What are dividends and their source?

Dividends are usually called a part of the net profit received by the company, which, by decision of the participants of the legal entity, is directed to payment to them in proportion to the share of their contribution to the authorized capital or by another method of distribution established in the company’s charter.

Net profit is the profit that remains at the disposal of the company after making all obligatory payments to the budget.

Payment of dividends to the founders of an LLC is possible under certain conditions from net profit, which are defined in the relevant legislation.

Therefore, the source of dividends to the founders is profit. It is calculated on the basis of accounting information. To decide on the payment of dividends to an LLC, the owners must first approve the financial statements, which reflect the presence of net profit.

The legislation provides for the possibility of paying interim dividends. Their source is undistributed profit of the current year. However, such an opportunity exists if the enterprise received it during the selected period of time (quarter, half-year).

Attention! Since the current algorithm for calculating profit determines the need to determine it on an accrual basis for the year, its final size can only be determined based on the results of the past year. Then, if the founders decide to pay dividends, it will be necessary to take into account the amounts they received interim during the year.

The following payments made by owners are not considered dividends:

- Payments to a liquidated organization in an amount not exceeding the owner’s contribution to the authorized capital.

- If payments are made to the founders in the form of the organization buying out their shares in the company into ownership.

- Payments to a non-profit organization for its activities provided for by its charter, if it is one of the owners of the company.

https://youtu.be/i56Wg3XwRSg

How dividends are paid

Important! Only the net profit of the enterprise can be distributed as dividends.

It is reflected in the balance sheet in line 1370 as undistributed. Profit can be distributed not only for the reporting period, but also for previous years (letter of the Federal Tax Service dated 10/05/2011 No. ED-4-3 / [email protected] ).

Payment of dividends to an LLC is carried out in accordance with the relevant decision of the meeting of its participants. A sample decision is given in the article “Sample protocol for calculating dividends to LLC participants.”

The decision is drawn up in the form of a protocol, which must contain:

- distribution period;

- amount to be distributed;

- an indication of cash or in-kind payment;

- a list of persons to whom accruals should be made in the specified amounts;

- payment terms.

The decision to pay dividends to the founders of the LLC is made by a majority vote, unless otherwise provided by the charter.

If there is only one participant, the decision is made by him alone and is documented in writing.

Reasons for payment

The basis for paying dividends is either a decision of the owner of the company or the minutes of a meeting of its participants. Therefore, to accept these documents, it is necessary to gather the owners of the company. For the meeting itself, it is also necessary to prepare financial statements for the relevant period, which will establish the fact that the business entity has received a profit.

It must be remembered that the decision to pay dividends is made not by the management of the company, but by its owners, who may also be more than one person.

Since annual reports are submitted to regulatory authorities no later than March 31, the meeting is held from March 1 to April 30 of the following reporting year.

A decision or protocol reflecting the will of the owners regarding the payment of such income must necessarily contain:

- The year for which such payment will be made.

- Part of the profit that the owners used to pay dividends.

- In what form will payments be made, as well as their schedule indicating the final deadline for making such payments.

Attention! In this case, it is sufficient to indicate in the decision or protocol only the total amount of dividends to be paid. This is due to the fact that the procedure for their distribution is determined in the company’s charter or in proportion to the share of participation of each owner.

Terms and frequency of payment

Companies make their own decisions about how often dividends are paid. The process can be performed once or twice a year, or quarterly. The procedure is voluntary, so the remaining money can be accumulated rather than distributed by the founders.

If a decision is made to transfer money to shareholders, the process is carried out in cash or in kind.

Attention! By law, it is allowed to issue dividends in cash, but this leads to risks for the company, since such actions raise suspicions of money laundering, and therefore often attract the attention of representatives of the Federal Tax Service.

Taxes are paid on the funds received, with the company acting as a tax agent for shareholders. The correct rates are taken into account:

- 13% is paid by individuals and legal entities represented by residents of the Russian Federation;

- 15% is used for non-residents;

- a 0% rate is applied exclusively to companies that own 50% of the company’s authorized capital for more than a year.

The decision on the payment of funds is made within 3 months after the end of the period represented by a quarter, half-year or year.

After this, a maximum of 20 days are given to compile a list of persons receiving dividends. As soon as the list is created, the money is transferred to trustees and nominee holders within 10 days. The period increases to 25 days for other shareholders included in the register.

For an LLC, the maximum period is 60 days from the date of the decision on the need to distribute profits. Companies often pay out funds once a year, which makes it easy to draw up the necessary paperwork.

