The certificate of delivery and acceptance of completed work in the KS-2 form is the primary document that is used when handing over and accepting contract work for the construction of industrial, housing, civil and other facilities.

The act is drawn up on the basis of data entered in the Logbook of work performed. The document is affixed with signatures and seals of the customer (general contractor) and the contractor performing construction and installation work. The act is used when drawing up a Certificate of the cost of work performed and expenses in the KS-3 form.

How to fill out an act in form KS-2?

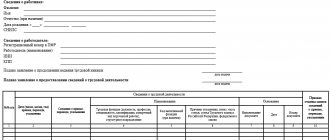

The following information is entered into the KS-2 work completion certificate:

- Number and date of drawing up the act.

- Information about the investor, customer, work contractor: name of organization, address, telephone, fax.

- Information about the construction site and the facility under construction: name and address.

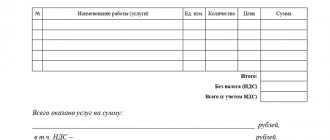

- A table with information about the work performed: names, unit price numbers, units of measurement, quantity, prices per unit of measurement, cost.

- Total cost of work.

- Full names, positions and signatures (with transcript) of the persons who carried out the delivery and acceptance of the work.

Stop wasting time filling out templates and forms

The KUB service helps you issue invoices in 20 seconds and prepare other documents without a single error, due to the complete automation of filling out templates.

KUB is a new standard for issuing and sending invoices to customers.

Start using the CUBE right now 14 days FREE ACCESS

Sample of filling out form KS-2 for the act of acceptance of work performed

Images of completed forms, which are presented for free download in different formats, will help you correctly draw up an act of acceptance of completed work in form KS-2 2019-2020.

The KUB service will help you automate the process of issuing a certificate of delivery and acceptance of completed work KS-2. Register on the site, and you will no longer have to enter details and data into the primary document forms manually.

Stop wasting time filling out templates and forms

The KUB service helps you issue invoices in 20 seconds and prepare other documents without a single error, due to the complete automation of filling out templates.

KUB is a new standard for issuing and sending invoices to customers.

Start using CUBE right now

14 days

FREE ACCESS

In what cases are KS-2 and KS-3 issued?

Question:

In what cases are KS-2 and KS-3 issued?

Answer:

Forms KS-2 (Certificate of completed work) and KS-3 (certificate of cost of work) are unified forms that are approved by Resolution of the State Statistics Committee of Russia dated November 11, 1999 No. 100.

On January 1, 2013, Federal Law No. 402-FZ dated December 6, 2011 “On Accounting” (hereinafter referred to as Law No. 402-FZ) came into force. It does not contain requirements for the need to compile primary accounting documents according to unified forms. Does this mean that absolutely all previously used unified forms are not required to be used?

Since January 1, 2013, there is no requirement to use unified forms when preparing primary accounting documents in Law No. 402-FZ, but their use is common for many business entities. In addition, independent development of document forms other than the unified ones requires time, special knowledge and additional costs for setting up software for new forms, and the use of such forms can cause difficulties in working both within the organization and with counterparties.

In particular, the Certificate of Acceptance of Work Completed (Form No. KS-2) is used for the acceptance of completed contract construction and installation work for industrial, residential, civil and other purposes, and the Certificate of Cost of Work Performed and Expenses (Form No. KS-3) is used for settlements with the customer for work performed.

The forms of documents used to submit completed work strongly depend on the form of the contract. Many builders bypass the need to draw up KS-2 and KS-3 by drawing up contracts in the required manner. Conclusion: the mandatory preparation of forms KS-2 and KS-2 is not regulated by regulatory documents of the Russian Federation. Only the details of the parties, the name and cost of the work are mandatory (Law No. 402-FZ). But it should be borne in mind that if the case goes to court (in case of disagreements between the Customer and the Contractor or non-payment), then only KS-3 can be a confirmation of the COST of the work, i.e. monetary document.

Question:

When making mutual payments for work performed, is it necessary to create a final statement of resources for the Certificate of Completion of Work KS-2?

Answer:

The obligation to compile a final statement of resources for KS-2 is not regulated by regulatory documents of the Russian Federation. It is recommended, when drawing up a contract, to indicate in a separate paragraph the list and forms of reporting documents that are generated by the Contractor and transferred to the Customer at the stage of mutual settlements for work performed.

Question:

Please provide a specific clause of the MDS that prohibits adjusting the price downward.

Answer:

MDS 81-35.2004, clause 2.2 “Considering that the estimated standards are developed on the basis of the principle of averaging with minimization of the consumption of all necessary resources, it should be taken into account that the standards are not adjusted towards their reduction.”

