Legitimate motivations for layoffs in individual entrepreneurs

The Labor Code contains a list of possible grounds for severing employment relations with a worker. One of them is the reduction of individual entrepreneur employees (clause 2 of Article 81 of the Labor Code).

A similar measure occurs:

- Planned and associated with the modernization of the production process and its automation.

- Forced. There are many reasons: a change in the market situation, a decrease in demand for products, the need to reduce costs.

But regardless of the factors that influenced the individual entrepreneur’s decision to fire his employees, the reduction process must take place according to the established procedure. You cannot ignore a single document provided by law.

Individual entrepreneurs need to pay attention to the fact that Art. 81 contains these types of grounds for dismissal. It can be done by shortening:

- Numbers.

- State.

When using the first path, you should reduce the number of employees occupying certain jobs (positions).

If you start downsizing, then it is positions that need to be eliminated. Then the workers who occupy them will have to be laid off.

Journal "pravosovetnik"

From time to time, accounting and personnel department employees are faced with an unpleasant situation when it becomes necessary to terminate an employment contract due to a reduction in numbers or staff, or in the event of liquidation of an enterprise. You will learn how to do this so as not to violate the requirements of the law in this article.

In accordance with Article 81 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), an employment contract can be terminated by the employer, among other things, in the event of liquidation of the organization or termination of activities by the employer - an individual (clause

We recommend reading: additional leaves for medical workers

Stages of reduction of individual entrepreneur employees

A similar process takes place in a certain sequence:

| Stage | Description | Explanation |

| 1. | Individual entrepreneur decides to reduce staff | The decision is fixed by order. It lists the positions being reduced, the full names of the employees occupying them, and the timing of the upcoming termination of the employment agreement. The entrepreneur signs the document directly |

| 2. | Individual entrepreneurs hand over notice of layoffs to those being dismissed | Compiled in a free form. The employee must sign and date the document. Thus, he shows that he received information about his reduction on time |

| 3. | The individual entrepreneur offers the employee to fill another vacancy | This is possible if the individual entrepreneur really has available jobs |

| 4. | The individual entrepreneur informs the employment service authorities in writing about the planned reduction | The individual entrepreneur does this no later than 2 weeks before the actual date of dismissal |

| 5. | New staffing schedule is being developed | It will come into effect no earlier than 2 months after the order to reduce |

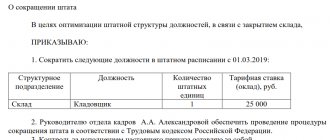

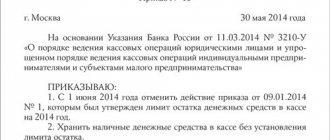

Reduction order

Order staffing

Important! It is wiser for an individual entrepreneur to follow the steps described and not violate the Labor Code.

Possible vacant positions

Even issuing a notice to an employee about imminent dismissal does not guarantee an exact reduction. The Labor Code of the Russian Federation states that the manager must offer an employee who is being laid off other possible vacancies available at the enterprise and corresponding to his qualifications.

An offer to transfer to a new vacancy can be included in the text of the notice of dismissal, or can be a separate document that the employee must read and sign. An employee’s refusal of a vacancy must also be in writing.

The Employment Center must be notified in writing of an upcoming reduction in the number of staff members. For this purpose , there are special deadlines for submitting notifications to the authorities:

- for enterprises: several months in general, and in case of mass layoffs - no less than 3 months;

- for individual enterprises: no less than after several years.

It is important to remember that each registration center may have its own rules for filing an application for layoff of an employee. Based on Article 82 of the Labor Code, the manager must warn the selected trade union body about the dismissal of employees. The deadlines in this case are the same as for notifications to the employment service: 2-3 months in advance (if a large number of workers are dismissed).

If among the total number of workers who are being laid off there are people from the trade union, then the decision to lay off them will be made in accordance with the trade union body on the basis of Article 373 of the Labor Code of the Russian Federation.

Deadlines for delivering notice of dismissal to an employee

A document informing about the layoff is sent to the worker within the following time frame:

- in the standard case - 2 months before dismissal (Article 180, Part 2 of the Labor Code);

- for those hired for seasonal work - at least 7 calendar days in advance (Article 296, Part 2 of the Labor Code);

- those who have concluded an employment agreement for a period of up to 2 months - 3 days in advance (all calendar days are taken into account without exception).