Typically, the procedure is implemented after the organization’s accountant prepares annual reports. This guarantees the correctness of the accruals and compliance with the restrictions established by law.

Attention! Since annual reporting is approved from March 1 to April 30 according to Federal Law No. 14, only after this the amount of remaining profit is calculated, which makes it possible to determine the deadline for transferring dividends within a few weeks.

Other payment rules include:

- it is allowed to issue money in parts, but this information must be contained in the Charter or the adopted decision;

- it is not allowed to exceed the period of 60 days;

- Members can claim the money within three years or such other period as reflected in the charter documents if they experience serious delays.

If shareholders do not withdraw their funds for various reasons, the amount is considered unclaimed and is therefore returned to the company’s account.

In what cases should dividends not be paid?

The legislation defines the conditions under which an organization has the right to pay dividends to its owners:

- The amount of net assets exceeds its own capital and reserve capital. – This condition must be observed both before and after the payment is made.

- The debt of the founders for the formation of the authorized capital must be fully repaid, that is, it must be paid in full.

- The full cost of the participation share was paid to the withdrawing participant.

- If the company does not have signs of bankruptcy or this procedure is not already underway in relation to it.

Important! Dividends can be paid if all conditions are met. Otherwise, the company's management must refuse to pay dividends to its owners.

When you can't pay dividends

Before deciding to pay dividends, in addition to the fact that there is net profit, you need to make sure that the restrictions established by law have not been violated. Dividends cannot be paid if:

- The authorized capital has not been fully paid;

- The company did not pay the cost of the share in certain cases;

- the company at this moment meets the signs of bankruptcy or after paying dividends may become so;

- The value of net assets is less than the authorized and reserve capital or will become less after the payment of dividends;

- According to accounting data, there is an uncovered loss.

The LLC must pay dividends to its participants no later than 60 calendar days from the date of the decision on the distribution of profits (clause 3 of Article 28 of Law No. 14-FZ).

How often can you make payments?

The company can make payments to its founders when carrying out activities that result in a positive financial result. It can be determined intermediately based on data from interim financial statements, that is, for 1 quarter, half a year, 9 months.

You might be interested in:

Depreciation of fixed assets: what is it, groups of fixed assets, methods of calculation in accounting in 2020

It is prohibited to make payments within a shorter period of time. The main thing is that this procedure is provided for by the company’s charter. The final financial result for the year can be determined after its end.

Since a loss may be incurred by the end of the year, it is recommended to make payments to the founders throughout the year, only if you are confident that in the end a profit will be made during the year. Most often, interim dividend payments are observed in small enterprises.

Attention! Once a decision is made to pay dividends, in accordance with the law, they must be paid within 60 days. However, other payment terms may be established in the organization’s charter.

Overdue dividends

Do I need to pay dividends this year that expired more than three years ago? Experts from the Legal Consulting Service GARANT Igor Kotylo and Anna Kuzmina answer the question.

Is it necessary to pay dividends for 2007 in 2012, if the deadline for their payment by decision of the shareholders' meeting was set until December 31, 2008 inclusive? The company's charter does not establish a period during which a shareholder has the right to demand payment of dividends.

In accordance with paragraph 1 of Art. 42 of the Federal Law of December 26, 1995 N 208-FZ “On Joint-Stock Companies” (hereinafter referred to as Law N 208-FZ), the company has the right to make decisions (announce ) on the payment of dividends on placed shares, unless otherwise provided by this Law. The decision to pay (declare) dividends based on the results of the first quarter, half of the year and nine months of the financial year can be made within three months after the end of the corresponding period.

The decision to pay dividends is made by the general meeting of shareholders. If the corresponding decision was made, by virtue of the provisions of paragraph 5 of Art. 42 of the Law on JSC, shareholders have the right to demand payment of declared dividends.

Accordingly, from the moment the general meeting of shareholders makes a decision on the upcoming payment of dividends, the shareholders have the right to receive such dividends, and the company has the obligation to pay dividends, that is, an obligation arises between the company and each of its shareholders (Article 307 of the Civil Code of the Russian Federation). By virtue of Art. 309 of the Civil Code of the Russian Federation, any obligation must be fulfilled properly. This fully applies to the company’s obligation to pay declared dividends.

