for failure to pay tax

The simplified tax system 6% calculator is intended for calculating the single tax for those taxpayers who have chosen the “income” tax base. To calculate the simplified tax system 6, the calculator will ask you to fill in the initial data.

Use our service “STS 6% Calculator”.

You will need to indicate the amount of income for each quarter, the amount of insurance premiums paid (including for voluntary insurance), sick leave benefits and advance payments for the single tax. If necessary, it is possible to reflect payment of the trade fee.

You can separately calculate the tax for the quarter.

The ability to calculate a single tax under the simplified tax system for individual entrepreneurs without employees has been implemented. The difference between this calculator is the reduction of tax on a fixed insurance payment.

From 2020, constituent entities of the Russian Federation have the right to reduce the tax rate down to 1%. Therefore, before using the calculator, it is recommended that you check your local laws and find out what percentage applies in your area.

The publication “Single Tax under the Simplified Taxation System (STS)” will help you calculate your tax yourself.

The penalty calculator under the simplified tax system will calculate the amount of penalties that must be paid when filing a clarifying declaration or late payment of tax.

Use our Penalty Calculator.

The formula for calculating penalties in the calculator corresponds to the norms of clause 4 of Art. 75 of the Tax Code of the Russian Federation: 1/300 of the Central Bank refinancing rate for each day of late payment. Since 2020, the refinancing rate has been equal to the key rate (directive of the Central Bank of the Russian Federation dated December 11, 2015 No. 3894-U).

Read more in the article “The Central Bank equated the refinancing rate to the key rate.”

For current rates as of the required date, see the material “Information on the refinancing rate of the Central Bank of the Russian Federation.”

FINE (IP) = DEBT × ((RATE1 / 100) / 300) × DAYS (ST1) DEBT × ((RATE2 / 100) / 300) × DAYS (ST2),

DEBT - the amount of tax not paid on time;

RATE1 - the key rate valid in the period between the first day of accrual of penalties and the day preceding the day on which another rate began to apply (if it was introduced), or the day preceding the day of debt repayment (if another rate was not introduced);

RATE2 - another rate (if introduced) for the period from the date of introduction to the day preceding the day of debt repayment;

DAYS (ST1) — period of validity of the RATE1 indicator in days;

DAYS (ST2) — period of validity of the RATE2 indicator in days.

23.08.2017

Simplified taxation is attractive as long as you regularly fulfill your obligations as a taxpayer. As soon as you stop doing this, the same sanctions apply as for everyone else, and there are no concessions here.

What are the consequences of late payment of taxes under the simplified tax system? It depends on what exactly you did wrong: you didn’t pay an advance or an annual tax.

Late advance payment under the simplified tax system

Entrepreneurs and LLCs must make advance payments by the 25th of each quarter, that is, by April 25, July and October. If this is not done, there will be no fines, but the penalty counter will be activated.

They are calculated based on 1/300 of the Central Bank refinancing rate for each day of delay.

[/su_box]

From October 1, 2020, it has become even more unprofitable for enterprises to have tax debts - from the 31st day of delay, penalties will be calculated based on 1/150 of the refinancing rate.

An example of calculating penalties for advance payments of the simplified tax system

Morozko LLC owed an advance payment to the budget for the first quarter in the amount of 25 thousand rubles. The refinancing rate in 2020 is 7.5%.

25,000 x 9% x 1/300 = 6.25 rubles. for each overdue day.

25,000 x 7.5% x 1/150 = 12.5 rubles. in a day.

If Morozko LLC continues not to pay, then penalties for advances made in the 2nd and 3rd quarters will be added to this amount. The Federal Tax Service will issue penalties for late payment of the simplified tax system only when it receives the annual declaration and calculates everything, and during this time the amount will accrue noticeably.

We invite you to read: Personal income tax when selling a donated apartment

Kbk and sizes

Quote (Magazine “Simplified” 04/14/2015): Penalties for non-payment of advance payments under the simplified tax system Many simplifiers faced such a problem at the end of the year. At the end of the quarters, we did not pay advance payments due to the fact that we were unable to pay the minimum tax. And at the end of the year, tax inspectors calculated penalties for non-payment of advance payments.

How to act in this situation? How are penalties for non-payment of taxes calculated under the simplified tax system? Do I need to pay advances on the minimum tax? In practice, many simplifiers do not pay advance payments under the simplified tax system. Or they pay them at the KBK for the minimum tax. They justify this by saying that at the end of the year they will have to pay a minimum tax. However, the BCC for paying tax according to the simplified tax system and the minimum tax are different.

