The inventory list of securities and strict reporting forms was introduced into the status of regulated documentation by the State Statistics Committee on August 18, 1998 through Resolution No. 88. It is the basis for drawing up an inventory, in which, during inventory activities, information is recorded regarding the availability of specific securities and BSO at the enterprise. In this article we will tell you how to fill out the INV-16 inventory of securities and strict reporting document forms, and consider possible errors.

What is the INV-16 inventory used for?

This inventory list is filled out during the inventory procedure in relation to existing SSBs and securities (see → accounting for strict reporting forms in accounting in 2020). The INV-16 inventory inventory makes it possible to identify discrepancies between the actual data on the availability of designated papers and forms and the information reflected in the accounting data register.

They resort to drawing up the INV-16 form in order to reflect inventory data obtained during a control check at the end of the reporting period, as well as during a procedure characterized by a change in the materially responsible employee for BSO and securities. If a discrepancy between the quantitative indicators of actual and accounting data is detected, a decision is made regarding the possible write-off of the shortage and registration of surpluses.

Who fills out the inventory list INV-16

The form is drawn up by a commission charged with the function of conducting an inventory, with the participation of financially responsible persons. The personal composition of the commission is determined by the head of the organization in his order, drawn up at the initial stage of planning inventory activities. The MOL cannot be a member of the commission, but his presence during the inspection is strictly required.

The inventory form is prepared in two copies, the first of which is to be transferred to the accounting service, and the other is left to the responsible person (or group of such employees) to whom a specific set of securities is transferred for storage.

When changing the materially responsible employee, the inventory list must be drawn up in triplicate. To the previously designated recipients of the inventory (accounting department and the entity receiving the securities), the person carrying out the process of transferring the set of securities to the new responsible entity is added.

Purposes of using the inventory act

The INV-6 form was introduced by Decree of the State Statistics Committee of Russia No. 88 dated August 18, 1998. and is a kind of act that during the audit reflects the actual presence or absence of valuables at the transportation stage. Drawing up a document is advisable in cases where it is necessary to check a group of valuables in transit (long delivery, for example).

INV-6 must be drawn up in two copies, one of which must be transferred to the accounting department, while the second remains in the hands of the inventory commission.

What elements does the INV-6 inventory act form consist of? Mainly, this is the title page and a massive tabular part.

The title page includes the following information:

- The name of the company, as well as its structural division, if any;

- Inventory act code in accordance with the OKUD classifier;

- Company activity code according to the OKPO classifier;

- A document that serves as the basis for audit control in an organization. We are talking about an order or instruction from the head of the company indicating the number and date of the document;

- The period of the audit of values in the organization (beginning and ending);

- Number and date of drawing up the act;

The tabular part requires the reflection of the following information:

- Serial number;

- A list of valuables at the transportation stage indicating the name, item number, unit of measurement of the asset (including according to the OKEI classifier).

- The actual date of shipment of goods and materials from the supplier’s territory;

- The name of the counterparty and the type of its activity in accordance with the OKPO code;

- Information about inventory items based on available transport documentation and accounting data, namely: name, number and date of document preparation, quantity and amount of inventory items.

At the end of the tabular part of the document, the full cost of the audited inventory items at the transportation stage must be indicated in words.

There is also a space provided to confirm the authenticity of the inspection by the chairman and participants of the inventory commission, reflecting the position held, full name and signature.

At the bottom of the INV-6 act, information about the company employee responsible for checking the data reflected in the document and the calculations made should be indicated.

You can download INV-6 - sample filling - using the link provided:

It is important to note that due to the actual absence of acquired assets on the company’s territory, the act in question does not reflect information about the financially responsible employee

Who signs the inventory INV-16

The form is signed:

- the chairman and members of the commission who carried out the inventory procedure (signatures are placed on the last sheet of the inventory and confirm the correctness of the activities carried out);

- financially responsible entities participating in this process (a signature is placed on the first sheet of the inventory before the start of the inventory to confirm the fact that all valuables have been taken into account, the documents have been submitted to the accounting department, and the MOL also signs on the last sheet after the inspection, the signature confirms agreement with the results obtained );

- an official who verified the accuracy of the data entered in INV-16 (usually an accountant to whom the inventory list is submitted for further processing and verification of the results);

- the head of the organization, based on the results of the decision made on the strategy of action based on the results of the inventory procedure - the head makes a decision regarding the further fate of surpluses and shortages.