Federal Law No. 409-FZ of December 28, 2010 (hereinafter referred to as Law No. 409-FZ), which entered into force on December 31, 2010, Art. 42 of Law N 208-FZ is supplemented by paragraph 5, which establishes that if during the period for payment of dividends determined in accordance with the rules of paragraph 4 of Art. 42 of Law N 208-FZ, declared dividends are not paid to a person included in the list of persons entitled to receive dividends, such person has the right to apply to the company within three years after the expiration of the specified period with a demand for payment of declared dividends to him. The company's charter may provide for a longer period for filing this requirement, but this period cannot exceed five years from the date of expiration of the dividend payment period, determined in accordance with the rules of paragraph 4 of Art. 42 of Law No. 208-FZ. If the deadline for filing a claim for payment of declared dividends is missed, the specified period cannot be restored, unless the person entitled to receive dividends did not submit this claim under the influence of violence or threat.

Provisions of paragraph 5 of Art. 42 of Law No. 208-FZ apply to claims the deadline for submission of which has not expired before the day Law No. 409-FZ comes into force (clause 3 of Article 4 of Law No. 409-FZ).

According to paragraph 1 of Art. 197 of the Civil Code of the Russian Federation, for certain types of claims, the law may establish special limitation periods, shorter or longer than the general period. Before Law No. 409-FZ came into force, no such special period was established for filing claims for payment of dividends declared by the company. Consequently, until December 31, 2010, the specified right of the shareholder was limited by the general (three-year) limitation period.

The expiration of the limitation period, the application of which is declared by a party to the dispute, is the basis for the court to make a decision to reject the claim (Clause 2 of Article 199 of the Civil Code of the Russian Federation). Therefore, the court may refuse to satisfy the relevant claims of shareholders declared after the expiration of the statute of limitations (see, for example, the decisions of the Supreme Arbitration Court of the Russian Federation dated January 13, 2010 N VAS-17398/09, dated December 25, 2008 N 16341/08 and dated June 18, 2008 N 4822/08, decisions: FAS Volga District dated October 19, 2011 in case N A57-10117/2010, FAS North-Western District dated October 29, 2008 N A56-14002/2006, FAS Moscow District dated February 28, 2006 N KG-A40 /11096-05 and dated October 26, 2005 N KG-A40/9233-05, Federal Antimonopoly Service of the Ural District dated November 7, 2005 N F09-3726/05-C5).

Thus, the shareholder’s claim for the payment of dividends due to him is subject to judicial protection only within the statute of limitations, which is determined in the manner provided for in Art. 42 of Law No. 208-FZ. In other words, if as of December 31, 2010, the three-year statute of limitations for a shareholder to file a claim for payment of dividends due to him has not expired, then the right to judicial protection continues to apply until the statute of limitations expires. It follows from the question that as of December 31, 2010, the three-year statute of limitations for the shareholder to file a corresponding claim has not expired, but it has expired at the moment.

After the expiration of the period specified in clause 5 of Art. 42 of Law No. 208-FZ of the term, dividends declared and unclaimed by the shareholder are restored as part of the company’s retained earnings (paragraph 3 of clause 5 of Article 42 of Law No. 208-FZ). Therefore, the company cannot pay dividends without making a new decision on their payment.

How are dividends distributed?

The owners of the company can be either one person or several participants. In the first case, the need to distribute dividends does not arise. However, if there are several founders, then it is necessary to determine the procedure for distributing dividends.

The minutes of the meeting of company participants can only contain the total amount of net profit that the founders allocated for the payment of dividends. The method of distribution of dividends is determined in the articles of association.

Most often, this document provides for distribution in proportion to the owner’s share of participation in the authorized capital. That is, each founder has a percentage ratio (for example, 50%).

The total amount of dividends is multiplied by this percentage, as a result of which the amounts due to be paid to the owners are determined in monetary terms.

Attention! The charter may also provide for a different procedure for the distribution of dividends. If payments are made to owners without following the distribution procedure, these amounts cannot be considered dividends.

For the company, this may lead to the fact that it will have to tax the amounts paid with insurance premiums. Since in this case, payments will be considered not as dividends, but as income paid to an individual (if the owner is an individual).

Tax rate in 2020

Tax on the payment of dividends is levied on both individuals and legal entities.

The calculation of tax for individuals depends on whether they are considered residents of the country or not:

- Personal income tax for residents - 13%;

- Personal income tax for non-residents - 15%.

The status is determined based on the number of days over the last year the person was on the territory of Russia (the days do not necessarily have to be consecutive). If the number is at least 183, then the person is considered a resident.

