Order for the appointment of a cashier (sample)

When the order for the appointment of a cashier is drawn up, signed and read out, the director of the organization, against receipt, acquaints the accountant, who will now perform the duties of a cashier, with the regulatory documents governing the procedure for conducting cash transactions.

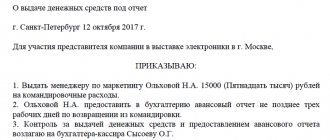

After the preamble, the word “ I ORDER ” is written in the center in capital letters.

Further, the order for the appointment of a cashier must contain the last name, first name and patronymic of the accountant who is planned to be assigned the duties of a cashier, and the name of the cash register. The responsibilities of the new cashier should be listed below. Among others, it is necessary to provide for his responsibility for conducting cash and cash transactions. In addition, provide for the obligation to maintain incoming/outgoing cash orders and at the end of the cash register shift to draw up appropriate certificates. And, of course, sign all the necessary documents as a cashier. The last phrase of the order should be a mention that an agreement on full financial responsibility was concluded with the employee who will now perform the duties of a cashier.

General requirements for orders

All orders related to changes in the cash register can be issued in any form. The main thing is to indicate the name of the company (full name of the individual entrepreneur), the date of drawing up the document, and also do not forget about the signatures.

Important detail: If a company has been keeping a cash book in one copy since June 1 and does not bind it, then the sheets for the period from January 1 to May 31 inclusive must be sewn together.

The order must be endorsed by the head of the company, and then it must be familiarized with it to those employees who will fulfill the requirements outlined in it. So, the employee who has been assigned new responsibilities must be familiarized with the order to appoint a cashier. Or, say, the order to maintain a cash book must be signed by the cashier and the chief accountant. After all, it is the cashier who makes entries in the cash book and endorses it at the end of each day, and the chief accountant is responsible for maintaining this document (clause 4.6 of Directive No. 3210-U). If the cash book is also signed by an accountant who checks the entries in the document with the primary account, then he must also be familiarized with the order.

It is not necessary to stamp orders. But it is better to state the basis for their publication. Thus, in orders related to cash procedures, the basis will most often be Directive of the Bank of Russia dated March 11, 2014 No. 3210-U. Or the company’s current Regulations on the conduct of cash transactions, if it contains a condition on the issuance of a particular order.

The main thing to remember

1 An order for the appointment of a cashier must be in those companies that do not have a corresponding position in the staffing table.

2 You can issue an order that the company maintains a cash book in one copy. And he keeps it together with receipts, consumables and supporting documents.

3 Entrepreneurs have the right to no longer maintain cash documents and a cash book, but such refusal must be formalized by order.

Additional information about the cash register

Article: “Ten new rules according to which cash transactions must be completed” (“Glavbukh” No. 12, 2014).

Documents: Directive of the Bank of Russia dated March 11, 2014 No. 3210-U; Article 151 of the Labor Code of the Russian Federation.

Test There is no cashier position in the staffing table of Vega LLC. The manager decided that he himself would accept and issue cash. Is it necessary to issue an order in this case? Yes. No. The manager can issue and accept cash directly (clause 4 of Bank of Russia Directive No. 3210-U dated March 11, 2014). But if he does not intend to keep track of cash on his own, then he will need an order to appoint a cashier.

Order for the appointment of a cashier sample 2020

Delivery of goods Part 2. Where to get the goods? PART 1. Conduct cash register audits: - periodic scheduled - in the morning on the first working day of each month; - sudden - once every six months; — annual – as of December 31 of the reporting year; - when changing cashiers. 9. Determine the place where cash is stored - a loose safe in the office of the accountant-cashier No. 401.

Even if the staffing table does not include the position of a cashier and there is a single job description indicating that all the cashier’s functionality is included in the accountant’s list, the presence of an order assigning duties is mandatory. A cashier can be a person specially hired for the position of cashier (senior cashier) or accountant -cashier and other employee, including the chief accountant or head of the organization (clause

Cash transactions

- presence of the signature of the chief accountant or accountant (if they are absent, the signature of the manager) and checks this signature with the available sample;

- compliance of the cash amount indicated in figures with the amount indicated in words;

- availability of supporting documents named in the PKO.

