Who is considered an accountable person?

Very often, in the course of business activities, expenses for the needs of the enterprise have to be made by employees on the instructions of the head of the organization. In this case, the employee is given money on account, i.e. this is followed by his obligation to submit a report for the amounts received and spent. Such an employee is an accountable person for the accounting department.

Money can be issued to accountants:

- for business and administrative expenses - in the amount determined by production needs, and for periods determined by production needs;

- for travel expenses - for the period established by the manager’s order to send the employee on a business trip, and in the amount that should include travel expenses, living expenses and daily allowances.

Accounting for accountable amounts (their receipt, write-off, reflection of the balance or overexpenditure) is carried out on the active-passive accounting account 71 “Settlements with accountable persons”.

IMPORTANT! The accountant must maintain analytical accounting for each amount issued for reporting.

Accounting for business and operational accountable amounts

An employee, going on a business trip, has the right to reimbursement of the amount of travel expenses incurred for the purpose of:

- payment for travel to the destination;

- payment of housing rent;

- payment of daily expenses;

- payment of other expenses agreed with the employer.

It is also necessary to take into account that an employee can only claim travel allowances if he is a full-time employee. The amount of money issued on account is regulated by collective labor agreements or the charter of the enterprise. Funds issued in foreign currencies must be accounted for in separate subaccounts.

The issuance of travel allowances to an employee is accompanied by accounting entries and execution of relevant documents. Having paid funds from the cash register to the account, the following entry is made: Dt account 71 Kt account 50. If the money was transferred to a corporate payment card, the operation is recorded with the entries: Dt 55 Kt 51, Dt 71 Kt 55.

The further accounting procedure depends on the purpose for which the employee was sent on a business trip. If production needs are fulfilled, accounts 20, 23 or 29 are debited with account 71. Travel of an administrative and managerial nature is written off to account 26, for the sale of goods - to account 44.

A business trip associated with the acquisition of property for an enterprise is included in the cost of the purchased asset and is reflected in the corresponding account for inventory, non-current assets, and goods.

The amount of VAT on travel payments of a production nature is taken into account by the following entries:

- Dt “VAT” Ct “Calculations for accountable amounts” – the VAT amount is accepted for accounting.

- Dt 68 “Calculations for taxes” Kt 19 “VAT” - tax deduction of VAT was carried out.

It should be remembered that VAT is not deducted for expenses not related to production. A posting is made: Dt “Other expenses” Kt “VAT”, meaning VAT is written off.

Confirmed expenditure of travel funds for a large amount is subject to reimbursement by the enterprise in favor of the employee, posting - Dt account 71 Kt account 50. If the employee returns unspent amounts, the operation has the opposite form: Dt “Cash” Kt “Calculations for accountable amounts”.

In addition to travel expenses, the company can issue funds to the employee as an account for the purpose of paying for:

- business and operating expenses;

- purchases of small wholesale goods;

- entertainment expenses.

Business and operating expenses involve the purchase of goods, payment for fuel and lubricants and services. Entertainment expenses are classified as general business expenses and include the costs of receiving foreign representatives, buffet services, translation services, etc. They do not include expenses for entertainment events and recreation in health resorts.

Goods purchased with cash issued on account are recorded in the accounts of non-current assets, inventories or goods.

Let's consider an example: 3,000 rubles were issued from the cash register for the purchase of materials, of which 2,500 rubles were actually spent. The accountant makes the following entries:

- DT “Calculations for accountable amounts” CT “Cash desk” – 3000 rub. – issued to an accountable person for the purchase of materials.

- Dt “Materials” Kt “Calculations for accountable amounts” – 2500 rub. – reflects the amount of expenses for materials.

- Dt “Cash desk” Kt “Settlements for accountable amounts” – 500 rub. – the accountable person returned unused funds to the cash desk.

If the remaining accountable amounts are not returned by the employee within the prescribed period, or an advance report on the funds spent has not been provided, the following posting is made: Dt 94 Kt 71. Depending on the method of withholding the amount, postings can be made:

- Dt “Payroll calculations” Kt “Shortages and losses” – deduction of the accountable amount from the employee’s salary;

- DT “Settlements with employees for other transactions” DT “Shortages and losses” – the employee’s receivables for the unreturned accountable amount are displayed.

Before using account 71 in accounting to draw up correspondence on transactions for recording and collecting accountable amounts from an employee, you need to familiarize yourself with the accounting policies of the enterprise. In special cases with a score of 71, accounts 91 and 99 can also be used.

