Accounting in public catering

Contents According to GOST 30389-2013 (put into effect by order of Rosstandart dated November 22, 2013 No. 1676-st), catering establishments include:

- Dining rooms.

- Snack bars.

- Bars.

- Cafeterias.

- Fast food establishments.

- Buffets.

- Cooking.

- Cafe.

- Restaurants.

Accounting at these enterprises is not regulated by separate regulatory acts of accounting legislation. In this regard, companies can independently develop an accounting algorithm, using various methods and industry instructions that do not contradict current laws (Letter of the Ministry of Finance dated April 29, 2002 No. 16-00-13/03). Read about what provisions are used when drawing up accounting policies in the article

“Accounting Regulations and Accounting Policies of the Organization”

. At the same time, the specifics of the industry are such that a number of accounting features are present in almost all catering enterprises:

- nuances of production accounting (where accounting is very close to factory production with complex technology);

- some specific types of expenses and write-offs.

- nuances of inventory accounting;

Let's consider the main nuances and features of their use in public catering establishments.

Where to begin

- Allow payment against salary in the point of sale settings. If a magnetic card, proximity card or fingerprint is required for payment, set the setting “by employee card”; if the cashier can accept payments without cards - “select from the list”. Also select the check format: non-fiscal or fiscal. By law, non-fiscal checks are sufficient, but fiscal ones can also be registered in Presto.

- Add the counterparty organization and create employee cards.

- If cards are used, connect the reader to the cashier's workstation. Issue cards to employees and add them to their Presto profiles. If an employee loses a card, you can replace it and block the old one.

- To control expenses, set restrictions - how much money employees can spend on salaries or how many times they can use this method. For example, “per month 10,000 rubles. and no more than 3 times a day” or “300 rubles per day. and no more than 2 times a day.” In this case, the “per month” limit is counted from the 1st day of the calendar month, and the “per day” limit is valid for 24 hours.

- Set up a system of discounts for those who order food as part of their salary.

advokat-martov.ru

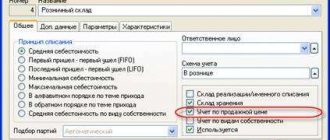

Ministry of Finance of Russia dated October 31, 2000 No. 94n, raw materials and goods in the pantry should be accounted for in account 41.1 “Goods in warehouses”, goods and products of own production in buffets (bars) - in account 41.2 “Goods in retail trade”.

Traditionally, a restaurant or cafe has 3 main divisions: a warehouse (pantry), a kitchen and a visitor's room. Some catering companies additionally highlight bar accounting and takeaway sales, as well as organizing entertainment for visitors.

There is currently uncertainty regarding raw materials and finished products in production (kitchen). The fact is that in the instructions for using the chart of accounts of accounting, from the characteristics of account 20 “Main production” the words contained in the old instructions are removed: account 20 “Main production” “... is used to account for the costs... of public catering enterprises for the production of their own products (in parts of raw materials and materials)".

From this it logically follows that account 20 “Main production” should no longer be used in public catering. On the application of regulatory documents governing the issues of accounting for production costs and calculating the cost of products (works, services).” Note! This permission applies specifically to accounting.

Based on the foregoing, we can conclude that public catering organizations currently determine independently how products (raw materials) are accounted for, either by the purchase price and reflected on account 10 “Materials” or account 41 “Goods”, or at the selling price with the addition of a trade margin and, accordingly, reflected in account 41 “Goods”.

It should be borne in mind that the chosen method of accounting for products (raw materials) must be recorded in the accounting policies of the organization.

Personalization of data

The amounts transferred for food for employees are their income in kind and are subject to personal income tax (clause 1 of Article 210, clause 1 of clause 2 of Article 211 of the Tax Code of the Russian Federation).

When organizing meals on a buffet basis, the amount of such natural income for a specific employee cannot be determined. The Ministry of Finance of Russia recognizes that in the absence of the opportunity to personify and evaluate the economic benefit received by each employee, income subject to personal income tax does not arise (letter of the department dated April 15, 2008 No. 03-04-06-01/86, resolution of the Federal Antimonopoly Service of the Ural District dated 08/20/2009 No. Ф09-5950/09-С2).

And yet, in order to avoid claims from regulatory authorities, it is advisable to organize meals for employees in such a way that it is possible to determine the income received by each of them.

As for compensation and subsidies, these forms of payment for food are subject to personal income tax. The calculated amount of tax must be withheld directly from the employee’s income upon actual payment (Clause 4 of Article 226 of the Tax Code of the Russian Federation). In this case, the withheld tax amount cannot exceed 50% of the payment amount.

Tailed Employee

A dog, as you know, is a friend of man, but also a faithful and reliable guard. To protect their office from uninvited guests, the management of some companies makes a simple decision - to place a booth at the entrance and put a guard dog on a chain. And everything would be fine, but in order to avoid claims from regulatory authorities, pets will have to be kept according to the standards established by kennel clubs, depending on the breed of guard dogs (clause 4 of the letter of the State Tax Inspectorate for Moscow dated November 24, 1998 No. 11- 13/35186).

In accounting, the costs of maintaining dogs are taken into account in account 26 “General business expenses”. In tax accounting, it would be correct to classify such expenses as other expenses (clause 6, clause 1, article 264 of the Tax Code of the Russian Federation).

Let’s not forget to accrue insurance contributions: they are subject to taxation into extra-budgetary funds of payments in favor of employees made within the framework of labor relations, including those provided for by labor and collective agreements, local regulations (letter of the Ministry of Health and Social Development of Russia dated May 19, 2010 No. 1239 -19 and dated August 5, 2010 No. 2519-19).

