The benefits to which unemployed women are entitled are mainly paid by the social protection authorities at their place of permanent registration.

But there are some exceptions: if a pregnant woman was fired due to the liquidation of the company, then she has the right to receive “maternity” payments. They are calculated based on the average salary in the region of the federation where this benefit is calculated.

It is calculated for 140 days of maternity leave and can be paid in the woman’s hands or transferred to her bank account. These payments are made at the expense of the Social Insurance Fund. There are categories of unemployed women who are also entitled to maternity benefits. This:

- female students studying full-time;

- contract employees;

- employees dismissed due to the liquidation of the company.

If a woman’s pregnancy proceeds without complications, then the duration of such leave is 140 calendar days - 70 days before childbirth and 70 after childbirth. But some women have the right to extended leave:

- if a multiple pregnancy is detected;

- if the birth occurred by caesarean section;

- women living in regions contaminated after the Chernobyl accident;

- women living in areas classified as contaminated after the accident that occurred on.

Not only the mother, but also the father at the place of work has the right to receive a one-time benefit for the birth of a child. If a woman is single, then such benefits are awarded to her by the Department of Social Protection of the Population.

A non-working woman, a housewife, has the right to receive the same benefits as a working woman, with the exception of maternity benefits and benefits when registering in the early stages of pregnancy. Today, 12 weeks is considered early pregnancy.

If a woman registers with a antenatal clinic before 12 weeks, then she is entitled to a benefit in the amount of 628.47 rubles at a time. This issue is regulated by Article 4 of Federal Law No. 81 Federal Law of May 19, 1995.

Maternity leave if the woman does not work

Only those women who are officially employed and for whom the employer pays contributions to the Social Insurance Fund can receive paid maternity leave. This happens because the Social Insurance Fund fully compensates the employer for these expenses. This happens after the employer submits a report to this extra-budgetary fund and shows on what basis the payments were made.

The basis is a sick leave issued by a medical institution where the woman is registered as a pregnant woman. It is issued at 30 weeks of pregnancy (for multiple pregnancies - at 28 weeks). Sick leave must be issued in accordance with all the rules.

Therefore, unemployed women do not have to count on receiving payments. The situation is exactly the same if a woman worked unofficially, that is, without drawing up an employment contract. If a woman does not work, then maternity benefits will depend on:

- on the amount of the scholarship. In Moscow this is a minimum of 1,500 rubles per month;

- on the amount of allowance for a mother who is a military personnel. Its average in Russia is 30,000 rubles per month.

Payment is made in the amount of 100% of the woman’s average income for the last 2 years.

If a woman has registered at the Employment Center

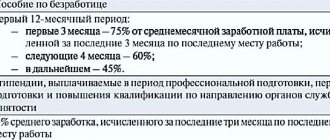

If the expectant mother is registered at the labor exchange and receives unemployment benefits, then she is not provided with a lump sum benefit.

She will receive a standard benefit - a minimum fixed amount or a percentage of wages.

This percentage is provided only for the first 12 months and is:

- 3 months – 75% of average earnings for three months;

- next 4 months – 60%;

- 5 months – 45%.

For the remaining year, the woman will receive a minimum benefit of 850 rubles. After the birth of the child, she can apply for maternity benefits.

Maternity benefits for students

Only female students enrolled in a full-time study program can apply for maternity benefits. Correspondence students are deprived of this right. The exception is a working part-time student. She can apply for benefits at her main place of work. Expectant mothers who receive:

- initial professional;

- secondary vocational;

- higher professional;

- postgraduate professional.

Important! The father of the child does not have the right to receive this benefit instead of the mother, a student. In addition, she has the right to be granted academic leave.

Students who become mothers during their studies are entitled to the following benefits:

- for registration in the early stages of pregnancy;

- for pregnancy and childbirth;

- one-time benefit;

- to care for the child until he is 1.5 years old.

To apply for benefits, you need to contact various authorities. The educational institution only bears the cost of paying sick leave. To do this, you need to contact the accounting department and submit a sick leave certificate. While the sick leave is valid, the student cannot be expelled for poor academic performance.