Therefore, if you do not pay advance payments or pay them at the BCC of the minimum tax, the inspectorate considers that there were no payments. And charges penalties for non-payment of advance payments according to the Tax Code. And these penalties are assessed by law, they must be paid. It turns out that advances must be paid not on the KBK minimum tax, but on the KBK tax. Otherwise, tax authorities will charge penalties.

Deadlines for paying advances under the simplified tax system Let us remind you that advance payments for the “simplified” tax must be made no later than the 25th day of the month following the expired reporting period. That is, for the first quarter the advance must be transferred no later than April 25, for the first half of the year - no later than July 25, and for 9 months - no later than October 25. This follows from paragraph 2 of Article 346.19 and paragraph 2 of paragraph 7 of Article 346.21 of the Tax Code of the Russian Federation.

Please note: if the 25th falls on a weekend or non-working holiday, the payment deadline is postponed to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). How to calculate penalties for advances under the simplified tax system. The amount of penalties is determined in accordance with Article 75 of the Tax Code of the Russian Federation.

Amount of penalties = Unpaid amount of tax (advance) × Number of days of delay × 1/300 × Refinancing rate valid during the period of delay

Example 1. Calculation of penalties for an advance payment not paid on time under the simplified tax system. Dar LLC, which applies the simplified tax system with the object income minus expenses, did not accrue and pay on time the advance payment for the “simplified” tax for 9 months of 2014 in the amount of 43,000 rub. The arrears were repaid only on February 10, 2020 - at the time of preparation of the annual reports. The total delay in payment was 108 days.

That is, from October 26 - this is the day following the day established for payment of the advance payment for 9 months, and before the day of payment of the arrears. Of these: 6 days - in October 2014; 30 days - in November 2014; 31 days - in December 2014; 31 days - in January 2014; 10 days - in February 2014. The refinancing rate during the period of delay did not change and amounted to 8.25% (Instruction of the Bank of Russia dated September 13.

2012 No. 2873-U).

This means that the amount of penalties for arrears is 1277.1 rubles. (RUB 43,000 × 108 days × 1/300 × 8.25%).

Penalty for non-payment of advances There is no penalty for late payment of advance payments of taxes (paragraph 3, paragraph 3, article 58 of the Tax Code of the Russian Federation). Such a sanction can only be imposed for non-payment of the tax itself, that is, this means the transfer of a “simplified” tax at the end of the year (Article 122 of the Tax Code of the Russian Federation).

Tax Code of the Russian Federation Article 346.21. Procedure for calculating and paying tax

Quote: 7. Tax payable at the end of the tax period is paid no later than the deadlines established for filing a tax return in Article 346.23 of this Code.

Advance tax payments are paid no later than the 25th day of the first month following the expired reporting period.

Quote: 1. Penalty is the amount of money established by this article that the taxpayer must pay in the event of payment of due amounts of taxes or fees, including taxes paid in connection with the movement of goods across the customs border of the Customs Union, later than those established by law about taxes and fees deadlines.

2. The amount of the corresponding penalties is paid in addition to the amounts of tax or fee due for payment and regardless of the application of other measures to ensure the fulfillment of the obligation to pay a tax or fee, as well as measures of liability for violation of legislation on taxes and fees.

3. A fine is accrued for each calendar day of delay in fulfilling the obligation to pay a tax or fee, starting from the day following the tax or fee payment established by the legislation on taxes and fees, unless otherwise provided by Chapters 25 and 26.1 of this Code.

4. The penalty for each day of delay is determined as a percentage of the unpaid amount of tax or fee.

The interest rate of the penalty is assumed to be equal to one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at that time.

5. Penalties are paid simultaneously with the payment of taxes and fees or after payment of such amounts in full.

For non-payment of tax, a fine of 20% plus interest is charged. For particularly large violations, criminal prosecution is permitted. In addition to collecting land, transport, and property taxes, individual entrepreneurs are required to pay personal income tax, VAT, and others. If the individual entrepreneur does not pay taxes after receiving the notification, then a system of penalties comes into force, which includes:

The accrual of penalties for non-payment of taxes by individual entrepreneurs under the simplified tax system begins from the first day of late payment. For a fine, an offense is established to find the offender guilty. The reasons and facts of non-payment are established. A notice of violation is sent to the defaulter.

If the amount of non-payment is more than 3 thousand rubles, then the court has the right to file a claim within 6 months after the fact of delay is established. In case of a smaller amount, the court begins consideration of the non-payment case after 3 years.