Question:

Are the machines and mechanisms taken into account in the standard used for the delivery of materials from an on-site warehouse or store?

Answer:

The machines included in the price are intended for horizontal and vertical intra-building movement of materials from the on-site warehouse to the place of storage, including unloading at the on-site warehouse.

Question:

Where can I get this correction factor? Is this the same coefficient for all prices? (This refers to the transition coefficient from FER to TEP)

Answer:

The coefficients for the transition from FER to TER were published in the interregional collection of coefficients for converting the estimated cost of construction and installation work in the constituent entities of the Russian Federation, Issue No. 3, 2009 (approved by letter of the Ministry of Regional Development of the Russian Federation No. 4255-SK/08 dated February 18, 2009)

In turn, the FAU “Federal Center for Pricing in Construction and the Construction Materials Industry” by letter dated May 15, 2012 N 584-16810/fts determines: “... it is recommended that the development of estimate documentation be carried out using territorial estimate standards brought into line with state estimate standards, or using federal estimate standards included in the federal register of estimate standards.” Those. without using conversion indices from FER to TER.

In this regard, we can say that at the regional level (financing from the local budget), the application of these coefficients is under the jurisdiction of regional rule-making organizations (regional pricing centers).

Question:

Is it possible to use TER and FER*Kt in one local estimate? (Kt – transition coefficient from FER to TEP)

Answer:

MDS 81-36.2004, paragraph 1.1, states that in the case of complete or partial absence of territorial unit prices (TER) or sectoral unit prices (OEP), the recalculation of unit prices into the territorial price level as of January 1, 2000 is carried out using territorial (industry) correction factors taking into account local construction conditions.

If you follow this paragraph of the MDS, then the use of TEP and FER prices in one estimate, taking into account the territorial coefficient, is possible.

But, if you refer to the letter dated May 15, 2012 N 584-16810/fts (see the answer to the previous question), then it turns out that it is impossible.

In controversial situations, this issue must be agreed upon:

- — with budget financing: with regional pricing centers in construction;

- - with non-budget financing - with the customer (investor).

Question:

Finally, is it possible to use the 2001 database?

Answer:

No. According to the order of the Ministry of Construction of the Russian Federation dated January 30, 2014 No. 31/pr, from April 1, 2014 it is necessary to use GESN and FER as amended in 2014.

Question:

This means the Base as amended in 2014, but the price level in 2001 is not the current one?

Answer:

Absolutely right. Regulatory collections as amended in 2014, but the cost of work is given as of 01/01/2000.

Question:

How many kilometers are taken into account when transporting material? Because the price for transporting material 5 km and 15 km will be different.

Answer:

Federal estimated prices take into account all costs (selling prices, markups of supply and sales organizations, costs of containers, packaging and supplies, transport, loading and unloading and procurement and storage costs) associated with the delivery of materials, products and structures from bases (warehouses) of organizations -contractors or supplier organizations to the on-site construction warehouse. Transport costs are taken from the condition of transporting goods by road over a distance of up to 30 kilometers. When calculating transportation costs, the costs of delivering materials are determined taking into account the gross weight.

It is recommended to calculate additional costs for transporting materials, products and structures by road over a distance of more than 30 kilometers on the basis of design data on the mass of materials, products and structures used during construction and installation (repair and construction) work and estimated prices for the transportation of goods by road , differentiated by classes of cargo and types of transportation given in the federal estimated prices for the transportation of cargo for construction.

Due to the fact that the form for calculating additional costs has not been established, calculations can be performed in an arbitrary form convenient for verification. It is recommended that calculations be made for each local estimate and included in the article “Materials” (Extract from letter dated 07/07/2010 No. 26347-IP/08).

Question:

What is working with supplier prices?

Answer:

If you create your own prices by suppliers, you have accumulated a fairly large database of these same prices, and there is a need to transfer these prices by suppliers to another estimator or transfer them to another computer, then you use the functions of working with suppliers in the “Regulatory Base” window. If you do not create your own prices for suppliers, then you do not need to use these program functions.

Question:

Is it possible to adjust prices when applying the basis-index method if it is known that the actual cost of an individual material is much higher, and the cost of other materials remains unchanged?

Answer:

The functionality of the “Construction Technologies - SMETA” program allows you to edit the cost of materials. But, in this case, the meaning of the basis-index method is lost. Perhaps, if you need to edit the cost of resources, you should use other calculation methods, for example, resource.

Question:

Do estimate programs in the Russian Federation have a uniform file format? What if another estimator has a different program, for example a grand estimate or ABC?

