Since 2020, when registering a business, individual entrepreneur registration certificates are not issued, since by order of the Federal Tax Service No. MMV-7-14 / [email protected] dated September 12, 2016, their issuance was canceled , and as a document confirming the creation of a new business entity, the businessman is given a sheet at the inspection entries in the Unified State Register of Individual Entrepreneurs. At the same time, the legal significance of the document is by no means less than that of the certificate of state registration of individual entrepreneurs, since its main function is the same - certifying the fact of making an entry in the state register. Today, both of these documents are in equal circulation - both certificates received before 2020 and registration sheets in the Unified State Register of Individual Entrepreneurs, which began to be issued quite recently.

What is OGRNIP and how to decipher it

OGRNIP is the main state registration number of an individual entrepreneur. The code contains important information that directly relates to the organization of the individual entrepreneur.

PGGKKOOOOOOOO

In the presented sequence, each of the symbols carries certain information. The decoding is as follows:

- The first character P consists of one digit, which characterizes the affiliation of the organization. For individual entrepreneurs – 3, for government agencies – 2;

- The symbols under the GG code represent the year when the individual entrepreneur was entered into the Unified State Register;

- KK signs – code of the subject of the Russian Federation. Code designations for each region are established in Article 65 of the Russian Constitution;

- The symbols 0-0 are the number itself under which the individual entrepreneur is listed in the register. This part of the code can contain from 6 to 12 characters;

- The last character is H. The control number is calculated from the remainder of dividing the sum of the previous characters by 13.

Not only an individual entrepreneur, but his potential partners should know what OGRNIP is. Using the code, you can easily find all the information about the individual entrepreneur and draw some conclusions about its reliability and potential.

Certificate of state registration of property rights is no longer issued

Help! According to the new legislation, an extract from the Unified State Register is required to determine ownership and transactions with it. No one has canceled the technical passports for apartments, where the LIVING AREA is clearly written. Why does the heating network make charges based on the old certificate of ownership, where the total area is indicated! With balconies and loggias. Are they right in collecting money for non-existent heat consumption?

The certificate of ownership was canceled and abolished. It has not been issued since July 15, 2016! Yes, it’s not necessary! After all, now the only evidence of a registered right is NOT a document, but a record of this right in the Unified State Register of Real Estate (USRN), which is maintained by Rosreestr.

Definition of abbreviations

OGRNIP is the main state registration number of an individual entrepreneur. OGRNIP is indicated when receiving individual entrepreneur status in the entry sheet from the register, since since 2020, State Registration Certificates have been canceled.

Since the numbering of entrepreneurs is not continuous, and the code is assigned using a special method, OGRNIP has been unique for every businessman in Russia for 100 years. This eliminates confusion and possible fraud when registering an individual entrepreneur. In cases where two people have the same full name, the numbers will be different, which makes it possible to uniquely identify the counterparty.

The IP number consists of 15 digits, divided into semantic blocks:

- The first character in OGRNIP is always “3”, this is its distinctive feature.

- The second and third characters are the year in which the individual entrepreneur status was assigned (last 2 digits).

- The fourth and fifth characters designate the subject of the Russian Federation according to the generally accepted encoding in accordance with the Constitution.

- The combination of 4 to 7 digits is the code of the payer’s Federal Tax Service;

- The next seven-digit block is the serial number of the registration authority record for the current year.

- The final symbol is a verification symbol to monitor compliance of OGRNIP with the established criteria. It is found as the remainder of dividing a 14-digit number by 13. If the result is a whole amount, then “0” is written down.

Calculation method:

- the number from the first 14 digits of the number is divisible by 13;

- the remainder is discarded;

- the result is multiplied by 13;

- The 2nd number is subtracted from the 1st number to obtain a control symbol.

31691020016775 : 13 = 2437770770521,15

2437770770521 x 13 = 31691020016773

31691020016775 — 31691020016773 = 2

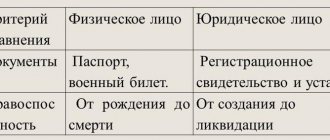

OGRN is the main state registration number of a legal entity.

Differences between decryption and IP:

- total number of characters - 13;

- the first digit is “1” or “5”;

- The last check character is calculated by dividing by 11.

117774620854 : 11 = 10706783714

There is no remainder of the fraction, the final digit in the OGRN is “0”. The control category coincided, the organization was entered into the register in 2020 by the Interdistrict Inspectorate of the Federal Tax Service of Russia No. 46 for Moscow.

