Correct organization of storage of primary accounting documents: regulatory framework

There is no single document that would contain all the information about how and how long documents should be stored. Therefore, you have to be guided by several regulations, which sometimes contradict each other.

The fact that an organization must store primary documents is stated in Article 29 of the Law “On Accounting” dated December 6, 2011. No. 402-FZ.

The requirements for storing accounting documents are specified in paragraph 6 of the “Regulations on documents and document flow in accounting”, approved by the USSR Ministry of Finance on July 29, 1983 No. 105.

It states, in particular, that:

- Primary documents and accounting registers must be transferred to the archive.

- Before being transferred to the archive, they must be stored in the accounting department in special rooms or locked cabinets under the responsibility of persons authorized by the chief accountant.

- Documents must be completed in chronological order.

The obligation to store accounting and tax data is also stated in the Tax Code of the Russian Federation (clause 8, clause 1, article 23).

The list of accounting and reporting documents that need to be stored can be found in the “List of standard management archival documents generated in the process of activities of state bodies, local governments and organizations, indicating storage periods,” approved by Order of the Ministry of Culture of Russia dated August 25, 2010 No. 558. The same list also indicates storage periods for each type of document.

The rules for organizing state archival affairs are prescribed in the Federal Law of October 22, 2004 No. 125-FZ “On Archival Affairs in the Russian Federation.”

Purpose of new Rules

The new Rules are intended for state authorities, local governments, organizations creating archives for storing, compiling, recording and using archival documents generated in the process of their activities.

They do not apply to the organization of storage, acquisition, recording and use of documents from the Archival Fund of the Russian Federation and other archival documents containing information constituting state secrets.

The New Rules are a normative document. Their regulatory status determines more stringent requirements for their content. Previously published rules (see above) included not only norms (rules, requirements), but also recommendations and methods on how these norms should be applied. All provisions of a recommendatory, methodological and descriptive nature are excluded from the new Rules. It was in this part that the draft of these Rules during the discussion was criticized by archivists, who constantly said that the Rules should be detailed and contain not only the rules themselves, but also the mechanism for their implementation.

Where to store documents

According to the law on archival affairs, non-governmental organizations have the right to create their own archives. But they have no such obligation. The company is only obliged to ensure the safety of documents and, upon request, present them to regulatory authorities.

1C-WiseAdvice uses a unique patented technology for processing primary documents “Processing”. Primary paper originals are scanned immediately. An accountant works only with an electronic copy of a document, and always sees what operations were performed on this document. An undeniable advantage is the ability to quickly prepare a response to a request from the Federal Tax Service. Upon request, the client can receive a database of electronic documents.

More details

Company archive and third-party archive

Documents that have a permanent storage period and temporary ones, but more than 10 years, are transferred to the company archive. Completed cases are transferred according to their inventory. When sending cases to a third-party archive (most often a state or municipal institution), they are accompanied by the following:

- a letter of relationship with a request addressed to his supervisor, which indicates the number of cases and their last dates;

- inventory in 3 copies;

- historical information about the company (only for the first application);

- a certificate documenting the incomplete preservation of files or individual documents in them, if necessary.

Cases are handed over according to the act according to the inventories. After passing the examination, the cases are accepted by the archive for storage.

Storage period for accounting documents in an organization

The Accounting Law says that accounting documents must be kept for at least five years (clause 1, article 29 of law 402-FZ), and the Tax Code establishes a period of 4 years for documents that were the basis for tax accounting and tax calculation (clause 8 clause 1 of Article 23 of the Tax Code of the Russian Federation), and for calculating insurance premiums - 6 years (clause 6 of clause 3.4 of Article 23 of the Tax Code of the Russian Federation). A contradiction arises here, because Some documents, for example, invoices, relate to both accounting and tax accounting. In these cases, it is safer to use a longer term.

In the List of Standard Documents from the Ministry of Culture, longer deadlines are assigned for some documents, even permanent ones.

