Settlements with accountants

Accountable amounts include not only advances for travel expenses, but also the issuance of money for the purchase of office and household goods, fixed assets, fuels and lubricants, food and other expenses for the needs of the institution.

Reporting funds can only be issued to employees with whom employment contracts have been concluded. It will not be considered an error to issue funds to an employee working under a civil contract, for example, for the purchase of building materials. In small organizations, it is permissible to issue an order that specifies specific officials and names to whom it is permissible to provide money against an advance report. Below you will find a sample order for the appointment of accountable persons 2020.

A budgetary institution must establish a limit on settlements with accountable persons and a maximum period for which money is issued. The legislation does not indicate restrictions on terms and amounts; therefore, the organization independently determines the rate of funds issued against the advance report and the terms.

The deadline for submitting the advance report is no later than three working days, established by clause 6.3 of Instructions No. 3210-U. The institution does not have the right to approve a longer period. And if the organization does not have an order on the timing of reporting on accountable amounts, then employees are required to report on the day the reporting period ends (the period for which the money was issued) or on the first working day (upon returning from a business trip).

General order on the appointment of accountable persons

Let us note that from August 19, 2020, employees can receive money not only on the basis of an application, but also on the basis of the organization’s administrative document (clause 6.3 of the Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U).

If a company issues money periodically to the same employees, these transactions should be streamlined by establishing a list of persons who have the right to receive money on an ongoing basis. You can set limits on the amounts and timing of advances. In order not to issue a separate order on the timing of reporting on imputed amounts, you can also display this important point in a single document.

Sample order on accountable persons, 2018

The advantages of this method of regulating cash discipline are obvious:

- accounting is “in the know” about who and how much money can be given out;

- employees plan their expenses in advance;

- employees (unlike the accountant, who are not always aware of the deadlines for the advance report) are familiar with the deadlines for submitting the advance report upon signature;

- document flow is optimized: there is no need to write an application for each advance.

If your company issues money from the cash register sporadically or you need to give funds to an employee who is not listed in the general document, then an order to issue amounts for a one-time occasion would be more suitable for you.

Sample order for one-time withdrawal of funds from the cash register

Let us remind you that for a one-time receipt of money by an employee, the employee’s application is also suitable, as was the case before August 19, 2020. But the example we have given will allow you to regulate in more detail the deadline for submitting the advance report, and appoint a person in charge (an accountant) who controls the reporting on advances issued. And the very fact of issuing an order from management and familiarizing itself with it will create in the employee a greater sense of responsibility than his statement.

Is it possible to do without the manager’s order?

The amendments to Bank of Russia Directive No. 3210-U dated March 11, 2014 abolished the requirement for an employee to submit an application for receipt and a manager’s order to disburse funds. Now you can issue money on the basis of either only an order from the manager, or an application from an employee with a resolution from the director.

In practice, most accounting and HR workers continue to require both documents. Why? One order is not enough for the auditor, since there is no calculation of the amount and justification for the purpose of the report. The inspector will definitely require you to justify the expenses incurred. And vice versa, many inspectors consider a statement with the director’s resolution, but without an official order, to be insufficient.

To eliminate problems with inspection authorities, tax officials recommend maintaining the old procedure for issuing an issue: drawing up both an application and an order.

Order for the issuance of money for reporting, sample 2018

One of the important documents when issuing accountable money is the order of the manager. A correctly drafted order will protect the company from claims from tax authorities. In this article we will look in detail at how to draw up an order for the issuance of accountable amounts in 2020.

Attention

Procedure for registering the issuance of accountable amounts With the Central Bank updating the instructions for conducting cash transactions, the issuance of accountable funds is now carried out according to new rules. From August 19, 2017, to issue an accountable amount, you can only draw up an order, without writing an application from the employee. However, organizations are not obliged to cancel previously established rules.

If it is convenient for a company to use statements, then it has the right to leave them (

Rules for drawing up a document

There is no unified form, but pay attention to the following rules:

- Create a document on the institution’s letterhead in a single copy. If such a form is not available, then in the header of the document indicate the name of the government agency (full), number, date and name of the order.

- A sample of a new order for reporting should be registered in the order register in the usual manner.

- When creating a new order, strictly follow the chronological order, otherwise the inspectors will suspect forgery.

- Only the head of the organization or his deputy or the person acting as head has the right to approve the document.

- In the document, be sure to indicate the following details: Accountable person: last name, first name and patronymic (if any), position.

- Subreport amount: indicate the amount in words and figures, in rubles and kopecks.

- Purpose: write down the specific purpose of the allocated money.

- Reporting deadline: indicate the deadline (day, month, year) until which the money was issued.