The following abbreviations are also used in document flow:

- GRN is the state registration number of any records in the database. For individual entrepreneurs it starts with the number “4”, for legal entities - with “2”, “6”, “7”, “8”, “9”;

- EGRIP is a unified state register of individual entrepreneurs. Contains complete information about Russian individual entrepreneurs - registered and liquidated;

- Unified State Register of Legal Entities - a similar database with information on legal entities;

- TIN - individual tax number of the payer. Until 2001, it was the main identifier for entrepreneurs.

Is the Certificate of State Registration B issued in 2020?

- name of the body that carried out the procedure;

- Full name of the business entity;

- serial number of the form;

- registration number (OGRNIP), under which you can find all the initial information about the individual entrepreneur and changes made to the register.

- date of entry of information into the register;

Certificates of state registration of an individual as an individual entrepreneur were issued on secure forms with the official seal - P61003. And the USRIP entry sheets, which have been issued since 2020, are printed on ordinary A4 sheets.

Example of OGRNIP

314220119000137

Each number contains information about the individual entrepreneur:

- 3 – the code belongs to an individual entrepreneur;

- 14 – means that the entry was entered into the register in 2014;

- 22 – subject of the federation in which the enterprise operates;

- 1900013 – number under which the individual entrepreneur is entered in the Unified State Register of Legal Entities;

- 7 is a control number that is used to confirm the authenticity of the OGRNIP. It is calculated as follows: 31422011900013/13 = 7

The remainder coincides with the last digit, which means that the OGRNIP is original and meets the structural requirements established by the legislation of the Russian Federation. If the owner does not want to count the balance manually, then you can use special online services that will carry out the calculations automatically in a short period of time.

The registration certificate is not issued since 2020

You must decide on your tax regime before registering. If you want to get help from the employment center (compensation for registration costs, 58,000 rubles), you need to register with them before (! OKVED - activity codes that are indicated when registering an LLC I have compiled a collection - OKVED codes for small businesses. Preparation to create an organization begins with choosing OKVED.

- On the Federal Tax Service website you can find out how often a particular name is used: just fill in “Name” Since the year No. 129-FZ of the city came into force.

- Now you can pay the authorized capital within four months from the date of registration (in any shares). In excess of this amount you can have property, but it must now be assessed (regardless of the amount).

- Unfortunately, from September 1, 2014, you can only deposit the minimum amount of 10,000 rubles in cash (first paragraph of clause Distribute shares of the authorized capital between participants (if there is more than one participant).

- The minimum authorized capital is 10,000 rubles.

https://youtu.be/IqXpu2tIZWY

OGRNIP certificate number

The individual entrepreneur receives the OGRNIP certificate in question when submitting an application to the tax office to which he is registered by registration.

In order to register with the tax office as an individual entrepreneur, you need to provide a package of documents, including:

- application in form No. P21001;

- photocopy of passport;

- a receipt for payment of a special fee for completing the registration process.

After this, the citizen is assigned a personal number.

The OGRNIP certificate number itself consists of 15 numbers, each of which has its own meaning. So:

- first digit – indicates that the number belongs to a legal entity (one) or individual entrepreneur (three);

- 2nd and 3rd – year of assignment of the record;

- 4th and 5th – code of the subject of the Russian Federation;

- from 6th to 14th – serial number of the record from the beginning of the year;

- 15th – control value.

This number is indicated in contracts, details, as well as on reporting forms to the Federal Tax Service, Pension Fund, Social Insurance Fund and other organizations.

Knowing the OGRNIP number, you can check the reliability of an individual entrepreneur, find out information about other business activity codes, registration date, place of residence, citizenship, etc.

Certificate of state registration of an individual as an individual entrepreneur is a document reflecting an important requisite of an individual entrepreneur - OGRNIP. Previously, it was issued to all individual entrepreneurs, but from 01.01.

[email protected] came into force , by which the certificates that had become customary were cancelled. Now the businessman is given a sheet of entry from the Unified State Register (USRIP).

Let's take a closer look at this novella.

General provisions

To conduct business activities without creating a legal entity and legally, a citizen must register as an individual entrepreneur.

Without this registration, any business activity of an individual will be illegal and subject to suppression. Confirmation of permission to engage in individual business until 01.01.

