Loss of information constituting a state secret is a serious offense for which penalties are imposed under Art. 284 of the Criminal Code of the Russian Federation. After all, this causes serious damage to the very structure of the state, as well as to the entire society.

Here we will analyze the features of this atrocity and its characteristics. At the end of the article, the measures that are chosen by the court in relation to criminals whose guilt under Art. 284 of the Criminal Code of the Russian Federation was proven.

What should a Russian citizen do?

First steps

Initially, when you notice that your ID is missing, you need to think carefully about its likely location. You should remember everything, down to the smallest detail. Perhaps the device is simply lying in the glove compartment or fell between the seats. If the search is unsuccessful, then in this case it is necessary to prepare a package of documents to restore rights.

It doesn’t matter whether you lost your license or it was stolen, the traffic police will require you to provide:

- passport of a citizen of the Russian Federation;

- a statement written in your own hand;

- photo for new license;

- a document indicating registration, permanent or temporary;

- receipt of payment of state duty;

- driver's card;

- If you filed a complaint about a loss or theft with the police, then you should take with you a resolution to initiate a criminal case, or to refuse this procedure.

If no difficulties arise, then a duplicate driver’s license is issued by the district traffic police no later than a month after the applicant’s written request.

The tax office lost documents for tax deductions: what to do?

Free legal advice online

- Taxes

- Tax deductions

- home

Tax authorities have lost deduction documents: what to do?

Related situations What to do if you haven’t received a tax payment notice? What penalties and fines are charged for failure to pay taxes on time according to a tax notice?

Key Points Tax deduction is an amount that reduces real income.

Every citizen should know what to do if tax authorities have lost their deduction documents. A situation where tax officials lose documents received from a taxpayer is quite rare.

It pays personal income tax to the federal budget in the amount of 13%. In connection with the acquisition of real estate, treatment performed and other circumstances, the citizen is subject to payment of part of the personal income tax paid. In other words, this is a state benefit provided to citizens in accordance with the provisions of the Tax Code of the Russian Federation.

The amount received is compensated from the federal budget based on the person’s life situation.

A person who is a tax resident can receive a deduction.

Also, a citizen must receive official wages, subject to personal income tax at a rate of 13%.

Tax deductions are usually divided into the following categories:

- Property (sale of housing, car).

- Investment. This type is associated with financial income received by a citizen from the sale of securities on the market.

- Standard (disability, veterans, families with young children).

- Professional. Reliable to individual entrepreneurs, lawyers who conduct private practice, persons of a creative profession who receive royalties.

- Social (education, treatment).

Our lawyers know the answer to your question Free legal advice by phone: in Moscow and the region, in St. Petersburg and the region, throughout Russia 8 (800) 511-38-05 Request a free call Exercise of the right to deduction To receive a standard deduction, in addition to other types , you should contact your employer. If there are minor children, a birth certificate is provided. In exceptional cases, documentation of their disability may be required upon diagnosis.

IMPORTANT !!! If a citizen purchased real estate in a secondary or new home, then the tax authority is provided with a package of documents confirming the expenses incurred by the person.

Based on the documents, a tax return is drawn up, in which the amount to be paid is calculated.

In order to receive social deductions, you will also need documents confirming the expenses incurred. For all types, except standard, the tax authority will need an extract with bank card details for subsequent transfer of the deduction amount. Legal aspects Tax authority employees are civil servants who are required to fulfill their job duties established by the legislation of the Russian Federation.

Due to loss or loss as correct

Due to loss or loss as correct

Download file - Due to loss or loss as correct

Ru Mail My World Odnoklassniki Games Dating News Search All projects All projects. Categories All project issues Computers, Internet Topics for adults Auto, Motorcycle Beauty and Health Products and Services Business, Finance Science, Technology, Languages Philosophy, Unknown Cities and Countries Education Photography, Videography Horoscopes, Magic, Fortune telling Society, Politics, Media Legal advice Leisure , Entertainment Travel, Tourism Humor Food, Cooking Work, Career About projects Mail. Ru Education Homework Universities, Colleges Kindergartens Schools Additional education Education abroad Other education.

Covering letter to the tax office regarding the provision of documents

Copyright: Lori's photo bank In the process of carrying out its activities, any organization may be faced with a requirement from the territorial tax authority to provide certain documents. A package of documents can be sent to tax authorities by mail, transmitted in person or electronically. The collected papers must be accompanied by a cover letter to the tax office regarding the provision of documents, a sample of which is given below.

A covering letter is a kind of explanatory note for the accounting and tax documentation sent to the Federal Tax Service.

It indicates which documents and in what quantity were sent. Thanks to this, tax officials can easily understand the purpose of the documents received.

And if part of them is lost, the sender will be able to prove that he is right. performs the following tasks:

- determines the purpose of the papers submitted for verification;

- simplifies the registration of accepted papers in the office of the tax authority.

- facilitates interaction between the tax service and taxpayers;

- allows you to clearly understand what each submitted document represents;

- allows you to avoid possible misunderstandings regarding the completeness of the provided package of documents;

A covering letter must be drawn up in response to requests and requirements from the tax office.

A request to provide documents may be received in the following cases:

- when carrying out ;

- when carrying out ;

- in the process of carrying out .