The fine for failure to pay income tax for an entrepreneur is 20% of the amount of income that an individual entrepreneur received for the reporting period. It is important to know that only a penalty will be charged for failure to make advance payments.

In what cases are advance payments made under the simplified taxation system?

As already mentioned, when applying the simplified taxation system, tax is paid. It must be paid after the tax period. However, advance payments must also be made during the reporting period . The difference between the tax period and the reporting period is clear from the table.

| Taxable period | Reporting period |

| year | first quarter |

| half year | |

| nine month |

This information is contained in paragraphs 1 and 2 of Article 346.19 of the Tax Code of the Russian Federation.

Advance payments are calculated differently depending on what object of taxation is used in an organization or an individual entrepreneur, “income” or “income minus expenses.” If the tax base is “income”, then advance payments are calculated according to the following scheme:

- the tax base for the reporting period is determined;

- The amount of the advance is determined by the formula:

Advance payment = cumulative income from the beginning of the year x tax rate (6%)

- The amount of advance payment that must be paid is calculated:

Advance payment payable = Advance payment – Social contributions – Advance payments paid for previous reporting periods

Social contributions include:

- disability benefits;

- contributions to compulsory pension insurance;

- health insurance contributions;

- compulsory social insurance in case of temporary disability and in connection with maternity;

- insurance premiums against accidents and occupational diseases.

Such a “deduction” cannot be more than 50% of the amount of the accrued advance (tax) for organizations; for individual entrepreneurs it can be taken into account in full.

If the object of taxation is “income minus expenses,” then the calculation of advance payments is as follows:

- the tax base for the reporting period is determined using a formula;

tax base = income – expenses (both indicators are cumulative from the beginning of the year)

- The amount of the advance is determined by the formula:

Advance payment = tax base x tax rate (15%)

- The amount of advance payment that must be paid is calculated:

Advance payment due = Advance payment – Advance payments paid for previous billing periods

Please note that social contributions are included in expenses here and are therefore not highlighted separately.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

KBC for transferring penalties in 2020 and 2020

- Pension insurance - 182 1 0210 160

- Medical insurance - 182 1 0213 160

- Disability and maternity insurance - 182 1 0210 160

- Injury insurance - 393 1 0200 160

- Federal income tax budget - 182 1 01 01011 01 1000 110

- Income tax in reg. budget - 182 1 01 01012 02 1000 110

- VAT — 182 1 0300 110

- Property tax, except for the Unified State Social Insurance System - 182 1 06 02020 02 1000 110

- Tax on property included in the Unified State Social System - 182 1 06 02020 02 1000 110

- Personal income tax (and individual entrepreneurs “for themselves”) - 182 1 0100 110

- STS “income” - 182 1 0500 110

- STS “income-expenses” and minimum tax - 182 1 05 01021 01 1000 110

- UTII - 182 1 0500 110

Compare the amount of the additional payment with the advance payment for 9 months

Example. Calculation of tax under the simplified tax system for additional payment at the end of the year

For those who take into account expenses, at the end of the year it is necessary to calculate the tax at the regular rate and the minimum tax (clause 6 of Article 346.18 of the Tax Code of the Russian Federation). The one whose amount is greater will be payable.

This is interesting: Changing the structure of the enterprise and staffing

Situation No. 2. The amount to be paid is negative. It turns out that for the year you have to transfer less “simplified” tax than you have already paid for the first quarter and half of the year. Then you don’t have to transfer the advance accrued for 9 months at all.

As for penalties, following the recommendations of the Ministry of Finance noted above, in this situation they should be reduced to zero. After all, the annual tax amount is less than advance payments for the first quarter and half of the year. And you paid them without delay. However, keep in mind that the procedure in which tax authorities reduce penalties is not clearly regulated. It is unlikely that inspectors will reduce the amount of penalties automatically. Therefore, clarify this issue with the inspectorate as soon as you submit your annual declaration under the simplified tax system. And be prepared for the fact that you will have to submit additional applications and argue with inspectors, defending your innocence.

Situation No. 3. The additional payment is greater than or equal to the accrued advance payment for 9 months. Then transfer the entire accrued down payment for 9 months as soon as possible. Because late fees are growing daily. And you can transfer the remaining amount for additional payment later - until the end of March next year, if you keep records in the company. Or until the end of April, if you work for an individual entrepreneur (clause 7 of Article 346.21 of the Tax Code of the Russian Federation). Please include late fees along with the advance payment. Calculate the amount of penalties using the formula:

Amount of penalties for late advance payment

Amount of late advance payment

When can you avoid paying penalties?