2017 was recorded by a certificate of registration.

Previously, after registration with the tax authority, an individual entrepreneur was issued a certificate of state registration

Currently, the certificate for both the private entrepreneur and the company has been cancelled. But this does not mean that the registration itself is canceled. It’s just that there are fewer strict reporting forms in the area of registering an entrepreneur.

The cancellation of the registration certificate is another step towards the transition to document flow between the entrepreneur and the fiscal authorities in electronic form. However, it is still impossible to completely eliminate conventional paper-based documents.

Instead of a registration certificate, a pre-existing form of extract from the Unified State Register is issued - the Unified State Register of Entrepreneurs (USRIP) entry sheet in form 60009.

An extract from the Unified State Register of Individual Entrepreneurs is currently issued to individual entrepreneurs instead of a canceled registration certificate

There are three main ways to register an individual entrepreneur:

- Independent preparation of documents directly at the tax office.

- Self-registration by sending documents by mail.

- On the Internet on the website of the Federal Tax Service.

- Asking for help in registering from a third-party commercial organization.

Self-registration will cost much less than the help of a professional registrar, but will take much longer.

The cost of self-registration officially includes only the price of the state fee, which is 800 rubles.

Of course, the time, effort, transportation, office and other expenses spent by the entrepreneur on this event are, as always, not taken into account.

Also, the costs of making a seal and opening a bank account are not taken into account, since they are not mandatory - you can work without a seal and a bank account.

The cost of registration with the help of a third-party organization will cost the entrepreneur more. Of course, if it consists only of providing separate legal certificates, then you can limit yourself to an amount of 100–200 rubles.

But usually the organization undertakes to carry out full paperwork and go through all bureaucratic procedures. Such a service will cost the future entrepreneur between two and five thousand rubles.

An entrepreneur takes the first test of ability to manage money and time at the moment when he decides on how to register his business.

The initial stage of self-registration of an individual as an individual entrepreneur is the collection of necessary documents. Their list is quite simple:

- Application for state registration.

- Receipt for payment of state duty.

- Application for transition to one of the taxation systems: simplified (STS);

- unified tax on imputed income (UTII);

- general system (OSNO).

An application for state registration of individual entrepreneurs is drawn up according to form P21001.

Completing this form requires care. To correctly prepare the document, it is necessary to carefully study all the requirements specified in Appendix No. 20 of the Federal Tax Service Order No. MMV-7–6 / [email protected] dated January 25, 2012.

When filling out the fields in print, Courier New font size 18 pixels is used.

When filling out manually, a pen with paste and black ink is used, and entries are made only in printed capital letters.

In the application, pages 1,2 and sheets A, B are filled out. The most difficult is filling out sheet A, which indicates the economic activity codes according to OKVED.

On sheet A of the application the codes of economic activity are indicated

The number of codes is not limited. On page A there are columns for 14 codes, but it is not prohibited to continue it. In this case, you need to write down at least four characters of the code.

Sometimes when drawing up an application, the question arises where to get the TIN. The easiest way to find out your individual tax number (TIN) is on the Federal Tax Service website. There is a special form for this: by filling it out, you can receive a TIN immediately.

In order to find out your TIN, just fill out a special form on the Federal Tax Service website

Similarly, on the same website of the Federal Tax Service, you can issue a receipt for payment of the state fee for registering an individual entrepreneur.

It is easy to pay the state fee at any bank branch or with the help of a third-party commercial organization. When filling out the receipt form manually, you need to find out the details of the specific Federal Tax Service where the registration will be carried out.

Registration of a new individual entrepreneur is carried out by the regional tax office that serves the area at the citizen’s place of residence indicated in his passport.

If there is only temporary registration, then registration documents are submitted to special registration tax inspectorates, usually located in large cities.

For example, in Moscow, documents are accepted at the Federal Tax Service No. 46, located at the address: 125373, Moscow, Pokhodny proezd, building 3, building 2.

You can submit documents:

- in electronic form, through the online service of the Federal Tax Service;

- by mail;

- independently to the tax authority;

- directly to the tax office through an authorized representative.

When handing over documents personally to a tax authority employee, the application is signed in the presence of the latter.

If the application and other related documents are sent by mail or transferred by an authorized representative, then they must be notarized. In the case of a proxy, a power of attorney is issued to him, and also in sheet B of the application the value “2” is entered, and not “1”, when the documents are transferred and received personally by the applicant.

