Account 50 “Cash” in accounting

Cash settlements with legal entities, individuals, and counterparties are carried out through cash transactions, the main ones of which are:

- Issuance of wages;

- Administrative expenses;

- Receipts from cash sales;

- Expenses for the purchase of inventories by accountable persons, etc.

All cash transactions related to the disposal, receipt and movement of cash are taken into account in accounting under account 50 “Cash” and are reflected in the cash book. The basis for making entries are primary documents - cash outgoing and incoming cash orders (form KO-2 and KO-1).

Using account 50 “Cash” you can get all the information about cash in the organization, the sources of its receipt and further circulation. Account balance 50 shows the total amount of cash and monetary documents. The account is active, therefore the debit of the account records the receipt and receipt of cash at the cash desk. The credit of the account reflects the amount of cash issued from the cash register.

Sub-accounts shown in the figure can be opened for account 50 “Cashier”:

Cash desk - accounting entries

Accounting entries for the cash register are generated with the participation of the active account. 50. The main cash transactions are collected in table No. 2.

Table No. 2. Typical transactions at the company's cash desk

| Account by debit | Loan account | |

| Receipt of funds to the cash desk - postings | ||

| The balance of the accountable amount was returned to the cash desk - posting | ||

| Reflects the movement of funds between cash points | ||

| Posting revenue to the cash register - postings | ||

| The advance payment previously transferred to the counterparty supplier was returned in cash. | ||

| Cash loan received | ||

| Receipt of cash on claims is reflected | ||

| Posting cash proceeds to the organization's cash desk - posting can be done directly through the account. 90 | ||

| The company employee who was at fault was compensated for damages. | ||

| Contribution to the authorized capital in cash | ||

| Surplus funds were discovered during an inventory; exchange rate differences are reflected; assets of the organization were sold | ||

| Cash received from a company branch | ||

| Issuance of funds from the cash register - postings | ||

| Cash deposited into a bank account | ||

| An advance payment was issued to the supplier for the products | ||

| Refund of advance payment to buyer reflected | ||

| Loan repayment in cash is reflected | ||

| The payment of earnings to company personnel in cash is reflected | ||

| Issuance of accountable amounts in cash is reflected | ||

| Loans issued to an employee | ||

| The income due at the end of the reporting period was paid to a participant who is not an employee of the enterprise | ||

| The shortage detected during inventory is reflected | ||

The main supporting primary documents when keeping records of cash transactions are orders and statements, pay slips, agreements with counterparties, cash books, advance reports, etc. In this case, cash transactions in terms of retail revenue are generated in 1C on the date of implementation, with the mandatory registration of all relying documents - PKO, retail sales report.

Note! According to the Directives of the Central Bank No. 3210-U, individual entrepreneurs have the right to apply a simplified procedure for maintaining cash accounting. That is, do not issue orders (receipts and expenses), do not set a limit on the balance of money. If the formation of orders is necessary, the unified forms should be followed when issuing orders.

To account for the organization’s cash, there is an accounting account 50; the debit of the account shows the amounts coming into the cash register from counterparties, and the credits showing outgoing amounts. Of course, the balance reflects the amount of money available in cash at a particular point in time. All cash transactions must be reflected in this account.

Business transactions related to the movement of cash are called cash transactions. In addition to cash, the cash register can store monetary documents, which include, for example, tickets and vouchers.

Such transactions include cash inflows and cash outflows.

Account 50 in accounting: typical entries, examples

Accounting account 50 is an active account “Cash”, it is used to record the movement of cash in the cash desk of the enterprise, control over their receipt, expenditure and intended use. Let's look at which accounts account 50 corresponds to, as well as typical transactions for account 50 using the example of an operation for issuing cash from the cash register to a sub-account for payment for the services of a counterparty.

Count 50: basic information

Account 50 is the active accounting account. An increase in the resource account on it is reflected as a debit, and a decrease as a credit. For example, if funds from an accountable person are deposited at the cash register, then debit entries will be generated on the account, and if a certain amount of funds is withdrawn from the cash register for transfer somewhere, then account 50 will be involved in credit entries.

