From your employees' salaries, you withhold personal income tax or personal income tax - 13%, transfer it to the state, and give the remaining money to the employee. This is how it happens in life.

You hired an employee and agreed that you would give him 20 thousand rubles a month. The employment contract must indicate a salary of 22,990 rubles. This amount includes 13% personal income tax, which you will transfer to the state. Every month you pay 20 thousand rubles to the employee and 2,990 rubles to the tax office.

Submit reports in three clicks

Elba is suitable for individual entrepreneurs and LLCs with employees. The service will prepare all the necessary reporting, calculate salaries, taxes and contributions, and generate payments.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

What is 6-NDFL?

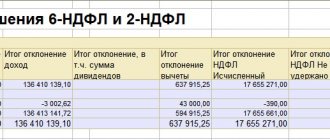

You must report for withheld and transferred personal income tax. For this, they came up with two reports: 6-NDFL, which is submitted every quarter, and 2-NDFL, which the tax office expects only once a year.

In addition to employee salaries, personal income tax must be paid on other income that individuals receive from you:

- remuneration under civil law contracts,

- dividends,

- interest-free loans,

- gifts, the total value of which exceeds 4,000 rubles during the year.

If the physicist received income from you at least once during the year, you need to submit 6-NDFL.

In the report, indicate general data for all physical entities. persons who received income from you. There is no need to separate information for each person; there is another report for this - 2-NDFL.

Report form 6-NDFL

Rules for filling out 6-NDFL

Quarterly personal income tax reporting

In order to strengthen tax control, extensive changes to the Tax Code of the Russian Federation regarding personal income tax reporting will come into force from January 1, 2016, in particular, now tax agents will report quarterly.

According to the amendments made to paragraph 2 of Art. 230 of the Tax Code of the Russian Federation, tax agents will be required not only to keep records of income received from them by individuals in the tax period, tax deductions provided to individuals, calculated and withheld taxes in tax registers, but also to submit personal income tax reporting to the tax authorities.

According to the new edition of this norm, which will come into force in 2020, tax agents will submit to the tax authority at their place of registration:

1) a document containing information on the income of individuals of the expired tax period and the amount of tax calculated, withheld and transferred to the budget system of the Russian Federation for this tax period for each individual, annually no later than April 1 of the year following the expired tax period, in the form , formats and in the manner approved by the federal executive body authorized for control and supervision in the field of taxes and fees, unless otherwise provided by clause 4 of Art. 230 Tax Code of the Russian Federation;

2) calculation of personal income tax amounts calculated and withheld by the tax agent for the first quarter, six months, nine months - no later than the last day of the month following the corresponding period, for the year - no later than April 1 of the year following the expired tax period, in the form formats and in the manner approved by the federal executive body authorized for control and supervision in the field of taxes and fees.

So, two concepts are introduced: a document containing information about the income of individuals for the past tax period, and the calculation of personal income tax amounts.

The document containing information on income, in the author’s opinion, means the currently submitted information on income in Form 2-NDFL, approved by order of the Federal Tax Service of the Russian Federation dated November 17, 2010 No. ММВ-7-3/ [email protected]

The calculation of personal income tax amounts is a new quarterly personal income tax report. The form and order in which this calculation will be presented will be determined by the Federal Tax Service. The corresponding draft has not yet been adopted.

GOOD TO KNOW

Currently, the draft order of the Federal Tax Service of Russia “On approval of the form for calculating the amounts of personal income tax calculated and withheld by the tax agent (form 6-NDFL), and the procedure for filling it out, as well as the format and procedure for submitting the calculation of the amounts of income tax are being approved individuals calculated and withheld by a tax agent in electronic form” (not yet published), where it is assumed that reporting will be submitted in Form 6-NDFL and will not entail additional administrative burden on tax agents.

The concept of this calculation is disclosed in a new paragraph introduced by Federal Law dated May 2, 2015 No. 113-FZ in Art. 80 Tax Code of the Russian Federation. Calculation of the amounts of personal income tax calculated and withheld by the tax agent, according to form 6-NDFL, is a document containing generalized information by the tax agent on all individuals who received income from the tax agent (a separate division of the tax agent), on the amounts of income accrued and paid to them , provided tax deductions, calculated and withheld tax amounts, as well as other data serving as the basis for calculating tax.

