Calculation of benefits

Payment for temporary disability is regulated by Law No. 255-FZ of December 29, 2006, the procedure for calculating benefits is set out in the Regulations, approved. Government Decree No. 375 dated June 15, 2007 (as amended on January 19, 2019). Sick leave is accrued according to the general rules for any employed person:

- Average daily earnings are used for calculation;

- average earnings include all income and remuneration subject to insurance contributions (within the limit);

- to determine the amount of benefits, earnings for the previous two years are taken;

- the amount of benefits is affected by the length of service (100% of average earnings - for more than 8 years of experience, 80% - from 5 to 8 years, 60% - for up to 5 years of experience; if the experience is less than 6 months, the calculation is based on the minimum wage).

But calculating sick leave after maternity leave has a number of nuances. They are related to the determination of the billing period, which is taken into account for the purpose of payment.

https://youtu.be/tox5_Bv6SwY

Indicators affecting accruals

When calculating the amount of the due payment, they adhere to the procedure approved by Law No. 255, put into effect in 2006, with participation in the calculations of the length of service, duration of absence, and average daily pay. Each of these indicators should be considered separately.

Insurance experience

For a female employee officially registered at the enterprise, the actual length of service implies the period when contributions to the Social Security Fund were made for the woman. The longer a person works, the higher the percentage of the payment compared to the average wage. For those who have worked for more than 8 years, the accounting department will calculate 100% compensation based on the average wage for the billing period in question.

For other workers with less experience, the following percentage scale applies:

- if you have worked for 5-8 years, the sickness benefit will be 80% of earnings;

- for shorter periods worked - 60% of average earnings will be added.

If a woman worked for no more than 6 months, then the calculation standard for the minimum wage in the country should be applied.

When determining the length of service, it is taken into account that the maternity period is also included in the length of service, therefore a woman who has worked at the enterprise for more than 5 years and went on maternity leave for 3 years, on sick leave after maternity leave, has the right to count on full compensation, using the length of service indicator equal to 100%. .

In addition to maternity leave, the length of service will include:

- time worked under an employment contract in the municipal or civil service;

- period spent in firefighting, military service or law enforcement;

- another period worked, subject to the availability of contributions through the Social Insurance Fund.

When chronologically overlapping periods, one selected period is taken into account (without the possibility of summing up the length of service).

To determine the amount involved in calculations on a temporary disability certificate, a woman has the right to choose the periods for which the average daily payment must be calculated, or take into account the last couple of years before maternity leave, if earnings at that moment were maximum. When calculating average earnings, all amounts accrued in favor of the employee, from which the Social Insurance Fund was paid, will be taken into account, i.e. Payments of vacation pay and bonuses are also taken into account.

Duration of actual sick leave

There are subtleties when determining the amount of payment based on the duration of the illness. It is calculated in calendar days, taking into account holidays and weekends.

Depending on the reason for issuing sick leave, I use the following rules in calculations:

- if the employee herself is ill, the law provides for payment for the full period of absence from work;

- if a sick child under the age of 7 is being cared for, the period of treatment at home or in a hospital is paid in full;

- if the child is over 7 years old, but has not yet reached the age of 15, only the first 15 days of treatment at home are fully paid for, and if the illness lasts longer, only half is compensated for a period of more than 15 days;

- when staying in a hospital with a child 7-15 years old, payment for the certificate of incapacity for work is made in full, for the entire period;

- when it is necessary to provide care for a minor who has reached the age of 15, full payment is required for the first 3 days, and then the calculation is based on half the amount.

