Some products simply cannot be sold without packaging without harming their quality. The manufacturer can package them in preparation for sale and include the price of the packaging in the cost price. But if the container can be reused without damaging the product, buyers are often asked to return it. A housewife going to the market with a milk can is dealing with returnable (reusable) containers.

Let's consider how operations with returnable packaging are accounted for in production, how this dynamics is reflected in accounting entries and in tax accounting.

What is container

Containers are the main element of the packaging complex for goods, designed to preserve commercial quality during movement, storage and sale of products.

REFERENCE! The Italian word tara comes from the Arabic tarha, meaning “something thrown away.”

The terms “container” and “packaging” do not duplicate each other, despite the fact that the Guidelines for accounting of inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, call containers “outer packaging.” GOST 17527-2003 “Packaging: terms and definitions” directly calls not to consider them synonymous.

According to legislative clarifications, containers differ from packaging in that without containers, products in principle cannot be sold, while packaging only facilitates this process and makes it more convenient.

FOR EXAMPLE. The washing machine can theoretically be delivered to the store and to the consumer without any additional work with it. However, since it is expensive, and the appearance of the product may be damaged during transportation, the body and its elements are protected with a cardboard box, foam pads, and plastic film. All this is packaging.

Lemonade cannot be sold without some kind of container in which it is placed when bottling. A plastic or glass bottle will be a container, and a film in which 6 bottles or a box are packed at once will be a package.

https://youtu.be/YC5nLBnj4wM

BASIC: non-returnable packaging

When calculating income tax, take into account the cost of non-returnable packaging in the cost of materials (goods) that were received by the organization in this container (clause 3 of Article 254 of the Tax Code of the Russian Federation).

An example of how the receipt of non-returnable packaging is reflected in accounting and tax purposes. The organization pays the cost of the packaging separately, and it does not plan to use it in the future. The organization applies a general taxation system

LLC "Proizvodstvennaya" is engaged in the production of meat and sausage products. In May, the organization purchased raw materials for production. In the same month, Master fully paid the supplier for raw materials. The raw materials arrived at the organization in plastic packaging, the cost of which is paid separately by the “Master”. Polyethylene packaging is single-use packaging, which means it is non-returnable. The contract does not contain conditions for returning the packaging.

In shipping documents, the cost of packaging is highlighted as a separate line. In accordance with these documents, the cost of raw materials is 7080 rubles. (including VAT - 1080 rubles), packaging cost - 590 rubles. (including VAT - 90 rubles).

Since the packaging is non-returnable and the organization does not plan to use it, the accountant included its cost in the cost of purchased raw materials. At the same time, the accountant made the following entries.

May:

Debit 10-1 Credit 60 – 6500 rub. (7080 rub. – 1080 rub. + 590 rub. – 90 rub.) – raw materials in containers are capitalized;

Debit 19 Credit 60 – 1170 rub. (1080 rub. + 90 rub.) – VAT on purchased materials in containers is taken into account;

Debit 60 Credit 51 – 7670 rub. (RUB 7,080 + RUB 590) – payment is transferred to the supplier.

When calculating income tax for May, Master's accountant took into account the cost of non-returnable packaging (500 rubles) and raw materials (6,000 rubles) as part of material expenses.

Situation: is it necessary to take into account the cost of non-returnable packaging received along with materials (goods) when calculating income tax? The organization does not pay separately for the cost of packaging. The organization plans to use the packaging in production or sell it.

No no need.

Containers, the cost of which is included in the total cost of materials (goods) and which the organization plans to use in the future, cannot be regarded as received free of charge (Clause 2 of Article 248 of the Tax Code of the Russian Federation). This means that the market value at which such packaging is accepted for accounting cannot be taken into account as part of non-operating income on the basis of paragraph 8 of Article 250 of the Tax Code of the Russian Federation.

Thus, the cost of packaging, recognized as income in accounting, is not taken into account as income in tax accounting. Therefore, a permanent difference is formed in accounting, which leads to the emergence of a permanent tax asset (clauses 4, 7 of PBU 18/02). In this case, do the wiring:

Debit 68 subaccount “Calculations for income tax” Credit 99

– reflects a permanent tax asset on income that does not increase taxable profit.

At the time of sale or transfer of containers for production, do not take their cost into account as expenses. This is explained by the fact that it has already been taken into account as part of material costs when purchasing materials (goods) in such containers (clause 3 of Article 254 of the Tax Code of the Russian Federation). Moreover, if an organization plans to sell containers, when calculating income tax, take into account only the income from this operation (clause 1 of Article 248 of the Tax Code of the Russian Federation).

Container classification

Containers are divided into types for several reasons:

- Application in the production process:

- containers that are used in the technological process itself;

- containers for warehouse storage;

- container for placing goods sold in it.

- According to the material of manufacture:

- metal;

- cardboard;

- glass;

- polyethylene;

- plastic;

- ceramic;

- fabric, etc.

- By form:

- bottles;

- boxes;

- barrels;

- boxes;

- banks;

- packages;

- canisters;

- flasks;

- tubes;

- bags, etc.

- By purpose:

- consumer – the one in which the product reaches the final buyer (can be individual or group);

- production - containers used for storing raw materials and product elements, as well as for moving them within production;

- transport – to facilitate transportation and storage (can be small or large);

- special (preservative) - to ensure the safety of products.

- By frequency of use:

- one-time;

- multi-turn (return);

- special - is part of the product itself, equipment for it.

IMPORTANT! When they talk about the type of container, they most often mean its shape, and when they talk about the type of container, then the material.

On the accountant's desk!

Operations with containers “under products”: accounting and taxes

Author: Source:

Any enterprise constantly deals with various types of containers in which goods are delivered from the manufacturer (seller). Moreover, the enterprise itself can act as both a seller selling goods in containers and a buyer receiving them. And the container itself can be either an integral part of the product or serve only to preserve the goods supplied in it. All this affects the accounting and taxation of container transactions.

Containers are a type of inventory intended for packaging, transportation and storage of products, goods and other material assets. The Civil Code obliges the seller to transfer the goods in containers, except in cases where the goods do not require packaging by their nature (Article 481 of the Civil Code of the Russian Federation). Provisions on packaging are reflected in contracts between counterparties. The seller and buyer have their own container accounting, which depends on a number of factors: the type of container and the type of activity of the organization; accounting for returnable, deposited and non-returnable packaging, as well as those reflected in the supplier’s accompanying documents and not reflected in them, is different.