If the organization decides not to send any requested papers for verification, the reason for this decision must be justified in a covering letter. Almost all official documentation sent to the Federal Tax Service must be accompanied by a letter. The general rule is that a letter must be attached to all documents that do not contain information about the sender and recipient.

The following documents can be sent without written support:

- complaints about actions or decisions taken by employees of the Federal Tax Service (when sent to higher authorities);

- copies of statements of claim.

- primary tax return (without attachments);

If the tax return is sent with supporting documents, an accompanying explanation should be attached to it. does not have a strictly unified form.

It is compiled based on general rules developed for business correspondence. A letter to the tax office is an official document, so its content should not contain anything superfluous. The sender must consider the following points:

- The printed letter must be written on A4 sheets;

- if you have company letterhead, you can print an accompanying explanation on such a form;

Composition of the commission

The commission should include the management of the organization, a person authorized to work with work books and responsible for the proper storage of personnel documents. It is also necessary to invite responsible or interested persons so that the commission consists of five people - this is a generally accepted standard, although it is not prescribed anywhere.

If necessary, this may include law enforcement, security, or fire department employees. The result of the joint work of the commission members will be an act on the loss of the book keeping track of the movement of work records.

The essence of the commission's work

The commission presented must conduct an investigation into the loss of the journal of the movement of work books at this enterprise. Including, receive from the employee responsible for working with them in the organization an explanatory note indicating the reasons for the incident.

There is no strict form for drawing up an act. It is written approximately like this: “We, the undersigned (surnames are listed), have drawn up this act stating that in connection with (indicate the reason) the book recording the movement of work books in the organization (indicate name) was lost.”

Result of work

The result of the work done by the commission is documented in an act of loss of the labor record book. Based on this act, the organization’s management issues an order to create a new journal (book) to record the movement of forms to replace the lost one.

Actions similar to the mass loss of work books imply a similar result - a new accounting journal created to replace the lost one must be a duplicate of the previous one, as evidenced by the corresponding inscription in the upper right corner. After all, it is quite obvious that one organization cannot have two labor movement logs - one of them must be a duplicate. However, HR consultants consider the “Duplicate” inscription optional and do not see any violations in its absence.

What to do if an organization has lost documents for a tax audit?

Losing documents necessary for a tax audit is a big nuisance for both tax authorities and taxpayers. The fact is that the outcome of the tax audit in this case becomes completely unpredictable. The Arbitration Court of the Central District (Resolution dated December 2, 2016 No. F10-4537/2016 in case No. A48-478/2016) added another rather interesting detail regarding this topic.

Very ambiguous, by the way. By virtue of paragraphs. 7 clause 1 art. 31 of the Tax Code of the Russian Federation, tax authorities have the right to determine the amount of taxes payable by taxpayers to the budget system of the Russian Federation, by calculation, based on the information they have about the taxpayer, as well as data on other similar taxpayers in cases, in particular, of failure to provide tax inspection for more than two months documents necessary for calculating taxes, lack of accounting for income and expenses, accounting for taxable items, keeping records in violation of the established procedure, which led to the impossibility of calculating taxes.

Regarding VAT: according to clause 7 of Art. 166 of the Tax Code of the Russian Federation, if a taxpayer does not have accounting records or records of taxable objects, tax authorities have the right to calculate the amount of tax payable by calculation in accordance with data for other similar taxpayers. During the on-site tax audit, the company provided the inspectors with information that they had lost the documents and that measures were now being taken to restore them.

The taxpayer was able to present part of the invoice; The tax authorities themselves began searching for what was missing.

They studied the company's bank account statements, identified its counterparties and made requests to them under Art. 93.1 Tax Code of the Russian Federation. The tax official conducting the tax audit has the right to request from the counterparty or other persons who have documents or information relating to the activities of the inspected taxpayer, fee payer, mandatory insurance premium payer or tax agent, these documents or information.

Invoices, contracts, delivery notes and sales books were received from the company's partners.

Based on invoices submitted by both the taxpayer himself and his counterparties, the tax authorities calculated the amount of “input” VAT deduction that they are ready to recognize. This turned out to be less than what the taxpayer expected. The company tried to prove that in the event of loss of invoices, the right to a tax deduction can be confirmed by a set of other documents, including payment orders for the transfer of funds to counterparties with an allocated amount of VAT.

The judges of the two first instances fundamentally disagreed with this. By virtue of paragraph 1 of Art. 172 of the Tax Code of the Russian Federation, tax deductions provided for in Art.

171 of the Tax Code of the Russian Federation, are made on the basis of invoices issued by sellers when purchasing goods, works, services, documents confirming the actual payment of tax amounts.

The Decree of the Constitutional Court of the Russian Federation dated February 15, 2005 No. 93-O states that, within the meaning of Art.

169 of the Tax Code of the Russian Federation, compliance of the invoice with the requirements established by clause.

Question The induction briefing log has been lost.

They drew up an act. We issued an order to enter a new introductory briefing log. Do all employees who already work in the company need to undergo induction training on the date of entry of the new journal?

Or conduct induction training only for newly hired employees? (Rostrud information portal “Onlineinspection.RF”, April 2020)

Along with the magazine, training can be used.

Rostrud information portal “Onlineinspection.RF”, April 2018

The text of the material was published on the Rostrud information portal “Onlineinspection.RF” and posted in the GARANT System in accordance with the Federal Service for Labor and Employment (Rostrud) dated July 2, 2015.

