Free legal assistance

If a non-working mother applied for benefits not at her place of permanent registration, then she will need a certificate stating that the benefit was not assigned by the social security authorities at the woman’s place of permanent registration. The payment deadline is no later than the 26th of each month. How and where to get it? A woman who was working at the time of receiving benefits will receive benefits from the employer on the day the salary is transferred.

- working women;

- expectant mothers who are studying full-time in institutions providing vocational, secondary specialized or higher education;

- unemployed women dismissed as a result of the reduction or liquidation of the employer.

How and where to get it?

A woman who was working at the time of receiving benefits will receive benefits from the employer on the day the salary is transferred.

An unemployed mother will receive money from social security authorities - on a bank card or savings book.

Size

A working woman will receive money based on the average monthly income from the employer over the past two years. The amount is divided by 730 days and multiplied by the number of vacation days. The % coefficient is taken into account (to calculate daily earnings). An unemployed woman will receive 581 rubles.

What should be distinguished from maternity benefits is a one-time payment for the birth of a child, which for 2020, taking into account indexation, is 15 thousand rubles.

Child care money is paid every month. The amount is 40% of a woman’s salary.

You need to find out how long you can receive maternity benefits in order to decide on your personal or family budget. The benefit is paid in a lump sum, taking into account vacation days. Child care payments are made for 1.5 or three years.

The maximum amount of maternity leave in 2020 is determined by current laws.

Who pays maternity benefits - the state or the employer? See.

When do they go on maternity leave? Detailed information .

What are the deadlines for paying maternity benefits on sick leave?

The timing of maternity payments is the period of time during which the employer is obliged to pay the pregnant employee. When a child is about to be born, you want to receive sick pay as early as possible. When should I expect payment and what determines the date of funds transfer? You can find the answers in this article.

The terms of payment of maternity leave for sick leave in social security are also clearly defined by the Order of the Ministry of Health and Social Development, as well as for employers. The amount is transferred to a bank account (or by mail) no later than the 26th day of the month following the month of receipt of documents. The period is longer than for working women.

Rules for document preparation

Girls must find out on their own when exactly they will be able to receive the required payments. This is necessary to plan various events related to maternity leave and the birth of a baby.

The doctor independently sets the optimal date when a woman should leave her place of work. This point must be agreed upon with the employer. A girl who wants to exercise her right to early rest must contact a medical institution to obtain a sick leave. It indicates in which organization the expectant mother is being observed, as well as who is her attending physician.

Handing over a certificate of incapacity for work to the employer is not the moment of going on leave, since this requires an official order from the manager.

To find out when the money will arrive in the girl’s bank account, the date of transfer and registration of documents is determined. The total period is 10 days , and documentation can be transferred before maternity leave, during this period, as well as within six months after its end.

How long does it take for maternity benefits to be paid after filing sick leave according to the 2020 law?

The procedure for issuing sick leave for pregnancy and childbirth In general, sick leave for pregnancy and childbirth is issued at the place where the pregnant woman is registered at the obstetric stage of 30 weeks of pregnancy (28 weeks for a multiple pregnancy).

The expectant mother has the obligation to properly fill out a sick leave certificate, indicating information about the medical institution and the attending physician. Submitting sick leave does not mean going on vacation. Such an event must be formalized by an appropriate order from the employer.

Additional payment for caesarean section in 2018 for the unemployed

Social Insurance Fund, care should be taken to avoid errors due to which sick leave may not be accepted.

Payment (surcharge) of money for caesarean section

Not all pregnant women are entitled to this benefit, but only working women and those dismissed in connection with the liquidation of organizations, termination of activities by individuals as individual entrepreneurs, termination of powers by notaries engaged in private practice, and termination of the status of a lawyer, as well as in connection with the termination of activities other individuals whose professional activities, in accordance with federal laws, are subject to state registration and (or) licensing, during the twelve months preceding the day they are recognized as unemployed in the prescribed manner.

Monthly support

In 2020, the Government of the country adopted a number of amendments to the current regulations, which entailed the following changes:

- the indicators of the minimum and fixed threshold of payments for each infant until they reach 1.5 years have undergone correction.

