1. Taxpayers are obliged to:

for four years, ensure the safety of accounting data and other documents necessary for the calculation and payment of taxes, as well as documents confirming income received (for organizations - also expenses incurred) and taxes paid (withheld);

for four years, ensure the safety of accounting data and other documents necessary for the calculation and payment of taxes, as well as documents confirming income received (for organizations - also expenses incurred) and taxes paid (withheld);

.

If the officials carrying out the inspection have sufficient grounds to believe that documents evidencing the commission of offenses may be destroyed, hidden, altered or replaced, these documents are seized in the manner prescribed by Article 94 of this Code, according to an act drawn up by these officials. The act of seizure of documents must justify the need for seizure and provide a list of seized documents. When seizing documents, the taxpayer has the right to make comments, which must be included in the act upon his request. Seized documents must be numbered, laced and sealed or signed by the taxpayer (tax agent, fee payer). If the taxpayer (tax agent, fee payer) refuses to affix a seal or signature to the seized documents, a special note is made to this effect. A copy of the act on the seizure of documents is transferred to the taxpayer (tax agent, payer of the fee).

1. Seizure of documents and items is carried out on the basis of a reasoned resolution of an official of the tax authority carrying out an on-site tax audit.

This resolution is subject to approval by the head (his deputy) of the tax authority that made the decision to conduct a tax audit.

2. Confiscation of documents and objects at night is not allowed.

3. Seizure of documents and objects is carried out in the presence of witnesses and persons from whom the documents and objects are seized. If necessary, a specialist is invited to participate in the excavation.

Before the seizure begins, the tax official presents a resolution on the seizure and explains to those present their rights and obligations.

4. A tax official invites the person from whom documents and items are being seized to voluntarily hand them over, and in case of refusal, he makes the seizure forcibly.

If the person from whom the seizure is being made refuses to open the premises or other places where documents and objects subject to seizure may be located, the tax official has the right to do this independently, avoiding causing unnecessary damage to locks, doors and other objects.

5. Documents and items that are not related to the subject of the tax audit are not subject to seizure.

6. A protocol on the seizure, seizure of documents and objects is drawn up in compliance with the requirements provided for in Article 99 of this Code and this article.

7. Seized documents and items are listed and described in the seizure protocol or in the inventories attached to it, with a precise indication of the name, quantity and individual characteristics of the items, and, if possible, the value of the items.

8. In cases where there are not enough copies of the documents of the person being inspected to carry out tax control activities and the tax authorities have sufficient grounds to believe that the original documents may be destroyed, hidden, corrected or replaced, the tax authority official has the right to seize the original documents in the manner prescribed this article.

When such documents are confiscated, copies are made of them, which are certified by a tax official and handed over to the person from whom they are confiscated. If it is impossible to make or transfer the copies made simultaneously with the seizure of the documents, the tax authority transfers them to the person from whom the documents were seized within five days after the seizure.

9. All seized documents and objects are presented to witnesses and other persons involved in the seizure, and, if necessary, are packed at the site of seizure.

Seized documents must be numbered, laced and sealed or signed by the taxpayer (tax agent, fee payer). If the taxpayer (tax agent, fee payer) refuses to affix a seal or signature to the seized documents, a special note is made about this in the seizure protocol.

10. A copy of the protocol on the seizure of documents and objects is handed over against receipt or sent to the person from whom these documents and objects were seized.

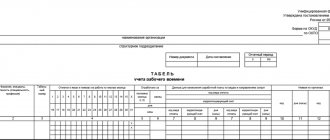

Waybill (Bill of Lading)

designed to account for the movement of inventory items and payments for their transportation by road. A consignment note for the transportation of goods by road is drawn up by the consignor for each consignee separately for each vehicle trip with the obligatory completion of all details.

Bill of lading form

According to clause 1.2. Resolution of the State Statistics Committee of Russia dated November 28, 1997 N 78, when transporting goods, motor transport organizations must draw up a consignment note in form No. 1-T.

The form of the consignment note consists of two sections:

1. Commodity, which determines the relationship between shippers and consignees and serves to write off inventory from shippers and post them to consignees.

2. Transport, which determines the relationship of shippers of motor transport customers with organizations - owners of motor vehicles that carried out the transportation of goods, and serves to record transport work and settlements of shippers or consignees with organizations - owners of motor vehicles for the services provided to them for the transportation of goods.

Drawing up a consignment note

The shipper is required to prepare waybills for each vehicle trip. It does not matter whether the vehicle is the property of the consignor or whether he used the services of a third party to provide transportation services.

The consignor-seller, the consignee-buyer and the carrier participate in filling out the consignment note.

The waybill (BW) is issued in four copies:

- the first one remains with the shipper and is intended for writing off inventory items;

- the second, third and fourth copies, certified by the signatures and seals (stamps) of the shipper and the signature of the driver, are handed to the driver;

- the second is handed over by the driver to the consignee and is intended for the receipt of inventory items from the consignee;

- the third and fourth copies, certified by the signatures and seals (stamps) of the consignee, are handed over to the organization that owns the vehicle.