After submitting documents to the tax authority personally or through an intermediary, the tax inspector issues a receipt confirming their receipt with the obligatory entry number and stamp.

After the expiration of three days from the date of submission of documents, you must again contact the tax office to obtain registration documents. The issuance of these documents is carried out in accordance with the received receipt or power of attorney for their receipt, if a trusted person comes to collect the documents.

The package of permitting registration documents includes:

- entry sheet of the Unified State Register of Individual Entrepreneurs according to form No. P60009;

- certificate of registration with the tax authority.

After cancellation of the registration certificate, the main document indicating the registration of a new businessman is the registration sheet in the Unified State Register of Individual Entrepreneurs.

The USRIP entry sheet is the main document issued to an individual entrepreneur after his registration with the tax authorities

The OGRNIP identifier has fifteen digits, each of which includes a piece of information about the businessman. Code structure:

- At the beginning of the number, the number 3 is placed if the number is primary, or the number 4 when it is additional.

- The second and third digits indicate the year of registration.

- The fourth and fifth digits indicate the code of the region in which the tax office that carried out the registration is located.

- The sixth and seventh numbers indicate the code of the Federal Tax Service itself, in which the individual entrepreneur was registered.

- Next, the number recorded in characters from the eighth to the fourteenth inclusive shows the serial number of the entry in the Unified State Register of Individual Entrepreneurs.

- And finally, the fifteenth digit is calculated by dividing the number of the fourteen digits that formed before it by the number 13. But in this case, it is not the number itself that is entered into the fifteenth place, which, naturally, will not be an integer, but a fraction, but the digit of the lowest digit of the number the remainder obtained from division.

As a result, firstly, the uniqueness of the OGRNIP number is achieved, and secondly, the ability to check the number for its authenticity.

If you don’t have a very good relationship with mathematics, then the authenticity of the OGRNIP identifier can be checked for free by entering its number on specialized websites.

However, to verify authenticity, it is easier to use the following calculation algorithm, which you perform yourself:

- Divide the fourteen digits of the number by 13 and round the result to the nearest whole number.

- Multiply the resulting number by 13.

- From the original number of fourteen digits, subtract the number obtained as a result of the second action.

Obtaining a certificate of registration of individual entrepreneurs in 2020: procedure

- Identification. If an individual entrepreneur is registered by a citizen of the Russian Federation, then such a document is a passport. Non-citizens of the Russian Federation and stateless persons must submit to the Federal Tax Service a copy of the residence permit and a translation of a foreign passport, certified by a notary.

- A document confirming payment of the state duty. An individual registering an individual entrepreneur is obliged to pay a fee to the budget in the amount of: Payment can be made in several ways:

- make an electronic payment through the online service of the Federal Tax Service;

- generate a receipt through the Federal Tax Service website and pay the amount through the bank;

- fill out the receipt manually and pay it at the nearest bank branch.

The application should also include information about the types of activities that the IN plans to engage in. The code of the main activity should be indicated in column 1 on page 3, codes of additional activities - in column 2 on page 3. Read also the article: → “Application for registration of individual entrepreneurs. Sample filling, form 21001.”

05 Jul 2020 glavurist 3640

Share this post

- Related Posts

- An employment contract for the duration of a specific job

- What Documents Are Needed to Sell an Apartment from the Owner in 2020

- Receipt for State Duty for Registration of Rights to Real Estate

- How to transport a newborn baby in a car

Tasks and forms of OGRNIP

Each individual entrepreneur is endowed with a large number of personal codes, which have their own functions. Knowing the OGRIN, you can request a certificate from the Unified State Register with detailed information about a specific organization.

The statement can take two forms:

- Electronic, which is provided instantly. The user only needs to enter the number in the appropriate line on the site;

- A printed extract, for the production of which you need to fill out an application and send it by registered mail to the tax office at your place of residence, attaching a receipt for payment of the state duty.

The law establishes the following rules governing the provision of data from the register:

- A certificate containing information about the individual entrepreneur is issued to the director free of charge. Production time is no more than 5 working days;

- The period for producing an extract for third parties is the same, however, you will have to make payments to the state, which amount to 200 rubles;

- There is also an urgent discharge. Its production is carried out within one working day. The state duty when choosing this option is 400 rubles.