Accounting in public catering: questions and answers

Accounting, taxation, reporting, IFRS, analysis of accounting information, 1C: Accounting

01/27/2003 subscribe to our channel

The publication in No. 11 of the BUKH.1S magazine for 2002 of the article “Features of accounting for raw materials and finished products in catering organizations” caused a great response among those readers who are in one way or another connected with this industry. Judging by reader responses, questions about which accounts and at what prices to account for raw materials; how to calculate the selling prices of finished products in public catering deserve more detailed coverage.

The author of the article is V.V. Patrov, member of the Methodological Council on Accounting under the Ministry of Finance of Russia, Doctor of Economics, Professor at St. Petersburg State University, answers these questions. Public catering is a rather complex activity, because it performs several functions: production, sale of own-produced products and purchased goods, as well as organizing their consumption.

The pricing process is also quite complex.

Unfortunately, in recent years very few regulatory documents have been issued on accounting in public catering, despite the presence of a number of problems in this area. This article is devoted to one of these problems.

Public catering enterprises as property

Public catering on which account to include food products?

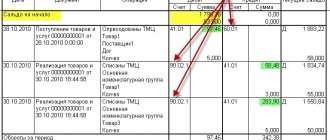

Sales revenue is recognized as income from ordinary activities and is recorded in the following entries:

- Dt 57 Kt 90.1 - revenue received from the card (acquiring).

- Dt 50 Kt 90.1 - cash proceeds received at the cash desk.

- Dt 91 Kt 57 - the bank’s acquiring commission is taken into account.

- Dt 51 Kt 57 - acquiring proceeds are credited to the account (minus the bank commission).

- Dt 90.2 Kt 20 (41) - write-off of the cost of products sold.

- Dt 62 Kt 90.1 - non-cash revenue from certain persons.

Nuances of cost accounting Cost accounting is regulated by PBU 10/99 (approved by order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n). However, they provide only general rules for accounting for expenses and do not reflect the specifics of the industry. Therefore, the cost accounting algorithm is developed by the company independently and recorded in the accounting policy.

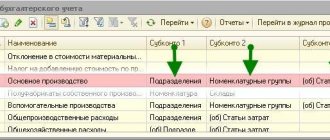

According to PBU 10/99, costs are divided into direct and indirect.

Direct costs include all costs directly attributable to the production of products: raw materials, wages, depreciation, etc. Direct costs are accounted for on account 20.

Indirect costs include other costs not related to production: salaries of administrative personnel, accruals for them, rent of premises, etc.

We recommend reading: Diploma of higher education series and number

e. Accounting for indirect costs is carried out using accounts 25, 26. However, often companies on account 20 take into account only the cost of raw materials used for preparing dishes, and the remaining costs are included in debit 44 “Business expenses”. In Soviet times, this approach was used almost everywhere.

Where to begin

- Allow payment against salary in the point of sale settings. If a magnetic card, proximity card or fingerprint is required for payment, set the setting “by employee card”; if the cashier can accept payments without cards - “select from the list”. Also select the check format:

- non-fiscal - if, under an employment or collective agreement, you can withhold funds from employees’ salaries;

- fiscal - if the agreement does not provide for this.

- Make sure employees are hired.

- If cards are used, connect the reader to the cashier's workstation. Issue cards to employees and add them to their Presto profiles. If an employee loses a card, you can replace it and block the old one.

- To control expenses, set restrictions - how much money employees can spend on salaries or how many times they can use this method. For example, “per month 10,000 rubles. and no more than 3 times a day” or “300 rubles per day. and no more than 2 times a day.” In this case, the “per month” limit is counted from the 1st day of the calendar month, and the “per day” limit is valid for 24 hours.

- Set up a system of discounts for those who order food as part of their salary.

Accounting in public catering

→ → Current as of: February 1, 2020 Public catering (catering) is an independent branch of the economy, consisting of enterprises of various forms of ownership and organizational and management structure, organizing food for the population, as well as the production and sale of finished products and semi-finished products, as in an enterprise catering, and outside it, with the possibility of providing a wide range of services for organizing leisure time and other additional services (). We will tell you about accounting in public catering and postings in public catering in our material.

Accounting in public catering is carried out in accordance with and on the basis of the requirements.

The basis for accounting at a specific catering enterprise is, which is developed based on the characteristics of this organization. is maintained on the basis of primary accounting documents, which the organization also develops independently and enshrines in its Accounting Policy. A catering enterprise can use unified primary forms for accounting for operations in public catering, approved by .

When carrying out operations and maintaining accounting records in public catering, it is necessary, in particular, to refer to the following industry documents: Rules for the provision of public catering services (); Methodology for accounting for raw materials, goods and production in mass catering enterprises of various forms of ownership (); Basic provisions for accounting of raw materials (products), goods and production in enterprises

Meals for employees: all paid for

Expertise of the article: Yu.V. Volkova , Legal Consulting Service GARANT, professional accountant-expert

The company has several options for providing employees with free lunches. We will talk about what taxes, depending on the chosen option, should be levied on the cost of food and how to organize this process more rationally from a tax point of view.

In many companies, free meals are part of the social package that the company provides to employees in order to stimulate their work.

At the same time, not always an enterprise can afford to maintain a buffet or canteen. For organizations with a small staff, it is more profitable to order lunches externally or issue food vouchers to employees. Let's consider the taxation and accounting of free food depending on the chosen method of its provision.