Don't forget to appoint a responsible person, for example, a chief accountant. If the organization does not have an accounting department, then control over compliance with this order should be entrusted to the manager.

Accountable person

An employee of a company or its affiliate who receives a certain financial amount in advance for future expenses is called an accountable person.

The list of such persons is determined and approved by the head of the company. Which issues an order for the enterprise, which clearly indicates the last names, first names and patronymics of the appointed accountable persons. The procedure for providing accountable amounts of money is regulated by the “Rules for Conducting Cash Transactions” and other documentary acts.

Transfer of money to an accountable person

The next deposit can be issued only after a full report on the previous advance has been provided. The amount of funds allocated for future business expenses, as well as the timing of their implementation, is established by the head of the company or the financial director of the division.

The accountable person has the right to spend the allocated money strictly for its intended purpose. It is prohibited to transfer or exchange allocated finances between accountable persons.

An employee who has spent the advance money entrusted to him is required to provide a detailed report on expenses, to which all evidentiary documents must be attached (all kinds of checks and travel tickets).

Who are called accountable persons?

The category of accountable persons may include any employees of the enterprise:

- secretaries who receive money from the cash register to purchase stationery, materials for office equipment and other office equipment,

- caretakers, to whom money is given to purchase household or household supplies. Accountable persons also include specialists who often go on business trips; they are given funds in advance against the report to pay for tickets, hotels, entertainment expenses, etc.,

- drivers who receive “cash” to pay for gasoline and other fuel liquids and spare parts also have accountable status,

- accountants and cashiers of enterprises.

Separately, we can single out employees of branches and structural divisions who do not have an independent balance sheet and receive money for business and other expenses from the main cash register of the enterprise.

Sample order for the issuance of accountable amounts in 2018 for the purchase of fuel and lubricants

Driver of GBOU DOD DYUSSHOR "ALLUR" Shoferkin S.P. submitted an application for the issuance of funds for the purchase of fuels and lubricants in the amount of 8,500 rubles. Gasoline brand - AI-95.

The concept of accountable money

Any funds issued by an accountant or cashier of a company to any of the employees in advance (i.e. in advance) to pay for any needs related to the activities of the enterprise are called accountable .

The law does not establish limits for the amounts issued for reporting, so they are determined at each enterprise individually, depending on existing capabilities and needs.

At the same time, all expenses incurred in the form of subaccounting must be economically justified and caused by real need.

Do I need to update the reporting order every year?

The concept of accountable money Any funds given by the accountant or cashier of a company to any of the employees in advance (i.e.

in advance) to pay for any needs related to the activities of the enterprise are called accountable. 6.3 Instructions of the Central Bank of Russia dated March 11, 2014 No. 3210-U):

- or from the date of expiration of the period for which the cash was issued;

- or from the day you start work.

An employee who has received money for travel expenses submits an advance report within 3 working days after returning from a business trip (p. But in any case, it is necessary to draw up an order for the release of funds.

This is an administrative document used to formalize the issuance of money to accountable persons (subclause 6.3, clause 6 of Bank of Russia Directive No. 3210-U dated March 11, 2014).

An order to receive amounts is issued upon each issue. Please note that the latest changes to Directive No. 3210-U allow you to issue both an administrative document and an application from an employee for a manager’s visa. Info Moreover, you need to fill out documents both when issuing cash and when transferring money to the employee’s card.

It is possible to order the approval of a list of accountable persons for all employees at once, if cash is issued to several persons during the day. The required details in this case remain the same as in a regular order. However, there are some peculiarities - the amounts and deadlines must be specified separately for each employee.

- Important

- An employee’s debts on old advances do not affect the issuance of money.

The procedure for issuing funds for reporting

- The first step at the enterprise is to determine a list of employees who, due to their official needs, can take cash from the cash register on a regular basis.

- Next, a corresponding order is issued, which, in addition to the list of employees, prescribes the conditions for the use of accountable funds.

- After this, on the basis of this document, the employees mentioned in the order can receive the necessary amounts without additional orders from management.

However, the amount of finance issued in this way cannot exceed the limits specified in the order. In addition, the employee must report on his expenses during the period also specified in the document.

If, after spending the amount allocated for the report, some balance is left, it must be returned to the cashier, but if, on the contrary, the employee had to pay extra for the needs of the enterprise from his own, the accountant is obliged to reimburse these expenses. In this case, all expenses must be documented.

It should be noted that employees who are not mentioned in the order as accountable persons can also receive cash from the cash register to complete tasks set by the employer, but only on condition that a separate order from the director of the company is first drawn up for this.

Is it possible to do without an order?

The presence of an order on accountable persons is not strictly mandatory ; however, if the enterprise uses the practice of transferring funds to employees on account (and without this, the activities of any organization are practically impossible), it is better to stock up on this document. Otherwise, as a result of a sudden inspection by the tax service or labor inspectorate, sanctions from regulatory structures in the form of a fine, which can be imposed both on the legal entity itself and on its director, cannot be ruled out.

We draw up an order on accountables

The employer decides for himself who to issue funds on account. The law does not oblige you to issue any organizational and administrative document for this purpose, for example, an order, which defines the list of accountable persons. At the same time, depending on the specifics of the activity and the management features of the organization, such an order may be issued.

The order is drawn up in any form. It indicates the full name and positions of the persons to whom funds may be issued on account.

If the organization does not have a developed, say, Regulation on settlements with accountable persons or similar instructions, the order can fix, for example, the deadline for issuing funds on account, when such a period is the same in all cases of issuing funds, as well as other features of issuing accountable money .

The order for the release of funds for the report must be familiarized to the persons indicated in it.

For an order approving the list of accountable persons in an organization, we will provide a sample of its completion.

Sample order on accountable persons

Today, the order on accountable persons does not have a single standard template that is mandatory for use, so organizations and enterprises have every right to write it in any form or according to a template developed within the company and approved in its accounting policies. Moreover, like any other administrative document, it must include a number of certain data, in particular:

- number and date of compilation;

- Company name;

- a complete list of accountable persons indicating their positions, full names;

- the maximum amounts allowed to be issued for reporting purposes;

- goals and deadlines for which money can be issued.

We are preparing an order for the issuance of accountable amounts

Part 1 Art. 15.1 Code of Administrative Offenses of the Russian Federation):

- for officials in the amount of 4,000 to 5,000 rubles;

- for legal entities - from 40,000 to 50,000 rubles.

Sample order for the appointment of accountable persons 2020 A sample order for accountable amounts is drawn up in any form. Most often in a single copy. It must indicate:

- registration number and date of compilation;

- Company name;

- a complete list of accountable persons indicating their positions, full names;

- the maximum amounts allowed to be issued for reporting purposes;

- goals and deadlines for which money can be issued.

The order must be signed by the director of the company. Without his signature it is considered invalid.

How to place an order

In terms of design, the order is also quite variable: it can be created in handwritten format or printed on a computer using a standard A4 (or even A5) sheet or company letterhead. In this case, the order must be certified by the autograph of the head of the company or another person authorized to endorse such documents.

In addition, everyone who is mentioned in it must leave their signatures under the order: the reporting employees themselves, as well as the employees responsible for implementing the order - by this they indicate that they have read and agree with the document.

It is not necessary to certify the order with a seal, because as of 2020, the norm for the use of seals and stamps by legal entities has ceased to be a legal requirement.

The order is usually written in a single copy and, during the period of validity, is contained together with other regulatory and administrative papers of the enterprise. After the relevance of the order is lost, it is transferred for storage to the archive, where it lies until the expiration of the legally established period, then it, along with other outdated documents, can be sent for disposal.

Grounds for issuing money on account

In order to issue funds on account, the organization must have one of the following documents (clause 6.3 of the Central Bank Instruction No. 3210-U dated March 11, 2014, as amended, valid from August 19, 2017):

- administrative document of a legal entity;

- written statement from the accountable.

Let us recall that until August 19, 2017, a written statement by the accountable person was mandatory (clause 6.3 of the Central Bank Instruction No. 3210-U dated March 11, 2014, as amended, valid until August 19, 2017). Now the organization itself decides how to justify the issuance of cash. Draw up an administrative document (for example, an order) or receive from a person an application for the release of funds to the account (we will discuss a sample of it below).

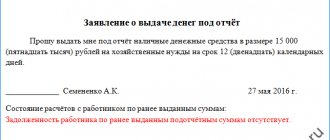

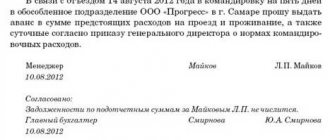

Such an application, drawn up in any form, must contain information about the amount of cash and the period for which it is issued. The application must bear the manager's signature and date. Similar information, as well as full name. accountable, the registration number must be contained in the administrative document (CBR Letter dated 09/06/2017 No. 29-1-1-OE/20642).

How to receive the money

Before the introduction of the amendments, in order to receive money, the employee sent an application to the accounting department or human resources department, which indicated the required amount and an explanation of what it would be spent on.

But in 2020, from August 19, it became easier to issue reports to employees. The changes are provided for by the instruction of the Central Bank of the Russian Federation dated June 19, 2017 No. 4416-U. From August 19, 2007, it is not necessary to submit an application. To issue money, an order or other administrative document of the company on behalf of the director is sufficient. The form of such a document is arbitrary. But it must contain the following details: