When is severance pay paid upon dismissal?

What is severance pay upon dismissal? The Labor Code of the Russian Federation contains a list of situations when an employer must pay additional severance pay to an employee upon termination of an employment contract:

- refusal to work in updated conditions resulting from technological or organizational changes at the enterprise (clause 7, part 1, article 77);

- reluctance to change place of work for medical reasons (clause 8, part 1, article 77);

- the inability of an employee to move with colleagues to another region (clause 9, part 1, article 77);

- liquidation of the employer (clause 1, part 1, article 81);

- reduction of employees (clause 2, part 1, article 81);

- joining the army (clause 1, part 1, article 83);

- return of the former employee to the workplace by court decision (part 2, paragraph 1, article 83);

- inability of an employee to perform job duties due to disability (Part 5, Clause 1, Article 83).

Dismissal at your own request

Every citizen has the right to voluntarily terminate an employment contract; the employer is notified of this 14 days in advance. If an employee leaves the company of his own free will, he is not entitled to any benefits.

All he can receive is payments upon dismissal of his own free will, which include compensation for unused vacation and wages for days worked. An exception in this case would be an employment contract that stipulates additional payments upon dismissal.

https://youtu.be/RUkCP_GR4vg

How to calculate severance pay upon dismissal

Currently, the legislation provides for three months (in fact, it can be up to six months, more on this below) and two weeks (for example,

severance pay upon leaving the army) severance pay. That is, the amount of compensation can be equal to the average two-week or three-month (total) earnings. Therefore, when calculating the final amount of benefit payment, it is necessary to calculate the employee’s average daily earnings, which, depending on the conditions of dismissal, will be multiplied by one or another indicator, depending on the reasons for termination of the contract. For example, how to calculate disability benefits?

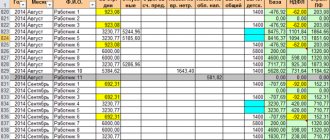

Step 1. Determine average earnings

We divide the accrued payments for the year by the days worked for the billing period. Read more in the article “Calculations upon dismissal.”

Step 2. Calculate benefit payment

If an employee quits due to disability or, in other words, for medical reasons, then, according to Article 178 of the Labor Code of the Russian Federation, he is paid two weeks' average earnings. Therefore, we multiply the average daily rate by the number of working days in the first two weeks after the “separation” and get the amount of severance pay to be paid. In this case, the calculation excludes Saturdays and Sundays (weekends) or other holidays on which a person would not work according to the schedule.

Everything is clear with weekends, but how to calculate if the month for which severance pay is paid has non-working holidays, for example, as is considered

severance pay for cumulative working hours? So, in January, non-working holidays are days from the 1st to the 8th, in February there is a holiday on February 23rd, and in May workers have a rest on the 1st and 9th. How to calculate payments in this case: taking into account these days or without them? The legislative situation has not yet been settled and is still controversial. There are two positions in particular, both supported by court decisions. The first says that the holidays approved by Art. 112 of the Labor Code of the Russian Federation does not need to be included in the calculation of severance pay, since the employee did not work on these days. This opinion and its rationale can be read, for example, in the Appeal Ruling of the Moscow City Court dated December 16, 2016 in case No. 33-48738/2016.

On the other hand, there are many opposing court decisions, from which it follows that holidays must also be taken into account and benefits must be paid taking them into account. One of the latest such decisions is the Appeal ruling of the Yaroslavl Regional Court dated April 16, 2018 in case No. 33-1984/2018. In rendering its verdict, the judicial panel referred to the fact that the presence of holidays cannot become a reason for reducing wages (salaries) for employees. And on this basis, the court decided to pay severance pay to the employee dismissed due to staff reduction, taking into account non-working holidays.

Step 3. Payment of severance pay

The employer transfers the amount received on the employee’s last day of work, which coincides with the day of termination of the contract. If dismissal is issued on a weekend, the date of the order cannot be postponed. Therefore, all payments must be made either on a non-working day or in advance - on the last working day before the employee leaves.

You can read more about dismissal on a day off here.

In what cases is the benefit provided?

Labor legislation obliges employers to make the necessary payments upon dismissal of an employee if the contract is terminated in the following cases:

- Liquidation of the organization.

- Staff reduction.

- Conscription of an employee for military service.

- Reinstatement by decision of the court or labor inspectorate.

- Refusal to move to another locality.

- Refusal to transfer to another position for medical reasons.

- Recognition of an employee as incapacitated for medical reasons.

- Refusal to work when working conditions change.

- Reduction of a manager due to the fault of the founders.

- Termination of an employment contract upon change of ownership.

- The employer made mistakes when concluding an employment contract, in which the employee could not move to another position for medical reasons, a court decision for citizens who do not have educational documents or were deprived of the right to engage in this activity.

In the next two months after termination of the contract, the person is paid compensation, the amount of which is the average salary. If a person is registered with the employment center, the payment of compensation is extended to three months.

The average monthly salary is paid to those employees whose dismissal was caused by a violation of the contract. The manager and chief accountant who were fired are paid compensation in the amount of three average salaries. In other cases, the payment is the amount of two weeks' salary. Citizens who are employed in seasonal work are also included in this category.

Severance pay upon retirement

At the moment, this is a very relevant request on social networks and on specialized websites. In fact, the Labor Code of the Russian Federation does not provide any additional guarantees in terms of money for pensioners upon dismissal. And in general, to quote one well-known politician, the state does not owe such workers anything. However, a local regulatory act, the same regulation on remuneration, may provide for a separate payment in these circumstances. In addition, when a person retires for a well-deserved retirement (each case, of course, is individual), the employer has the right to reward the employee for conscientious and long-term work. The list of possible awards contains Article 191 of the Labor Code of the Russian Federation, which lists such types of incentives as

- Gratitude;

- cash bonus;

- valuable gifts;

- certificates of honor, etc.

In addition, the Labor Code of the Russian Federation does not say that it is possible to apply only one type of incentive; you can apply all of them at once. Therefore, as we can see, there would be a desire, and there are opportunities to add money to a retiring pensioner (if finances allow).

Amount of payments upon dismissal

The Labor Code applies to all organizations, including individual entrepreneurs. The amount of dismissal payments depends entirely on the position of the dismissed person and his salary and is equal to the average salary for one month.

If the dismissal occurs due to staff reduction or liquidation of the enterprise, then the amount of payment must be at least 1 salary. An increase in payment is made only by decision of the manager. Also, at the discretion of the manager, payments upon dismissal are made by agreement of the parties. Compensation is issued on the day of dismissal and can be paid for no more than 3 months.

Dismissal of management positions is carried out under different conditions. That is, if the dismissal is carried out at the request of the owner of the enterprise, then the payment is made in three times the salary. But the payment can be canceled for a number of special reasons, such as: the manager’s guilt is proven - theft, tardiness, absenteeism, or the terms of the contract were violated.

Other cases of benefit payment

Separately, it is worth mentioning the option of reinstating a former employee to his previous position; severance pay upon reinstatement is a combination of two related payments:

- payment for forced absence for the entire period from the moment of dismissal until the moment of reinstatement;

- compensation for moral damage.

The first is calculated based on the employee’s average earnings for the 12 calendar months preceding the illegal dismissal; for more details, see Article 234 of the Labor Code of the Russian Federation and our text. The second payment is calculated by the court according to the rules of Article 1101 of the Civil Code of the Russian Federation.

For clarity and convenience, we will arrange the reasons for dismissal and the amount of benefits in the form of a table:

| No. | Grounds for dismissal | Benefit payment amount |

| 1 | Liquidation (clause 1, part 1, article 81 of the Labor Code of the Russian Federation), reduction in number (clause 2, part 1, article 81 of the Labor Code of the Russian Federation) | Average monthly earnings |

| 2 | Violation of the rules for concluding an employment contract through no fault of the employee (if it is impossible to continue working (clause 11, part 1, article 77 of the Labor Code of the Russian Federation) | |

| 3 | Refusal to transfer for medical reasons (clause 8, part 1, article 77 of the Labor Code of the Russian Federation) or recognition of the employee as completely incapacitated (clause 5, part 1, article 83 of the Labor Code of the Russian Federation) | Two-week average earnings |

| 4 | Conscription for military service (clause 1, part 1, article 83 of the Labor Code of the Russian Federation) | |

| 5 | Reinstatement of a former employee (clause 2, part 1, article 83 of the Labor Code of the Russian Federation) | |

| 6 | Refusal to transfer to another location (clause 9, part 1, article 77 of the Labor Code of the Russian Federation) | |

| 7 | Technological changes (clause 7, part 1, article 77 of the Labor Code of the Russian Federation) |

Procedure for payment of compensation

Article 178 part 1 of the Labor Code of the Russian Federation was recognized as inconsistent with the Constitution. The regulatory document does not establish uniform conditions for receiving benefits. The amount of compensation is determined depending on the reason for termination of cooperation, the average profit of an individual, the number of days worked per month, and the territorial affiliation of the legal address of the enterprise.

Payment terms, amount

Article 178 of the Labor Code of the Russian Federation defines the periods when the director is obliged to accrue compensation in case of unscheduled dismissal. The minimum period is 60 days. When liquidating a company or reducing staff, the employer must transfer funds in the amount of average income for the current period. Financial assistance is provided for no more than 2 months. The period is increased to a quarter if, after termination of the contract, the citizen registered with the employment center, where he was not provided with a vacancy within 2 weeks. For residents of the Far North, payments are allowed for six months, subject to registration at the labor exchange.

The amount of the benefit is determined by the basis for dismissal reflected in the order. If the company's activities are terminated, the number of employees is reduced, or the rules for concluding a contract are violated due to the fault of the manager, an average profit is paid. Exceptions are seasonal workers and citizens working under a fixed-term agreement.

It is important to know! Persons operating during a specified period of the year receive compensation for 2 weeks. For employees who have signed an agreement for a period of no more than 2 months, benefits are accrued according to the rules of the local regulatory document. If the drawn up act does not indicate the conditions for issuing a subsidy, payment is not made.

According to Article 178 of the Labor Code, certain categories of citizens are entitled to compensation, the amount of which is the average profit for 2 weeks. Reasons for calculating the reduced amount:

- employee refusal to accept an alternative position;

- conscription;

- reinstatement of an employee after illegal dismissal;

- disagreement with a change of place of residence;

- inability to perform official duties as determined by a doctor;

- changing clauses of the agreement.

https://youtu.be/fI11DfghJIQ

To calculate, the average income per day must be multiplied by the number of working days following the month after dismissal. When establishing the amount of compensation, the period of labor activity is taken into account. The length of time spent on annual leave or sick leave, as well as holidays and weekends are not taken into account when calculating. The tax is levied on benefits amounting to three times the average income of a citizen. Insurance premiums are not deducted from compensation.

Supporting documents

There is a procedure for providing a subsidy upon termination of the agreement. To receive financial assistance, you must have documents confirming the termination of cooperation:

- warning on behalf of the manager about the upcoming dismissal;

- the employee’s consent to cancel the contract if notified by the employer earlier than 2 months before termination of cooperation;

- dismissal order;

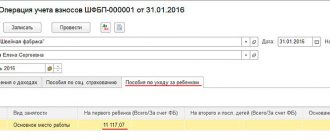

- note-calculation form T-61;

- primary cash document on financial transfer.

To receive funds after dismissal before the next employment, the employee must have supporting documents. Based on a written application and a copy of the work record book, the former employer is obliged to provide financial support. If after 3 months a citizen has not found a job, he has the right to demand compensation if he has a certificate of registration on the stock exchange within 2 weeks after the termination of cooperation.

Attention! Labor Code art. 178 with comments allows for an increase in the period of registration with the employment center in the event of deterioration of health, assignment of government duties.

Calculation notes for form T-61 can be found here.

When severance pay is not paid

Severance pay may not be paid when it is expressly provided for by law (see table above and first section). However, not all employers profess this approach in relations with their staff and independently decide to expand the list of reasons when money is paid in an increased amount upon dismissal. For example, in the wage regulations, the employer may provide

severance pay upon voluntary dismissal if the employee has worked for the company for more than five years. In fact, there could be any reason; we only strive to show that relations with employees should not be limited only to the norms of the labor code. This is a partnership, so first of all it must be mutually beneficial. However, it happens that one of the parties upsets the balance, and then the second party (in this case the employer) has every right to reduce its social, moral and financial obligations. In other words, there are cases when an employer may not pay benefits upon dismissal:

- the employee failed the hiring test;

- termination of an employment contract due to guilty actions or loss of trust;

- termination of employment relations before the deadline established by the parties;

- fixed-term employment relationships up to six months, etc.

Naturally, you will not find anything like this in the Labor Code of the Russian Federation, but the code allows employers to adopt their own local regulations that do not contradict the norms of the law, and this state of affairs does not contradict the current legislation.

There are also nuances regarding payments, for example related to seasonal workers and workers who work in the Far North. These nuances relate to payments for the period of employment after dismissal. We will also look at the table for convenience, let’s immediately discuss that the amount of the payment is the average monthly salary, paid every month (until the moment of employment, there are some nuances, more details here).

| No. | Personnel category | For what period is it paid? |

| 1 | Standard worker | Up to three months (Article 178 of the Labor Code of the Russian Federation) |

| 2 | Worker from the Far North | Up to six months (Article 318 of the Labor Code of the Russian Federation) |

| 3 | Seasonal workers, including those hired for up to 2 months | Not paid |

| 4 | Part-timers |

Article 178. Severance pay

1. Severance pay is a sum of money paid to an employee on the day of dismissal - the last day of work.

2. Parts 1 and 2 art. 178 establish a unified procedure for the payment of compensation upon termination of an employment contract in connection with the liquidation of an organization and a reduction in the number or staff of the organization’s employees.

Maintaining the average monthly earnings for the period of employment, but not more than two months from the date of dismissal, with severance pay included, means that the average earnings are paid for the second month of the employee’s non-employment.

A citizen enjoys the right to receive the average salary for the second month after dismissal, regardless of the reasons for the delay in employment. He may refuse a job in the same organization offered by the manager before dismissal, or a job offered by employment authorities after dismissal.

3. The two-week period established for applying to the employment agency is extended if the citizen, for valid reasons, for example, in the case of temporary disability, performance of state and public duties, was unable to apply there in a timely manner. If the employment authorities do not have the opportunity to offer a dismissed employee (including those receiving an old-age pension) a suitable job, he is issued a certificate, on the basis of which his average earnings for the third month after dismissal are retained. If a citizen twice, without good reason, refuses offers of suitable work, then the certificate is not issued and the average earnings for the third month are not retained.

According to Art. 4 of the Employment Act, such work is considered suitable, incl. work of a temporary nature, which corresponds to the professional suitability of the employee, taking into account the level of his qualifications, the conditions of the last place of work (with the exception of paid public works), state of health, and transport accessibility.

Paid work, including temporary work and public works, which requires or does not require (taking into account the age and other characteristics of citizens) preliminary training, meeting the requirements of labor legislation and other regulatory legal acts containing labor law norms, is considered suitable for citizens:

- those looking for work for the first time (who have not previously worked) and at the same time do not have qualifications; dismissed more than once within one year preceding the start of unemployment, for violation of labor discipline or other guilty actions provided for by the legislation of the Russian Federation; those who have ceased individual entrepreneurial activity or left the members of a peasant (farm) enterprise in the manner established by the legislation of the Russian Federation; those seeking to resume work after a long (more than one year) break, as well as those sent by the employment service for training and expelled for guilty actions;

— those who refused to undergo vocational training or receive additional vocational education after the end of the first period of payment of unemployment benefits;

- registered with the employment service for more than 18 months, as well as those who have not worked for more than three years;

— those who contacted the employment service after the end of seasonal work.

A job cannot be considered suitable if: it involves a change of place of residence without the consent of the citizen; working conditions do not comply with labor protection rules and regulations; the proposed earnings are lower than the average earnings of a citizen calculated over the last three months at the last place of work. This provision does not apply to citizens whose average monthly earnings exceeded the subsistence level of the working-age population, calculated in a constituent entity of the Russian Federation in the prescribed manner. In this case, a job cannot be considered suitable if the salary offered is below the subsistence level calculated in a constituent entity of the Russian Federation in the prescribed manner (Article 4 of the Employment Law).

The organization pays the average salary saved for the period of employment upon presentation of a passport and work book, and for the third month from the date of dismissal - a certificate from the employment service. When a citizen is employed during the second or third months from the date of dismissal, he retains the average earnings for the actual number of days of unemployment. Additional financial assistance provided by the employer to a dismissed employee is not taken into account when paying him the average salary for the period of employment.

When assigning a citizen the status of unemployed, employment authorities do not take into account the payment of severance pay, as well as the average salary retained for the period of employment (Article 3 of the Employment Law).

4. The legislator reduces the amount of severance pay to the amount of two weeks’ average earnings upon termination of an employment contract on the grounds specified in Part 3 of Art. 178. The reason for the termination of labor relations is also objective factors, for example, the conscription of an employee for military service or his assignment to an alternative civilian service that replaces it, or the reinstatement of an employee who previously performed this work.

In contrast to the termination of an employment contract in the event of a reduction in the number or staff of employees (clause 2, part 1, article 81 of the Labor Code), termination of an employment contract if the employee refuses to continue working due to a change in the terms of the employment contract determined by the parties, or the employee refuses to be transferred to another work required by him in accordance with a medical report, or the employer does not have the corresponding work (clauses 7, 8, part 1, article 77 of the Labor Code) is also possible during the period of temporary incapacity for work of the employee, therefore the payment of severance pay may not coincide with the date of publication order to dismiss an employee. Based on Part 1 of Art. 140 of the Labor Code, if the employee did not work on the day of dismissal, the corresponding amounts must be paid no later than the next day after the dismissed employee submits a request for payment. At the same time, by virtue of Part 6 of Art. 84.1 of the Labor Code, upon a written request from an employee who has not received a work book after dismissal, the employer is obliged to issue it no later than three working days from the date of the employee’s application.

In addition to the grounds for termination of the employment contract specified in Art. 178, severance pay in accordance with Part 3 of Art. 84 of the Labor Code is paid upon termination of an employment contract due to a violation of the mandatory rules for concluding an employment contract established by the Labor Code or other federal law, if this violation excludes the possibility of continuing work (clause 11, part 1, article 77 of the Labor Code). Severance pay is paid in the amount of average monthly earnings if the violation was caused by the employer. If the violation occurred through the fault of the employee, then severance pay is not paid to him.

The legislator does not in all cases use the term “severance pay” when defining the payment of compensation to an employee upon dismissal. So, according to Art. 181 of the Labor Code, in the event of termination of an employment contract with the head of the organization, his deputy and the chief accountant in connection with a change in the owner of the property, compensation is paid in the amount of not less than three average monthly earnings of the employee. Based on Art. 279 of the Labor Code, in the event of termination of an employment contract with the head of an organization in connection with the adoption by an authorized body of a legal entity, or the owner of the organization’s property, or a person (body) authorized by the owner of a decision to terminate the employment contract, he is paid compensation in the amount determined by the employment contract, but not less than three times average monthly earnings.

5. If you are dismissed due to an unsatisfactory result of the hiring test, the employment contract is terminated without payment of severance pay (see commentary to Article 71).

An employee who has entered into an employment contract for a period of up to two months is not paid severance pay. The right to receive severance pay for this category of workers may be established by federal laws, a collective agreement or an employment contract (see commentary to Article 292).

When employees engaged in seasonal work are dismissed due to the liquidation of an organization, reduction in the number or staff of employees, severance pay is paid in the amount of two weeks' average earnings (see commentary to Article 296).

Upon termination of an employment contract with an employer who is an individual who is not an individual entrepreneur, the cases and amount of severance pay paid are determined by the employment contract (see commentary to Article 307).

On the payment of severance pay, the retained average monthly salary for the period of employment to an employee dismissed due to the liquidation of an organization or a reduction in the number or staff of employees of an organization located in the Far North and equivalent areas, see commentary. to Art. 318.

The payment of severance pay to an employee of a religious organization is determined by the employment contract concluded with him (see commentary to Article 347).

On maintaining the average salary for the period of employment for a released trade union worker after the end of his term of office, see the commentary. to Art. 375.

Severance pay in the amount of average monthly earnings, as well as average monthly earnings for the period of employment, paid in accordance with Art. Art. 178 and 375 of the Labor Code, being compensation payments related to the dismissal of an employee, are not subject to personal income tax.

6. Commanders of military units are given the right to dismiss workers (including pregnant women and women having children) in the manner established for employees released during the liquidation of an enterprise, institution, or organization. For the second and third months of the employment period, these employees are paid the average salary provided for by current legislation upon release in connection with the liquidation of an enterprise, institution, organization, simultaneously with the payment of severance pay upon their dismissal from work (Decree of the President of the Russian Federation of September 7, 1992 N 1056 " On the procedure for dismissing employees during the redeployment of military units and paying them benefits and compensation”).

The wives of military personnel undergoing military service under a contract on the territory of the Russian Federation are paid severance pay at the place of military service of their husbands in the amount of two months' average salary in cases where their termination of the employment contract is due to the movement (transfer, secondment) of military personnel to a new place of military service to another locality of the Russian Federation or the former USSR (Order of the Russian Ministry of Defense dated July 11, 2002 N 265 “On payment to the wives of military personnel serving under contract, severance pay in cases of termination of their employment contract in connection with the movement of military personnel to a new place of military service in another locality ").

Wives of military personnel undergoing military service under a contract on the territory of the Russian Federation are paid severance pay at the place of military service of their husbands in the amount of two months' average salary in cases where their termination of the employment contract is due to the transfer of their husbands to a new place of military service in another locality of the Russian Federation or former USSR. The payment of severance pay to the wives of military personnel is made by the security authorities, in which their husbands are serving in military service on the day they apply for this benefit. To assign severance pay, a serviceman submits a report upon command, to which is attached a certificate of his wife’s average salary, and presents her work record book with a record of dismissal from work at his own request in connection with his transfer to a new place of military service in another locality or duly certified in the form of an extract from the work record book. When assigning severance pay to a serviceman’s new place of military service, a certificate is additionally attached to the report indicating that his wife is not provided with severance pay at her previous place of military service. Payment of severance pay to the wives of military personnel by security agencies stationed outside the Russian Federation is made in accordance with the established procedure in rubles (Order of the FSB of Russia dated May 8, 2008 N 229 “On strengthening the social protection of military personnel of the federal security service agencies”).

A retired or retired judge is paid severance pay based on the monthly monetary remuneration for the last position for each full year of work as a judge, but not less than six times the monthly monetary remuneration for the position being left. In this case, for a judge who has previously resigned or retired, only the time spent working as a judge that has passed since the end of the last resignation is taken into account (Article 15 of the Law on the Status of Judges).

Employees of organizations and (or) facilities, other legal entities located on the territory of a closed administrative-territorial entity, released in connection with the reorganization or liquidation of these organizations, as well as in the event of a reduction in the number or staff of these workers, are retained for the period of employment (but no more than than 6 months) average salary taking into account monthly severance pay and continuous work experience (Article 7 of the Law of the Russian Federation of July 14, 1992 N 3297-1 “On a closed administrative-territorial entity”).

7. When collecting average earnings in favor of an employee reinstated in his previous job, or if his dismissal is declared illegal, the severance pay paid to him is subject to offset (clause 62 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 N 2).

8. In practice, the text of collective agreements and agreements includes norms that strengthen the social protection of dismissed workers. For example, it is provided:

- in case of dismissal due to a reduction in headcount or staff, the employer makes compensation payments on the basis of compensation agreements in the manner and on the terms that are determined directly in the organizations: a) to dismissed employees - at least three times the average monthly salary; b) employees of pre-retirement age, but no more than two years before the statutory retirement date - payment of a monthly benefit in the amount of two times the minimum tariff rate, but not lower than the subsistence level in the region until retirement age or the moment of employment; c) for employees of retirement age - in the amount of no less than three times the average monthly earnings, and for those dismissed from organizations located in the Far North and equivalent areas - not less than nine times the average monthly earnings; d) dismissed employees with two or more dependents - in the amount of at least five times the average monthly salary; e) for dismissed employees whose family has no other breadwinners - in the amount of at least five times the average monthly salary; f) employees dismissed from organizations located in the Far North and equivalent areas - in the amount of at least eight times the average monthly salary. If an employee has the right to receive several payments, only one payment is made at the employee’s choice. At the request of the employee, payments can be replaced with payment for his retraining if the educational institution is located on the territory of the subject of the Russian Federation where the employee lives, but not in excess of the costs determined by the specified payments (Industry tariff agreement in the housing and communal services of the Russian Federation for 2014 - 2016) ;

— upon termination of an employment contract due to the liquidation of an organization or a reduction in the number or staff of the organization’s employees, it is recommended in the collective agreement to establish severance pay for the period of employment in the following amount: upon dismissal of workers of pre-retirement age (men aged 58 to 60 years, women aged from 53 to 55 years old) - in the amount of at least 150% of average earnings; upon dismissal of workers permanently working in the Far North and equivalent areas - in the amount of at least 200% of average earnings (Federal Industry Agreement on Construction and the Building Materials Industry of the Russian Federation for 2014 - 2020);

— payment of compensation upon dismissal in addition to severance pay; payment of a one-time benefit in the event of the dismissal of an employee two or more years before retirement age (Industry agreement for federal state budgetary and government institutions under the jurisdiction of the Ministry of Health of the Russian Federation, for 2013 - 2020);

— payment of additional severance pay to those who have worked in the organization for at least 10 years, if this is provided for in the collective agreement (Industry tariff agreement for organizations of the chemical, petrochemical, biotechnological and chemical-pharmaceutical industries of the Russian Federation for 2012 - 2014).

Increasing the size of severance pay, their payment in cases not provided for by law, as well as material support provided to employees, are made at the expense of the profit received by the organization and cannot lead to an increase in the cost of products.

Golden parachutes

The Labor Code of the Russian Federation provides that in the event of a change in the owner of the company, top management can be dismissed (this does not mean for guilty actions, but because the team will change and the law allows this to be done), this applies to general directors, their deputies and chief accountants. If the new owner decides to part with the “old” employees, then he is obliged to pay them severance pay or compensation in the amount of at least three monthly earnings (for more details, see Articles 181, 278 and 279 of the Labor Code of the Russian Federation, and also here).

When can you count on a larger amount?

The grounds for calculating compensated payments when expelling a working person are reflected in the Labor Code of the Russian Federation, in internal departmental acts, as well as in the collective agreement and employment contract.

The Labor Code of the Russian Federation has adopted various amounts of financial compensation - from 2-week average income to large amounts. The amount of remuneration depends on the reason for breaking the employment contract. The benefit can be paid by the company, depending on the reason for leaving, for 3 months, if all the conditions of the Labor Code of the Russian Federation are met and the person does not get a job during the specified time. And in the Far North and similar regions, severance pay can be paid even for six months.

An employee receives the greatest remuneration when an institution is downsized or liquidated.

To receive such a payment in such situations for a longer period of time, after deduction, you will need to register with the labor exchange no later than 2 weeks, and then not get a job through the employment service for 3 months.

If the above conditions are met, the dismissed employee will receive benefits from the company for 3 months after the date of deduction.

To prove that the former employee did not get a job, he is required to present a monthly certificate from the employment service to his former manager.

The procedure for paying remuneration when a person is dismissed due to the closure of a company is shown in the table.

The listed terms for payment of remuneration are preserved if the person brings a certificate from the employment service stating that he was not employed during this time.

Expulsion of heads of companies, their deputies and heads. Accountants are regulated (Articles 181, 278, 279) of the Labor Code of the Russian Federation, which provide for special accruals. For this category of workers, compensation is issued in the amount of 3 monthly income. However, they are not given severance pay while they are looking for work.

https://youtu.be/gXAUMelo9as

Taxes and fees on severance pay

Many people are interested in whether severance pay upon dismissal is subject to personal income tax. Officials have already issued many clarifications on this matter, the latest of which can be read in Letter No. 03-04-06/69183 dated November 23, 2016. It follows from the document that, on the basis of clause 3 of Art. 217 of the Tax Code of the Russian Federation, the employer must not withhold tax.

There are two exceptions to this rule:

- Personal income tax is levied on amounts that exceed three times the average monthly earnings (2 times more for employees of legal entities and private practitioners registered in the Far North and equivalent regions).

- The tax is levied if additional compensation is paid, which is not provided for either by the Labor Code of the Russian Federation or by the organization’s collective agreement.

Payment of compensation upon dismissal by agreement of the parties

If termination occurs by mutual agreement, then the employee is entitled to payments. Severance pay upon dismissal by agreement of the parties may contain vacation days that were not used, wages for working days, and bonus payments. The benefit may include payments that are not provided for by law or regulations; they are assigned at the discretion of the employer.

According to the law, compensation must be paid upon such termination of the contract, since the initiator of this is directly the employer. But employees should be attentive to proposals of this kind. Most often, dismissal occurs due to imminent liquidation, and by making this offer, employers try to save money on payments.

Two weeks earnings

Remuneration equal to the average salary for 2 weeks, in accordance with Part 3 of Art. 178 of the Labor Code of the Russian Federation, provided upon termination of the contract due to:

- With the citizen’s refusal to transfer to another job for medical reasons or if the employer does not have the appropriate job. If it is impossible to carry out other activities at the enterprise due to health reasons, the employee provides a conclusion issued by a medical commission in the manner prescribed by law.

- Calling a person to serve in the Armed Forces or sending him to alternative service.

- Reinstatement of an employee who previously carried out this professional activity.

- Refusal of a citizen to be transferred to another location together with the employer.

- Recognition of the employee as having completely lost the ability to perform professional tasks, according to the conclusion of the medical commission issued in the prescribed manner.

- Refusal of a person to continue activities due to a change in the terms of the contract previously determined by the parties.

According to Art. 178 of the Labor Code of the Russian Federation, severance pay may be assigned in other cases established by a labor or collective agreement.