If you have received a letter from the tax office/tax authority, the first thing you need to do is determine the status of the document received. This is important because it is the status of the letter that affects the responsibilities of its recipient.

- Tax notice

- Tax requirement

- Request for clarification or correction of tax returns

- Refusal to provide documents

- Tax sanctions

The rules for interaction between taxpayers and tax authorities are enshrined in a special act: the Tax Code of the Russian Federation. The Tax Code of the Russian Federation lays down not only the fundamentals of taxation, but also the rules for conducting correspondence between tax authorities and taxpayers.

So, when conducting correspondence with the tax office (if you have already received a letter from the tax office), you need to take into account the following principles:

- everyone is obliged to submit tax documents that are required for the calculation and payment of taxes, when this is provided for by the Tax Code of the Russian Federation and in accordance with the procedure established in it;

- everyone must comply with the legal requirements of the tax authority to eliminate identified violations of laws on taxes and fees.

Therefore, you must comply with the requirements of the tax authorities if they are sent in cases that are directly described in the Tax Code of the Russian Federation and in accordance with the established procedure.

Letter from the tax office: what types of documents can come from the tax authority?

Tax notice

Individuals pay a number of taxes (transport and land taxes, property tax) based on the notification. Tax authorities calculate these types of payments independently based on data from the authorities involved in registering property rights.

The taxpayer may not pay property tax or pay it in a smaller amount if he has the right to a benefit

The obligation to pay tax arises no earlier than the date of receipt of such notice. Taxes must be paid no later than December 1 of the year following the expired calendar year.

If the taxpayer has his own personal account, the notification will be sent electronically.

If the notification contains an error, contact the tax office at your place of residence (preferably before December 1).

Reasons for not receiving receipts

Do not be mistaken that if receipts have not been received, the citizen is exempt from paying tax. It is his responsibility, on his own initiative, to interact with the tax office and report the acquisition or alienation of property, as well as notify the address to which notifications should be sent.

In fact, in some cases, the absence of receipts in the mailbox actually means an exemption from paying property taxes due to the individual being classified as a preferential category of citizens. However, if the fact of the benefit is not confirmed, you should be concerned if the tax does not arrive and contact the tax office to clarify the issue.

The most common reasons for not receiving a notification are:

- Change of residential address by the owner. After moving, a citizen changes his main place of residence, but the official authorities have not yet been notified of the fact of a change in registration.

- Problems with the postal service. Despite the fact that notifications are sent by registered mail, in some situations there are interruptions in the work of postal employees, which leads to a delay in delivery.

- If a citizen registers as a user of his personal account on the Federal Tax Service portal, the tax office does not send information about upcoming tax payments, because All necessary data is available in your personal account. Failure to receive paper receipts is not a valid reason for missing a tax payment. If the registered account owner requires paper receipts, he must request that his local tax office mail the receipts.

- In some cases, the amount of tax transfer does not exceed 100 rubles. In this case, receipts are also not sent to the taxpayer by mail. The Federal Tax Service employees will send a notice of such a tax at the end of the period, after which the Federal Tax Service will not be able to declare the need to pay the tax (for the last three years).

First of all, don't panic. Secondly, relax and enjoy:

- The taxpayer is obliged to make payment only after receiving the notice;

- The notification must arrive on time;

- It can be delivered personally or by registered mail;

- The notice can be obtained in the electronic “Taxpayer Account” on the tax service website.

Until this happens, you are protected by Article 57 of the Tax Code of the Russian Federation. Specifically, its 4th article, the meaning of which boils down to the fact that if a person has not received a notification from the tax service on time, he should not pay.

From the point of view of the law, you can only be charged tax for the previous three years, without any penalties or fines. So there's really nothing to worry about. In case of litigation, tax authorities have no chance.

We suggest you read: Claim for unjust enrichment jurisdiction

You can stand in line at the nearest territorial branch, but why? It’s easier to wait until everything is settled without your intervention.

There are several reasons for missing payments:

- The tax amount does not exceed 100 rubles, in which case the letter, as a rule, is not sent;

- You did not notify the service that you have taxable property;

- After recalculation, it turned out that in previous years you overpaid;

- Error on the part of the tax authorities.

Make sure you have already received receipts for this apartment or car. In this case, there is absolutely nothing to blame you for and no action is required from you. The busy schedule of tax officials may mean that chain letters are not sent to everyone.

You should also not discount our mail; a certain percentage of letters are lost or arrive very late.

Most often, problems arise precisely because of financial recalculations and too small a payment amount. Don't worry, sooner or later you will receive your bills and be able to pay them, it's just not the time yet. Article 57 of the constitution still protects taxpayers from mistakes on the part of government officials.

This is extremely simple - if the letter has not arrived, it means that the payment obligations have not occurred. As soon as you put your signature on the registered letter, that’s it, it’s time to pay the bills.

