Who is a homeworker

Homeworkers are persons who have entered into an employment contract to perform work at home using materials and using tools and mechanisms provided by the employer or purchased by the homeworker at his own expense (Article 310 of the Labor Code of the Russian Federation).

Homeworkers can be people of working professions: assemblers of various products, seamstresses and knitters, masters of artistic crafts, etc. The result of their labor has a natural material form, and their labor is, as a rule, unskilled.

A homeworker can involve family members in work, but labor relations do not arise between them and the employer. And after completing the work, he contacts the employer personally.

When using personal property, the employer is obliged to reimburse expenses and pay compensation for wear and tear of equipment (Article 188 of the Labor Code of the Russian Federation).

Currently, an actively developing non-standard form of employment is home-based work. Such labor relations are preferred by both employers and employees.

The article discusses cases when an employee can work at home, the features of formalizing such labor relations, and recording working hours.

The home-based form of labor organization opens up real opportunities for reducing employer costs. Such a labor process can significantly save production and administrative space, reduce utility bills, rent, heat and energy saving costs, etc. The undoubted advantage of home work for the employer is also the possibility of expanding production capacity without resorting to investments (the case when an employee, by agreement with the employer, uses his own means of labor).

Regulatory regulation of labor relations with homeworkers

Homeworkers are considered to be persons who have entered into an employment contract with an employer to perform work at home with personal labor from materials and using equipment, tools, mechanisms and devices allocated by the employer or purchased at the expense of this employer (part one of Article 304 of the Labor Code of the Republic of Belarus dated 07/26/1999 No. 296-Z, hereinafter referred to as TK).

The work of a homeworker is also regulated by:

– Regulations on the working conditions of homeworkers, approved by Resolution of the Ministry of Labor of the Republic of Belarus dated April 11, 2000 No. 48 (hereinafter referred to as Regulation No. 48));

– collective and labor agreements.

Not only workers engaged in production, but also workers of various positions and professions can work from home, if this is possible due to the nature of their work functions.

However, the preemptive right to conclude an employment contract to perform work from home is granted (clause 3 of Regulation No. 48):

– women with children under 16 years of age (disabled children under 18 years of age);

– disabled people and pensioners (regardless of the type of pension assigned);

– persons with reduced ability to work, who are recommended to work at home in accordance with the established procedure;

– persons caring for disabled people or long-term ill family members who need care for health reasons;

– persons employed in jobs with a seasonal nature of production (during the off-season period), as well as full-time students studying in educational institutions;

– persons who, for objective reasons, cannot be employed directly in production in a given area.

Organization of work in home conditions is allowed only for persons who have the necessary living conditions, practical skills, or who can be trained in these skills to perform certain jobs (clause 9 of Regulation No. 48).

We provide compensation to the homeworker

In cases where a homeworker uses his tools, equipment, machinery and devices, he is paid compensation for their wear and tear (depreciation). Its size and order are determined by agreement with the employer. By agreement of the parties, the homeworker may also be reimbursed for other expenses associated with performing work at home for the employer (cost of electricity, water, etc.) (Article 306 of the Labor Code).

Important! The amount of compensation for the use of employee property in the interests of the employer is not established by law; therefore, it is determined by written agreement of the parties.

Example 1

With the accountant of the organization Salyut LLC Petrova O.A. an employment contract has been concluded with a place of work at home. The salary for October 2012 of this employee amounted to 4,000,000 rubles. To perform his work duties, the accountant uses a personal computer and printer.

The employment contract provides for monthly compensation for wear and tear (depreciation) of equipment in the amount of RUB 300,000. – for a computer and 100,000 rubles. for the printer.

The employee has one dependent child aged 15 years.

The following entries will be reflected in the accounting records of Salut LLC in October 2012 (see Table 1):

Documentation of relations with homeworkers

When concluding an employment contract with persons whose place of work is at home, the employer is obliged to require all the documents necessary when hiring employees with a place of work in the organization, namely:

– identity document, military registration documents (for those liable for military service and persons subject to conscription for military service);

– work book, with the exception of those entering work for the first time and part-time workers;

– a diploma or other document on education and professional training confirming the right to perform this work;

– assignment to work on account of reservation for certain categories of workers in accordance with the law;

– individual rehabilitation program for a disabled person (for disabled people);

– declaration of income and property, insurance certificate, medical certificate of health and other documents confirming other circumstances related to work, if their presentation is provided for by legislative acts (clause 4 of Regulation No. 48).