Periods for calculating sick leave after maternity leave

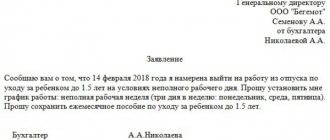

According to Art. 14 of Law No. 255-FZ and clause 11 of the Regulations, if periods of parental leave or maternity leave occurred in the accounting years, they can be excluded by choosing earlier ones instead, i.e. replace the years. But the years for calculating sick leave after maternity leave can be replaced not with any, but only with those immediately preceding the excluded ones, and only if, as a result of the replacement, the amount of benefits received increases (Letter of the Social Insurance Fund dated November 11, 2015 No. 02-09-14/15-19989, letters Ministry of Labor dated 03.08.2015 N 17-1/OOG-1105, dated 09.12.2015 N 17-1/OOG-1755). A prerequisite for replacement is a written statement about this from the employee herself.

Example 1

Secretary Ivanova provided sick leave in July 2020. The calculation period is 2020 and 2020. But in 2020, the employee was on maternity leave. Immediately after that, I took out maternity leave until November 2020. If Ivanova wants, she can replace 2020 and 2020 with the previous years 2020 and 2015.

One year replacement only

Replacement is allowed for any year with excluded days. But it is possible to change even one year, leaving the one in which the earnings were the highest. It is recommended to choose periods with maximum income.

Example 2

Manager Petrova’s maternity leave began in May 2016. Maternity leave ended in February 2020, after which she returned to work. In 2020, Petrova was ill and was issued sick leave. The calculation period for calculating benefits includes 2020 and 2020, however, they include excluded “maternity” periods. At the request of Petrova herself, both of them can be replaced with previous years. But since the manager’s maximum salary was in 2020, she decided to leave it in the accruals, asking only 2020 to be replaced. For replacement, you can take 2020 or 2020 - it is recommended to choose based on your highest taxable income. The woman chose 2020 (in 2020 there was an exclusion period, and less wages were accrued). Thus, its calculation period will include the years 2020 and 2020.

Transition from one maternity leave to another

It often happens that, not having time to go to work after the first maternity leave, a woman goes on a second one, and after going to work in the first months she takes sick leave. How to proceed in this case? The rule remains the same - you can replace years that have excluded days. Calculation of sick leave after leaving maternity leave assumes that in order to receive the maximum amount of benefits, a change in the calculated years is necessary. The replacement is made at the request of the employee for previous years in which there is taxable earnings (FSS letter dated November 30, 2015 N 02-09-11/15-23247). Even if they are not fully worked out. It is impossible to remove from the calculation period years in which there are no excluded “maternity” days.

Example 3

The employee was on maternity leave from March 2014 to November 2020 with her first child. At the end of 2020 she returned to work. In mid-2017, I went on maternity leave again with my second child. I started working in June 2020. In July 2020, the woman was ill for several days, later providing sick leave for payment. What years are included in the billing period?

If there is no application from the employee to change the years, then 2020 and 2020 are used for calculations. If their average monthly income was below the minimum wage in effect on the date of the onset of the disease, the calculation will be made from the minimum wage.

If there is an application from the employee, you can replace 2020 and 2017. One of them is replaced by 2020, which cannot be removed from the calculation period - there are no excluded periods in it. The second year will be replaced at the employee’s choice - you can leave 2020 or take 2020, 2014 or 2013.

If there is no income in recent years.

Sick leave after maternity leave cannot be calculated based on an amount less than the minimum wage established in a given region.

If a woman does not have more favorable years to recalculate sick leave, then the minimum wage is taken as a basis.

When it is possible to confirm a higher income only for one year preceding the vacation, the calculation can be made based on it.

In this case, the division factor does not change; it is always equal to 730.

If the amount obtained during the calculation is small, it is compared with the amount that will be obtained during the calculation, taking into account the minimum wage.

The most profitable result is used for payments. This is how sick leave is calculated after maternity leave: changing years allows you to increase the amount of payments.

An example of calculating sick leave after maternity leave.

After working just one year after graduating from college, the employee is going on maternity leave in 2020. An application is made for parental leave.

Papers are provided for maternity leave. In 2019, the employee returns from vacation and begins work duties.