Besides ignoring the problem, there are several other options:

- Receive notification using your electronic account;

- Visit the tax office, stand in line and provide copies of documents for the property;

- Call and find out what the problem is.

If the apartment was purchased recently and receipts have not yet been received for it, it is better to spend time resolving this issue:

- Call the tax office;

- Find out the reception time for your question;

- Specify the list of required documents;

- Visit the valiant staff.

This action will relieve you of any liability. Until 2015, a citizen was not required to “surrender” on his own, but a change in legislation made the work of the tax service easier and made life somewhat more difficult for taxpayers. Now it will not be possible to blame everything on the oversight of officials, and in case of litigation, problems may arise.

In all other cases, you can spend time either calling or visiting your personal account on the service website. This action will not take more than a couple of minutes, but will help solve the problem no less effectively than visiting the department itself. The main thing is not to worry about possible fines; in this regard, the taxpayer is well protected by the law, and if you are sure that the problem arose not through your fault, sort it out to the last minute.

Perhaps you did not receive a tax notice because the tax office does not have information about whether you have taxable property. You are required to declare such property before December 31 of the year following the expired tax period (year). In this case, you need to present documents certifying the ownership of housing, identity documents, and your Taxpayer Identification Number (TIN) to the tax office.

! From January 1, 2020, for failure to report the presence of real estate, a fine of 20% of the unpaid tax amount is provided. Documents for notification of property can be personally taken to the tax office or sent by registered mail. You can also send the corresponding message electronically.

Info

Persons who have property tax benefits do not receive notifications within the time limits established by the state. Who is exempt from the payment being studied? Today it is:

- elderly people (retirement age);

- veterans;

- disabled people (group 1 or 2, as well as disabled people since childhood);

- heroes of the country;

- persons engaged in creative activities subject to taxation.

All of the above categories of citizens do not need to think about why their apartment taxes are not being received. They do not need to make this payment. This means that the Federal Tax Service will not notify about taxes.

To pay or not? Perhaps all known situations with the absence of tax notifications have already been studied. But how should a taxpayer behave? And do you need to think about paying taxes if there are no receipts? As already mentioned, the absence of payment receipts does not relieve the taxpayer of responsibility for paying taxes.

Attention

The parameters of the vehicle itself and its owner must be indicated;

- Attached to the message is a copy of the certificate of registration of the car with the traffic police in the name of the taxpayer.

If you own several transport vehicles at once, a declaration must be submitted for each of them.

A message of this type is sent only once. If, after this, no notification has been received regarding the amount required for payment, the owner will have every right not to do anything. To do this, you will need to present an identification document and provide your TIN. If you use your personal account, a tax notice will not be sent by mail. To receive it on paper, you will have to make a request through your personal account. Keep in mind! If the total amount of taxes calculated by the tax authority is less than 100 rubles, a tax notice is not sent to the taxpayer by mail.

In a number of Baltic countries, as an experiment, the government carried out the transition of its activities from the “paper” field to electronic media. This reduces the degree of bureaucracy, but, as experience has shown, it does not protect against hacker attacks at all.

Claim (tax claim)

Taxes that are not paid on time become arrears, on which penalties are charged for each day of delay. If there is such a debt, the tax authority sends a demand (this is the next version of the letter from the tax office). The demand is a notification about the existence of a tax debt with a requirement to pay it off, about the amount of penalties accrued for the days of delay.

Typically, the request is sent within 3 months from the day following the due date for tax payments. Penalties in the request are calculated on the day specified in the request. For penalties that accrue after this date, a separate claim will be sent after the tax amount has been paid.

The tax must be paid within the period specified in the request (if the request does not indicate a deadline, then you have 8 working days from the date of receipt of this document ).

If the requirement is not fulfilled, the tax authority has the right to go to court to collect taxes and penalties.

What to do if you haven’t received a transport tax notice?

From the point of view of the law, you can only be charged tax for the previous three years, without any penalties or fines. So there's really nothing to worry about. In case of litigation, tax authorities have no chance.

We invite you to familiarize yourself with: Tax rates, tax period, calculation procedure and deadlines for personal income tax payment

Make sure you have already received receipts for this apartment or car.

Important

This period was first established in 2020 in the current version of Art. 409 of the Tax Code (TC) of the Russian Federation. Previously, the payment deadline set by law was October 1, and even earlier (until 2015) - no later than November 1. At the same time, property tax in Russia is still paid in accordance with the notification procedure, i.e.

