Before registering an individual entrepreneur, many future entrepreneurs study the regulations of the current legislation of the Russian Federation relating to their future activities. And this is absolutely correct, given the high level of responsibility in this area. And it is the responsibility of individual entrepreneurs under the legislation of the Russian Federation that is one of the most important and topical topics.

In our publication today, we will look at what responsibility an individual entrepreneur bears in accordance with civil (property), labor, administrative, tax and criminal legislation.

Property liability of individual entrepreneurs for debts

Individual entrepreneurs are liable for their obligations with their property (Article 24 of the Civil Code of the Russian Federation). That is, the individual entrepreneur’s liability for debts extends to the entrepreneur’s personal property. The exception is essential items - the only housing and the land on which it is located, as well as household items, including clothing, shoes and food (Article 446 of the Code of Civil Procedure of the Russian Federation).

In case of harm to individuals and legal entities, the individual entrepreneur’s liability will be expressed in compensation for losses. Losses mean direct damage (real property losses) and lost profits in the form of lost income.

Civil contracts, as a rule, provide for more than just compensation for damages. The text of the documents also includes other sanctions.

The most common type of property sanctions is penalties. Penalties can be in the form of fines (in a fixed form) or in the form of a payment that depends on the duration of the violation (penalty).

Property liability of an entrepreneur

What are the features of the property liability of an individual entrepreneur? In the Civil Code Art. 401 states that if an individual has not fulfilled his obligations, then he is forced to bear responsibility.

If the individual entrepreneur proves that the failure to fulfill the obligation is due to impossible fulfillment due to difficulties that arose not through the fault of the individual entrepreneur, then the entrepreneur is given the opportunity to fulfill his obligations within a certain period. Liability for offenses of non-payment of taxes occurs upon proof of guilt.

In Art. 24 of the Civil Code states that a citizen, and therefore an individual entrepreneur, is liable with all his property to the state.

The exception is property that cannot be recovered by law. Foreclosure on property can only be imposed by a court.

Responsibility of individual entrepreneurs in accordance with labor laws

If an individual entrepreneur is an employer, he must comply with the norms and requirements of labor legislation.

The individual entrepreneur bears financial responsibility to the employees. Article 234 of the Labor Code of the Russian Federation talks about the obligation to compensate lost earnings to an employee in such cases as:

- suspension from work;

- layoffs;

- delay in issuing a work book.

For the above actions on the part of the employer, the employee has the right to demand compensation for moral damage (Article 237 of the Labor Code of the Russian Federation).

If an individual entrepreneur causes damage to an employee’s property, the entrepreneur must compensate him for the damage in full. Compensation for damage occurs at market prices that are in effect at the time of compensation (Article 235 of the Labor Code of the Russian Federation).

An employee’s property means not only property used by him to perform work functions, but also personal belongings (which are in the office during working hours).

In order to claim compensation for damage, an employee does not have to prove in court the unlawfulness of the employer’s actions. In accordance with Article 233 of the Labor Code of the Russian Federation, it is enough to prove the fact of damage to property and indicate the amount of damage caused.

An employer who proves that he did not violate the law is not liable (Article 1064 of the Civil Code of the Russian Federation).

Personal property liability

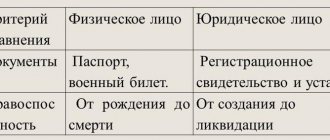

If legal entities are liable only within the framework of their activities and the property that is registered as a legal entity, then an individual entrepreneur is liable for his obligations with all his property.

The liability of an individual entrepreneur under the legislation of the Russian Federation arises in the following situations:

- improper registration of business, permits, licenses, etc.;

- violation of deadlines for payments to the budget, reporting;

- non-compliance with labor legislation;

- violation of safety standards, etc.

The entrepreneur is obliged to compensate for debts and unfulfilled obligations, as well as losses associated with them that arose in the course of work, if the court obliges him to do so.

A loss is a property loss. They are valued and measured in monetary terms. Losses also include lost profits. Causing losses relates more to civil liability when an individual entrepreneur does not fulfill his contractual obligations with counterparties. Sometimes the entrepreneur is not directly at fault.

An entrepreneur is a natural person, and the law does not divide his property and liability into personal and business. Article 446 of the Code of Civil Procedure contains a list of property that can be used to repay debts, including property acquired jointly during marriage (this means that in court such property will be divided between spouses to pay off debts).