When an employee receives information about the upcoming layoff, he may not wait for the allowed period, but resign early. But at the same time, he must make a written statement.

Important! The specified terms are valid when others are not specified in the labor agreement concluded with the employer - an individual ( Article 307 of the Labor Code ).

basic information

All options for terminating an employment relationship are prescribed in labor legislation.

The abbreviation has several options, including the standard type. This means that the employer is eliminating a number of specific positions, as well as employees if they occupy those jobs. Important! According to labor law, an individual entrepreneur is considered an individual, so the reduction procedure differs from the usual standard procedure when the employer is an organization or any other legal entity.

The reduction can have two options. What is planned is related to production optimization or modernization. The forced option may already have many reasons, including market destabilization and financial losses, which lead to the need to reduce spending. It is worth considering that the reason is the basis for the reduction order, but the process itself will not change, since it is prescribed by law.

Also, all penalties can be applied to an individual entrepreneur, as well as to a legal entity, if the rights of employees are not respected during layoffs. Any violation may make it possible for the employee to return to his previous workplace.

Features of the reduction procedure in individual entrepreneurs

Severing labor relations with individual entrepreneurs is no different from the procedure described in Art. 84.1 TC:

| No. | What's happening | A comment |

| 1. | Individual entrepreneur writes a dismissal order due to reduction | The document is issued 2 months after the notification is delivered to the employee. If the employment contract provides for a different period, the individual entrepreneur takes it into account |

| 2. | A note-calculation is drawn up | This is performed by the accountant of the individual entrepreneur or he himself, if he has the authority to do so. |

| 3. | Labor report is being filled out | It is important to write all formulations and justifications as in the Labor Code |

| 4. | Issuance of a work permit to an employee. Full cash settlement | Performed on the day of dismissal |

How to register a sole proprietorship name

The established rules allow the use of the following images in brand names:

- individual words, a set of words, an abbreviation in Cyrillic or Latin;

- artistic image: drawing, graphics, printmaking, set of symbols;

- three-dimensional image.

The list of acceptable options for names, trademarks, and logos is quite wide. It is limited by existing legislation and common sense. It is impossible to choose the name of a well-known product as a name for a trademark.

When choosing a business name for your individual entrepreneur, you should remember that such names are divided into two categories. The first category is official names, the second is commercial names.

It is allowed to develop and apply a commercial name without registration. Therefore, it may not be included in the constituent documents.

The creation of a memorable individual name, sign, logo can be entrusted to specialized organizations. Their experienced so-called “naming” specialists will always help. It should be remembered that the services of professionals in this area are expensive.

Is it necessary to register an individual entrepreneur's name? It is necessary for several reasons:

- Firstly, going through this procedure allows you to make sure that the chosen name does not contradict all established standards (legal, moral, ethical).

- Secondly, it will be possible to understand and clearly track what effect an individual name gives. How many additional clients have you been able to attract and how quickly your profits are increasing?

There are a number of reasons that may lead to a refusal to register a chosen name. The main reason is an attempt to register an already existing and registered name. To avoid this, it is necessary to refer to the Rospatent name database at the preparatory stage.

Specialists of this organization will determine the originality of the chosen name. If registration is not possible, a written refusal of registration will be sent indicating the reason for the refusal. The legislation details the restrictions imposed on business names.

Once you have met the necessary requirements, you can apply to register your individual name. An official application is made. A package of required documents is attached to this application. He is sent to Rospatent.

You can submit an application yourself. If this fails, you can entrust this procedure to any trusted person: your representative, relative, employee. The list of documents to answer the question of how to register a business name is as follows:

- application to Rospatent of the established form;

- a receipt indicating payment of the state duty;

- copies of documents confirming registration of individual entrepreneurs;

- a separate letter listing all economic activity codes.

It is advisable to choose a name that is easy to pronounce and does not cause problems in spelling. It is especially important that the name reflects the activities of the individual entrepreneur and is associated with the reliability and integrity of the entrepreneur. Avoid: confusing terms, unclear phrases, geographical names.

It is necessary to carefully approach the choice of foreign words. Before use, if the exact meaning of a word is unknown, be sure to check all translation options and possible interpretations in dictionaries and draw analogies with other languages.