The third copy, which serves as the basis for calculations, is attached by the organization - the owner of the vehicle to the invoice for transportation and sent to the payer - the customer of the vehicle, and the fourth is attached to the waybill and serves as the basis for accounting for transport work and calculating wages to the driver.

Filling out the consignment note

When shipping goods, the seller-shipper draws up a consignment note in form N 1-T in four copies.

The table in the product section displays data about the product and its cost (per unit and total), unit of measurement, number of pieces, type of packaging, etc.

Column 2 “Number of the price list and additions to it”, column 3 “Article or price list number” is filled in if the selling organization approves prices for goods in a special price list and assigns a specific article to the goods. However, filling out these fields is not mandatory.

In column 5 “Price, rub. cop.” the price of the goods is indicated taking into account excise tax and VAT (if the goods are subject to these taxes).

Column 10 “Weight, t” indicates the gross weight of the cargo in tons (all goods in total in this line).

Column 11 “Amount, rub. cop.” counts as column 4 multiplied by column 5.

The line “Margin, %” indicates the percentage of the trade markup established by the selling organization. This column can only be filled in by trade organizations.

On the part of the shipper, the document is signed by the persons responsible for the release of goods and the chief accountant, and a stamp is affixed.

As a rule, an invoice and a delivery note in form N TORG-12 are also attached to the document.

In the table “Loading and unloading operations” of the transport section, the shipper enters data on the method of loading (manual) and the time of arrival for loading and departure of the vehicle.

The arrival time is determined by the time the forwarding driver presents the waybill at the checkpoint.

The departure time is indicated at the moment of signing the invoice and handing it over to the forwarder.

When accepting the goods for delivery, the forwarding driver enters his data under the table in the transport section in the first three copies of the invoice. The first copy of the waybill remains with the supplier. It serves as the basis for writing off the goods. The remaining copies are given to the driver.

If, upon delivery of the cargo to the consignee, no discrepancies or deviations in the quantity and quality of the goods specified in the documents were found, then dashes are entered in the corresponding fields of the invoice.

Next, the consignee puts his signature and seal in the goods section of the consignment note, and also fills out his part of the table “Loading and unloading operations” of the transport section: the method of unloading, the time of arrival of the vehicle for unloading and its departure from the consignee’s warehouse after unloading.

The second copy of the consignment note (and attached documents) remains with the buyer and serves as the basis for posting the goods.

The driver delivers the third and fourth copies of the consignment note to his trucking company.

In this case, columns 20-44 are filled out by the driver and accountant of the transport organization. The vehicle mileage, idle time, prices for transport services, etc. are indicated here.

Based on the data indicated in these columns, the cost of transport services and the driver’s salary are calculated.

Column 26 “For transport services per client” indicates the total cost of transport services.

https://youtu.be/i7z4M8jA9UQ

Column 27 “For transport services due to the driver” indicates the amount of wages accrued to the driver for transporting cargo.

The motor transport company, after indicating in the TTN the data necessary for payments for transport services (transportation distance, cost of services, downtime for loading and unloading, etc.), sends to the customer of transport services one (third) copy of the TTN and an invoice for payment for transportation services .

Based on the remaining (fourth) copy of the TTN and the waybill, the trucking company pays the driver wages.

TTN for transit delivery

Transit trade consists of two transactions independent from each other: a trading company enters into a contract for the purchase and sale of goods with a supplier, on the basis of which it undertakes to pay for the purchased goods, and the supplier undertakes to ship the goods to the warehouse specified by the trading organization, and a separate agreement with the buyer of the goods , within the framework of which he undertakes to supply goods for a fee.

In this case, the trading company will act as the buyer of the goods in the first contract, and as its seller in the second.

In this case, the commodity transport lines are filled in as follows.

The line “Payer” indicates the trading company.

Who to put in the “Consignor” line depends on the moment of transfer of ownership.

If at the time of dispatch of the goods the trading company became its owner, then it will be indicated in this line. If after dispatch the supplier remains the owner, then the supplier will appear in the “Consignor” line.

Filling out the “Consignee” line depends on who actually accepts the goods at the final buyer’s warehouse.

If this is done by the buyer himself, then he needs to be indicated.

If unloading is carried out by a representative of a trading company, then the name, address and telephone number of the trading company should be indicated as the consignee.

In any case, the “Loading point” field should contain the supplier’s address, and the “Unloading point” field should contain the address of the final buyer.

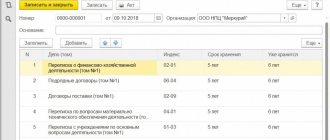

Storage periods for waybills

The storage period for primary accounting documentation is at least five years.

Each organization must be guided by Federal Law 125-FZ of October 22, 2004, according to which it is necessary to ensure the correct storage of primary documentation for a specified period.

The duration of deadlines for certain groups of documents may be regulated by various federal laws, as well as other legal acts of the Russian Federation, lists and regulations.