A student mother can count on paid maternity leave. But the amount received will depend on the size of the scholarship the student receives. In Moscow, the minimum scholarship amount is about 1.5 thousand rubles.

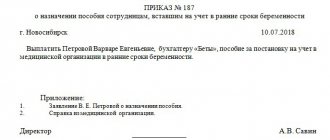

One-time benefit for women registered in the early stages of pregnancy

Pregnant women who registered with the antenatal clinic early in pregnancy (up to 12 weeks), in accordance with Art. 9 of Federal Law No. 81-FZ “On state benefits for citizens with children” dated May 19, 1995, have the right to receive an additional lump sum payment to the maternity benefit - on February 1, 2020, the amount of this payment is 675.15 rubles in accordance with Decree of the Government of the Russian Federation dated January 29, 2020 N 61.

There are a number of other benefits that a pregnant woman may qualify for. For example, in Moscow, in addition to federal payments, there is also a payment for the fact that a woman registers with a doctor for a consultation for up to 20 weeks. This payment is made in a lump sum. If a woman has a Moscow registration, then she has the right to apply for this payment in one of the RUSZN of the city of Moscow (District Departments of Social Protection of the Population). It does not depend on the place of study, the fact of service or work, but you can get it if you have a certificate of the established form, which is recorded in the Letter of the Moscow Department of Health No. 33-18-3165 dated 08.11.2006.

Amounts of maternity benefits

Depending on the status of a pregnant unemployed woman, the amount of benefits she can qualify for will depend.

The amount of maternity payments depends on the status of the recipient:

- working women receive benefits in the amount of 100% of average earnings;

- dismissed due to the liquidation of the organization - in the amount of 300 rubles;

- female students - in the amount of the scholarship;

- military personnel - contract women - in the amount of monetary allowance.

Unemployed women can count on receiving the following benefits:

- lump sum payment at the birth of a child;

- benefits until the child reaches 1.5 years of age.

The following payments are also available to the unemployed, independent of the employment of the mother and father:

- a one-time benefit to the pregnant wife of a military man who is serving on conscription;

- one-time benefit when placing children in a family;

- monthly allowance for a large low-income family;

- monthly allowance for the children of a conscript;

- maternal (family) capital, at the birth of a second or subsequent child.

Unemployed women can receive the following benefits through the social protection authorities:

- one-time benefit, which is paid at the birth of a child - 16,759.09 rubles;

- child care allowance up to 1.5 years old. If the child is the first, then the amount of the benefit is equal to 3,142.33 rubles, but if the second or subsequent children were born, then the amount of the benefit will be equal to 6,284.65 rubles.

A separate category of women are the wives of military personnel undergoing compulsory military service upon conscription in the army. They have their own payment amount. A woman receives 26,539.76 rubles monthly during pregnancy, and after the birth of a child – 11,374.18 rubles.

List of unemployed mothers on the waiting list

Those who are entitled to money in connection with BiR are:

- do not have official labor status;

- were calculated a year before the decree, but due to the liquidation of the enterprise (registration on the stock exchange is required);

- lost their position due to bankruptcy of the enterprise;

- notaries, lawyers who have resigned;

- wives of conscript soldiers.

It is mandatory for a woman who has lost her job to join the stock exchange within 12 months, especially if she is already pregnant or planning a pregnancy. Otherwise, she will lose the right to receive a number of cash payments related to BiR.

Important! Since the beginning of 2010, a new rule has been in force in the Russian Federation. It states that a woman can receive benefits for a child from 0 to 1.5 years old if she and the child are registered at the same registration address.

Benefits for unemployed women at the labor exchange

Women who are officially recognized as unemployed and who are registered with the Labor Center can receive maternity benefits.

Therefore, it is necessary to issue a certificate of incapacity for work at the appropriate time. There are several reasons for this:

- pregnant women are paid for the entire vacation of varying lengths (140, 156, 194 days, depending on the circumstances). In 2020, a non-working woman is entitled to 581.73 rubles. for each month of maternity leave, however this amount is indexed annually (in 2020 - from February 1);

- a woman cannot be deregistered as unemployed during maternity leave;

- for the period of maternity leave, the woman's unemployment benefit is extended: the benefit itself is not accrued, but it will be paid after the end of maternity leave (if 18 months have not passed since registration with the employment service);

- If, after maternity leave, a woman wants to apply for child care benefits, the payment of unemployment benefits to her will be suspended for the period of its payment.

