Legal collection

Let's look at the step-by-step process of collecting funds from a company employee:

- Establishing basic information. It is necessary to determine the amount of damage incurred. It is also necessary to identify the person responsible.

- Organization of a commission for an internal investigation. The commission includes an accountant, a specialist who can determine the amount of damage (this is needed, for example, in the event of equipment breakdown). Experts from third-party companies can take part in the commission. However, this is not always possible. A simpler option is to obtain an expert opinion, which will be used in further work. The commission is required to establish the amount of damage and determine the list of objects that suffered damage.

- Request an explanation from the employee. The guilty person draws up an explanatory statement in writing.

- Work of the commission. Representatives of the commission must analyze documents related to the damage. Then a conclusion is drawn up regarding the guilt of the employee and the amount of material losses. The legality of collection of funds is established.

- Issuance of an order. The document concerns the employer’s will regarding the withholding of funds from the employee. If the commission has determined that recovery of damages will not be legal, there is no need to issue an order.

- Sending the order to the accounting department. Deductions from wages, if this collection option is chosen, are carried out on the basis of an order. Therefore, you need to provide it to the accounting department.

This is the most common and simplest way to recover property damage.

IMPORTANT! An order to withhold funds must be drawn up within a month after the fact of damage.

Calculation of the amount of damage

Once the initial facts for consideration have been established, it is important to accurately determine the amount of damages. It usually consists of the following sections:

- the amount of damage actually caused to the enterprise;

- the cost of material assets or repairs of damaged property;

- the amount of damage that the employee caused to third parties or third-party organizations and which had to be compensated in connection with this.

If it is necessary to determine at what prices the calculation should be made, then the market prices that were in effect on the date of the violations or the one indicated in the relevant documents are usually taken.

The nuances of deducting the amount of damage from wages

Recovery of damages must be preceded by an investigation. Without it, any deductions will be illegal. Let's consider the rules that need to be taken into account when conducting an investigation:

- The amount of material damage is determined based on the residual value of the equipment (if it is damaged) or the purchase price of the product (the markup will not be taken into account). For example, if a PC written off due to natural depreciation is broken, nothing can be recovered from the employee. This is due to the fact that the residual value in this case is zero.

- Simultaneous disciplinary action may be imposed. This could be, for example, a reprimand.

- The amount of damage cannot include lost profits. For example, if an employee committed a guilty act, due to which an agreement beneficial for the company was not concluded, no funds will be recovered.

The investigation involves obtaining evidence about the guilt of the person and the amount of damage. If this evidence is not available, the withdrawal of funds from the employee’s salary is not entirely legal.

How to properly file a claim for material damage from an employee?

Current labor legislation is focused both on protecting the rights of employees and on maintaining the legitimate interests of the employer, therefore, if it is necessary to recover damages, one must first of all focus on the requirements of the law. The leading legislative act in this case is the Labor Code of the Russian Federation, which regulates the main aspects of the behavior of all parties in a controversial situation. So, as a rule, in order for material damage to be compensated, you will need:

- find out the general circumstances of the incident and presumably identify the guilty employee;

- create a commission that will conduct an internal investigation;

- conduct an internal investigation (request explanations from employees, carefully study all the circumstances, make a conclusion about the guilt of the employee and the likelihood that the damage can be recovered);

- issue an appropriate order.

Important! If several workers are found guilty, then collective financial liability arises. In this case, the damage is calculated for each culprit separately (the degree of guilt is taken into account).

At the same time, recovery of damages from an employee can be carried out both out of court and in court. It is possible to avoid going to court if the culprit admits the damage caused and agrees to voluntarily repay the amount. You can also do without a trial in a situation where the amount of damage does not exceed the wages of the perpetrator (monthly earnings), no more than a month has passed since the discovery of the fact of causing material damage, and the employment relationship between the parties is preserved.

A judicial procedure for compensation is provided in a situation where the amount of damage exceeds the monthly salary of the perpetrator, and more than a month has passed since the moment the damage was discovered. Going to court to recover damages from an employee cannot be avoided even in a situation where the employee no longer works for the company: funds must be recovered from those fired in court.

In what cases is it impossible to recover material damage?

Legislative acts provide cases in which the employer is prohibited from collecting funds. Consider these cases:

- The damage occurred due to force majeure circumstances. For example, these could be natural disasters during which the employee was unable to keep the property safe and sound.

- Losses are formed due to natural economic risk.

- Losses are caused by employee actions performed out of extreme necessity. It could be self-defense. For example, when detaining a thief, an employee dropped a PC.

- The employer has not created an environment in which the property can be kept intact. For example, there are no safes for storing especially valuable items, bars on the windows, or reliable locks.

If the employer recovers funds in these circumstances, the employee may well challenge the decision.

When does responsibility come?

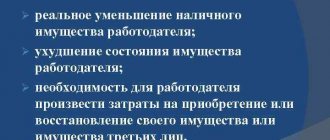

The onset of financial liability for causing damage to the employer’s property is provided for by the Labor Code of the Russian Federation (Article 283). Financial liability can be characterized by two characteristics:

- one of its parties must be an individual who works for the employer at the time of damage to property;

- The amount of liability depends on the extent of the damage and the nature of the violation that led to damage to the property.

Financial liability occurs provided that:

- direct damage;

- illegal behavior, negligence, improper performance of professional duties;

- the fault of the employee who caused the damage.

If damage to the employer's property is caused by force majeure, defense, or extreme necessity, financial liability does not arise. Also, the employee is not responsible for property when the employer has not provided the necessary conditions for its safety.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Full or partial recovery of damages

You can recover material losses in full or in part. Recovery options depend on the specific circumstances.