We will tell you in the article what is the legal storage period for invoices and other documents at an enterprise.

Certain laws and regulations may require longer retention periods.

If different legal acts establish different time periods for the same document, then you need to focus on the longer one.

Changes from October 1, 2020

On October 1, 2020, Government Decree No. 981 dated August 19, 2017 comes into force.

This document puts into effect:

- new invoice form;

- new form of sales book;

- new form of purchase book;

- a new form of the journal for recording received and issued invoices.

However, in addition to this, amendments were also made to the rules that relate to the storage of invoices. Let's tell you more about them.

Storing invoices in chronological order

The provisions of the commented resolution provide for more detailed rules for storing invoices. It is envisaged that invoices will need to be stored in chronological order as they are issued (compiled, corrected) or received. The same approach should be applied to storing confirmations from the electronic document management (EDF) operator and notifications to customers about receipt of an invoice. Also see “Register of electronic document management (EDF) operators”.

Storage periods for invoices

From October 1, 2020, you will still need to store invoices for 4 years. During this period, it is necessary to organize storage:

- to the principal (principal) - copies of invoices that were given to him by the intermediary. The intermediary receives them from sellers when purchasing goods (works, services) for the principal (principal);

- to the customer of construction work (investor) - copies of invoices that were handed over to him by the developer (customer performing the functions of a developer). He, in turn, receives them from sellers when purchasing goods (works, services) for the buyer (investor);

- to the customer of forwarding services - copies of invoices that were handed over to him by the forwarder. He receives these invoices from sellers when purchasing goods (works, services) for the customer.

It is required to store all types of invoices: primary, adjustment and corrected. Copies of paper invoices received from intermediaries must be certified by their signatures (principals, principals, developers or forwarders).

Clarification of deadlines affected not only invoices

Also, Government Decree No. 981 dated August 19, 2017 clarifies that from October 1, 2020, certain other “accounting” documents on various transactions must be stored for 4 years. We list the shelf life in the table.

| Operation | What to store |

| Import from EAEU countries | Applications for the import of goods and the payment of indirect taxes, their certified copies, copies of bills of lading and other documents confirming the payment of VAT. |

| Import from other countries | Customs declarations, their certified copies and other documents on payment of VAT at customs. |

| Travel expenses for rental accommodation and travel | strict reporting forms (copies thereof) with the VAT amount highlighted as a separate line. |

| according to VAT, which is restored by the shareholder, participant or shareholder | Documents with which the parties formalize the transfer of property, intangible assets, property rights (clause 3 of Article 170 of the Tax Code of the Russian Federation) - in the form of notarized copies. |

| according to VAT, which is restored when the value decreases (subclause 4, clause 3, article 170 of the Tax Code of the Russian Federation | accounting certificate-calculation (Article 171.1 of the Tax Code of the Russian Federation. |

| – according to VAT, which is restored upon the purchase or construction of fixed assets | accounting certificate-calculation (Article 171.1 of the Tax Code of the Russian Federation). |

Also, for 4 years it is necessary to store primary and other documents with summary (summary) data on transactions of each month or quarter, which are recorded in the sales book.

If upon inspection it turns out that there are no accounting documents, then this is a gross violation of the rules for accounting for income and expenses. For this, the company faces a fine of 10,000 rubles. under Article 120 of the Tax Code of the Russian Federation. The same punishment will occur if you do not comply with the procedure and period for storing documents.

The following penalties may be applied to an official (Article 15.11 of the Code of Administrative Offenses of the Russian Federation):

- fine from 5,000 to 10,000 rubles. – for the first violation;

- from 10,000 to 20,000 rub. or disqualification for a period of one to two years - for a repeated violation.

If you find an error, please select a piece of text and press Ctrl+Enter.

>Retention period for invoices from suppliers

We study the storage periods of primary accounting documents (Polukhina M

Based on the results of both on-site and desk tax audits, the tax authority draws up an audit report. The procedure and timing for its preparation are stipulated in Art. 100 Tax Code of the Russian Federation. If violations are identified and the taxpayer agrees with them, the latter makes appropriate changes in accounting (makes additional taxes, pays penalties and fines, etc.).

Each organization must be guided by Federal Law 125-FZ of October 22, 2004, according to which it is necessary to ensure the correct storage of primary documentation for a specified period. The duration of deadlines for certain groups of documents may be regulated by various federal laws, as well as other legal acts of the Russian Federation, lists and regulations. We will tell you in the article what is the legal storage period for invoices and other documents at an enterprise.

When determining the storage period, you must be guided by the Accounting Law, according to which primary accounting documentation must be stored five years after the year in which it was compiled. Certain laws and regulations may require longer retention periods. If different legal acts establish different time periods for the same document, then you need to focus on the longer one.

How long to keep LLC accounting documents

This question is asked by all entrepreneurs, without exception, who have recently opened an enterprise and have not understood the intricacies of the system.

So how long to keep LLC documents, a year, two or more? You can understand this issue in detail by reading Federal Law No. 125-FZ “On Archiving in the Russian Federation” point by point.

The storage periods for accounting documents vary.

What can be said by combining all the subpoints? Accounting documents must be kept in an LLC at least as long as there is a possibility that a tax audit may require them.

According to Article 89 of the Tax Code of the Russian Federation, inspection is subject to a period not exceeding three years preceding the decision to conduct this inspection. That is, we store it for exactly three years, and then the fun begins.

Article 23 of the Tax Code of the Russian Federation, subclause 8 of clause 1, clearly informs us that tax payers are required to keep documentation confirming the accrual of taxes for four years and no less. That's it, gentlemen. Not for three years, but for four, we have been carefully storing accounting documentation and making sure that not a single piece of paper is lost.

What specific documents do we give preference to and keep as the apple of our eye?

- tax accounting data;

- documents confirming income;

- documentary evidence of expenses;

- proof of tax withholding;

How to count these four years? The next day after the end of the tax period is the first day of the four-year reporting period.

Accounting also confirms the rules for storing primary documentation.

According to the order “On Accounting” No. 129-FZ, financial statements should be stored as specified in the rules of state archival affairs.

But no less than five years after the last time financial statements were compiled for them.

What happens? And the fact is that you are obliged to store documents strictly for the period during which the tax service may request them for verification.

That is three years.

If, as a result of the inspection, you do not have documents that are five years old, you may be fined for improper storage of documentation and nothing more.

But not everything is so simple and transparent in the accounting and tax jungle. There is documentation that should be stored much longer than the periods that we just discussed. What are these documents?

- Primary documents for the acquisition of property. We save these documents for as long as necessary. What is it for. First, depreciation. Secondly, when selling property, you need to get confirmation of its initial value somewhere7 and don’t forget about property tax.

- Fixed assets. For unprofitable companies, Article 283 of the Tax Code provides for a rule for reducing the tax base of the current period due to losses of the previous tax period. Naturally, the documentation should confirm this. Losses can be taken into account for ten subsequent years, which means that the documents must be in proper order (Article 283, paragraph 4). Tax inspectors have the right to request primary documents confirming the financial result to confirm the data on losses specified in the submitted declaration.

- For rural enterprises working with a single agricultural tax, it is also necessary to store documents on losses during the entire period of their write-off. Article 346.6 paragraph 5 of the Tax Code of the Russian Federation.

- For persons working under the so-called “simplified” system, unified social tax. Article 346.18 paragraph 7 of the Tax Code of the Russian Federation.

- To write off bad receivables, it is also necessary to have supporting primary documents for the tax service. Destruction of supporting documents deprives the company of the right to recognize a bad debt as an expense, because there will be nothing to confirm the amount.

- We won’t dwell too much on joint-stock companies, since the question was still raised about how long it is necessary to store the documents of an LLC, and not an OJSC. So, to put it briefly, you need to keep documents for tax reporting in an OJSC - annual financial statements, as well as the charter, as long as the company exists. If a company goes into liquidation, the documents are sent to the state archive. An agreement concluded with the archive in advance for this procedure is required. If there was no such agreement, only the document on the company’s personnel gets into the archive. Where the remaining documents will be stored will have to be decided by the chairman of the liquidation commission, or maybe the bankruptcy trustee.

- The company is required to keep annual tax reports for at least 10 years. quarterly - five years, this is in the presence of annual ones.

- If there are no quarterly reports, monthly reports are also stored for at least five years.

- Purchase and sales books and invoices should be kept for a full five years from the date of the last entry in the journal. Clause 15.27 of the “Rules for Maintaining Accounting Logs”. In the List of Standard Management Documents there is an item regarding invoices, and it says that these same invoices should be stored for five years, period.

Again, tax authorities during audits must be guided by the legislation on taxes and fees. But the List is not included there.

Conclusion : how long should LLC documents be kept? It turns out that no less than five years, and in terms of fixed assets, generally throughout the entire existence of the company. The storage period for documents must be calculated from the first of January following the year in which they were created.

How to store paper documents?

The accounting policy of the enterprise must state how and where documentation should be stored, and also appoint a person responsible for the implementation of this item or even a commission consisting of the most qualified employees.

By the way, it is not necessary to store documentation in the office. The law does not prohibit choosing other places for storage, for example, specialized archiving companies.

But a joint stock company is required by law to store documents such as annual reports and articles of association exactly where the head office is located.

By the way, storing documentation in electronic form is permitted by law with the small caveat that the documents will necessarily contain an electronic signature of the person responsible for drawing up the document.

To store documentation in electronic form, the company creates a corporate information system. It is served by a certification center, which ensures the use of electronic signatures in electronic documents.

Documents that are subject to long-term storage will deteriorate and fade over time. To ensure that their contents are readable, those responsible for storage must take care and make copies in a timely manner.

When a company is liquidated, documents subject to long-term storage are handed over to the archives. If the company is reorganized, the documents are transferred to the successor organization.