You will have to permanently store, for example:

- annual financial statements with appendices (including consolidated and IFRS);

- transfer acts, separation and liquidation balance sheets;

- certificates of registration with the tax authorities;

- Books of accounting of income and expenses (KUDiR) - for organizations and individual entrepreneurs that use the simplified tax system. Here the terms from the List of Standard Documents conflict with the Tax Code. KUDiR is a tax accounting document, and according to the Code it must be stored not permanently, but for 4 years. In such cases, it is safer not to destroy the document for at least 10 years, because in organizations that are not sources of acquisition of state and municipal archives, the term “permanently” cannot be less than 10 years;

- leasing agreements for the organization’s property and documents thereto;

- documents on the revaluation of fixed assets, determination of depreciation of fixed assets, assessment of the value of the organization’s property;

- acts on the transfer of rights to real estate from balance sheet to balance sheet;

- gift agreements;

- documents on transactions with securities;

- correspondence about the division of joint property of legal entities;

- transaction passports.

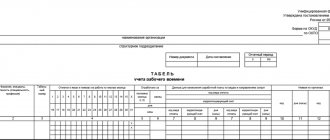

Documents on personnel and income paid must be kept for 75 years, for example:

- employment contracts;

- registers of information on the income of individuals;

- statements for the issuance of dividends;

- personal accounts and employee cards. Moreover, if there are no personal cards, then the storage period for other documents is extended to 75 years: on the acceptance of work performed under contract and labor contracts, calculations of payments for insurance premiums, cards in form 1-NDFL, information on the income of individuals, documents on receipt of salaries and others payments

If personnel documents were created after 2003, they are stored not for 75, but for 50 years (Article 22.1 of the Law of October 22, 2004 No. 125-FZ).

Documents are stored for 10 years, for example:

- for the sale of movable property;

- agreements on the pledge of the organization’s property and documents thereto;

- operational reports on foreign currency accounts abroad.

The storage period for documents that confirm the loss is determined in a special way Organizations on the general system and on the simplified tax system with the object “Income minus expenses” can carry forward losses to future periods for 10 years and thereby reduce the tax base. The organization is obliged to keep documents confirming the loss for the entire period until it is completely used (clause 4 of Article 283 and clause 7 of Article 346.18 of the Tax Code of the Russian Federation).

Other cases of increasing the shelf life of primary products

If Landscape Design LLC operated with a loss, and then took it into account when calculating income tax, the documents would have to be kept for the entire period of transferring the loss plus 4 years after it was completely written off. In this case, it is impossible to get rid of either the primary document confirming the loss received, or other certificates and calculations on the basis of which this loss was transferred.

For example, accounting and tax documents for losses incurred in 2020 and taken into account over the next 10 years will have to be stored until the end of 2033.

Read more about the nuances of accounting for losses in the article “How and for what period can losses be carried forward?” .

The storage period for accounting documents will also have to be increased in the following case. Landscape Design LLC provided services to a customer who did not promptly pay for the work performed and did not respond to letters and complaints. The company was not excluded from the state register, but did not repay its debt. Landscape Design LLC was able to take into account bad receivables only in 2020, and all documents of the organization related to this situation will have to be stored until the end of 2023.

When does the storage period for accounting and reporting documents begin?

Order of the Ministry of Culture No. 558 states that the countdown should begin on January 1 of the year following the year of completion of office work. Eg:

- For accounting policies, this is the year when they were last used for reporting.

- For contracts – the year the contract expires.

- For primary documents, this will be the year in which the documents were accepted for accounting.

- For tax accounting documents, the year when these documents were last used to calculate tax.

So, if an organization has a bad debt, then it is necessary to store documents confirming this debt for another 4 years after it is written off (follows in aggregate from paragraph 8, paragraph 1, article 23 and paragraph 1, article 252 of the Tax Code of the Russian Federation ).

For primary documents that reflect the formation of the initial cost of depreciable property, the countdown period begins from the moment when this property is fully depreciated in tax accounting (letter of the Ministry of Finance of Russia dated January 19, 2018 No. 03-03-06/1/2598).

The laws do not stipulate separate periods for storing electronic documents; accordingly, they are subject to the same terms as for paper documents.