Tax declarations (calculations) for those taxes for which taxpayers are exempt from the obligation to pay them in connection with the application of special tax regimes, in terms of activities the implementation of which entails the application of special tax regimes, or property used for the implementation of such activities (clause 2 of article 80 of the Tax Code of the Russian Federation).

Taking into account the changes made, the calculation of personal income tax amounts and a document containing information on the income of individuals for the year will be submitted by tax agents in electronic form via telecommunication channels. If the number of individuals who received income in the tax period is up to 25 people, tax agents can submit the specified information and calculation of tax amounts on paper (as amended by clause 2 of Article 230 of the Tax Code of the Russian Federation, which will be in effect from 2020).

Thus, starting from the new year, legislators are increasing the limit on the number of employees from 10 to 25 people, which allows them to submit information about their income on paper. At the same time, the possibility of presenting information about the income of individuals on removable electronic media (for example, on flash cards or disks) will be excluded. Since 2020, the electronic form of presentation of such information implies their transmission only via telecommunication channels.

GOOD TO KNOW

According to legislators, the introduction of a new obligation for tax agents to submit quarterly personal income tax reports will increase the efficiency of tax administration and tax collection, and will also significantly increase the volume of personal income tax revenues to the budgets of constituent entities of the Russian Federation and local budgets.

Tightening tax agent liability

Article 76 of the Tax Code of the Russian Federation has been supplemented with clause 3.2., according to which the decision of the tax authority to suspend operations of a tax agent on his bank accounts and transfers of his electronic funds is also made by the head (deputy head) of the tax authority in the event of failure of the specified tax agent to provide a calculation of tax amounts for income of individuals calculated and withheld by the tax agent to the tax authority within 10 days after the expiration of the established deadline for submitting such a calculation.

The decision to suspend transactions on his bank accounts and transfers of his electronic funds is canceled by a decision of the same tax authority no later than one day following the day the relevant tax agent submits a calculation of the personal income tax amounts calculated and withheld by the tax agent.

Another addition was made to Art. 126 of the Tax Code of the Russian Federation. Clause 1.2 establishes that failure by a tax agent to submit within the established period of time the calculation of personal income tax amounts calculated and withheld by the tax agent to the tax authority at the place of registration entails a fine from the tax agent in the amount of 1000 rubles. for each full or partial month from the day established for its submission.

IMPORTANT IN WORK

From 2020, liability for failure to submit personal income tax reports will be tightened.

Also, starting from the new year, Art. 126.1 of the Tax Code of the Russian Federation, which establishes liability for the submission by a tax agent to the tax authority of documents containing false information.

According to this article, the submission by a tax agent to the tax authority of documents containing false information entails a fine of 500 rubles. for each submitted document containing false information.

At the same time, it is clarified that the tax agent may be exempt from liability under Art. 126.1 of the Tax Code of the Russian Federation, if he independently identified errors and submitted updated documents to the tax authority before the moment when the tax agent learned that the tax authority discovered the unreliability of the information contained in the documents submitted to him.

Message about the impossibility of withholding the tax amount

When paying income in kind, the tax agent, as a rule, does not have the opportunity to withhold personal income tax on the income received. In this case, the tax agent must calculate and withhold from other cash payments during the year. Otherwise, by virtue of clause 5 of Art. 226 of the Tax Code of the Russian Federation, he is obliged to inform the tax authorities and the individual taxpayer about the impossibility of withholding personal income tax. The message is submitted in form 2-NDFL.

According to the new changes from 2020, if it is impossible to withhold the calculated amount of tax from the taxpayer during the tax period, the tax agent is obliged, no later than March 1 of the year following the expired tax period in which the relevant circumstances arose, to notify the taxpayer and the tax authority at his place of residence in writing. accounting about the impossibility of withholding tax, the amount of income from which tax was not withheld, and the amount of unwithheld tax.