When a new company is spun off, it receives the personal files of the employees who transferred to the new structure and documents related to the scope of the new company.

Destruction of documents. To destroy a document, you must first draw up an act, which will be signed by the head of the company, and only then can you proceed directly to the destruction of documents.

Moreover, in the act it is not necessary to carefully rewrite each of the papers going for destruction. It is enough to rewrite the names of homogeneous groups. What is considered homogeneous groups should be thought out independently.

For example, invoices can be considered homogeneous documents and so on.

Determining the shelf life of delivery notes and invoices in non-standard situations

If the right to deduction is used later

The right to deduct tax is valid for three years after the end of the period for receiving the invoice. If the company decides to exercise its right later, then the storage periods are shifted, since the four-year storage period of the s/f begins to count from the end of the period in which the refundable VAT is included in the declaration.

For example, if the company received goods in the second quarter. 2020, and VAT on them was deducted in the II quarter. 2020, then the beginning of the storage period for c/f and invoices for tax purposes is shifted by one year.

If the s/f is received later than the goods with the invoice

If goods with an accompanying invoice are received in one period, and an invoice for them is received later in another period, then the shelf life is shifted. Moreover, not only the storage period of the s/f is shifted, but also the invoice used as the basis for confirming the acceptance of values for accounting.

If materials are received according to the invoice, but not paid for

In this case, a debt arises that can be written off after three years due to the expiration of the statute of limitations. The invoice must be stored for 4 years. from the end of the limitation period, a total of 7 years.

If an act of reconciliation with the debt specified in it is drawn up annually with the counterparty, which is signed by both parties, then the three-year limitation period begins to count anew from the moment of signing this act. Accordingly, the storage period for the invoice and invoice confirming this debt is shifted.

If the reconciliation act is signed annually, then the limitation period will constantly shift, and at the same time, the end period for the need to store documents will be postponed every year. In this case, the storage period can increase indefinitely, and storage of the invoice must be ensured by both the buyer and the seller.

Retention period for work completion certificates

Acts are drawn up in addition to civil contracts, for example, contracts. In accordance with the act, the contractor reports to the customer on the actions performed. That is, the act acts as the primary document on the basis of which work is transferred and accepted.

For primary accounting documentation, a storage period of 5 years is established. Thus, acts of completed work must be kept for five years from the end of the period of validity of the contract or agreement, in addition to which this act is drawn up.

An example of determining the shelf life of delivery notes and invoices

In the third quarter 2020 The company received a delivery note and an invoice from the seller. According to the invoice, the company received goods that were delivered to the receipt in the same period. Based on the s/f, the added tax on these values in the same quarter is sent for deduction, and the s/f itself is entered using a registration entry in the purchase book.

Sales of income received in the third quarter. valuables were produced in the next IV quarter, their value in the IV quarter. included in tax expenses.

| Document | Storage period | The number from which the period is calculated | Last day of the storage period |

| Invoice | 4g. from the end of the quarter in which the tax was deducted | 01.10.2016 | 30.09.2020 |

| Consignment note, when used as a basis document for accepting valuables for accounting and confirming the presence of the right to deduct tax | 4g. from the end of the quarter in which the tax was deducted | 01.10.2016 | 30.09.2020 |

| Consignment note, when used as a basis document to confirm the value of the value of valuables for inclusion in tax expenses | 4g. from the end of the year in which this cost is included in tax expenses | 01.01.2017 | 31.12.2020 |

| Consignment note used as a primary document for accounting purposes | 5l. from the end of the year in which the received values are delivered to the parish | 01.01.2017 | 31.12.2021 |

Thus, if the period is unambiguously determined by the invoice, then for the delivery note you need to choose the longest period. In this example, the last day of the storage period for c/f is 09/30/2020, for the invoice – 12/31/2021.

Is it necessary for the SF to have a TN?

If there is an invoice, is a delivery note required? The consignment note is issued as an accompanying document for the shipped goods. An invoice is an independent document that can be issued by a supplier of services or goods after shipment of goods or completion of service provision within up to 5 days (clause 3 of Article 168 of the Tax Code of the Russian Federation).

Can a delivery note and an invoice have different dates? The dates of drawing up the invoice and the c/f may not coincide .

Do the numbers have to match?

The Tax Code of the Russian Federation does not introduce any rules regarding the same numbering of invoices and invoices.

Is it possible to issue one invoice for several invoices?

The Tax Code allows for the preparation of s/f for several invoices, subject to full compliance with Articles 168-169 of the Tax Code of the Russian Federation, i.e. if the s/f is issued within 5 days from the date of first shipment.

The procedure for storing documents at the enterprise

Registers and primary documentation can be stored in both paper and electronic formats. The storage procedure is determined by the Regulations approved by Letter of the Ministry of Finance 105 dated July 29, 1983. First of all, the storage space must meet certain requirements:

- Be inaccessible to a wide range of people;

- Have suitable parameters for the state of the ambient air;

- Have a high degree of safety and fire resistance.