Container classification

The company deals with different types of packaging.

The first characteristic by which containers are classified is the possibility of their reuse. This class includes:

− reusable packaging. It is distinguished by its “reusable” use. These are, as a rule, wooden, cardboard, metal, plastic, glass, woven containers (all kinds of boxes, bags, bottles, barrels, containers, etc.);

− disposable containers, the reuse of which is impossible. This is most often paper, polyethylene, etc. It is also called “consumer” packaging, in which the product is delivered to the final consumer. In the terms of the supply agreement, the parties can stipulate the “future” of the container, that is, whether it can be returned or not. In this case, the following are distinguished:

− returnable packaging (to the supplier or packaging repair organization);

− non-returnable containers (as a rule, these are disposable containers). It is important to know that when shipping goods in returnable containers, the seller must issue a number of documents. Within two days after shipment of the goods, you must issue a certificate indicating the quantity, cost of the container and the date of its return. Instead of a certificate, the seller can put a corresponding stamp on the shipping documents for the goods being shipped (clause 8 of the USSR Gossnab Resolution No. 1 of January 21, 1991).

Information about returnable packaging is indicated in the specification according to form No. TORG-10. In it indicate the type of container, its quantity, weight. One copy is intended for the buyer, the other remains with the seller.

If the returnable container is closed, then for each unit of container you will also need a packaging label in the form No. TORG-9. It is issued in three copies: one is placed in a container, the other is attached to the invoice, the third remains with the seller (Decree of the State Statistics Committee of December 25, 1998 No. 132).

The next conditional classification feature of containers is its functions, according to which containers can be “divided” into:

− outer packaging, which can be easily separated from the product and used regardless of the further “fate” of the product;

- direct packaging, characterized by the fact that it is inseparable from the product, and its use is possible only after the product has been consumed. For example, a perfume bottle, bottles, cans for canned food and paints, etc.

The composition of the container also takes into account the materials and parts used for its manufacture and repair - the so-called container materials. These could be parts for assembling boxes; container rivets; iron blanks for hoops, etc.

As a rule, containers are taken into account as part of inventories.

A separate type of container is container equipment, which is intended for storing, transporting and selling goods from it. For example, bread containers and refrigeration units are container equipment. This is a reusable container for long-term use (more than a year), is the property of the supplier organization and can be taken into account on its balance sheet as part of fixed assets if its cost exceeds 20,000 rubles.

Source documents

To register the sale (release) of inventory items to a third party, use a consignment note in the TORG-12 form. It is drawn up in two copies: the first remains in the organization handing over the valuables and is the basis for their write-off; the second copy is transferred to a third party and is the basis for their receipt.

If, upon receipt of products, the containers are not highlighted in a separate line in the shipping documents, the buyer should fill out the TORG-5 form, reflecting the containers in it at the price of possible sales, since the enterprise can use it in the future - in production or trade.

To process the return of packaging, there is a 1-T form confirming this fact. It contains two sections: product (front side) and transport (back side). The transport section is used to account for transport work and settlements of shippers, consignees and organizations that own vehicles.

The transport section includes information about transport, cargo and loading and unloading operations, as well as other information, including taxation.

The consignment note in form 1-T is issued in four copies:

− the first remains with the shipper and is intended for writing off inventory;

− the second is handed over by the driver to the consignee and is intended for the receipt of inventory items from the consignee;

− the third and fourth copies, certified by the signatures and seals (stamps) of the consignee, are handed over to the organization that owns the vehicle.

The movement and movement of containers within the enterprise is reflected in reports of the TORG-30 form.

There are other forms that are given in the “Album of unified forms of primary accounting documentation for recording trade operations” (approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132).

"The price of the issue"

The presence and movement of containers (except container equipment) are taken into account:

− on the subaccount “Containers under goods and empty” of the “Goods” account − by trade organizations and public catering organizations;

− on the subaccount “Containers and container materials” of the “Materials” account − by all other organizations.

Containers are accepted for accounting at actual cost. It is formed either based on the costs of purchasing this type of material assets from third-party organizations, or, in the case of self-production of containers, based on the own costs previously “collected” in the expense accounts.

Synthetic and analytical such containers are allowed to be kept at accounting prices if the range of containers is extensive and the speed of its turnover is high. Registration prices are set by the organization independently by type of container. These can be contractual, planned, average or actual prices of the previous period.

If there is a difference between the actual cost and the accounting price of the container, it is written off from cost accounts (in case of self-production) or settlement accounts (for purchase) to financial results accounts (clause 166 of the “Methodological guidelines for accounting of inventories” ", approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, hereinafter - Methodological Instructions).

When the packaging is received, the buyer of the packaged goods records it at the price indicated in the accompanying documents, and if the cost of the container is not highlighted as a separate line, at the price of its possible sale.

In tax accounting, the cost of packaging is determined based on the purchase price and other costs associated with its purchase or creation, excluding VAT and excise taxes, except for the cases mentioned in Article 170 of the Tax Code, when these taxes are taken into account in the cost of acquired values.

Containers are taken into account as part of inventories if their cost does not exceed 20,000 rubles and their useful life does not allow them to be classified as depreciable property, or as part of depreciable property if their service life is more than a year and their cost is more than 20,000 rubles per year. unit.

Accounting for non-returnable packaging

The supplier takes into account the cost of non-returnable packaging as part of the costs of main production if packaging occurs in the production department, or as part of sales costs if the products are packaged after they are delivered to the warehouse at actual or accounting prices (clause 172 of the Guidelines).

Most often, the cost of non-returnable packaging is not indicated as a separate line in shipping documents, but is included in the price of the transferred goods.

Let's consider an example of accounting for non-returnable packaging at a retail enterprise.