Hiring without the specified documents is not permitted.

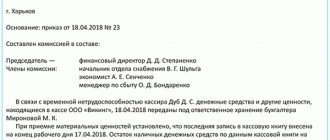

Employment as a home worker should be formalized by order of the employer (clause 7 of Regulation No. 48).

We will take into account the specifics of remuneration for homeworkers

Due to the specific nature of the work, the working hours of these employees cannot be counted, therefore, when determining earnings, calendar days are used, including generally established weekends and holidays.

Example 2

The homeworker worked from July 1 to July 15, 2012 and from July 23 to July 31, 2012, which is 24 calendar days, and from November 16 to November 22, 2012 (7 calendar days) he was on sick leave (general illness). The temporary disability benefit amounted to RUB 2,340,450. (conditionally). The employee's salary is RUB 3,800,000.

For reference: in July 2012 there are only 31 calendar days, incl. 1, 7–8, 14–15, 21–22, 28–29 days off, 3 – holiday.

The following entries must be made in accounting (see Table 2):

However, when calculating the average monthly (average daily) earnings in the number of days into which earnings are divided, do not include periods of release from work due to temporary disability, labor and social leaves, and in other cases provided for by law.

Example 3

The homeworker submitted a certificate of incapacity for work for the period from November 1 to November 8, 2012 (8 calendar days, of which November 7 is a holiday, November 3 and 4 are weekends). In September, the salary of this employee for 30 calendar days was 3,500,000 rubles, in October for 31 calendar days – 3,000,000 rubles.

A contract has been concluded with the homeworker. The organization operates on a 5-day work week with days off on Saturday and Sunday.

We will calculate temporary disability benefits for a homeworker.

1. Average daily earnings must be calculated taking into account the period of the two previous months - August and September, taking into account 61 calendar days (30 + 31).

2. Average daily earnings will be 106,557 rubles. ((RUB 3,500,000 + RUB 3,000,000) / 61 calendar days).

3. The benefit should be assigned 8 calendar days in advance: (106,557 rubles × 6 calendar days × 80%) + (106,557 rubles × 2 calendar days × 100%) = 724,588 rubles. Accounting entries in accounting:

D-t 69 – K-t 70 – RUR 724,588. – temporary disability benefits were accrued to a homeworker for October 2012.

Important! For persons whose working hours cannot be counted ( homeworkers , insurance agents, collectors of secondary raw materials, people involved in marketing, etc.), crew members of river and sea fleets, benefits are calculated from earnings determined according to the rules of paragraphs. 31–34 of the Regulations on the procedure for providing benefits for temporary disability and pregnancy and childbirth, approved by Resolution of the Council of Ministers of the Republic of Belarus dated September 30, 1997 No. 1290, hereinafter referred to as Regulation No. 1290).

In this case, the average daily earnings must be determined by dividing the total amount of earnings for the corresponding period by the number of calendar days in this period. The number of days into which earnings are divided does not include periods of release from work due to temporary disability, labor and social leave, and in other cases provided for by law (clause 37 of Regulation 1290).

Work performed by a homeworker in excess of the working hours established in the employment contract is not recognized as overtime and is paid at a single rate, unless the employment contract provides for higher pay.

The employer has the right to award bonuses to homeworkers in accordance with its existing bonus regulations, collective and labor agreements.

For work overtime, on public holidays, holidays (part one of Article 147 of the Labor Code) and weekends, bonuses are calculated on earnings at single piece rates or at a single tariff rate.

For reference: organizations must draw up and submit forms of statistical reporting on labor. The procedure for filling them out is regulated by the Instructions for filling out statistical indicators on labor in the forms of state statistical observations, approved by Resolution of the Ministry of Statistics of the Republic of Belarus dated July 29, 2008 No. 92, with amendments and additions.

Please note that homeworkers are counted in the payroll for each calendar day as whole units.

Working hours

A key feature of an employment contract is compliance with internal labor regulations. What about homeworkers?

For him, internal labor regulations are limited not by the office, but by the production process.

For homeworkers, submission to internal labor regulations means submission to them within the framework of concluded employment contracts.