Who else is entitled to benefits?

Benefits are provided to women who lost their jobs through no fault of their own

There is also a category of women who lost their jobs through no fault of their own. They have the right to receive all payments and benefits that are due to working women. This:

- unemployed people registered for 1 year before giving birth, after dismissal from their last place of work due to the closure of the enterprise;

- dismissed on the same basis during pregnancy or care leave;

All types of payments and benefits also receive:

- Persons who are not included in the insurance system in case of disability or birth of a child.

- Women military personnel in contract service.

- Wives of conscript soldiers.

- Full-time students.

Full-time students

Female students are given the right to care for their child, while maintaining the right to continue their studies in the future. They are granted academic leave and receive benefits from the state.

Full-time education gives them equal rights to working mothers. It does not take into account whether they study in a paid or free department. The right to receive leave and payments is granted to students:

- primary and secondary vocational educational institutions;

- institutions of higher education;

- postgraduate educational institutions.

The husband of a student mother cannot apply for leave and benefits for himself.

Leave is granted for 140 days: half of them before childbirth, half after. In case of complicated pregnancy and childbirth, as well as if twins are born, the leave is increased.

To take leave, you must obtain a certificate from the antenatal clinic and submit it to the educational institution.

Female students can receive the following funds:

- A one-time payment for early (up to 12 weeks) registration in the amount of 543 rubles.

- For pregnancy and childbirth in an amount equal to the scholarship. Credited after 10 days.

- Maternity benefit 14,497 rubles. If both parents are students, then it is issued at the place of study; if the husband works, then the money is issued at his enterprise.

- Monthly payments for child care up to one and a half years old. 2718 rubles for the first, 5436 rubles. - for the next one.

Documents for receiving maternity benefits

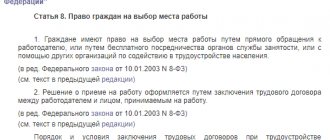

As a general rule, a woman must contact her employer, that is, the policyholder, for payment of such benefits. Unemployed women should contact:

- military personnel - contract women or equivalent - at the place of their service;

- female students – full-time students – to an educational institution;

- directly to the Social Insurance Fund: if the pilot project “Direct Payments” is running in the region;

- the employer does not want or cannot pay sick leave.

To receive maternity benefits, a woman must submit documents confirming her right to receive it. Such documents include:

- application requesting benefits;

- applicant's passport;

- sick leave issued in accordance with current legislation.

If a woman applies directly to the Social Insurance Fund, she must additionally submit:

- a certificate of your income for the last 2 years. If it cannot be obtained, then a written application for making a request through the Pension Fund of the Russian Federation;

- a court decision that the employer is unable to make the appropriate payments.

Payments for the birth of a child and for care up to 1.5 years

This birth payment must be registered with the USZN no later than the baby turns six months old. Its size will be 16873.47 rubles. For unemployed people, you will need to provide a work book, passport and insurance policy.

Until the child reaches 1.5 years of age, the mother is paid an allowance in the amount of:

| Employed | Not working |

| For the first child - based on average earnings over the last 2 years | The minimum benefit amount is 4465 rubles. |

| For the second child - based on average earnings over the last 2 years, maximum 24,536 | The minimum benefit amount is 6284 rubles. |

| Until three years, 50 rubles are not paid to non-employees, only if the enterprise has been liquidated | |

One-time birth benefit for unemployed people

A non-working woman, after giving birth to a child, has the right to apply for a one-time benefit. To do this, she needs to visit the social protection department at her place of permanent registration.

The amount of benefit for a non-working mother is 16,759.09 rubles at a time. You must apply for payments no later than 6 months from the date of birth of the child.

If a child is born into the family of a conscript, the mother of such a child will receive a different lump sum - 26,539.76 rubles. It will be paid subject to the following nuances:

- the pregnancy period is 180 days - confirmed by a certificate from the antenatal clinic;

- the father is currently undergoing military service - confirmed by a certificate from the military registration and enlistment office.