Example 1 |

| The selling organization purchased goods worth 59,000 rubles for resale. (including VAT 9,000 rubles) and disposable containers for their packaging costing 11,800 rubles. (including VAT 1800 rub.). The goods were packaged at the warehouse. The seller included the cost of packaging in the price of the goods and sold it to the buyer with a 15% markup. Calculation of the selling price : purchase price of the goods - 50,000 rubles. (59,000 − 9000); the price of the product with a markup is RUB 57,500. (50,000 + 50,000 x 1.15); the price of the goods after packaging is 67,500 rubles. ((57,500 + (11,800 – 1800)); VAT on the sales amount: 12,150 rubles (67,500 rubles x 18%); final sale price of the goods - 79,650 rubles (67,500 + 12,150) . In the seller’s accounting records, the following entries were made: Debit 41 “Goods” subaccount “Goods in warehouse” Credit 60 “Settlements with suppliers and contractors” - 50,000 rubles - goods were capitalized at the purchase price; Debit 41 “Goods” subaccount “Containers under the goods and empty "Credit 60 - 10,000 rubles - containers are capitalized; Debit 19 "VAT on purchased valuables" Credit 60 - 9000 rubles - reflects the "input" for goods; Debit 19 Credit 60 - 1800 rubles - reflects the "input" for the containers; Debit 68 Calculations with the budget" subaccount "Calculations for VAT" Credit 19 - 9000 rubles - accepted for deduction of "input" VAT on goods; Debit 68 Credit 19 - 1800 rubles - accepted for deduction of "input" VAT on packaging; Debit 44 "Sale expenses" Credit 41 - 10,000 rubles - the cost of packaging is written off as expenses; Debit 62 "Settlements with buyers and customers" Credit 90 "Sales" subaccount "Revenue" - 79,650 rubles - sales of packaged goods are reflected; Debit 90 subaccount “VAT” Credit 68 − 12,150 rub. − VAT is charged for payment to the budget. In the income statement, the purchase price of goods will be included in the cost of sales in the amount of 50,000 rubles, and the purchase cost of packaging will be included in business expenses in the amount of 10,000 rubles. The following entries will be made in the buyer’s accounting: Debit 41 “Goods” Credit 60 − 67,500 rub. − the goods have been received (together with the container); Debit 19 Credit 60 − 12,150 rub. − reflected “input VAT”; Debit 68 Credit 19 − 12,150 rub. − accepted for deduction of “input” VAT (if there is a supplier invoice). |

In this example, the cost of disposable packaging is included in the sales price of the product and is not paid separately by the buyer. If the cost of packaging is paid by the buyer separately (above the price of the goods), then its actual cost is included in the cost of sales as the packaging is sold along with the sale of goods. For a non-trade supplier, the cost of non-returnable packaging (at actual cost or at accounting prices) is written off from the credit of the “Materials” account (sub-account “Containers and packaging materials”) to the debit of the account for accounting for settlements as shipment (issue) (clause 173 of the Methodological Instructions ).

Accounting for reusable (returnable) packaging

Returnable reusable packaging is reflected in the seller's accounting not as a write-off of a current asset, but as a transfer of it to the buyer, for whom a debt is formed at the cost of the transferred container. One object can “travel” from seller to buyer several times, therefore, in accounting, for settlements between the seller and buyer for such transactions, account 76 “Settlements with various debtors and creditors” is used. The use of sales accounts will lead to distortion of revenue and financial reporting figures. Let's look at what prices reflect the movement of returnable packaging. From the buyer - at the prices established by the contract (clauses 178, 180 of the Methodological Instructions). From the seller - at actual cost or accounting prices (clauses 173, 176 of the Methodological Instructions). The supplier writes off the difference between the actual (accounting) and contract price as financial results. The supplier can avoid these differences if it stipulates in the supply contract that the contract price of returnable packaging corresponds to its registration price.

Example 2 |

| According to the terms of the supply agreement, the container must be returned to the supplier (ownership of it does not pass to the buyer). It was returned on time in full. Let’s assume that the actual cost of the container in the seller’s accounting is 10,000 rubles, in the contract with the buyer of the goods it is valued at 15,000 rubles. The seller's accountant will make the following entries: Debit 76 Credit 41 “Goods” subaccount “Containers under goods and empty” - 10,000 rubles. − returnable packaging was handed over to the buyer; Debit 76 Credit 91 “Other income” − 5,000 rubles. − the difference between the accounting and contract price of the container is reflected; Debit 41 Credit 76 − 10,000 rub. − the return of packaging by the buyer is reflected; Debit 91 “Other expenses” Credit 76 − 5000 rub. − the difference between the accounting and contract price of the container is written off. Since there is no transfer of ownership of the container to the buyer and there is no sale of the container, VAT is not charged. The buyer's accountant will make the following entries: Debit 41 Credit 76 − 15,000 rub. − containers have been received and must be returned to the supplier; Debit 76 Credit 41 − 15,000 rub. − the container was returned to the supplier. |

Features of accounting for deposit packaging and VAT

In the purchase and sale agreement, the parties may stipulate the amount that the buyer is obliged to transfer to the seller in the event of non-return of the packaging. This amount is a deposit. In the primary documents for the supply of goods, the seller allocates returnable containers in separate positions at the deposit price (excluding VAT).

The Tax Code states: “When selling goods in reusable containers that have deposit prices, the deposit prices of this container are not included in the tax base if the specified container is subject to return to the seller” (Clause 7 of Article 154 of the Tax Code of the Russian Federation). In other words, the transfer of containers on collateral with the condition of return is not a sale.

A supplier who purchases (or manufactures) containers for use as collateral cannot deduct “input” VAT: it is possible only when purchasing goods used to carry out transactions subject to VAT (Article 170 of the Tax Code of the Russian Federation). But in the case when the buyer does not return the deposit container, the amount of the deposit must be included in the VAT tax base (letter of the Federal Tax Service of Russia for the city of Moscow dated October 2, 2007 No. 19-11/093454, Department of the Federal Tax Service of Russia for the city of Moscow dated April 19, 2004 No. 24-11/26611, dated July 22, 2003 No. 24-11/42674).

When the contract provides for the payment of a deposit to fulfill the obligation to return the packaging by the buyer, when selling goods in this container it is taken into account at the deposit price. In this case, deviations from the actual cost are also possible, and the postings for accounting for packaging will be the same as in the case without making a deposit, only postings for the transfer and return of the deposit amount will be added.

