Rules and procedure for calculating and paying dividends to the founder of an LLC - postings, terms, nuances

If a legal entity is created and operates as an LLC, the profits earned must be distributed among its owners (founders, participants) properly.

We are talking about the calculation and subsequent payment of dividends due to the co-owners of the organization.

For an LLC, all aspects of profit distribution are regulated by the twenty-eighth article of 14-FZ.

It is necessary to understand when and under what conditions dividends are paid to the co-owners of the LLC, and how earned profits are distributed among the founders.

The article describes typical situations. To solve your problem, write to our consultant or call for free:

Moscow - CALL

+7 St. Petersburg — CALL

+8 ext.849 — Other regions — CALL

It's fast and free!

In addition, it is important to clarify the mechanism for calculating and paying dividends to LLC shareholders, as well as those situations when the founders of a legal entity do not have the right to share net profit.

Correct accounting of accrued and paid dividends deserves special attention, since it is of great importance for a legal entity organized as an LLC.

Concept

The distribution of profits in the LLC is realized through the mechanism of dividend payments. Thus, dividends are usually called a part of the net profit of a legal entity, distributed among co-owners in proportion to their current shares (parts) in the authorized capital (CA) of this legal entity or in another accessible way provided for by the charter.

The verdict on the partial distribution of profits earned by a business company for a certain period is passed by a general meeting of participants of this company.

The net profit of an organization is the profit remaining at its disposal after paying taxes and other necessary payments.

From the net profit of an LLC, dividends can be paid to its participants only if specific conditions provided for by current legislation are met.

It is the profit earned by a legal entity that is the source of dividend payments made in favor of the founders of the LLC.

Profit to be distributed among the founders of a business company is calculated according to its accounting data.

Thus, in order to make an informed decision on the accrual and payment of dividends based on the results of a specific period, the co-founders of the LLC must first certify its reporting, which clearly confirms the presence of a sufficient amount of net profit.

As you know, official financial statements are prepared and sent to the tax service once a year.

However, the current provisions of the law on LLCs provide for the possibility of paying dividends to shareholders not only for the year, but also for interim periods (meaning a quarter, half a year).

The source of interim dividends is the retained earnings of a legal entity recorded in reporting in the current year.

It should be noted, however, that an LLC has the right to pay interim dividends to its participants if retained earnings of the required amount were actually received by the legal entity for the corresponding period (quarter, half-year).

It is also important to take into account the fact that profit is determined by the accrual (cumulative) total for the calendar year.

Accordingly, the final amount of earned profit can be determined solely based on the results of the already completed year.

If the co-owners decide on dividend payments based on the results of the past year, they will have to take into account the amounts of interim dividends already paid (received) during this year.

Rules for paying dividends to the sole founder.

Is it possible not to pay?

An LLC has the right to pay appointed dividends to its founders if the following conditions stipulated by current legislation are strictly observed:

- The business company (LLC) does not show signs of financial insolvency. There is no bankruptcy procedure being carried out in relation to this legal entity.

- The retired founder was fully paid (reimbursed, compensated) for the current value of the share transferred to the business company.

- The authorized capital of the LLC is fully paid by the current participants. There is no outstanding debt of the founders.

- The value of net assets exceeds the total value of its authorized capital (AC) and reserve fund (RF).

The above requirements are provided for by the twenty-ninth article 14-FZ.

If they are not complied with simultaneously at the time of the expected distribution of profits, dividends cannot be paid (until the existing inconsistencies are completely eliminated or ceased).

When are participants paid?

A legal entity (LLC) pays dividends to shareholders if it actually carries out activities that result in a positive financial result (profit) over a certain period of time.

As mentioned earlier, profit to be distributed among the founders of a legal entity can be recorded in reporting not only for the year, but also for interim periods (meaning a quarter, half a year).

Consequently, a decision on dividend payments can be made by a meeting of participants once a year, once every six months, or, alternatively, once a quarter, as provided for in Article 28 (twenty-eight) of Article 14-FZ.

Is monthly issuance possible or not?

Payment of dividends for shorter periods (for example, a month) is not permitted.

The procedure for making dividend payments is regulated by the charter of the LLC, taking into account current legal requirements.

The final result of net profit is determined for the past year, which has already completed.

It is recommended to make any interim payments when there is confidence in obtaining the required amount of profit for the entire year.

How to get - ways to get

Payment of dividends is carried out either by decision of the sole owner of the legal entity, or on the basis of the minutes of the general meeting of co-owners.

In order to make the necessary decisions, it is necessary to generate LLC reports for the appropriate period of time and convene a meeting of shareholders - the owners of the LLC.

The verdict must contain the following information:

- specific payment period;

- part of the earned profit directed by the co-owners of the legal entity for dividend payment;

- form and schedule of dividend repayment (the final date for making these payments is indicated).

It is not at all necessary to indicate the distribution procedure in the protocol, since dividends are usually paid to the founders in proportion to their shares of participation, unless a different algorithm is stipulated by the charter of the LLC.

You can limit yourself to indicating the total amount of dividends to be paid.

If the decision has already been made by the general meeting of shareholders of the LLC, it must be finally executed within 60 (sixty) days, unless another period for the implementation of such payments is provided for by the charter of the legal entity.

Procedure for accrual and payment

There is a certain procedure in accordance with which dividends are accrued and paid to the founders of a business company (LLC).