For unemployed pregnant women, there are special conditions in this regard. They should issue a certificate of incapacity for work for several reasons:

- Pregnant women are paid for their entire leave according to the BiR, lasting 140, 156, 194 days. True, in a rather small size. In 2020, a non-working woman is entitled to 581.73 rubles. for each month of maternity leave, however, this amount is indexed annually (in 2020 - from February 1).

- A woman cannot be deregistered as unemployed during maternity leave.

- For the period of leave under the BiR, the woman's unemployment benefit is extended : that is, the benefit itself is not accrued, but it will be paid after the end of the maternity leave (if 18 months have not passed.

Payment amount

Calculation of additional payment for childbirth with complications is carried out in the following order:

- The definition of the calculation period is 12 calendar months preceding the start of maternity leave.

- Calculation of average daily earnings using the formula:

Maternity leave if the child dies

The calculation method we have considered is carried out in general situations, but in life everything is possible and cases may be different. Therefore, faced with such a terrible situation when an employee’s child dies after birth, the accountant is faced with the problem of calculating maternity payments.

If the B&R benefit has already been transferred in full to the employee before the birth, then it can no longer be withheld. The withholding of this payment is not provided for by law. This means that the woman will be on vacation until her sick leave ends . It is also impossible to reduce a woman’s leave under the BiR, since such an opportunity, in accordance with Russian legislation, is provided only for maternity leave.

The opposite situation is also possible. A woman may not want to go on leave on her own, but it is also impossible to force her to go on such leave. An employee may go on vacation later than expected (30 weeks), or independently reduce her leave under the B&R.

If a woman gives birth before taking maternity leave, then sick leave can be issued in two ways:

- For the period of incapacity for work, it must be at least 3 days - in the event that the child was stillborn or died in the first 6 days of life;

- For 156 days - if the child was born alive, but died more than 6 days from the moment of birth.

Important! The legislation does not separately regulate the issue of providing maternity leave in the event of the death of a child.

Is maternity sick leave subject to personal income tax?

Personal income tax - personal income tax (income tax). In fact, maternity benefits, like payments for any other sick leave, are considered the recipient’s income . It is taken into account when applying for a subsidy and is indicated in income certificates for 3, 6 months or another period.

How to calculate sick leave in 2020

To calculate maternity leave in 2020, you need the following data:

- Total earnings for these years (income for which the employer paid mandatory insurance contributions).

- Duration of the exclusion period (number of days during these two years when the woman was on sick leave, on maternity leave, etc.)

- The number of days of maternity leave (usually 140, indicated on sick leave).

This is important to know: What income is taken into account when calculating sick leave

Sick leave is calculated according to the following algorithm:

- the number of days in the calculation period is found (exclusion periods are subtracted from 730);

- the average daily earnings for the billing period are calculated (total earnings for the previous 2 full years are divided by the number of days);

- The size of the B&R benefit is determined (average daily earnings are multiplied by the number of days of maternity leave).

If during the billing period the employee had very little income, none at all, or the woman has been working in the organization for less than 6 months, sick leave according to the BiR is calculated based on the minimum wage (minimum wage) at the time of maternity leave. From January 1, 2019, the minimum wage in Russia is 11,280 rubles.

Let's look at an example of calculating the minimum benefit amount.

For how long is sick leave granted?

Labor and employment leave is established in the form of a period of incapacity for work or, in other words, sick leave.

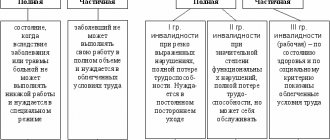

To determine the number of days of rest after the birth of a child, several factors should be taken into account:

- general medical indications of the doctor;

- features of a specific pregnancy case (possible large families);

- the need for prenatal health sessions (mainly for women living in unfavorable conditions);

- the complexity of childbirth (affects the woman’s recovery period).

The terms and conditions for issuing sick leave according to BiR are presented in the table:

Procedure for paying maternity sick leave in 2020 and list of required documents

There is no need to confuse childcare benefits for children up to one and a half years old and maternity benefits. Family members caring for the baby are entitled to receive care payments: grandparents, fathers, and maternity benefits are intended only for mothers who gave birth or adopted a child. Maternity pay is a one-time payment and is provided on the basis of a certificate of incapacity for work.

- be officially employed, with payment of insurance premiums;

- register with a medical institution;

- submit an application to the employer about the desire to exercise the right to receive leave under the BIR for the period established by law;

- Attach a sick leave certificate issued in accordance with the rules to the application.

We recommend reading: What items does not the bailiff have the right to seize for loan debts?

Is it possible to contact the FSS?

Benefits are paid not from the company’s funds, but from the Social Insurance Fund. Initially, the money is transferred to the company, after which it is sent to the employee.

The head of the company does not have the right to violate payment deadlines even if he has not received money from the Social Insurance Fund. In this case, the benefit is paid from the organization’s funds, after which they are returned from the state fund.

If the management of the company constantly violates the deadlines for paying benefits, then the girl can directly contact the Social Insurance Fund with an application to receive payments to her bank account.

How long does it take for maternity pay to accrue after taking sick leave?

This may be due to the employer’s desire to temporarily use the money received or an error in the work of the public service. The employee must receive the due payments no later than the next salary after the documentation is completed. If a delay occurs, she has the right to go to court.

Then the delay in payments can be challenged either in the State Tax Inspectorate or by filing a claim in court. In practice, the latter method is recommended, since the processing time of an application to the inspectorate can take up to 2 months. Can maternity payments be delayed due to the fault of Social Insurance Fund employees? This situation can occur with a fictitious “zero” balance of the organization.

How long does it take for maternity pay to be paid after filing sick leave?

Also, in the case of complicated childbirth, after it, having issued the appropriate certificate at the antenatal clinic, you can submit it to the HR department of the employer company to credit you with additional funds and extend maternity leave for the appropriate number of days.

Responsibility for paying maternity benefits falls on two organizations - the employer and the Social Insurance Fund. In fact, problems may arise with obtaining funds. This may be due to the employer’s desire to temporarily use the money received or an error in the work of the public service.

How long does it take for maternity leave to be paid?

- Federal Law No. 255. The regulatory act establishes the rules for social insurance of women in connection with temporary disability and maternity.

- Federal Law No. 81. Determines the list of benefits for pregnant women and women with children.

- Order of the Ministry of Health and Social Development No. 1012n. The departmental act approves the procedure and conditions for determining and paying benefits to citizens who have children.

The expectant mother has the obligation to properly fill out a sick leave certificate, indicating information about the medical institution and the attending physician. Submitting sick leave does not mean going on vacation. Such an event must be formalized by an appropriate order from the employer.

Procedure for paying maternity sick leave in 2020 and list of required documents

- be officially employed, with payment of insurance premiums;

- register with a medical institution;

- submit an application to the employer about the desire to exercise the right to receive leave under the BIR for the period established by law;

- Attach a sick leave certificate issued in accordance with the rules to the application.

Unemployed women with unemployed status also have the right to go to a medical institution at their place of residence and receive a sick leave certificate according to the BiR. The benefit will be paid through the Social Security Administration if the woman lost her job as a result of the liquidation of the organization, and in the case where the work experience is less than 6 months. If a woman did not work anywhere before pregnancy, the B&R benefit is not provided even in the minimum amount.

We recommend reading: Cost of Vehicle Not Taxable to Personal Income Tax 2020

Maternity payments for a non-working mother

- are registered with the Employment Service (ESS) as persons who have lost their jobs due to layoffs from an enterprise during its liquidation (or termination of activities in the form of individual entrepreneurs or self-employed people);

- study full-time in educational organizations at various levels - paid in the form of a scholarship.

To apply for benefits, in the first case, a woman must contact the territorial Department of the Social Protection Service, and in the second case, she must contact the educational institution where she is receiving her education.

To receive payment, an unemployed woman must provide:

- statement;

- sick leave from a medical institution;

- work book or extract with marks from the last place of work;

- a certificate from the Employment Service confirming registration as unemployed.

The decision to receive benefits is made within 10 days from the date of application. You can apply for maternity benefits any day after receiving maternity leave. but no later than 6 months after its completion.

How long does it take for maternity benefits to be paid after filing sick leave according to the 2020 law?

Maternity payments: deadline and procedure After submitting all the necessary documents, the Social Insurance Fund is obliged to confirm their compliance with the law and previous reporting within ten days. Then, within ten days, she makes transfers of funds to the settlement light opened by the organization or the pregnant woman.

It is important that his competence (education and permission to practice medicine in the relevant field) can be confirmed. The second document for registration of maternity leave is an application from the employee. It is written in any form addressed to the immediate supervisor. To avoid misunderstandings, the text should indicate the same period as in the certificate of incapacity for work. The following factors need to be taken into account:

Payment of sick leave for pregnancy and childbirth

In the regions where the pilot project operates, maternity benefits are paid by the territorial branch of the Social Insurance Fund. To receive benefits, the employee, in the general manner, submits to her employer a sick leave certificate and an application for leave, and the employer, in turn, transfers all the necessary information to the Social Insurance Fund (clause 2 of the Regulations, approved by Government Resolution No. 294 of April 21, 2011). Based on the information received, the Social Insurance Fund directly transfers maternity benefits to the employee’s bank account or by mail.

- if the overpayment was due to an accounting error;

- in case of dishonesty on the part of the employee (for example, if the employee provided the employer with false information about the earnings received at the previous place of work, as a result of which the amount of the benefit was incorrectly determined).

Another 16 days for maternity leave: Primary sick leave or continuation?

Martynyuk N.

Sick leave for an additional 16 days of maternity leave is issued if the birth was complicated. It is often written out not as a continuation of the main maternity sick leave, but as a primary certificate of incapacity for work. Let's figure out what to do if you receive such a slip for payment.

How to do it right

Of course, such sick leave should be issued as a continuation of the sheet for the main maternity leave. After all, an additional 16-day maternity leave is not a new insurance event. This is a continuation of the same insured event. The FSS takes the same position.

From authoritative sources

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

Ilyukhina Tatyana Mitrofanovna - Head of the Department of Legal Support of Insurance in Case of Temporary Disability and in Connection with Maternity of the Legal Department of the Federal Social Insurance Fund of the Russian Federation

“The certificate, issued for an additional 16 calendar days in the case of complicated childbirth, is essentially a continuation of the certificate of incapacity for work, on the basis of which the employer granted maternity leave and paid the corresponding benefit.

Therefore, it should be designed as a continuation, and not as a primary sheet.”

Indeed, the FSS has long recognized that in a single insured event, only the first sheet can be primary, and all the rest must be a continuation. The same approach can be found in court decisions.

What to do if the sick leave brought by the employee is issued as a primary one?

Strictly speaking, you do not have the right to leave the sick leave presented to you with reliable information without payment (for more details, see Civil Code, 2011, No. 21, p. 72). Therefore, it is unlawful to send the employee home to get a piece of paper that would have been issued as a continuation.

From authoritative sources

Ilyukhina Tatyana Mitrofanovna , Federal Social Insurance Fund of the Russian Federation

“If a slip for an additional 16 days for maternity leave is issued as a primary one, then there is no need to re-issue it - you need to pay the benefit.”

However, not all social insurance departments are ready to agree to issue such a sheet as a primary one. According to reports from our readers, some local FSS branches consider this to be incorrect. Of course, you can ask the maternity leaver to contact the maternity hospital to reissue the certificate, but usually new mothers do not have time for such trips. Moreover, maternity hospitals sometimes refuse this, believing that everything was done correctly.

All that remains is to pay the benefit and, in the event of a dispute with the Social Insurance Fund, be ready to prove that payment for such sick leave is acceptable and the Fund is obliged to offset (reimburse) the money you paid. Here are the arguments.

Argument 1. The procedure for registering and issuing sick leave does not say that a sheet issued for an additional 16 days must necessarily be a continuation of the main maternity sick leave. It does not specify at all how it should be designed: as a primary one or as a continuation. Therefore, formally, both options have the right to exist.

Note. In the old rules for issuing sick leave, it was directly stated that when filling out such a sheet, the word “continuation”9 is underlined. This is not the case in the current rules.

Argument 2. The very procedure for issuing maternity sick leave is designed in such a way that sometimes, purely technically, it does not allow the maternity hospital to issue a certificate for an additional 16 days as a continuation. After all, in the continuation sheet you need to indicate the number of the primary sheet. And the maternity hospital does not always have information about this number, since sick leave for 140 days of maternity leave is usually issued not by it, but by the antenatal clinic.

Argument 3. The employer has no right at all to control the correctness of registration of sick leave and compliance with the procedure for issuing it. Therefore, the Social Insurance Fund cannot refuse to offset (reimburse) the benefit amount to the employer if there are such violations in the sick leave. In such cases, the Social Insurance Fund has the right to demand reimbursement of expenses for payment of benefits from the medical institution that incorrectly filled out the form. This is the position of YOU.

When an employee brings you sick leave for 140 days of maternity leave, take a copy of it, give it to her and ask her to attach it to the exchange card. Then, if a woman suddenly has the right to an additional 16 days of vacation, it will be easier for the maternity hospital to issue sick leave for them as a continuation. By the way, antenatal clinic doctors who prescribe sick leave are sometimes given the same advice to expectant mothers.

How to calculate sick leave benefits if it is registered as primary

Due to the fact that the certificate for an additional 16 days is issued as a primary one, and not as a continuation, a new insured event does not arise. Therefore, it is logical to calculate the payment for such sick leave based on the same average daily earnings on the basis of which sick leave was paid for the main maternity leave.

However, the FSS specialist has a different opinion.

From authoritative sources

Ilyukhina Tatyana Mitrofanovna , Federal Social Insurance Fund of the Russian Federation

“If an initial certificate of incapacity for work was issued for an additional 16 days of maternity leave, then the benefit for it must be calculated as for a new insured event, that is, the calculation period must be re-determined and, based on it, the daily earnings. There is no other option."

We warn you: there are no official letters from the FSS on this matter and it is not a fact that its local branches adhere to the same position. Therefore, you can calmly follow it only if the start dates of additional and main maternity leave fall within the same calendar year. Otherwise, the daily allowance for additional leave may differ from the daily allowance for the main 140 days. If the new daily allowance:

This is important to know: Sick leave protocol: 2020 sample

less, then your social insurance has no reason to complain, but a woman on maternity leave can complain to the labor inspectorate;

more, then the maternity leaver will be satisfied, but social insurance may make claims regarding the calculation of benefits.

Therefore, we advise you to send your request to your FSS department so that you have a written explanation.

Note. Do not forget also that in order to pay for an additional 16 days, a woman must write an application for an extension of maternity leave. They are not provided automatically upon presentation of sick leave, but only if there is a written application from the employee and for the number of days indicated in this application.

And she must write an application for parental leave for up to one and a half years (if a woman wants to take advantage of it) from the day following the end of the additional 16 days of maternity leave. If this application was written in advance - from the day following the last day of the main maternity leave for 140 days, it must be rewritten. Otherwise, it turns out that the woman has two vacations during these 16 days. Of course, you cannot pay both benefits, but your personnel documents will be a mess.

Don’t be confused by the empty field in the “date 1” line of the sheet for an additional 16 days of maternity leave. It is intended to indicate the expected (and not actual) date of birth, so it is filled out only on sick leave for the main maternity leave.

Art. 255 Labor Code of the Russian Federation; clause 48 of the Procedure, approved. By Order of the Ministry of Health and Social Development dated June 29, 2006 N 624n (hereinafter referred to as the Procedure)

subp. 2 p. 2 art. 1.3 of the Law of December 29, 2006 N 255-FZ

clause 1 art. 10 of the Law of December 29, 2006 N 255-FZ; Art. 7 of the Law of May 19, 1995 N 81-FZ

Art. 255 Labor Code of the Russian Federation; clause 3, part 2, art. 4.1, clause 1, part 1, clause 1, part 2, art. 4.3, part 5 art. 13 of the Law of December 29, 2006 N 255-FZ

approved By Order of the Ministry of Health and Social Development dated June 29, 2006 N 624n

clause 72 of the Procedure, approved. By Order of the Ministry of Health and Social Development dated 01.08.2007 N 514

Resolution of the Presidium of the Supreme Arbitration Court of December 11, 2012 N 10605/12

For what period, where and when are maternity benefits paid - a lawyer answers

If it is the woman’s own fault for not receiving maternity benefits, then she will be able to receive the money only if 3 years have not passed since the date of assignment of maternity benefits. If there is fault of the fund or the employer, then you can receive the payment in full for any period without restrictions.