Example 3 |

| The organization (buyer) purchased goods worth 59,000 rubles, including VAT - 9,000 rubles. The goods were packed in reusable (returnable) containers, for which, in accordance with the terms of the contract, deposit prices were set in the amount of 8,000 rubles. The buyer's accountant will make the following entries: Debit 76 “Settlements with various debtors and creditors” Credit 51 “Current account” - 8,000 rubles. − the deposit amount was transferred to the supplier; Debit 41 “Goods” subaccount “Goods in warehouse” Credit 60 “Settlements with suppliers and contractors” - 50,000 rubles. − the goods have been received; Debit 19 “VAT on purchased valuables” Credit 60 − 9000 rub. − VAT is allocated from the cost of goods; Debit 41 subaccount “Containers under goods and empty” Credit 76 − 8000 rub. − containers have been received and must be returned to the supplier; Debit 44 “Sales expenses” Credit 60 − 500 rub. − the costs of delivering containers are reflected; Debit 19 “VAT on purchased valuables” Credit 60 − 90 rub. − VAT is reflected on the cost of delivery of containers; Debit 76 Credit 41 − 8000 rub. − the container was returned to the supplier; Debit 51 Credit 76 − 8000 rub. − the deposit cost of the packaging was returned by the supplier; The following entries were made in the supplier's accounting: Debit 51 Credit 76 − 8000 rub. − the collateral value of the container was received; Debit 62 “Settlements with buyers and customers” Credit 90 “Sales” subaccount “Revenue” − 59,000 rubles. − sales of goods are reflected; Debit 90 Credit 68 “Calculations with the budget” subaccount “Calculations for VAT” − 9000 rubles. − VAT is charged on the cost of the goods; Debit 41 Credit 76 − 8000 rub. − the return of packaging by the buyer is reflected; Debit 76 Credit 51 − 8000 rub. − the deposit amount was returned. Since there is no transfer of ownership of the container to the buyer and there is no sale of the container, VAT is not charged on transactions with returnable containers. |

The situation is different, if the buyer violates the terms of the contract, the deposit container will not be returned on time and it will become his property. It often happens that the buyer returns only part of the deposit container to the seller. Let's consider an example (in order to simplify the example, we will consider only transactions associated with the movement of collateral containers).

Example 4 |

| The supplier purchased 100 boxes as returnable packaging at a price of 59 rubles. (including VAT 9 rubles) for a total amount of 5900 rubles. (59 RUR x 100 pcs.). The supplier shipped the goods to the buyer in these boxes at a deposit price of 50 rubles. for one box. The buyer transferred a deposit in the amount of 5,000 rubles. According to the supply agreement, the buyer is obliged to return the containers in full to the supplier, but returned only 80 boxes. The supplier's accountant made the following entries: Debit 76 “Other debtors and creditors” Credit 41 “Goods” subaccount “Containers under goods and empty” - 5000 rubles. (50 rub. x 100 pcs.) - returnable packaging was transferred to the buyer at the deposit price; Debit 51 “Current account” Credit 76 − 5000 rub. − the deposit amount for returnable packaging was received from the buyer; Debit 41 Credit 76 − 4000 rub. (50 rub. x 80 pcs.) - the container returned by the buyer has arrived; Debit 76 Credit 51 − 4000 rub. − the deposit for the returned container is transferred to the buyer; Debit 76 Credit 41 REVERSE − 1000 rub. (50 rub. x 20 pcs.) - the deposit value of the unreturned container was reversed; Debit 41 Credit 19 “VAT on purchased assets” REVERSE − 180 rub. (9 rubles x 20 pcs.) - VAT, previously taken into account in the cost of unreturned packaging, was reversed (since the boxes were originally purchased as collateral packaging); Debit 91 Credit 41 REVERSE − 180 rub. ((59 rub. x 20) – 1000 rub.) - the difference between the purchase and deposit price of unreturned containers is reversed; Debit 68 “Calculations with the budget” subaccount “Calculations for VAT” Credit 19 − 180 rub. − accepted for deduction of VAT related to the cost of unreturned packaging; Debit 62 “Settlements with buyers and customers” Credit 91 “Other income and expenses” - 1000 rubles. − sales of unreturned packaging are reflected; Debit 91 “Other income and expenses” Credit 68 subaccount “VAT calculations” − 180 rubles. (RUB 1,000 x 18%) – VAT is charged on the sale of unreturned packaging; Debit 91 “Other income and expenses” Credit 41 − 1000 rub. (50 rub. x 20 pcs.) - the cost of sold packaging is written off; Debit 76 Credit 62 − 1000 rub. − the amount of the deposit received as payment for sold non-returned packaging is offset. The buyer will reflect his transactions as follows: Debit 41, subaccount “Containers under goods and empty” Credit 76 − 5000 rubles. (50 rub. x 100 pcs.) - returnable packaging arrived; Debit 76 Credit 51 − 5000 rub. − the deposit for returnable packaging is transferred to the supplier; Debit 76 Credit 41 − 4000 rub. (80 rub. x 50 pcs.) - the container was returned to the supplier; Debit 94 “Shortages and losses from damage to valuables” Credit 41 − 1000 rub. (50 rub. x 20 pcs.) - the shortage of returnable packaging is written off; Debit 73 “Settlements with personnel for other operations” Credit 94 − 1000 rub. − the shortage of containers was attributed to the perpetrators. Or (if the culprits are not identified): Debit 91 “Other income and expenses” Credit 94 − 1000 rub. − the shortage of packaging was written off; Debit 51 Credit of the settlement account (60, 76) − 4000 rub. − the returned deposit amount has been received (less the cost of the unreturned packaging). |

Income tax

For income tax purposes, it is important to classify containers according to the returnability criterion, which is determined by the terms of the agreement (contract). At the same time, expenses in tax accounting must be documented, not only by contracts, but also by documents drawn up for all transactions with property.

Non-returnable packaging (level 2)

