Reflection of data in submitted reports

Information on the amount of income and withheld tax is indicated in the 6-NDFL reporting. When determining the date of taxation of dividends, the requirements of Art. 226 Tax Code of the Russian Federation. The organization acts as a tax agent in relation to the recipient of income, which means the emergence of responsibilities for calculating, withholding tax and transferring it to the budget within the time limits specified by law.

Starting from 2020, the dividend tax rate is set at 13% for residents of the Russian Federation and 15% for non-residents. Previously, the rate was reduced (for residents the value was 9%). Persons receiving benefits for previous periods pay tax at the current rate. When determining status, periods of stay of a person exceeding 183 days during the year are taken into account, excluding the time of treatment and training.

Payment source

An individual can receive income in the form of dividends from the following organizations:

- Joint Stock Company (if an individual is the owner of company shares);

- Limited Liability Company (if an individual is the owner of a share of the authorized capital of the organization).

The source of payment of cash receipts, that is, a joint-stock company or LLC, is recognized as a tax agent who is responsible for calculating and paying personal income tax, as well as filling out 6-personal income tax with dividends; a sample can be found on our website.

It should be noted that if a joint-stock company issues income from shares not to the shareholder himself, but to his representative (depository), then the obligations of the tax agent for calculating and paying tax are assigned to him (the depositary).

Reflection of dividend amounts in reporting

The inclusion of information in the reporting is determined depending on the organizational form of the company performing the payments. The payers of the amounts are LLC or JSC. The following forms of payment are provided:

- Receiving amounts determined depending on the share of participation of persons in the authorized capital of companies registered as LLCs.

- For shares accounted by joint-stock companies on a separate account of a person or by managing shares - participants in the securities market.

When paying remuneration from participation in an LLC, the payment procedure is determined by the charter documents. The taxation of amounts received in a joint-stock company depends on whether the remuneration was received by the distributing company from participation in other authorized capital and whether it was taxed. When making calculations, previously made deductions are taken into account to avoid repeated taxation.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Example of filling out dividends in 6-NDFL

Questions often arise in calculating personal income tax. It is necessary to have a clear understanding of the recipients of dividends, the timing of their accrual and payments, as well as the timing of the transfer of personal income tax. The reliability of Form 6-NDFL depends on this, and any attempts to incorrectly reflect the original data will lead to fines from the tax office.

Recipients of dividends

The form must reflect all funds that are subject to personal income tax and paid to participants:

- founders of an LLC who have their own share in the authorized capital of the enterprise;

- JSC shareholders owning a block of shares.

At the same time, it takes into account employees and those who do not work at this enterprise. In other words, the fact of employment in the company is optional.

Tax agents for dividends

If a Russian organization pays dividends accrued from the net profit of any Russian organization or company registered abroad, then it is considered a tax agent. By law, this issuing organization is required to charge, withhold and remit taxes.

Features of tax calculations

An enterprise in the form of an LLC must transfer the tax no later than the day following the settlement with the recipient. Amounts withheld for remuneration to JSC shareholders have a one-month deferment for transfer. If income is received by a person who is also an individual entrepreneur applying a special regime, tax is withheld in the usual manner.

When payments are made to non-residents and residents in the same period, amounts calculated at different rates are indicated separately in the reporting.

When setting the rate, the following conditions are taken into account:

- Possibility of changing a person’s status during the reporting year. Change can occur in both categories.

- Determination of the rate depending on the category of the recipient confirmed at the time of receipt of the amounts.

- The final determination of status is made at the end of the annual period. At the same time, the tax is recalculated from the beginning of the year based on the actual status data.

Information on dividends received must be reflected separately from information on other income. An important condition for income taxation is the inability to obtain a tax deduction if a person does not have other income.

Personal income tax on dividends

The tax rate on dividends depends on the status of the recipient of the founders' payments. If he is a resident of the Russian Federation, then a rate of 13% should be applied; if the recipient is not a resident, then the rate is 15%. The exception applies only to agreements to avoid double taxation concluded with foreign countries. It is necessary to determine what status the recipient of the founding payment belongs to at the time of its distribution.

Important! For residents of the Russian Federation, the personal income tax rate on dividends is 13%, for non-residents – 15%.

A resident in the Russian Federation is a person who stays on the territory of Russia for at least 183 calendar days within 12 consecutive months. The time spent by a person in the Russian Federation is not interrupted if leaving the Russian Federation is due to the following reasons:

- Training or treatment, the duration of which is less than 6 months;

- Performing duties related to work (services) on offshore hydrocarbon deposits.

In addition, the following persons are also recognized as residents, regardless of the time of their stay in the Russian Federation:

- Russian military personnel who serve abroad;

- Officials who were sent abroad.

Formation of information in section 1 of form 6-NDFL

The amount of information in Section 1 of Form 6-NDFL depends on the rates applied when assessing amounts at the time of their payment. If an organization has transactions for non-residents and residents, the amounts must be reflected separately. For each bet, a separate block is filled in on lines 010 to 050.

| Line number | Information reflected in the line |

| 010 | The amount of the applied rate |

| 025 | The amount of dividends paid since the beginning of the reporting year, including personal income tax |

| 020 | The amount of income received by an individual, including the amount of amounts received reflected in line 025 |

| 030 | The amount of tax benefits - deductions provided to a person by an organization |

| 045 | Amount of tax withheld |

| 040 | The amount of personal income tax calculated from the income reflected in line 020 |

| 060 | List of recipients of amounts. Employees dismissed within a year and re-employed are indicated once |

| 070 | Total personal income tax amount |

| 080 | The amount of tax calculated but not withheld. The amount is recorded on an accrual basis. |

In case the data of section 1 takes up more than a page, lines 060, 070, 080 point to 1 page. If an unwithheld tax arises and there is no way to withhold it, the organization must notify the person and the Federal Tax Service within a month.

Dividends on account of profits received from previous periods

As is generally accepted, shareholder payments are made once a year at the end of the tax period. If the company has retained earnings, dividend payments may not be made every year, and this will be completely legal.

Accrual and transfer of amounts for dividends are carried out according to calculations reflected in accounting and reporting. When allocating a company's profit for previous periods, accountants should be sure that it does not cover the costs of previous years. If such an amount has accumulated in the current account of the joint-stock company, then, by decision of the board of shareholders, this amount is sent to the participants. There are no restrictions under tax legislation on the payment of dividends from profits received for previous years.

If we talk about an LLC, then the decision to pay dividends can be made by a meeting of participants based on the results of the quarter, not the year. Consequently, the decision to pay dividends against the profits of previous years can be made at any time.

To summarize, we note that the reflection of dividends in the 6-NDFL report depends on the applicable tax rates and the legal form of the company that makes such payments. For each of them, an appropriate procedure has been established for transferring amounts of money and reflecting them in tax reporting.

Similar articles

- Report 6-NDFL

- Personal income tax on dividends - rates and BCC

- Determination of a tax agent for income tax

- Personal income tax on dividends

- Does the individual entrepreneur submit 3-NDFL to the simplified tax system?

Filling out section 2 of the form

The information in section 2 is formed based on the indicators of the reporting 3 months. When presenting information, it is not necessary to generate data from the beginning of the reporting year. Information for a particular reporting period is reflected in section 2.

| Line number | Information reflected line by line |

| 100 | Date of payment or issuance in property form |

| 110 | The personal income tax withholding day coinciding with the calculation. When issuing a tax deduction, a date with zero data is entered |

| 120 | The date of transfer of the withheld tax, set as the day following the calculation or indicating a zero format similar to line 110. If the date falls on a weekend, the first working day is indicated |

| 130 | Dividend amount |

| 140 | Tax amount |

The company is allowed to issue required dividends in non-monetary form in the event that there are no funds in the company’s account. In reporting, the issue date is the day the assets are actually transferred. The possibility of making settlements with property must be determined by the constituent documents.

The value of the transferred property must correspond to market valuation. When filling out data in the reporting on line 140, there is no total indicator, “0” is indicated. Withholding is carried out for other payments to a person made in cash.

We reflect dividends in Section 2

Unlike the date indicated for the actual payment of wages, as the last day of the month in which the accrual was made, the date of actual receipt of dividends is indicated as the date of actual receipt of cash payments. On the day the money is received in the employee’s bank account, or on the day the funds are issued in person, personal income tax must be withheld; it turns out that these two dates will be identical (line “100” and “110”).

It should be noted that if among the recipients of dividend payments there are residents of the Russian Federation and non-residents of the Russian Federation, then Section 1 of the form will be filled out twice at two tax rates. But in the second block of Section 1, the amount is reflected once for all tax rates on the first sheet after the title page. However, in Section 2 there is no need to make any divisions. The dates of actual payment of income and the dates of transfer of tax amounts are entered in chronological order and do not depend on the number of completed Sections 1.

Features of filling out the form when there is a discrepancy between deadlines

Unlike LLCs, in which the payment of dividends and tax withholding must coincide in date, in a JSC personal income tax is transferred within a month. If the JSC's calculations and tax transfers do not coincide across reporting periods, the data is indicated in different quarters.

An example of how amounts are reflected in reporting

The enterprise JSC "Salut" made dividend payments to the company's shareholders in the amount of 325,000 rubles. Payments to shareholders were made on June 15, tax amounts were transferred on July 5. Data are presented in reporting based on the results of the 2nd and 3rd quarters.

The financial statements of JSC Salyut for the 2nd quarter reflect the following lines:

- 020 – dividends in the amount of 325,000 rubles;

- 040 – accrued tax in the amount of 42,250 rubles;

- 070 – the amount of personal income tax on dividends in the total composition of withheld taxes.

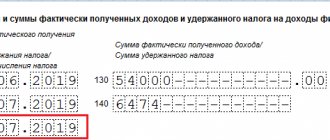

In the reporting of JSC Salyut for the 3rd quarter:

- 100 – June 15;

- 110 – June 15;

- 120 – July 5;

- 130 – 325,000 rubles;

- 140 – 42,250 rubles.

In form 6-NDFL for the 2nd quarter, the amount of the transferred tax is not reflected; only 1 section is filled out. Information on repayment of obligations is indicated in the 3rd quarter.

Example of filling out 6-NDFL for dividends

How should 6-NDFL be filled out for a JSC when paying dividends?

In accordance with the report generation algorithm (approved by order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected] ), summary data on the amounts of payments to individuals, including dividends, are reflected in 6-NDFL in section 1.

For the report form in the latest edition, see the material “Attention! New form 6-NDFL.”

To enter data into 6-NDFL on dividends, the following are provided:

- page 025 - information on the total amount of accrued dividends for the period;

- page 045 - information about personal income tax withheld from dividend amounts.

Note that these lines are decoding information showing the volume of dividends and taxes on them in the total volume of income and tax withholdings for all individuals:

- page 025 reveals the amount of dividends included in the final indicator for the amounts of income on page 020;

- page 045 contains information on the amount of personal income tax on dividends in the entire amount of calculated personal income tax indicated on page 040.

Before reflecting dividends in 6-NDFL, you should familiarize yourself with the proposed algorithm for forming the 1st section of 6-NDFL for JSC:

- Page 020 - reflects the amount of income received by individuals on an accrual basis from the beginning of the year. Wherein:

- The line includes all income in respect of which the JSC acts as a tax agent: both in terms of dividends and in terms of all other types of payments to individuals (for example, salaries), i.e. data from both Appendix 2 to the profit declaration and from 2 -NDFL.

- As many sections of 1 report must be completed as the number of tax rates that were applied. That is, if dividends were due to non-resident individuals, a separate section is formed for them.

Read more about the nuances of filling out line 020 of 6-NDFL in the article “Procedure for filling out line 020 of form 6-NDFL” .

- Page 025 - information on the amount of dividends included in the indicator on line 020 is indicated.

- Page 040 - information is provided about the withheld personal income tax from the amounts shown on line 020.

- Page 045 - it is clarified what amount of personal income tax on dividends is included in the indicator on line 040.

- Page 070 - Personal income tax on dividends is included in the generalized indicator of withheld tax (since dividend payments, as a general rule, are made without withheld personal income tax).

Errors that occur when reflecting dividends

When entering data on the taxation of dividends into reporting, errors may occur, the most common of which include:

- Section 2 is completed only during the tax transfer period. Data are not included in later periods during the year.

- Entering information into section 2 when calculating tax on the last day of the quarter.

- Indication in the composition of payments of amounts that are not dividends. Information on payments accrued disproportionately to the shares of participants, in case of incomplete payment of the authorized capital, liquidation of the enterprise within the limits of the contribution share and in other cases established by law is not reflected.