GOOD TO KNOW

The deadline for informing the taxpayer and the tax authority about the impossibility of withholding personal income tax will be extended by a month. Moreover, they will report not only the amount of tax, but also the amount of income from which such tax is not withheld.

If there are separate divisions

Tax agents - Russian organizations with separate divisions will have to submit forms 2-NDFL and 6-NDFL for individuals who received income from such separate divisions to the tax inspectorates at the location of these separate divisions.

As part of the performance by tax agents of duties related to the submission to tax inspectorates of information on citizens’ income in form 2-NDFL, the Federal Tax Service of Russia, in a letter dated January 28, 2015 No. BS-4-11/ [email protected], indicated, among other things, that the submission information regarding the income of employees of separate divisions, as well as the transfer of personal income tax to the tax office other than the place of registration of these divisions is not allowed.

Changes regarding personal income tax

| Provisions of the Tax Code of the Russian Federation | Until 01/01/2016 | From 01/01/2016 |

| Clause 3 of Art. 226 Tax Code of the Russian Federation | Tax amounts are calculated by tax agents on an accrual basis from the beginning of the tax period the results of each month in relation to all income for which a tax rate of 13% is applied, accrued to the taxpayer for a given period, with the offset of the tax amount withheld in previous months of the current tax period. The amount of tax in relation to income in respect of which other tax rates are applied is calculated by the tax agent separately for each amount of the specified income accrued to the taxpayer | Tax amounts are calculated by tax agents on the date of actual receipt of income on an accrual basis from the beginning of the tax period in relation to all income for which a tax rate of 13% is applied, accrued to the taxpayer for a given period, with the offset of the tax amount withheld in previous months of the current tax period. The amount of tax in relation to income in respect of which other tax rates are applied, as well as to income from equity participation in an organization, is calculated by the tax agent separately for each amount of the specified income accrued to the taxpayer |

| Clause 4 of Art. 226 Tax Code of the Russian Federation | The tax agent withholds the accrued amount of tax from the taxpayer at the expense of any funds paid by the tax agent to the taxpayer upon actual payment of the specified funds to the taxpayer or on his behalf to third parties. In this case, the withheld tax amount cannot exceed 50% of the payment amount | When paying a taxpayer income in kind or receiving income in the form of a material benefit, the tax agent withholds the calculated amount of tax from any income paid in cash. In this case, the withheld tax amount cannot exceed 50% of the amount of income paid in cash. |

| Clause 5 of Art. 226 Tax Code of the Russian Federation | If it is impossible to withhold from the taxpayer the calculated amount of tax, the tax agent is obliged, no later than one month from the end of the tax period in which the relevant circumstances arose, to notify the taxpayer and the tax authority at the place of his registration in writing about the impossibility of withholding the tax and the amount of tax | If it is impossible to withhold the calculated amount of tax from the taxpayer during the tax period, the tax agent is obliged, no later than March 1 of the year following the expired tax period in which the relevant circumstances arose, to notify in writing the taxpayer and the tax authority at the place of his registration about the impossibility of withholding the tax, on the amount of income from which tax is not withheld and the amount of tax not withheld |

| Clause 6 of Art. 226 Tax Code of the Russian Federation | Tax agents are required to transfer the amounts of calculated and withheld tax no later than the day of actual receipt of cash from the bank for the payment of income, as well as the day of transfer of income from the accounts of tax agents in the bank to the accounts of the taxpayer or, on his behalf, to the accounts of third parties in banks. In other cases, tax agents transfer the amounts of calculated and withheld tax no later than the day following the day the taxpayer actually receives income - for income paid in cash, as well as the day following the day of actual withholding of the calculated amount of tax - for income received by the taxpayer in kind or in the form of material benefit | Tax agents are required to transfer the amounts of calculated and withheld tax no later than the day following the day the income is paid to the taxpayer . When paying a taxpayer income in the form of temporary disability benefits (including benefits for caring for a sick child) and in the form of vacation pay, tax agents are required to transfer the amounts of calculated and withheld tax no later than the last day of the month in which such payments were made |