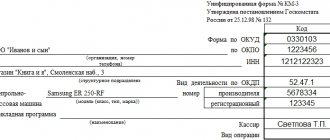

on the basis of a tax notice, which indicates the amount of tax to be paid, the object of taxation (apartment, room, residential building, garage and other buildings and premises) and the payment deadline, in case of violation of which a penalty (penalty) will be charged, calculated in accordance with clause . 3-4 tbsp. 75 of the Tax Code of the Russian Federation for each day of delay as a percentage of the unpaid tax (for individuals it is now 1/300 of the refinancing rate established by the Central Bank - from September 18, 2017 it is set at 8.5%).

Request for clarification or correction of tax returns

In addition to the documents reviewed, there may be a requirement to provide clarifications or correct tax returns if, during audits, the tax office discovered errors or any discrepancies between the information submitted by the individual and the data at the disposal of the tax authority.

For reference: each submitted document is checked by tax officials; these activities are called a desk tax audit (i.e., this audit does not require visiting the taxpayer, which distinguishes it from an on-site tax audit).

The obligation to send a declaration can arise only in connection with the payment of personal income tax (in cases provided for by the Tax Code of the Russian Federation). For example, a declaration must be submitted if income was received under a civil contract from another individual (for example, from renting out your property), if there was a sale of real estate that was owned for less than a specified period, if you are applying for tax deductions.

Since the possibility of sending demands during control activities is directly provided for by the Tax Code of the Russian Federation, the taxpayer is obliged to comply with them. The deadline for submitting documents is 10 days from the date of receipt of the request.

If you do not have time to submit documents and information within this period, you must notify the tax authority about this in writing.

Failure to pay taxes may result in legal action

If a person has a debt in the amount of over 3 thousand rubles and if 3 months have passed from the due date for making payment, the tax service has the right to file a claim and submit the case to the court for forced collection of the debt.

The lawsuit is filed to forcefully recover unpaid funds from the debtor. The debtor's property or funds in bank accounts can serve as security for payment.

Another case is when the total amount of debt is less than 3 thousand rubles. Then the service will not be able to demand its return immediately - only after three years have passed from the end of the period provided for fulfilling the requirement. In this case, the claim must be filed within six months from the end of the three-year period.

Since the payer's obligation to pay tax is unconditional from a legal point of view, the tax service has the right to apply to the court for an order. This is a simplified version of the judicial consideration of the issue: the court issues a document for execution (court order), without resorting to summoning the parties and without conducting a trial.

In addition, the collector, represented by the tax authority, has the right to inform his immediate employer about the existence of a debt from the payer. He can transfer a writ of execution to collect funds to organizations that make any types of periodic payments to the debtor (scholarship, salary, pension, etc.).

Watch the video. What to do if tax comes on a sold car:

Dear readers of our site! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your specific problem, please contact the online consultant form on the right. It's fast and free! Or call us at :

+7-495-899-01-60

Moscow, Moscow region

+7-812-389-26-12

St. Petersburg, Leningrad region

8-800-511-83-47

Federal number for other regions of Russia

If your question is lengthy and it is better to ask it in writing, then at the end of the article there is a special form where you can write it and we will forward your question to a lawyer specializing specifically in your problem. Write! We will help solve your legal problem.

Refusal to provide documents

In rare cases, you may not give a substantive answer and not provide documents, that is, answer with a polite refusal to provide them.

In particular, this is possible under the following conditions:

- if clarification is requested by the tax authority after the completion of control activities. The desk audit is carried out within 3 months from the date of submission of the relevant document. During this time, tax officials must have time to carry out all verification activities (including requesting documents and information from the taxpayer if there are any contradictions).

If demands for explanations or documents are sent beyond the above-mentioned period, then they are illegal;

— if the tax office asks for documents that you have previously provided. Tax officials cannot repeatedly request documents that you have previously sent to them. If such a request is received, a reasoned refusal can be sent;

- refusal on your part is also possible if the tax authorities, in your opinion, require documents on a declaration in which there are no contradictions. To ensure that the submitted documents are correct, we recommend that you seek legal advice. This will reduce the risk of being held accountable for failure to comply with the requirements of the tax authority.

Implementation of electronic systems

For many centuries, our ancestors relied only on paper for everything related to documentation. The Internet and electronic media did not appear yesterday or even the day before, but their full implementation into public life is proceeding at too slow a pace.

Today there are thousands of websites of various ministries, administrations and territorial divisions of various organizations:

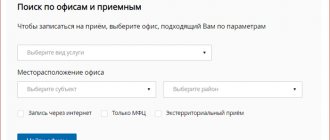

- You can make an appointment by pressing just a couple of buttons and without sitting in line for hours, for example on the Gosuslugi portal;

- There is an opportunity to get advice online;

- Some of the notifications and notices, if desired, can be “ordered” into your electronic account;

- Some payments can be made without looking up from the screen.

But all this does not relieve the postal service so much and does not get rid of dozens of pieces of paper - receipts, notifications, payments.