This means the obligation:

- carry out the employer’s tasks for the specified type of activity and production norm;

- comply with deadlines for receipt of materials, delivery of finished products or work;

- undergo training, etc.

In all other respects, the homeworker organizes working hours at his own discretion. He can work at a time convenient for him, including in the evening, at night, on Saturday or Sunday, and on holidays.

Basic provisions for remuneration of homeworkers

For settlements with homeworkers, a piece-rate, time-based or other wage system may be used (clause 13 of the Regulations).

The work of homeworkers is paid at piece rates for work actually performed or products produced that meet the established requirements for its quality (clause 14 of the Regulations).

To encourage homeworkers for long-term continuous work, the employer has the right to pay them remuneration based on the results of the organization’s work for the year. The procedure and conditions for payment of these remunerations are the same as those established for the organization as a whole. For the main results of economic activities, homeworkers can be awarded bonuses in accordance with the existing bonus regulations in the organization (clause 15 of the Regulations).

If, by agreement between the employer and the homeworker, the homeworker’s working time includes the time he receives raw materials and supplies, as well as the time he delivers the finished product directly to the organization, such time is paid on a time basis based on the tariff rate for the work performed, but not higher than the tariff rate of a 2nd category worker the corresponding type of work (paragraph 2, clause 16 of the Regulations).

Time tracking and wages

Home work is, as a rule, piecework. The employer's control over the labor process of remote workers comes down to maintaining a time sheet, taking into account the normal working hours - no more than 40 hours per week and 8 working hours per day.

In the case of remote work with piecework wages, it is most convenient to keep a time sheet by recording deviations https://www.berator.ru/enc/siv/40/30/20/.

If the terms of the employment contract stipulate that the employee sets his own work schedule, then there can be no talk of payment for overtime work, additional payments for night work and work on weekends and non-working holidays.

Homeworkers are also entitled to northern allowances, but also with special features.

If the employer is registered in the Far North or equivalent areas, and the homeworker lives in an area with normal climatic conditions, then in this case the employee’s wages are calculated without applying the regional coefficient and percentage bonuses. In the opposite situation, these coefficients and allowances should be applied to the homeworker’s salary (Decision of the Supreme Court of the Russian Federation of May 6, 2011 No. 78-B11-16).

Regional coefficient

The size of the regional coefficient and the procedure for its application for calculating wages are established by the Government of the Russian Federation (Part 1 of Article 316 of the Labor Code of the Russian Federation).

The sizes of regional coefficients operating in the regions of the Far North and equivalent areas for workers and employees of non-production industries are centrally established in the Information Letter of the Department for Pensions of the Ministry of Labor of Russia dated 06/09/2003 N 1199-16, Department of Income and Living Standards Ministry of Labor of Russia dated May 19, 2003 N 670-9, Pension Fund dated June 9, 2003 N 25-23/5995.

Note. Payment of the regional coefficient and percentage bonus must be specified in the employment contract

Employment contracts with homeworkers living in regions of the Far North and equivalent areas must reflect the benefits and compensation provided to them in accordance with the Law of the Russian Federation of February 19, 1993 N 4520-1 “On state guarantees and compensation for persons working and living in the regions of the Far North and equivalent areas,” namely:

- payment of the regional coefficient of wages in the legally established amount;

- payment of percentage bonuses to wages for work in the Far North and equivalent areas.

This follows from paragraph 5 of the Recommendations for concluding an employment agreement (contract), reflecting the specifics of regulating social and labor relations in the conditions of the North, approved by Resolution of the Ministry of Labor of Russia dated July 23, 1998 N 29.

Compensation and guarantees

Homeworkers enjoy the guarantees and compensations provided by labor legislation to all employees working under an employment contract:

- annual paid leave of at least 28 calendar days;

- additional holidays;

- study leaves;

- sick leave and child benefits.

When paying sick leave, you should take into account how the working hours are set for a homeworker.

If working hours are not established and remote workers plan their work and rest time independently, when paying sick leave, you must follow the schedule established in the organization. And if the employee’s working hours and rest time differ from those generally accepted in the organization, and this is enshrined in the employment contract, then in the case of sick pay, you will have to follow it.