The container in which the supplier transfers the goods to the buyer without the requirement to return it is recognized as non-returnable. Single-use containers (made of cardboard, paper, polyethylene, etc.) are not returned to the supplier. Usually the buyer does not pay separately for such packaging. Its cost is included in the price of the transferred goods. For tax purposes, non-returnable packaging is assessed based on the purchase price and other costs associated with its purchase, excluding VAT and excise taxes (except for the cases specified in Article 170 of the Tax Code of the Russian Federation). The seller takes into account the cost of non-returnable packaging as part of material costs (subclause 2, clause 1, article 254 of the Tax Code of the Russian Federation). It is written off as expenses on the date of its transfer to production (clause 2 of Article 272 of the Tax Code of the Russian Federation). When calculating income tax, the assessment of self-made containers is carried out similarly to the formation of the cost of finished products (Article 319 of the Tax Code of the Russian Federation). As a rule, the supplier in shipping documents does not indicate the cost of non-returnable packaging as a separate line, but includes it in the price of the transferred goods. The buyer reflects in tax accounting the cost of purchased goods and materials according to the invoice and does not separate out the costs of packaging from the price of the goods (clause 3 of Article 254 of the Tax Code of the Russian Federation). Other rules apply when the cost of non-returnable packaging is specified separately in the documents. Non-returnable packaging accepted from the supplier along with products or goods is included in the costs of their purchase (clause 3 of Article 254 of the Tax Code of the Russian Federation). If packaged products are recognized as fixed assets, packaging costs form the initial cost of depreciable property (Clause 1, Article 257 of the Tax Code of the Russian Federation). If goods are purchased by a trade organization for further resale, the cost of non-returnable packaging is written off as distribution costs (Article 320 of the Tax Code of the Russian Federation). But only on the condition that, according to the accounting policy for tax purposes, purchased goods are valued based on purchase prices. Indeed, on the basis of this norm, trading organizations have the right to formulate the cost of goods taking into account all the costs associated with their purchase, including the costs of non-returnable packaging.

Returnable packaging (2nd level)

Unless otherwise established by the supply agreement, when transferring goods in reusable containers, the buyer is obliged to return them to the supplier in the manner and within the time limits established by law or the terms of the transaction (Article 517 of the Civil Code of the Russian Federation). The ownership of returnable packaging does not pass to the buyer. In tax accounting, the cost of returnable packaging is determined in the same way as non-returnable packaging (clause 2 of Article 254 of the Tax Code of the Russian Federation). The cost of materials used for packaging and other preparation of goods sold is classified as material costs (subclause 2, clause 1, article 254 of the Tax Code of the Russian Federation). The costs of returnable packaging are included in material costs on the date of commencement of its use. Documentary evidence is provided by invoices for the transfer of containers to the buyer. Reusable packaging that meets the criteria for depreciable property in accordance with paragraph 1 of Article 256 of the Tax Code is taken into account as part of fixed assets. Its cost reduces taxable income through depreciation.

Collateral container (level 2)

Income and expenses in the form of property received or transferred as security for an obligation in the form of a pledge are not reflected in tax accounting (subclause 2, clause 1, article 251, clause 32, article 270 of the Tax Code of the Russian Federation). Therefore, the seller does not include the deposit received for returnable packaging in income, and the buyer does not include the paid deposit in expenses. If the buyer does not return the container, the deposit amount becomes the property of the supplier. According to paragraph 3 of Article 250 of the Tax Code, the seller receives non-operating income, and the buyer incurs corresponding non-operating expenses. At the same time, non-returned packaging from the buyer at the market price forms non-sales income (clause 8 of Article 250, subclause 13 of clause 1 of Article 265 of the Tax Code of the Russian Federation). If returnable packaging equipment, accounted for as part of fixed assets, has become unusable or is not returned by the buyer, the seller can write off its residual value in tax accounting (subclause 12, clause 1, article 265 of the Tax Code of the Russian Federation).

| Subscription to the mailing list of announcements of new portal articles |

See also:

Accounting and tax reporting forms

Tax debtors are caught in the net.

How to explain the losses?

Laws you've been waiting for

How to quickly liquidate a company with debts

Personal income tax: current issues of providing tax deductions

- 1

Features of the concept of returnable packaging

Returnable (reusable) packaging is a mandatory element of packaging, the availability of which is guaranteed by the supply agreement. It can be returned to the manufacturer undamaged and reused without compromising the quality of the product packaging. Examples of returnable packaging include glass jars and bottles, fabric bags, boxes, containers, etc.

According to Art. 481 of the Civil Code of the Russian Federation, for some types of goods delivery in containers is mandatory. Violation of this clause may become the basis for recognizing the product as being of low quality, which may cause claims from the buyer or even the return of the product.

The container is recognized as returnable in the text of the purchase and sale agreement (clause 3 of Article 254 of the Tax Code of the Russian Federation). This means that it must be returned to the supplier in its original condition, unless the parties agree otherwise (Article 517 of the Civil Code of the Russian Federation). The seller takes a deposit from the buyer for returnable packaging, and after delivery it returns the deposit.

Container: depending on the method of use

The packaging also includes packaging components (parts for repair and manufacturing of containers).

General scheme of container movement in the organization.

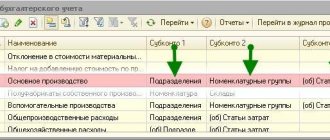

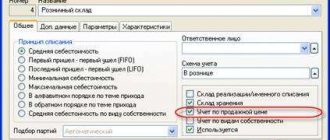

For all organizations (with some exceptions), it is recommended to keep container records in the subaccount “Containers and packaging materials” of account 10 “Materials” of the chart of accounts. For organizations engaged in trading activities and public catering, it is recommended to keep records of containers in the subaccount “Containers under goods and empty” of account 41 “Goods”. Containers used to carry out the technological production process, i.e. containers, as industrial and household equipment, depending on their service life, can be accounted for in the fixed assets account. Accounting for containers in warehouses and departments is carried out similarly to accounting for materials.

Regardless of the terms of purchase, packaging is accepted for accounting at the actual cost, which is the sum of all costs for delivery or manufacturing of packaging.

Analytical accounting of containers is carried out in quantitative and cost terms by warehouses, divisions and storage locations, by financially responsible persons, and within them - by types and groups of containers.

Acceptance of containers from suppliers and buyers, movements within the enterprise, transfer of containers to production and externally must be documented with primary accounting documents. Primary accounting documents must be properly executed, with all necessary details filled in, and have appropriate signatures.

The write-off of unsuitable containers is carried out after inspection and identification of the reasons for its unsuitability. The inspection and determination of those responsible for damaging the packaging must be carried out by a special commission. The result of the inspection is documented in a corresponding act. Unsuitable containers are subject to mandatory delivery for disposal to the appropriate department of the organization or other organizations for recycling.

According to the method of use, containers can be disposable (single use such as plastic, paper, etc. packaging) and reusable. Reusable packaging, depending on supply contracts, may be subject to mandatory return to suppliers of products (goods). Such containers are called returnable and are boxes, barrels, buckets, cans, fabric bags, etc.