In a number of Baltic countries, as an experiment, the government carried out the transition of its activities from the “paper” field to electronic media. This reduces the degree of bureaucracy, but, as experience has shown, it does not protect against hacker attacks at all.

Tax sanctions

As for sanctions , various types of liability may be applied for violation of the law in the area in question. Thus, for non-payment of taxes there is a fine of 20% of the debt amount (tax liability). For failure to provide information to the tax service as part of control measures - a fine of 100 to 300 rubles for individuals (administrative liability). If tax evasion is large or especially large, then criminal liability is applied.

We hope we have helped you understand what forms of interactions and consequences are hidden behind the wording of the letter from the tax office . There is no need to shelve this document: solving the problem in a timely manner will help prevent a bigger problem.

You may also be interested in: What to do if you receive a police summons

You may also be interested in: Taxes: main changes from 2020

What happens if you don't pay taxes by December?

Want to know more? Read us :

Actions in case of non-receipt of a tax document

If you have not received any notifications with payment documents from the service by mail, there is a risk of missing the statutory deadline for making mandatory payments. In certain situations, this may lead to the accrual of penalties. Additionally, the violator will be subject to tax liability.

Please note! If you have not received a notification from the tax service, as well as the previously specified receipt, it is recommended that you strictly follow the steps outlined below and no problems will arise.

First step

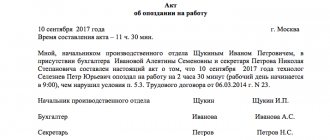

Contact the tax authorities directly to receive notification in person. If you do not have a proper tax notice, tax officials will recommend that you personally come to the inspection office located in the territory of residence of the taxpayer, or in the place where the real estate is located.

There you can receive the specified message in your hands. The relevant information can also be transmitted through the main resource of the Federal Tax Service of the Russian Federation (including the citizen’s personal account).

Second step

Notify the relevant tax service about the fact of official ownership of real estate and (or) transport.

Important! If there is no message from the tax authority, you will have an obligation before the end of the year that follows the previous tax period to notify the service about the presence of any vehicles or real estate registered in your name. The body to which the notification is sent can be chosen by the payer independently.

Along with such notification, attach documents certifying your right to the declared property (real estate, vehicles). The ownership of each object indicated in the message must be documented.

You will not have to report to the service if you have previously received a notification from it regarding payment of the obligatory tax payment for a particular object, or if there are preferential terms for payment of tax payments. These reasons give the payer the right not to worry about informing the service (in accordance with paragraph 2.1 of Article 23 of the Tax Code).

As soon as the service receives a message from the owner about the presence of taxable objects, the tax authorities have the right to give him a notification for the purpose of making tax payments exclusively for the 3 years preceding the statement. The period is limited by the moment a person acquires the right to taxable property.

The method by which the payer sends a message to the service may vary:

- by postal service (registered mail is used);

- during a personal visit (on purpose);

- electronic document (including using the payer’s personal account).

Attention! Since the beginning of 2020, for the fact of failure by the owner to report the presence of taxable property (real estate, vehicles), for which the service has not sent notifications (except for cases of non-receipt of the latter due to the presence of legal benefits), a fine is imposed. Its amount will be 20% and will be calculated from the amount of unpaid tax.

If there is evidence of intentional non-payment of taxes, the fine will be increased to 40%. Liability for the violator may arise within three years (the statute of limitations for tax claims). They are counted from the day when the tax legally had to be paid.

It should be understood that the tax service must have compelling reasons to hold the defaulter accountable. An evidence base is required that fully indicates the fact of an offense on the part of the guilty person.

Requirement to make tax payments

Such a letter comes from the tax office if there is a debt to the Federal Tax Service. Here it is recommended to study the declaration for a specific tax, as well as instructions for making payments. Also worth paying attention to:

- The amount that has been accrued.

- The amount of funds that were paid.

- Payment details.

If an error is found in the documentation, you must:

- Make the necessary additional payment or send a more accurate version of the declaration to the Federal Tax Service.

- Call the employee who sent the letter.

- Describe the current situation and measures taken.

If payments are made correctly and there are no errors, you still need to call the Federal Tax Service and explain the situation.

Penalties accrued: what to do

It happens that not only did the tax notice not arrive on time, but a penalty was accrued. What to do in this case? Again, contact the tax office. This situation indicates that the deadline for paying property taxes has been missed. That is, December 1 has already passed, and the payer is still waiting for a notification from the Federal Tax Service. This is the wrong approach. As we said, it makes sense to wait only until the end of October. And then - act.

If it is not your fault, and the delay occurred due to the Federal Tax Service, the inspectors will sort it out and reset the accrued amount of penalties. Including in your budget settlement card. And then they will send a new summary notice with a different deadline for fulfilling the tax obligation.

If you find an error, please select a piece of text and press Ctrl+Enter.