Service Temporarily Unavailable

information about the employee and employer who entered into an employment contract;

5.2. place of work indicating the structural unit in which the employee is hired;

5.3. employee's labor function;

5.4. basic rights and obligations of the employee and the employer;

5.5. term of the employment contract;

5.6. terms of remuneration;

5.7. work and rest schedule.

The employment contract may also provide for other conditions that do not worsen the employee’s position in comparison with the law and the collective agreement.

6. An employment contract can only be changed with the consent of the parties.

7. Employment as a home worker is formalized by order of the employer.

8. For homeworkers who have not previously worked, the employer creates work books in the manner and under the conditions determined by labor legislation.

9. Organizing work at home is permitted only for persons who have the necessary living conditions, practical skills, or who can be trained in these skills to perform certain jobs.

10. The employer provides tools, equipment, mechanisms and devices for free use to homeworkers, and repairs them in a timely manner.

In cases where a homeworker uses his own tools, equipment, mechanisms and devices, he is paid compensation (depreciation) for their wear and tear, the amount and procedure for payment of which are determined by agreement with the employer.

By agreement of the parties, the homeworker may also be reimbursed for other expenses associated with performing work at home for the employer (cost of electricity, water, etc.).

11. The specific type of work for homeworkers is selected taking into account their professional skills and health status.

Certain types of home-based work, in accordance with the general rules of fire safety and sanitation, as well as the living conditions of homeworkers, may only be permitted with the permission of the relevant authorities.

12. The procedure and terms for the provision of raw materials, supplies and semi-finished products, payments for manufactured products, reimbursement of the cost of materials (if the products were made from their own materials), and export of finished products are established in the employment contract and (or) collective agreement.

13. In cases where homeworkers perform work in other organizational and technical conditions (using their own tools, equipment, etc.), the employer, taking into account economic feasibility, can set production standards for them based on the specific conditions for performing work at home.

14. All work performed is paid to homeworkers at a single rate, unless the employment contract provides for higher payment.

The employer has the right to award bonuses to homeworkers in accordance with his existing bonus regulations, collective agreements, and labor agreements.

15. Social insurance of homeworkers is carried out in the manner established by law.

16. Homeworkers are granted labor leave in accordance with labor legislation.

17. Expelled.

Occupational Safety and Health

In relation to a homeworker, the employer must:

- conduct training and instructions on labor protection when hiring and do not allow persons to work who have not undergone training and instructions;

- if necessary, provide him with personal protective equipment, flushing and neutralizing agents.

Medical examinations are also relevant to homeworkers, since the work they perform should not be contraindicated for them due to health reasons (Article 311 of the Labor Code of the Russian Federation). If an employee has medical contraindications, the employer does not have the right to allow him to work (Article 212 of the Labor Code of the Russian Federation). Only workers engaged in certain jobs should undergo mandatory preliminary and periodic examinations (Article 213 of the Labor Code of the Russian Federation).

There is no special assessment of workplaces based on working conditions for home-based workers (Clause 3, Article 3 of Federal Law No. 426-FZ of December 28, 2013).

Who is a homeworker and what branch of law regulates labor relations with him?

The definition of the concept of “homeworker” is contained in the Labor Code of the Russian Federation. They are considered a person who works from home, but has an employment contract with the employer (Article 310 of the Labor Code of the Russian Federation). The conclusion of an employment agreement automatically subjects the relationships arising under it to the requirements of labor law (Article 16 of the Labor Code of the Russian Federation) and, accordingly, to the main document of this law - the Labor Code, in which Chapter is devoted to the peculiarities of regulating the work of those working at home. 49.

Since 2020, the Labor Code of the Russian Federation has turned out to be the only legal document in matters of regulation of home-based work in connection with the abolition of the Regulations on the working conditions of homeworkers, which was approved by Resolution of the State Committee for Labor of the USSR and the Secretariat of the All-Union Central Council of Trade Unions dated September 29, 1981 No. 275/17-99 (order of the Ministry of Labor of Russia dated December 29. 2016 No. 848). The provision was applied to the extent that did not contradict the Labor Code of the Russian Federation, and explained in detail many aspects of interaction between the parties.