This procedure provides for the sequential implementation of the following stages:

- Determination of the current amount of net assets of a legal entity. The calculation formula is regulated by the norms of current legislation.

- The actual value of the LLC's net assets must be greater than the sum of the current values of its authorized capital (AC) and reserve fund (RF). If this requirement is not met, dividends will not be payable.

- The final verdict on the distribution of profits between the participants is made. The meeting of co-owners decides how to manage the net profit - pay dividends to shareholders or, alternatively, use it for the development of the company. If you still decide to pay dividends, you need to clarify how much of the net profit should be distributed among the founders. In addition, you should decide exactly how the profit will be distributed among shareholders (for example, in proportion to the current shares).

- The decision is approved by a majority and documented in the minutes of the general meeting. The protocol reflects the name of the legal entity, a list of current participants indicating their shares, a list of issues for discussion, the verdict rendered, as well as the amount, terms and method of payment. If the period is not specified in the protocol, dividends are paid to the founders within sixty days from the date of the appropriate verdict.

- The head of a business company issues an order instructing the chief accountant or other authorized person to ensure the execution of the verdict passed by the general meeting of shareholders and documented in the appropriate minutes. This order is usually drawn up by a secretary or clerk. The minutes of the meeting of shareholders are the basis for issuing this order and an appendix to it.

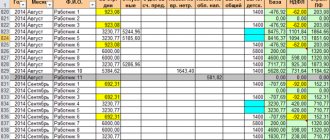

- The amounts of dividends paid are calculated using the selected algorithm. The most common option is that the total amount of net profit to be distributed is multiplied by the percentage share of each participant. Taxes are immediately withheld from the obtained values (for example, personal income tax for citizen shareholders), which are transferred directly to the budget. Dividends (without tax amounts) can be paid either by non-cash transfer from a current account or in cash from the cash register.

- The necessary reports are compiled and submitted to the tax service in compliance with the established deadlines. For example, for each of the citizen founders, 2-NDFL and 6-NDFL are issued and submitted.

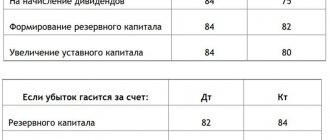

Accounting entries for accrual and payment

All monetary transactions related to the accrual and payment of stipulated dividends to the founders of a legal entity are recorded in accounting by certain entries.

| Action | Debit | Credit |

| Posting – dividends are accrued to entities not related to the company’s employees at the expense of retained earnings | 84 | 75 |

| Dividends are awarded to the company's employees | 84 | 70 |

| Tax is withheld from dividends paid to entities other than employees of the company | 75 | 68 |

| Tax is withheld from dividends paid to company employees | 70 | 68 |

| Posting – dividends were paid to entities not related to the company’s employees | 75 | 51,50 |

| Posting - dividends are transferred to the company's employees | 70 | 51,50 |

| Taxes withheld from dividend payments are transferred (transferred) to the budget | 68 | 51 |

| Dividends that could not be paid to entities other than employees of the company are written off (returned) to the account of retained earnings | 75 | 84 |

| Dividends that could not be paid to the company’s employees are written off (returned) to the account of retained earnings | 70 | 84 |

How to reflect transactions with dividends to the recipient on the accounts?

The recipient's dividend transactions will be reflected in the accounting records as follows:

| Account correspondence | Contents of a business transaction | |

| Debit | Credit | |

| 76 | 91 | Income is reflected on the date of the decision to pay it |

| 51 | 76 | Dividends received |

Dividend calculation: postings

Dividends are part of the net profit paid to the participants or shareholders of the company. The amount of profit to be distributed is determined at the end of the financial year. Its amount is reflected in the final annual entry on the credit of account 84.

A decision on such payment can only be made by a general meeting of participants or shareholders of the company. If there is only one founder, then the decision to distribute part of the positive financial result is made only by him.

Settlements with the founders are reflected in account 75 of the chart of accounts. For calculations on the payment of income, the Ministry of Finance in Order No. 94n recommends opening a subaccount 2 for it. Analytical accounting should be kept in the context of each founder. An exception is made for settlements with shareholders - owners of bearer shares in a joint-stock company, since it is impossible to establish their identification data.

Accruals are reflected on the date of the decision to pay part of the company’s undistributed positive financial result to the owners.

Dividends accrued: posting Dt 84 Kt 75.

The payment of income to the founder is reflected by the entry Dt 75 Kt 50, 51.

The decision to pay dividends: who makes it?

The law establishes that based on the results of the year’s activities, the company has the right to declare dividends on shares, but may not do so. This is a company right established by law.

Such obligations are not provided for, and decisions on the payment of income on shares or the use of profits for other needs are made at the general meeting of shareholders. If it decides to pay dividends, then the board of directors, after careful analysis, determines their size, which will be recommended to the general meeting. Shareholders are given the right to agree and approve the recommended payment amount or to reject it and refuse to declare dividends. The general meeting has no right to establish a different amount of dividends. In Russia, the amount of dividends is set in national currency (rubles) per share minus personal income tax.

Instructions 70 count

Instructions for using the chart of accounts for accounting the financial and economic activities of organizations in accordance with Order No. 94n dated October 31, 2000

Account 70 “Settlements with personnel for wages” is intended to summarize information on settlements with employees of the organization for wages (for all types of wages, bonuses, benefits, pensions for working pensioners and other payments), as well as for the payment of income on shares and other securities of this organization.

