What do 2-NDFL certificate codes mean in 2018

In 2020, 2-NDFL certificates should be filled out and submitted in accordance with the new edition of the Procedure for filling out 2-NDFL (Order of the Federal Tax Service of Russia dated January 17, 2018 No. ММВ-7-11/19).

You will see the codes that are required to be filled out in the help on our diagram.

Special reference books have been developed with decoding of the codes in the 2-NDFL certificate - 2020.

There should be no mistakes when submitting 2-NDFL, so that the tax agent is not fined at the rate of 500 rubles. for each incorrectly completed certificate (clause 1 of Article 126.1 of the Tax Code of the Russian Federation). If the legal entity itself finds and corrects errors before they are discovered by the tax inspector, a fine can no longer be imposed (Clause 2 of Article 126.1 of the Tax Code of the Russian Federation).

When drawing up a new 2-NDFL certificate for 2020, the accountant must correctly apply not only the codes of various incomes and deductions, but also the code of the identity document for his employee or contractor and the code of the country of citizenship in 2-NDFL. Updated codes must be applied from the very beginning of the tax period - from 01/01/2018.

To correctly enter the listed codes, you should know which reference books to consult.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Sample of filling out dividends in 3-NDFL

We looked at an example of filling out dividends in 3-NDFL in 2020 on a paper form above. Now let’s turn to a simpler method of registration - through the “Declaration” program.

Example 3

In 2020, Vasily received dividends from Organization LLC in the amount of RUB 79,400. Suppose the company was liquidated soon and did not pay personal income tax. Until April 30, 2020, Vasily reported on the income received to the Federal Tax Service by filing a declaration.

Features of filling in the program:

- When setting conditions, note the general source of income.

- We fill out payments from a Russian source on the “Income received in the Russian Federation” page. Please note that there is a separate tab for them. We add the payment source using the “+” icon. In the window that appears, indicate the company details, the amount received, and the tax paid. An adjustment for deduction 601 (if necessary) should be made in the line “Taxable amount of dividends.” We take all this data from 2-NDFL.

In the example under consideration, there is no withholding tax, because the organization failed to fulfill its duty as a tax agent.

- The report is ready. It can be printed or saved to an electronic file (). It will be possible to reflect dividends in 3-NDFL for 2020 in the same way, but only in the program for the corresponding year.

IFTS and OKTMO codes

IFTS and OKTMO codes are necessary details for the 2-NDFL certificate (as well as any form of reporting), so that the powerful electronic flow of 2-NDFL certificates is accurately sent to the desired tax service and identified to the specific area in which the tax agent is registered.

Any organization can find the Federal Tax Service code - these are the first four digits of its Taxpayer Identification Number.

The OKTMO code has been used in Russia since the beginning of 2014. This abbreviation stands for “All-Russian Classifier of Municipal Territories”. It is necessary when filling out some official documents and declarations in order to determine the territorial affiliation of the company. You can find the code in the information letter of the Federal State Statistics Service or on the all-Russian tax website nalog.ru.

It is with the help of codes in reporting that tax officials can easily submit their statistical reports, using software tools to collect data on the citizenship of taxpayers and their location (according to the codes of identification documents), on the income of citizens and deductions from this income.

Codes of forms of reorganization (liquidation) of an organization

Appendix 2 (the directory “Codes of subjects of the Russian Federation and other territories”) to the Procedure for filling out the 2-NDFL certificate has lost its force and has been replaced by Appendix 2 “Codes of forms of reorganization (liquidation) of an organization.”

This list contains only 6 codes for different cases of tax agent reorganization:

- when converting it, code 1 is indicated;

- merger - code 2;

- separation - code 3;

- accession - code 5;

- separation with simultaneous accession - code 6;

- upon complete liquidation of a tax agent, its successor will indicate code 0.

Lawmakers have addressed a long-standing gap in the law. Now individuals who received income from reorganized organizations have the opportunity to request an amendment to 2-NDFL from the legal successor. He must also submit 2-NDFL reports to the tax office for the employees of this reorganized organization, using the codes listed above in section 1.

If the organization has not undergone reorganization, this code is not filled in - the field remains empty.

Citizenship (country code) and identity document code

Section 2 of the updated certificate 2-NDFL was reduced by almost half - lines about addresses of residence and place of residence were removed from it. Here, when filling out, you need to indicate 2 types of codes: the country code to clarify citizenship and the code of the identity document. These codes were also in the previous certificate form. They haven't changed.