The storage room must be specially prepared. The ideal option would be a fireproof metal safe or cabinet with a secure lock.

A responsible person must be appointed who is charged with ensuring the safety and security of the entrusted archival documentation throughout the entire storage period. After the established deadlines, documents may be destroyed.

At the same time, a commission is assembled to evaluate the documentation regarding the expiration of their storage periods. Papers to be destroyed are transferred under a transfer deed to a specialized company engaged in processing these raw materials. The destruction of documents with an expired storage period is subject to mandatory documentation.

Rate the quality of the article. We want to become better for you: If you have not found the answer to your question, then you can get an answer to your question by calling the numbers ⇓ Legal Consultation free Moscow, Moscow region call

One-click call St. Petersburg, Leningrad region call: +7 (812) 317-60-16

Call in one click From other regions of the Russian Federation, call

One-click call

Closed the business - must keep invoices and other documents

Let's look at an example. Individual entrepreneur K.N. Ryabinin decided to cease commercial activities. Since the landlords urgently demanded to vacate the premises, the businessman transported all the documents to his home and placed them in the free space in the utility room. Invoices took up a considerable volume, since the sale of goods was carried out in small batches to numerous counterparties. Some time passed and the documents stored in an unsuitable room faded, became damp and lost their original appearance.

However, the law states that businessmen are obliged to ensure the safety of archival documents during their storage period (Part 1 of Article 17 of the Law “On Archival Affairs in the Russian Federation” dated October 22, 2004 No. 125-FZ) - otherwise they may be punished under Art. 13.20 or 13.25 Code of Administrative Offenses of the Russian Federation. We should also not forget that tax authorities have the right to conduct an on-site audit for the last 3 years of an individual entrepreneur’s activity, therefore, even after closure, the entrepreneur will have to keep documents (including invoices) if they confirm the calculation of taxes and their payment (clause 48 of the Procedure for accounting for income and expenses and business transactions for individual entrepreneurs, approved by order of the Ministry of Finance No. 86n, Ministry of Taxes of Russia No. BG-3-04/430 dated 08/13/2002).

How long should documents be kept?

Retention periods for different documents can vary significantly. Thus, tax documents must be stored for at least 4 years (subclause 8, clause 1, article 23, subclause 5, clause 3, article 24 of the Tax Code). The storage period for documents generated in the course of the activities of organizations is also established by the List of standard management archival documents generated in the process of activities of state bodies, local governments and organizations, indicating storage periods, approved by Order of the Ministry of Culture of Russia dated August 25, 2010 No. 558 (hereinafter referred to as the list No. 558). Thus, clause 368 of list No. 558 also sets a 4-year storage period for invoices.

In some cases, this period may increase to 6 years. For example, a 6-year period is provided for participants in regional investment projects (clause 3 of Article 89.2 of the Tax Code). The annual financial statements, together with the audit reports, await permanent storage (Part 1, Article 29 of the Law “On Accounting” dated December 6, 2011 No. 402, paragraphs 351, 408 of List No. 558).

If a company has hired employees, it collects a decent amount of documents that need to be retained for much longer than the specified deadlines. For example, an act on the investigation of an industrial accident with investigation materials must be stored for at least 45 years (Part 6 of Article 230 of the Labor Code of the Russian Federation), and an act on the case of an occupational disease - for 75 years (clause 33 of the regulation “On the investigation and recording of occupational diseases ", approved by Decree of the Government of the Russian Federation dated December 15, 2000 No. 967).

The legally established periods for storing documents cannot be reduced. For violation of the terms of storage of accounting documents, a fine is provided for in Art. 15.11 Code of Administrative Offences.

For information on what liability is provided for a businessman for tax violations, see the material “Responsibility for tax violations: grounds and amount of sanctions.”

We organize the correct storage of invoices

Let's continue with the example. Stepanova P.A., who previously worked as the chief accountant for individual entrepreneur K.N. Ryabinin, found a similar job in the newly opened one. Remembering the previous employer's omissions to ensure the safety of invoices and other documents, she decided to take control of this issue in the new company.

Since the company had just started operating, it was necessary first of all to organize the storage of documents, including invoices. She did not find any special requirements for storing invoices in the legislation, so she decided to follow the storage procedure established for accounting documents, according to which accounting documents must be stored in special rooms, safes or cabinets (clause 6.2 of the regulation, approved by letter of the Ministry of Finance dated July 29. 1983 No. 105).

Meanwhile, invoices do not belong to strict reporting forms and are not documents containing commercial secrets, so they can be stored without safes and metal cabinets. The management of Vozrozhdenie LLC allocated a separate isolated room in the company’s office for this purpose. The Chief Accountant identified those responsible for the safety of documents (clauses 6.2–6.4 of the regulations, approved by letter of the Ministry of Finance No. 105).

Vozrozhdenie LLC did not file invoices in the journal of received and issued invoices, since since 01/01/2015 companies do not keep this journal unless they are developers or forwarders and do not carry out intermediary operations.