| Clause 1 of Art. 223 Tax Code of the Russian Federation | The date of actual receipt of income for the purpose of calculating personal income tax is defined as the day of: 1) payment of income, including transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties - when income is received in cash; 2) transfer of income in kind – when receiving income in kind; 3) payment by the taxpayer of interest on borrowed (credit) funds received, acquisition of goods (work, services), acquisition of securities - upon receipt of income in the form of material benefits | The date of actual receipt of income for the purpose of calculating personal income tax is defined as the day of: 1) payment of income, including transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties - when income is received in cash; 2) transfer of income in kind – when receiving income in kind; 3) acquisition of goods (work, services), acquisition of securities - upon receipt of income in the form of material benefits. If payment for acquired securities is made after the transfer of ownership of these securities to the taxpayer, the date of actual receipt of income is determined as the day the corresponding payment is made to pay for the cost of the acquired securities; 4) offset of counter similar claims; 5) writing off bad debt from the organization’s balance sheet in accordance with the established procedure; 6) the last day of the month in which the advance report is approved after the employee returns from a business trip; 7) the last day of each month during the period for which borrowed (credit) funds were provided, upon receipt of income in the form of material benefits received from savings on interest when receiving borrowed (credit) funds |

- Back

- Forward

Deadlines for submitting 6-NDFL

6-NDFL should be submitted once a quarter:

- for the 1st quarter - until April 30

- for half a year - until July 31

- 9 months before October 31

- for a year - until March 1 of the next year.

If you paid an individual for the first time only in the 2nd quarter, submit 6-NDFL for six months, 9 months and a year.

Anton is an individual entrepreneur and works alone. In June, he turned to a copywriter who wrote 5 articles for the site. Everything was formalized under a copyright contract. Anton paid 10,000 rubles to the copywriter and 1,495 rubles in personal income tax to the state. In July, Anton needs to submit 6-NDFL for six months, 9 months, and then report for the year.

4-NDFL

And according to Art. 126 of the Code, tax authorities may take measures that relate to violation of the deadlines for filing 4-NDFL. This declaration is submitted by those individual entrepreneurs who have just started their activities. It must be submitted within five days after the month in which the first income may be made. This will allow you to calculate the required advance payments.

Another reason for filing 4-NDFL is when the amount of expected income has changed sharply by 50 percent, either upward or downward. Then, according to paragraph 10 of Art. 227 of the Tax Code of the Russian Federation will have to recalculate advance payments. This condition is also provided for in the clarifications of the Ministry of Finance of Russia dated April 1, 2008 No. 03-04-07-01/47 “On the procedure for calculating advance payments for personal income tax.”

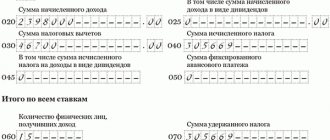

How to fill out section 1 of the 6-NDFL report?

Summarizes data for all months of the reporting period - from January 1 to June 30.

Line 020: indicate the income of individuals from January 1 to June 30 - before personal income tax was deducted from it. Salary from January to June, including salary for June, which you paid already in July. Vacation pay and sick leave benefits paid from January to June - it doesn’t matter for what period. Other income that the physicist received from January to June and from which you must withhold personal income tax.

Line 030 - the amount of deductions for income from line 020. For example, children's, property, social deductions.

Line 040 - the amount of personal income tax on income from line 020.

Lines 025 and 045 - fill out only if you paid dividends.

Line 050 - fill in if there are foreign workers with a patent.

Line 060 - the number of people whose income you reflected in 6-NDFL.

Line 070 is the amount of personal income tax that has been withheld since the beginning of the year. It may not coincide with the amount in line 040. For example, it is not possible to withhold personal income tax until the end of the year, or income was received in one quarter, and tax was withheld in another.

Line 080 is personal income tax, which you will not be able to withhold until the end of the year. For example, personal income tax on a gift worth more than 4,000 rubles to a person who does not receive cash income from you.

Line 090 - fill in if tax was returned to employees.

Is it possible in an agreement to assign the obligation of a tax agent for personal income tax to an organization?