What is more important - the list or law No. 402-FZ

Comparing the storage periods for accounting documents specified in the list and Law No. 402-FZ, the following conclusions can be drawn:

- the list establishes different storage periods depending on the type and significance of documents classified as accounting;

- Law No. 402-FZ provides for a 5-year storage period for accounting documents, but does not specify the terms by type of documentation;

- in paragraph 1 of Art. 29 of Law No. 402-FZ states that the basis for determining the storage periods for documentation is a list.

Thus, when deciding the fate of an invoice, balance sheet or accounting certificate, it is necessary to proceed primarily from the deadlines indicated in the list. However, their storage period cannot be less than 5 years.

The storage period for accounting documents specified in Art. 29 of Law No. 402-FZ, also concerns the accounting policies and standards of the company, including documents existing in electronic form. The latter also cannot be destroyed within a 5-year period. The storage period begins with the year following the year of their last use (Clause 2, Article 29 of Law No. 402-FZ).

What to do when the storage period for accounting and tax documents has expired

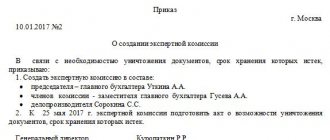

According to the rules, in order to destroy documents, you must first create an expert commission by order of the manager.

The commission conducts an examination of the value of the documents and draws up an act on the allocation of documents for destruction. Attached to it is an inventory of the cases that will be destroyed.

After destruction, you need to draw up another document - an act of destruction.

Be careful!

Documents with different shelf life can be stored in one folder; in such cases, files are unpacked and documents that cannot yet be destroyed are filed into new files.

Destruction of documents

After the established period, the primary material should be disposed of. You can’t just throw away forms and forms. Just like you can’t hand over papers to waste paper. It is important to comply with documentation destruction requirements.

To destroy the primary, you must proceed in the following order:

- Create a special commission. Be sure to include the head of the organization, an archivist, the chief accountant and other specialists as desired in the commission.

- Approve the destruction order. In the order, write down what specific documentation should be destroyed.

- Conduct an examination. The full commission must examine the papers to determine whether the storage period has expired.

- Draw up an act. It will reflect the conclusions of the expert commission on the issue under consideration. Moreover, the act is drawn up in any form.

- Destroy the documents.

- Transfer the act of destruction to the archives.

Responsibility for storing accounting documents

If the organization does not have primary documents during the inspection (they did not file, lost, destroyed ahead of time, etc.), the company will be fined under Article 120 of the Tax Code of the Russian Federation for 10 thousand rubles, and if the violation affects more than one tax period - for 30 thousand rubles. If all this contributed to underestimation of taxes, the minimum fine will be 40 thousand rubles.

Officials for lack of documents are fined under Article 15.11 of the Code of Administrative Offenses of the Russian Federation by 5-10 thousand rubles, and in case of repeated violation - by 10-20 thousand rubles. or disqualified for 1-2 years.

The most serious punishment is provided for in the Criminal Code. If they prove that the document was stolen or destroyed for personal gain, the punishment will be a fine of up to 200 thousand rubles. and even imprisonment for up to a year (clause 1 of Article 325 of the Criminal Code of the Russian Federation).

In addition, do not forget that, without receiving documents confirming the expenses, the tax office can withdraw expenses for them and charge additional taxes, penalties and fines.

Outsource your accounting to 1C-WiseAdvice, and you will have access to . With us, your documents will always be in perfect order and safety.

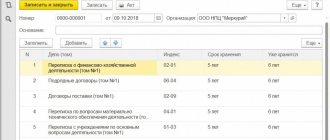

Rules for forming nomenclature

The nomenclature of cases (ND) is approved at the initial stage of the enterprise’s operation by the manager after checking the EPC. The abbreviation EPK in the nomenclature of cases is an expert verification commission; The generated document is agreed with it. When the ND is approved, an employee responsible for the formation and maintenance of files is appointed by order of the manager. All his functional responsibilities are specified in the job description. Most often, the list of HR department files for 2020 (with new storage periods) is maintained by a HR department specialist.