When selling products (goods), the cost of packaging may be included in the sales price and the buyer may not pay separately (in addition to the cost of the product). As a rule, this applies to disposable containers. The cost of such packaging is included in the cost of products sold and is reflected in the debit of the “Main production” account, if packaging of products in containers is carried out in the production divisions of the organization or in the debit of the “Sales expenses” account, if packaging of products in containers is carried out after they are delivered to the warehouse finished products. If the cost of packaging is paid by the buyer separately (reusable packaging), then the cost of packaging is written off from the supplier as a debit to the settlement account as the products (goods) are shipped.

If the container is to be returned to the supplier (returnable container), then in all payment documents it is indicated on a separate line at the prices specified in the relevant contracts, without including its cost in the sales price of the products packaged in it.

Reusable packaging, for which, in accordance with the terms of the contract, the price deposit amount (deposit container) is established, is accounted for by the amount of the deposit (deposit price). The deposit container is returnable and upon shipment of products (goods), the cost of the container is reflected in the payment documents (invoice, payment order) separately at the deposit prices and is paid by the buyer in addition to the cost of the products (goods) packaged in it.

Returnable packaging (Reusable packaging) is a reusable container that, according to the contract, is subject to return to the supplier by the buyer (under the purchase and sale agreement).

Non-returnable packaging is packaging that, according to the contract, cannot be returned to the supplier. Non-returnable containers can be referred to as durable containers, as they are disposable.

Nuances of accounting for returnable packaging

Possible accounting difficulties are caused by the special status of returnable packaging: despite the fact that it is delivered to the buyer along with the goods, the ownership of it remains with the seller. An important point that determines accounting is the classification of reusable containers into different types of assets:

- material and production inventories;

- fixed assets.

Accounting for returnable packaging as stock

It is possible to register returnable containers as inventories in accounting if their useful life does not exceed 1 year or one operating cycle (if it exceeds 12 months).

To reflect transactions with such containers, the following are used:

- account 22 “Low value and wearable items”;

- subaccount 10.4 “Containers and packaging materials” - for warehouse and in-production storage and movement;

- subaccount 284 “Containers for goods” - mainly used by trading enterprises.

Accounting for returnable packaging as a main means of production

If the period of use of the container is greater than 12 months, and the cost is included in the limit established for the fixed assets, it falls under the definition of a fixed asset and should be recorded in the corresponding account 115 “Non-current assets”. Like all fixed assets, it is subject to depreciation and subsequent write-off.

Accounting for containers at the supplier

The supplier gives the container along with the goods, retaining ownership of it. In the receipt documents, a separate line is allocated to account for the cost of purchasing such containers; it is not added to the cost of other inventories, but is calculated at net realizable value. When it arrives with the goods, it will have a separate line on the delivery note or invoice.

Stock containers are recorded on account 41 “Containers under goods and empty,” and special containers are recorded on account 01 as fixed assets.

Accounting for containers from the buyer

The safety of returnable packaging and its return can be guaranteed by the text of the contract; in this case, no deposit is required, but sanctions for damage or loss of packaging are stipulated. This procedure will have to be taken into account in off-balance sheet account 002 “Inventory and materials accepted for safekeeping.”

The buyer who has paid a deposit for returnable packaging undertakes to return it to the seller in undamaged condition, after which he will receive the deposit amount back. This procedure is subject to accounting on balance sheet accounts 10 “Container” (if the goods arrived for your own use) and 41 “Container under the goods” (if resale is planned).

Example of posting dynamics of returnable packaging

Uchkuduk LLC entered into 2 agreements:

- Agreement for the supply of lemonade for its subsequent resale to the consumer. Lemonade in glass bottles is in plastic boxes of 6 pieces. The boxes are multi-return containers, for non-return of which there is a fine of 5,000 rubles. – reimbursement of the cost of boxes.

- Agreement for the supply of drinking water for employees of Uchkuduk LLC. Water cans are provided by the supplier on a returnable basis with a deposit of RUB 2,000.

Postings regarding containers under Contract 1, made by Uchkuduk LLC (buyer):

- debit 002 “Inventory and materials accepted for safekeeping” – 5,000 rubles. – plastic boxes in which lemonade is supplied are accepted;

- credit 002 – 5,000 rub. – plastic boxes are returned to the supplier.

Postings regarding containers under Contract 1, made by Zhazhda LLC (seller):

- debit 62 “Settlements with buyers and customers”, credit 41 “Container” - 5,000 rubles. – plastic boxes containing bottles of lemonade were handed over;

- debit 41 “Containers”, credit 62 “Settlements with buyers and customers” – 5,000 rubles. – plastic boxes were returned by the buyer.

Postings regarding containers under Contract 2, made by Uchkuduk LLC (buyer):

- debit 76 “Settlements with various debtors and creditors”, credit 51 “Settlement accounts” - 2,000 rubles. – a deposit has been paid for drinking water cans;

- debit 10 “Container”, credit 76 “Settlements with various debtors and creditors” - 2,000 rubles. – received canisters of drinking water;

- debit 76 “Settlements with various debtors and creditors”, credit 10 “Container” - 2,000 rubles - drinking water cans were returned to the supplier;

- debit 51 “Current accounts”, credit 76 “Settlements with various debtors and creditors” - 2,000 rubles. – deposit amount received for water canisters.

Postings regarding containers under Contract 2, made by Zhazhda LLC (seller):

- debit 51 “Current accounts”, credit 62 “Settlements with buyers and customers” – 2,000 rubles. – a deposit was accepted for drinking water cans;

- debit 62 “Settlements with buyers and customers”, credit 41 “Container” - 2,000 rubles. – canisters of drinking water were handed over to the buyer;

- debit 41 “Container”, credit 62 “Settlements with buyers and customers” – 2,000 rubles – drinking water cans were returned;

- debit 62 “Settlements with buyers and customers”, credit 51 “Settlement accounts” - 2,000 rubles. – the deposit amount for water canisters has been returned.

Answers to common questions

Question No. 1 : How can the buyer reflect returnable packaging in accounting on off-balance sheet accounts?

Answer : Returnable packaging should not be included in the cost of products and its cost is highlighted in the primary documents as a separate line. The price of returnable packaging (deposit) is determined by the contract and the buyer transfers it to the supplier in case of non-return of the packaging. The supply agreement may provide that in order to fulfill the obligation to return the packaging, the organization is required to pay a deposit. Received containers are accounted for at the collateral value established in the contract. You need to make the following wiring:

| Operation | Debit | Credit |

| the amount of the deposit for the return of the packaging has been transferred | 60 (76) | 50 (51) |

| reflects the amount of the deposit for returnable packaging | 002 | |

| Returnable packaging received, paid separately | 10-4 (41-3) | 60 (76) |

| returnable packaging returned to the supplier | 60 (76) | 10-4 (41-3) |

| deposit returned | 50 (51) | 60 (76) |

| the deposit amount for the packaging was written off | 002 |

If the organization does not return the container (violates the contract), then the deposit is not returned and the amount of the deposit is considered as the purchased container. The following transactions are made:

| Operation | Debit | Credit |

| The receipt of returnable packaging at the cost of the deposit was reversed | 10-4 (41-3) | 60 (76) |

| containers were capitalized at cost (excluding VAT) | 10-4 (41-3) | 60 (76) |

| VAT on packaging is taken into account based on the invoice from the supplier | 19 | 60 (76) |

| deposit amount written off | 002 |

Returnable packaging is not a product for transactions subject to VAT (for resale) and VAT amounts are not accepted for deduction, but are included in the cost of the packaging. If the buyer returns the returnable container, the amount of the deposit does not increase the VAT base.

Returnable packaging from a tax perspective

Tax Code of the Russian Federation in paragraph 7 of Art. 154 regulates taxation in transactions with returnable packaging:

- When paying a deposit for the packaging, this amount is not included in the VAT calculation base.

- If the reusable packaging is not returned, it is considered that it was purchased for a deposit price, and this operation is already subject to VAT (after the expiration of the return period and receipt/sending of a corresponding notification from the former owner of the container).

- A supplier who has not received his container back must allocate VAT from its cost, include the remaining amount in the tax base, and send an invoice to the buyer who has become the owner of the container for the allocated VAT.

- If the buyer keeps the container for himself, then VAT will need to be written off as “other income,” and if he resells it, it will need to be deducted.

NOTE! All documents regarding reusable packaging that has not been returned lose their validity, and instead, documentary evidence of the purchase and sale of packaging, subject to the usual taxes for this transaction, becomes relevant.

How is returnable packaging taken into account by the supplier and buyer?

For some types of reusable containers supplied with products (goods), the supplier may charge the buyer a deposit (instead of the cost of the container), which is returned to him after receiving the empty container in good condition from him. Collection of security deposits for containers is carried out in cases stipulated by agreements.

182. Reusable packaging, both purchased and home-made, for which, in accordance with the terms of the contract, the price deposit amount is established (hereinafter referred to as the deposit container), is accounted for by the amount of the deposit (hereinafter referred to as the deposit price).

192. Container equipment is a type of container designed for storing, transporting and selling goods from it.

Additionally

Inventories

The main thing

Containers received from suppliers along with the goods are taken into account simultaneously with the receipt of goods (clause 178 of the Methodological Instructions). Non-returnable reusable packaging paid (to be paid) to the supplier in excess of the cost of the goods is accounted for at the price specified in the contract: Debit 41-3 Credit 60. If it is not paid to the supplier separately, but it can be used in the purchasing organization or sold, it is valued up to market value prices taking into account the physical condition with the simultaneous assignment of the revaluation amount to the financial performance accounts: Debit 41-3 Credit 91-1.

Returnable containers are accounted for by the buyer at deposit prices in account 41-3 “Containers under goods and empty.” When the deposit container is returned to the supplier in good condition, the buyer is reimbursed its cost at the deposit prices (clause 183 of the Methodological Instructions). The containers returned to the supplier are written off at the prices stipulated in the contract from the credit of account 41-3 “Containers under goods and empty” to the debit of the settlement account (clause 180 of the Methodological Instructions).

Example 17 Let's use the condition of example 14.

Let's consider the reflection of these transactions with the buyer of the goods. Let's assume that the buyer is engaged in retail trade. The cost of the purchased goods is 900,000 rubles, including VAT - 150,000 rubles. Goods are accounted for at sales prices. The selling price of the goods including taxes is RUB 1,600,000.

The following entries need to be made in accounting:

Debit 41-2 Credit 60

— 750,000 rub. — goods purchased from the supplier are capitalized;

Debit 19-3 Credit 60

— 150,000 rub. — the amount of VAT on purchased goods has been allocated;

Debit 41-2 Credit 42

— 700,000 rub. — the trade margin is reflected.

When accounting for goods at sales prices, the difference between the purchase and sale prices is reflected separately in account 42 “Trade margin”. If a trading enterprise takes into account the movement of containers under goods and empty containers at average accounting prices established by groups (types) of containers in relation to the composition and prices for them, the difference between the purchase prices for containers and the average accounting prices is also charged to account 42;

Debit 41-3 Credit 60

— 30,000 rub. — reusable containers were received from the supplier;

Debit 60 Credit 51

— 30,000 rub. — funds were transferred as security for the obligation to return reusable packaging.

They are accounted for in off-balance sheet account 009 “Securities for obligations and payments issued.” Issued collateral is written off as the debt is repaid.

Debit 009

— 30,000 rub. — reflects the amount issued to secure the obligation to return the packaging;

Debit 60 Credit 41-3

— 30,000 rub. — the container was returned to the supplier;

Debit 51 Credit 60

— 30,000 rub. — funds previously transferred to secure the obligation to return the packaging have been received;

Credit 009

— 30,000 rub. — the write-off of the provision for the return of reusable packaging is reflected.

According to paragraph 235 of the Methodological Instructions, goods, when accepted from suppliers, are received in net weight. When registering certain goods, the net weight (net) is determined by subtracting the tare weight according to the marking from the total weight of the goods (gross). After the container is released, it is weighed. If its actual weight is greater than the weight indicated on the label, a difference in the weight of the product occurs, called a tare weight. A curtain of containers can occur, for example, when goods are absorbed into it. The veil is formalized by a special act. A mark is made on the container (paint, chemical pencil, ink) indicating the number and date of the act of veiling to prevent repeated actuation of the same container.

Identified shortages are taken into account in the debit of account 94 “Shortages and losses from damage to valuables” and the credit of account 41 “Goods” and are written off in the following order:

A comment

Contracts for the supply of goods may provide that the buyer is obliged to return the container to the supplier. Return of packaging is used in cases where the packaging can be reused by the supplier without compromising the quality of the goods sold. Such containers are called returnable containers

, as well as

reusable containers

.