Inventory forms and their completion

The main document for reflecting inventory results is the inventory.

Order of the Ministry of Finance No. 52n approved 10 inventory records. They are shown in the table. After compiling any of them, it is signed by the chairman and all members of the institution’s commission who participated in the inventory.

Table

| No. | Download OKUD form code | Purpose of the inventory list |

| 0504081 | Securities | |

| 0504082 | Cash account balances | |

| 0504083 | Debt on credits, borrowings (loans) | |

| 0504084 | The state of the government debt of the Russian Federation in securities | |

| 0504085 | The state of the public debt of the Russian Federation on loans received and guarantees provided | |

| 0504086 | (Comparison sheet) of strict reporting forms and monetary documents | |

| 0504087 | (Comparison statement) for non-financial assets | |

| 0504088 | Cash | |

| Settlements with buyers, suppliers and other debtors and creditors | ||

| Calculations based on receipts |

Step-by-step instructions: inventory according to the new rules

Form 0504081

The form is used to reflect inventory results:

- valuable papers

- financial investments of institutions in securities.

Forms 0504082 and 0504088

To reflect the balances of the institution's funds in the accounts of the Central Bank of the Russian Federation and credit institutions after the inventory, an inventory is used (f. 0504082). Please note that entries about the availability of funds are made in the inventory based on bank statements.

When inventorying cash at the institution's cash desk, use form 0504088.

An example of filling out an inventory list of cash (form 0504088) The form is used to reflect the results of the inventory of cash, valuables and documents held at the institution’s cash desk

Forms 0504083, 0504084 and 0504085

F. 0504083 is used to reflect the results of the inventory of debt on credits, borrowings (loans). Only those loans, credits and advances that are registered with the institution are taken into account.

If during the inventory a debt to the Russian Federation in securities is revealed, then f. is used to formalize the results. 0504084.

Please note that the amount of debt with an expired statute of limitations in this case is recorded in terms of indicators:

- amount of debt at face value;

- interest charges;

- total debt as of the inventory date (in foreign currency and rubles).

To reflect the results of the inventory of the public debt of the Russian Federation for loans received and guarantees provided, an inventory inventory is used (f. 0504085).

Inventory list of strict reporting forms and monetary documents (f. 0504086)

To document the results of the inventory, use strict reporting forms (f. 0504086). In addition to the commission members, financially responsible persons also participate in its preparation. A receipt is required from the latter.

Form 0504087

F. 0504087 is used to reflect the results of an inventory of non-financial assets carried out in an institution - fixed assets, materials, etc.

An example of filling out an inventory list of fixed assets (form 0504087) When taking inventory on account 0.101.00.000 An example of an inventory list for animals (form 0504087) When taking inventory of animals and young animals

Form 0504089

This form is used to reflect the results of an inventory of settlements with customers, suppliers, other debtors and creditors. Exceptions are settlements for debt obligations, for which separate Inventory records are compiled.

Example of an inventory list (form 0504089) settlements with contractors Example of an inventory list (form 0504089) Information about the service

Inventory list of payments for receipts (f. 0504091)

This form is used to reflect the results of an inventory of calculations of income (income receipts) of institutions.

How to fill out the INV-16 inventory

The inventory form is placed on four sheets.