To apply for a one-time benefit at the birth of a child, an unemployed mother must submit the following documents to the social security authority:

- statement. It is filled out directly at the social security authority. The application form is issued by the inspector;

- child's birth certificate. It is issued by the registry office when registering a child;

- birth certificate;

- a certificate from the second parent from the place of work stating that he did not receive such benefits. If the child’s father is unemployed, then a certificate is issued at the regional employment center about non-receipt of benefits;

- if the woman is a single mother, then it is necessary to submit an additional certificate from the registry office about this fact.

How to get a?

Registration of maternity payments is a standard procedure consisting of several stages:

- Registration at a medical institution, obtaining a confirmation certificate from the antenatal clinic.

- Preparation of the necessary accompanying documentation. You can find out about the list of papers that are needed to process maternity payments from the social protection authorities, the Central Social Security Office or legal consultations.

- Writing an application, submitting it along with a package of prepared documentation for consideration.

Once the application has been reviewed, the woman will be notified of the decision.

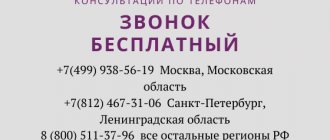

Where to contact?

The greatest difficulty is the question of where to apply for registration. Here you need to focus on the type of benefit that the parent plans to receive.

To receive benefits for BiR, you must contact the Center for Labor Protection. Only women who have official unemployed status and are registered with the Employment Center can do this.

For undergraduate and graduate students, you will need to contact the educational institution. Maternity payments are guaranteed to expectant mothers who receive a scholarship and successfully pass their final exams.

Social security at the place of residence of the future parent is also responsible for processing payments. If you plan to issue a payment on the occasion of the birth of a baby, this can be done at the place of work of the husband of an unemployed lady.

Future parents who are officially recognized as unemployed and registered with the Employment Center have the right to go on maternity leave at the 30th week of pregnancy (28 weeks - if a difficult birth is expected, the birth of 2 or more newborns is expected).

Required documents for accrual

The specific list of documents required to receive funds directly depends on the status of the applicant and her membership in a certain category:

- A written application for the accrual and issuance of benefits (written in any form, the legislator does not provide a single approved sample of an application);

- A certificate from a medical institution about the current pregnancy (confirms the fact of pregnancy and the registration of the future mother in labor);

- Confirmation from the Employment Center that the applicant has been assigned unemployed status;

- Information about past places of official employment (a copy of the work record book, civil contracts for the performance of certain works, provided that the woman has paid tax deductions);

- Information from the Tax Service on the liquidation of the enterprise where the woman is employed, or whether it is in the process of liquidation;

- Student ID and a certificate from the educational institution confirming completion of full-time study;

- Passport details of the applicant indicating the place of registration and place of actual residence;

- Bank account or card (if the future parent intends to receive payments through the bank);

- Certificate of incapacity for work;

- Data from social security authorities confirming that funds were not issued earlier;

- Child's birth certificate;

- Certificate of registration of marriage relations.

Women who are adoptive parents have the right to receive payments after establishing maternal status through the court. However, maternity benefits are not provided for them.

Child care allowance

The amount of such payments is as follows:

- RUB 3,142.33 per month for the first child;

- 6284.65 rub. - on the second and subsequent ones;

- for working people - per child - maximum 24,536.55 rubles.

The benefit must be applied for no later than 6 months from the date the child reaches the age of 1.5 years.

On the initiative of Vladimir Putin, from January 1, 2018, needy families whose average per capita income does not exceed 1.5 regional subsistence levels of the working population are paid a one-time allowance for their second child. But if the benefit for the first is paid through social protection authorities, then for the second - from maternity capital funds through the PRF.

If the subject of the federation deems it necessary, then large families, at the birth of the third and subsequent children, are assigned a lump sum allowance. The size is set by the regional authorities.

If a child is born into a family in which the father is serving in military service, then the child benefit will be slightly different. It is 11,374.18 rubles. It is paid for the entire period from the moment of conscription until the father’s dismissal from the ranks of the RF Armed Forces, until the child reaches 3 years of age.