Account balance 50 is debit. It is calculated by adding debit turnover to the opening balance and subtracting credit turnover from it. The ending balance shows the balance of funds in the cash register on a specific date.

Cash resources on hand are assets. The cash balance at the reporting date is reflected in the enterprise's balance sheet in the asset category (line 1250). When preparing annual financial statements, most business accountants try to bring account balance 50 to zero.

Accounting is carried out in both national and foreign currencies.

Account 50 “Cash” in accounting

Cash settlements with legal entities, individuals, and counterparties are carried out through cash transactions, the main ones of which are:

- Issuance of wages;

- Administrative expenses;

- Receipts from cash sales;

- Expenses for the purchase of inventories by accountable persons, etc.

All cash transactions related to the disposal, receipt and movement of cash are taken into account in accounting under account 50 “Cash” and are reflected in the cash book. The basis for making entries are primary documents - cash outgoing and incoming cash orders (form KO-2 and KO-1).

Using account 50 “Cash” you can get all the information about cash in the organization, the sources of its receipt and further circulation. Account balance 50 shows the total amount of cash and monetary documents. The account is active, therefore the debit of the account records the receipt and receipt of cash at the cash desk. The credit of the account reflects the amount of cash issued from the cash register.

Sub-accounts shown in the figure can be opened for account 50 “Cashier”:

Typical transactions and examples of transactions on account 50

Let's look at typical transactions for this account in Tables 1 and 2.

Table 1. The most common and widespread entries in the debit of account 50:

| Account Dt | Kt account | Description of transaction posting | A document base |

| 50 | 50-2 | Cash transferred from operating cash desk to cash desk | KO-1, KM-6, KM-4 |

| 50 | 51 | Transferring funds from the current account to the cash desk | KO-1, bank statement, check counterfoil (checkbook) |

| 50 | 52 | Transferring funds from a foreign currency account to the cash desk | KO-1, bank statement |

| 50 | 62 | Advance received from buyer/payment received for goods | KO-1, cash receipt. |

| 50 | 70 | Return of excess wages to the cash desk. | KO-1 |

| 50/50-3 | 71 | Return to the cash desk the balance of accountable amounts/cash | KO-1 |

| 50 | 73-1 | Payment of loans from employees | KO-1 |

| 50 | 75-1 | Contribution of the founder to the authorized capital | KO-1, constituent documents |

| 50-1 | 90.01.1 | Sales revenue/income from other operations | Cash register |

Table 2. Main entries for the credit of account 50:

| Account Dt | Kt account | Description of transaction posting | A document base |

| 04 | 50-1 | Purchase of intangible assets | KO-2 |

| 51 | 50 | Transferring cash from the cash desk to the bank | KO-2 |

| 60 | 50-1 | Payment to the supplier (contractor) for goods received (work performed) | KO-2 |

| 52 | 50-1 | Refund of advance payment to the buyer from a special bank account | KO-2 |

| 70 | 50 | Issuance of wages to employees | KO-2, T-53 |

| 70 | 50 | Payment of income from participation in the organization to employees | KO-2 |

| 71 | 50/50-3 | Issuance of accountable amounts/cash documents | KO-2 |

| 73-1 | 50 | Obtaining a loan by an employee | KO-2 |

| 75-2 | 50 | Payment of income from participation in the organization to persons who are not employees | KO-2 |

| 76 | 50-1 | Payment of obligations in the form of debt to other counterparties | KO-2 |

| 94 | 50 | Reflection of cash shortages | INV-15, INV-26 |

Practical example with wiring

VolgaDon LLC and Garant LLC concluded an agreement for the provision of legal services in the amount of RUB 8,800.00. To pay for consulting legal services under the contract, employee of VolgaDon LLC Yuzik K.M. received funds for reporting in the amount of RUB 9,000.00. To perform settlements with Garant LLC, Yuzik K.M. provided the accountant with an advance report and returned the balance to the cashier.