Incorrect use of foreign words, expressions, and phrases may negatively affect future attitudes toward individual entrepreneurs. This is especially necessary if you plan to promote your products via the Internet.

So, an individual entrepreneur may have a name in the form of a trademark or service mark. It is permissible to use verbal, pictorial, volumetric or other designation as it. The names of trademarks and service marks are regulated by the Civil Code of the Russian Federation.

Among the obvious prohibitions, there are less obvious ones. In particular, according to the text of the Civil Code, it is impossible to register a trademark that represents the generally accepted name of a product (for example, the TV brand “TV”). It is prohibited to include information about the object's function in the name.

Trademark registration is one of the services. It is necessary to submit the appropriate application to this body, having previously paid the state fee. List of documents for registration of a trademark/service mark:

- application for registration of a designation as a trademark indicating information about the individual entrepreneur;

- designation in two copies: one is given in the application by pasting or using computer technology, the second is presented in the application;

- a description of the designation, which is intended to clarify it and reveal its conceptual content;

- a list of goods/services for which the individual entrepreneur requests trademark registration.

Now directly about how to register the name of an individual entrepreneur. An individual entrepreneur can submit documents either independently or by issuing a power of attorney for a representative. You can submit an application for registration of a trademark with a personal visit, by mail or by fax (the latter requires the submission of original documents subsequently).

A positive decision to register an individual entrepreneur’s name in the form of a trademark (service mark) or a decision to refuse registration is made after an examination of the designation’s compliance with the requirements of the Civil Code.

You should learn about possible reasons for refusal from Art. 1483 Civil Code of the Russian Federation. If a positive decision is made on the application, the trademark is registered in the register, information about this registration is published, and the entrepreneur receives a certificate for the trademark.

{amp}gt;Does the individual entrepreneur have an abbreviated name?

Find out what: How to close an individual entrepreneur with debts in 2020

Employees with preferential right to remain at work

For employees of individual entrepreneurs, the requirements of the Labor Code apply fully. It is important for an entrepreneur to determine whether there are workers at his enterprise who have a preferential right not to be fired. Similar immunity (subject to identical qualifications and efficiency) belongs to workers (Article 178 of the Labor Code):

- supporting two or more dependents;

- whose family does not have anyone who has an official income;

- those who were injured in the production of this individual entrepreneur or suffered from an occupational disease;

- who became disabled while defending the country during hostilities.

The collective agreement may also contain additional categories of employees.

It is very important for a businessman to take into account what is prohibited from cutting (Article 261, Part 4 of the Labor Code):

- women bearing a child;

- employees whose baby is less than 3 years old;

- single mothers who have a child under 14 years of age or under 18 if the child is disabled.

Important! To comply with legal norms, it would not hurt for individual entrepreneurs to create a special commission that will carefully study all candidates submitted for reduction and propose a list of employees.

Can an individual entrepreneur have a name as an organization?

To answer the question whether an individual entrepreneur can have a name as an organization, it is necessary to refer to the provisions of Russian civil legislation. In particular, Art. 1538 of the Civil Code states that individual entrepreneurs in their activities can use commercial designations that are not brand names for personal characteristics and to indicate the ownership of various enterprises.

That is, the essence is the following: all official documents will mention the full last name, first name, patronymic of the individual entrepreneur, and for a store, salon, or company a commercial name will be used. You can also register a trademark.

Such designations are not subject to mandatory inclusion in the constituent documents of a business entity, as well as in the Unified State Register of Individual Entrepreneurs. Please note that before an individual entrepreneur registers a company name, he should make sure that it does not contradict the moral values of society.

Cash payments upon layoffs

An individual entrepreneur who has been made redundant is required to pay:

- earned funds;

- compensation for vacation not used on time.

Funds are issued to the employee no later than the day of dismissal. When he is absent for a valid reason, confirmed by documents, the amounts due to him are paid on the day the employee voices his demands for payment.

If the individual entrepreneur acts differently and refuses to issue funds on time, he faces a fine.

Payments provided

In addition to generally established payments, upon dismissal, wages are given for the period of work before the layoff, including possible bonuses and other cash payments, and compensation for unused vacation.