Sick leave this year can be calculated in two ways:

- The minimum wage is taken into account, since over the past 2 years the employee was on maternity leave and she was not paid a salary.

- The calculation will take into account one year that preceded going on maternity leave.

If an employee wants to increase the amount of sick leave payments, she must write a statement to the employer with a request to take into account the period before going on maternity leave.

And only if the amount calculated for this year exceeds that obtained when calculating sick leave taking into account the minimum wage, this period will be used.

Accounting staff will in any case take a more profitable period. But to change the established period, you will need to write an application.

Without it, accounting has no right to change years.

Application for changing the period for pregnancy benefits. [24.00 KB]

Sick leave after childbirth: how many days and how is it paid?

Calculation of benefits from the minimum wage

If the actual average daily earnings for the entire billing period are less than those calculated from the minimum wage, the calculation of sick leave after maternity leave in 2020 must be made based on the minimum wage in force on the date of opening of the sick leave. When working part-time, the minimum wage is applied in proportion to the time worked.

In all other respects, one must be guided by the general rules for temporary disability benefits.

Here is an example of a full calculation of sick leave after maternity leave.

Example 4

In August 2020, accountant Kirillova went on maternity leave, and then immediately went on maternity leave. She returned to her official duties in May 2020. The accountant submitted an application for a standard deduction for a child immediately after she started work. Kirillova brought in sick leave in June 2020. She was ill for 5 days. Accrued salary: 2020 – 180,000 rubles, 2020 – 258,000 rubles, 2014 – 238,400 rubles. Work experience – 10 years. The minimum wage in 2020 is 11,280 rubles.

The billing period is 2020, 2020. But since there were no accruals in this period, Kirillova wrote an application to replace the years, choosing 2020 and 2014 (and not 2020, since it also has an excluded period).

First, we check the applied base limits for calculating social insurance contributions in the years being replaced: in 2020 - 670,000 rubles, in 2014 - 624,000 rubles. Since Kirillova’s income taken into account in these periods is less than the limit, we take them into account in full.

We calculate the average daily earnings:

(258000 + 238400): 730 = 680 rubles.

We compare with the average daily earnings from the minimum wage as of the start date of sick leave:

11280 x 24 months : 730 = 370.85 rubles; Since the employee’s actual earnings are higher, sick leave is calculated based on the average daily amount of 680 rubles.

Kirillova has more than 8 years of work experience, so benefits are calculated from 100% of earnings.

We calculate the allowance: 680 x 5 days. = 3400 rubles.

Of these, 3 days are paid by the employer: 680 x 3 = 2040 rubles,

The remaining 2 days are reimbursed by the FSS: 680 x 2 = 1360 rubles.

Personal income tax is withheld from the accrued amount, and we apply the standard deduction for a child:

(3400 - 1400) x 13% = 260 rubles.

For days of illness, Kirillova will be paid:

3400 – 260 = 3140 rubles.

Read also: Sick leave under the pilot project

Typical mistakes when calculating sick leave

Mistake #1. Two years of replacement are given immediately after maternity leave, and not for the entire period of raising the child. A mother who returned from maternity leave in 2020 will only be entitled to one year of maternity leave in 2020. This is often forgotten, mistakenly believing that sick leave will be considered according to the best indicators at least until the child reaches adulthood. Of course this is not true.

Mistake #2. After the age of seven, the difference between outpatient and inpatient treatment begins to affect the child. Remember that in case of treatment at home, only the first 14 days will be fully paid, after which the benefit amount will be halved.

Is it possible to take a vacation at your own expense after maternity leave?

The duration of absence from work to care for a child is limited to the moment the child reaches three years of age. However, after the baby’s birthday, a situation often occurs when the child does not start going to kindergarten, and there is no one to look after the baby, and therefore the mother does not have the opportunity to start work. Then young mothers begin to worry and look for options to get out of the current situation.

The most common solution is to write an application for unpaid leave . The Labor Code allows you to do this. It should be taken into account that the length of time away from work is not limited by law, i.e. a woman can request 28 or more calendar days.