Full recovery

Withholding the full amount of material losses is legal in cases where the following employees are at fault:

- Head of the company.

- Chief accountant or deputy manager if an agreement on full financial responsibility has been concluded with employees.

- Damage was caused by any employee with whom there is a liability agreement. The same employee is given valuable property on the basis of documents. For example, this is a cashier or storekeeper.

- An employee who was given valuable property on a one-time basis, if papers were drawn up at the same time. For example, an employee received money on account.

Full recovery is possible in the following circumstances:

- The employee caused damage while under the influence of alcoholic beverages.

- The damage was not caused during the performance of work duties. For example, a taxi driver used a car for his personal needs, and in the process crashed the car.

- Criminal intent was detected (that is, the damage was caused deliberately).

- An employee responsible for the security of commercial information disclosed confidential information.

The employer can receive full compensation even if the employee was convicted in connection with causing damage.

Partial recovery

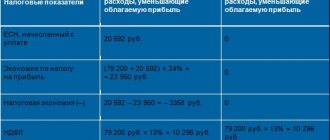

Partial compensation involves withholding funds in the amount of the average monthly salary. It is relevant in cases where it is impossible to apply the provision of full liability. Payments are not made at once, since more than 20% cannot be withheld from one employee’s salary.

IMPORTANT! The average monthly salary is not the employee’s income for the current month. It must be calculated by dividing the total annual salary by the number of months.

Commentary on Article 248 of the Labor Code of the Russian Federation

Compensation by an employee for damage caused to the employer can be made in three ways: by order of the employer, voluntarily or by court decision.

By order of the employer, the amount of damage caused may be withheld from the guilty employee if the following conditions are simultaneously met:

— the amount of damage does not exceed the employee’s average monthly earnings;

- the order for recovery was issued no later than one month from the day when the employer finally established the amount of damage caused by the employee.

Although this is not directly stated in the commented article, it appears that the employee must be notified of the employer’s order before deductions are made from his earnings. This is due to the fact that if the employee disagrees with the order, compensation for damage is possible only by a court decision.

Employees responsible for causing damage, after explaining the procedure for compensation, may express a desire, without any coercion, to compensate for the specified damage in whole or in part within the limits established by law. Compensation for damage by agreement with the employer is possible in various ways: by depositing money into the cash register; transfer of equivalent or similar property; fixing what was damaged.

By agreement of the parties to the employment contract, compensation for damage by installments is allowed. In this case, the employee must give a written undertaking to compensate for damages, indicating specific payment terms. This form of compensation can only be accepted with the consent of the employer. If the employee refuses to compensate for the damage and stops making payments, the employer can recover the lost amounts by his own order by deducting from the employee’s salary.

In case of dismissal of an employee and refusal to pay, the outstanding debt is collected in court.

Damages caused by an employee are subject to recovery in court in the following cases:

— if the amount of damage caused exceeds the employee’s average monthly earnings;

- if the employer missed the one-month deadline for issuing an order to recover damages;

- if the employee does not agree to voluntarily compensate for the damage caused to the employer;

- if the employee bears full financial responsibility in accordance with the law;

- if an employee who gave a written commitment to voluntarily compensate for damage quits and at the same time refuses to reimburse the outstanding debt.

An employer may file a claim for recovery of material damage from employees within a year from the date of discovery of the material damage. Missing the limitation period is not a reason for the court to refuse to accept the application. If there are good reasons, the court may restore the limitation period (Article 392 of the Labor Code).

The employer should take into account that Art. 138 of the Labor Code establishes maximum limits for monthly deductions from employees’ wages: as a general rule, they cannot exceed 20% of the amounts due to the employee. As an exception to this rule, a deduction of no more than 50% of an employee’s salary is allowed in cases specifically provided for by federal laws (see commentary to Article 138).

Failure by the employer to comply with the procedure for compensation of damages established by the commented article gives the employee the right to appeal the employer’s actions in court.

Bringing an employee to disciplinary, administrative or criminal liability does not relieve him of the obligation to compensate the employer for material damage caused.

How to recover damages from a resigned employee

If the employee was fired (or quit), retaining funds will be difficult, as the employer loses financial leverage. However, it is possible to receive compensation. To do this you need to go to court. Full recovery can be achieved through a judicial authority. Let's look at the procedure for going to court:

- Establishing a statute of limitations. The statute of limitations in this case is one year. It begins to be calculated from the moment the damage is discovered (for example, from the date the inventory is completed).

- Establishing the amount of damage caused. If the employee has already paid part of the compensation, then the amount of payments is deducted from the total amount of damage.

- Filing a claim. The application can be either handwritten or printed. It must indicate the name of the court, the address of the company, the essence of the claims and their justification. It is also advisable to include information about an attempt to resolve the problem pre-trial, if any.

- Filing a claim in court. Supporting documents must be attached to the claim.

Before filing a claim, you need to check the feasibility of going to court. This can be done on the basis of judicial practice.

The procedure for recovery by the employer

The employer in the situation under consideration has the right to recover only the amount provided for by law. He can pay the full amount only when this is provided for in Articles 242 and 243 of the Labor Code.

In other cases, the rule applies that only an amount that does not exceed the employee’s usual average earnings can be recovered. In both cases, the payment is 20% of the employee’s current salary until paid in full.

If an employee leaves without paying the debt, a lawsuit will need to be filed to collect the remaining balance of the debt.