Also, employees who are laid off receive additional special payments. The manager must pay severance pay in the form of a month’s salary and provide the employee with an average monthly salary for the duration of employment over the next two months.

Some questions and answers

Question 1. An individual entrepreneur was notified of his upcoming dismissal due to staff reduction 3 weeks before the event. Is this action of the entrepreneur legal?

Answer. The action of an individual entrepreneur is legal when this period is fixed in the employment agreement concluded with the worker. If the specified clause is not in the document, the notice must be sent no later than 2 months before dismissal.

Question 2. Are there situations when an individual entrepreneur has every right not to notify employees of an upcoming reduction or dismissal with impunity?

Answer. This is perfectly acceptable if:

- The business activities of the individual entrepreneur were terminated by court order. Then employment agreements with personnel are terminated after the court decision comes into force. Notice becomes unnecessary.

- The individual entrepreneur does not want to continue working, so he does not renew the license for his activities.

Question to the expert

An individual entrepreneur was fired due to redundancy. He was not paid anything except his salary and vacation compensation. Why was he not given severance pay, and what will happen to subsequent payments for 2-3 months?

Answer. In an individual entrepreneur, payment of severance pay and other compensation amounts to an employee dismissed due to staff reduction is mandatory when it is written down in the employment contract. If there is no such clause in the document, payments are not made. This is confirmed by judicial practice.

Legal adviser K. L. Pavlova

Errors

Most often, individual entrepreneurs encounter several errors that do not comply with the basic reduction regulations. For example, it is necessary to notify the employee, and within the specified period, that is, two months in advance. The only exception is another specified period, which was specified when the person was employed in the contract. You need to remember that if the notification period is not specified, then the process follows the standard system.

Another common mistake is failure to pay the required funds. Upon dismissal, full payment is made. Here, only severance pay is considered an exception if there was no written agreement with the employee on its payment. All other payments, including compensation for unworked vacation or early dismissal, must be received by the employee.

Individual entrepreneurs must understand that, despite a number of relaxations in relation to them, they must be fully guided by the basic reduction regulations. Those points that may not be fulfilled are also spelled out in the labor code.

Reduction of staffing positions of an individual entrepreneur is carried out according to the standard procedure, but in this process there are a number of differences from the usual plan, since an individual entrepreneur is considered an individual. Severance pay should not be paid by such an employer unless additional agreements have been signed. All other aspects are fully regulated by law, as with standard staff reductions.

Mistakes when downsizing individual entrepreneurs

The process of dismissing individual entrepreneurs is simple, and it is possible to follow all its stages. But often an entrepreneur fails to avoid mistakes. The most common of them are contained in the table:

| No. | Error |

| 1. | The individual entrepreneur did not give the employee a notice of dismissal against receipt |

| 2. | The individual entrepreneur did not adjust the staffing table, leaving a position in it that he himself had reduced |

Important! The presence of such errors makes the individual entrepreneur vulnerable. His decision can be challenged, and the businessman will lose significant funds.

When an individual entrepreneur violates the layoff procedure, the employee has the right to appeal his decisions.

First of all, you should contact the labor inspectorate. Most likely, an individual entrepreneur inspection will be scheduled. When an employee was fired illegally, he should try to recover by going to court. If a decision is made in his favor, the individual entrepreneur must compensate the employee for the time of forced absence. It is possible that the court will also oblige him to pay the amount of moral damage. Rate the quality of the article. Your opinion is important to us:

Reduction for an individual entrepreneur

Contents Procedure for reducing the number or staff of employees Reducing employees requires the employer to follow a clear sequence of actions.

Particular attention should be paid to the preparation of documents, as well as the timing of interaction with employees and regulatory authorities. In order not to miss anything, we will consider the procedure for laying off employees step by step. 1. Making a decision to reduce the number or staff of employees The very first step that an employer must take is making a decision about the upcoming reduction of employees.

This decision is formalized by order of the authorized body of the employer. In an organization, as a rule, the manager is vested with such powers, unless otherwise stated in the charter. If the employer is an individual entrepreneur, then the order for layoffs is signed by the entrepreneur himself.

Based on the literal interpretation of the text of Art. 178 of the Labor Code of the Russian Federation, the guarantees specified in it are established only for employees of organizations.