If the Tax Code does not impose the duty of a tax agent on an organization, and according to the agreement it must calculate and pay personal income tax (for example, when purchasing a vehicle from an individual), the corresponding terms of the agreement will be void.

Let us turn to Letter of the Ministry of Finance of the Russian Federation dated March 22, 2016 N 03-04-05/15838. Department specialists noted that the generally binding rules for taxation of personal income, including the procedure for paying tax, are established by Chapter. 23 “Tax on personal income” of the Tax Code of the Russian Federation. These provisions are mandatory in nature and do not depend on the will of the taxpayer and tax agent.

For your information. If income is received under a civil law agreement concluded with an individual, the responsibility for calculating and paying personal income tax falls on the individual receiving such income (Letter of the Ministry of Finance of the Russian Federation dated March 31, 2016 N 03-04-05/18280).

Remember that a transaction that violates the requirements of a law or other legal act and at the same time encroaches on public interests or the rights and interests protected by law of third parties is void unless it follows from the law that such a transaction is contestable or other consequences of its violation not related to with the invalidity of the transaction (Article 168 of the Civil Code of the Russian Federation).

The obligation to calculate and pay personal income tax arises for an organization only if it is recognized as a tax agent in relation to payments made to an individual.

Thus, the conditions specified in the contract obliging the organization to calculate and pay this tax, when this obligation is not assigned to it by the Tax Code of the Russian Federation, will be void.

The terms of the agreement obliging the taxpayer to pay personal income tax will also be recognized as void if, according to the Tax Code of the Russian Federation, the corresponding obligation is assigned to the tax agent (Letter of the Ministry of Finance of the Russian Federation dated 03/09/2016 N 03-04-05/12891, Determination of the Supreme Court of the Russian Federation dated 01/13/2016 N 304- KG15-17425).

For your information. A Russian organization is not recognized as a tax agent in relation to funds transferred to an individual under an agency agreement if such organization, acting as an agent under this agreement, is not the source of income for this individual (Letters of the Ministry of Finance of the Russian Federation dated April 15, 2016 N 03-04- 05/21896, dated 02/24/2016 N 03-04-06/10104, 03-04-06/10099).

How to fill out section 2 of the 6-NDFL report?

Indicate only payments for the third quarter - from July 1 to September 30, separately for each month.

Line 100 - date of receipt of income:

- Salary is the last day of the month for which you pay it.

- Remuneration under a civil contract, vacation pay and sick pay - the day the income is paid.

Line 110 is the tax withholding date. Usually matches line 100. Exceptions:

- With advance payment - the day of payment of the final salary for the month.

- For material benefits, gifts worth more than 4,000 rubles - on the next salary day.

- For excess daily allowances - the nearest salary payment day for the month in which the advance report is approved.

Line 120 is the date when the tax must be paid. Determined according to Article 226 of the Tax Code. If this date is in the 4th quarter, do not include income in section 2, even if you have already shown it in section 1. For example, do not include in section 2 a salary for June that was paid in July.

Line 130 is the entire amount of income for the 2nd quarter, before personal income tax was withheld from it.

Line 140 - the amount of personal income tax withheld for the 2nd quarter.

In one block of lines 110-140, show income for which all three dates coincide: receipt of income, withholding and payment of tax. You can submit a report on paper if you have no more than 10 employees. And only electronically - if you have more than 10 employees.

income in kind

Example 2

An employee of Volna LLC was paid income in kind on September 5, 2016 in the amount of 30,000 rubles, but it was not possible to withhold tax from him in the amount of 3,900 rubles. Income in kind in 6-NDFL for 9 months will be reflected as follows:

020 – indicate the amount of income received: 30,000 rubles,

040 – we reflect the calculated personal income tax on income in kind of 3900 rubles,

080 – 3900 rubles personal income tax, because the tax was not withheld by the tax agent, we show it in this line.

In Section 2:

100 – date of receipt of “natural” income 09/05/2016.

110 – in our example, income was not paid in money, which means we do not indicate the date in this line.

120 - no tax was withheld, this date is also zero.

130 – indicate the amount of natural income of 30,000 rubles.