The documentation generated by the organization in the course of its activities is compiled into files in accordance with the approved nomenclature of files. The cover of the case should include the following information:

- name of the organization and structural unit;

- case number in accordance with the approved rules;

- title;

- shelf life.

In this case, only the originals of executed and executed forms, which were published in one calendar annual period, are sewn into the folder. Papers are filed by number and in chronological order. When a file accumulates 250 sheets or its thickness exceeds 4 cm, a second volume is created. The period of maintenance of the nomenclature of files in the organization (and then in the archive) is 75 years, since it is the basis for compiling inventories of permanent and temporary storage files.

Agreement with the archive

The third-party archive, as well as the organization, are legal entities. Their relationship is formalized by a contract (agreement). Documents of public, historical significance, handed over “outside”, are stored at the expense of government funds, and documents of the company that it does not want or does not have the opportunity to store on its territory are stored for a fee.

The recommended version of the contract contains, in addition to the usual details (name, date, names of the parties to the contract), such a clause as “Procedure for the implementation of the contract”, which states in detail:

- how the nomenclature of transferred cases is formed and how it is agreed upon;

- who ensures the selection, preparation and transfer of cases, who brings them to an orderly state (usually this is the responsibility of the company);

- who carries out the examination of the documentation (usually this is the responsibility of the archive);

- what is the composition of the commission that controls the transfer of cases;

- in what form are cases transferred (using containers, in bundles), etc.

State and municipal archival institutions indicate in the contract that the documents are of public or historical value. The wording may be as follows: “This agreement regulates the relations of the parties in the process of transferring to the “Archive” documents generated as a result of the activities of the “Organization”, as well as their subsequent use for scientific, practical and other purposes.” Based on the clause mentioned above, the contract contains the entry “free storage” or something similar in meaning. Thus, participants in relationships in the field of archival affairs comply with the requirements of Federal Law No. 125, Art. 17-1.

If the company is not liquidated or closed, but it is not possible to store documents on its territory, they are rented out “to the outside” for a fee. In order to reduce costs, it is advisable not to specify a specific storage period for files in the agreement with the archive. The wording could be as follows: “Documents are stored in the archive until required by the organization. After the expiration of the period (years), the documents are destroyed.”

Accounting for costs of storing documents and registers

Expenses for storing documents in the company’s own archive are usually collected on account 26 “General business expenses (OCR)”. Such costs may include:

- payment of utilities;

- renovation of premises;

- rental payments if the building is rented by an organization;

- wages with contributions to employees, etc.

Postings:

- Dt 26 Kt 60, 76 – utility payments, rent payments;

- Dt 26 Kt 23, 10, 70, etc. cost accounts (or 60, 76) - depending on whether the repairs are carried out in-house or by a third-party organization;

- Dt 26 K 70, 69, 68 – wages with deductions, if an individual employee is registered in the archive;

- Dt 19 Kt 60, 76 – VAT is recorded on services of third-party organizations;

- Dt 68 Kt 19 – VAT deductible on services of third-party organizations;

- Dt 60 Kt 51, 50 – payment for services of third-party organizations.

Note that the organization can carry out repairs on its own and at the expense of the established repair fund. Then the wiring will be like this:

- Dt 26 Kt 96 – monthly contributions to the fund;

- Dt 96 Kt 23, 10, 70, etc. – actual expenses for repairing the archive.

To account for third-party archive services, use account 97 “Deferred expenses”:

- Dt 97 Kt 60, 76 – the cost of archive services is recorded in accounting;

- Dt 60, 76 Kt 51 – the cost of archive services has been paid;

- Dt 26 Kt 97 - part of the storage costs is included in the costs.

The portion of expenses included in the monthly costs is calculated based on the manager’s order indicating the period for writing off the costs of archive services (for example, 12 months).

In tax accounting, “archival” costs are classified as other expenses directly related to the production and sale of products, as management expenses (Article 264-1 of the Tax Code of the Russian Federation, paragraph 18). Amounts are included in calculations for NU purposes.

It should be borne in mind that according to Art. 149-2 Tax Code of the Russian Federation, paragraphs. 6, archive services are not subject to VAT, therefore, the tax amount will not have to be excluded from costs.