In some cases, penalties are not charged. For example, when a taxpayer’s account is blocked or money is seized by court order. Or when, when calculating taxes or contributions, a businessman was guided by a court ruling.

You will also avoid penalties if the arrears arose due to an error in the payment order, which can be corrected by clarifying the payment - in this case, the penalties will be reversed. The error is corrected by clarification if it is not associated with an incorrect indication of the account number, recipient bank or KBK.

Questions that arise

A number of questions remain open. Difficulties arise in relation to advance payments most often when receiving losses and determining income when calculating tax. What clarifications on this matter are there in legislative acts?

Do I need to pay an advance payment if a loss is incurred?

Is it necessary to calculate the advance amount and pay it to the budget if the period turns out to be unprofitable?

According to Art. 346.18 Tax Code, payers who work on the simplified tax system “Income minus expenses” transfer the minimum tax if the amount of the single tax is less than the minimum.

Video: advance payments of the simplified tax system

That is, the company must pay a minimum tax if losses are incurred during the tax period.

If you have not paid advance amounts, you do not have to worry, since such an obligation will not arise. Some companies still transfer funds in order to pay less at the end of the year.

If a company operates under the simplified tax system “Income” and a loss is recorded, it is still necessary to pay 6%. The results are calculated quarterly on an accrual basis at the beginning of the tax period.

Is an advance considered income?

There is no consensus on whether advance payments are taxable. There is no mention of this in the Tax Code, and therefore the following point of view arises: the advance payment does not need to be included in profit under the simplified tax system, which means that it is not worth paying tax on it.

If a company operates under the simplified tax system, income is considered to be:

- profit from the sale of products/services and property rights;

- non-operating profit.

Advance amounts are not considered profit from sales. In accordance with Art. 249 of the Tax Code, sales revenue is determined based on all receipts that are associated with determining the amounts for goods sold or rights to property.

According to Art. 39 Tax Code sale of products is a paid transfer of ownership rights to products, works or services. Upon receipt of an advance, there is no transfer of ownership.

Advance payments and non-operating profit are not considered. In accordance with the provisions of Art. 41, profit is a benefit of an economic nature, expressed in cash or in kind, subject to evaluation.

If a taxpayer applying a simplified tax regime receives an advance, then there is no benefit. This is explained by the fact that the company will be liable to the enterprise that transferred the advance amount.

Provided that the goods are not provided to the buyer, the advance payment must be transferred back. This means that in this case, advances are not considered profit. Accordingly, taxes on them do not need to be calculated and paid.

Inspectors have a different point of view. If the company operates on the simplified tax system “Income”, the calculation takes into account the profit from the sale, as well as non-operating income.

The date of receipt of profit is the day when funds arrive at the cash desk, property, work, services are received, and debt is repaid. Let's consider the provisions of Ch. 25 of the Tax Code of the Russian Federation.

Property objects, works, services that were received from a person in advance of payment for products/services/work by payers who determine profits and costs using the accrual method cannot be taken into account as profit.

In accordance with Art. 39 of the Tax Code, the date of actual sale of goods can be determined in accordance with Art. 346.17 clause 1 of the Tax Code of the Russian Federation.

This is the rationale for the fact that advances received against shipments from the taxpayer are considered a taxable item in the period in which they are received.

This is interesting: Checking water meter readings by the management company

Is it necessary to keep a log of received and issued invoices under the simplified tax system? Read here.

Whether personal income tax is taken into account in expenses under the simplified tax system, see here.

The Tax Service is of the opinion that the advance payment should be included in income. The problem of determining the tax base also arises when repaying an advance.

According to the rules prescribed in Art. 346.15 clause 1 of the Tax Code of the Russian Federation, when determining the objects of taxation, profit from Art. 251 Tax Code is not taken into account.

The amount of the advance payment that is returned to the company is not mentioned in this regulatory act.

This means that if advance payments transferred to the seller were taken into account in the list of costs when calculating the tax base, then the returned amount should be reflected in income.

If the amounts of advances were not reflected in expenses, then the returned amounts are not indicated in the profit of the taxpayer.

If you have switched to the simplified tax system, then sooner or later questions about making advance payments will arise.

In order not to get into trouble in the form of penalties and problems with submitting reports at the end of the year, it’s worth looking into this.

After all, if the advance payment is not paid in full or the payment is completely overdue, you will have to bear responsibility for it. And this is fraught with additional costs for the company.

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- Regions

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.