In the credit of account 70 “Settlements with personnel for wages” the following amounts are reflected:

- wages due to employees - in correspondence with accounts of production costs (selling expenses) and other sources;

- wages accrued from the reserve formed in accordance with the established procedure for the payment of vacations to employees and the reserve of benefits for length of service, paid once a year - in correspondence with account 96 “Reserves for future expenses”;

- accrued social insurance benefits, pensions and other similar amounts - in correspondence with account 69 “Calculations for social insurance and security”;

- accrued income from participation in the capital of the organization, etc. — in correspondence with account 84 “Retained earnings (uncovered loss).”

The debit of account 70 “Settlements with personnel for wages” reflects the paid amounts of wages, bonuses, benefits, pensions, etc., income from participation in the capital of the organization, as well as the amount of accrued taxes, payments under executive documents and other deductions.

Amounts accrued but not paid on time (due to the failure of recipients to appear) are reflected in the debit of account 70 “Settlements with personnel for wages” and the credit of account 76 “Settlements with various debtors and creditors” (sub-account “Settlements for deposited amounts”). .

Analytical accounting for account 70 “Settlements with personnel for wages” is maintained for each employee of the organization.

Chart of accounts

Typical transactions for account 70

By debit of the account

| Contents of a business transaction | Debit | Credit |

| Salaries were paid from the organization's cash register | 70 | 50 |

| Salary was transferred from the current account | 70 | 51 |

| Salary transferred from foreign currency account | 70 | 52 |

| Salary was transferred from a special bank account | 70 | 55 |

| Personal income tax is withheld from salary | 70 | 68 |

| The debt of employees for vouchers at the expense of social insurance funds is reflected | 70 | 69-1 |

| Accountable amounts issued to the employee are offset against wages | 70 | 71 |

| The amount of material damage was withheld from wages | 70 | 73-2 |

| Personal insurance payments withheld from salary | 70 | 76-1 |

| Salary not received on time deposited | 70 | 76-4 |

| The accrued salary of an employee transferred to a branch allocated to a separate balance sheet was written off (posting in the accounting of the head office) | 70 | 79-2 |

| The accrued salary of an employee transferred to the head office is written off (posting in the branch accounting) | 70 | 79-2 |

| The amount of the shortfall in excess of the norms of natural loss was withheld from the salary | 70 | 94 |

| Amounts issued on account and not returned within the prescribed period are withheld from wages | 70 | 94 |

By account credit

| Contents of a business transaction | Debit | Credit |

| Wages accrued to employees involved in construction or acquisition of non-current assets | 08 | 70 |

| Wages accrued to employees engaged in primary production | 20 | 70 |

| Salaries accrued to employees engaged in auxiliary production | 23 | 70 |

| Salaries accrued to employees engaged in production maintenance | 25 | 70 |

| Salaries accrued to employees involved in the management of the organization | 26 | 70 |

| Salaries paid to employees involved in repairing defects | 28 | 70 |

| Wages accrued to employees engaged in service production | 29 | 70 |

| Salaries paid to sales employees | 44 | 70 |

| Social benefits accrued at the expense of the Social Insurance Fund (sick leave, etc.) | 69 | 70 |

| Accrued payments due from other organizations | 76 | 70 |

| The salary of an employee transferred from a branch allocated to a separate balance sheet is taken into account (posting in the accounting of the head office) | 79-2 | 70 |

| The salary of an employee transferred from the head office is taken into account (posting in the branch accounting) | 79-2 | 70 |

| Dividends accrued to founders who are employees of the organization | 84 | 70 |

| Wages accrued to employees engaged in obtaining other income or working in non-production departments of the organization (kindergartens, holiday homes) | 91-2 | 70 |

| Salaries were accrued to employees who eliminated the consequences of emergency situations (earthquake, flood, fire, etc.) | 91-2 | 70 |

| Salary accrued from a previously created reserve | 96 | 70 |

| Wages have been accrued to employees engaged in performing work, the costs of which are taken into account in future expenses | 97 | 70 |

Business and Accounting

> Postings for accrual of personal income tax from dividends

Dividends received transactions

TAXATION 2020: accounting entry of dividends paid.

According to Article 42 of Federal Law No. 208-FZ of December 26, 1995 on JSC, the timing of payment of dividends should not exceed 60 days from the date of the decision to pay them.

It often happens that the decision to pay dividends falls on one tax period, but in fact the shareholder (participant of the joint stock company) receives them in another period.

Let's consider how these transactions will be reflected in the accounting of the dividend recipient.

In accounting, dividends are included in other income on the date of announcement of the decision on the distribution of profit in the amount distributed in favor of the organization receiving the dividends (clauses 7, 10.1, 16 of PBU 9/99 “Income of the organization”). Recognition of income from participation in another organization is reflected by posting debit 76-3 credit 91-1, and receipt - debit 51 credit 76-3.

In tax accounting, income from equity participation in other organizations is taken into account when calculating income tax as part of non-operating income on the date of receipt of funds to the taxpayer's current account (cash) (clause 1 of Article 250, subclause 2 of clause 4 of Article 271, clause 2 of Article 273 tax code).

An example of an accounting entry for receiving dividends

Sigma LLC, the recipient of the dividends, received a message from another organization, of which the LLC is a member, about the decision made on April 16, 2012 to distribute dividends.