An important nuance for obtaining leave at your own expense is the consent of the management, since the boss is not obliged to let the employee go for such a long time. Therefore, before leaving work, you should reach certain agreements and obtain documented confirmation of the manager’s consent in the form of an order assigning a vacation of an agreed duration in your name.

Practical examples of benefit calculation

So we have all the variables. Let's try to calculate the amount of payments for a woman who has recently returned from maternity leave.

Example 1. A bank employee who returned from maternity leave several months ago found herself on two-week sick leave with complications of the flu. 2011 and 2014 were selected for the best years with total earnings of 800 thousand rubles. Experience including maternity leave - 7 years.

First, we calculate the average daily salary for these two years. 800000 / 730 = 1095 rubles per day. According to 255-FZ, when calculating payments for sick leave, both weekends and holidays are fully taken into account, so we multiply 1095 by 14 (number of sick days) and 0.8 (work experience coefficient for 7 years). In total, the employee will be paid 12,264 rubles.

Example 2. A mother takes a week's sick leave to care for her sixteen-year-old daughter, who has chickenpox. She has 21 years of experience, and a few months ago she just returned from maternity leave due to the birth of her second child.

As last time, we start from the average salary. Let’s say a woman chose two years with earnings of 600 thousand rubles or 822 rubles a day. Here only the first three days are fully paid, so she will receive 822 * 3,411 * 4 rubles per week. The experience coefficient is 100%, it can be neglected, so in the end the employee will receive 4110 rubles. And if her newborn son or she herself got sick, the reducing coefficient would not apply, and the payments would be 822 * 7 = 5754 rubles.

Registration of sick leave during a regular vacation may become the basis for its extension. There are two exceptions to this rule, both of which apply to maternity leave.

- If the recipient of sick leave is a teenager between the ages of 15 and 18, the extension of leave will be refused. In this case, the type of treatment - outpatient or inpatient - does not matter.

- When diagnosing a child with chronic diseases. This prohibition helps protect the employer so that parents do not take sick leave for care at any time convenient for them, extending paid leave by one to two weeks.

In all other cases, sick leave for care extends leave in exactly the same way as a standard certificate of incapacity for work due to one’s own illness.

How to calculate?

The amount of payment for sick leave can be calculated using the formula:

Formula:

Disability benefit = SWP x CDN x KS

- SWP – average salary for a 2-year period;

- KDN - the number of calendar days that the employee was considered disabled;

- KS – length of service coefficient, depending on the employee’s length of service in official work.

Average earnings are calculated as follows: take the total salary for 2 years and divide by the number of days - 730. In addition, the amount of earnings for the year should not exceed the maximum base for calculating contributions. For example, for 2020 it is 755 thousand rubles, and for 2020 – 815 thousand rubles.

The length of service coefficient includes not only the employee’s work experience, but also 3 years of maternity leave.

The same is true for maternity leave, which is also taken into account in the length of service for disability.

In addition to leave for her own illness, an employee can go on sick leave due to the illness of a child.

In this case, payment is calculated as follows (table of duration of sick leave per child):

- if the child is under 7 years old, then the mother’s sick leave is paid for the entire period of treatment;

- if a child aged 7-15 years receives inpatient treatment, the mother is also paid full disability leave;

- if a child of this age is treated on an outpatient basis, then only the first 15 days of sick leave are paid in full, and only 50% is accrued for subsequent days;

- a mother whose child over 15 years of age receives outpatient or inpatient treatment is paid only for 3 days, and then a benefit of 50% is awarded.

Step-by-step procedure for calculating sick leave for child care.

Calculation example for 2020

Example conditions:

The woman’s maternity leave ended in January 2020, and in March she went on sick leave for 5 days.

Her work experience, which included contributions to the Social Insurance Fund, totals 6 years. She spent 3 of them on maternity leave.