Rules for conducting cash transactions: who conducts cash transactions

In addition to the cash limit, there is also a limit on cash payments between organizations/individual entrepreneurs. This limit is 100 thousand rubles. within the framework of one agreement (clause 6 of Bank of Russia Directive No. 3073-U dated October 7, 2013). That is, for example, if an organization buys goods worth 150 thousand rubles from another legal entity under one contract. and plans to make payments in installments, then the amount of all cash payments should not exceed a total of 100 thousand rubles, the remaining amount should be transferred to the seller by bank transfer.

We recommend reading: How a pension is calculated in 2020 for a man born in 1959

If there are several cashiers in the organization, then one of them is appointed as a senior cashier (clause 4 of the Procedure for conducting cash transactions). An accountant-cashier is an employee whose job responsibilities, in addition to the duties of a cashier, include maintaining accounting records at a specific site. Example. Excerpt from the job description of a senior cashier Example.

Sample order on performing the function of a cashier in 2020

For non-compliance with the law regarding the conduct of cash transactions, administrative liability is provided. Part 1 of Article 15.1 of the Code of Administrative Offenses establishes: Let us present the main cash transactions of a budgetary institution in the form of a table.

We recommend reading: Calculation of Certificate of Incapacity for Work in 2020

A separate division (branch, representative office) that has a bank account also sets a cash limit. The head of the organization issues an administrative document (for example, an order from the manager) on the established cash limit of the organization. Note: The cash balance limit does not need to be approved by the bank.

Order No. 2. On maintaining a cash book

It follows from the new rules that the cash book can be printed in one copy. And either file the sheets together with the primary document (as cashier’s reports were previously stored), or bind them separately. In addition, the cash book can be maintained electronically. In this case, the accountant will not need to print it out at all.

First of all, the order must say what the company decided to do with the cash book opened at the beginning of 2014. Namely, whether the organization will close it and start a new one from June 1. Next, specify in the order the selected option for registering and storing the cash book. It will be electronic or paper. If paper, then how many copies of each sheet.

Companies that want to play it safe can keep the book under the old rules. That is, print out the sheets in two copies, attach receipts and consumables to one of them, and stitch and number the second. Then indicate so in the order.

Important detail If a company has been keeping a cash book in one copy since June 1 and does not bind it, then the sheets for the period from January 1 to May 31 inclusive must be sewn together.

For organizations that have separate divisions, it is also necessary to establish a procedure for transferring copies of cash book sheets to the head office. Specify in the order whether these copies need to be certified (1) and how often the documents should be sent to the accounting department (2). The sample is above.

Order for the appointment of a cashier sample 2020

7 of the Federal Law of 07/03/2016 No. 290, from 02/01/2020 new cash register equipment can only be used through a fiscal data operator. If the agreement on labor relations contains a condition implying the assignment of incentive payments in accordance

We compose additional agreement:...Additional agreement N 5-ds/11 to the employment contract 02.09.2008 on temporary combination of Moscow X September 26, 2011 Limited Liability Company "xxx" (LLC "xxx"), hereinafter referred to as "Employer", with one The parties, represented by Director xxxxxxxxx, acting on the basis of the Charter on the one hand, and Nxxxxxxxxxxxxx, holding the position of chief accountant, hereinafter referred to as the “Employee”, on the other hand, together referred to as the “Parties”, have entered into this additional agreement to the employment contract dated 02.09.2008 about the following: 1. With the consent of the Employee and in accordance with Art.

Order for the appointment of a cashier sample 2020

- According to documents drawn up in accordance with the established procedure, accepts cash into the cash register and issues money from the cash register.2.1.7.

- Maintains a cash book based on receipts and expenditure documents, checks the actual availability of cash amounts with the balance in the cash book.2.1.8.

- Monitors compliance with the cash balance limit established in the organization at the end of the working day. 2.1.9.

- Compiles inventories of old banknotes, as well as relevant documents for their transfer to bank institutions for the purpose of replacing them with new ones.2.1.10.

In general, everything is quite prosaic - the director himself draws up (or downloads the finished) text of the order, prints it out, signs it, affixes a seal and puts it in a folder with other mandatory documents of the LLC.

