What does the FSS check?

There are several main points that exist in the activities of almost any company that may be of interest to the Social Insurance Fund:

- Calculation and payment of contributions (correctness of calculation, whether payment is timely);

- The procedure for spending money that the policyholder has accrued for insured events such as maternity leave, sick leave or parental leave;

- Vouchers;

- The procedure for spending money transferred when an employee receives an injury.

Thus, inspectors from the Social Insurance Fund ensure that the transferred insurance payments are justified, and that the contributions are calculated correctly and transferred on time.

For additional control of reports sent to the FSS, companies can check them using a special FSS check. It checks whether the employer has filled out the calculation correctly, determined the base, as well as the amount of accruals and payments. This check is carried out based on control ratios and is performed free of charge.

How to successfully pass an on-site inspection by the FSS and the Pension Fund of Russia

From the article you will learn:

1. What are the criteria for selecting policyholders to conduct on-site inspections by extra-budgetary funds.

2. How to prepare for an on-site inspection by the Social Insurance Fund and the Pension Fund of Russia.

3. How to build optimal interaction with inspectors.

3. What documents do inspectors request during an inspection and how best to prepare them.

In the previous article, I described what kind of checks extra-budgetary funds arrange for policyholders and what is the procedure for conducting them from the point of view of legislation. However, in practice, what is described in such detail and complexity in the law happens somewhat differently. For example, the legislation allocates as much as 2 months for conducting an on-site inspection of the FSS and the Pension Fund of Russia (not counting suspensions), but for me, as in most cases, the inspection actually took less than a week. In this article, I will share my experience of passing an on-site inspection by the FSS and the Pension Fund of the Russian Federation and give practical recommendations on how best to behave with inspectors and what to pay attention to when preparing documents.

A small clarification to save your time: if you have already received a notification about the upcoming inspection and are now closely preparing for it, I suggest that you immediately move on to the second part of the article - practical advice on passing an on-site inspection by the FSS and the Pension Fund of the Russian Federation. Well, if there is no notification yet, and you want to assess the likelihood of an inspection in order to prepare for it in advance, I recommend reading in order.

How to determine the likelihood of an on-site inspection by the Social Insurance Fund and the Pension Fund of Russia

How can you determine whether you are facing an on-site inspection by the FSS and the Pension Fund of Russia in the near future? To do this, we will use the criteria for selecting insurance premium payers for on-site inspections, which are established in the letter of the Pension Fund of the Russian Federation No. TM-30-24/13848, FSS of the Russian Federation No. 02-03-08/13-2872 dated December 21, 2010. Despite the fact that this letter is from 2010, there were no later clarifications, therefore, apparently, the FSS and the Pension Fund of the Russian Federation are currently guided by it. In accordance with the letter from the FSS and the Pension Fund of the Russian Federation, the criteria for selecting policyholders for inspections are as follows:

- The number of calculations for 9 months of the previous year provided to the Pension Fund and the Social Insurance Fund does not match.

- The policyholder covers the costs of compulsory social insurance at the expense of the Social Insurance Fund (temporary disability benefits, maternity benefits, childbirth benefits, etc.).

- Late provision of individual personalized accounting information (forms SZV-6-1, SZV-6-2, ADV-6-3, ADV-6-2). This applies to periods before 2014, since starting from 2014, the RSV-1 report form includes persuance accounting information.

- The insurer has significant amounts of payments in favor of employees that are not subject to insurance premiums (for example, amounts of compensation for the use of personal property of employees for business purposes, amounts of financial assistance within the limits established by law, etc.).

- Application of reduced insurance premium rates. More information about the application of reduced tariffs can be found here.

- The presence of errors and inconsistencies based on the results of desk audits.

- Having arrears on insurance premiums for more than two periods in a row.

- Classification of the policyholder as one of the largest payers, which are characterized by the largest amount of the taxable base, the largest number of insured persons or the average number of employees.

- Reducing the amount of accrued contributions compared to previous periods without changing the number of employees.

- Availability of information from the tax authorities on the implementation of various tax and contribution minimization schemes by the policyholder.

Thus, the more criteria your organization or individual entrepreneur meets, the higher the likelihood of an audit.