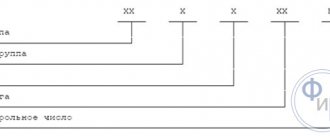

In the field “Citizenship (country code)” the 3-digit digital code of the state of which the taxpayer is a citizen is indicated, according to the All-Russian Classifier of Countries of the World (OKSM). For example, a citizen of the Russian Federation will have code 643 on the certificate, and a citizen of the Republic of Belarus will have code 112.

If the taxpayer does not have citizenship, then the code of the state that issued the document proving his identity is entered in the “Country Code” field.

And the code of the identification document in 2-NDFL is still taken from Appendix 1 to the Procedure for filling out the 2-NDFL form, approved by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11 / [ email protected] - the reference book “Codes types of documents identifying the taxpayer.”

For example, a passport of a Russian citizen has code 21, and a Russian birth certificate has code 03. This directory contains codes for documents such as a military ID, a foreign citizen’s passport, a residence permit in the Russian Federation, a refugee certificate and others like that. That is, any individual with any document can be identified.

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

How to fill out personal income tax reporting when paying dividends

Tax base for dividends

Dividends received by citizens who are tax residents of the Russian Federation from a Russian company are subject to personal income tax at a rate of 13% (clause 1 of Article 224 of the Tax Code of the Russian Federation).

At the same time, the tax base for them is determined taking into account the features established by Art. 275 of the Tax Code of the Russian Federation, separately from other income taxed with personal income tax at a rate of 13% (clause 2 of Article 210 of the Tax Code of the Russian Federation). The tax on dividends is calculated, withheld and paid to the budget by the Russian company that is the source of their payment, which is recognized as a tax agent (clause 3 of Article 275 of the Tax Code of the Russian Federation). In paragraph 4 of Art. 275 of the Tax Code of the Russian Federation states that the amount of tax is calculated for each recipient of dividends separately in relation to each payment of the specified income. The calculation is made according to the formula given in paragraph 5 of Art. 275 Tax Code of the Russian Federation:

Н = К x Сн x (D1 – D2),

where N is the amount of tax subject to withholding;

K is the ratio of the amount of dividends of the recipient to the total amount of dividends;

Сн - tax rate;

D1 - the total amount of dividends to be distributed in favor of all recipients;

D2 - the total amount of dividends received by a Russian organization, which was not previously taken into account when determining the tax base.

The formula shows that if the company itself receives dividends from other organizations, the amount of dividends to be paid to participants and the tax base for dividends will be different (the tax base will be less due to indicator D2).

Form 6-NDFL

Section 1 of Form 6-NDFL provides the following general indicators:

— the amount of accrued income (line 020), including the amount of accrued income in the form of dividends (line 025);

— amount of tax deductions (line 030);

— the amount of calculated tax (line 040), including the amount of calculated tax on income in the form of dividends (line 045).

According to clause 3.3 of the Procedure for filling out form 6-NDFL (approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. MMV-7-11 / [email protected] ), line 025 shows the sum of accrued income in the form of dividends, cumulative for all individuals, on an accrual basis from the beginning tax period. The question arises: what should be shown on this line - the amount of dividends distributed in favor of the participants or the tax base, adjusted according to the rules of Art. 275 of the Tax Code of the Russian Federation? If the amount is distributed in favor of the participants, then where should the adjustment to the tax base be reflected?

The only option is line 030. It reflects the sum of tax deductions generalized for all individuals that reduce income subject to taxation on an accrual basis from the beginning of the tax period. But tax deductions for personal income tax are listed in Art. 218-221 of the Tax Code of the Russian Federation, and they do not apply to income from equity participation (clause 3 of Article 210 of the Tax Code of the Russian Federation).

In a letter dated June 26, 2018 No. BS-4-11/ [email protected], specialists of the Federal Tax Service of Russia indicated that line 030 is filled in according to the values of codes for types of taxpayer deductions approved by order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected] Among them is deduction code 601 - an amount that reduces the tax base for income in the form of dividends.

Thus, when filling out section 1 of form 6-NDFL, line 025 indicates the total amount of income in the form of dividends distributed in favor of individuals, and line 030 indicates the amount that reduces the tax base for income in the form of dividends.

Help 2-NDFL

Section 3 of the 2-NDFL certificate (approved by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11 / [email protected] ) contains the columns “Income Code”, “Income Amount”, “Deduction Code”, “Deduction Amount”. Codes of income and deductions are given in the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected] For income in the form of dividends, code 1010 is set.