Order for the appointment of a cashier sample 2020

The head of a small enterprise has to draw up an order for the appointment of a cashier in two cases: - at the request of financial and other organizations: for example, if a small enterprise has started working with a cash register, then banks in this case may request a copy of the order for the appointment of a cashier; - if there is one cashier at the enterprise, but he is temporarily absent. For this it is necessary

We recommend reading: Changes in Criminal Code Art. 228 V 2020

Info When the order for the appointment of a cashier is drawn up, signed and announced, the director of the organization, against receipt, acquaints the accountant, who will now perform the duties of a cashier, with the regulatory documents governing the procedure for conducting cash transactions.

Can the chief accountant be a cashier?

Currently, there are no regulatory prohibitions that would prevent the chief accountant from performing the duties of a cashier on a part-time or part-time basis. Another question is whether it is worth doing this, even after concluding an agreement with the chief accountant on full financial responsibility.

It is not for nothing that the signatures of various company employees are provided on cash orders. The consequences of neglecting this obvious rule of collegiality for the sake of safety are evidenced by numerous sentences involving chief accountants-cashiers. For example, as in verdict No. 16 of September 18, 2020 in case No. 01-0222-2017:

If you completely trust your chief accountant and are confident that he will be able to manage the cash register, then you need to formalize everything properly, and not give a “verbal order”, as in the excerpt from the verdict we cited. However, first it is necessary to calculate whether it is really more economically profitable to entrust the cash register to the chief accountant, rather than outsource it.

Order for the appointment of a cashier (sample 2020)

Order on appointment to the position of director of an LLC From the moment the order on appointment to the position of director is issued, the actual activity of the enterprise begins. After all, it is the director who is responsible for economic activities and entering into relationships with other market participants. Accordingly, it is the director who is the first person of the company and it is he who makes such decisions. There are two ways to prepare such a document:

First of all, the personnel officer or the head of the enterprise fills out the header of the order: its serial number and the date of preparation. Next, the preamble of the order is drawn up, indicating the reason why it was issued (for example, due to a serious illness of an employee or production necessity).

What you need to know

The economic and financial activities of various types of individual entrepreneurs, as well as legal entities, must be carried out strictly in accordance with current legislation.

This point is confirmed using special primary accounting documentation.

Moreover, its format must necessarily comply with special forms established at the legislative level.

Particular attention will need to be paid to the order to transfer the right to sign primary documents. Since this document is especially important compared to the others.

Its presence will significantly simplify a large number of different procedures that are associated with documenting business activities.

Basic moments

To avoid various difficulties, it is worth familiarizing yourself in advance with the basic definitions and purposes of some documents.

All this together will allow you to avoid various kinds of difficulties when it is necessary to study legislative acts regulating the type of issue under consideration.

The term “primary documents” refers to documents reflecting all kinds of accounting and business transactions at the enterprise. Such documents represent evidence of their accomplishment.

We suggest you read: Obtaining a US visa, processing times

“Order for the right to sign” is a special document that reflects a list of certain individuals.

This list includes citizens who have the right to confirm the legality of drawing up certain primary documents.

This issue is discussed in as much detail as possible in Article No. 9 of Law No. 402-FZ of December 6, 2011. This legislative act highlights the main nuances associated with documentation of the type in question.

“Authorized persons” are citizens who have the right to sign a document giving authority to create primary documents.

Such positions usually include accountants, directors of enterprises, and founders.

In fact, the person authorized to perform such actions is established by the charter of a particular enterprise. Everything primarily depends on the organizational and legal form.

Why is this necessary?

Sample order for senior cashier 2020

Next, the preamble of the order is drawn up, indicating the reason why it was issued (for example, due to a serious illness of an employee or production necessity). After completing the preamble, we move on to the administrative part of the text of the order, which begins with the words “I ORDER”.

- The procedure for determining the limit on the cash balance at the institution's cash desk, with the exception of days of payment of wages (benefits, scholarships).

- Cash delivery to the bank when the approved balance is exceeded.

- Assignment of job responsibilities to the cashier (responsible employee).

- Reception and issuance of cash on the basis of incoming and outgoing orders, mandatory maintenance of a cash book.

- Cash balance limit in the cash register.

- Rules for ensuring the safety of documents and cash at the enterprise.