It is important to calculate maternity benefits correctly. The amount should not be less than the minimum and more than the maximum. If the excess amount is paid, it will not be possible to recover it from the woman. The exception is counting errors, as well as initially incorrectly submitted information, for example, earnings certificates with erroneous amounts.

How to calculate benefits for complicated childbirth - instructions and example of calculation

Maternity benefits for complicated childbirth are calculated in the same way as for normal childbirth. In 2020, only some indicators changed, and the calculation formula remained the same as before.

Let's consider what is needed to calculate benefits for complicated childbirth:

Step 1. Determine the amount of the citizen’s income for the last 2 years.

Step 2. Calculate a woman’s average daily earnings using the formula:

You should divide the amount received in “step 1” by 731. This is the number of days taken for calculation this year.

From this amount you can subtract exception days when the employee was on sick leave, on maternity leave, etc.

Remember that if you get an amount less than 2020.81 rubles, then you should not use the calculated earnings in further calculations. The maximum will be taken into account.

Step 3. Calculate the benefit amount using the formula:

This is important to know: Order for sick leave: sample 2020

The data obtained from “step 2” and the number of days that the law allows a woman in labor are substituted into the formula.

In our cases it is either 156 or 194 days.

Duration of vacation

Circumstances

Minimum payout

Maximum payout

156 calendar days (70 before, 86 after childbirth)

Childbirth with complications in the prenatal or postpartum period. Complicated childbirth with operations.

194 calendar days (84 before, 110 after childbirth)

Complicated childbirth in multiple pregnancies.

Here are examples of calculating benefits for complicated births.

Example 1. With 156 prescribed days

Citizen Felitsina went on vacation on April 1, 2018.

Let's calculate the amount of maternity benefits for Felitsina's complicated childbirth:

- Number of days in the billing period: 731 – 28 = 703 days.

When calculating, subtract any days you did not work. For example, sick leave is also considered time that should be deducted from the calculation.

Example 2. With 194 prescribed days

Citizen Baronskaya worked for 1.5 years.

Let's calculate what maternity benefit she will receive:

- Let's calculate the number of days that we will take into account in the calculation: 731 – 30 – 14 = 687 days.

An example of calculating maternity benefits for normal childbirth can be found in our article here.

When are maternity benefits transferred?

Please note that if an enterprise participates in the federal program of the Social Insurance Fund, then maternity payments will be provided from its budget. In this case, the employee provides a paper sick leave form directly to the employer.

Based on Article 255 of the Labor Code of the Russian Federation, a pregnant woman has the right to receive maternity leave. She is given a total of 140 days, starting from the 28th week of pregnancy. For the entire time the employee is absent from the workplace, she is paid benefits. It is calculated based on the employee’s average monthly earnings.

Deadlines for payment of benefits

When going on maternity leave, the expectant mother should know what types of payments she is entitled to and when benefits should be transferred. It is important to understand that the entire maternity leave is divided into several parts, each of which provides different payments.

At the 30-week stage of pregnancy, the expectant mother receives a sick leave certificate from the antenatal clinic, which she must submit to work at the same time as applying for leave related to her pregnancy and childbirth. Sick leave is issued for a period of 140 days. In the event of a complicated birth or if an employee gives birth to several babies at once, she has the right not to extend sick leave.

This type of leave must be paid within 10 days after the woman brings her sick leave to work. If the employer is unable to pay the money within this period, he is obliged to transfer all funds no later than the day of the next salary payment.

Small companies may not have such an amount at the time of filing the application, but in this case the manager is obliged to contact the Social Insurance Fund so that the money is paid directly to the employee. The benefit is paid one-time for all 140 days of vacation. It is necessary to take into account 100% of the woman’s average daily earnings for the previous 2 calendar years.

After the end of sick leave, a young mother has the right to write an application for leave to care for a child up to 1.5 years old and receive a monthly benefit in the amount of 40% of the average monthly earnings. This type of cash payment must be transferred to the employee every month at the same time that other employees receive wages.