According to the tax service, dividends received by an individual are shown in section 3 of the 2-NDFL certificate under income code 1010. In this case, code 601 is indicated in the “Deduction Code” field, and in the “Deduction Amount” field the amount that reduces the tax base is reflected. income in the form of dividends. Moreover, if dividends are paid on shares of Russian organizations, then tax agents provide information on income in accordance with Appendix No. 2 to the income tax return (approved by order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3 / [email protected] ). In this case, submission of information on such income in Form 2-NDFL is not required. Such clarifications are contained in the letter of the Federal Tax Service of Russia dated June 26, 2018 No. BS-4-11/ [email protected]

Income codes (salaries, bonuses, sick leave, dividends) in the 2-NDFL certificate

Section 3 of the 2-NDFL certificate contains a table with a list of income. Income is posted by month, code, and deduction related specifically to that income. Here you need to enter the codes of income paid to the individual. If these codes are not entered, the 2-NDFL certificate will not be accepted (clauses 1–2 of Article 230 of the Tax Code of the Russian Federation). You can find income codes in Appendix 1 to the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/387.

Amendments were made to the list of income (order of the Federal Tax Service of Russia dated October 24, 2017 No. ММВ-7-11/ [email protected] ). New income codes have appeared, which are shown in our diagram.

Previously, for all listed new income there was one code 4800 “Other income”.

The main codes in the 2-NDFL certificate - 2020 remain the same:

- salary code in certificate 2-NDFL 2020 - 2000;

- award code in certificate 2-NDFL 2020 - 2002;

- sick leave code in certificate 2-NDFL 2020 - 2300;

- vacation code in certificate 2-NDFL 2020—2012;

- The dividend code in the 2-NDFL certificate for 2020 is 1010.

Last year, income and deduction codes have already changed (Order of the Federal Tax Service of Russia dated November 22, 2016 No. ММВ-7-11/633). For example, bonus codes have been clarified:

- 2002 - bonuses included in wages according to law or internal regulations;

- 2003 - bonuses from the organization’s profits and its target funds.

Income codes that are always subject to personal income tax

Income code 2000 is wages, including bonuses (for harmful and dangerous work, for night work or combined work).

Income code 2002 is a bonus for production and similar results that are provided for in employment contracts and legal norms.

Income code 2003 - a bonus from the company’s net profit, targeted income or special purpose funds.

Income code 2010 - income from civil contracts, excluding copyright contracts.

Income code 2012 - vacation pay.

Income code 2300 - sick leave benefit. It is subject to personal income tax, so the amount is included in the certificate. At the same time, maternity and child benefits are not subject to income tax, and they do not need to be indicated in the certificate.

Income code 2610 - indicates the employee’s material benefit from loans.

Income code 2001 is remuneration for board members.

Income code 1400 - an individual’s income from renting out property (if it is not transport, communications or computer networks).

Income code 2400 - an individual’s income from leasing vehicles, communications equipment or computer networks.

Income code 2013 - compensation for vacation that the employee did not have time to take.

Income code 2014 - severance pay.

Income code 2611 is a forgiven debt written off the balance sheet.

Income code 3021 - interest on bonds of Russian companies.

Income code 1010 - transfer of dividends.

Income code 4800 is a “universal” code for other employee income that is not assigned special codes. For example, daily allowance in excess of the tax-free limit or sick leave supplement.

Generate a 2-NDFL certificate automatically in the online service Kontur.Accounting.

Deduction codes in the 2-NDFL certificate

We have already mentioned the “Deduction Code” columns in section 3. There, deductions are tied to a specific income code. For example, if we pay an employee financial assistance with income code 2760, then in the same line we should immediately enter deduction code 503 for the amount of 4,000 rubles, which is allowed not to be subject to personal income tax (subclause 28 of article 217 of the Tax Code of the Russian Federation).

Section 4 of the 2-NDFL certificate is a table with a list of standard, social and property tax deductions due to the taxpayer. Let us recall that reference to investment deductions has been removed from this section. In this section, it is also necessary to fill in the “Deduction Code” column. These codes are in Appendix 2 to Order No. ММВ-7-11/387.

Amendments were also made to the current list of deductions (order of the Federal Tax Service of Russia dated October 24, 2017 No. ММВ-7-11/ [email protected] ). Only one new deduction code was added - 619 (profit from operations on an individual investment account).

Let us remind you that last year corrections and additions were also made to the list of deductions. In particular, standard children's deductions were coded in a new way: instead of codes 114–125, more specific codes 126–146 appeared.

And now, to consolidate the above, we will enter the data into the updated form of the 2-NDFL certificate according to the example proposed below.