- Rules for storing and transporting funds.

- Frequency and algorithm for conducting checks of cash discipline. Determination of responsible persons (commissions) for conducting inspections, including surprise ones.

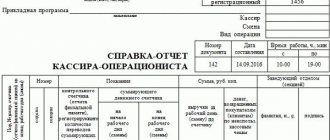

Cashier's journal

This can be once a day, for example in the evening - at the end of the working day. Or maybe your store is open around the clock and the shift ends in the morning, then the report is taken in the morning.

Z - the report can be restored in two ways: Each error in the cashier-operator’s journal must be certified by the signature of the person responsible for maintaining the journal.

That is, next to each correction you need to write: “believe the corrected one” and sign.

No. A cash book is another document that individual entrepreneurs and organizations are also required to have in order to maintain accounting records. Correctly filling out the cashier's journal will not save you from tax fines if you WANT to pay them))). Examples of a certified cashier's journal.

But a significant portion of tax payers are still forced to work with cash register equipment.

At the tax office - in the operational control department of the MIFTS (cash register registration department), in which the cash register was registered. IMPORTANT! The requirement for the mandatory use of cash register systems when working with cash is contained in paragraph 1 of Art. 2 of the Law “On the Application of CCP” dated May 22, 2003 No. 54-FZ. Working with cash register means obeying all the rules established by regulatory documents and drawing up all the necessary cash documents and reports. How to issue an order to assign cashier duties to an accountant if there is no such position on staff?

Chief accountant ___________ / Sidorova E.

Next, the preamble of the order is drawn up, indicating the reason why it was issued (for example, due to a serious illness of an employee or production necessity). In the case where the chief accountant is the only one in the organization (and this most often happens), then these functions can be assigned directly to him.

2nd floor/5th floor

pan. Houses. RUB 3,800,000 The page you requested was not found. Buying, selling, renting apartments, country real estate in Korolev and Yubileiny.

1994-2019. The rule that allows the VAT deduction to be applied not only in the period in which the right to it arose, but in subsequent periods, does not apply to all types of deductions. Now accountants don't have to wonder about this! Yes, if not in ShR, there can be no additional payment.

2. Yes, if not in ShR, there can be no additional payment. He doesn’t mind, he’s a specialist, they’ll encourage him in a different way.

The main thing is that everything according to the documents is correct.

He doesn’t have anything like that in the DI, but I understand from the forum that if the DI initially had the duty of a cashier, then there would be no need for an order to assign duties. In general, the main thing for me is that there are no problems with the docks. _____, st. _____, house _____. 2. Set a cash balance limit in accordance with Appendix No. 1 to this order. 3. Entrust the management of cash transactions to accountant-cashier Ivanova M.I. in accordance with her job description.

1 4. Appoint accountant-cashier Ivanova M.I. as the representative of Alpha LLC, authorized to receive from the current account and deposit cash into the organization’s bank accounts.

Order on assigning cashier duties to an accountant sample

Let us note that the choice of a fixed salary or interest rate both in the additional agreement to the employment contract and, accordingly, in the personnel order is entirely at the discretion of the parties. As a rule, chief accountants and personnel officers prefer a percentage rate, so as not to later make changes to the additional agreement and not to issue another personnel order when the salary increases for the whole company.

If there is a need to carry out transactions with cash and draw up cash receipts and debit orders, the bank with which the institution cooperates will definitely inquire about the order.

We recommend reading: Benefits for a Second Child in 2020

In 2020, an order for the cashier responsible for cash register

Next, the preamble of the order is drawn up, indicating the reason why it was issued (for example, due to a serious illness of an employee or production necessity). After completing the preamble, we move on to the administrative part of the text of the order, which begins with the words “I ORDER”.

- persons using cash registers or strict reporting forms (read more about accounting for funds when using online cash registers);

- employers giving money to employees on account.

- organizations that are not small;

- individual entrepreneurs and organizations that are small businesses (you will find the criteria for small businesses in);

- organizations with separate divisions;

How to write an order about responsibility for KKM

This condition guarantees full compliance with labor laws.