To receive a monthly child care allowance until the child reaches 1.5 years of age, the following documents are required:

- statement;

- the child’s birth certificate, and also, if there are older children, their birth certificates;

- a certificate from the Housing Office stating that the child lives with one of the parents;

- a certificate from the employment center stating that the woman does not receive benefits.

It is best to apply for all benefits after the birth of the child. You don’t have to worry that the social security authorities won’t pay you extra. The benefit is assigned from the moment the child is born, and not from the moment of registration. But do not forget that payments must be made within six months from the birth of the baby.

Each subject of Russia has the right to assign additional cash payments to unemployed women. Therefore, before applying for benefits, you need to consult about additional appointments, if any, in your constituent entity of the Russian Federation.

Payments through social security before and after childbirth

If a woman is unemployed, she has two ways to apply for government assistance.

If she is an individual entrepreneur, then all payments are made by the Social Insurance Fund. In other cases, you need to contact the social security authorities.

Conditions for receiving EDV at the birth of a child

A one-time benefit under the BIR is provided by law only to officially employed women or students.

If a woman does not have a job, she can count on receiving a payment if:

- was fired within a year;

- the dismissal was carried out at the initiative of the employer or as a result of its bankruptcy;

- the woman does not receive unemployment benefits.

The amount of benefit for an unemployed woman is different from that paid by the employer.

It depends on the woman's stipend or her earnings for a certain period. Registration can begin at 30 weeks of pregnancy or after the birth of the baby. The payment will still be made upon delivery, that is, after the birth.

Amount of monthly care payments

Both employed and unemployed women are entitled to maternity benefits, provided for the first 1.5 years after the birth of a baby.

If there is no official place of work, then you should contact the social security authorities at your place of residence.

In this case, the benefit amount cannot be calculated based on wages, so a fixed amount is used.

It is established at the legislative level, therefore it is indexed annually.

- Since May 2020, the amount of the monthly benefit for the first child is 4 thousand 465 rubles.

- For the second and subsequent children, 6 thousand 284 rubles are paid.

- If the benefit is issued through the employer, then 40% of the average monthly salary is calculated.

If the family is low-income and the woman gave birth to a child in 2020, then you can apply for the “Putin Allowance”.

This is an additional payment that is provided regardless of the receipt of federal benefits and the presence (or absence) of work. Paid for 1.5 years for the first or second child.

The amount for the first-born is fixed and amounts to 10 thousand 500 rubles.

Regional multiplying factors are taken into account in the final calculation. For the second child they pay only the subsistence minimum. capital.

They apply for benefits from the social security authorities.

In addition to low family income, another condition is important. It consists in the presence of a registered marriage between the parents of the baby.

The indicated amounts are provided throughout the entire period. Also, a young mother has the opportunity to extend maternity leave and receive payments for another 1.5 years. But the amount of the monthly benefit will be only 50 rubles. It has not been indexed since 2001.

Sick leave for unemployed people

An unemployed woman has the right to obtain a sick leave certificate. It is necessary to receive various benefits, the payment of which is guaranteed by the state.

A sick leave certificate is issued at the antenatal clinic where the woman is registered. The deadline for registration is strictly regulated:

- 140 days for a normally developing singleton pregnancy. A woman is given 70 days before giving birth to prepare for this event and 70 days after giving birth to recover;

- if a woman gives birth with complications (caesarean section), then another 16 days are added to the postpartum period. The total duration of sick leave is 156 days. 16 days are added to the postpartum period, as the woman needs more time to recover;

- 194 days are given to women diagnosed with multiple pregnancies. If this fact is revealed during childbirth, then another 54 days will be added to the 140 days of sick leave.

If days are added to the main sick leave, the amount of the benefit must be recalculated. In this case, the woman is issued a new sick leave. This is done by the maternity hospital, and the stamp on the certificate of incapacity for work must be from this particular medical institution.

The sick leave is issued by the doctor who observes the woman during her pregnancy. The document must be drawn up in accordance with current legislation. Otherwise, the woman will be denied payments.

Both public and private medical institutions have the right to issue sick leave for maternity benefits. But the latter must have the appropriate license to carry out such activities and provide medical services.