My experience and recommendations for passing an on-site inspection by the FSS and the Pension Fund of Russia

And now, as promised, I will tell you about my experience of passing an on-site inspection by the FSS and the Pension Fund of Russia (successful, by the way) and give practical advice. First of all, our organization became the object of inspection not by chance, but because it met several criteria for selecting policyholders for inspections:

- Application of reduced rates of insurance premiums (the organization operates in the field of information technology);

- Large amounts of reimbursement of expenses for compulsory social insurance for temporary disability and in connection with maternity from the Social Insurance Fund (mainly due to maternity leave, child care up to 1.5 years);

- Availability of payments to employees that are not included in the base for calculating insurance premiums (compensation for the use of personal vehicles, financial assistance for the birth of a child).

The audit took place in December 2013, respectively, the periods of 2010, 2011 and 2012 were checked. About two weeks before the start of the inspection, a representative of the Pension Fund called and warned that our organization was included in the plan for on-site inspections, said when the inspection would begin, what documents (in general) needed to be prepared, provided her coordinates, and also announced the composition of the commission: one representative at a time from the Social Insurance Fund, the Pension Fund of the Russian Federation and from the tax office (since reduced tariffs were applied). Later, about three days later, a representative of the FSS called and also informed about the upcoming inspection. No further notifications (by mail, fax, email, etc.) were received to our address.

In a telephone conversation, PFR and FSS inspectors clarified the address to which they should go for inspection (our address did not coincide with the legal address). By the way, the inspectors, as it turned out, do not care at all what address the organization will provide them with premises for conducting the inspection: legal or some other.

It is better if the on-site inspection of the FSS and Pension Fund takes place on your territory , and not on the territory of the inspectors, for the following reasons:

- Ensuring the safety of documents. Inspectors do not have the right to seize original documents or take them outside the premises of the insured. However, if the inspection takes place on their territory, the FSS and Pension Fund authorities may request original documents for review, that is, some of the documents will have to be transported, then returned and constantly monitored so that the documents are not lost or damaged during transportation. Therefore, when an inspection takes place on your territory, you can be sure that all documents are safe and sound, since neither you nor the inspectors will take them out.

- Saving time and material resources. If the check takes place on your territory, then there is no need to waste time traveling to the FSS and the Pension Fund of the Russian Federation upon their requests (to provide documents, give explanations, etc.). In addition, you can provide all documents to the inspectors in originals, that is, save your time and resources on preparing copies of documents and drawing up inventories for them. True, inspectors can still request copies of individual documents in order to attach them to the audit materials, but this is much less than copies of all the documents being checked.

- An opportunity to find out in more detail what is required of you and avoid unnecessary questions from inspectors. I will give an example: the FSS inspector asked me “the basis for the use of reduced tariffs by our organization,” and all documents confirming our compliance with the criteria established by law (average number of employees, share of income from IT activities, extract from the register of accredited organizations) were provided on the first day of inspection. I didn’t immediately understand what was required of me, and I think the inspector himself didn’t immediately understand it. As a result, I brought a printout of Article 58 of Law No. 212-FZ, which lists the categories of policyholders who have the right to apply reduced insurance premium rates. You won't believe it, but this suited the inspector quite well. If the inspection took place on the territory of the inspectors, it is difficult to imagine how much time and effort it would take to resolve this issue.

- Personal contact. No matter how trite it sounds, inspectors are people too, and if the inspection takes place on your territory, you have the opportunity to establish personal contact with them and try to win them over. However, in order for personal contact with inspectors to be to your benefit and not to your detriment, you need to adhere to certain rules of communication with inspectors.

Communicate with inspectors, adhering to certain rules:

- First of all, prepare yourself psychologically and remember just two things: 1. Everything in your organization is only “white”, 2. You are a competent specialist who knows his job. Keep these statements in mind at all times: during the test, this is the truth that you must believe in with all your soul, regardless of how things really are. At the same time, you need to behave accordingly, confidently, calmly, and with dignity. This is very important, because inspectors, especially those with experience, are excellent psychologists; they can immediately see when a person is nervous or trying to be cunning. Therefore, in order for people to believe you, you yourself must firmly believe that you are right.