Thus, Article 517 of the Civil Code of the Russian Federation (Civil Code of the Russian Federation) defines:

“Unless otherwise established by the supply agreement, the buyer (recipient) is obliged to return to the supplier the reusable containers and packaging means in which the goods were received, in the manner and within the time limits established by law, other legal acts, mandatory rules adopted in accordance with them, or the agreement.

Other containers, as well as packaging of goods, must be returned to the supplier only in cases stipulated by the contract.”

Often, the supplier sets a special deposit fee for returnable containers (deposit containers). This fee is returned to the buyer upon receipt of the empty container in good condition.

In accounting and tax accounting, reusable packaging can be accounted for as inventory (if its expected use period is up to 12 months) or as a fixed asset (if its expected use period is up to 12 months). In this case, the limit on the value of fixed assets should be taken into account.

Problematic situation in accounting

It should be noted that in the accounting of returnable packaging there is a contradiction in regulatory regulation. Thus, Methodological guidelines for accounting of inventories, approved. Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 N 119n stipulates that returnable packaging transferred by the supplier to the buyer must be written off from the balance sheet using entries D 76 K 10. And upon its return from the buyer, reverse entries are made (D 10 K 76) (clauses 176, 184 ). Thus, the document stipulates that returnable packaging can be written off as expenses only when the container is completely written off from accounting (for example, due to its wear and tear).

The stated approach contradicts the general requirements. Accounting Regulations “Accounting for Inventories” PBU 5/01, approved. Order of the Ministry of Finance of the Russian Federation dated 06/09/2001 N 44n provides for the recognition of the value of inventories when they are released into production and otherwise disposed of (clause 16). There are no special rules for containers. That is, containers can be recognized as expenses when they are transferred for the first use.

In my opinion, the rules for accounting for returnable packaging specified in the Methodological Instructions contradict the general principles of accounting and should not be applied. At the same time, since this regulatory document is formally in force and has been registered with the Ministry of Justice, there is a risk that the regulatory authorities will adhere to these rules.

For income tax

The Tax Code of the Russian Federation establishes the rule:

If the cost of returnable packaging accepted from a supplier with inventories is included in the price of these valuables, the cost of returnable packaging at the price of its possible use or sale is excluded from the total cost of their acquisition. The cost of non-returnable containers and packaging accepted from the supplier with inventories is included in the amount of expenses for their acquisition.

The classification of containers as returnable or non-returnable is determined by the terms of the agreement (contract) for the acquisition of inventories (clause 3 of Article 254 of the Tax Code of the Russian Federation).

Paragraph 12 of Article 265 of the Tax Code of the Russian Federation provides that non-operating expenses include “expenses for operations with containers, unless otherwise provided by the provisions of paragraph 3 of Article 254 of this Code.”

This norm was included in the first edition of Chapter 25 of the Tax Code of the Russian Federation, which came into force on January 1, 2002. In this edition, the norm was included in paragraph 13 of Art. 265 in the form of “expenses for operations with containers”. By Federal Law No. 57-FZ of May 29, 2002, the norm was adjusted to the current one and moved to clause 12 of Art. 265 Tax Code of the Russian Federation.

Today there are practically no official explanations about which operations with containers fall under clause 12 of Art. 265 Tax Code of the Russian Federation.

In one case, the tax authority, referring to this norm, believed that returnable packaging should be written off as expenses only after it has been completely worn out. The taxpayer wrote off the returnable packaging as an expense when transferring it to production. The judicial authority sided with the taxpayer (Resolution of the Federal Antimonopoly Service of the East Siberian District dated September 10, 2008 N A33-664/08-F02-4336/08 in case N A33-664/08, Determination of the Supreme Arbitration Court of the Russian Federation dated December 22, 2008 N VAS-16452/ 08 refused to transfer this case to the Presidium of the Supreme Arbitration Court of the Russian Federation for review in the manner of supervision).

According to VAT

the rule is set:

When selling goods in reusable containers that have deposit prices, the deposit prices of these containers are not included in the VAT tax base if the specified container is subject to return to the seller (clause 7 of Article 154 of the Tax Code of the Russian Federation).

The word "Tara"

«

The word “tara” came into Russian from German (Tara). The same word is used in Italian. The word “container” came to European languages from Arabic, where tarha means “waste, discount” (Etymological Dictionary of the Russian Language M.R. Vasmer (1950-1958)).

The procedure for accounting for transactions with containers is described in paragraphs 160 - 198 of the Methodological Instructions for Accounting for Inventories, approved. By Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 N 119n.

Definitions from regulations

Civil Code of the Russian Federation (Article 517)

Unless otherwise established by the supply agreement, the buyer (recipient) is obliged to return to the supplier the reusable containers and packaging means in which the goods were received, in the manner and within the time limits established by law, other legal acts, mandatory rules adopted in accordance with them, or the agreement.

Other containers, as well as packaging of goods, must be returned to the supplier only in cases stipulated by the contract.

Guidelines for accounting of inventories, approved. By Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 N 119n:

162. Containers under products (goods) can make a single or multiple turnover (reusable container).

163. Agreements for the supply of products (goods) may provide for the use of reusable packaging, subject to mandatory return to suppliers of products (goods) or delivery to container repair organizations (returnable packaging).

Returnable packaging typically includes:

wooden containers (boxes, barrels, tubs, etc.), cardboard containers (boxes made of corrugated and flat glued cardboard, etc.), metal and plastic containers (barrels, flasks, crates, cans, baskets, etc.), glass containers ( bottles, cans, carboys, etc.), containers made of fabrics and non-woven materials (fabric bags, packaging fabrics, non-woven packaging fabrics, etc.), as well as special containers, i.e. containers specially made for packaging certain products (goods).

Agreements, standards and technical specifications may provide for special requirements for containers (product packaging) and conditions for the return of such containers.

164. For some types of reusable containers supplied with products (goods), the supplier may charge the buyer a deposit (instead of the cost of the container), which is returned to him after receiving the empty container in good condition from him. Collection of security deposits for containers is carried out in cases stipulated by agreements.

182. Reusable packaging, both purchased and home-made, for which, in accordance with the terms of the contract, the price deposit amount is established (hereinafter referred to as the deposit container), is accounted for by the amount of the deposit (hereinafter referred to as the deposit price).

192. Container equipment is a type of container designed for storing, transporting and selling goods from it.