There was a maternity leave during the billing period, during which she went out in 2020. The employee can choose to calculate from the minimum wage or take an earlier 2 years before going on sick leave due to pregnancy.

If the calculation of sick leave payments is carried out according to the minimum wage, then it is taken at the time of calculations of 9,489 rubles.

Calculation:

If the calculation is carried out according to the minimum wage:

Leaf allowance = (9489 * 24 / 730) * 5 * 80% = 1247.88

If this amount does not suit the employee, she has the right to submit an application for recalculation of sick leave payments for other years. Then the calculation will be carried out according to the provided 2-NDFL income certificate.

The application indicates the desired recalculation period of 2013 and 2014. According to the certificate, the annual salary was 420 thousand rubles. and 500 thousand rubles. respectively. Then the amount of sick pay will be calculated as follows:

Allowance = (420000 + 500000)/730 × 5 × 0.8 = 5041 rub.

As a result of replacing the years, the amount of the benefit is greater, and the woman will receive it for the days of incapacity for work.

Personal income tax must be withheld from the accrued benefit amount.

Who can take sick leave to care for a child?

A sick leave for child care is an official document that is issued by a doctor when a child is diagnosed with any disease and guarantees the payment of temporary benefits to a working relative. If previously only close family members - father, mother or guardians - were allowed to care for the sick, then since 2014 the rules have changed.

Now the doctor issues sick leave to any relative who will care for the child during illness. Situations are not allowed when, for example, sick leave is issued to the father, the mother or grandmother sits with the child, and the father goes to work.

Neither the degree of relationship nor whether the child lives together or separately with a caring relative is taken into account. The only point: a family member must work and be registered with the social insurance fund (FSS). Mothers who are on maternity leave due to pregnancy or caring for a child under 3 years old, but who work part-time or are engaged in light work, can apply for sick leave.

How to calculate maternity benefits in 2020

A certificate of incapacity for work cannot be issued:

- for a schoolchild or student;

- for an unemployed pensioner;

- for a mother who is not working or is on maternity leave.

If a child has a long-term illness, sick leave is issued for several family members (in turn) within the period established by law, but only for one of them at a time.

The employer does not have the right to demand documents confirming relationship; to receive benefits, it is enough to present a certificate of incapacity for work with a stamp. Grounds for release from work:

- acute course of the disease in a child or exacerbation of the chronic stage;

- treatment that will require the intervention of treating personnel or a set of measures using medications.

Sick leave is not issued for the treatment of chronic diseases in remission.

If two children are sick, one sheet is issued. If there are three or more, a second sick leave is issued. In cases where one of the children has already recovered and the second is sick, the certificate of incapacity for work is extended until the last patient is discharged.

Treatment can take place on an outpatient basis at home with regular visits to the doctor and drug treatment, or as an inpatient treatment in a day hospital or with hospitalization of the patient. In the latter case, serious medical intervention may be required and the child must remain in the institution together with an adult relative.

Procedure for replacing billing periods

The employee goes to work the day after the certificate of incapacity for work is closed.

She must present sick leave for payment within 6 months, otherwise she will be denied payment for days of incapacity for work.

The woman attaches a statement to the sick leave with a request to take into account the periods of work that she has chosen in the calculation of benefits. If in the selected period there is time of work for another employer, then the woman must provide a certificate in form 182n.

If the employee does not write an application to change the periods for calculating benefits, then the employer will be forced to calculate it based on the minimum wage, taking into account the woman’s work experience.

Temporary disability benefits must be accrued within 10 days from the date of filing the application, provided that there are no errors or inaccuracies in the sick leave certificate. As a rule, the benefit is paid along with the next salary or advance payment.

The calculated amount of benefits is paid to the employee in the same way as wages: in cash at the company’s cash desk or by transfer to a bank card. Read about whether sick leave for child care during vacation is paid here, and whether it is possible to transfer or extend leave due to sick leave is discussed here.