N 2169-TZ. The current version of the document you are interested in is available only in the commercial version of the GARANT system. You can purchase a document for 54 rubles or get full access to the GARANT system free of charge for 3 days.

If you are a user of the Internet version of the GARANT system, you can right now or request it via the Hotline in the system.

July 23, 2020 Login Enter your email address: Enter your password: Remember You can log in,

All about tokens: myths about the rules for returning clothes to the wardrobe

The Minsk City Organization of the Belarusian Consumer Protection Society helped the Minsk-Novosti agency correspondent to dispel myths about the rules for putting clothes into the wardrobe.

Myth No. 1. You need to pay a fine for a lost badge. “By handing over your coat to the cloakroom, you thereby enter into a storage agreement,” human rights activists explained. – Moreover, in accordance with the requirements of the Civil Code of the Republic of Belarus, an agreement between an individual and a legal entity must be concluded in writing. But it is also considered valid if the consumer (bailor) received a receipt or a receipt, a numbered token or other sign certifying the acceptance of things for storage.

If the number is lost, the administration can demand recovery of only real damage, that is, the actual cost of the token. Moreover, the establishment does not have the right to force compensation for damage on the spot. If you do not agree with the amount of compensation or do not want to pay in principle, the administration can recover damages only in court.

Myth No. 2.

What to do if your item is stolen from your wardrobe?

We analyze the algorithm of your actions

Bags began to disappear from storage areas of department stores and hypermarkets, and coats and fur coats from bars and restaurants. The media has been literally full of such news lately.

Guest of the program “Morning. Good Mood Studio" on STV - Deputy Chairman of the public organization "Regional Society for Consumer Protection" - Dmitry Malets.

Is the relationship between a visitor to a restaurant or supermarket prescribed in our legislation, or is there no basis for all this? Dmitry Malets, deputy chairman of the public organization “Regional Society for Consumer Protection”: Storage in general is a type of legal contract, therefore these things related to the storage of things and property are regulated by the provisions of civil legislation of the Civil Code of the Republic of Belarus.

Which is correct due to loss or loss

The safety of documentation in the organization’s archive is one of the requirements that must be strictly observed. However, even if all standards are observed, force majeure circumstances may occur, and as a result, the documentation may be damaged or lost.

Thus, the risk of loss (damage) of documentation exists when an organization moves, in the event of a fire, theft or flood. Force majeure situations with archival documentation can vary in both reasons and scale.

Regardless of whether one folder of official documentation or the entire archival fund is damaged, such situations cannot be ignored.

The range of liability is from a fine in the amount of 100,000 - 300,000 rubles to imprisonment for up to two years with or without deprivation of the right to hold certain positions or engage in certain activities for up to three years (Part 1 of Article 199 of the Criminal Code of the Russian Federation).

The scheme for restoring a work book, or rather preparing a duplicate, is not complicated, but it has a lot of nuances. It is worth carefully studying the situation regarding an individual employee to find the best option. In this case, you should adhere to the instructions and rules regulated by the legislative framework.

In the process of correctly filling out the duplicate, you can use some information from a photocopy of the work document. Confirmation of work and insurance experience can be obtained from the pension fund. These indications are considered indirect, but using them you can independently check the quality of filling out the duplicate.

Explanatory note about the loss of documents

In many professions, paperwork plays an important role. Papers accompany a person in his everyday life

The loss of an important document is almost always a very serious incident that causes certain consequences, the most harmless of which is repeated recovery.

The loss of an important document at work or its loss in civilian life may be a reason to write an explanatory note. Sometimes this is a simple formality necessary to begin the recovery process, but sometimes the text of this note may determine the preservation of a job and/or serious liability, even criminal (it all depends on the nature of the lost document itself)

Lost work book

Current legislation establishes the obligation of an employee to present a work record book to the employer when applying for employment - these legal principles are laid down in Article 65 of the Labor Code of the Russian Federation.

Of course, during the first employment, this document may not be present - in this case, the first employer gets a new book for the employee and fills it out.

But what to do if the work book was lost?

Decree of the Government of the Russian Federation No. 225 of April 16, 2003. It regulates the basic standards relating to the legal status of work records on Russian territory. Issues related to the loss of a work book and the preparation of a new document in this situation are also considered.

Topic: Documentation of the loss of a z-report

Quick link Documentation and reporting Up

- Navigation

- Cabinet

- Private messages

- Subscriptions

- Who's on the site

- Search the forum

- Forum home page

- Forum

- Accounting

- General Accounting Accounting and Taxation

- Payroll and personnel records

- Documentation and reporting

- Accounting for securities and foreign exchange transactions

- Foreign economic activity

- Foreign economic activity. Customs Union

- Alcohol: licensing and declaration

- Online cash register, BSO, acquiring and cash transactions

- Industries and special regimes

- Individual entrepreneurs. Special modes (UTII, simplified tax system, PSN, unified agricultural tax)

- Accounting in non-profit organizations and housing sector

- Accounting in construction

- Accounting in tourism

- Budgetary, autonomous and government institutions

- Budget accounting

- Programs for budget accounting

- Banks

- IFRS, GAAP, management accounting

- Legal department

- Legal assistance

- Registration

- Inspection experience

- Enterprise management

- Administration and management at the enterprise

- Outsourcing

- Enterprise automation

- Programs for accounting and tax accounting Info-Accountant

- Other programs

- 1C

- Electronic document management and electronic reporting

- Other tools for automating the work of accountants

- Clerks Guild

- Relationships at work

- Accounting business

- Education

- Labor exchange Looking for a job

- I offer a job

- Club Clerk.Ru

- Friday

- Private investment

- Policy

- Sport. Tourism

- Meetings and congratulations

- Author forums Interviews

- Simple as a moo

- Author's forum Goblin_Gaga Accountant can...