- Create a comfortable environment for inspectors. It’s better if they are in a separate room: it’s easier for them and for you, too. You can unobtrusively put a kettle, tea, something for tea in their office, show them where to pour water, etc. Some people think that if the inspectors are uncomfortable, they will want to leave and finish the inspection quickly. Believe me, this is not true. The inspection will not be completed faster than planned, but the fact that the inspectors will not want to stay on your territory for a long time is rather a minus (see tip No. 1): they have the right to request copies of the necessary documents and call you to them to give explanations – and this means additional time and resources. And, by the way, the fact that an inspector is on your territory does not mean that he is busy with an inspection. For example, for the last two days out of five, one of the inspectors was watching football on his laptop. Well, we don’t feel sorry, but the person is pleased. So, it’s better to push out your workers, but not the inspectors.

- Maintain a distance when communicating with inspectors. When offering tea, coffee, water and other amenities, do so in an emphatically polite manner, out of decency, and not out of a desire to bribe. In no case should you be too intrusive, constantly asking “is anything needed?” or offer some kind of treats, especially alcoholic drinks. All this will only cause suspicion and irritation on the part of the inspectors, because, firstly, although the inspection is joint, they are representatives of different structures and will “keep the bar” in front of each other, and secondly, and most importantly, they are when performing an official task, the purpose of which is to identify violations on your part, if any.

- Stand up for your opinion. If the inspectors point out errors to you, in their opinion, do not agree and do not try to explain everything right away. It’s better to say that you need some time to think about everything and prepare an answer. During this time, collect the necessary arguments and evidence that you are right. Even if you understand that there is a violation, this is not a reason to despair; on the contrary, you need to get together and, firstly, understand what the threat may be, and secondly, try to correct it. For example, if you do not have a certificate of temporary incapacity for work, in this case you need to contact a medical specialist. institution to issue a duplicate, and provide the inspectors with an explanatory note why the document is missing, and a copy of the request for a duplicate, as confirmation that you have taken action. Or, as was in my case. The inspectors stubbornly insisted that only employee compensation for the use of a personal car, which is owned by right of ownership, is not subject to contributions; if the car is driven by power of attorney, then such payments should be included in the base. However, I found and printed excerpts from the Civil Code of the Russian Federation, from which it follows that property can be owned not only by right of ownership, but also by the right of use and disposal. And since the definition of “personal property” is not specified by law, this means that property used by proxy also falls under this definition. As a result, the inspectors accepted my position, especially since all the necessary documents for payment of compensation were available.

- Remember that no matter how the inspectors behave, you have opposite interests with them, just be as diplomatic as possible and keep your ears open. In my case, I initially acted according to the first three rules and the inspectors adhered to the same style of communication, nothing personal. As a result, they did not find any violations, although they did find an unpaid amount of penalties for contributions to the Social Insurance Fund for 2011, a total of no more than 10 rubles, which we paid and parted ways with. However, I know of a case where the inspectors themselves chose a semi-formal style of communication, they seem to be such kind people, absolutely positive-minded. The policyholder communicated with them in the same vein, like “normal guys who understand.” The inspectors talked about their difficult life, and the policyholder talked about his pressing problems, how difficult it is to support a business, how high taxes are... And it seemed like everyone understood, sympathized, and turned a blind eye to mistakes, only in the on-site inspection report they wrote “Hold to account” and the fine was soldered. So be careful.

Now, let's talk about the most important thing - what documents are requested by the FSS and Pension Fund inspectors during an on-site inspection. As I already said, in my case, a tax inspector also participated in the audit, who also had his own list of required documents. Even when notifying by phone, the inspectors announced an approximate list of documents, which included constituent documents, internal regulations on wages, pay slips, cash and bank documents, documents confirming expenses at the expense of the Social Insurance Fund for 3 years, subject to inspection, as well as documents confirming the application of the reduced tariff. When the inspectors arrived, they handed in a request for documents, which spelled out all possible documents directly or indirectly related to the calculation and payment of insurance premiums: constituent documents, personnel documents, accounting registers, reporting to funds and various supporting documents. This requirement contained a list of documents that inspectors could request; it was rather universal. In fact, documents during the inspection were provided upon verbal requests from inspectors and their volume was less than what was required.