Is compilation necessary? Important! Even if the staffing table does not include the position of a cash register employee and there is a single job description indicating that all cashier functionality is included in the accountant’s list, an order assigning duties is required. Info

Under these conditions, cash transactions cannot be carried out by anyone other than a cashier, who is selected from the existing staff or hired separately.

Important

In large organizations If we are talking about individual entrepreneurs, then the employee’s written consent to assign duties is not required.

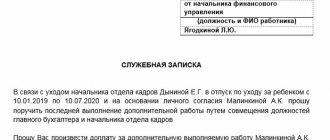

If the cashier in the institution is absent for good reasons (vacation, illness) or such a position is not provided at all, since the enterprise is still small, then the duties of this employee can be assigned to the accountant.

To do this, a corresponding document must be prepared and signed.

It is called “Order on assigning cashier duties to an accountant.”

Further, the order for the appointment of a cashier must contain the last name, first name and patronymic of the accountant who is planned to be assigned the duties of a cashier, and the name of the cash register.

The responsibilities of the new cashier should be listed below. Among others, it is necessary to provide for his responsibility for conducting cash and cash transactions. In addition, provide for the obligation to maintain incoming/outgoing cash orders and at the end of the cash register shift to draw up appropriate certificates.

And, of course, sign all the necessary documents as a cashier.

The last phrase of the order should be a mention that an agreement on full financial responsibility was concluded with the employee who will now perform the duties of a cashier.

Any sample order for the appointment of a cashier is certified by the signatures of the director of the organization and the newly appointed cashier.

It could be:

- AMC 100K – if the organization sells food products;

- autonomous cash registers with ECLZ and fiscal memory type ORION-100K or MERCURY-180K;

- mobile payment terminals with a modem and battery type YARUS C2100;

- printers that do not work without a computer or terminal (they are called fiscal registrars) like FPrint -5200PTK and the like;

- receipt printers (they do not have built-in memory, which means they do not need to be registered with the tax office) of the types Shtrikh 600, MPRINT R58 USB, etc.

In short, regardless of the model, the cash register must be registered.

In addition to appointments, the order prescribes the employee’s authority to keep a journal, draw up the necessary reports, and sign cash documents from the official “cashier” or “administrator.”

Product is king!

- Part 18. Delivery from the USA

- Part 17.

Angry birds attack! - Part 16. Not China alone!

- Part 15.

Do you want a unique thing that we don’t have? We'll get her! - Part 14. About quality and failures

- Part 13. First product

- Part 12.

Packing orders - Part 11. Little surprises

- Part 10.

Let's start developing a web storefront - Happy new year friends!

- Part 9. Second batch of goods

- Part 8. The store now has a logo!

- Part 7. Emotions as a gift

- Part 6. Who are the stakeholders?

- Part 5. What will be sold?

- Part 4. Action Plan

- Part 3. Delivery of goods

- Part 2. Where to get the goods?

- PART 1.

First of all, the personnel officer or the head of the enterprise fills out the header of the order: its serial number and the date of preparation. Next, the preamble of the order is drawn up, indicating the reason why it was issued (for example, due to a serious illness of an employee or production necessity). After completing the preamble, we move on to the administrative part of the text of the order, which begins with the words “I ORDER”. In the text we indicate the name of the accountant who will act as cashier, and the name of the cash register.

All the duties of the cashier that the accountant will assume must be specified in the body of the order, namely: to be responsible for maintaining the cash register and cash transactions, as well as maintaining incoming and outgoing cash orders, drawing up certificates at the end of the cash register shift and signing all necessary documents on behalf of the cashier.

We invite you to familiarize yourself with: Closed will: rules and procedure for drawing up, conditions of inheritance, sample writing

After the order to appoint a cashier has been issued, the head of the enterprise is obliged to familiarize the accountant, against receipt, with the regulatory documents that prescribe the procedure for conducting cash transactions. The last paragraph of the order states that an agreement on full financial responsibility was concluded with the employee appointed to the position of cashier.

The order is certified by the signatures of the head of the enterprise and the employee who was appointed to the position of cashier. After the above package of documents is completed, the accountant (or chief accountant) must sign a new job description for him. An employee, as a rule, must be paid extra for holding multiple positions. Additional payment for combining positions is established only by agreement of each party to the employment contract (Article 151 of the Labor Code of the Russian Federation).