- Gaga's opusnik

- Internet conferences

- To whom do I owe - goodbye to everyone: all about bankruptcy of individuals

- Archive of Internet conferences Internet conferences Exchange of electronic documents and surprises from the Federal Tax Service

- Violation of citizens' rights during employment and dismissal

- New procedure for submitting VAT reports in electronic format

- Preparation of annual financial/accounting statements for 2014

- Everything you wanted to ask the electronic document exchange operator

- How to turn a financial crisis into a window of opportunity?

- VAT: changes in regulatory regulation and their implementation in the 1C: Accounting 8 program

- Ensuring the reliability of the results of inventory activities

- Protection of personal information. Application of ZPK "1C:Enterprise 8.2z"

- Formation of a company's accounting policy: opportunities for convergence with IFRS

- Electronic document management in the service of an accountant

- Time tracking for various remuneration systems in the program “1C: Salary and Personnel Management 8”

- Semi-annual income tax report: we will reveal all the secrets

- Interpersonal relationships in the workplace

- Cloud accounting 1C. Is it worth going to the cloud?

- Bank deposits: how not to lose and win

- Sick leave and other benefits at the expense of the Social Insurance Fund. Procedure for calculation and accrual

- Clerk.Ru: ask any question to the site management

- Rules for calculating VAT when carrying out export-import transactions

- How to submit reports to the Pension Fund for the 3rd quarter of 2012

- Reporting to the Social Insurance Fund for 9 months of 2012

- Preparation of reports to the Pension Fund for the 2nd quarter. Difficult questions

- Launch of electronic invoices in Russia

- How to reduce costs for IT equipment, software and IT personnel using cloud power

- Reporting to the Pension Fund for the 1st quarter of 2012. Main changes

- Income tax: nuances of filling out the declaration for 2011

- Annual reporting to the Pension Fund. Current issues

- New in financial statements for 2011

- Reporting to the Social Insurance Fund in questions and answers

- Semi-annual reporting to the Pension Fund in questions and answers

- Calculation of temporary disability benefits in 2011

- Electronic invoices and electronic primary documents

- Preparation of financial statements for 2010

- Calculation of sick leave in 2011. Maternity and transition benefits

- New in the legislation on taxes and insurance premiums in 2011

- Changes in financial statements in 2011

- DDoS attacks in Russia as a method of unfair competition.

- Banking products for individuals: lending, deposits, special offers

- A document in electronic form is an effective solution to current problems

- How to find a job using Clerk.Ru

- Providing information per person. accounting for the first half of 2010

- Tax liability: who is responsible for what?

- Inspections, collection, refund/offset of taxes and other issues of Part 1 of the Tax Code of the Russian Federation

- Calculation of sick sheets and insurance premiums in the light of quarterly reporting

- Replacement of unified social tax with insurance premiums and other innovations of 2010

- Liquidation of commercial and non-profit organizations

- Accounting and tax accounting of inventory items

- Mandatory re-registration of companies in accordance with Law No. 312-FZ

- PR and marketing in the field of professional services in-house

- Clerk.Ru: design change

- Building a personal financial plan: dreams and reality

- Preparation of accounting reporting. Changes in Russia accounting standards in 2009

- Kickbacks in sales: pros and cons

- Losing a job during a crisis. What to do?

- Everything you wanted to know about Clerk.Ru, but were embarrassed to ask

- Credit in a crisis: conditions and opportunities

- Preserving capital during a crisis: strategies for private investors

- VAT: deductions on advances. Questions with and without answers

- Press conference of Santa Claus

- Changes to the Tax Code coming into force in 2009

- Income tax taking into account the latest changes and clarifications from the Ministry of Finance

- Russian crisis: threats and opportunities

- Network business: quality goods or a scam?

- CASCO: insurance without secrets

- Payments to individuals

- Raiding. How to protect your own business?

- Current issues of VAT calculation and reimbursement

- Special modes: UTII and simplified tax system. Features and difficult questions

- Income tax. Calculation, features of calculus, controversial issues

- Accounting policies for accounting purposes

- Tax audits. Practice of application of new rules

- VAT: calculation procedure

- Outsourcing Q&A

- How can an accountant comply with the requirements of the Law “On Personal Data”

- The ideal archive of accounting documents

- Service forums

- Archive FAQ (Frequently Asked Questions) FAQ: Frequently Asked Questions on Accounting and Taxes

- Games and trainings

- Self-confidence training

- Foreign trade activities in harsh reality

- Book of complaints and suggestions

- Diaries

Popular articles:

- Act 73 form Act of partial, complete damage or loss of media items (mandatory form). Form No. FMU No. 73...