In addition, legal entities can also be recipients of dividends. The procedure for calculating tax for them is established by the Tax Code.

The tax amount is set as follows:

- For a Russian company - 13%;

- For a Russian company, if it owned at least 50% of the number of shares at least 365 days before the date of the decision to pay dividends - 0%;

- Foreign company - 15% or another rate when it is established by foreign tax legislation in order to avoid double taxation.

To confirm a Russian company’s right to a benefit, it must submit one of the forms included in the following list of documents:

- Purchase and sale agreement;

- Deciding on division, conversion, etc.

- Court decisions;

- Memorandum of association;

- Transfer certificate

- Etc.

Attention! Dividend tax must be paid not only by persons on OSNO, but also by those using special regimes (under the simplified tax system, UTII, UST). This is indicated in the relevant chapters of the Tax Code.

Payment of dividends to LLC founders in 2020 step-by-step instructions

Step 1. Determine the amount of net assets and dividends

An organization can pay dividends if its net assets are greater than its authorized capital. The amount of capital is known; it is necessary to calculate net assets.

This indicator can be calculated according to data from the balance sheet.

The calculation is made using the formula:

Net assets = (line 1600 - Debt of the founders) - (line 1400 + line 1500 - Income of future periods).

Important! If the resulting result turns out to be less than the amount of the authorized capital (and this may happen if the balance sheet reflects the loss of previous years), then dividends cannot be paid.

Step 2. Deciding to pay dividends

If the conditions for payment are met, then it is necessary to gather all the founders and make a decision whether to pay dividends or not. In the latter case, they can be sent to develop the company.

You might be interested in:

Accounting policies of organizations: why they are needed, approval deadlines, samples for 2020

In addition, the owners must decide whether to pay all or any part of the net profit as dividends. Another issue that needs to be resolved at the meeting is how to distribute profits among participants. This can be done in proportion to the available shares, or according to some algorithm (it must be recorded in the Charter).

The decision to pay must be made by a majority. If, for example, there is only one owner of the company, then he makes the decision alone.

Based on the results of the meeting, minutes are drawn up. It must contain the name of the company, a list of the owner of the company and the size of the shares, the agenda, the decision made, the amount, timing, payment format.

You can specify the payment period in the protocol. If it is not indicated, then this must be done within 60 days from the date of the decision.

Step 3. Place an order to pay dividends

The clerk, secretary or other responsible person issues an order for the payment of dividends. In it, the manager instructs the chief accountant or other person to ensure the implementation of the decision made at the meeting and documented in the form of minutes. The latter is included as an annex to the order.

Step 4. Withhold taxes and make payment

Dividends are calculated according to the selected algorithm. At the same time, the amount of tax that is withheld from each amount is determined.

Dividends can be paid either from the cash register or from a current account. After this, no later than the next day, the business entity transfers the tax to the budget.

Example of dividend calculation:

At the end of the year, the LLC had a net profit of 313,440 rubles. The authorized capital is formed by three participants: Ivanov with a share of 20%, Petrov with a share of 35% and Sidorov with a share of 45%.

All necessary conditions for payment of dividends have been met.

Let's calculate the amount of dividends for each participant in proportion to his share in the capital:

- Ivanov - amount of dividends 313440x20% = 62688 rubles;

- Petrov - amount of dividends 313440x35% = 109704 rubles;

- Sidorov - amount of dividends 313440x45% = 141048 rubles.

Let's determine the amount of tax that needs to be withheld from the payment:

- Ivanov - tax 62688x13% = 8149 rubles.

- Petrov - tax 109,704 x 13% = 14,262 rubles.

- Sidorov - tax 141048x13%=18336 rubles.

Total payout in hand:

- Ivanov - 62688-8149=54539 rub.

- Petrov - 109704-14262=95442 rub.

- Sidorov - 141048-18336=122712 rubles.

When and how to pay dividends to the founder of an LLC using the simplified tax system

The LLC Law (Federal Law No. 14-FZ of February 8, 1998 “On Limited Liability Companies”) provides for the payment of dividends quarterly, semi-annually or annually. Moreover, any payment of dividends must be based on net profit figures according to accounting data. At the same time, at the moment, legal entities are required to submit financial statements to the Federal Tax Service only at the end of the year. Consequently, if at the level of the company’s management a decision is made to pay profits to the owners, for example, quarterly, then the company’s balance sheet in this case will also have to be compiled based on the results of each quarter.