- Inclusion in the list of recipients of persons who do not have the right to receive amounts, for example, those who were not included in the list of shareholders on the date of the decision on payments.

When making calculations, difficulties arise in establishing the date of actual payment. The settlement day determines the period for reflecting the data in the reporting form.

Determining the payment date

Issuing dividends through the company's cash desk or to the recipient's personal bank account allows you to accurately determine the date of payment. Controversial issues of establishing the date of settlements arise in situations:

- Sending amounts to the recipient by postal order. The payment date is considered the day the funds are sent, regardless of the date the person receives the amount. The budget is settled the next day after the transfer is sent. The transfer of amounts is made at the place of registration of the organization making the payments.

- Payments of amounts to the founder excluded from the composition. The day of settlement is considered to be the date of actual disbursement of funds in a manner similar to transactions with existing participants.

- Transfers of dividends to a specially opened bank account under an agency agreement. The date of issue is the day the amounts are transferred to the JSC for subsequent receipt by shareholders. The fact that funds are received or returned to the company’s account due to the expiration of the agreement does not affect the tax collection procedure.

The procedure for settlements and the establishment of payment dates are determined by the meeting of shareholders, founders and statutory documents. Exceeding the amount over the approved amount or changing the order of operations without the consent of all members is not carried out. To transfer amounts to a salary project card, an application from the person is required.

Accountant's Directory

Personal income tax on dividends is transferred no later than the next day after the amount is paid to the founder (clause 6 of Article 226 of the Tax Code). It does not matter whether the money was issued from the cash register or transferred to the card of the participant himself or a third party indicated by him.

For example, if amounts were paid on April 5, 2020, then personal income tax on them must also be paid on April 5 or April 8, taking into account holidays that fall out. If settlements with the founders in 2020 took place on April 4, then the deadline for payment will be Friday, April 5.

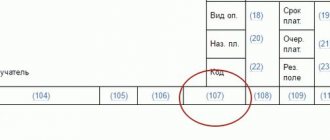

It is precisely according to the deadline established for settlements with the budget that the operation falls into section 2 of form 6-NDFL. This is important to remember when you need to reflect carryover amounts - payments at the junction of quarters. Indeed, the second section contains transactions for the last three months of the reporting period/year. And it is wrong to include unnecessary operations in the section.

When the established deadline for settlements with the budget falls on a weekend or holiday, the deadline is legally postponed to the next working day (Clause 7, Article 6.1 of the Tax Code). This is the date that should appear in section 2. Below, using an example for 2020, you will see how this rule works in practice.

https://youtu.be/i56Wg3XwRSg

Reflect dividends on lines 100-140 separately from wages, even if this happens - you paid out all the amounts together. The reason is that the date of receipt of income from the salary is different - not the payment day, but the last calendar day of the month for which the calculation is made. In addition, the nature of the payments is completely different.

Take note: in a joint stock company, personal income tax must be transferred no later than 1 month from the date of payment of dividends (clause 9 of Article 226.1 of the Tax Code).

Dividends in 6-NDFL: example of filling in 2020

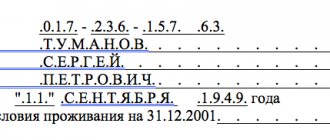

At the end of the second quarter of 2020, Dom LLC received a net profit of 150,000 rubles. On July 9, 2019, the general meeting of founders decided to use this amount to pay dividends.

The authorized capital of the company is divided equally between two participants:

50% belongs to director A.N. Petrov – citizen of the Russian Federation;

50% is in the possession of US citizen I.N. Petrova, who is not listed among the staff of the Dom society.

As of July 9, 2020, the accountant of Dom LLC accrued the following amounts of income in accounting:

Debit 84 Credit 70

– 75,000 rub. (RUB 150,000: 50%) – income accrued to Petrov;

Debit 84 Credit 75-2

– 75,000 rub. (RUB 150,000: 50%) – Petrova’s income is accrued.

On July 12, the amounts were paid by bank transfer. For personal income tax accounting purposes, this date is considered the day the income was received and will be entered by the accountant in the personal income tax register. On the day of payment, entries were made on income tax withholding:

Debit 70 Credit 68

– 9750 rub. (RUB 75,000: 13%) – tax was withheld from payments to Petrov;

Debit 75-2 Credit 68

– 11,250 rub. (RUB 75,000: 15%) – deduction was made according to Petrova.