The list includes real estate, cars, luxury goods and many other assets owned by a businessman.

How does an individual entrepreneur fail to meet its obligations? There is a list of property that is not confiscated by law (the only home, a car if the individual entrepreneur is disabled, food, clothing, money in the amount of the minimum wage for each family member, etc.).

If there is not enough property to cover the debts, the entrepreneur will continue to be responsible and pay the balance as best he can.

Financial liability is enshrined not only in the rules of law, but also in contracts, acts, receipts, under which the individual entrepreneur puts his signature. There is no bankruptcy procedure for an entrepreneur, so you will have to answer for all obligations.

One violation committed, depending on the severity, can be tax, criminal, administrative, etc. The difference lies in the scope and severity of the sanctions.

Administrative responsibility of individual entrepreneurs

An individual entrepreneur bears administrative responsibility in various areas - from environmental safety to tax payment.

Businessmen and individual entrepreneurs are treated as officials in the Code of Administrative Offences.

In accordance with Article 23.1 of the Code of Administrative Offenses of the Russian Federation, an individual entrepreneur is brought to administrative responsibility in court at the request of the control body.

In the field of labor relations

Administrative liability of individual entrepreneurs in the field of labor relations (for violation of labor protection and labor legislation) is expressed in fines of up to 5,000 rubles. In case of repeated violation of a similar law, the individual entrepreneur may be disqualified for a period of 1 to 3 years (clause 2 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). That is, the entrepreneur loses the right to occupy leadership positions in the executive management body (of a legal entity), to carry out entrepreneurial activities (for the management of a legal entity) and to join the board of directors.

In accordance with Article 5.28 of the Code of Administrative Offenses of the Russian Federation, if the employer evades participation in negotiations related to the conclusion of a collective agreement (and if the permissible period for its conclusion is violated), he will pay a fine of up to 3,000 rubles.

A fine of 3,000 rubles is also provided for those employers who do not provide information for collective bargaining (Article 5.29 of the Code of Administrative Offenses of the Russian Federation).

A fine of up to 5,000 rubles is provided for individual entrepreneurs who refuse to conclude a collective agreement (Article 5.30 of the Code of Administrative Offenses of the Russian Federation).

Violation (failure to fulfill) obligations under a collective agreement threatens the entrepreneur with a fine of up to 5,000 rubles (Article 5.31 of the Code of Administrative Offenses of the Russian Federation).

In economic activity

If an individual entrepreneur works without registration as an individual entrepreneur, in accordance with Article 14.1 of the Code of Administrative Offenses of the Russian Federation, he will need to pay a fine of up to 2,000 rubles.

An individual entrepreneur who has changed his place of residence must notify the registration authority about this within three days (clause 5 of Article 5 of the Law of August 8, 2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”). Without reporting a change of residence, an entrepreneur will pay a fine of up to 2,000 rubles (Article 14.25 of the Code of Administrative Offenses of the Russian Federation).

In accordance with Article 14.5 of the Code of Administrative Offenses of the Russian Federation, an individual entrepreneur who does not have a cash register may be fined up to 4,000 rubles.

Tax liability of an individual entrepreneur

Fixed fines are set for some violations of tax laws. An entrepreneur who violated the deadlines for providing information on opening (closing) bank accounts must pay a fine of 5,000 rubles in favor of the state (Article 118 of the Tax Code of the Russian Federation).

In accordance with the current tax legislation, in the event of a violation, an individual entrepreneur must transfer a share of his income to the state in the following situations:

- in case of non-payment (incomplete payment of taxes) - the individual entrepreneur transfers from 20 to 40% of the amount of unpaid tax (Article 122 of the Tax Code of the Russian Federation);

- failure by a tax agent to fulfill the obligation to withhold (transfer) tax - the individual entrepreneur transfers 20% of the amount that should be transferred (Article 122 of the Tax Code of the Russian Federation).

Since 2006, tax authorities have the right to collect fines from individual entrepreneurs independently, out of court. The procedure is carried out based on the decision of the head of the tax office. As a rule, this concerns unpaid taxes (for the tax period).

Violation of the deadline for registration with the Pension Fund in accordance with Article 27 of the Law of December 15. 2001 No. 167-FZ “On compulsory pension insurance in the Russian Federation” threatens a fine of up to 10,000 rubles for individual entrepreneurs.