From the certificate you can learn a huge amount of useful information, both about the individual entrepreneur and about the organization as a whole:

- Last name, first name, patronymic of the owner;

- OGRNIP itself;

- Taxpayer identification number;

- Citizenship of the individual entrepreneur and his place of permanent residence;

- Field of activity;

- The date when the citizen was registered as an individual entrepreneur;

- Information about current licenses;

- Information about the termination of the enterprise's activities.

The main task of such a document is to verify a potential partner for doing business. All information presented in the state register is reliable and current. The database of individual entrepreneurs is updated quarterly.

Since 2020 the Certificate of Incorporation is no longer issued

Until recently, a certificate of state registration was provided by the tax authority if a positive decision was made on the application for the formation of a legal entity. The authenticity of the issued certificate is certified by the signature of the head of the tax authority. Starting from this year, each enterprise is required to have its own OGRN, which is assigned upon registration.

Since this year, not a single aspiring entrepreneur will receive the coveted certificate of registration of individual entrepreneurs, since it has been cancelled. This document has equivalent legal force and equally confirms the fact of making an entry in the state register. However, previously issued certificates are still valid!

https://youtu.be/KnoaldFyguc

Data checking

When an entrepreneur, in the process of commercial activity, needs to obtain any information about a counterparty, for example, whether the individual entrepreneur has a OGRN or not, he makes a request to the Unified State Register of Individual Entrepreneurs. Businessmen can check the status of a business partner using an extract, which they receive based on one of the details - it is possible to find out the OGRNIP by the TIN or full name of an individual entrepreneur. The information in the register is constantly updated, the issued certificate contains the most recent data.

Thus, businessmen are insured against unscrupulous market participants by receiving information in advance about:

- legitimacy of the partner’s actions;

- main location;

- availability of current licenses;

- work experience;

- termination of activity.

If you need to check the compliance of other documents, you can contact:

- to the State Administration for Migration Issues to clarify passport data;

- on court portals, find out whether the counterparty is listed as bankrupt;

- to the website of the Ministry of Internal Affairs to establish the criminal status of an individual entrepreneur;

- to federal educational resources to check the relevance of the diploma.

Since 2020, registration certificates will not be issued

First of all, you need to determine on what basis the individual entrepreneur acts in the contract. Organizations indicate both their registration data and the data of the person who acts on behalf of the company. The individual entrepreneur acts on his own behalf, and therefore must indicate his personal information.

We recommend reading: How to Pay for Sick Leave in 2020

The basis for the activities of an individual entrepreneur is the documentation that is issued to the newly registered entrepreneur. The name and form of the document confirming the fact of making an entry about a new individual entrepreneur in the Unified State Register of Individual Entrepreneurs is established by the order of the Federal Tax Service No. ММВ-7-14/

https://youtu.be/O5YIWgDooSc

Where to get OGRNIP

OGRNIP is issued to each individual entrepreneur as soon as he has received a license to carry out his activities. The number is assigned by the tax office.

You can find out the assigned identifier in two ways:

- From the certificate that is issued to the citizen after completing registration as an individual entrepreneur;

- Receive an extract from the Unified State Register. To do this, just visit the official website or make a request to the tax office.

OGRNIP is considered a kind of license to carry out business activities. Doing business without a state registration number will entail administrative or criminal liability.

The certificate is valid throughout the Russian Federation and has no expiration date. Therefore, when an individual entrepreneur moves to another city or region, there is no need to change the certificate.

Do they currently issue a certificate of registration of individual entrepreneurs?

If the certificate does not have the required stamps or signatures, it is considered invalid. To prevent fraudsters from falsifying this certificate, the form contains several levels of protection. After receiving a certificate of registration of an individual entrepreneur, the entrepreneur needs to always have it at hand. It is necessary for registering a bank account, signing agreements with partners, as well as for employing hired workers. The registration certificate is considered valid until the entrepreneur himself decides to suspend his business activities. If an individual entrepreneur registers an enterprise with a temporary registration, the validity of the certificate will expire along with the registration. For those who registered an individual enterprise under permanent registration, the certificate is issued for an unlimited period. There is no need to change it even if you move, since it is considered valid throughout the entire Russian Federation.

Interesting: How many days does alcohol leave the body?

The changes, as explained by the tax service, were created with the aim of increasing the interaction of individuals and legal entities with tax authorities. This is the official reason, also stated in the order dated September 12, 2020. The fewer papers an individual entrepreneur needs to issue and prepare when registering, the faster the individual entrepreneur registration process will be. It should be added that before this the registration process took five working days, now the same process takes only three days.