So, what documents did I provide during the on-site inspection of the FSS and the Pension Fund of Russia:

- Documents confirming the right to apply a reduced rate of insurance premiums for organizations operating in the field of information technology: statistical forms of PM for 9 months of each year, containing information on the average number of employees; extract from the register of accredited organizations operating in the field of IT; Applications for confirmation of the main type of economic activity and confirmation certificate for each year, which indicates the share of income from the main type of activity in the field of IT. In addition, the tax inspector requested books of income and expenses according to the simplified tax system, a notification about the possibility of applying the simplified tax system, information on the average number of employees, as well as accounting registers “account analysis” for accounts 90, 91, 51, 50.

- Constituent documents and internal administrative documents on remuneration (certified copies): charter, orders for the appointment of a director and chief accountant, regulations on remuneration, bonuses, payment of financial assistance, travel (since some employees receive an allowance for the traveling nature of work ), staffing with all editorial staff.

- Documents confirming expenses incurred at the expense of the Social Insurance Fund: sick leave for temporary disability with calculations of benefits, certificates from employees from other places of work for calculating benefits; sick leave for pregnancy and childbirth with calculations and supporting documents; documents for payment of a one-time benefit at the birth of a child, for provision of parental leave for up to 1.5 years and payment of benefits.

- Time sheets, orders for employee bonuses (the inspectors quickly returned these documents; most likely, they were interested in the fact that the documents were available without a detailed check).

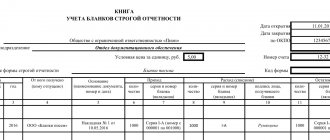

- Advance reports, cash documents (cash books, cashier-operator reports), bank statements (looking at the number of packs with statements, and there were about 36 pieces, one thick pack for each month, the inspectors did not take them to their office for verification, but requested account card 51 in electronic form).

- Documents confirming payments to employees that are not included in the base for calculating insurance premiums: orders for the payment of financial assistance at the birth of a child with statements from employees and copies of birth certificates of children, documents for the payment of compensation for the use of personal vehicles for business purposes.

- Civil contracts with certificates of work performed, loan agreements for employees.

- Salary statements (by types of accruals for the organization as a whole) and pay slips (by types of accruals for each employee) on a monthly basis - I generated these documents in 1C ZUP.

- Accounting registers “account card” for accounts 91, 73, 76, 51, 50 in electronic form.

- Reports to the Social Insurance Fund, including interim 4-FSS Calculations, reports to the Pension Fund of the Russian Federation RSV-1 and personalized accounting information.

Perhaps this is the end of the list of documents that I provided during the on-site inspection of the FSS and the Pension Fund of Russia. I draw your attention to the fact that documents were required for the entire period under review, 2010-2012. The inspectors kept some documents for longer (for example, payroll statements, documents confirming expenses at the expense of the Social Insurance Fund), some were returned on the same day (advance reports, cash documents).

And finally, a few recommendations on how to prepare documents for an on-site inspection by the Social Insurance Fund and the Pension Fund:

- Be proactive. It is necessary to understand that inspectors come to the inspection with a clear plan, based on a preliminary analysis of the reports you submitted, on the results of previous inspections and information about the organization as a whole, collected from various sources. This plan identifies aspects in which the presence of significant errors and irregularities in the calculation and transfer of insurance premiums is most likely. Based on the inspection plan, a list of requested documents is generated. This way, you can get ahead of events and prepare in advance the documents that are most likely to interest inspectors. For example, if the organization had payments to employees that were not subject to contributions, or paid remuneration under civil contracts, the inspectors will most likely request documents justifying these payments. Therefore, before starting the inspection, try to make the most complete and detailed list of documents that need to be prepared in order to avoid surprises during the inspection.

- Prepare your documents in advance. Using the compiled list, identify documents that require significant improvements or that are missing altogether. And first of all, start preparing these documents so as not to deal with this during the verification process. I practically re-printed pay slips and time sheets, and the personnel officer finalized the staffing schedule and changes to it.

- Pay attention to the signatures. Firstly, the signatures of the chief accountant and director on the documents must correspond to the orders on the appointment of these officials. That is, if in 2011 there was one chief accountant, and in 2012 there was another, then the signatures on the documents for these periods should be different. You especially need to pay attention to this if documents are printed for several periods at once. Secondly, signatures must be present in the document if this is a mandatory requirement. For example, in cash documents, in expense reports, signatures of the director and employee in the orders of the manager, in contracts, etc. By the way, inspectors are unlikely to check the authenticity of the signature, but they will probably notice its absence.

- Provide documents for inspection in a neat and assembled form. They greet you by their clothes, so the inspectors will form their impression, at least a first impression, based on the form in which the documents are provided. Agree, piles of “documents” piled up in a chaotic manner suggest certain thoughts about the state of accounting in general and calculations of insurance premiums in particular. Therefore, it is better to organize documents by type and period so that you can easily find the document you need. Whether to staple documents or not is up to you. Some believe that it is better to staple the documents so that the inspectors do not have the opportunity to take something with them, although this is illegal. I didn’t staple the documents (with the exception of bank statements, cash documents and expense reports), but put them in ring binders, because, in my opinion, it’s much more convenient to view documents and make copies if necessary. By the way, no missing documents were noticed after the check.

- Well, the main recommendation is to remove all unnecessary documents before checking. Carefully look through all the folders with documents to be checked and leave only the “white” ones: the inspectors do not necessarily need to see the calculations of “gray” salaries, if any, your drafts, notes, bookmarks like “missing order” or “replace”, etc.

That’s probably all I wanted to tell you about my experience of passing an on-site inspection by the FSS and the Pension Fund of Russia, about interacting with inspectors and preparing documents. I tried to present everything in as much detail as possible so as not to miss important details. I hope the article did not bore you, and the information presented in it will be useful to you.

If you find the article useful and interesting, share it with your colleagues on social networks!

If you have any comments or questions, write to us and we’ll discuss them!

What checks does the FSS conduct?

There are several types of FSS checks (Law No. 255-FZ):

- Desk - during such an audit, payments for insurance coverage are reconciled based on claims for compensation, or information from the tax office;

- Unscheduled on-site visit - carried out if social insurance has received a complaint from an insured person, suggesting that the insurance coverage was accrued incorrectly to him;

- Scheduled on-site audit - such an audit is carried out together with the tax office in order to determine the correctness of payments for insurance coverage;

- A check necessary to determine the correctness of the calculations, as well as the timeliness and completeness of payment of contributions due before 2020.

The main goal of all inspection activities is to monitor companies’ compliance with Russian legislation. A desk audit is carried out upon receipt of each report from the company. If, as a result of the “camera camera”, violations are identified or a decision is made, the FSS will send an inspection report to the person being inspected. If the camera meeting is successful, then no reports are sent to the companies.

Important! You can find out about upcoming scheduled inspections of the FSS on their official website for the regional office.

Fine for failure to submit FSS

As practice shows, the biggest troubles for novice entrepreneurs are associated with the Social Insurance Fund. Why? At the beginning of their activities, organizations, as a rule, do not conduct business activities, they have no sales revenue, have no employees and do not pay wages. All this creates the illusion that she has no responsibilities towards the Social Insurance Fund.

However, it is not. The situation is further aggravated by the size of penalties for forgetfulness or poor legal preparation of novice entrepreneurs. Unlike Art. 119 of the Tax Code of the Russian Federation, in which liability for failure to submit “zero” tax returns is limited to 100 rubles, Federal Law of July 24.

1998 N 125-FZ in relation to beginning entrepreneurs cannot be called anything other than draconian. Judge for yourself - in accordance with paragraph 1 of Art. 19 of Federal Law N 125-FZ, late submission of reports (including zero) is punishable by a fine of 1000 rubles. The second such violation within a calendar year will cost the entrepreneur 5,000 rubles.

Agree, quite a considerable sum for beginning entrepreneurs. Why only for beginners? Problems with delays in submitting reports, unfortunately, also happen to long-term business entities.

An accountant is also a person - he can get sick or, let’s be honest, simply miss this “red date of the calendar”, with the onset of which the Social Insurance Fund has a great opportunity to improve its budget at the expense of its own policyholders.

To ensure that accountants have as few such unpleasant moments as possible, this article was written.

Deadlines for submitting reports to the Social Insurance Fund

According to paragraph 1 of Art. 24 of Federal Law N 125-FZ, policyholders quarterly, no later than the 15th day of the month following the end of the quarter, in the prescribed manner submit reports to the insurer at the place of registration in the form approved by it.

When does the obligation to submit reports to the Social Insurance Fund arise?

As stated in paragraph 1 of Art. 24 of Federal Law N 125-FZ, all insurers must submit reports. From Art. 6 of this Law it follows that a person acquires the status of an insurer from the moment of registration with the Social Insurance Fund.

Thus, the answer to the question of at what point an organization is obliged to submit reports to the Social Insurance Fund depends on its status as an insurer, since the legislator associates the obligation of legal entities and individuals with their status as an insurer, and not with the fact of accrual of insurance premiums and insurance payments or conducting business and hiring employees.

The courts also proceed from this understanding of the emergence of the obligation to submit reports to the Social Insurance Fund. In the Resolution of the Federal Antimonopoly Service NWZ dated 10.04.

2006 N A26-9560/2005-25 states: the legislator associates the obligation of legal entities and individuals to submit reports to the Fund with their status as an insured.

The case materials contain a certificate of state registration of the Institution as a legal entity and an insurance certificate confirming the registration of the Institution as an insurer at its location in the Regional Branch of the Social Insurance Fund of the Russian Federation. Thus, the obligation of the Institution to submit reports to the Fund in the form approved by the insurer (in this case, payroll statements of Form 4-FSS of the Russian Federation) within the prescribed period arose from the moment of such registration.

It should be noted that this approach is generally accepted in judicial practice and the insured has no chance to prove his case in this situation. Evidence of this can also be found in the Resolutions of the Federal Antimonopoly Service of the Eastern Military District dated April 10, 2006 N A82-6404/2005-35, and the Federal Antimonopoly Service of the North Kazakhstan Region dated October 17, 2006 N F08-5081/2006-2132A.

In accordance with Art.

3 of Federal Law N 125-FZ, the insured is a legal entity of any organizational and legal form (including a foreign organization operating on the territory of the Russian Federation and employing Russian citizens) or an individual employing persons subject to in accordance with paragraph.

1 tbsp. 5 of the Law on compulsory social insurance against accidents at work and occupational diseases. Since the introduction of the “one-stop shop” system into practice, registration as an insurer with the Social Insurance Fund has been completely invisible for newly created organizations.

The registration body, that is, the territorial body of the Federal Tax Service, vested with the appropriate powers, provides the fund with information about the registered legal entity, which independently, without a special application from the policyholder, registers it.

Unfortunately, often officials of organizations find out about this only after receiving a report from a desk audit and a decision to prosecute them in the form of a fine.

Under what law and how are policyholders held liable?

As noted above, Art. 119 of the Tax Code of the Russian Federation is more humane in relation to organizations than Art. 19 of Federal Law N 125-FZ. In this regard, many policyholders, realizing that they have committed an offense, make an attempt to answer specifically under the Tax Code.

The formal basis for this is contained in Art.

19, according to which the insurer holds the insured liable in a manner similar to the procedure established by the Tax Code of the Russian Federation for holding liable for tax offenses.

However, despite this seemingly saving norm for policyholders, we are forced to admit that attempts to bear liability under Art. 119 of the Tax Code of the Russian Federation, unfortunately, are doomed to failure. The fact is that Law No. 125-FZ refers to the norms of the Tax Code of the Russian Federation only for the purpose of determining the procedure for bringing to responsibility, and not establishing the size of the sanction.

The applicant's reference to the need to apply clause 2 of Art. to these legal relations. 119 of the Tax Code of the Russian Federation is not taken into account by the court of cassation, - this was the conclusion made by the FAS DO in Resolution No. F03-A73/06-2/3387 of October 11, 2006. The court motivated this decision as follows: in Art.

2 of Federal Law N 125-FZ states that the legislation of the Russian Federation on compulsory social insurance against industrial accidents and occupational diseases is based on the Constitution of the Russian Federation and consists of this Federal Law, federal laws adopted in accordance with it and other regulatory legal acts of the Russian Federation Federation.

Thus, the above-mentioned Federal Law is special and regulates the legal relations of the policyholder, insurer and insured person, while the norms of the Tax Code of the Russian Federation are not related to special legislation on the payment of insurance premiums for compulsory social insurance against accidents at work.

Link in art.