Filling out the first sheet

- full name of the company;

- the name of its structural unit in respect of which the inventory is being carried out;

- document the basis by which the inventory of securities and BSO was initiated (from the proposed list, you should select the name of the administrative document that regulates the inventory process, the remaining options are crossed out);

- details of the document that serves as the basis (date with number);

- start and completion dates of the inventory activity indicating the type of operation;

- the number assigned to the form and the date of its preparation;

- in the middle of the front sheet the name of the form itself is indicated;

- the “receipt” section is filled out by materially responsible persons; it is required to obtain a receipt from each MOL, who were previously charged with ensuring the safety of the list of valuable documents entrusted to them;

- in the same paragraph, points are indicated confirming the fact that the responsible persons have transferred documents to the accounting service before the inventory actions take place, as well as indicating the acceptance of securities for the receipt and accountable responsibility of a particular person or, conversely, the write-off of retired securities and BSO;

- under the receipt, personal signatures of the responsible persons involved are recorded with a decoding of their initials and positions;

- the fact of counting the list of documents that are securities and forms during the inventory process is indicated (the date this action was performed is indicated);

- at the end of the first sheet, the date is indicated on which information about the actual availability of securities and strict reporting forms is provided.

What is BSO

Norms and concept

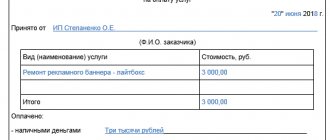

Strict reporting forms (SRF) are documents confirming the receipt of cash for services rendered in areas of activity defined by the classifiers OKVED 2 (029-2014) and OKPD 2 (OK-034-2014). They replace a check, are made in 2 (or 3) copies, and can be used by legal entities and individual entrepreneurs.

Strict reporting forms include receipts, coupons, tickets, vouchers (tourist), subscriptions, etc. Accounting rules are regulated by Resolution No. 359 (05/06/2008).

The inventory is carried out simultaneously with the cash register audit; based on the results, the INV-16 act is filled out.

The inventory of funds, monetary documents and strict reporting forms is described in the video below:

Purposes of their use

For most areas of activity, forms defined by law are available:

- tickets for urban public transport, air, railway;

- vouchers;

- season tickets;

- pawnshop receipts.

Legal entities and individual entrepreneurs have the right to develop their own options, which must contain:

- form name and number (6 characters);

- name of the enterprise (full name of the individual entrepreneur), address;

- TIN of the entrepreneur;

- Name of service;

- the price of the service provided, expressed in a specific amount;

- amount paid in cash (bank card);

- a number indicating the time of registration and settlement;

- position and full name of the employee who issued the receipt, his signature and seal of the company.

Legal entities use BSO in situations where cash register equipment (CCT) is impossible or unprofitable to use:

- at fairs;

- during peddling trade;

- sale of tickets in vehicles;

- during street trade in live fish, kvass, beer, ice cream, milk;

- when trading securities;

- sale of periodicals and folk art items;

- payment for porters;

- in populated areas where a cash register connection is not available.

Individual entrepreneurs use forms if they are cheaper than purchasing, installing and maintaining a cash register.

Normative base

The scope of application of the BSO is determined by Federal Law No. 54. When conducting business activities specified in paragraph 2 of Art. 346 of the Tax Code, individual entrepreneurs on UTII and PSN have the right not to use the cash register until 01.07. 2018. From July 1, 2018, all entrepreneurs will switch to online cash registers.

Law No. 290 defines UTII and PSN payers, who are subsequently allowed to use strict reporting forms in paper or electronic form created by an automated system. In addition, distance selling allows sending purchase information to a computer or phone.

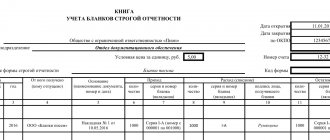

Ledger

If a legal entity or individual entrepreneur maintains accounting records, it is mandatory to fill out the Book of Accounting for this documentation (clause 13 of Resolution No. 359). It must be numbered, laced, sealed, and signed by the manager and accountant.

The employee responsible for maintaining the Book is financially responsible. A book is not necessary if the sheets are printed automatically by a system that stores the data in its memory. BSO (according to paragraphs 14-16 of Article 359) are stored sealed in special bags for 5 years.

It is important to take into account that the services that allow the use of BSO according to the classifier do not coincide with the list in the law on the use of cash register devices. When in doubt, entrepreneurs are forced to seek clarification from Tax Inspectorate employees.

BSO inventory is the topic of this video:

https://youtu.be/vjjXM_PYUJs