The amount of dividends due to Sigma LLC amounted to 500,000 rubles. The amount of dividends minus income tax at a rate of 9% was actually credited to the current account on June 8, 2012.

in accounting :

G———————————————————————————————————————————T————— —————T——————————T——————————¬ | accounting transaction | Debit | Credit | Amount, | | (wiring) | | | rubles | +———————————————————————————————————————————+————— —————+——————————+——————————+ | April 16, 2012 | +————————————————————————————————————————————————— ———————————————————————————+ |Part of the profit distributed in favor of | 76-3 | 91-1 | 500,000 | |organizations are reflected in other | | | | |income | | | | +———————————————————————————————————————————+————— —————+——————————+——————————+ |IT IS REFLECTED | 68 | 77 | 45,000 | |(RUB 500,000 x 9%) | | | | +———————————————————————————————————————————+————— —————+——————————+——————————+ | June 8, 2012 | +————————————————————————————————————————————————— ———————————————————————————+ |Reflects the amount of tax withheld by the tax authorities| 91-2 | 76-3 | 45,000 | |agent | | | | |(RUB 500,000 x 9%) | | | | +———————————————————————————————————————————+————— —————+——————————+——————————+ |Cash (minus withheld | 51 | 76-3 | 455,000 | |tax) was received current account | | | | |organizations | | | | |(500,000 - 45,000) rub. | | | | +———————————————————————————————————————————+————— —————+——————————+——————————+ |IT REDEEMED | 77 | 68 | 45,000 | +———————————————————————————————————————————+————— —————+——————————+——————————+

If income from participation in another organization is reflected in accounting in one tax period, and in tax accounting in another, then a taxable temporary difference (TDT) and a corresponding deferred tax liability (DTL) arise in accounting (clauses 12, 15 of PBU 18 /02 “Accounting for corporate income tax calculations”). IT arises at the time of recognition of income in accounting, and is extinguished upon recognition of income in tax accounting (clause 18 of PBU 18/02).

Category: Reporting of commercial organizations

A company can invest its money or property in the authorized capital of other enterprises. At the same time, she receives part of the profit from their activities (dividends on the shares she owns).

In accounting, these incomes are classified as other income and reflected on line 080 of the report if two conditions are met:

- receiving profit from contributions in the authorized capital of other companies (dividends on shares) is not a normal activity of the company;

— the amount of income does not exceed 5 percent of the total amount of revenue for the reporting period.

If these conditions are met, then reflect such receipts by posting:

Debit 76 Credit 91-1

— income from equity participation in the authorized capital is accrued (dividends on shares).

If these conditions are not met, then reflect all income received on line 010 “Revenue (net) from the sale of goods, products, works, services less value added tax, excise taxes and other similar payments.”

Accrue income from participation in the authorized capitals of other companies or dividends on shares on the day when the decision on their distribution is made.

On dividends received from a Russian company, income tax is charged at a rate of 6 percent. In this case, the amount of tax is withheld by the company that paid it. Therefore, investors receive income (dividends) minus the tax amount.

On the day of receipt of income (dividends) from a Russian company, make the following entries in your accounting:

Debit 99 Credit 76

— reflects the amount of income tax that was withheld by the company paying income (dividends);

Debit 51 (50, 52…) Credit 76

— income from equity participation (dividends) is received minus income tax.

Example

CJSC Aktiv owns 1,000 shares of the open joint-stock company Stil. In 2005, the meeting of Style shareholders decided to pay dividends for the previous year in the amount of 50 rubles. per share. Dividends were paid in cash.

The Aktiva accountant made the following entries:

Debit 76 Credit 91-1

— 50,000 rub. (1000 pcs. x 50 rub./pcs.) - the amount of dividends declared by “Style” has been accrued;

Debit 99 Credit 76

— 4500 rub.

(RUB 50,000 x 9%) - reflects the amount of income tax withheld by Style from the income of Asset;

Debit 51 Credit 76

— 45,500 rub. (50,000 - 4,500) - the amount of dividends was transferred to the Aktiva settlement account.

In Form No. 2 for 2005, line 080, the accountant will reflect dividends in the amount of 50,000 rubles. The amount of tax withheld by “Style” is shown on line 150 of the report.

If dividends came from a foreign company, they are subject to income tax at a rate of 15 percent. The company that received them must transfer the tax amount to the budget.

Interesting

Not a single business operation is complete without accounting. Paying and receiving dividends is no exception. Let's figure out what entries should be made in the accounting of the company that distributed the dividends and the founding organization.

We issue dividends...

The source of dividend payment is the net profit received by the company.

To summarize information about its availability and movement, account 84 “Retained earnings (uncovered loss)” is intended. And to reflect all settlements with the founders, account 75 of the same name is intended.

At the same time, operations on the payment of dividends here must be taken into account separately in a special subaccount 75-2 “Calculations for the payment of income.”

Thus, based on the results of the general meeting, at which it was decided to allocate part of the profit to pay dividends, the accountant must make the following entry for each founder:

DEBIT 84 CREDIT 75-2

– dividends are accrued to participants (shareholders).

However, there is an exception to this rule: if the founders are employees of the organization, the accrual of dividends to them must be reflected in the credit of account 70 “Settlements with personnel for wages”.

The wiring will be like this:

DEBIT 84 CREDIT 70

– dividends were accrued to employees who are founders.

Such entries reflect the accrual of both annual and interim dividends. Note that when drawing up the balance sheet, the amount of interim dividends paid during the year must be reflected separately in the “Capital and Reserves” section (letter of the Ministry of Finance of Russia dated December 19, 2006 No. 07-05-06/302).