Organization of accounting of settlements with accountable persons

Funds are issued for reporting in accordance with clause 6.3 of the Bank of the Russian Federation Directive No. 3210-U dated March 11, 2014 on the basis of an employee’s application endorsed by the manager (or individual entrepreneur) with the amount and period for which the money is taken stated in it. From 08/19/2017 (directive of the Bank of Russia dated 06/19/2017 No. 4416-U), such an application is not mandatory, and issuance can be carried out without an application on the basis of an order from the manager (or individual entrepreneur). Cash is issued from the cash register using a cash receipt order.

Read about the rules for preparing this document in the article “How to fill out an expense cash order (RKO)?”

The employee must report no later than 3 days after the end of the period for which the money was issued. For this purpose, there is a document such as an advance report, which reflects the amount of funds received and what it was spent on. Documents confirming the expenses incurred must also be attached to the report.

What should I do if the employee has not returned the accountable amount or provided an advance expense report? How to reflect the non-return of the accountable amount in accounting and tax accounting? Answers to these and other questions are in ConsultantPlus. If you don't have access yet, get a free trial online.

See also “Deadline for submitting an advance report by an accountable person.”

IMPORTANT! Until August 19, 2017, there was a rule that it was impossible to issue funds on account to a person who had not accounted for previous amounts. It has been canceled since August 19, 2017. See here for details.

The procedure for issuing money for reporting

2017 brought changes to the procedure for issuing money on account. Directive of the Central Bank No. 4416-U dated June 19, 2017 made the following changes to paragraph 6 of the Procedure for conducting cash transactions:

- It is allowed to issue money on account not only on the basis of an employee’s application, but also on the basis of an administrative document of the manager;

- The mandatory return of the previous accountable advance in order to receive a new one has been cancelled.

The period for which the money is issued is set by the head of the organization, stated in the application or order, and can be set individually for each employee.

Sample application for reporting

Sample order for reporting

The nuances of travel expenses

A business trip is an employee’s departure to an area remote from his main place of work to perform official functions. The preparation of documents on the basis of which it is necessary to keep accounting records of settlements with accountable persons in this case must be carried out in accordance with the Decree of the Government of the Russian Federation “On the peculiarities of sending employees on business trips” dated October 13, 2008 No. 749.

The issuance of money for a business trip is calculated based on the cost of round trip travel, housing costs and daily allowance.

It should be taken into account that:

- the day of departure and the day of arrival are considered to be the dates recorded in the transport tickets;

- living expenses will have to be taken into account based on the documents provided by the accountable;

- daily allowances can be established and issued in accordance with internal documents regulating their amount, for example, regulations on business trips (Article 168 of the Labor Code of the Russian Federation).

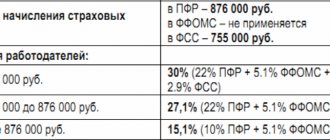

To correctly calculate the tax base for personal income tax, daily allowances are taken into account within the limits established by law: 700 rubles. in Russia and 2500 rub. - on a business trip abroad (paragraph 12, clause 3, article 217 of the Tax Code of the Russian Federation), to calculate income tax, expenses include the amount within the amount stipulated by the employer’s internal documents (employment contract, order, business trip regulations).

IMPORTANT! That part of the daily allowance that is paid in excess of the norm established by law is considered the employee’s income and is subject to personal income tax and insurance contributions.

You can learn about the nuances of reflecting daily allowances in tax reporting from the article “How to correctly reflect daily allowances in excess of the norm in 6-NDFL?” .

Current questions on a given topic.

Question No. 1. For what purposes can funds be issued to an employee of an enterprise for reporting purposes?

Answer: All funds that are issued for reporting to an employee of the enterprise must be of a strictly targeted nature, namely:

- payment for any specific service;

- purchase of stationery and envelopes;

- purchase of fuels and lubricants for official vehicles;

- payment for travel tickets for a business trip, as well as payment for a hotel;

- purchase of office equipment, etc.

Question No. 2. Can the funds that need to be given to the employee for the purchase of office supplies be provided from the proceeds received?

Answer: In accordance with Directive No. 3073-U dated 10/07/2013. Clause 2 of the Central Bank of the Russian Federation, an enterprise has the right to spend funds from the proceeds received strictly for established purposes. The issuance of funds on account is included in the list of such purposes.

Postings for accounting on account 71

According to Section VI of the instructions for using the chart of accounts (order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), account 71 “Settlements with accountable persons”:

- debited to cash accounts 50 “Cash” (if cash is given to the accountant) or 51 (when funds are given in non-cash form);

- is credited to accounts that record expenses related to the employer’s business activities, and to cash accounts in the event of the return of unspent amounts.

Amounts for which the employee did not report must be returned to the employer - such an operation will be recorded as a credit to account 71 and a debit to cash accounts 50, 51.

If the balance of money is in debt to the employee, then it should be taken into account in the debit of account 94 “Shortages and losses from damage to valuables” in correspondence with account 71. Such debt can be deducted from the employee’s salary, in this case a posting will be made Dt 70 Kt 94 When the employer does not have the opportunity to withhold the debt from the salary, account 73 “Settlements with personnel for other operations” is used, and the posting will look like this: Dt 73 Kt 94.

Note! If an employee has lost (or forgotten to take) documents confirming expenses, then the decision to reimburse the employee for expenses is made by the head of the company. The supporting document will be an explanatory note from the employee attached to the advance report, and the basis for accepting the advance report will be an order from the director of the company.

Let us summarize the information about which accounts account 71 can correspond with.

| Account 71 “Settlements with accountable persons” corresponds to: | |||

| by debit with accounts | on a loan with accounts | ||

| the name of the operation | Corr. check | the name of the operation | Corr. check |

| Funds were issued for accounting or to compensate for overexpenditure of accountable amounts | 50, 51, 52 | Acquisition of material assets, goods | 07, 08, 10, 41 |

| Funds spent on expenses and household needs | 20, 23, 25, 26, 44 | ||

| VAT on purchased goods and materials | 19 | ||

| Return of the balance of accountable money | 50, 51 | ||

| There was a delay in the return of accountable amounts | 94 | ||

The expense report submitted to the accounting department is checked by the accountant, and its approval (by signing) is carried out by the manager (or individual entrepreneur). After this, the accountant can make all the necessary entries for expenses in accounting.

ConsultantPlus experts explained how to take into account the costs of an advance report when calculating income tax. Get trial access to the system and move on to the Ready Solution.

Settlements with accountable persons mean settlements between an organization and its employees, conditioned by the advance payment of cash to them to pay for business, travel and other expenses.

The issuance of advance amounts of money to a specific employee of the organization, we remind you, is possible only if he fully reports on previously received advances. In addition, the transfer of accountable amounts by one employee to another is not permitted. The organization, as a rule, receives funds intended to pay for business and travel expenses from the current account to the cash desk for distribution to accountable persons. Organizations that have constant cash revenue for goods sold have the right to use cash for business and other expenses within the limits established by the credit institution.

Accounting for such settlements is kept on account 71 “Settlements with accountable persons”. This account is active-passive, since at the end of the accounting period there may be balances of both unused accountable amounts and expenses not reimbursed by the organization for the submitted advance reports.

Accounting

The amount of funds issued to employees of the organization for reporting is reflected in the accounting entry:

debit of account 71 “Settlements with accountable persons”, credit of accounts 50 “Cash”, 51 “Settlement accounts”, 52 “Currency accounts”, 55 “Special accounts in banks”.

The intended use of these funds is documented in an advance report - a summary document that provides the entire list and amounts of expenses incurred based on the documents attached to it.

Sales receipts, invoices, cash receipts, receipts for cash receipts, acts of work performed, invoices, invoices, transport documents, acts of purchase of material assets from individuals, etc. are accepted as primary supporting documents confirming the appropriateness of using accountable funds.

It should be noted that only a properly prepared advance report is the basis for recording transactions on settlements with accountable persons in the reporting period in which these transactions took place, i.e. based on the date of approval of the advance report by the head of the organization.

In addition to the accounting aspect of checking advance reports on the substance of expenses incurred by accountable persons, the organization must consider the content of this document based on the current norms of tax legislation. Restrictions on cash settlements between legal entities apply to similar settlements carried out through accountable entities. In other words, facts of direct deposit of funds received on account by an employee of one organization to the current account of another counterparty organization are considered a violation of the current cash circulation procedure. In such cases, the violating organization is subject to penalties in the amount of twice the amount deposited into the current account.

Moreover, organizations, when accepting advance reports from accountable persons, must record the deadline for their submission, since they must be submitted to the accounting department no later than three working days after the expiration of the period for which they were issued, or from the day of return from a business trip. The need for information about the deadlines for submitting advance reports is explained by the current procedure for including material benefits in taxable income

Chapter XII. Accounting for settlement transactions

individuals. Material benefit from an employee’s use of the organization’s funds can be obtained in cases of untimely return of unspent accountable amounts or their unreasonable receipt. At the same time, for tax purposes it is necessary to determine how many days the accountable amounts were used for other purposes. To do this, the established and actual dates of the report on the expenditure of accountable amounts are compared. The identified material benefit is considered as the income of an employee of the organization, which is subject to personal income tax at the rate of 13%. Income also includes excess daily allowances against established norms and payment of expenses that do not correspond to the nature of the production task.

Accountable amounts, as noted above, are issued not only for the purchase of inventories, payment for services and work, but also for payment of travel expenses. In this regard, we will consider the current procedure for calculating travel expenses in accordance with the established standards for their reimbursement. Regulatory acts regulate the composition of travel expenses reimbursed by the organization. Thus, such expenses include payment for the rental of residential premises; daily allowance; travel expenses to and from the business trip; costs for using bedding.

Travel expenses associated with production activities are considered recognized expenses for ordinary activities and are included in the cost of production. At the same time, the organization needs information about the payment of travel expenses that exceed the established norms in order to subsequently adjust the taxable profit. Such information is provided when travel expenses are reflected in cost accounts in the context of the subaccounts “Costs within the approved standards” and “Costs in excess of the established standards.”

The return of unused accountable amounts is reflected on the basis of the cash receipt order by the accounting entry:

debit account 50 “Cash”,

credit of account 71 “Settlements with accountable persons”.

In cases where accountable persons do not return previously received advance amounts or do not submit an advance report on the spent accountable amounts, the write-off of such amounts is reflected in the accounting entry:

Accounting

debit of account 94 “Shortages and losses from damage to valuables”, credit of account 71 “Settlements with accountable persons”.

When deducting from wages a previously received accountable amount or an amount for which an advance report has not been submitted, the following entry is made:

debit of account 70 “Settlements with personnel for wages”, credit of account 94 “Shortages and losses from damage to valuables.”

If it is impossible to collect the balance of unspent accountable amounts from wages, record:

debit of account 73 “Settlements with personnel for other operations”, subaccount 2 “Calculations for compensation of material damage”, credit of account 94 “Shortages and losses from damage to valuables”.

After the expiration of the limitation period, the amount of unreimbursed material damage is written off as the organization’s losses by the accounting entry:

debit account 91 “Other income and expenses”, subaccount 2 “Other expenses”,

credit account 73, subaccount 2 “Calculations for compensation of material damage.”

The use of imprest amounts in accounting is reflected in the credit of account 71 “Settlements with accountable persons” and the debit of accounts 07 “Equipment for installation”, 08 “Investments in non-current assets”, 10 “Materials”, 15 “Procurement and acquisition of material assets”, 41 “Products”, etc.

Analytical accounting of settlements with wards is carried out for each accountable person, reflecting the amount of debt generated for the advance received from the organization's cash desk, as well as the amount of write-off of this debt as the advance report is submitted and these expenses are charged to cost accounts or inventories, depending on the purpose and the nature of the use of imprest amounts.

12.7. Accounting for settlements with personnel for other operations

In addition to settlements for wages with depositors and accountable persons, there may be other types of settlements with employees of the enterprise. The most common settlements arising in connection with the purchase

Chapter XII. Accounting for settlement transactions

goods on credit, obtaining loans for individual housing and cooperative construction, starting a household, for compensation of material damage. To account for them, account 73 “Settlements with personnel for other operations” is used, to which sub-accounts can be opened: 73-1 “Settlements for loans provided”, 73-2 “Settlements for compensation of material damage”, 73-3 “Settlements for goods sold on credit”, etc.

Subaccount 73-1 “Settlements for loans provided” reflects settlements with employees of the organization for loans provided to them (for example, for individual and cooperative housing construction, the acquisition or construction of garden houses and the improvement of garden plots, starting a household, etc.). The debit of account 73 “Settlements with personnel for other operations” reflects the amount of the loan provided to an employee of the organization in correspondence with account 50 “Cash” or 51 “Cash accounts”. For the amount of payments received from the borrower-employee, account 73 “Settlements with personnel for other operations” is credited in correspondence with accounts 50 “Cash”, 51 “Settlement accounts”, 70 “Settlements with personnel for wages” (depending on the accepted payment procedure).

Subaccount 73-2 “Calculations for compensation for material damage” takes into account calculations for compensation for material damage caused by an employee of the organization as a result of shortages or thefts of cash and inventory items, defects, as well as compensation for other types of damage.

In the debit of account 73 “Settlements with personnel for other operations,” the amounts to be recovered from the guilty parties are included in the credit of accounts 94 “Shortages and losses from damage to valuables” and 98 “Deferred income” (for missing inventory items), 28 “Defects in production” (for losses from defective products), etc.

In the credit of account 73 “Settlements with personnel for other operations,” entries are made in correspondence with the accounts:

cash accounting - for the amounts of payments made;

70 “Settlements with personnel for wages” - for the amount of deductions from wages;

94 “Shortages and losses from damage to valuables” - for the amount of written off shortfalls in case of refusal to recover due to the unfoundedness of the claim.

Accounting

Subaccount 73-3 “Settlements for goods sold on credit” takes into account settlements with the organization’s personnel for goods purchased by them on credit.

The operation of issuing a loan to an employee is reflected in the debit of account 73-3 “Payments for goods sold on credit” and the credit of account 66 “Settlements for short-term loans and borrowings” or account 67 “Settlements for long-term loans and borrowings”.

Deductions from employees' wages to pay off debt on loans are taken into account in the debit of account 70 "Settlements with personnel for other operations" and the credit of account 73-3 "Settlements for goods sold on credit." When repaying debt on loans, accounts 66 or 67 are debited and account 51 “Current accounts” is credited.

Analytical accounting for account 73 “Settlements with personnel for other operations” is maintained for each employee of the organization

Results

Accounting for settlements of funds issued to an accountable person is based primarily on the correct and timely documentation of all transactions. Such operations include issuing money for expenses, reporting by the accountable person, returning unspent amounts, and recording expenses incurred.

Sources:

- Tax Code of the Russian Federation

- Labor Code

- Directive of the Bank of Russia dated March 11, 2014 N 3210-U

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Find out the cost of writing such a paper!

Reply within 5 minutes! Without intermediaries!

CONTENT

- INTRODUCTION

- CHAPTER 1. THEORETICAL ASPECTS OF ACCOUNTING FOR SETTLEMENTS WITH ACCOUNTABLE ENTITIES

- 1.1. Regulatory regulation of settlements with accountable persons

- 1.2. The essence of settlements with accountable persons

- 1.3. Documentation of settlements with accountable persons

- CHAPTER 2. METHODOLOGICAL ASPECTS OF ACCOUNTING SETTLEMENTS WITH ACCOUNTABLE ENTITIES

- 2.1. Analytical and synthetic accounting of settlements with accountable persons

- 2.2. Features of taxation when accounting for settlements with accountable persons

- CHAPTER 3. PRACTICAL ASPECTS OF ACCOUNTING FOR SETTLEMENTS WITH ACCOUNTABLE ENTITIES IN SmegCrown LLC

- 3.1. Brief economic characteristics of SmegCrown LLC

- 3.2. The procedure for accounting for accountable amounts issued for business and entertainment expenses

- 3.3. Organization of accounting of accountable amounts issued for travel expenses

- 3.4. Improving accounting and control of settlements with accountable persons at SmegCrown LLC

- CONCLUSION

- BIBLIOGRAPHY

INTRODUCTION

According to existing accounting standards, the generated financial statements do not provide information about transactions with reporting entities. Indeed, data on the balances and movement of settlements with reporting persons for the reporting period is not reflected in any form of accounting reporting and interested parties (shareholders, managers and audit and tax authorities) cannot obtain information about the status of these settlements from the accounting data.

At the same time, practice shows that accounting for settlements with accountable persons is one of the most labor-intensive areas of accounting. Here the accountant is faced not only with documents on civil law, accounting and tax accounting, but also directly with each employee of this organization.

Transactions with accountable persons in accounting are of great importance, since they are associated with many other sections of accounting - cash transactions (receipt of accountable amounts and delivery of unspent amounts), settlements with suppliers and contractors, operations for the movement of material assets, operations for compensation of material damage , shortages, provision of loans, etc., which makes the work highly labor intensive.

Based on the above, the relevance of the topic of the final qualifying work lies in the fact that the area of accounting for settlements with accountable persons and personnel for other operations includes a variety of business transactions: cash purchases of household and office supplies, fuels and lubricants, payment for minor repairs office equipment, vehicle repair; expenses for business trips within the country (Russian Federation) and abroad, entertainment expenses, provision of loans to employees, compensation for material damage, shortages, etc.

Due to the wide variety of business transactions in this area of work, many problems arise related to the preparation of primary and reporting documents, the calculation of standards, etc.

The daily allowance standards that organizations must apply when paying income tax, which are often revised by the government, in relation to personal income tax, increase the relevance of accounting for settlements with accountable persons.

According to the law of business, it is necessary to maintain not only business relationships with partners (negotiations, presentations), but also friendly ones - meetings in an informal setting. The main part of entertainment expenses is carried out in cash through accountable persons. Moreover, not all of these expenses can be classified as entertainment expenses. In this regard, one of the most difficult areas of accounting for settlements with accountable persons is entertainment expenses, since in this area of work there are many problems associated with the preparation of primary and reporting documents, with the calculation of standards.

The subject of the financial accounting is accounting of settlements with accountable persons.

The object of the VKR is settlements with accountable persons at the wholesale trade enterprise SmegCrown LLC.

The purpose of the VKR is to improve accounting and control of settlements with accountable persons.

To achieve the goal, it is necessary to solve the following tasks:

— review the regulatory framework for accounting of settlements with accountable persons;

— consider the documentation of settlements with accountable persons;

— identify the essence of settlements with accountable persons;

— reveal the concept of analytical and synthetic accounting of settlements with accountable persons;

— study the peculiarities of taxation when accounting for settlements with accountable persons;

— consider the procedure for accounting for accountable amounts for business, entertainment and travel expenses in SmegCrown LLC;

— analyze the correctness of accounting for settlements with accountable persons at SmegCrown LLC and make proposals for improvement.

Accounting for the accounting item “Card account”

In accounting, accounting for payments by non-cash card may be accompanied by the following transactions:

Possible correspondence under the non-cash procedure

| № | Contents of operation | Accounts | |

| Dt | CT | ||

| 1 | Funds from the company's current account are credited to the card | 55 (sub-account called “Card Account”) | 51 |

| 2 | The employee was given money on account (a transaction was made to pay for any goods, services, or the person withdrew money from an ATM) | 71 | 55 (sub-account called “Card Account”) |

Find out the cost of writing such a paper!

Reply within 5 minutes! Without intermediaries!

The power of attorney indicates the date of its issue and validity period. If the power of attorney does not indicate a validity period, then such a power of attorney is valid for 1 year from the date of issue. If the power of attorney does not indicate the date of its issue, then such a power of attorney is not valid.

The official assignment for a business trip is drawn up on the basis of the relevant information from the business trip plan. When sending an employee on an urgent (unscheduled) business trip, the assignment is drawn up on the basis of the decision of the head of the organization (other authorized person), expressed, for example, in a resolution on a memo (other document).

Please note that this document has two functions.

Firstly, it specifies the essence of the task, the implementation of which is assigned to the employee during the business trip, and, secondly, it reflects the main results of the execution of the assignment in a brief written report. A brief report on the performance of a job assignment is drawn up by the employee immediately after arrival and filled in by hand in the appropriate column of the assignment.

A travel certificate is a document issued to an employee for the duration of his official duties outside his permanent place of work. It is a document certifying the time spent on a business trip (time of arrival at destinations and time of departure from them). It serves as a justification for the place and time of a business trip and is attached to the advance report for calculating daily allowance and accounting for travel expenses.

The main document for settlements with accountable persons is an advance report - a document that combines generalized data on primary documents confirming expenses made by accountable persons and accounting records reflecting these expenses in the organization’s accounting.

The report must be completed by the reporting person himself, and not by the accountant. Very often, this is why a company limits the circle of accountable persons. After all, not every person can immediately correctly fill out an expense report, and then the accountant has to explain to the newcomer how this is done. If accountable persons constantly deal with filling out these documents, then they already know the filling procedure well.

Supporting documents (invoices, checks, receipts, invoices, etc.) confirming the fact of the intended use of funds are attached to the advance report. The advance report indicates the organization, full name and position of the reporting person, number, date of the advance report, purpose of the advance, amount, on the reverse side the date, serial number, to whom, for what and according to what document was paid, the amount.

The advance report is signed by the reporting person, approved by the manager, and signed by the accountant. Without approval of the report, the accountant has no right to accept the report. The report is checked by the chief accountant, that is, the compliance of the attached documents with the recorded amounts is established.

Based on the data reflected in the advance report approved by the head of the enterprise, the accounting department repays the advance (writes off the accountable amounts from the employee), and, if necessary, pays the employee the difference between the funds actually spent and the amount of the advance (overexpenditure).

Amounts issued but not spent by the accountable person are subject to return to the enterprise's cash desk using cash receipt orders.

Accountable persons report to the accounting department about the amounts spent within three working days.

It is recommended that the issuance of cash against a report is made subject to a full report from a specific accountable person on the advance previously issued to him.

The issuance of cash against a report or in order to compensate for overexpenditure on an advance report from the cash registers of enterprises is carried out using cash receipts. Documents for the issuance of money must be signed by the manager, chief accountant of the enterprise or persons authorized to do so. In cases where the documents (applications, invoices, etc.) attached to the cash vouchers have the permission of the head of the enterprise, his signature on the cash vouchers is not required.

It should be noted that when purchasing goods in cash at an enterprise, it is necessary to comply with the established maximum size of cash accounts between legal entities. 100 thousand rubles

It should also be noted that in the new Federal Law No. 402-FZ “On Accounting”, which came into force on January 1, 2013, there is no mention of unified forms of primary documents. All forms of primary documents, including those for accounting of settlements with accountable persons, will be approved not by the accounting policy of the organization, but by the manager upon the recommendation of the official charged with maintaining accounting records.

Report for sub-report

The employee must report for the funds issued in a strictly defined manner. First of all, pay attention to the deadline: the report is submitted to the accounting department no later than three working days from the moment the employee returns to work or from the end of the period for which the money was allocated.

An employee can submit a report in one of two options:

- advance report in form 0504049 with attached primary documents (tickets, checks, etc.);

- statement or cash order - if accountable funds were allocated for payments to individuals (salaries, fees, etc.).

On the front side of the advance report, the employee fills out information about himself: full name, personnel number, position, structural unit. On the reverse side, in columns 1 to 6, in separate entries, based on primary documents, he enters data on the funds spent: amount, expense item, date and number of the supporting document. Primary documents must be attached to the expense report and numbered in the same order as the entries in the report.

The accountant or manager accepts the report. Each institution establishes its own procedure and timing for reviewing the report as part of its internal accounting policy; legislation does not regulate this point.

Having received the advance report from the employee, the accountant checks whether it is filled out correctly and whether all documents are attached. Data on expenses that the institution accepts for accounting are entered in columns 7–10. Opposite each amount is the analytical account number.

The accountant reflects the expenses accepted by the institution for accounting as follows:

| Debit | Credit | Description |

| 0 10500 340 “Increase in the cost of inventories” | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | Expenses accepted by the institution for accounting using funds issued on account |

| 0 10600 000 “Investments in non-financial assets” | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | |

| 0 30200 000 “Settlements for accepted obligations” | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | |

| 0 40120 000 “Expenditures of the current financial year” | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | |

| 0 10900 000 “Costs for the production of finished products, performance of work, services” | 0 208XX 660 “Reduction of accounts receivable of accountable persons” |

A situation may arise when the employee did not spend all the funds or, on the contrary, invested his own. In the advance report, he enters these amounts in the Remaining/Overexpenditure column. In accounting, this will be reflected as a debt of the reporting person or institution. The overexpenditure is recorded and reimbursed to the employee in the same manner as the advance payment, and to return the balance, the accountant creates a record using one of the options:

| Debit | Credit | Description |

| 0 20134 510 “Receipts of funds to the institution’s cash desk” | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | Accountable funds were returned to the institution's cash desk |

| 0 20111 510 “Receipts of funds from the institution from personal accounts in the treasury body” (for budgetary and autonomous institutions) | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | Accountable funds were returned to the institution’s personal account |

| 0 20121 510 “Receipts of funds from an institution in a credit institution” (for autonomous institutions that have an account in a credit institution) | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | Accountable funds were returned to the institution’s personal account |

| 1 30405 000 “Settlements for payments from the budget with the financial authority” (for government institutions) | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | Accountable funds were returned to the institution’s personal account |