Read more about the obligation to maintain an invoice journal in the material “Invoice journal: who will need it in 2017.”

They also decided not to make separate files of invoices - they simply filed invoices together with invoices.

Documentation: storage periods and transfer to the archive

6.6 Regulations on documents and document flow in accounting, approved by the USSR Ministry of Finance dated July 29, 1983 No. 105, the chief accountant ensures the safety of primary documents, accounting registers, accounting reports and balance sheets, their execution and transfer to the archive. Based on clause 6.2. of the specified Regulations, documents before they are transferred to the archive must be stored in the accounting department in special rooms or locked cabinets under the responsibility of persons authorized by the chief accountant. Manually processed primary documents of the current month related to a specific accounting register are completed in chronological order and must be bound. The issuance of primary documents from the accounting department and archives to employees of other structural divisions, as a rule, is not allowed, and in some cases can only be done by order of the head of the organization or the chief accountant (clause 6.6 of the Regulations).

Failure to comply with these requirements for storing documents in the event of their loss may subject the organization to liability for tax offenses. Based on clause 6.8 of the Regulations, in the event of loss or destruction of documents, the head of the organization must appoint by order a commission to investigate the reasons for the loss of documents. Based on the results of the commission’s work, an act is drawn up, approved by the head of the organization. If necessary, representatives of investigative authorities, security and state fire supervision are invited to participate in the work of the commission, who confirm the reason for the loss of documents with the appropriate certificate.

In addition, when facts of theft are revealed, as well as in the event of a natural disaster, fire and other emergency situations, Law No. 129-FZ in accordance with paragraph 2 of Art. 12 obliges to carry out an inventory, based on the results of which an inventory of lost or damaged documents is compiled.

After carrying out the above procedures, it is necessary to notify the tax authorities in writing about the fact of loss or destruction of documentation, attaching copies of certificates from the relevant authorities and a list of lost documents.

It should be noted that the taxpayer’s actions should not end there, since measures should be taken to restore lost documents with the aim that when conducting an audit, the tax authorities may try to determine the amount of taxes by calculation in accordance with subparagraph 7 of paragraph 1 of Article 31 of the Tax Code of the Russian Federation. And this method can lead to the fact that not all received and destroyed invoices can be confirmed by counterparties, which will lead to additional taxes, penalties and fines.

Learn how to correctly calculate the shelf life of an invoice

Now it's time to figure out how to determine the start date of the invoice retention period.

The procedure for storing invoices is described in clause 10 of the Rules for maintaining invoices (until October 1, 2017 - clause 14 of the Rules for maintaining a log of received and issued invoices), approved by Government Decree No. 1137 of December 26, 2011. According to this regulatory document invoices must be stored in chronological order according to the date of their issuance or receipt for the relevant tax period.

The Ministry of Finance of the Russian Federation in letters dated July 19, 2017 No. 03-07-11/45829, dated March 30, 2012 No. 03-11-11/104 explains that the storage period begins to count after the end of the period in which the invoice was last used for preparation of tax reporting, calculation and payment of tax, confirmation of income and expenses. That is, if the company reflects the VAT from the specified invoice in the declaration for the 3rd quarter of 2020, the storage period will begin from 10/01/2017.

For information on how to correctly fill out a VAT return, read the material “What is the procedure for filling out a VAT return (example, instructions, rules).”

In practice, it often happens that when filing documents, invoices are not separated from delivery notes and the same periods are established for their storage. This approach is explained by the fact that a voluntary increase in the storage period (according to paragraph 1 of Article 29 of Law No. 402-FZ, the storage period for invoices is 5 years and exceeds the storage period for invoices) does not contradict the law. However, with this method, the established storage period for invoices will be violated in the event of:

- their receipts after the end of the tax period;

- there are errors that require correction;

- untimely submission for some reason.

To prevent this violation, it is recommended to organize the storage of invoices and primary documents separately.

Where do you register?

The current forms of documents intended for registration of invoices were approved on December 26, 2011 by Decree of the Government of the Russian Federation No. 1137.

It came into force on January 30, 2012, but new forms began to be used on April 1, 2012 (Letter No. 03-07-15/11 dated January 31, 2012).

Paper and electronic types of invoices are subject to registration . Now the company needs to keep 3 books instead of 4:

- invoice journal;

- Book of purchases;

- sales book.

Tax officials explained that the preparation of invoices is allowed both on paper and in electronic form (Article 169 of the Tax Code of the Russian Federation).

Read more about why an invoice is needed for both sellers and buyers here.

Book of purchases and sales

The new format of the purchase book is given in Appendix 4 of Decree No. 1137. The changes made to it are not so global.

Changes in the purchase and sales ledger:

- There are 3 new columns (2a, 2b, 2c) provided for information on corrections.

- The names of columns 6 to 12 have changed slightly.

- Column 6 – country of origin code.

The book consists of line and tabular parts. The entered data must correspond to the information given in the 2nd part of the accounting log. Registration is carried out after receiving invoices from the seller (for more details on how to process an invoice if it arrives late, read here).

The issued invoice is entered into the sales book . Visually, it is similar to the purchase book (Appendix 4 of Resolution No. 1137). The contents of columns 4-9 are identical to the titles of columns 6-12 of the purchase book.

The chronological book is filled out. The information must correspond to section 1 of the accounting log.

If prices decrease, an adjustment invoice must be created. The supplier records it in the purchase ledger. When the price rises, the buyer needs to correct the sales book.

Another innovation is additional sheets. Sheets are convenient to use for recording corrective invoices . If the books are kept in electronic form, then additional sheets are endorsed with the manager’s digital signature. But this does not cancel the requirement to compile books on paper (clause 22 and clause 24 of Resolution No. 1137).

Both books are signed by the head of the organization. They must be numbered, laced and sealed. They are issued for one quarter. Therefore, they need to be put in order before the 20th of the next month.

Magazine

Resolution No. 1137 made it possible to combine 2 journals - issued and received invoices - into one. Now, according to Appendix 3 of Resolution No. 1137, the magazine consists of 2 parts.

It is now possible to make changes by creating new copies of invoices . The name, identification code and checkpoint of the taxpayer are entered in the header. A journal is compiled for one quarter. You must have 4 magazines per year.

The design of the magazine is similar to books: management signature, numbering, stitching, sealing. This must be done before the 20th day of the following month after the end of the reporting period.

You can also keep a journal using special computer programs. But if the manager does not have an electronic signature, then he will need to print the document at the end of the quarter.

When should an invoice's shelf life be extended?

The previously agreed mandatory 4-year storage period for invoices may be extended. This is due to the fact that from 01/01/2015 companies can transfer tax deductions. The right to transfer VAT deductions within a 3-year period from the date of registration of goods (works, services) is enshrined in clause 2 of Art. 171 Tax Code of the Russian Federation.

For more information on how to determine the deadline for reporting deductions in a tax return, read the material “The Ministry of Finance explained how long a deduction can be postponed.”

Taking into account the date of receipt of goods from the considered example (08/11/2017), it must be declared in the declaration for the 3rd quarter of 2020 if the company postpones the deduction for exactly 3 years. The 4-year shelf life will need to be counted from 10/01/2020, i.e. in this case it will actually be 7 years.

When considering the extended shelf life of invoices when transferring deductions, it is necessary to remember that it cannot be transferred to a deduction when returning the advance to the buyer for 3 years. The deduction can be made only in the tax period in which the conditions provided for in the articles of Art. 171, 172 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated July 21, 2015 No. 03-07-11/41908).

How long to keep invoices

You have in your hands a set from the supplier - an invoice and a delivery note. How many years should they be stored? The delivery note must be kept for five years. After all, it is the primary document. You use it not only in tax, but also in accounting.

Let’s imagine that the date for issuing documents is August 10, 2020. The countdown starts on January 1, 2020. Therefore, the document must be stored until January 1, 2021. An invoice is not a primary document. The minimum five-year period from the Accounting Law does not apply to it.

The invoice storage period is four years. For how long to store other documents, read the article “Your Archive of Accounting Documents - Unbreakable Rules” in the Seminar for Accountant magazine. If you don't have a subscription, sign up for free for three days.

Storage period for electronic invoices

Now more and more businessmen are switching to electronic document management, including using electronic invoices. An electronic invoice is equivalent to a paper one (clause 1 of Article 169 of the Tax Code), the procedure for its execution is regulated by the order of the Ministry of Finance of Russia “On approval of the procedure for issuing and receiving invoices in electronic form via telecommunication channels using an enhanced qualified electronic signature” dated November 10. 2015 No. 174n.

Even before the storage of an electronic invoice is organized, i.e. already during its execution, it is necessary to take into account that it must be signed with a qualified electronic signature (clause 6 of Article 169 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated 05/05/2015 No. 07-01-06/25701).

For more information about which electronic signature is safer to use for documents, read the material “How to sign an electronic primary document: position of the Ministry of Finance 2015.”

The storage periods for electronic invoices are the same as for paper ones - 4 years (clause 1.13 of the Procedure, approved by order of the Ministry of Finance of the Russian Federation dated November 10, 2015 No. 174n, subclause 8 of clause 1 of Article 23 of the Tax Code). Companies are not required to store printed paper copies of electronic invoices (letter of the Federal Tax Service dated 02/06/2014 No. GD-4-3/1984).

Fresh materials

- Certificate of non-admission to the apartment, sample EVERYTHING THAT CONCERNES THE COMPANY BURMISTR.RU CRM system APARTMENT.BURMISTR.RU SERVICE FOR REQUESTING EXTRACTS FROM ROSSREESTR AND CONDUCTING…

- Balance sheet of JSC Accounting (financial) statements of enterprises 39,149.84 billion rubles — JSC VTB CAPITAL 4,892.93 billion…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Exemption from VAT Notification of the use of the right to exemption from VAT Notification of the use of the right to exemption from VAT...