Next is another important point: financial statements are compiled on an accrual basis, that is, at the end of a quarter, half a year, 9 months and a year as a whole. And this indirectly means that if in the first quarter of the year the company had some profit, but large expenses are planned in subsequent months, then it is better not to distribute quarterly dividends to the founders. After all, even if an LLC pays profit to owners more often than once a year, the total amount of such payments in one way or another should not exceed the annual net profit of the company. That is, ultimately, you still need to focus on the annual balance sheet data. So, in this regard, despite the formal possibility of distributing dividends quarterly, it is better to do this at the end of the year after the preparation and approval of the annual financial statements.

When paying dividends annually, you must comply with the deadlines provided for by the above-mentioned law on LLCs. The decision on the distribution of profits between the founders is made at the annual meeting of the founders of the LLC. Such a meeting should be held strictly in March-April of the year following the reporting year. The payment of dividends itself must be made within 60 days after the corresponding decision is made on the distribution of profits between the participants of the LLC.

This is important to know: KBK USN: penalties in 2020 for legal entities

When paying profits to the founders, 13% of personal income tax is withheld from it. Contributions to funds, as is the case when paying wages to employees, are not accrued in this case. Based on the results of the year in which the company paid profit to the founders, this fact is reflected in income certificates in form 2-NDFL. That is, if we are talking about, say, profit for 2020, then it will be paid in 2019, and accordingly, information about this income of an individual will appear in the 2-NDFL certificates for 2020, which the company will submit in 2020. However, at the moment, the legislation provides for the submission by companies - tax agents of another report on payments to individuals - a quarterly certificate 6-NDFL. Data on dividend payments in this certificate will also be reflected upon the fact of their implementation, that is, when paying income based on the results of 2020, for example, in May 2020, the amount paid to the founder must be taken into account in the 6-NDFL certificate submitted based on the results of the 2nd quarter of 2020 of the year.

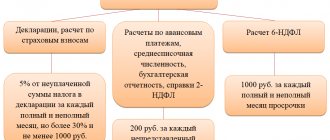

Reporting when paying dividends

The reporting procedure depends on the type of organizational form of the company that issues dividends: LLC or JSC.

In each situation, it is necessary to prepare and submit 2-NDFL certificates and 6-NDFL reports for each dividend recipient. They indicate the amounts received by each of the founders.

The 2-NDFL report is submitted before April 1 of the year following the reporting year. The 6-NDFL report must be submitted no later than the last one for the month following the reporting quarter.

In addition, the law requires filing an income tax return. However, only joint stock companies need to do this. The Ministry of Finance clarified in its letter that LLCs do not prepare this report.

Attention! The declaration on NP is drawn up in this way: the title page is filled out, section A is filled out on sheet 03, after which Appendix 2 is filled out for each recipient of dividends. The report is sent before March 28 of the year following the year of transfer of dividends.

If the recipient of dividends is a foreign company, then it is necessary to submit a tax calculation (information) on the amounts of income paid and taxes withheld.

How to correctly calculate dividends under the simplified tax system in 2020

Organizations that apply a simplified tax regime have the opportunity to please their participants (shareholders) with the amount of dividends.

But a problem arises: simplifiers do not have to pay income tax. It is because of this that companies using the simplified tax system must be guided by separate laws when making payments.

What to do when calculating dividend amounts? Are such payments included in expenses under the simplified tax system? What is the procedure for determining and terms of payment?

This is important to know: Closing an individual entrepreneur on the simplified tax system without employees in 2020

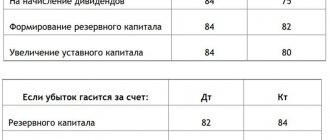

Accounting entries

Let's consider how an accountant should record the payment of dividends in accordance with the current chart of accounts.

| Debit | Credit | Operation |

| 84 | 75 | Dividends were accrued to persons who do not work in the organization |

| 84 | 70 | Dividends were accrued to the company's employees |

| 75 | 68 | Tax was withheld from dividends from persons not working in the company |

| 70 | 68 | Tax was withheld from dividends from company employees |

| 75 | 50, 51 | Dividends were paid to persons who do not work in the organization |

| 70 | 50, 51 | Dividends were paid to company employees |

| 68 | 51 | Personal income tax on dividends has been paid |

| 75 | 84 | Unpaid dividends to non-employees are written off to retained earnings |

| 70 | 84 | Unpaid dividends accrued to the company's employees were written off to retained earnings. |