There are several options that the head of an organization can resort to if it is necessary to perform the duties of one employee by another.

First option. An order is drawn up, signed, and then an agreement on full swearing is concluded with the employee.

responsibility, is certified, then changes are made to the employment contract of the accountant (or the chief accounting specialist in the organization, depending on the circumstances), which provide for him to perform all the functions of a cashier. This option is more logical. Second option. An order and an agreement are formed and signed, as in the first option, plus amendments to the acting status are made.

Then, after the title, the reasons for the absence of the employee as such are indicated.

Set a cash balance limit in accordance with Appendix No. 1 to this order.

Entrust the management of cash transactions to accountant-cashier Ivanova M.I.

in accordance with her job description.1 4. Determine the representative of Alpha LLC, authorized to receive from the current account and deposit cash into the organization’s bank accounts, accountant-cashier Ivanova M.I. 5.

Assign responsibility for preparing cash documents to accountant-cashier Ivanova M.I.

6. Prepare cash documents using the 1C: Accounting program. 7. Set the deadline for issuing wages to employees of the organization - 5 working days, including the day of receiving cash from a bank account. 8.

STATE UNITARY ENTERPRISE "TREST MOSOTDELSTROY No. 1" on the assignment of cashier duties dated November 15, 2008 No. ____Due to the absence of a cashier position in the staffing table, I ORDER: 1.

Assign cashier duties to L.K. Kosterina.

– chief accountant from January 20, 20092.

I entrust control over the implementation of the order to the Deputy Head of Economics and Finance Zelenyuk V.K. Manager _____________ Yu.P. Sorokin signature The order has been read by: _____________________ L.K. Kosterina "___"____________ 20___

This review will require an additional signature of the employee who assumes the rights and responsibilities of the cashier. Footnote to the agreement on mat. responsibility will also be useful. Without it, the order will also be valid, but it will need to be supplemented with an annex in the form of this agreement.

At the end of the text of the document there must be at least two signatures: the accountant-cashier and his manager. The date is already at the beginning. If it is not planned to make changes to the job description of an accountant (or chief accountant) regarding the performance of the duties of a cashier, then the Order must contain a line (at the end of the first paragraph on the appointment) “with an additional payment in the amount of XXX.” This condition guarantees full compliance with labor laws.

Even if the staffing table does not include the position of a cash register employee and there is a single job description indicating that all cashier functionality is included in the accountant’s list, an order assigning duties is required.

Contents: An order is a strong-willed decision of the organization’s management, drawn up in accordance with the requirements of the Labor Code of the Russian Federation.

What an order to impose financial liability will look like depends on what type of liability the person is involved in. Responsibility can be assigned to a specific citizen, that is, be of an individual nature, or to a group of employees, for example a brigade, and be called collective.

We invite you to familiarize yourself with: Sample power of attorney from the city administration

This point must be reflected in the order. The form of the order has not been approved by the legislator, but below we will consider the characteristic points. This order is issued if it is necessary to hold a specific worker accountable.

238, 242, 243 and 248 of the Labor Code Reason: act on the results of the internal investigation dated December 23, 2019 No. 133.

I do not dispute the amount of damage caused and agree with the deduction from wages. Ivanova G.G. refused to sign.

We are familiar with: The Order on collective financial liability of the 2020 model can be found on our website. In this case, when concluding an employment contract, an agreement on full financial responsibility is immediately concluded.

If an employee was initially hired for a job that does not involve performing such duties, and he was additionally charged with this job function, then the sequence of actions is as follows. Secondly, it is published about the assignment of cashier duties in a combination manner. — upon request from financial and other organizations:

First of all, the personnel officer or the head of the enterprise fills out the header of the order: its serial number and the date of preparation.

Next, a preamble is drawn up, which indicates the reason why it was issued (for example, due to a serious illness of an employee or production necessity).

Order for cashiers in connection with online cash registers

A fairly common situation is when a small enterprise does not have a cashier on staff or only one cashier position is indicated in the staffing table. The head of a small enterprise has to draw up an order for the appointment of a cashier in two cases: - at the request of financial and other organizations: for example, if a small enterprise has started working with a cash register, then banks in this case may request a copy of the order for the appointment of a cashier; - if there is one cashier at the enterprise, but he is temporarily absent.