Answer:

For the exchange of estimate documents between various software systems, the ARPS format has been developed. Only local estimates are transmitted through the ARPS format.

Question:

Does the software package make backup copies?

Answer:

When opening a project and when closing a project while saving changes, the program creates a backup copy of the project. You can open a backup copy of the project in the “Project Manager” window by selecting the project and right-clicking on it once.

Question:

How to install the resource-index method?

Answer:

If you need to calculate estimate documentation using the resource-index method, you set the “basis-index” method.

Question:

Can there be several SSRs in one project? For example, construction and commissioning works.

Answer:

It is not recommended to create several consolidated estimates within the framework of one project. You can create local estimates for construction, installation and commissioning work as part of one consolidated estimate.

Question:

How to add a local estimate?

Answer:

To do this, you need to create a local estimate and, when choosing the form of a printed document, indicate “local estimate.”

Question:

Is the procedure for local estimates established by the program?

Answer:

The order of local (object) estimates is established by the estimator in the “Project Structure” window in the “Number” column to the left of the name of the local (object) estimates.

Question:

If one estimate is calculated using the resource method, then the transition index must be applied separately to each estimate calculated using the basis-index method?

Answer:

If the document property “resource method” is set on the estimate, then the conversion indices to current prices will not be applied to the resources of such an estimate.

Question:

Can a local estimate be made inactive without deleting it?

Answer:

To ensure that the cost of the estimate does not participate in the calculation of the entire project, right-click on it once and select the “Exclude” command.

Question:

Have you encountered a situation where the estimate in Construction Technologies is compiled in TERs, but in the Grand Estimate there are only TERs? Will the estimate open?

Answer:

You can load into the “Construction Technologies - ESTIMATE” program and read (print) a project compiled in TER, even if these TER are not in your program.

Question:

Internal communication networks - which chapter of the consolidated estimate should be correctly attributed to?

Answer:

Chapter 5 includes transport and communication facilities:

- external work on the installation of all types of communications - external (telephony, etc.) and internal - (control room, intercom, subscriber room, etc.)

But, if we are talking about laying internal communication networks of a construction site (residential building, workshop, etc.), in this case, these works are included in the local estimate, which relates to the object estimate (chapter of the consolidated estimate calculation) to which refers to the construction site.

Question:

Is the mini boiler house, which will subsequently heat the buildings, classified as temporary structures?

Answer:

The costs of construction, installation, installation of a boiler room, which will subsequently serve the facility being used for its intended purpose, are included in the cost of construction and installation work of the construction site.

The funds necessary for the operation of the boiler room during construction work during the heated period are included in winter price increases and are determined using the average indicator according to GSN81-05-02-2007, GSNr 81-05-02-2001.

The funds necessary for the operation of the boiler room during construction work during the unheated period are included in winter price increases and are determined by a separate calculation, because The costs of winter increases in heating costs outside the heating season are not taken into account.

Question:

What about scaffolding? Have you disassembled the walking boards, for example, and should we apply material return to these boards? Or metal fencing? (*the question refers to temporary buildings and structures)

Answer:

Construction, disassembly, and wear of walking boards are classified as non-title temporary buildings and structures and are taken into account as part of the overhead cost standards.

Metal fencing applies to title buildings and structures if this fencing is special or architecturally designed; in this case, it is necessary to determine the return amounts from disassembly. If this is an ordinary fence, not architecturally designed, then these are non-title buildings and structures and the costs of construction, disassembly and wear and tear are taken into account by overhead cost standards.

Scaffolding and scaffolding not provided for in the estimated standards for construction work or in the standards for installation of equipment are classified as non-title buildings and structures, and the costs of construction, dismantling and wear and tear are taken into account by the overhead cost standards. If scaffolding and scaffolding are provided for in the estimate standards, for example FER8-7-1-1, then this work takes into account the costs of installing the scaffolding, and the resource part of the price shows the consumption of materials for the wear of scaffolding parts.

Question:

Can temporary buildings and structures be used as a percentage in work completion certificates?

Answer:

The rules and procedure for accounting for the cost of erecting temporary buildings and structures must be specified in the contract. By agreement of the parties, it is possible to use an average percentage.

Question:

What about the summer increase in the cost of work?

Answer:

The methods for calculating the estimated cost of construction do not provide for the cost of increasing the cost of work carried out in the summer.

Question:

How to take them into account when making mutual settlements? (the question refers to unforeseen costs).

Answer:

As specified in the contract. There are two possible options. First option: calculation based on actual work performed. In this case, the reserve of funds intended for the contractor remains with the customer, and payment is made for the actual volumes of work performed, even if these volumes are more or less than those specified in the contract price. Option two: payment according to the prepared estimate, taking into account unforeseen costs. In this case, the scope of work and its cost are not revised, and all additional costs incurred by the contractor during the work must be covered from unforeseen costs.

Question:

When mutual settlements are made, the cost of general contracting is also taken into account - as stipulated in the contract?

Answer:

The cost of general contracting is services, not construction and installation work. Therefore, a separate contract is concluded for general contracting services and payment for these services is closed in a separate act.

why is a cube more convenient?

Convenient online invoicing

Instantly send invoices by e-mail to your buyer

Debt control for each customer

Management reporting

Organized storage of all your documents

20% discount on accounting services from your accountant

Stop wasting time filling out templates and forms

The KUB service helps you issue invoices in 20 seconds and prepare other documents without a single error, due to the complete automation of filling out templates.

KUB is a new standard for issuing and sending invoices to customers.

Start using the CUBE right now 14 days FREE ACCESS

Do you need help filling out documents or advice?

Get help from expert accountants to prepare documents

+7

[email protected] kub-24

MOSYURPODRYAD

Form for saving (downloading) and filling out Word

Acceptance certificate for completed work KS-2

Acceptance certificate for completed work KS-2

Brief information and advice from a lawyer about the act of form KS-2

Resolution of the State Statistics Committee of Russia No. 100 dated November 11, 1999 states that the KS-2 act formalizes the acceptance of construction and installation

works Acceptance of other work, including design or survey work, can be carried out using this form, but it is easier to use the standard work acceptance certificate (work acceptance certificate).

From January 1, 2013

forms of primary accounting documents contained in albums of unified forms of primary accounting documentation, for example KS-2,

are not mandatory

when accepting even construction and installation work. The parties to the contract have the right to either adjust the form or use their own. This is indicated by Information of the Ministry of Finance of Russia No. PZ-10/2012 “On the entry into force of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” from January 1, 2013. In civil arbitration disputes, the use of forms was not considered mandatory before. However, until 2013, in arbitration tax disputes, courts occasionally considered it necessary to comply with the established form for tax purposes when accepting construction and installation work.

Compliance with accounting forms is desirable because they are familiar. The requirement of the customer (contractor) to use the KS-2 form is justified when the parties indicated in the contract the need for its use, regardless of whether construction and installation work was carried out, design and survey work, or any other.

When independently producing or adjusting the form, it is necessary to take into account the mandatory requirements for the primary accounting document. They are established by Article 9 of the Federal Law “On Accounting”:

Title of the document; date of its preparation; name of the organizations (entrepreneurs) that compiled the document; content of the fact of economic life; the number of natural and (or) monetary units of this fact of economic life; indication of units of measurement; signatures indicating surnames, initials and positions. In addition, the article requires that the primary accounting document be drawn up when the fact for which it is drawn up is committed, and if this is impossible, immediately after its completion.

When independently producing or adjusting the form, it is also necessary to take into account the specific requirement of Part 4 of Article 9 of the Federal Law “On Accounting”: the forms of primary accounting documents used to document business facts must be approved by order (instruction) of the head of the organization.

Avor: Lawyer Kotelnikov A.V.

Our video about what to do if the customer does not sign the act:

https://youtu.be/sE1rB3CyhmU

Our legal advice on the certificate of completion of work

The customer does not sign the work completion certificate. What to do. Procedure for the contractor (subcontractor - in the case of a subcontract agreement)

What needs to be taken into account when drawing up a certificate of completion of work (report of delivery or acceptance of work). 8 brief explanations from a lawyer.

Is it possible to force the customer to accept the work performed or to sign a certificate of completion? Consultation using judicial practice that it is possible to bring a claim for an obligation.

In what cases does the customer have the right to refuse to sign the work acceptance certificate? What reasons for not signing the acceptance certificate for completed work are justified? Consultation with a lawyer based on the law and judicial practice of arbitration courts.

What do we know about "ks-ka"

In the classic version, acts KS-2 and KS-3 do not contain complete data on the amounts payable. Yes, any budget program prepares these acts correctly and correctly. But! The amount that is indicated in these acts and the amount that is actually expected to be paid from the customer are two different amounts. The amount to be received from the customer is affected by the terms of the contract. For example, the terms of advance payment, guarantee (insurance) deductions and terms of their return. Since the estimate program does not contain the terms of the contract, it cannot provide this data, nor can it calculate the amount expected from the customer. And “KS-ki” programs, in addition to the cost of the work performed, also show the amount of the advance payment offset by this act, the amount of warranty deductions and, as a result, the amount that is expected from the customer.