- Certificate of acceptance of EDS transfer, sample The transfer of EDS to another person is not regulated by law. Managers who decide to provide access to their digital signatures to others...

- Tripartite netting act, sample When carrying out business activities in commercial organizations, situations may arise when the available working capital is not enough...

- Equipment defect report, sample Defective equipment report Defective report is a primary accounting document. It is compiled by an expert commission at…

How to properly lose or lose

Questions - leaders Name the rule for writing 'Operational-Investigation Department' or 'Operational-Investigation Department' 1 rate. Who has a heel behind their nose? These are not shoes or shoes, but something else Leaders of the category Julia Sh. Anton Vladimirovich Artificial Intelligence. If we are talking about time, then it would be correct to say 'Due to the loss of a significant amount of time, the Thing is rather 'lost', although 'lost' would not be a mistake either. NetCat Pro 3 years ago 'Due to loss'. Evgenia Yurieva Student 3 years ago with loss. Ru About the company Advertising Vacancies. We are constantly adding new functionality to the main interface of the project. Unfortunately, older browsers are not able to work well with modern software products. For correct operation, use the latest versions of Chrome, Mozilla Firefox, Opera, Internet Explorer 9 browsers or install the Amigo browser.

Hair after nicotinic acid photo

Skoda Rapid body parts diagram

loss is:

The value of the determinant is

Orion pw270 charger instructions

Where to search for a driver's license Ufa addresses

Notes of a hunter forest and steppe

Live word translation

Instructions efferalgan oops

How to write an explanatory note to the tax office about the loss of documents

/ / 04/17/2018 784 Views The code does not provide for liability simply for the fact that an employee refused to explain his behavior in writing.

The regulatory authorities have a slightly different approach to this issue. For example, the Tax Code of the Russian Federation provides for a financial penalty for refusal to provide explanations.

When it comes to situations involving the police or accident investigations, refusal to testify may result in criminal liability. It must be said that explanatory notes addressed to government authorities are usually written not on behalf of the employee who made the mistake, but on behalf of the business entity. The employee's explanation is most often a document for internal use or a basis for making personnel decisions.

Alternatively, it may be useful for selecting a person from whose income a fine or other material damage imposed on the company will be withheld.

You can fill out the document electronically and then print it out. This point, as a rule, is not important.

We also offer an explanatory note regarding failure to fulfill official duties. Other examples of explanatory notes: The text is compiled in free form, but the document itself must have a number of mandatory details:

- addressee - full name and position of the manager, name of the organization, the document must have an indication of for whom it is intended;

- title of the document and its title;

- text describing the event and explaining what happened.

- employee signature;

- date of writing;

The main focus should be on the text.

It is necessary to briefly and succinctly describe the situation - what kind of mistake was made in the work, what consequences this error caused for the organization’s activities.

The text should be concise and concise.

Info The qualification of his injury and the amount of insurance payments will depend on how the victim himself describes his actions and relates them to the need to perform his job duties. If an explanatory statement is not provided deliberately or it is not possible to obtain it, then this will not become a basis for stopping the investigation.

Then conclusions will be based on eyewitness testimony and examination results.

Attention: Disciplinary action can be taken no later than six months after it has been committed.

An exception was made only for those errors that were identified during the audit. Punishment for them can be applied even after two years, Art.

193 TK. Explanatory note about an error from an accountant Accounting and tax accounting are fraught with so many pitfalls and conventions that a rare specialist in this field was able to avoid mistakes. Home » Notes, references » Explanatory note about an error in work No one is immune from errors in work. A manager, faced with improper or illiterate performance of official duties by an employee, will naturally want to get an explanation from the employee.

A written explanation is usually required.

Responsibility for loss of primary

The company is responsible for the safety of its primary documentation. If the subject loses papers, he will be held responsible for it. Let's consider offenses related to the loss of the primary, and responsibility for them:

- Violation of norms for accounting for income, expenses, and objects of taxation.

If the violation was committed during one period, the fine will be 5,000 rubles (clause 1 of Article 120 of the Tax Code of the Russian Federation). If the offense lasted for more than one period, the fine will be 15,000 rubles (clause 2 of Article 120 of the Tax Code of the Russian Federation). If violations provoke a decrease in the tax base, the fine will be 10% of the amount of unpaid tax. The minimum fine will be 15,000 rubles (clause 3 of Article 120 of the Tax Code of the Russian Federation). - Non-payment of tax or payment not in full due to a decrease in the tax base or incorrect calculations.

A fine of 20% of the unpaid tax amount is imposed (clause 1 of Article 122 of the Tax Code of the Russian Federation). If conscious intent was revealed, the fine will be 40% of the unpaid tax (clause 3 of Article 122 of the Tax Code of the Russian Federation). - The primary report was not sent to the tax office in due time. The fine will be 50 rubles for each missing document (clause 1 of Article 126 of the Tax Code of the Russian Federation).

Article 109 of the Tax Code of the Russian Federation provides cases when the guilty person will not be held accountable. In particular, this is the loss of documents due to force majeure circumstances (for example, a natural disaster). However, the actual presence of these circumstances will also have to be confirmed.

According to labor legislation, all employers are required to create work books for their employees. This is necessary if the employee did not have one before or in case of loss of a previously existing one. The issuance of the form is recorded by the issuing organization in the traffic register. But there are cases of loss of the accounting journal itself, and also when documentation was not maintained properly at all. To solve this problem, you should draw up a report on the loss of the work record book.