19 of Federal Law N 125-FZ on bringing the insured to liability by the insurer in a manner similar to the procedure established by the Tax Code of the Russian Federation for bringing to liability for tax offenses, does not mean the possibility of applying other norms of the Tax Code of the Russian Federation to relations on compulsory social insurance without a special purpose for that instructions in the relevant legislative acts.

Thus, a reference to the procedure for holding the policyholder liable established in the Tax Code will not allow him to reduce penalties to the amounts provided for in Art. 119 of the Tax Code of the Russian Federation.

However, this rule can still be of good service to the policyholder.

The fact is that when an offense is detected as a result of tax control, the FSS is obliged to comply with the general procedure for bringing the taxpayer (fee payer or tax agent) to tax liability.

The subject of consideration by the Federal Antimonopoly Service of Moscow Region was the case of holding the policyholder liable for failure to submit reports on time. The organization did not submit a payroll statement for the fourth quarter of 2004 until January 15, 2005, and again for the first quarter of 2005.

Penalty for zero reporting

Source: https://obd2bluetooth.ru/shtraf-za-nesdachu-fss/

What does the FSS check during an on-site inspection in 2020?

As noted above, an on-site inspection can be either scheduled or unscheduled. To check whether contribution payers comply with legal requirements, the Social Insurance Fund draws up a plan for the year. Reasons for scheduled inspections include requests for funds for payment of benefits, complaints from employees, as well as processes of liquidation and reorganization of the company.

Important! The main thing that interests inspectors from the Social Insurance Fund is how the transferred amounts are spent, the procedure for calculating and paying contributions in the case of sick leave or maternity benefits.

Checking payments on certificates of incapacity for work. Example

The predominant amounts of costs are sent by employers to payments for certificates of incapacity for work. During absence, the employee receives average earnings calculated on the basis of the previous 2 years. When checking compliance with the calculation requirements, the Fund's auditor determines the completeness of the information.

| Indicators to check | Detailing |

| Leaflet details | Availability of a stamp, seal, and signatures of the responsible persons of the medical institution. |

| Correctness of filling | No corrections, complete information |

| Personal and employer details | Availability and compliance of data with documents |

| Validity period of the document | Start, end and renewal dates |

| Employee length of service | The total cumulative period of work, calculated from the work book |

| Calculated payment details | Accuracy of determining average daily earnings and amount payable |

| Application of coefficients | Availability of decreasing (when working with registration at half the rate) and increasing (when working in the Far North) coefficients |

The auditor's control is aimed at confirming:

- Completeness of the details of the certificate of incapacity for work.

- Compliance of all documents by dates - time sheets, dates of sheets.

- The accuracy of determining the average salary and length of service of an employee.

- Accuracy of intermediate calculation data and final amount.

When determining the length of service used for payments for certificates of incapacity for work, the total length of service is taken into account. Let's consider one of the common cases of errors made during calculations.

The enterprise PO Iskra paid disability benefits to employee M., who has a total length of service of less than 6 months. At the time of the onset of illness (opening the sheet), the employee’s length of service was 5 months 20 days. As of the date of closing the sheet, the length of service was 6 months 3 days. The accounting employee of Iskra PA determined the length of service at the time of calculation, which contradicted the date of occurrence of the insured event. The payment was made based on average earnings.

During a desk audit of the FSS maintenance department, the auditor identified a discrepancy in data, which led to pre-tax assessment. Payment to employee M. must be made based on the minimum wage.

Checking sick leave

Sick leave certificates are checked by FSS employees with special care, since they are the only confirmation that the employee needs to be paid benefits. The sheets are checked both during desk and on-site inspections. What exactly does the FSS check on sick leave:

- Does the sick leave form comply with State Standards and is it not a fake?

- Availability of the doctor's seal and signature on the sick leave (they must be clear and legible);

- Correct filling (all information about both the employee and the organization must be clearly filled out). If there are errors on the sick leave, they must be certified in the required manner.

Important! The FSS checks not only whether the employer filled out the sick leave correctly, but also how the medical institution filled it out. Errors in the employee's full name or employer's name are not allowed.

Why are FSS checks needed?