Making changes to the Unified State Register of Individual Entrepreneurs

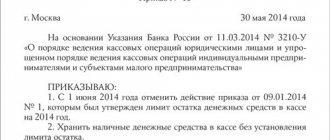

From January 1, 2020, in accordance with changes made to the legislation of the Russian Federation, the OGRNIP certificate is no longer issued. Instead of this document, private entrepreneurs receive an entry sheet in the Unified State Register of Individual Entrepreneurs.

The registration sheet contains the OGRNIP number, but, unlike the certificate, this sheet is printed not on letterhead, but on white A4 paper.

Please note that OGRNIP registration certificates issued to individual entrepreneurs before 2020 have not lost their legal force.

The Unified State Register of Individual Entrepreneurs is maintained by the Tax Service of the Russian Federation on the basis of primary forms submitted by individuals, as well as information from related departments.

Information about individual entrepreneurs is entered into the Unified State Register of Individual Entrepreneurs:

- FULL NAME.

- Floor.

- Where and when was he born?

- Registration address in the Russian Federation.

- Series, number, by whom and when the Russian passport was issued.

- Identification data of a foreign citizen's certificate.

- Information about permission to stay in the Russian Federation.

- Day and number of the entry on assignment of individual entrepreneur status.

- Date and reason for liquidation.

- License information.

- TIN with registration date.

- List of OKVED. The first code in the list is the main type of activity of the entrepreneur.

- The day and number of registration of the individual entrepreneur with social funds.

- Bank details.

Such information comes to the Federal Tax Service from the migration service and is entered into the Unified State Register of Individual Entrepreneurs within 5 days.

A citizen of another state conducting business activities on the territory of the Russian Federation, who changes basic data, registration or receives a Russian passport, must notify the Tax Service about this.

According to the instructions, application P24001 is submitted accompanied by copies of documents:

- identification;

- registration certificate or record sheet;

- certificate of registration;

- confirmation of changes.

If an individual entrepreneur has reorganized or added a type of activity, then it is necessary to fill out and submit form P24001 in order to assign a new OKVED code. This applies only to permanent transactions; individual contracts do not need to be recorded in the register.

Each change in the Unified State Register of Individual Entrepreneurs is registered under a separate state registration number, but the main number of the entrepreneur remains the same. 3 business days are allotted to notify the Tax Service; violation of the deadlines is punishable by a fine.

When submitting documents yourself, making changes to the Unified State Register of Individual Entrepreneurs is free of charge. If registration takes place through a representative of an individual entrepreneur, by mail or on the website, then the cost increases to 1000-2500 rubles. Confirmation of the update of information is the Unified State Register of Entrepreneurs (USRIP) entry sheet, which the registration authority issues after 5 days.

All about the certificate of registration of individual entrepreneurs in the Unified State Register of Entrepreneurs in 2020

Attention! Certificate forms issued before 2020 are still valid. They have the same legal force and can be applied under the same conditions as before. Holders of the form do not need to replace it with a recording sheet; their rights are protected by the previous document.

Interesting: Decision to approve a major transaction sample LLC

Questions regarding paperwork arise due to the analogy with legal entities. They cannot act independently, since an organization can be formed by several co-founders. All rights, obligations and shares in the capital are distributed between them by the charter of the enterprise, therefore in many contracts, acts and similar papers from legal entities you can find the wording “... acting on the basis of...”.

Replacement of OGRNIP

The current laws of the Russian Federation allow an entrepreneur to replace the OGRNIP by writing an application. The need for replacement may arise in a number of situations:

- When changing passport data;

- Loss of an old document;

- When changing your full name;

- Gender change.

Tax authorities also replace certificates that have become unusable. In this case, the citizen must provide evidence that confirms accidental damage to the document.

Certificate Ogrnip Not Issued Since 2020

If you have lost your individual entrepreneur registration certificate, it is enough to obtain an extract from the Unified State Register of Entrepreneurs containing information about all the latest changes made to the register. This paper is enough to find out under which OGRN the counterparty is registered and to check its reliability. To apply to the Federal Tax Service, you need to prepare 2 copies of a randomly drawn up application, a receipt for payment of the state duty in rubles for one copy and a written power of attorney for the representative, if he goes to the tax office instead of you.

