Notification of the opening of a separate division in the Federal Tax Service (sample attached)

All companies and individual entrepreneurs need to submit some kind of statistical reporting.

And there are so many forms of this reporting that it’s not surprising to get confused in them. To help respondents, Rosstat has developed a special service. using which you can determine what statistical reporting needs to be submitted to a specific respondent. However, unfortunately, this service does not always work correctly. Despite the fact that from January 1, 2019, types of economic activities are determined according to the new OKVED2 classifier, in order to determine the rate of contributions “for injuries” for 2020, the old OKVED codes must be indicated in the application for confirmation of the main type of activity and the confirmation certificate. The Tax Service has changed its position regarding filling out field 101 “Payer Status” in payments for the transfer of insurance premiums.

Now it is recommended for legal entities to use the status “01”, and individual entrepreneurs – “09”. The Federal Tax Service has approved a new procedure for obtaining a deferment (installment plan) for payments to the budget.

Now the rules are the same for both taxes and insurance premiums (except for “injury” contributions). From 01/01/2019, insurance premiums in case of temporary disability and in connection with maternity must be paid to the Federal Tax Service. And for reimbursement of benefits, as before, you must contact the Social Insurance Fund.

The list of types of state control in which a risk-based approach is applied has been expanded. Now this list also includes checks for compliance with labor legislation requirements carried out by the labor inspectorate.

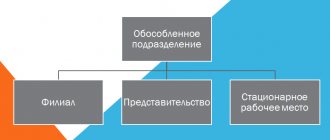

In accordance with the norms of domestic legislation, Russian legal entities can open their own separate structural divisions. The procedure for opening them and the requirements for them are described in the relevant acts of rulemaking.

In some cases, a company opening a separate division sends a notification about the opening of a separate division to the Federal Tax Service. Legal entities have the opportunity to open separate divisions. To notify tax authorities about such an opening, you need to send a message to the Federal Tax Service about the opening of a separate division.

Civil legislation does not provide for the possibility of opening structural units not directly named in Art. 55 Civil Code of the Russian Federation. That is, the Civil Code of the Russian Federation directly implies the possibility of opening only a branch or representative office.

Slightly different provisions are specified in Article 11 of the Tax Code of the Russian Federation. which directly allows for the opening of other structural units with permanent jobs.

The Federal Tax Service of Russia issued order No. dated 06/09/2011 which approved the form of notification of the creation of a separate division. This form is used for cases of opening separate divisions that are not branches and representative offices.

Sheet No. 1 of the specified form contains a field intended to indicate the tax inspection code, and therefore, to answer the question of where to submit a message about the opening of a separate division, you should study the specified Order. Appendix No. 13 to the above-mentioned Order of the Federal Tax Service of Russia directly states that the notification must indicate the code of the tax inspectorate at the address of the main organization. The Federal Tax Service of Russia approved the notification form, put into effect a general procedure for filling out an application, and also indicated the basic and mandatory requirements for such an application, but did not develop or publish a sample for filling out a message about the creation of a separate division.

When filling out a message, all fields intended to indicate the TIN and KPP must be filled out on each page of the application. The requirements for each column to be filled out are set out in Appendix No. 13 to the Order of the Federal Tax Service of Russia. It should be remembered that if several separate divisions are opened (except for branches and representative offices), one application must be filled out with attached second sheets in an amount equal to the number of representative offices being opened.

Procedure

To register these formations, different documents are required. Therefore, we will clarify this issue a little.

Technically, the registration of both is approximately the same, so we will consider them together.

| We indicate in the charter | We do not indicate in the charter |

| P13001, sheets 001, sheet K, sheet M | P14001, sheets 001, sheet O, sheet P |

| Charter, new edition, 2 copies. | Order on the establishment of a branch/representative office |

| Minutes/decision to amend the charter in connection with the indication of a branch/representative office therein | Regulations on the branch/representative office, copy |

| State duty for changing the charter, 800 rubles. | Orders on the appointment of a manager and ch. accountant of the branch/representative office, copy |

| Regulations on the branch/representative office, copy | A copy of the Certificate/sheet of registration of the main company (optional, but it is better to attach) |

| Orders on the appointment of a manager and ch. accountant of the branch/representative office, copy | |

| A copy of the Certificate/sheet of registration of the main company (optional, but it is better to attach) |

In both cases, packages of documents are submitted to the registration authority.

If we are talking about a separate division, then we submit the following:

- Completed application form C-09-3-1.

- Order of the sole executive body on the creation of a separate division.

Submits the director or his representative by proxy to the territorial Federal Tax Service.

Clause 1 of Article 126 of the Tax Code of the Russian Federation implies liability for violating the deadlines for sending a message about opening an OP.

For such a violation, a fine of 200 rubles is imposed for each document not submitted on time.

A fine of 300 to 500 rubles is imposed on officials. In case of conducting activities without tax registration, the organization will be obliged to pay a fine in the amount of 10% of the income received, but not less than 40,000 rubles.

Let's just say that the liability if you do not register an OP on time is quite small, by business standards. Conducting activities without registration is already more serious. At the same time, the labor costs to create it are in any case much less than the possible consequences.

Krasnogo Tekstilshchik, 10-12, letter “O” (entrance from Sinopskaya embankment) tel How to register an LLC? How to open your own business? What documents are needed to open? What do you need to open a company? So: Step-by-step instructions for registering an LLC. It takes about a week to prepare all the documents (you can try very hard and prepare them in a couple of days). The period for registering an LLC with the tax office is 5 working days (3 working days from 2020). A separate division can be formed in another region, city or district of an urban district, that is, in another municipal entity. One of the main conditions for recognizing a unit as separate is the presence of a stationary workplace or workplaces in it. Moreover, they must be organized for a period of more than 1 month (Article 11 of the Tax Code of the Russian Federation). trade retail chains, whose head offices and stores are located in different regions of the country and districts of the same city; banking organizations. Separate divisions can be different and created for various reasons. From 01/01/2019, insurance premiums in case of temporary disability and in connection with maternity must be paid to the Federal Tax Service. And for reimbursement of benefits, as before, you must contact the Social Insurance Fund.

In accordance with the norms of domestic legislation, Russian legal entities can open their own separate structural divisions. The procedure for opening them and the requirements for them are described in the relevant acts of rulemaking.

So, the company decided to create a separate division. Before registering it, she will need to prepare a package of certain documents.

At this stage, the organization's actions are as follows:

- The decision to create a separate division is made by the enterprise management body - the board of directors, the supervisory board, the meeting of shareholders.

- Based on this decision of the governing body, presented in the form of a protocol, an order is issued to create a unit.

The order must reflect:

- name of the new division;

- the basis for its creation, for example, the minutes of the general meeting of shareholders (number and date);

- location of the unit;

- a manager who is appointed and removed from office by a decision of the management body of the parent enterprise, for example, by a decision of the supervisory board or a general meeting of shareholders;

- within what time the unit must be registered.

The document is signed by the head of the parent company.

- Based on the order, an internal local act is developed - the Regulations on a separate division (branch or representative office). It establishes:

- the degree of legal capacity and powers of the new unit;

- activities;

- functions;

- management structure;

- other aspects that relate to the activities and actions of the unit.

- Also, the order is the basis for amending the constituent documents if we are talking about a branch or representative office. They can be formatted as:

- a separate document that is attached to the current charter or constituent agreement, for example, amendment No. 1;

- new edition of the constituent document.

- a copy of the decision of the governing body to create a separate division;

- a copy of the approved regulations on the separate division;

- a copy of the constituent documentation and its amendments (as a separate document or as a new edition);

- a copy of the state registration certificate of the main enterprise;

- a copy of the orders on the appointment of the head and chief accountant of the new division;

- a copy of the payment order or bank statement confirming payment of the state registration fee, certified by the seal and signature of the head of the credit institution;

- TIN/KPP of the parent company;

- its full name;

- tax office code;

- OGRN of the parent enterprise;

- number of new units;

- Full name of the head of the company, his Taxpayer Identification Number;

- contact information (phone number, email address);

- round seal of the company.

- TIN and KPP of the parent organization;

- full name;

- tax authority code;

- OGRN of the parent organization;

- number of closing units;

- Full name of the head of the enterprise, his personal tax identification number;

- contact information (phone number, email address);

- company seal.

Once the necessary documentation has been collected, we move on to the next stage.

A legal entity is obligated to report the creation of a separate division to the tax office within a month after the decision is made, for example, after the date of the minutes of the general meeting of shareholders. According to paragraph 3 of Art. 83 of the Tax Code of the Russian Federation, a new division of an enterprise must undergo the procedure of tax registration and inclusion in the Unified State Register of Legal Entities.

See also: “The Supreme Court again canceled the large fine for failure to register a unit.”

Registration of a separate division is carried out by the tax authorities. To do this, the enterprise must contact the tax office that will have jurisdiction over the territorial unit (municipal entity).

To register a branch or representative office, you must submit documents according to the following list to the tax authorities:

The application itself is a one-page form. The company should not have any difficulties filling it out.

The application shall indicate:

If the application is submitted not personally by the manager, but by a representative, then his data is filled out in the document. At the same time, his powers must be documented. Typically, a standard power of attorney form is used for these purposes.

The application is submitted in 2 copies. You can also provide a copy of the application as a second copy. This is necessary to mark on it the date of acceptance by the tax inspector.

The procedure for closing a branch or representative office differs from closing another separate division. According to sub. 3.1 clause 2 art. 23 of the Tax Code of the Russian Federation, an enterprise is obliged to notify the tax authority of the closure of a branch, representative office or other separate division within 3 days from the date of termination of activity.

The procedure for closing a branch and representative office is similar to the procedure for opening it. Such separate divisions are removed from tax registration with a full package of documents: a certified copy of the administrative document on the closure of the division (for example, minutes of a meeting of the board of directors), changes to the charter and the Unified State Register of Legal Entities, an application in form P13002.

To close another separate division, it is enough to submit an application to the tax authority in form C-09-3-2, which indicates:

At the same time, applications for registration and deregistration of a unit are almost identical. The only difference is in the title of the document itself. The application is also drawn up in 2 copies. You can provide the original document and a copy of it, on which a tax inspector will mark acceptance.

If the closed enterprise was responsible for the centralized payment of income tax, then in addition to the above documents, notifications in Forms 1 and 2 should be sent to the Federal Tax Service.

See here for details.

But the main difference between a branch and a representative office and an individual enterprise is that information about them must be included in the constituent documents. OP, regardless of type, act on the basis of provisions approved by the legal entity. Managers carry out activities on the basis of a power of attorney and are appointed by a legal entity.

The procedure for opening an OP can be divided into two large stages - registration and organization. Let's look at them in more detail. Existing legislation regulates only the procedure for organizing branches and representative offices.

The process of creating other OPs is practically no different from that prescribed by law.

Let's take a step-by-step look at how to register a separate division in 2020: Step 1. Make a decision to create an OP.

According to Article 5, a company can create an OP based on the decision of the company's participants.

The creation of separate divisions is carried out in the manner prescribed by law. Each step of the registration procedure has its own order, which, if followed, greatly simplifies the process.

The procedure for creating an OP is as follows:

- Adoption of an appropriate decision by the general director or general meeting.

- Drawing up an order to create a structural unit.

- Registration of changes in the organization.

- Register the branch with the tax office.

- Next, comes the appointment of a responsible manager and the vesting of his powers by issuing a power of attorney.

- Hiring full-time employees.

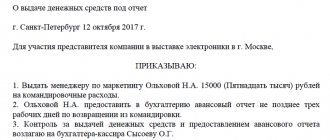

An example of an order to create a separate unit

Limited Liability Company "Korsak"

Order No. 1-op on the creation of a separate division

02/20/2021 Svetlogorsk

In connection with the expansion of the economic activities of Korsak LLC and the need to organize jobs outside the location of Korsak LLC,

- To create, from March 20, 2021, a separate division “Kaliningradsky” LLC “Korsak” without vesting the powers of a branch or representative office with the location: Russia, Kaliningrad region, Kaliningrad, st. Dimitrova, 20.

- I entrust the leadership of the separate division to myself.

- The chief accountant, Elena Valerievna Serova, must ensure that a message is sent to the Federal Tax Service No. 32 about the creation of a separate division in the approved form.

- Head of the HR Department Kuznetsov I.K. ensure the introduction of changes to the order on the staffing table and ensure the hiring of employees to staff a separate unit.

- I entrust myself with control over the execution of this order.

General Director Pavlova Pavlova A.M.

The following have been familiarized with the order:

Chief accountant Serova Serova E.V.

Head of HR Department Zheleznov Zheleznov M.P.

When a manager issues an order to create a separate unit

The Civil Code calls only representative offices and branches separate divisions of a legal entity. And the Tax Code is any division territorially isolated from the organization where a workplace is equipped.

Any separate division has its own characteristics. They are created only by a legal entity - an organization. The unit must be located outside the location of the legal entity. And on the basis of such a unit a workplace is created (for at least 1 month). Are there all the signs? Within a month after the actual creation (and this is the date of hiring the first employee), the organization is obliged to report this fact to the tax office. And an internal order to create a separate division is issued with the correct organization of management activities.

We are opening a separate division under the simplified tax system

In this case, a worker means a place where the employee must be or where he needs to arrive in connection with his work, which is directly or indirectly under the control of the employer (Part 6 of Article 209 of the Labor Code of the Russian Federation). A separate division of an organization is recognized as such regardless of whether its creation is reflected in the constituent and other organizational and administrative documents of the organization, and regardless of the powers vested in the specified division. As you can see, the concept of a separate division in the Tax Code of the Russian Federation is broader than a branch or representative office.

The easiest way to expand your business is to create a separate LLC division. In accordance with Art. 11 of the Tax Code of the Russian Federation, even one workplace that exists outside the legal address of the organization must be registered as a separate division. Responsibility for failure to fulfill the obligation to report to the tax office information about created separate divisions is provided for in Art. 126 of the Tax Code of the Russian Federation (clause

The management of a legal entity must register a separate division within a month after the fact of its appearance. The creation date can be considered the day of employment of the first employee.

Let us consider in detail how to open a separate division of an LLC in 2020 - 2020. To do this, the management of the legal entity must take the following actions:

- arrange a stationary workplace outside the walls of the LLC;

- fill out form C-09-3-1;

- submit the completed form to the Federal Tax Service at the location where the separate unit appears;

- From 01/01/2017, it is necessary to inform the tax authority about vesting the OP with the authority to make payments to individuals (clause 7, clause 3.4, article 23 of the Tax Code of the Russian Federation). The form of such a message is approved by Order of the Federal Tax Service dated January 10, 2017 No. ММВ-7-14/ [email protected] In this case, payment of insurance premiums and reporting on payments made by the OP is made at its location (clauses 7, 11 of Art. 431 Tax Code of the Russian Federation).

The last point is not relevant for all separate units. Only those separate divisions that make payments to individuals are required to register with these funds.

Contents of the order to create a separate unit

Normative acts do not establish a unified form of order. Therefore, the organization develops and approves such a form independently. However, the order to create a separate unit must reflect the following information:

- on the creation of a branch, representative office or other separate division without vesting the rights of a branch (representative office)

- location of the representative office

- goals and objectives

- You can specify the rights and manager. In the latter case, if this is an employee, it is correct to additionally issue an order for employment.

An order to create a separate division is entered into the employer's order register, but may have a special number (for example, as in our example).

Form S-09-3-1 sample filling

Related publications

The company has the right to open its branches in territories other than the territory of the parent organization. These can be branches, representative offices or other types of units - the main characteristic of a separate unit is its territorial remoteness and the presence of at least one stationary workplace equipped for work.

Accounting in branches and representative offices

It all depends on the purpose of creating the OP. It could just be a separate warehouse that does not conduct independent payments, or maybe, for example, a separate store.

Accounting here will differ, depending on whether the separate division has its own balance sheet or not.

| There is a balance | No balance |

| Independent accounting | Accounting is carried out by the parent organization |

| Reporting is submitted independently | Reporting is submitted by the parent organization |

| Have a separate bank account | The bank account of the parent organization is used |

| Independent settlements with counterparties | Settlements with counterparties are carried out by the parent organization |

Notification of the opening of a separate division in the Federal Tax Service

The creation, any changes in previously provided information, or the closure of divisions must be reported to the regulatory authorities. Where to submit a message about opening a separate division? If this is not a branch or representative office, the company must report the creation of a division to the tax office at the location of the organization (not the OP). There is no additional need to report the creation of new branches or representative offices, since information about them must be indicated in the Unified State Register of Legal Entities. A message to the Federal Tax Service about the opening of a separate division must be sent no later than 1 month.

How to register a separate division

Subdivisions are registered at the location of each of them. This should not be confused with the rules for registering branches. I have my own rules for them. For those divisions that are not in the organization’s charter, the rules are completely different.

Having opened a bank account, units must register with the Social Insurance Fund. For this purpose, divisions submit certain documents to the fund within 30 days from the date of creation. There is no need to submit documents to the Pension Fund and the Federal Compulsory Medical Insurance Fund. After registration, the tax office independently sends data to these authorities.

Sample of filling out a message about the creation of a separate division

In the header of the form, indicate the INN and KPP, you must indicate the code that identifies the tax office to which the message is being submitted.

Next, the form is divided into 2 parts; the manager or representative of the company fills out his contact information (phone number, email address, etc.) on the left side.

The second sheet of the message about the opening of a separate division (you will find a sample form below) contains information about the separate division. Enter the TIN and KPP of the organization, page number. The “Checkpoint 3” field is filled in if the inspection is notified of changes.

Filling procedure

The document can be filled out either handwritten (legibly, in block letters, using a blue or black pen), or printed using computer technology. To maintain a neat appearance, it is recommended to use 16 point Courier New font.

It is important to comply with the following requirements for filling out form C-09-3-1:

- The fields with the organization's TIN and KPP details are filled in on each page without exception, otherwise the document will be declared invalid.

- Each sheet is numbered in chronological order.

- No amendments, corrections, or blots should be allowed - in such cases, another form is drawn up and the old one is deleted.

NOTE. If several departments are opened at the same time, it is permissible to submit one application and attach as many sheets as the number of organizations to open.

What is a separate division

Separate divisions include any departments of the company, including branches and representative offices, remote from the central office at fairly large distances. At the same time, only those divisions that have stationary workplaces can be considered as such (that is, they must be registered and operate at the same address for at least one month).

Only enterprises and organizations have the right to open separate divisions ; individual entrepreneurs are exempt from this need, because by law they can carry out their activities anywhere in the country completely freely.

Separate divisions are in no way independent legal entities; they operate strictly within the framework established by the parent company and have only the funds that it provides.

The creation of separate divisions must be carried out in a certain order, and any company must include information about this in its registration documents.

Sample order approving the status of a separate unit

Only enterprises and organizations have the right to open separate divisions ; individual entrepreneurs are exempt from this need, because by law they can carry out their activities anywhere in the country completely freely.

Separate divisions are in no way independent legal entities; they operate strictly within the framework established by the parent company and have only the funds that it provides.

The creation of separate divisions must be carried out in a certain order, and any company must include information about this in its registration documents.

Requirements for order approval

The order must be certified by the director of the enterprise or another person authorized to sign such documents.

In addition, those responsible for its implementation and those employees who are mentioned in it must put their signatures under it.

Their autographs will indicate that they have read and agree with the order.

Order on the creation of a separate division (hereinafter referred to as OP)

The opening of an OP by a legal entity is accompanied by the publication of certain documents, one of which is an order to create an OP.

The mandatory form of this document is not provided for by law.

In case of conducting activities without tax registration, the organization will be obliged to pay a fine in the amount of 10% of the income received, but not less than 40,000 rubles.

Let's just say that the liability if you do not register an OP on time is quite small, by business standards. Conducting activities without registration is already more serious.

Krasnogo Tekstilshchik, 10-12, letter “O” (entrance from Sinopskaya embankment) tel How to register an LLC? How to open your own business? What documents are needed to open? What do you need to open a company? So: Step-by-step instructions for registering an LLC. It takes about a week to prepare all the documents (you can try very hard and prepare them in a couple of days).

The period for registering an LLC with the tax office is 5 working days (3 working days from 2020).

You can write the paper on a regular A4 or A5 sheet, or, if desired, use a company letterhead.

Writing is done by hand or in printed form . In this case, the second option is considered more advantageous, since from the very beginning it includes the necessary set of details and a legible text part.

Attention

Registration is carried out in one copy, but if necessary, you can create several copies at once.

Accounting in branches and representative offices

A separate division carries out activities in accordance with the goals and objectives of the parent company. Functions, types of activities, level of legal capacity and powers are determined by the parent organization and are enshrined in the regulations on the separate division. Including accounting, accounting is possible in two options.

- Option 1: the division does not have its own balance sheet.

In this case, the branch does not have its own accounting department and current account.

To register a branch or representative office, you must submit documents according to the following list to the tax authorities:

- a copy of the decision of the governing body to create a separate division;

- a copy of the approved regulations on the separate division;

- a copy of the constituent documentation and its amendments (as a separate document or as a new edition);

- a copy of the state registration certificate of the main enterprise;

- a copy of the orders on the appointment of the head and chief accountant of the new division;

- a copy of the payment order or bank statement confirming payment of the state registration fee, certified by the seal and signature of the head of the credit institution;

The application itself is a one-page form.

The employer of the head of the EP is not this separate division, but the parent organization; the order for his appointment is signed by the head of the organization or another authorized person.

When issuing an appropriate order on hiring and appointment to a position, the employer has the right to use both a unified form (T-1) and a random order form (provided it contains all the necessary details: document number and date, work start date , employee personnel number, etc.).

The hiring order serves as the basis for making entries in the work book of the head of the EP and the personal card of such an employee.

We note once again that the employer has the right to include the clause on the appointment of the head of the EP in the order on the creation of a separate unit, because

Order on the creation of a separate division 2020 sample

If we consider the question of how an order to create a separate unit 2020 is drawn up (a sample is presented here), then there is no clearly defined form.

Only enterprises and organizations have the right to open separate divisions ; individual entrepreneurs are exempt from this need, because by law they can carry out their activities anywhere in the country completely freely.

Separate divisions are in no way independent legal entities; they operate strictly within the framework established by the parent company and have only the funds that it provides.

The creation of separate divisions must be carried out in a certain order, and any company must include information about this in its registration documents.

Order approving the status of a separate subdivision

Such a document should be stored in a separate folder, together with the same administrative acts, and access to the folder should be limited. When a document loses its relevance, it is transferred to the archive, where it is stored for at least 3 years.

Only after this the order can be disposed of.

Notice of the creation of a separate division

It is important to remember that the organization is obliged to inform the tax authority about the creation of an OP. If this is not done, the company will be fined.

The tax authority must be notified no later than one month from the date of creation of the OP. In this case, the fine is 200 rubles for each individual document.

In some cases, the fine reaches 5,000 rubles.

The following documents will need to be submitted to the tax authority:

- Message about the creation of an OP. It is filled out according to the form approved by order of the Federal Tax Service No. ММВ-7-6/362;

- Notification of choice of tax authority. Filled out according to the form approved by order No. YAK-7-6/488. It is sent only by those organizations that have the right to choose an inspectorate for registering an OP;

- In addition to the notification and message, the organization can submit copies of documents that confirm the creation of the OP.

OPs can be branches, representative offices and other entities.

How to create a separate unit - sample order

At the top of the form indicate the title of the document, details of the main enterprise, city and date of registration. Further, justifications for the issued order must be given. The decision to create a separate division is made by the founders at a general meeting.

The details of this document are indicated in the initial part of the text of the order.

Further, based on the justification given, an order is given to perform the following actions: create a branch, representative office or other type of separate division with a specific name at its own address (the name and address should be included in the order); approve the regulation on the creation of the OP, this provision is attached to the order as an appendix; approve the staffing table of the new representative office, it is also attached as an appendix; appoint a specific person as the head of the newly created separate

Order on opening a separate division: sample

Moscow On the creation of a branch In connection with the increase in the number of clients of Altair LLC in the Moscow region, I order:

- From May 22, 2020, create a branch of Altair LLC with the branch location at the address: Kolomna, st. Gagarina, 6, bldg. 2. I reserve control over the execution of the order.

General Director Ivanov Ivanov S.A.

When a head of a separate division is appointed to a position, labor relations arise between him and the employer (Article 16 of the Labor Code of the Russian Federation). Based on the provisions of the concluded employment contract, the employer issues an order to appoint the head of the unit to the position (Art.

Order approving the regulations on the division

Its organization is obliged to register with the Federal Tax Service within 1 month from the date of creation ().

As a rule, the regulations providing for the functioning of such a unit are approved at the time of the creation of this unit.

But it may be approved later. The order approving the provision specifies the date from which such provision will come into force. Accordingly, the provision itself is an annex to the order.

Both the regulations on the unit and the order approving the regulations on it must be familiarized to employees against signature.

What you need to know about the regulations on a separate division of an LLC: sample

A private entrepreneur also has the right to a network of branches and representative offices and other structures, but the law does not consider them to be separate divisions. In particular:

- goals and objectives set for the EP;

- rights and obligations.

- principles of its management;

In the future, this document will be given to the branch, representative office, etc.

n. the right to lawful work. Also see

"". Each separate division operates on the basis of a special document - a statement about itself. Its foundations are laid in Art. 55 (clause 3) of the Civil Code.

How to draw up an order to create a separate unit?

That is, a division is territorially separate from the parent organization if it is located in the territory where tax accounting and tax control is carried out by a tax authority other than the one with which the organization is registered as a taxpayer.

Job creation is the second criterion for recognizing a unit as separate.

At the same time, a workplace is understood as a place where an employee must be in connection with his work and which is directly or indirectly under the control of the employer (Part.

6 tbsp. 209 of the Labor Code of the Russian Federation). Therefore, when considering disputes about the presence (absence) of a separate division, arbitration courts, first of all, pay attention to this point.

For example, if an organization rents premises to conduct activities, but the fact of creating jobs in them has not been established, then there is no separate division ().

It must be taken into account that separate

Example of a provision on a separate division

The division is headed by the head of the division, appointed by the director of LLC \"Company \"Name\".

The head of the Division has the right to make transactions on behalf of and in the interests of the company only on the basis of a power of attorney issued by the director of the company.

2. GOALS AND TYPES OF ACTIVITIES OF THE DIVISION 2.1.

The objectives of the Division are to expand the market for goods and services, as well as to generate profit.

2.2. To achieve its goals, the Division, guided by legislation and, where necessary, on the basis of licenses issued to the Company, carries out activities that correspond to the main directions of the company’s activities specified in its constituent documents.

3. LEGAL STATUS OF THE DIVISION 3.1.

The division has independence in carrying out its business activities within the limits determined by these Regulations.

The procedure for creating a separate division

- Opening a separate division is not the most difficult procedure, although it does cause some trouble. Let's start with the fact that the very possibility of its creation must be spelled out in the company's Charter (if such a clause is not there, then you first need to make changes to the Charter).

- Then, the corresponding decision must be made at the general meeting of founders and recorded in a special protocol.

- After this, at the enterprise

- an order is issued

- a certain package of documentation is collected, which necessarily includes the constituent papers of the company,

- an application is written to the territorial tax service,

- All interested government agencies, including social insurance funds, are notified of the event in a short time.

Only after complete completion of all the stages described above can a separate unit begin its activities.

Who writes the order to create a separate unit

Usually the direct executor of writing the order is an ordinary employee of the enterprise:

- legal adviser,

- personnel officer,

- secretary,

- head of a department directly related to the development of the organization.

However, in any case, this person, regardless of position, must have certain knowledge and skills in creating and approving administrative documents.

After drawing up the order, it is necessary to submit it to the director of the company for review and approval, since without his autograph it will not acquire legal force.

Sample order for the creation of a separate division

There are no unified standards for writing an order to create a separate division, so enterprises and organizations can create this document in any form or according to a model approved in the company’s accounting policy. One way or another, the order must contain a number of certain information, namely:

- number, date and place of creation - the locality in which the company is registered and its full name;

- reflect the fact of creating a separate division;

- indicate its status (branch or representative office);

- indicate the address where it will be located;

- list the functions that are assigned to the department;

- determine the order in which it should carry out its activities (as a rule, it is written here that the division is obliged to work as prescribed in the Charter of the parent organization);

- note the fact that, according to the law, a structural unit is not a legal entity;

- Finally, the order must indicate the persons responsible for its execution: this may be the director himself or some other employee of the enterprise (usually a deputy manager).

Regulations on a separate division without a separate balance sheet sample 2020

When creating a separate division, it is advisable to draw up regulations on a separate division of the LLC.

If the mandatory provisions on the branch/representative office are specified in Part 3 of Art. 55 of the Civil Code of the Russian Federation, then such a rule is not provided for other separate divisions. At the same time, in the regulations on a separate division that is not a branch or representative office, important features can be fixed - for example, types of activities and specifics of work, the procedure for managing the division, methods of monitoring its activities, etc.

Expanding the geographic boundaries of the business, the company's management begins to think about how to open an LLC branch in another city. Registering a branch is in many ways similar to creating a limited liability company itself. The main reason for this: the branch has the right to carry out production and trading activities on a par with the parent enterprise. Therefore, when opening a branch of an LLC, it must be registered with the tax authorities, the Pension Fund of the Russian Federation and the Social Insurance Fund.

To register a branch of an LLC, you must take the following steps:

- hold a meeting of LLC participants in order to make a decision on creating a branch;

- prepare regulations on the new branch;

- enter information about the branch into the charter of the LLC;

- approve at a meeting of company participants a new version of the charter and regulations on the creation of a branch;

- register changes in the charter with the Federal Tax Service of the Russian Federation;

- wait for a notification from the Federal Tax Service of the Russian Federation about making an entry in the Unified State Register of Legal Entities;

- register the branch with the tax office;

- appoint a branch manager;

- receive a letter from Rosstat about assigning statistics codes to the branch.

To register changes in the tax office, art. 17 of the Law “On State Registration of Legal Entities and Individual Entrepreneurs” dated 08.08.2001 No. 129-FZ requires the provision of the following documents:

- application in form No. P13001;

- decision to amend the constituent documentation of the LLC;

- receipt of payment of state duty. From 01/01/2019, when transferring documents for registration of changes in electronic form, payment of state duty is not required (see clause 32 of Article 333.35 of the Tax Code of the Russian Federation, introduced by Law No. 234-FZ of July 29, 2018).

- changes in the constituent documents (how to draw them up - in the article Procedure for amending the charter of an LLC);

Currently, registration with extra-budgetary funds and Rosstat occurs automatically; these departments independently exchange information with each other.

After carrying out all the procedures described above, the company management can open a separate current account for the branch.

Who writes the order to create a separate division Usually the direct executor for writing the order is an ordinary employee of the enterprise:

- legal adviser,

- personnel officer,

- secretary,

- head of a department directly related to the development of the organization.

However, in any case, this person, regardless of position, must have certain knowledge and skills in creating and approving administrative documents.

After drawing up the order, it is necessary to submit it to the director of the company for review and approval, since without his autograph it will not acquire legal force.

What is the basis for an order Every order issued, and this one is no exception, must be justified in some way.

indicate its status (branch or representative office);

- indicate the address where it will be located;

- list the functions that are assigned to the department;

- determine the order in which it should carry out its activities (as a rule, it is written here that the division is obliged to work as prescribed in the Charter of the parent organization);

- note the fact that, according to the law, a structural unit is not a legal entity;

- Finally, the order must indicate the persons responsible for its execution: this may be the director himself or some other employee of the enterprise (usually a deputy manager).

How to issue an order There are no rules for the execution of an order or its content, so it can be written on a simple blank sheet of A4 or even A5 format or company letterhead, either by hand or in printed form.

- Attention

- Sample documents

In order to expand their activities, organizations create separate divisions. In the article we will look at how to register a separate division, what order is used to formalize the decision to create a division, and also provide a sample order for the creation of a separate division in 2020.

I have my own rules for them. For those divisions that are not in the organization’s charter, the rules are completely different. Having opened a bank account, units must register with the Social Insurance Fund.

For this purpose, divisions submit certain documents to the fund within 30 days from the date of creation. There is no need to submit documents to the Pension Fund and the Federal Compulsory Medical Insurance Fund.

- In addition to the notification and message, the organization can submit copies of documents that confirm the creation of the OP.

The opening of an OP by a legal entity is accompanied by the publication of certain documents, one of which is an order to create an OP.

The mandatory form of this document is not provided for by law. For this reason, the organization has the right to use any form at its discretion.

By order, you can either approve the regulations on a separate subdivision, or not approve it, but formalize such approval with a separate order.

The order to create an OP is issued not only in relation to branches and representative offices, but also to any other territorially separate divisions of the organization that have stationary jobs created for a period of more than one month.

Since the organization must be registered with the tax authority at the location of each separate division, the order for the creation of an OP can include, among other things, a clause appointing a person responsible for preparing and sending the relevant documents to the tax authority.

Appointment to a position is one of the grounds for the emergence of labor relations (Article 16 of the Labor Code of the Russian Federation).

The appointment of the head of the OP is also no exception.

Based on Article 68 of the Labor Code of the Russian Federation, when hiring (including the head of an EP), the employer issues an order or instruction, guided by the provisions of the concluded contract. The order must not contradict such a contract. The order also indicates the probationary period if it is established by the employment contract.

The employer of the head of the EP is not this separate division, but the parent organization; the order for his appointment is signed by the head of the organization or another authorized person.

When issuing an appropriate order on hiring and appointment to a position, the employer has the right to use both a unified form (T-1) and a random order form (provided it contains all the necessary details: document number and date, work start date , employee personnel number, etc.).

The hiring order serves as the basis for making entries in the work book of the head of the EP and the personal card of such an employee.

We note once again that the employer has the right to include the clause on the appointment of the head of the EP in the order on the creation of a separate unit, because Russian legislation does not prevent the combination of these two legal relations in one document.

Can you please tell me if there is a sample order for the creation of a separate unit? if not, what mandatory items should it contain?

Separate structural according to Art. 55 of the Civil Code of the Russian Federation is a general concept. A separate division is presented, as a rule, in the form of representative offices or branches.

A branch is a separate division of a legal entity located outside its location and performing all or part of its functions, including the functions of a representative office.

A separate division of an organization is any division territorially isolated from it, at the location of which stationary workplaces are equipped for a period of more than one month.

Thus, the first criterion is territorial isolation.

In what cases can we talk about the territorial isolation of a unit? For example, as follows from the Resolution of the Federal Antimonopoly Service NWO dated 02.11.

2007 N A26-11293/2005, territorial isolation means the location of a structural unit of an organization geographically separate from the parent organization and outside the administrative-territorial unit of its registration, controlled by one or another tax authority.

That is, a division is territorially separate from the parent organization if it is located in the territory where tax accounting and tax control is carried out by a tax authority other than the one with which the organization is registered as a taxpayer.

Job creation is the second criterion for recognizing a unit as separate.

Therefore, when considering disputes about the presence (absence) of a separate division, arbitration courts, first of all, pay attention to this point.

For example, if an organization rents premises to conduct activities, but the fact of creating jobs in them has not been established, then there is no separate division (Resolution of the Federal Antimonopoly Service of the North-Western District of October 15, 2007 N A56-40913/2006).

It must be taken into account that a separate unit is also formed in the case when only one workplace is equipped at its location

The division usually occurs according to various personnel functions - part belongs to the parent organization, part is transferred to a separate unit.

In some cases, a company may change or supplement its accounting policies (clause 10 of PBU 1/2008, article 313 of the Tax Code of the Russian Federation). It is advisable to do this if the legislation has changed, and such changes affect the accounting methods adopted by the company, or the company itself changes previously adopted rules. How can an accountant work under the new rules? A record number of amendments will come into force in 2020. Please note: from January 1, 2011, you must register with the Pension Fund for the purposes of compulsory health insurance (Part 1, Article 3 of Law No. 212-FZ, Clause 4, Article 17 of Federal Law of November 29, 2010 No. 326-FZ); FSS of Russia (subclause 1, clause 2 of the Procedure for registration and deregistration of policyholders and persons equal to policyholders, approved by order of the Ministry of Health and Social Development of Russia dated December 7, 2009 No. 959n (hereinafter referred to as Procedure 2), subclause. From 01/01/2019, insurance premiums in case of temporary disability and in connection with maternity, you must pay to the Federal Tax Service. And for compensation of benefits, as before, you must contact the Social Insurance Fund. To open a branch or representative office of an organization in 2020, an order must be issued to create a separate division. A sample of such an order is attached to this article. In addition, you will need an order to appoint the head of the relevant division. For late submission of an application for registration at the location of a separate division, the organization may be brought to tax liability in the form of a fine in the amount of 5 thousand to 10 thousand rubles per based on Article 116 of the Tax Code of the Russian Federation. For evasion of an organization from registration with the tax authority, Art. 117 of the Tax Code of the Russian Federation provides for tax liability in the form of a fine in the amount of 20 thousand.

- home

- Sample documents

How to place an order

There are no rules for the execution of the order or its content, so it can be written on a simple blank sheet of A4 or even A5 format or company letterhead, either by hand or in printed form. At the same time, a printed version on letterhead will be much more advantageous, since it initially contains the details of the organization, legible text, and looks more solid.

The order is issued in a single copy , but if necessary, an unlimited number of copies can be made.

Requirements for the order

There are no special rules for issuing an order; it is issued in a single copy. It is certified by the head of the company, or by a person who has the right to sign such documents. In addition to the manager, the order is signed by the persons responsible for its execution. These are the employees indicated in the order.

Such a document should be stored in a separate folder, together with the same administrative acts, and access to the folder should be limited. When a document loses its relevance, it is transferred to the archive, where it is stored for at least 3 years. Only after this the order can be disposed of.