The accountant of VolgaDon LLC generated the following entries for the issuance of cash from the cash register to the sub-account for payment of legal services to a third-party organization:

| Account Dt | Kt account | Transaction amount, rub. | Description of transaction posting | A document base |

| 26 | 60 | 7 458,00 | reflected in costs (8,800.00-1,342.00) | Certificate of completed work (hereinafter referred to as the Certificate) |

| 19 | 60 | 1 342,00 | VAT is allocated from the cost of services | Act |

| 68 VAT | 19 | 1 342,00 | VAT is accepted for deduction | Act, invoice |

| 71 | 50-1 | 9 000,00 | From the cash desk of VolgaDon LLC, funds were issued under the report of Yuzik K.M. | KO-2, statement of the reporting person |

| 60 | 71 | 8 800,00 | Payment for | Act, advance report |

| 50-1 | 71 | 200,00 | Balance of unused funds Yuzik K.M. returned to the organization's cash desk | Act, advance report, KO-1 |

What is it used for in accounting?

Account 50 is called “Cash” and refers to section 5 of the Plan and is used to reflect incoming and outgoing transactions in relation to cash, that is, for cash accounting.

Almost every organization handles cash in the process of settlements with suppliers, customers, and personnel. Wages and other payments to employees, accountable money can be issued in money.

Each transaction involving cash flow is accompanied by an entry in accounting account 50.

Receipt of funds to the cash register: postings

Account 50 “Cash” is an active account, therefore the receipt of funds in the organization’s cash desk is reflected in the debit of this account.

The simplest cash transaction is the withdrawal of cash by check from a current account. This operation generates simultaneously a posting to the cash register and the current account. So, if received at the cash desk from a current account, the posting to account 50 will be as follows:

Debit account 50 – Credit account 51 “Current accounts”

Accounting for cash (receipt postings) for the most typical situations:

- return to the cash desk of an advance previously issued to the supplier:

Debit account 50 – Credit account 60 “Settlements with suppliers and contractors”

- receipt of cash from customers:

Debit of account 50 – Credit of account 62 “Settlements with buyers and customers”

Posting to the cash register for retail revenue or, what is the same thing, posting revenue to the cash register (posting), can be done directly with account 90 “Sales”, because there is no need to keep records of settlements with retail customers on account 62, because Payment and shipment are made simultaneously:

Debit account 50 – Credit account 90

- cash loan received at the cash desk:

Debit of account 50 – Credit of account 66 “Settlements for short-term loans and borrowings”, 67 “Settlements for long-term loans and borrowings”

- If the balance of the accountable amount is returned to the cashier, the posting will be as follows:

Debit of account 50 – Credit of account 71 “Settlements with accountable persons”

- compensation for material damage by an employee of the organization:

Debit of account 50 – Credit of account 73 “Settlements with personnel for other operations”

- Founders' funds were added to the accounts of contribution to the authorized capital:

Debit account 50 – Credit account 75 “Settlements with founders”

- Cash surpluses were identified as a result of inventory:

Debit account 50 – Credit account 91 “Other income and expenses”

Active or passive?

Accounting account 50 is active, as it is subject to the basic rules characteristic of active accounts:

- on account 50, assets are kept (cash in cash);

- the debit reflects the increase in the asset, the credit reflects its decrease;

- the balance is always debit or zero.

Please note: all accounts in which funds are recorded are active. This applies to account 51, where non-cash money is taken into account, 52 – to reflect foreign exchange transactions, 55 – to account for the movement of money through special accounts (letters of credit, deposits).

Characteristics - what debit and credit show

The credit of account 50 reflects the amounts of incoming transactions, that is, the amount of cash received at the cash desk from counterparties and employees:

- incoming payments from customers;

- refunds from employees;

- withdrawing money from a current account.

The debit of account 50 shows the amounts of expense transactions - cash outflows:

- payment to suppliers, sellers;

- issuance of income to staff - salaries, vacation pay, financial assistance, loans, etc.;

- issuance of accountable amounts;

- amounts in excess of the established limit, deposited at the bank at the end of the working day.

The balance in account 50 cannot be a credit balance, since the expense cannot be greater than the income. It is not possible to give out more money from the cash register than is available there.

Sub-accounts are opened to simplify accounting; information is summarized depending on the type of transactions performed.

In accordance with the Plan, the following sub-accounts can be opened on account 50:

- 50.1 – “Cash desk of the organization” - records are kept of cash in the cash register, their receipts and expenses;

- 50.2 – “Operational cash desk” - this sub-account is mainly used by transport organizations, communications enterprises that have points and places for selling tickets and providing storage services. This sub-account keeps records of the movement of cash in ticket offices, baggage offices of ports, stations, stopping points, ships, ferries, post offices;

- 50.3 – “Monetary documents” - here the movement of monetary documents (bills of exchange, paid tickets, postage stamps, etc.) is carried out.

Analytics and subaccounts

Analytical accounting for account 50 is carried out in the context of additionally opened sub-accounts:

- 50.1 “Cash of the organization” - used when accounting for the movement of cash resources in the cash desk of the enterprise;

- 50.2 “Operating cash desk” – used to account for funds in operating cash desks;

- 50.3 “Cash documents” – reflects the value of documents stored at the cash desk. These could be tickets, stamps, etc.

The number and composition of subaccounts may change based on the specifics of the organization’s accounting policies.

Cash Transaction Accounting

According to the law, any organization that has cash at its disposal must comply with the procedure for conducting cash transactions. The main cash transactions include:

- acceptance/issuance of cash, its storage;

- compliance with the cash limit;

- records management;

- depositing funds into the bank.

To record operations on the presence and movement of cash that are in the cash desk of the enterprise, account 50 is used. The accountant reflects the amounts of funds issued using Kt 50, when cash is received at the cash desk - according to Dt 50.

It should be emphasized that all transactions with cash held in the organization's cash register must be reflected in the cash book. The basis for making entries are cash receipts and expenses (form KO-1 and KO-2).

Specifics of working with the account

Transactions are recorded only on the basis of documentary evidence. Typical forms used to reflect movement on a count of 50 are:

- cash receipt order – confirms the receipt of funds (regardless of the type of receipt);

- expense cash order - used to formalize the issuance of money from the cash register;

- cash book - all incoming and outgoing cash orders are recorded in it.

These forms allow you to document the movement of funds in the cash register. To maintain accounting for account 50, other accounting registers are used:

- turnover balance sheet;

- journal-order;

- statement of account 50.

All of the listed registers duplicate information.

The company has the opportunity to establish accounting in accordance with its accounting policies. You can use only one of the specified registers, especially since, if necessary, the software product can generate any of the specified documents.

Characteristics of account 50

- issuing wages to employees;

- refund to the buyer;

- issuance of cash on account for the economic needs of the organization;

- cash receipts (for example, payments for goods, materials or services);

- collection procedure, etc.

Only the accountant-cashier (or a substitute person) has access to cash, as well as conducting transactions with it.

The debit of account 50 collects information about the receipt of cash, and the credit - about the issue from the cash register. For account 50 in accounting, you can open several sub-accounts, which are fixed in the Chart of Accounts (Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Documentary confirmation of transactions on account 50

The RKO must include the details of the recipient of the funds and the amount issued. The recipient must sign and date the amount given to him. The PKO is divided into two parts: one remains in the accounting department, and the second is handed out to the person who deposits cash into the cash register. The receipt must have the cashier's signature and company stamp.

Thus, the characteristics of account 50 include the main entries on it, documentary evidence and the purpose of its use.

Examples of postings for account 50

- Dt 50 Kt 90 - cash receipts from retail sales;

- Dt 50 Kt 51 (52, 55) - receipt of funds from the current account;

- Dt 50 Kt 60 - return of cash that was previously issued to the supplier as an advance;

- Dt 50 Kt 62 - the buyer paid for the goods, work or service in cash;

- Dt 50 Kt 66 (67) - cash loan received;

- Dt 50 Kt 71 - return of debt from the accountable person to the cashier;

- Dt 50 Kt 73 - compensation for damage by the guilty party;

- Dt 50 Kt 75 - the founder made a contribution in cash;

- Dt 70 Kt 50 - issuance of wages to employees from the cash register;

- Dt 71 Kt 50 - cash issued to the accountable person;

- Dt 66 (67) Kt 50 - repayment of the loan or interest on it in cash, etc.

Postings to account 50 are applied in accordance with Order of the Ministry of Finance No. 94n.

Table of accounting entries for account 50

As a rule, cash payments are used in organizations whose activities are related to retail trade. After all, the amount of revenue that the company receives goes to the cash desk in the form of cash. Let's look at typical cash transactions in retail organizations:

| Dt | CT | Description | Document |

| 50.01 | 90.01.1 | Receipt of sales proceeds to the organization's cash desk | Cash register |

| 50.01 | 90.01.1 | Receipt of income from other operations into the organization's cash desk | Cash register |

| 50.01 | Transfer of cash from the cash desk to the bank for subsequent crediting to the organization’s current account | Account cash warrant | |

| 55.01 | 50.01 | Transfer of cash from the cash desk to the bank for subsequent crediting to a special account of the organization | Account cash warrant |

An enterprise can use its own cash to pay contractors (suppliers of goods, contractors, etc.). These transactions are reflected in accounting by the following entries:

| Dt | CT | Description | Document |

| 50.01 | Payment to the supplier (contractor) for goods received (work performed) | Account cash warrant | |

| 50.01 | Refund of advance payment to the buyer from a special bank account | Account cash warrant | |

| 76 | 50.01 | Repayment of debt to other counterparties | Account cash warrant |

| 04 | 50.01 | Acquisition of an intangible asset | Account cash warrant |

An important aspect of using account 50 is the accounting of cash settlements with personnel. Through the cash register, an enterprise can pay:

- employee remuneration (salary, bonuses, allowances, etc.);

- funds to report for business needs;

- travel expenses.

Accounting for these transactions is reflected in the following entries:

| Dt | CT | Description | Document |

| 50.01 | Payment of salaries to employees in cash through the cash register | Account cash warrant | |

| 50.01 | Return to the cash desk of unused funds issued to an employee for business needs | Receipt cash order | |

| 73 | 50 | A loan was issued to an employee of the company | Account cash warrant |

| 50 | An employee of the company was given an advance for a business trip | Account cash warrant | |

| 69 | 50 | Debt on contributions to social funds was repaid in cash through the cash register | Account cash warrant |

In addition, account 50 is used to reflect cash settlements with the company’s shareholders, as well as with the participants of the partnership:

| Dt | CT | Description | Document |

| 75 | 50 | Dividends were paid to shareholders | Receipt cash order |

| 80 | 50 | The debt to the participants of the simple partnership has been repaid | Receipt cash order |

| 81 | 50 | Redemption of the organization's own shares | Receipt cash order |

| 58.4 | 50 | Contribution of cash by a participant as a contribution to the partnership share | Receipt cash order |

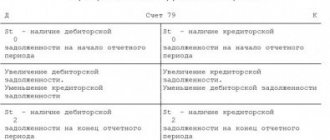

Balance sheet for account 50

The balance sheet is the most popular accounting register, in which information is grouped as follows:

- balance at the beginning of the period (Dt/Kt);

- turnover for the period (Dt/Kt);

- balance (balance) at the end of the period (Dt/Kt).

The balance sheet for account 50 is usually given in this form:

The report is very convenient to use. It displays data on balances and turnover for any accounting account or subaccounts. Also, with its help, the user receives detailed information on analytical accounting for the accounting account. For example, for subaccount 50.3 “Cash documents” you can generate such a statement detailing the balance and turnover for all types of documents related to cash.

Accounting account 50 is an active account used in accounting to reflect the movement of cash of an organization (individual). Postings to this account include transactions for the receipt and withdrawal of cash from the cash register. All actions with cash must be carried out on the basis of accompanying documents. Thanks to the 1C program reports “Turnover balance sheet” and “Account card”, it is possible to quickly obtain detailed information on the movement of funds broken down by period.