140 – no tax was withheld, so we will indicate a zero value in this line.

Procedure for withholding personal income tax

From any monetary remuneration paid to employees, personal income tax can be withheld from income that is paid in kind. But the total amount withheld should not exceed 50% of the total amount received by the employee (clause 4 of Article 226 of the Tax Code of the Russian Federation). If it is not possible to withhold the entire amount at once, the balance can be transferred to a subsequent payment. In this case, the current tax must first be withheld from the income, and 50% from the remaining amount.

Hold example

On September 20, Continent LLC gave employee A.P. Kravtsova a gift. a gift worth 65,000 rubles. This is Kravtsova’s first gift this year. Kravtsova’s salary is 25,000 rubles. Salaries are paid at LLC Continent twice a month, on the 10th the main payment and on the 25th the advance payment. Kravtsova's advance is 10,000 rubles.

Let's calculate personal income tax on a gift, taking into account that this is the first gift for the year:

(65,000 – 4,000) x 13% = 7,930 rubles

Let's calculate the amount of personal income tax that we can withhold from the advance payment on September 25:

10,000 x 50% = 5,000 rubles

The maximum possible amount of deductions is:

(25,000 – 25,000 x 13%) x 50% = 10,875 rubles

We withhold the remaining amount of 2,930 personal income tax rubles from the salary on the 10th, which means Kravtsova will receive a salary in the amount of:

25,000 – 3,250 – 10,000 – 7,930 = 3,820 rubles

Inability to withhold personal income tax

It is not always possible to withhold personal income tax from an employee. Such cases are provided for by the tax legislation of the Russian Federation for a number of reasons.

Causes

- employees of the enterprise received income exclusively in kind, and did not receive income in cash;

- payment of debt to the employee in accordance with a court decision that has entered into force;

- issuance of gifts to persons who are not full-time employees of the organization in an amount not exceeding 4 thousand rubles, as well as in the absence of further cash payments;

- when fulfilling the social obligation to provide the right to free travel on railway transport to retired employees.

Submission deadlines

If one or more of the above situations arise, you must contact the tax authorities before January 31 with a 2-NDFL certificate indicating the number “2” in the “Sign” column, as well as the corresponding notification.

Starting from 2020, the deadlines for submitting notifications have been changed, and in 2017 such information must be submitted to the tax authority no later than 03/01/2018.

Example of personal income tax calculation

In September 2107, the head of Continent LLC, on the basis of an order, gave employee P.P. Petrov a gift. laptop. The organization purchased a laptop for 45,000 rubles in a store. Petrov's salary is 85,000 rubles. This year, Petrov has already received a gift from the organization, the cost of which was 5,000 rubles.

The amount of the gift Petrov previously received exceeds 4,000 rubles, which means we withhold personal income tax from the laptop from the full cost.

Let's calculate personal income tax from a laptop:

45,000 x 13% = 5,850 rubles.

We deduct this amount from Petrov’s salary, which means Petrov’s salary in September will be:

85,000 – (85,000 x 13% + 45,000 x 13%) = 68,100 rubles

And the personal income tax withheld from Petrov and transferred to the budget will be:

85,000 x 13% + 45,000 x 13% = 16,900 rubles

How to calculate personal income tax

Personal income tax on income in kind is calculated on the day of issue. The value of transferred goods (services or property) is taken as the tax base. If part of the cost of the transferred goods is paid by the employee, this amount is not included in the tax base. Or the cost of the goods minus the amount paid is included. Based on the fact that, according to the law, personal income tax must be withheld from an employee on a gift worth more than 4,000 rubles, this amount does not need to be taken into account. But this amount can only be taken into account once a year.

For each employee, the amount of personal income tax must be taken into account personally. But the employee does not always receive income in kind individually. In some cases, this is the income provided for in the collective agreement for all employees of the organization. Examples include paying for a gym for employees or providing them with free meals. In such cases, personal income tax can be calculated as follows: the total amount transferred by the organization to the gym divided by the number of employees visiting it. Some organizations organize the issuance of special cards or coupons that take into account visits to the hall or canteen.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |