Using account 98 in accounting

Accounting account 98 is necessary to reflect information about income that is received in the current period, but can only be attributed to transactions that will take place in the future. Using this account, information about received assets (non-current or financial), the financial benefit from which will arise in the future, is quickly processed.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

According to clause 12 of PBU 9/99, income can be recognized and taken into account if there is precise confidence that potential benefits from the acquired assets will follow in the future.

The use of account 98 is as follows: it is formed from income that is expected in the future, such as:

- The difference that is expected from the excess of leasing payments over the cost of the property transferred to the financial lease (clause 4 of the Instructions, approved by Order of the Ministry of Finance dated February 17, 1997 No. 15 - until 2001, deferred income was taken into account on account 83).

- Budget funds have been allocated for the purchase of non-current assets or for financing current expenses (clause 9 of PBU 13/2000).

- Fixed assets received free of charge (clause 29 of Order of the Ministry of Finance dated October 13, 2003 No. 91n).

- The difference formed between the amount of recovery from the guilty persons for stolen property and the cost of the shortage (Order of the Ministry of Finance dated October 31, 2000 No. 94n - description of account 98).

Accounting account 98 is a passive reporting and distribution register. The credit of the account reflects the amounts of receipts relating to future periods. By debit - transferred income at the beginning of this reporting period. The account balance is always in credit.

Account 98 2 upon receipt of funds clarification 2020

Amounts recorded on account 98-00 are debited from this account on credit to account 91:

Analytical accounting for subaccount 98-02

is carried out for each gratuitous receipt of valuables.

— the movement of upcoming debt receipts for shortfalls identified in the reporting period for previous years is taken into account.

Debit 94-00 Credit 98-02 - reflects the amounts of shortages of valuables identified in previous reporting periods (before the reporting year), found guilty by persons, or amounts awarded for recovery by the court. At the same time, a posting is made for these amounts Debit 73-02 Credit 94-00.

Credit 73-02 Debit <cash account> - repayment of debt for shortfalls. At the same time, the received amounts are reflected: Debit 98-03 Credit 91 (profits of previous years identified in the reporting year).

— the difference between the amount recovered from the guilty parties for missing material and other valuables and the cost listed in the organization’s accounting records is taken into account.

Debit 73-02 Credit 98-00 reflects the difference between the amount to be recovered from the guilty parties and the cost of shortages of valuables. As the debt registered under 73 is repaid, the corresponding amounts of the difference are written off from 98-04 to credit 91.

Analytics for account 98

In accordance with the Chart of Accounts, the account for deferred income is supposed to be used to summarize a wide variety of information. In order to organize information, it is recommended to open the following subaccounts for account 98 (in transactions they are indicated with a “dot” or a hyphen):

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

- 01 - the following income is taken into account: rent paid in advance, subscription fee for service, transportation subscription, payment for utilities, etc.;

- 02—receipts received free of charge;

- 03 - expected receipt of debt for shortfalls identified earlier;

- 04 - excess of the amount collected from the perpetrators over the cost of the shortage.

For each subaccount, separate records are kept for each type of income. The list of subaccounts is open - enterprises can independently add other subaccounts according to their needs. The types of subaccounts to be opened should be indicated in the accounting policy of the enterprise.

Typical transactions for account 98

For account 98, the postings are described in the chart of accounts. Using subaccounts, the main transactions look like this:

- Dt 08 Kt 98.02 - fixed assets received free of charge at market value are accepted for accounting;

- Dt 98.02 Kt 91.01 - income is recognized in the amount of monthly depreciation;

- Dt 86 Kt 98.02 - budget funds have been received that are aimed at financing expenses;

- Dt 94 Kt 98.03 - the amount of the shortage confirmed in the court decision is reflected in the accounting;

- Dt 98.03 Kt 91 - the amount of the shortfall has been repaid;

- Dt 73 Kt 98.04 - reflects the amount of the difference between the amount of recovery of the shortage from the guilty employee and the real price of the lost property;

- Dt 51 Kt 98.01 - advance payment of rent was received for six months in advance;

- Kt 98.01 Kt 90.01 - reflects the monthly rent payment;

- Dt 10 Kt 98.02 - free material was received for production, reflected in accounting at market value;

- Dt 08 Kt 98.02 - equipment was transferred to the balance sheet as a charity;

- Dt 62 Kt 98.05 - transport leased;

- Dt 98.05 Kt 90.01 - regular lease payment accrued;

- Dt 51 Kt 98.02 - a grant was received with targeted use for landscaping;

- Dt 98.02 Kt 91.01 - plants were planted on the territory purchased through the grant.

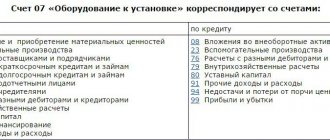

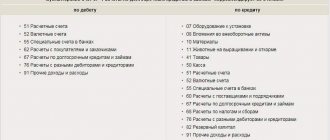

Account 98 “Deferred income” corresponds with the following Plan accounts:

by debit

- 68 “Calculations for taxes and fees”

- 90 "Sales"

- 91 “Other income and expenses”

on loan

- 08 “Investments in non-current assets”

- 50 "Cashier"

- 51 “Current accounts”

- 52 “Currency accounts”

- 55 “Special bank accounts”

- 58 “Financial investments”

- 73 “Settlements with personnel for other operations”

- 76 “Settlements with various debtors and creditors”

- 86 “Targeted financing”

- 91 “Other income and expenses”

- 94 “Shortages and losses from damage to valuables”

Reflection in the balance

The deferred income account has a constant credit balance at the end of the accounting period. For this reason, in the balance sheet, the balance is reflected in the liability in line 1530. It reflects only income clearly indicated in regulations:

- budget revenues to finance expenses;

- unused funds of targeted financing remaining from the previous period;

- the difference between the total value of lease payments and the value of the asset on the lessee’s balance sheet.

Companies receiving targeted funding from state and extra-budgetary funds reflect the use of such targeted proceeds on account 98. At the end of the year, the amounts of unused balances of target financing from account 86 are transferred to account 98.

In this case, data from account 98 is excluded from the formula for calculating the enterprise’s net assets (clause 6 of the Procedure, approved by order of the Ministry of Finance dated August 28, 2014 No. 84n).

***

To timely reflect in accounting information about income that will bring benefits in the future, account 98 is used. By its nature, this is a passive account, which has a special position in accounting. It is recommended to open sub-accounts for each type of income. In addition, it is recommended to keep records in the context of each of the assets or other income. The credit balance of the account at the end of the year is reflected in line 1530 of the balance sheet.

Deferred income: accounting procedure and reporting

Deferred income (FPI) is an important criterion taken into account when analyzing the economic and financial functioning of an organization. Regardless of the area, any company can receive income that must be attributed to future periods in accordance with approved regulations.

The correctness and timeliness of accounting for this type of income is very important, since calculated taxes directly depend on the amount of DBP.

In addition, when checking the final data of the accounting statements and financial results for the main activities, it often turns out that the solvency indicators of the organization have worsened compared to previous months and years.

If, during the analysis process, the coefficients of autonomy and provision of working capital do not satisfy the usual standard values, then it is necessary to determine how correctly the DBP amounts were allocated in accounting.

DBP - funds that were actually received by the enterprise in the current reporting period, but must be taken into account subsequently in other periods of time that have not yet occurred.

Considering the activities of a standard commercial organization, these first of all include advance payments from buyers for services not yet provided or goods not shipped.

At the time of direct recording of received income, when goods or services are not delivered to customers, payment for them should be classified as a liability. This is due to the fact that, in reality, mutual obligations under the existing agreement have not yet been fully fulfilled, and these funds have not been earned by the organization.

Summarizing the above, it is impossible to credit income to a balance sheet asset that cannot currently be compared with the expenses related to them.

Accounting for DBP is reflected in account 98, which is passive. The opening account balance shows the total amount of income at the beginning of the analyzed period of time. The loan shows those types of income that should be attributed to future periods. The debit account turnover reflects exactly what amount was written off to other accounting accounts for a given period.

The ending balance shows the amount of unwritten off income at the end of the established interval.

In addition to advance receipts from clients, it is advisable to reflect on this account such types of income as:

- payment for rent stipulated by the contract, received in advance ahead of the deadline specified in the contract;

- subscription fee for the operation of telephone landline and mobile communications and the Internet, paid by counterparties before the onset of the periods specified in the contracts;

- property and assets that the organization has capitalized under donation documents;

- planned receipts for shortages that occurred in previous periods, but are documented in the current period.

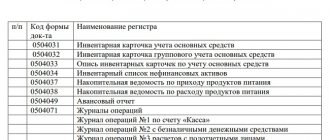

Account 98 in the standard chart of accounts has 4 subaccounts, and accounting for all regulated subaccounts must be kept in strict analytics of a certain type of acquired benefit.

So, subaccount 1 shows payment of rent, monthly utilities, subscription fees for communications services and revenue for the transportation of goods.

Subaccount 2 shows the amounts of assets that were received by the enterprise under gift agreements. Accounting is carried out for each type of such assets and shows their market value reflected by the date of actual acceptance for accounting.

Subaccount 3 takes into account future receipts of those amounts of shortages of materials and funds that were identified in past intervals. This subaccount also shows amounts recovered during legal proceedings.

Subaccount 4 displays the amounts of the actual cost of missing or damaged goods and materials, the residual value of missing or broken fixed assets and the amount of established losses of partially damaged materials.

If a commercial enterprise on a state-targeted basis was provided with financing in the form of material assistance, grants or subsidies during the reporting period, its accounting must be reflected in subaccount 2 of account 98.

This account subsequently corresponds with account 86 “Targeted financing”. This aspect is important for subsequent reporting.

When compiling the final balance sheet, DBP are displayed on line 1530 of the Liabilities of the balance sheet in the “Short-term liabilities” section (see figure).

It shows the value of funds received free of charge, receipts for identified thefts and shortages of past periods and the amount of targeted funding received by the organization over the past calendar year.

When filling out the balance sheet, it is necessary to remember that for the purpose of drawing up correct financial statements, advances received must be reflected separately from the DBP.

Therefore, payments transferred as an advance payment are subject to accounting on line 1520 and are one of the components of accounts payable.

In fact, line 1530 ultimately needs to show the amounts of the credit balance of account 98 and the credit balance of account 86 in the target financing provided analytics.

But in the case when the amount of unused targeted funding is large and significant in the overall indicators of the organization’s turnover, then it is advisable to show it separately. A special line in the “Short-term liabilities” section can be used for display.

The correct reflection in the accounting of DBP lies in timely and correct postings. In the event that an enterprise has received a DBP, in the presence of unified forms of primary documentation, it should be reflected in account 98 in relation to various accounts. Account 98 can correspond to:

- on Debit with accounts 68, 90 and 91;

- on the Loan with accounts 08, 50, 51, 52, 55, 58, 73, 76, 86, 91, 94.

Upon receipt of those funds that should be attributed to future periods, it is necessary to capitalize them on the basis of receipt of a cash order or payment order:

Dt 50, Dt 51/ Kt 98-1

If the income is received on account of work performed, subject to VAT, the amounts of this income are also taxed:

Dt 98-1/ Kt 68-2

After the period to which the income must be attributed, they are subject to write-off:

Dt 98-1/ Kt 90-1

In the case of gratuitous receipt of valuables in the presence of a transfer deed, the following entries are made:

Dt 08, Dt 10/ Kt 98-1

The amount of income accepted for accounting is written off as it is charged to expenses, or when depreciation is calculated:

Dt 98-1/ Kt 91-1

When subsidies, government assistance or grants are received, the following posting is reflected:

Dt 86/ Kt 98-2

To reflect shortages from previous years, their amount is shown in the entries:

Dt 94/ Kt 98-3

Debt for shortfalls must be attributed to the direct culprit:

Dt 73/ Kt 94

As the identified guilty employee pays off the resulting debt, the following entries are made in accounting:

Dt 50, Dt 70/ Kt 73

In case of deduction of the shortfall amounts from the employee’s earnings, or their receipt at the cash desk, entries are made to record the DBP as part of other:

Dt 98-3/ Kt 91-1

Inventory account 98

When taking inventory of DBPs, it is necessary to check how correctly their assessment was formed. As they are accepted for accounting, income is assessed as follows:

When taking inventory, which is carried out at the end of the year, the presence of balances and their validity must be determined.

Thus, subaccount 1 shows only income that must be attributed to the next year.

Subaccount 2 reflects part of the cost of non-current funds received free of charge, the depreciation of which has not been written off at the moment. It also shows the cost of materials and goods not transferred to cost accounts.

Among other things, it is necessary to verify how correctly the amounts for assets and funds received free of charge were written off. These amounts should be written off in accordance with depreciation for fixed assets and as they are included in sales or production expenses for material assets.

We invite you to watch an interesting video on the topic of the article.

To reflect the movement of future financial income in accounting, account 98 “Deferred income” is used in the chart of accounts.

In the economic life of a company, it happens when in the current month you receive income that you should receive in the next month/quarter:

- payment for renting premises several months in advance (if the contract provides for payments for several periods at once);

- Payment of utility services;

- for telecommunications and communication services (subscription payments);

- income from cargo transportation by all modes of transport (road, rail and air);

- receipt of money from the state budget (targeted funding) for commissioning of facilities (money has been received, and commissioning is expected in the future);

- in the current month, shortfalls related to the reporting year and to previous quarters/years were discovered, and the receipt of income for them is expected in the next month/quarter/year;

- receiving free fixed assets (fixed assets), materials, etc.;

- if the company is engaged in leasing sales, leasing income (amounts “above” the cost of the goods).

Refers to passive accounts. Interacts (corresponds) with accounts:

On loan: with accounts 94,08,86,50,55,52,51,58,91,73,76

By debit: with accounts 68,90,91

Subaccounts 98 accounts

- 98-1 “Income received for future periods.” On this sub-account, records are kept of the rent received, subscriber fees for communication and telecommunications services, utility services, passenger transport for subscriptions and travel documents (not one-time, but for a month, half a year, year, etc.).

Example.

Vostok LLC received rental payments several months in advance in the amount of 480,000 rubles.

The rental price per month is 120,000 rubles, including VAT 18%.

Postings:

Dt 51 Kt 98 The rental amount of 480,000 rubles was credited to the current account;

Dt 98 Kt 90.1 Revenue from receipt of rental payments for the month is reflected at 120,000 rubles;

Dt 90.3 Kt 68 VAT (value added tax) on the monthly rental amount is charged to the budget. 18,305 rubles.

Dt 76.AV Kt 68 VAT on the remaining amount of the rent, which acts as an advance, is accrued for payment to the budget. 54,915 rubles.

- 98-2 “Gratuitous receipts.” Movement, receipt, disposal of gratuitous fixed assets/funds, donated materials, etc. assets, as well as operations on budget financing from the budget for strictly defined purposes.

Regulatory documents - Order of the Ministry of Finance 91n dated October 13, 2003, 94n dated October 31, 2000, letter 07-02-06/223 dated September 19, 2012, Instructions PBU13/2000

Example 1.

Recipient LLC received free equipment worth 600,000 rubles (market value). The equipment has a useful life of 60 months. It is necessary to indicate income according to depreciation charges as other income (account 91.1).

Dt 08 Kt 98 Equipment was received that does not require installation. 600,000 rub.

Dt 01 Kt 08 The equipment was put into operation. 600,000 rub.

Dt 20 (44) Kt 02 Monthly depreciation. 10,000 rub.

Dt 98-2 Kt 91.1 Monthly income is reflected in the amount of depreciation charges. 10,000 rub.

Example 2.

Stroitel LLC received 50,000 kg of cement worth 150,000 rubles free of charge. Cement was capitalized at a price of 3,000 rubles per ton. In the next reporting month, 25,000 kg of cement is used.

Dt. 10 Kt 98 Cement was delivered to the receipt at market value. 150,000 rub.

Dt 20 Kt 10 25,000 kg released into production. 75,000 rub.

Dt 98-2 Kt 91.1 Material transferred to production is included in other income.

Example 3.

Regarding budget financing. Initially the amounts are taken into account:

Dt 86 Kt 98-2

In the future, as budget finances are used, the amounts of money spent are reflected in account 91.1 (other income)

- 98-3 “Future receipts from shortages discovered in the past.” If shortfalls are identified and receipt of financial/cash repayments is expected in the next month/quarter/year.

Example 1.

After an inventory of the unit was carried out on July 20 of the previous year, the inventory commission discovered a shortage of 20,000 rubles. The perpetrators have been identified and recorded in the internal investigation reports.

This amount is expected to be repaid in August of this year.

Dt 94 “Shortages” Kt 98-3 indicates the amount of the shortage. 20,000 rub.

Dt 73 “Settlements with personnel for other operations” Dt 98-3. 20,000 rub.

Dt 98-3 Kt 91.1 Accrue in other income after receiving money to repay the debt.

- 98-4 “Accounting for the difference between the value on the balance sheet of missing valuables and the amounts that must be paid by the guilty parties.” In the event that the amount from the culprit differs from the estimate on the balance sheet in a larger direction, the difference is taken into account in this sub-account and applied to other income in the process of repaying the debt.

Example 1.

The difference between the amount on the company’s balance sheet and the amount of recovery is taken into account:

Dt 73 “Settlements with personnel for other operations” Kt 98-4

Further, in the process of paying off the shortfall by those responsible, the funds are included in other income.

Dt 98-4 Kt 91.1

As for leasing, the regulatory document that defines the entire procedure for work in this area is Order of the Ministry of Finance 15 of February 17, 1997, Appendix No. 1. An enterprise that sells goods on lease - the lessor - carries out the following operations:

Dt 76 “Settlements with various debtors and creditors”

As soon as the funds arrive, the time comes to reflect in revenue:

Dt 98-1 Kt 90.1

Important! Analytical accounting is carried out for each object, case, material, etc.

According to the regulatory document - Order of the Ministry of Finance 66n dated July 2, 2010, the balance on the loan of account 98 is indicated in line 1530 of the enterprise's balance sheet - Deferred income.

- If you have received money for services that will be provided in the future, this account is used.

- A gift of fixed assets (fixed assets) or materials is indicated on account 98, the entire amount is written off as materials are released into production or fixed assets are depreciated into the account of other income.

- Shortages that are expected to be paid in the next reporting periods, interest on leasing, the difference between the value on the balance sheet and the amount of the shortfall - this account is used everywhere.

- In the balance sheet, information on account 98 (credit balance) falls on line 1530.

Questions and answers on the topic

No questions have been asked about the material yet, you have the opportunity to be the first to do so