When performing the functions of a tax agent, an organization must withhold and transfer to the budget income tax (if the founder is an organization) or personal income tax (if the founder is an individual).

The founder will receive dividends minus tax (except for cases where the founders are income tax evaders). The accountant must reflect these transactions with the following entries:

DEBIT 75-2 (70) CREDIT 68 subaccount “Calculations for income tax” (subaccount “Calculations for personal income tax”)

– withholding tax on dividends;

DEBIT 68 subaccount “Calculations for income tax” (subaccount “Calculations for personal income tax”) CREDIT 51

– tax is transferred to the budget;

DEBIT 75-2 (70) CREDIT 51 (50, 52)

– dividends were paid to the founder.

Accounting entries for dividend payments

- according to the accounting data for the payment period, there is a net profit;

- The management company has been paid in full;

- the amount of net assets exceeds the sum of the charter capital and the reserve fund (and for a joint-stock company also the amount of the excess of the value of preferred shares over the par value), and this ratio will not change after the issuance of dividends;

- there are no signs of bankruptcy, and they will not appear after the payment of dividends;

- the repurchase of shares was completed according to the existing requirements of shareholders - for JSC;

- the withdrawing participant is fully paid his share - for an LLC;

- the necessary sequence is observed in determining payments: first for preferred shares with advantages, then for other preferred shares and finally - for ordinary shares for the joint-stock company.

- Dividends were accrued to the founders (posting as of the date of the decision with a breakdown in the analytics of accounts 70 and 75 by participants): Dt 84 Kt 75 - for participants-legal entities and individuals who do not work for the dividend payer;

- Dt 84 Kt 70 - for individual participants who are employees of the dividend payer.

- Dt 75 Kt 68 - for participants-legal entities (income tax) and individuals who do not work for the dividend payer (personal income tax);

- Dt 75 Kt 51 (50) - to participants-legal entities and individuals who do not work for the dividend payer;

- Dt 68 Kt 51 - broken down by type of tax (profit or personal income tax).

- Dt 75 Kt 84 - listed on account 75.

Accrual and payment of dividends: postings

• D/t 84 – K/t 75/2 – for the amount of profit distributed for payment of dividends. Analytical accounting of accrued dividends personally for each participant is a list of names with the amounts of payments due, the results of which correspond to the credit turnover of account No. 75/2 of the specified transaction. Shareholders and participants in receiving dividends may or may not work for the company, so dividends should be calculated differently. Income accrual to company employees is made to account No. 70 “Settlements with employees for wages.” Postings for the payment of dividends to the founder, participants and shareholders working in the company:

Typically, the company's charter provides for the conditions for the distribution of dividends among shareholders in accordance with current legislation, which dictates the recognition of income accrued in proportion to the shares of participants. The total amount of profit, which, by decision of the meeting, is determined to be paid to shareholders, is multiplied by the percentage of funds contributed to the authorized capital by each participant. This determines the amount of dividend due to an individual shareholder. The postings accompanying the accrual of dividends will be indicated below.

Dividends accrued on shares: posting

When paying income to shareholders, the role of tax agent is performed by the company paying the dividends. Income can be issued to shareholders in two ways:

- in monetary terms;

- in kind.

Accrual of dividends to shareholders - posting between:

- D75.2 – K50 when issuing funds through the organization’s cash desk to pay dividends on shares;

- D75 – K90 when issuing income in kind to reflect the valuation of finished products transferred to the shareholder;

- D90 - K43 is used to write off the cost of goods issued.

When dividends are accrued to shareholders, the tax entry may look like this:

- D90 – K68 when calculating VAT on products that were issued as dividend income;

- D75 – K68 is used to reflect personal income tax amounts withheld from cash income of shareholders.

Prerequisites for dividend payments

Dividends (part or the entire amount of net profit) are paid to shareholders (in a JSC) or participants (in an LLC) at quarterly, semi-annual or annual intervals according to a decision made by the general meeting of the company. The adoption of such a decision and its subsequent execution are possible subject to the following conditions (letter of the Ministry of Finance of the Russian Federation dated September 20, 2010 No. 03-11-06/2/147, Article 43 of the Law “On Joint-Stock Companies” dated December 26, 1995 No. 208-FZ and Art. 29 of the Law “On LLC” dated 02/08/1998 No. 14-FZ):

- according to the accounting data for the payment period, there is a net profit;

- The management company has been paid in full;

- the amount of net assets exceeds the sum of the charter capital and the reserve fund (and for a joint-stock company also the amount of the excess of the value of preferred shares over the par value), and this ratio will not change after the issuance of dividends;

- there are no signs of bankruptcy, and they will not appear after the payment of dividends;

- the repurchase of shares was completed according to the existing requirements of shareholders - for JSC;

- the withdrawing participant is fully paid his share - for an LLC;

- the necessary sequence is observed in determining payments: first for preferred shares with advantages, then for other preferred shares and finally - for ordinary shares for the joint-stock company.

The meeting, making a decision on payment and documenting it in minutes, establishes the following:

- the amount intended for payment;

- form and timing of funds issuance;

- the amount of payments for each type of shares - in the joint-stock company;

- the date on which the list of shareholders will be compiled - in the joint-stock company.

Based on these data, the amounts allocated to each participant are determined depending on:

- the type and number of shares he has - in the joint-stock company;

- the size of his share (if there is no other distribution formula in the charter) - in an LLC.

If a legal entity has a single participant, the minutes of the meeting replace its sole decision.

The preferred form of issuance is cash, because the permitted property form is equated to sale (letter of the Ministry of Finance of the Russian Federation dated December 17, 2009 No. 03-11-09/405) and is extremely unprofitable from a taxation perspective.

The issuance period should not exceed:

- in JSC - 10 (for nominal holders and trustees) and 25 (for other shareholders) working days from the date on which the list of shareholders was compiled;

- in LLC - 60 days from the date of the decision.

If for some reason a participant has not received his share on time, then he has the opportunity to demand payment within 3 years (or 5 years if specified in the charter) from the date:

- decision-making - in the joint-stock company;

- completion of the 60-day period - in an LLC.

After a 3- or 5-year period, unclaimed amounts are returned to the legal entity’s net profit.

Tax calculation

Based on the minutes of the meeting (or the decision of the participant), the head of the legal entity issues an order for payment. It will already contain the amounts due to each recipient. When calculating them, it is advisable to immediately determine the amounts of withholding taxes, for the payment of which an extremely limited time is allotted (no later than the first business day following the day of payment of dividends):

- for personal income tax (payments to individuals) - according to clause 6 of Art. 226 Tax Code of the Russian Federation;

- for income tax (payments to legal entities) - clause 4 of Art. 287 Tax Code of the Russian Federation.

Taxes on payments made in 2017–2018 are calculated at the following rates:

- Personal income tax - 13% (clause 1 of Article 224 of the Tax Code of the Russian Federation) for individuals with Russian citizenship, and 15% (clause 3 of Article 224 of the Tax Code of the Russian Federation) for foreign citizens;

- income tax - 13% (subclause 2, clause 3, article 284 of the Tax Code of the Russian Federation) for companies established in the Russian Federation, and 15% (subclause 3, clause 3, article 284 of the Tax Code of the Russian Federation) for legal entities of foreign origin; when calculating tax on a legal entity that has owned more than half the share in the capital of the dividend payer for at least a year, a 0% rate can be applied (subclause 1, clause 3, article 284 of the Tax Code of the Russian Federation).

When the legal entity paying dividends is also their recipient, the tax paid by residents can be reduced by reducing the total tax base (the total amount of dividends allocated for distribution), which in this case will be calculated as the difference between the amounts intended for payment and received dividends (clause 2 of article 214 and clause 2 of article 275 of the Tax Code of the Russian Federation).

For more information about calculating tax on dividends, read the article “How to correctly calculate tax on dividends?”

For information on how to return tax to a foreigner who has become a resident, read the material “If a foreigner received dividends and then became a resident of the Russian Federation, the personal income tax refund is issued by the tax office.”

Emerging nuances ↑

The reflection of dividends in financial statements is always associated with many nuances. The most important ones include the following:

- when paying in cash;

- what to do when forming debt.

Find out what an investor's dividend calendar looks like in 2020 from the article: dividend calendar. Read all about interim dividends in 2020 here.

What are dividends and their essence, see here.

When paying in cash

The procedure for paying dividends is determined by clause 4 of Article No. 42 of Federal Law No. 208-FZ of December 26, 1995. According to it, the procedure for transferring dividends in cash itself is not illegal.

But it should be reflected appropriately in documents - with a cash settlement order. Currently required to be referenced in legislation.

Calculation of dividends to founders: postings from the payer

The accrual of dividends by entries in the accounting of the person paying the dividends must be made on the date when the meeting of shareholders (participants) decided to pay them.

The entries associated with the accrual of dividends will be as follows:

- Dividends were accrued to the founders (posting as of the date of the decision with a breakdown in the analytics of accounts 70 and 75 by participants): Dt 84 Kt 75 - for participants-legal entities and individuals who do not work for the dividend payer;

- Dt 84 Kt 70 - for individual participants who are employees of the dividend payer.

- Dt 75 Kt 68 - for participants-legal entities (income tax) and individuals who do not work for the dividend payer (personal income tax);

- Dt 75 Kt 51 (50) - to participants-legal entities and individuals who do not work for the dividend payer;

- Dt 68 Kt 51 - broken down by type of tax (profit or personal income tax).

- Dt 75 Kt 84 - listed on account 75.

To learn how account 84 is reflected in the balance sheet, read the article “Procedure for compiling a balance sheet (example).”

Highlights ↑

Today, many enterprises and companies are joint-stock companies. They issue shares (securities), in the presence of which a specific individual/legal entity has the right to receive some income.

Moreover, the date of receipt and the amount depend on many different factors - the type of shares, the start date of their ownership and many others.

There are specialized documents that determine the date of receipt of income. It is important to remember that the accrual of dividends to the organization’s employees is reflected in the accounting records.

This rule is very important to follow in all cases. Otherwise, there is a high probability of various kinds of difficulties arising with the tax service.

Before answering the question of which accounting entry means accrual of dividends to shareholders, you should familiarize yourself with some fundamental points. These include the following:

- what it is?

- who can be the owner?

- the legislative framework.

In this way, it will be possible to avoid difficulties and problems when generating reports.

What it is?

Income from shares represents dividends - they mean certain percentages of the company’s income for any reporting period (quarter, other).

Dividend payments are reflected in the accounting department using special entries.

Moreover, in this particular case, the term “posting” means a record in documents or a special database on a computer about the current and future state of an object.

Wiring always includes two main components (must be specified):

- debit account;

- credit account.

Also, the wiring must indicate the characteristic component of a specific action. This could be, for example, quantity or quality.

If dividends are the accounting object, then a more detailed analytical identifier is used when accounting for them. The purpose of the income, the counterparty, is always indicated.

Keeping records of dividend payments has many features and difficulties. You should familiarize yourself with them in advance to avoid mistakes.

If, during the audit, tax officials discover any errors, this may lead to the appointment of a desk audit.

Auditors quite often find many errors in the accounting of even bona fide taxpayers. Therefore, you should not attract the attention of the Federal Tax Service once again.

Who can be the owner

If all the shares of a company are owned by a single founder, then he will be the recipient of this income. In all other cases, it is necessary to rely on a special federal law.

According to this regulatory document, dividends can be received by persons who own shares on the date of drawing up the special calendar. There are some important rules.

These include the date the recipients were determined:

| Not earlier than 10 days | From the moment the decision is made |

| No later than 20 days | Dates of the decision to make the payment |

Direct owners of shares that allow receiving any dividends may be individuals/legal entities.

But regardless of the legal status of the owner, the tax agent will still be the company paying the dividends. This point is covered in the legal framework on this matter.

The legislative framework

Anyone who has anything to do with the payment of dividends should familiarize themselves in advance with the legislation in force on this matter.

The list of regulatory documents regulating this issue is relatively small. However, it is worth reading them all carefully.

Shareholders, accountants and other officials should study the following NAPs:

- Federal Law No. 208-FZ Chapter V:

| station No. 42 | The issue itself regarding the payment of dividends is revealed in detail. |

| station No. 43 | Situations are indicated when any restrictions are imposed on the payment of dividends |

- Federal Law No. 120-FZ of 09/07/01;

- Order of the Federal Property Management Agency No. 524 dated December 29, 2014;

- Federal Law No. 210-FZ of June 29, 2015;

- Federal Law No. 282-FZ of December 29, 2012;

- Federal Law No. 379-FZ of December 21, 2013;

All the federal laws mentioned above are not independent legal acts.

They only supplement the Federal Law No. 208-FZ “On Joint-Stock Companies” and edit its articles.

That is why, when performing a variety of actions, you should focus on this document.

It is also necessary to take into account paragraph 1 of Article No. 255 of the Tax Code of the Russian Federation when conducting transactions. This document explains in sufficient detail what exactly is considered an expense.

How to draw up minutes of a meeting?

The legislation does not establish any specific strict rules for the form of minutes of the meeting of founders or shareholders. The document is drawn up in free form, provided that it contains all the necessary details (number and date of the document, place of its preparation, what issues were considered, decisions on issues, signatures of those present).

If the organization has only one founder, then instead of the minutes of the meeting of founders, a participant’s decision on the need to pay dividends is drawn up. There are also no specific requirements for the form of the document, except for maintaining the necessary details. There is no need to show a detailed individual calculation of dividends for an individual recipient in the protocol or decision; it is enough to reflect the amount of the enterprise’s net profit that will be paid to the founders or shareholders.

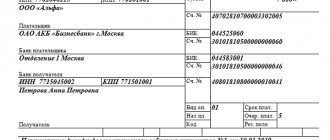

The calculation of dividends for each participant is carried out in the accounting certificate. Its form should be developed at the enterprise, and the document should be fixed in the accounting policy. The issuance of dividends from the cash register is formalized by a cash receipt order, and when transferred from a current account - by a payment order.

Taxation of dividends: rules

The legal entity that pays dividends is obliged to perform the functions of a tax agent, that is, withhold and transfer to the budget all necessary tax payments from the payment amount.

The list of taxes payable on dividends varies depending on the status of the recipient and whether he is a legal entity or an individual. In addition, tax rates depend on the source of payments (from the income of a foreign or Russian enterprise, from participation in the authorized capital or on shares) and on whether dividends were previously paid to this recipient in other organizations.

Profit tax must be charged on income received by legal entities. And if the recipient of dividends is an individual, then personal income tax is withheld.

What are dividends

Dividends are understood as part of the enterprise’s profit, which is subject to distribution among the founders, participants and other shareholders of the business entity. The size of the payment is determined depending on the share of shares owned by a particular person, as well as on their type.

The procedure for paying dividends is determined at the general meeting of shareholders, where it is decided what amount will be paid to each of the shareholders, and the frequency of such payments is also determined. The shareholders' decision is recorded in a corresponding act. As a rule, dividends are paid once a year, less often - once every six months or once a quarter. Payments to shareholders in the last two cases are called interim or preliminary.

The legislation provides for cases when a company cannot make payments to shareholders. These include:

- threat of bankruptcy;

- reduction in the authorized capital resulting from payment;

- The authorized capital of the company's participants has not been contributed in full.

The amount of dividends is subject to taxation. The company transfers tax at the time of payments to shareholders. According to changes made to the Tax Code, the tax rate is:

- for domestic companies from 01/01/2015 is 13%,

- for non-resident companies or individuals – 15%.

Answers to pressing questions about dividend accounting

Question No. 1. The company paid dividends quarterly throughout the reporting year. At the end of the year, the financial result of the activity was a loss. Will this somehow affect the dividends paid in the reporting year, since they should be paid from net profit, which, as it turned out, the organization does not have?

If at the end of the year the activity of an economic entity resulted in a loss, then all dividends paid to individuals - shareholders or founders of the organization should be considered as ordinary payments from the enterprise's profit after taxation. This means an increase in the tax burden. Of these amounts, it is necessary to withhold personal income tax in the amount of 13% of the amount of income and 30% in the form of insurance premiums.

Therefore, if the owner of an enterprise wants to receive dividends quarterly, without waiting for the end of the financial year, then the risks he faces should be explained to him. In this case, it is necessary that the annual financial result of the company’s activities must necessarily be profit. Otherwise, the amount of taxes payable to the budget may increase several times.

Question No. 2. Is there a need to withhold personal income tax from the amount of dividends paid to a founder engaged in entrepreneurial activities? If so, what tax rate applies to his income?

Yes, dividends paid to the founder-entrepreneur are subject to taxation in accordance with the general procedure. The legislation does not establish any exceptions or special conditions on this issue. Therefore, personal income tax must be withheld from the entrepreneur’s income received in the form of dividends. If an individual is a resident, then the tax rate is 9%, non-resident – 15%. In exceptional cases, the rate may be 30%.

Question No. 3. Is personal income tax withheld from the amount of dividends that will be paid by inheritance?

Income received as an inheritance is not subject to personal income tax. But in the case of payment of dividends, first of all, the right to receive income arises. Therefore, such income is subject to personal income tax. The rate will depend on whether the testator is a resident or not, and will be 9% or 15%.

Question No. 4. How to reflect on the accounts the accrual and issuance of dividends based on the results of the enterprise’s work to its only founder, who is also a director, if it is known that he is a resident, the net profit for the year amounted to 100,000 rubles. What documents should be used to document this?

The basis for recording dividends to be paid is the decision of the founder of the enterprise, formalized in writing. Since there is no unified form for such a document, the decision is drawn up in any form. Since the founder has resident status, 9% of personal income tax must be withheld from his income.

The amount of accrued dividends based on the performance of an economic entity for the year in accounting is an event after the reporting date and is shown in the explanatory note to the annual report.

Since the founder is also an employee of the enterprise, settlements with him for dividends can be reflected in account 70. In this case, the following entries must be made in accounting:

- Dt84 kt70 = 100,000 – for the amount of accrued dividends;

- Dt70 Kt68 = 9000 – for the amount of personal income tax withheld from the amount of dividends;

- Dt68 Kt51 = 9000 – personal income tax is transferred to the budget;

- Dt70 Kt51, 50 = 91000 – dividends were issued to the founder.

Question No. 5. How to correctly show in accounting the payment of dividends to a shareholder, partly in monetary terms, and partly in the physical equivalent of the finished products of the enterprise?

The issuance of dividends in cash and finished products is reflected in the accounts as follows:

- Dt75 Kt50 – dividends were issued from the cash register;

- Dt75 Kt90 – income from the sale of products to the shareholder when paying dividends;

- Dt90 Kt43 – write-off of the cost of products issued as dividends;

- Dt90 Kt68 – VAT on products sold as dividends;

- Dt75 Kt68 – personal income tax on income as dividends.

Dividends received from another posting organization

Hello, in this article we will try to answer the question “Dividends were received from another posting organization.” You can also consult with lawyers online for free directly on the website.

Then the payer indicates the BCC for the current period). The complex term “payment order” can be interpreted as an order to transfer a certain amount to the account of the tax system to pay tax. This order is used in all types of settlements.

The decision on the upcoming payment is made at the general meeting of LLC participants. the results are documented in a protocol. The right to distribute profits is assigned to the general meeting by Law No. 14-FZ in Art. 33 paragraph 2 and art. 37 clause 8. If there is only one participant, the justification will be the decision of this person.

If there is a large number of founders, profits are divided among them in proportion to the share of participation in the capital. In this situation, when calculating interim dividends, this operation is reflected in the debit of account 84.

The chart of accounts does not provide for the creation of subaccounts to this account. That is, accrued dividends are accounted for in the debit of account 84. Thus, before the balance sheet is reformed (when the financial result is written off to account 84), the organization experiences a loss.

It should not be closed, therefore, in this situation such reflection is allowed.

The procedure for calculating dividends at the enterprise

In the case of dividends issued, the certificate indicates:

- minutes of the meeting's decision;

- amounts distributed among shareholders;

- the amount of tax from each;

- the accountant's obligation to pay the final amount.

Receipt of dividends - entries reflecting this event in the recipient's accounting raise many questions. Which entries should the company receiving the dividends use? How much should dividends be reflected? How to apply PBU 18/02 in this case? Let's look at these questions in our article.

It does not matter what tax regime the company applies. The important thing is that dividends represent net profit received after all tax payments have been transferred to the budget.

If we are talking about the general taxation system, then before dividends are calculated, the company transfers income tax to the budget.

If an organization has switched to a simplified system, then the income tax is replaced by simplified taxes, and by UNEV - a single tax on imputed income.

How to reflect transactions with dividends to the payer in the accounts?

In both cases, an official document is drawn up on behalf of the company, which will become the basis for further activities of shareholders or founders.

Use a separate subaccount to account 75 for settlements with the founding organizations and with the founding citizens who are not on the staff of the organization (i.e., with those with whom an employment contract has not been concluded).

When calculating dividends to the founders - employees of the organization, use account 70.

When paying the fee in question, each organization must take care of issuing a special payment order.

For tax purposes, dividends received by legal entities and individuals from participation in other organizations are recognized as their income.

Moreover, regardless of the application of the general taxation regime or the simplified taxation system. Thus, in accordance with the amendments made by the Law of July 22, 2008.