It follows that if the state authority has not approved the list of localities remote from communication networks, then this indicates the absence of these localities in this subject of the Russian Federation. This means that cash register systems in these regions cannot be used offline. You can familiarize yourself with the Directory of areas remote from communication networks.

Three orders that you now need to work with the cash register

How this article will help: Ready-made sample orders will help you correctly formalize the appointment of a cashier, correctly maintain a cash book and free entrepreneurs from paperwork. What it will protect you from: From disorder in documents and violation of cash discipline.

Important detail The director can himself establish in the order how the company will maintain the cash book. And also appoint a cashier - an employee who will be responsible for issuing and receiving cash.

The new cash order has been in effect for just over a month, but companies and entrepreneurs already have a lot of questions. You will find answers to most of them in the material “30 answers to your questions about the cash limit, receipts, consumables and the cash book.” And in this article we looked at three situations that companies and entrepreneurs can easily resolve with the help of orders.

The first - about the appointment of a cashier - will establish who in the company is responsible for receiving and spending cash.

We invite you to familiarize yourself with Restriction of freedom as a type of criminal punishment under Art. 53 of the Criminal Code of the Russian Federation: differences from imprisonment

The company will need the second order in order to keep a cash book in one copy from June 1. With the help of such a document, you will establish how the cashier will have to file the sheets of the book and in what order he will store receipts, consumables, statements, as well as supporting documents.

Finally, the third order will be useful to those entrepreneurs who no longer want to set a cash balance limit, draw up receipts, consumables and maintain a cash book.

The first - about the appointment of a cashier - will establish who in the company is responsible for receiving and spending cash.

Finally, the third order will be useful to those entrepreneurs who no longer want to set a cash balance limit, draw up receipts, consumables and maintain a cash book.

Important detail The new cash procedure does not require the director to coordinate the candidate for cashier with the chief accountant. Accordingly, his signature on the order is optional. Companies that want to play it safe can keep the book under the old rules.

That is, print out the sheets in two copies, attach receipts and consumables to one of them, and stitch and number the second. Then indicate so in the order.

Important detail If a company has been keeping a cash book in one copy since June 1 and does not bind it, then the sheets for the period from January 1 to May 31 inclusive must be sewn together.

Those sheets of the cash book that you have accumulated from the beginning of this year to May 31 inclusive must be bound according to the old rules. That is, as required by paragraph 2.5 of the Bank of Russia Regulations dated October 12, 2011.

No. 373-P. All orders related to changes in the cash register can be issued in any form. The main thing is to indicate the name of the company (full name of the individual entrepreneur), the date of drawing up the document, and also do not forget about the signatures.

Important detail If a company has been keeping a cash book in one copy since June 1 and does not bind it, then the sheets for the period from January 1 to May 31 inclusive must be sewn together. 1 An order for the appointment of a cashier must be in those companies that do not have a corresponding position in the staffing table.

2 You can issue an order that the company maintains a cash book in one copy.

And he keeps it together with receipts, consumables and supporting documents.

3 Entrepreneurs have the right to no longer maintain cash documents and a cash book, but such refusal must be formalized by order.

Have a question? Our experts will help you within 24 hours!

Get answer New

Often, small businesses do not have cashiers on staff. The director most often has to issue an order to appoint a cashier in two situations: - if there was a request from financial or other organizations, for example, such an organization could be a bank if the company began to work with a cash register; - if he is registered at the enterprise, but for one reason or another he is temporarily absent. The personnel employee or the head of the enterprise himself must take care of filling out the order header.

In the header you need to indicate the registration number of the document, enter the date of preparation of such a document, the name of the enterprise and the form of business activity. The preamble of the order appointing an employee to a position must indicate the reasons why this order was issued. Here you can write about an illness, or about a productive need, and so on.

By the way, the order for the appointment of a cashier must be drawn up after the future cashier has familiarized himself with the regulatory documentation, which describes the procedure for maintaining the cash register. Moreover, all this must be done with confirmation of familiarization with a signature. It is also necessary to indicate that an agreement on his financial responsibility has been signed with the employee appointed to the position of cashier.