For non-payment or incomplete payment of insurance contributions to the Pension Fund, up to 40% of the contributions payable may be subject to recovery.

Criminal liability of individual entrepreneurs

The liability of an individual entrepreneur in accordance with criminal law is similar to the liability for violations in administrative law. The difference lies in the scale of violations and the amount of damage. Thus, for offenses of the same nature, but of different scales or resulting in different amounts of damage, an individual entrepreneur can be brought to either administrative or criminal liability.

In the field of labor relations

An individual entrepreneur may be fined up to 200,000 rubles (or sentenced to 180 hours of forced labor) if he refuses to admit a pregnant woman or a woman with children under 3 years of age in accordance with Article 145 of the Criminal Code of the Russian Federation.

Article 145.1 of the Criminal Code of the Russian Federation provides for liability for non-payment of wages for more than two months.

Employees can recover money from the employer with interest (Article 236 of the Labor Code of the Russian Federation). Compensation for losses to employees is regulated by the norms of Chapter 59 of the Civil Code of the Russian Federation.

In economic activity

Illegal business activity is one of the most common economic crimes. Article 171 of the Criminal Code of the Russian Federation provides for criminal liability for conducting business activities without a license.

An entrepreneur bears criminal liability in the following cases:

- illegal receipt of a loan (by providing a credit institution with knowingly false information about one’s financial situation) and malicious evasion of repayment of accounts payable (Articles 176, 177 of the Criminal Code of the Russian Federation);

- legalization (laundering) of funds or other property acquired by criminal means (Articles 174, 174.1 of the Criminal Code of the Russian Federation).

Article 177 of the Criminal Code of the Russian Federation, as already noted, provides for criminal liability for malicious evasion of repayment of accounts payable (including refusal to pay for securities, bills of exchange and bonds).

Malicious evasion is interpreted as the presence of a real opportunity to repay the debt (together with intent for non-payment of the debt).

In accordance with the Criminal Code of the Russian Federation, an individual entrepreneur can be brought to criminal liability:

- for illegal use of someone else’s trademark and service mark (Article 180 of the Criminal Code of the Russian Federation);

- for coercion to complete a transaction or refusal to complete it (Article 179 of the Criminal Code of the Russian Federation) a term of imprisonment of up to 10 years (for an organized group);

- for evasion of customs duties (Article 194 of the Criminal Code of the Russian Federation);

- evasion of taxes and fees, failure to fulfill the duties of a tax agent, for concealing property from which taxes should be collected (Articles 198, 199.1, 199.2 of the Criminal Code of the Russian Federation).

An individual entrepreneur who evades paying taxes is punished with penalties in the amount of 100 to 300,000 rubles or in the amount of wages (or other income) for a period of 1 to 2 years. The penalty is arrest for up to 6 months or imprisonment for up to 1 year.

Responsibility of individual entrepreneurs after closure

Former individual entrepreneurs are also liable for their previous actions committed as an individual entrepreneur. In particular, individual entrepreneurs are responsible to the Federal Tax Service and extra-budgetary funds. Thus, the Constitutional Court of the Russian Federation, in a resolution dated January 25, 2007, indicated that a person is obliged to answer for his debts, regardless of the loss of his special status as an individual entrepreneur.

After closure, the liability of an individual entrepreneur continues to apply to all of his property, with the exception of that property on which foreclosure cannot be imposed in accordance with current legislation.

The statute of limitations during which a former individual entrepreneur can be brought to property liability is three years.

In conclusion, we also remind you that you cannot be held accountable twice for the same offense.

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Re-registration of individual entrepreneurs with debts

An individual entrepreneur is responsible for the debt obligations of an individual, and vice versa. That is, a citizen is not prohibited from re-registering an individual entrepreneur with existing debts. But as soon as the information is received by the relevant authorities, funds will be debited from the debtor’s current accounts to write off the debt.

IMPORTANT! Re-registration of an individual entrepreneur is allowed only if there are no debts on taxes and fees.

To re-register an individual entrepreneur, you must provide a certificate confirming the absence of debts to the tax authorities.

Acting as an individual entrepreneur is accompanied by certain risks. Before you decide to open your own business, you need to carefully study all the positive and negative aspects. There are many requirements for individual entrepreneurs that must be met in a timely manner. Otherwise, the prescribed liability cannot be avoided.