The scope of inspections by the FSS bodies affects the following areas of enterprise activity:

- calculation and timely payment of contributions;

- targeted spending of funds for insurance cases;

- correct accounting of vouchers;

- cases of injuries that occurred at the enterprise and calculations carried out on them;

- monitoring the fulfillment of banks' obligations to provide information on the procedures for opening and closing accounts by policyholders.

FOR YOUR INFORMATION! The main goal of inspections by the FSS authorities is to confirm the intended use of fund funds by policyholders and the correctness of the algorithm for calculating benefits by officials at enterprises.

If during the inspection period the company’s employees had paid sick leave, then FSS employees carry out the following activities:

- check the dates on the sick leave and the time sheet;

- recalculate the insurance period taken into account to determine the percentage of payment for temporary disability;

- compare signatures on different documents to identify forgeries.

What documents will the FSS require during inspection?

The first thing that FSS employees check is the reports 4-FSS and 4a-FSS. The organization must store these reports for at least 5 years, since future benefits are calculated on the basis of previous periods.

In addition, the inspector may request other documents. Initially, documents are requested orally, and if they are not immediately provided, then a written request is sent, which the person being inspected is obliged to fulfill within 10 days. If suddenly the company being inspected does not meet the 10-day deadline, it has the right to ask for an extension. To do this, a letter is sent to the FSS indicating the request for an extension of the period, as well as the justification for its extension. In response, the FSS will send a decision in which the deadline may be extended or refuse to extend it.

Objections to the inspection report

The taxpayer has the right to appeal the data of the desk audit report. Objections submitted in writing based on the inspection materials are sent to the head of the territorial office of the Foundation. The period for consideration of objections by the head of the FSS TO is 10 days, calculated from the date of filing the objections (registration of the document with the FSS). Based on the evidence presented, a decision is made to reject the Fund’s claims or to hold them accountable. The decision can only be appealed through judicial proceedings.

On-site inspection results

Based on the results of the on-site inspection, the FSS draws up a report. Initially, before the inspection report, on the last day of the inspection, the inspector from the Social Insurance Fund draws up a certificate indicating the subject of the inspection, as well as the timing of the inspection.

Important! The report on the results of the inspection is drawn up within 2 months after the issuance of such a certificate. After drawing up the report, it is transferred to the audited company within 5 days.

The act is signed by both the inspector from the Social Insurance Fund and a representative of the company being inspected. If the company does not agree with the contents of the act, then it can present its objections before signing it (Read also the article ⇒ Inventory of wage calculations in 2020 + postings).

Procedure for conducting a desk audit

The place of the desk audit is the office of an employee of the executive body of the FSS. To initiate this type of verification activities, permission from the fund manager is not required. The inspection period is limited to a three-month period from the date of receipt of documentation on insured events or a report from the employer.

Cases when the policyholder is notified of a desk audit:

- Inconsistency between the information available to the fund and the information provided by the enterprise.

- Obvious errors were identified in the employer’s calculations.

- One or more paid insurance claims raises suspicions about the authenticity of the documentation.

If one of the grounds for notification appears, the employer is asked for clarification.

Enterprises are given no more than 5 days to provide explanatory documents and correct previously shown information.

To confirm that he is right, the employer can bring the inspecting employee extracts from the accounting and tax registers and attach additional supporting documents.

If an additional set of documents fails to convince the inspector, an offense is recorded. Based on the identified facts, an act is drawn up. If no errors or omissions were found in the policyholder’s documentation, there is no need to draw up a report. 3 months are allotted for verification.

Employer's liability

Fines that can be imposed by the FSS are provided for in Law No. 125-FZ and the Code of Administrative Offenses of the Russian Federation. For delay in providing calculation of contributions, a fine will be charged in the amount of 5% of insurance premiums for the last three months in the billing period. In this case, both the maximum and minimum limits must be observed - respectively, no more than 30% of the specified amount, but not less than 1000 rubles.

Let's consider the administrative liability for the employer in case of violation of the requirements of the legislation of the Russian Federation regarding the provision of certain documents:

| Violation | Fine, rubles |

| For violation of the deadline for providing information to the Social Insurance Fund on opening/closing a bank account | 1000 – 2000 |

| For late submission of calculations for social insurance and occupational diseases | 300 – 500 |

| Refusal to provide or untimely provision of information requested during the inspection, as well as provision of information incompletely or with errors | 300 – 500 |