A total of RUB 21,000 was withheld. (9,750 rub. + 11,250 rub.).

The calculations themselves, taking into account the amounts withheld, are also reflected:

Debit 70 Credit 51

– 65,250 rub. (75,000 rubles – 9,750 rubles) – the amount was paid to Petrov;

Debit 75-2 Credit 51

– 63,750 rub. (75,000 rubles – 11,250 rubles) – settlement with Petrova was made.

Personal income tax must be transferred to the budget, taking into account the weekend, on July 15.

For each income rate, the accountant filled out Section 1. Section 2 was completed without division by rates. And all amounts are shown in one block, since all three dates coincide - dividends to both residents and non-residents were paid on the same day. This means that there will be one date for withholding the tax and the deadline for transferring it to the budget.

The entire operation takes place in July, that is, the third quarter of 2020. The accountant filled out section 2 of form 6-NDFL for 9 months of 2020 for this operation as shown in the sample.

The company paid only part of the dividends

The company held a meeting of participants and distributed dividends. In the second quarter, it paid only part of the dividend.

For dividends, the date of receipt of income is considered the day when the company paid the money (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Therefore, in sections 1 and 2 of the calculation, reflect only that part of the dividends that the participants actually received.

Dividends are taxed at the same rate of 13 percent as wages, so the company adds dividends to income for the reporting period and reflects them in line 020. In addition, dividends must be shown in a separate line - 025. Show calculated personal income tax in lines 040 and 045. B Line 070 reflect the tax that was withheld in the reporting period.

In lines 100 and 110 of section 2, enter the date of payment of dividends (clause 4 of article 226 of the Tax Code of the Russian Federation). Line 120 shows the next business day. In line 130, write down the amount that was given to the founders, in line 140 - the withheld personal income tax. If the company issued dividends on different days, fill out several lines 100–140.

For example

Source: https://1atc.ru/dividendy-v-6-ndfl-2/

Sanctions for violation of reporting conditions

The Federal Tax Service provides for the imposition of penalties on organizations that perform their duties in bad faith.

| Violation | Amount of fine | Explanations |

| Submitting reports late | 1,000 rubles for each month in full or in part | Failure to comply with reporting requirements may result in the seizure of your current account. |

| Indication of data recognized as unreliable | 500 rubles | Any distortion of data, including details, is considered false information. |

Agents who independently discover inaccuracies in the tax information provided may be exempt from sanctions established by the Tax Code of the Russian Federation. Reliable data must be presented in the updated calculation. The penalty is lifted if the agent corrected the information before the Federal Tax Service Inspectorate discovered the unreliability of the reporting data.

Tax agents for dividends

The responsibility to withhold income from dividends rests with the tax agent, i.e. the organization that paid the income. In this case, income tax must be calculated separately for each income recipient. Tax is withheld at the time of actual payment of income, including when amounts are credited to the taxpayer’s bank account. If the recipient, for any reason, decides to refuse to receive the profit, personal income tax in any case must be withheld on the day of refusal.

In the event that the tax agent does not withhold in full or within the agreed time frame, the organization may be subject to a fine of 20% of the amount of personal income tax not transferred.

Example 1. Profit to be distributed to Rassvet LLC is 750,000 rubles. The founders of the company are three individuals: two residents of the Russian Federation with shares of 40% and a non-resident with a share of 20%. Based on the accrual results, Russian founders are entitled to 300,000 rubles minus the withholding tax of 13%, equal to 39,000 rubles from each payment. Dividends in favor of a foreign citizen are equal to 150,000 rubles. Withholding tax - 22,500 rubles.

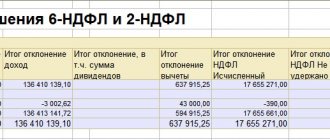

Based on the results of payments and withholding of personal income tax, tax agents are required to submit calculations and certificates of accrued amounts of income and withheld income in the following forms:

- 2-NDFL, compiled annually for each person;

- 6-NDFL has been provided quarterly since 2020 and reflects the total amounts of accrued and withheld tax for an organization (or individual entrepreneur).