At the very end, the order is certified by signatures. In addition, the employee entering the position is required to sign a job description in order to begin work.

What are the job responsibilities of an accountant-cashier? If there are several cashiers in an organization, then one of them is appointed senior (clause 4 of the Procedure for Conducting Cash Operations). An accountant-cashier is an employee whose job responsibilities, in addition to his duties, include accounting for a specific area.

Excerpt from the job description of a senior cashier Example.

Excerpt from the job description of an accountant-cashier How to assign the duties of a cashier to an employee In order to assign the duties of a cashier to an employee whose employment contract and job description do not provide for the performance of such duties, it is necessary (Art.

Art. 60, 60.2, 151 of the Labor Code of the Russian Federation): 1) enter into an agreement with him on combining positions and familiarize him with the cashier’s job description against signature. The agreement must establish: - the amount of additional payment for combination; - the period of combination - for example, for the period of vacation or until the employee is hired as a cashier;

Example. Order on temporary performance of duties In this case, there is no need to make any cash receipt orders!

View more:

After the above package of documents is completed, the accountant (or chief accountant) must sign a new job description for him. An employee, as a rule, must be paid extra for holding multiple positions.

Additional payment for combining positions is established only by agreement of each party to the employment contract (Article 151 of the Labor Code of the Russian Federation).

If during the year there are changes in the composition of persons or in the powers of these persons, it will be necessary to make appropriate changes to the order. The same order can reflect the norms of daily expenses adopted by the organization.

The cash balance limit can be calculated:

- based on current accounting data for the last 3 months,

- based on forecast data in cases where an increase in revenue turnover is expected.

The calculation itself must be drawn up in the form of a table and attached to the order.

The order must indicate:

- expenses for which cash can be used.

- frequency of collection of cash proceeds,

Based on the generated cash register, the cashier is obliged to issue funds to the employee.

The cash receipt order form consists of two parts:

- the cash receipt order itself;

- the tear-off part is a receipt (issued to the person who deposited the money).

If the amount of money indicated in the receipt coincides with the amount deposited, the cashier signs the order.

Then he puts a seal or stamp on the receipt for the order (if the organization has a seal) and issues a receipt to the depositor.

If the cash book from August 19, 2020 will be maintained not by the cashier, but by another employee, then the corresponding responsibilities must include

Cash transactions

You can check whether your company belongs to the SMP on the Federal Tax Service website.

Amounts in excess of the established limit must be deposited with the bank. Organizations/individual entrepreneurs can exchange cash with physicists (receipt/issuance) without any restrictions (clause 6 of Bank of Russia Directive No. 3073-U dated October 7, 2013).

Of course, documenting each cash transaction is also of considerable importance. After all, an unregistered transaction can lead to the fact that the money “on paper” will not coincide with its actual amount.

Responsibilities of a cashier order 2020

1.2. The cashier is appointed to the position and dismissed from the position in the manner established by the current labor legislation by order of the Head of the Organization. 1.3. The cashier reports directly to the __________ Organization.

Prepares cash reports. To properly perform job duties, must know: governing and regulatory documents (decrees, orders, orders, instructions, etc.) relating to the conduct of cash transactions; forms of cash and banking documents; rules for acceptance, issuance, accounting and storage cash and securities; procedure

Moscow Bar Association

In accordance with the “Procedure for conducting cash transactions in the Russian Federation”, approved by the Decision of the Board of Directors of the Central Bank of Russia dated September 22, 1993 N 40, —————————————————————— ¬ ¦ Limited Liability Company "Quint" ¦ ¦ ¦ ¦ Order to cancel the combination of positions ¦ ¦ ¦ ¦ August 1, 2006

1.2. An accountant-cashier is appointed to a position and dismissed from it upon the recommendation of the chief accountant-cashier by order of the general director of the company. An order to assign duties to an employee has recently become commonplace in almost any enterprise.

It is not difficult to draw up such a document. You just need to strictly follow a certain sequence of actions and not violate the Labor Code.

There are situations when one of the employees is absent from the workplace for one reason or another.

But the enterprise should not change its usual rhythm of work or stop altogether during this time.

In all of the above cases, the employee is absent from the workplace for a good reason, with the knowledge of the administration and management.