According to ch. 49 of the Labor Code of the Russian Federation, the nature of home work is determined by:

- implementation at the employee’s place of residence, which will be indicated in the employment agreement as his place of work;

- made from materials and means of labor purchased either by the employer or the employee himself;

- the possibility of involving members of the employee’s family without the employer having an employment relationship with them.

The established relationships do not require compliance with special rules when drawing up an employment contract (or changing it if the nature of the work for an already registered employee changes). However, in this document it is necessary to stipulate those points in which options for mutual obligations are allowed:

- selection of the party responsible for the acquisition of the necessary basic materials and labor tools, and the procedure for transferring them to the employee, if the employer is chosen as such party;

- the procedure for receiving production tasks, accepting the work performed and actually transferring it to the employer;

- the amount of compensation for labor equipment purchased by the employee and the procedure for its payment;

- the procedure for reimbursement of employee expenses for materials purchased by him independently, and for services arising at his place of residence in connection with the performance of work (electricity, water, telephone, Internet);

- prices per unit of work, algorithm for determining its total cost and calculation procedure;

- bonus conditions;

- the presence of additional grounds for dismissal in comparison with the norms of the Labor Code of the Russian Federation.

As with the employment of a regular employee, the hiring of a homeworker will be formalized by order of form T-1 or T-1a. In the line of this document that requires reflection of the conditions of employment and its nature, the home worker needs to make an entry that the work is carried out at home.

Read about the rules for issuing an employment order in the article.

Industrial accident investigation

The employer is also obliged to investigate accidents at work in relation to home-based workers.

An industrial accident is an event as a result of which an employee died or suffered health damage while performing work duties or in the interests of the employer (Part 1 of Article 227 of the Labor Code of the Russian Federation, paragraph 10 of Article 3 of the Federal Law of July 24, 1998 No. 125-FZ).

Only a commission has the right to determine whether an accident is related to production or not during an investigation, which must be organized by the employer (paragraph 6 of Article 228 of the Labor Code of the Russian Federation).

During the investigation, it is necessary to reliably confirm the fact that the employee was performing his job duties at the time of the accident. To do this, you should interview family members, neighbors, talk with the ambulance doctor who went to the scene on call, etc.

An injury received as a result of alcohol or other toxic intoxication or when the injured person commits a criminal offense is not considered work-related (Article 229.2 of the Labor Code of the Russian Federation).

Investigating an accident involving a homeworker should not present any major difficulties since the worker is usually within “reaching range” of the employer.

Features of dismissal of an employee working from home

With regard to dismissal for a home worker, all the usual grounds provided for by labor legislation are valid (Article 310 of the Labor Code of the Russian Federation). But additions to them are also possible, which should be included in the employment contract (Article 312 of the Labor Code of the Russian Federation). These may include the following:

- transferring the place of work to a place located at a different address;

- a one-time failure to deliver the agreed amount of work within the period established by the contract in the absence of a valid reason for this.

Dismissal on the grounds included in the employment agreement may be carried out by notification. But the employer will have to independently collect evidence confirming the occurrence of grounds for dismissal, and this can be quite difficult due to the impossibility of exercising real control over the homeworker’s place of work and his working hours.

Due to the lack of such control, in reality it causes difficulties and dismissal for a number of usual reasons. For example, it is impossible to fire a homeworker for violations of labor discipline such as absenteeism, tardiness, or showing up at work while intoxicated.

Just like regular workers, homeworkers are subject to rules prohibiting:

- establishment in the contract of grounds for dismissal of a discriminatory nature;

- dismissal during illness, sick leave and vacation;

- dismissal of pregnant women, women with young children and single parents.

All procedures related to dismissal in relation to a home worker are carried out as usual. When indicating the grounds for dismissal in the order, work book and personal card, there may be a reference to Art. 312 of the Labor Code of the Russian Federation, if the employment contract is terminated on the grounds provided for in its text.

For information on how to draw up a dismissal order, read the material “Drawing up a dismissal order (form, form, sample).”

Employment history

Information about home work is entered into the employee’s work book in the general manner.

By agreement of the parties, information about remote work may not be entered into the work book of the remote worker, and when concluding an employment contract for the first time, the work book of the remote worker may not be issued. In these cases, the main document about the work activity and length of service of a remote worker is a copy of the employment contract on remote work. Such an agreement can be written down either in a separate document or in the form of a provision on non-record of work in the work book included in the employment contract.