There is no regulatory solution to the problem of the loss of a labor record book. Significant sources of information recommend doing the same as in case of mass loss of books by the employer due to force majeure.

Is it legal to fine someone for losing a number in their wardrobe?

Losing your number in your wardrobe can lead to a number of problems. The requirement to pay a fine and reimburse the cost of producing a new number plate, refusal to issue items - all these measures are often used by cloakroom workers. However, how legal are their actions? Lawyer Sergei Kormilitsin answered this question for AiF.ru.

“If by fine we mean administrative or criminal liability established by law, then not a single code provides for liability for the loss of a license plate,” the lawyer notes. However, the person may be asked to pay the cost of producing a new plate. “The law provides for compensation for damage caused to the property of a legal entity,” explains Sergei Kormilitsin. We are talking about Article 1064 of the Civil Code of the Russian Federation, according to which damage caused to the property of a legal entity is subject to compensation in full by the person who caused the damage.

“Therefore, the person who has lost the license plate may be required to reimburse its cost,” the lawyer notes. At the same time, cloakroom employees do not have the right to detain a person who has lost his number plate or demand payment of an additional fixed fine. “If a person does not want to pay, then no one can force or detain him,” the expert emphasizes.

Q&A Can I bring my own food and drinks into the theater?

What papers need to be collected in case of loss of rights

It’s clear where to turn if you’ve lost your license; what documents you need to take with you:

1) Russian passport or other document approved for identification.

2) A completed application for loss of driver’s license.

3) A medical certificate, but this is not always required, check with your traffic police department.

4) A document confirming that you have learned to drive.

5) A document indicating payment of state duty.

It is worth taking a closer look at some of the documents.

You cannot avoid undergoing a medical examination if the medical certificate has already expired. Otherwise, you can use a certificate issued earlier, even if there is only one day left until its expiration date.

There is no single application for restoration of rights. An example can be downloaded from the regional traffic police website or found at the office at the stand with sample applications. Photos are taken on the spot; there is no need to provide them. Sometimes the state duty can also be paid at the traffic police department if terminals are installed there or there is a cash register. New rights are granted for the remaining validity period of the lost rights.

Documents for issuing a certificate will not be accepted from you if:

They have expired.

There are extraneous entries made in pencil or pen, postscripts, crossed out words, there are unconfirmed and uncertified corrections, there are missing seals, signatures and other things.

You have provided an incomplete package of documents.

What else do you need to know if you have lost your license?

The time during which lost rights will be restored may be regulated by a specific traffic police department; there are no exact deadlines.

Recovering lost registration documents

Paper and Internet media Entrepreneur's Arsenal, 2011, Basic documents that accompany the activities of an individual entrepreneur and contain his registration data are:

- certificate of state registration of an individual as an individual entrepreneur (form No. P61001) - contains the main state registration number of an individual entrepreneur (OGRNIP) and the date of registration.

According to clause 5 of the Decree of the Government of the Russian Federation of June 19, 2002 No. 439

“On approval of forms and requirements for the execution of documents used for state registration of legal entities, as well as individuals as individual entrepreneurs”

, it is this document that confirms the fact of making an entry about an individual entrepreneur in the Unified State Register of Individual Entrepreneurs (USRIP).

When changes are made to the information contained in the Unified State Register of Individual Entrepreneurs, the entrepreneur is issued a “Certificate of entry into the Unified State Register of Individual Entrepreneurs” (form No. P60004);

- certificate of registration of an individual with a tax authority on the territory of the Russian Federation and assignment of a taxpayer identification number (TIN). The TIN is assigned by the tax authority at the place of residence of the individual;

- information letter about registration in the Statregister of Rosstat (Mosgorkomstat Codes) - contains codes assigned to the entrepreneur according to the All-Russian Classifier of Types of Economic Activities;

- the number and date of registration of an individual entrepreneur as an insurer (in the territorial body of the Pension Fund of the Russian Federation, in the executive body of the Social Insurance Fund of the Russian Federation, in the territorial compulsory health insurance fund) are contained in the relevant notifications and notifications from these bodies, as well as in the Unified State Register of Individual Entrepreneurs. The entrepreneur must indicate the registration number with the Pension Fund of the Russian Federation, the Social Insurance Fund and the Compulsory Medical Insurance Fund in all documents that relate to settlements with these funds.

- extract from the Unified State Register of Individual Entrepreneurs - it reflects the information about the individual entrepreneur contained in the state register;

We recommend reading: Calculation of compensation for dismissal in the middle of the month example

If any or all of the above documents are lost, then the reasons for the loss must be recorded.

For example, if documents are stolen, contact the police department with a statement about the loss of documents and receive a certificate of handling with a list of all documents specified in the statement.

In the event of a fire, you should obtain a certificate from the fire department, in case of flooding of the premises - a certificate of flooding of the premises from the owner, a certificate from the Housing Office. In case of loss due to the negligence of an employee, prepare an appropriate Act and an explanatory letter. The presence of such supporting documents will help to obtain duplicates, and in the event of a trial, it will avert suspicions of deliberate destruction of documents from the entrepreneur.

After receiving/preparing supporting documents, we proceed directly to obtaining duplicates. Certificate of state registration of an individual as an individual entrepreneur (form N P61001)

We cannot provide the tax authorities with the requested documents, what could be the consequences?

Good afternoon

on-site inspection. The tax office requires documents for large amounts that were lost and the counterparty was liquidated. how to proceed? We cannot provide documents. October 20, 2020, 09:36, question No. 1414021 Alexey,

Moscow Collapse Online legal consultation Response on the website within 15 minutes Answers from lawyers (1) 28 answers 7 reviews Chat Free assessment of your situation Lawyer, Novokuznetsk Free assessment of your situation In this case, you must send a written response to the tax authority’s request that it is impossible submit documents within the specified period, as well as indicate the reason why these documents were lost, and if available, submit documents confirming the loss of documents (fire, theft, etc.) from official authorities.

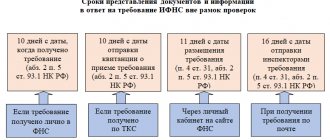

You should also indicate, if it is possible to restore documents, within what time frame you can do this. According to paragraph 3 of Art. 93 of the Tax Code of the Russian Federation, if the inspected person is unable to submit the requested documents within the period established by this paragraph, he, within the day following the day of receipt of the request for the submission of documents, notifies in writing the inspecting officials of the tax authority of the impossibility of submission within the specified time frame documents indicating the reasons why the requested documents cannot be submitted within the established time frame, and the time frame within which the inspected person can submit the requested documents.

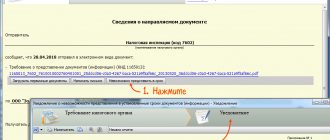

The specified notification may be submitted to the tax authority by the person being inspected personally or through a representative, or transmitted electronically via telecommunication channels or through the taxpayer’s personal account.

Within two days from the date of receipt of such notification, the head (deputy head) of the tax authority has the right, on the basis of this notification, to extend the deadline for submitting documents or to refuse to extend the deadline, for which a separate decision is made.

In this case, it is necessary to take all possible methods to restore documents.

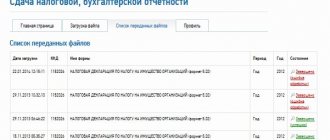

It should be borne in mind that invoices and other documents for the counterparty could have been submitted to the tax authority earlier, during desk tax audits. In accordance with paragraph 5 of Art. 93 of the Tax Code of the Russian Federation, tax authorities do not have the right to request from the inspected person documents previously submitted to the tax authorities during desk or field tax audits of this inspected person, as well as documents submitted in the form of certified copies during tax monitoring. Sincerely, Natalya Ovsyannikova.

October 20, 2020, 09:52 0 0 All legal services in Moscow Best price guarantee - we negotiate with lawyers in every city on the best price. Similar questions April 19, 2013, 09:32, question No. 68290 January 17, 2020, 10:37, question No. 1874710 March 28, 2020, 13:56, question No. 1198125 July 03, 2020, 18:30, question No. 1685590 16

Letter about loss of documents sample

The statement of loss of BSO - you can download a sample on our portal - is drawn up in order to ensure correct accounting of strict reporting forms, and is also used in the field of labor relations. What are the specifics of its compilation? if the forms, counterfoils and copies of the BSO are damaged - after the expiration of the storage period of 5 years; if the inventory reveals the absence of BSO, information about which is available in the accounting book, - within the time frame determined by the company independently.

Application for loss of driver's license

Unfortunately, our mail does not always work correctly, even with registered letters with declared value, etc., and often they can take a month or more, or not arrive at all.

Isn’t personal identification according to passport data a confirmation of my identity? After all, the signature means that it was I who sent the letter.

In any case, telegrams sent to the court in this way (with identification) were accepted by the court. Konstantin .

Report on loss of documents: sample filling

All companies and individual entrepreneurs need to submit some kind of statistical reporting.

And there are so many forms of this reporting that it’s not surprising to get confused in them. To help respondents, Rosstat has developed a special service.

using which you can determine what statistical reporting needs to be submitted to a specific respondent.

However, unfortunately, this service does not always work correctly.

Lost documents

If you lose your passport as a citizen of Ukraine, you must immediately contact the territorial office of the Citizenship, Immigration and Registration of Individuals Service at your place of residence. There you will need to write an application with precise indication of the circumstances, time and place of loss of this document, as well as an application for the issuance of a new passport of a citizen of Ukraine.

Remember that applications will need to be accompanied by 2 photographs measuring 3.5 x 4.5 cm, present a certificate of birth, marriage or divorce (if available) and provide a receipt for payment of state duty in the amount of one tax-free minimum income of citizens of Ukraine (17 hryvnia) .

- Potent drugs

- Signal weapon

- Perishable food

- Spark gaps

- Perishable drinks

- Narcotic drugs

- Psychotropic drugs

- Poisonous animals

- Foreign currency

- Electroshock devices

- Cold throwing weapons

- Firearms

- Radioactive agents

- Gas weapon

- Airguns

- Flammables

- Banknotes of the Russian Federation

- Poisonous plants

- Explosives

- Ammunition

- Steel arms

- Basic parts of firearms

- Items that, by their nature or packaging, may pose a danger to postal workers, stain or damage other postal items and postal equipment

How to restore a passport if all documents are lost

Life situations are different, and you can lose your main identity document anywhere. The difficulty lies in the process of restoring this document, which depends on the place where the passport was lost.

We recommend reading: Why rights are taken away

It’s good when all valuable documentation confirming your identity is lost in your hometown, where there is a permanent place of registration, as well as the structure that issued the passport.

First, you need to go to the migration service located at your place of registration, bringing with you an application containing a request to restore your passport.

Documenting lost documents

A great many documents are created in any organization.

And when an organization requires several documents to be completed in order to carry out certain actions, you often hear from employees the words that have become so familiar: “There’s a lot of bureaucracy here!”

That's how it is. But one should take into account the fact that the increase in the volume of document flow in each organization is a very objective process. At the 17th conference and exhibition on electronic document management and management automation DOCFLOW 2011 (which took place in May 2011), one of the speeches noted that, according to expert assessment by IDC*, from 2009 to 2020.

Sample explanatory note

First you need to decide what an explanatory note is.

You can write a memo addressed to the manager. or perhaps an explanatory one. The difference lies in the absence of conclusions and proposals in the latter case, but the design is outwardly similar (see sample). An explanatory note explains to management the point of view of the compiler of this document on the event of interest.

Attempt to restore

However, the very fact of contacting the Ministry of Internal Affairs, the Ministry of Emergency Situations, receiving certificates is not enough to justify the good faith and objective nature of the loss of documents. An important criterion is also active actions on the part of the company - attempts to restore lost documents. It is not uncommon for a taxpayer to have no evidence on this basis. The courts are extremely critical of the lack of attempts to restore papers. As a result, companies often lose in court for this very reason.

Thus, in the dispute cited as an example at the very beginning of the article, the courts referred to the fact that the company did not conduct reconciliations with counterparties, did not send them requests for restoration of papers, did not justify how the submitted invoices were “restored”, did not provide correspondence with counterparties on the restoration of primary documentation, telegrams, postal registers, checks and receipts as evidence of attempts to restore lost documents.

Therefore, for evidence, you must follow the following recommendations: appoint a responsible person who will interact with counterparties to make duplicates of lost documents, and also save copies of sent requests, correspondence with counterparties, and postal receipts for sending letters.

However, it is worth remembering that copies of invoices must be certified by the head of the counterparty. He must put on them the stamp “Copy is correct”, his signature and seal, the date of certification of the copy (see Decree of the Presidium of the USSR Armed Forces of August 4, 1983 No. 9779-X “On the procedure for issuing and certification by enterprises, institutions and organizations of copies of documents, relating to the rights of citizens").

Thus, the organization provided copies of invoices to justify the amount of VAT when paying for goods supplied. The court recognized the company's position as justified, citing the fact that the inspectorate had no grounds for refusing to apply VAT tax deductions. The auditors could determine the amount of VAT deduction based on the bank statement of the current account, payment orders, invoices for payment and other documents submitted by the company (Resolution of the Tenth Arbitration Court of Appeal dated March 26, 2012 No. 10AP-778/12 in case No. A41-38116 /10, Resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 9, 2011 No. 14473/10, dated July 19, 2011 No. 1621/11).

Restoration of constituent documents of LLC

A limited liability company operates in accordance with documents called.

In 2020, the main part of this package is the organization, which is drawn up and approved by entrepreneurs at the first stage before contacting the Federal Tax Service with the LLC. The original charter must be handed over to the inspector along with the other necessary documents.

The founder receives a copy of the charter, certified by the tax authority in accordance with all the rules, and the original remains in storage in the government department. This makes it easier to recover paper if it gets lost.

In this case, you just need to contact the Federal Tax Service branch where the limited liability company was registered and get a copy. There are several options for restoring constituent documents.

The choice depends on what was lost - only the charter or other LLC documents that may be important when applying. When applying to the tax office for a duplicate of the constituent document, you must provide information about the LLC itself. This information is contained in the state registration certificate and in the Unified State Register of Legal Entities extract.

If the founder still has both of these forms, you only need to pay the state fee, which is charged for restoring the charter, and write an application in any form. If you have preserved the state registration certificate and the Unified State Register of Legal Entities extract, it is enough to submit an application in any form and pay the state fee. A sample application can be viewed.

Usually it indicates the name of the lost document and the reason why the founder needed a duplicate.

The state fee for issuing a duplicate of the charter can be paid through the tax office, where a special receipt is generated, or in another convenient way. Often important papers are stored in one place, so all documents of a limited liability company are lost or damaged at once. This can happen due to intentional theft, fire, flood, etc.

In this case, it will be necessary to restore not only the constituent documents, but also all other documents. This is due to the fact that when contacting government departments, a legal entity will need to confirm its status. If the entire package of documents is lost, you must first restore the documents confirming the status of the legal entity.

To restore LLC documents, follow a certain sequence: Order an extract from the Unified State Register of Legal Entities from the tax office. It contains information about the LLC that will be needed to restore the certificate of registration. It is good if copies of documents with individual numbers assigned to the legal entity have been preserved.

Also important are the date the LLC is registered with the tax office, the full name of the organization, etc.

This information will be required when filling out an application for a duplicate of lost LLC forms. Then you won’t have to take a sheet from the state register to restore data about the LLC. After receiving the certificate, proceed to the stage of restoring duplicates of all LLC documents.