According to the legislation of the Russian Federation, an individual entrepreneur acts on the basis of his legal capacity, that is, the right to carry out commercial activities and subsequent receipt of profit is assigned to the businessman at the time of registration with the Federal Tax Service. The same time when an established businessman receives registration documents. Questions regarding paperwork arise due to the analogy with legal entities.

https://youtu.be/Cs5QYQt7pug

Differences between OGRNIP and OGRN

OGRNIP - stands for all-Russian state registration number of an individual entrepreneur.

Each entrepreneur is assigned his own unique code, which does not change as long as the entrepreneur conducts his activities.

This code is indicated in all contracts that the entrepreneur enters into, and this code is also indicated on the seal that the individual entrepreneur makes for himself.

The certificate itself may change if the individual entrepreneur makes any changes to his activities, BUT the OGRNIP always remains the same.

How to start a business in 2020 - step-by-step instructions and useful tips

USEFUL ADVICE When receiving a certificate of registration of an individual entrepreneur, you must check all the data specified in it. If an error is made in the document, but it is discovered later, the entrepreneur faces charges of providing false data and a fine.

If a future entrepreneur does not have a qualified electronic signature, but needs to submit documents via the Internet, the help of a notary is the way out of the situation. The notary office will certify the package of documents with its electronic signature. The notary will also receive an electronic certificate of individual entrepreneur registration.

We recommend reading: Child Doesn’t Walk But Has to Pay 2020

https://youtu.be/G7BneSpLuoI

Since 2020, registration certificates will not be issued

But I don’t know yet whether it will cost money or will be free for the legal entity itself. Previously issued certificates will be valid. The certificate on entering information about a legal entity registered up to a year has been lost. For the issuance of a duplicate of the specified certificate or Unified State Register of Legal Entities? Decree of the Government of the Russian Federation No. 760) a) for a legal entity - information about it when applying to the registration authority for the re-issuance of a document confirming the fact of making an entry in the state register, as well as when applying for urgent provision of information about it in the form of an extract from the state register; I agree with you, there is nothing else to tie it to. Please tell me, our company has gone through the first stage of liquidation (a liquidator has already been appointed), but the constituent documents have been lost (((please tell me a power of attorney (simple) from the liquidator to the tax authorities to receive duplicates? As for the authorities (banks) - they will have to come to terms with this . We are trying to get a certificate of making an entry in the Unified State Register of Legal Entities of a legal entity. State duty is 800 rubles or what and for what details? The rules for maintaining the register have lost force, but by order of the Ministry of Finance of the Russian Federation dated November 23, 2011. The question is: what details indicate in the receipt?? or do you need to cancel the liquidation and have the general do all this? You don’t have a director now, instead of him there is a liquidator, if the liquidator does not want to go himself, then you can send a request by mail or give a simple power of attorney to the courier. During liquidation, it is forbidden to change the composition of the participants , charter, address.

We recommend reading: The size of the land plot allocated to families with many children in the Krasnodar Territory 2020

Or will this issue be resolved after the resolution is cancelled, and no one will even think of demanding evidence? Why a record sheet, because we need a certificate of assignment of OGRN, not TIN. Neither a duplicate of the certificate of entry about a person registered before 2002, nor a sheet of entry about the same was given to us either by 46 or by the Department. When asked what we should do, since we have lost the certificate with the assignment of OGRN, and how to carry out registration actions - a notary without OGRN does not certify documents, they answered - file a complaint with the Ministry of Finance. N 438 “On the Unified State Register of Legal Entities” Accordingly, in paragraph:-) The procedure for obtaining an extract on making an entry (instead of a certificate with the state registration number) will not change. This means they must issue a duplicate in form 57001. A repeat certificate is issued only to organizations registered after the year only on the date of registration of the organization) The rest are out of luck, only a record sheet is issued (i.e. the date of issue of the certificate in form 57001 is not the date of registration, but only the date of entry to the register, accordingly, only a record sheet is issued) A question has arisen: the LLC is registered before the State Polling Shlina 200 rubles, details as for issuing an extract from the Unified State Register of Legal Entities. Today, when submitting a request to 46, a colleague was informed that duplicate Record Sheets are no longer issued. They refer to the Decree of the Government of the Russian Federation dated No. 462. 23 rules approved by the resolution contain: 23. The information specified in paragraph 20 of these Rules is provided upon request for a fee (subject to the submission of a document confirming payment simultaneously with the request): (as amended.