When to use account 46

According to the Chart of Accounts, account 46 is called “Completed stages of work in progress” (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n). Therefore, score 46 is most in demand in construction.

Thus, accounting entries for account 46 are made to summarize information about stages of work completed in accordance with concluded contracts that have independent significance.

By virtue of the official instructions for account 46, it is, if necessary, used by organizations performing long-term work, the initial and final deadlines for which usually relate to different reporting periods.

For example, entries in accounting account 46 in construction can directly reflect construction, as well as scientific, design, geological, etc. work.

The accounting department maintains analytical accounting for account 46 by type of work.

KEEP IN MIND

Completed stages of work can be reflected on account 46 only if they are paid for by the customer.

The use of account 46 must be specified in the organization’s accounting policies.

The need to use account 46

As can be seen from the example, this account reflects exclusively the contractual cost of the construction project. Since amounts are reflected in this account only after payment by the customer, maintaining it allows you to clearly see the cost of the contract. At the same time, these operations increase the complexity of accounting.

The use of counting has supporters and opponents. The feasibility and necessity of its use for construction organizations has not been approved by any legislative act. Existing regulatory documents are in the nature of recommendations.

Account calculation procedure 46

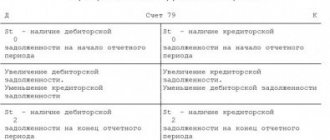

The debit of account 46 takes into account the cost of stages of work completed by the organization, paid by the customer, accepted in the prescribed manner, in correspondence with account 90 “Sales”.

At the same time, the amount of costs for completed and accepted stages of work is written off from the credit of account 20 “Main production” to the debit of account 90 “Sales”. The amounts of funds received from customers in payment for completed and accepted stages are reflected in the debit of cash accounts in correspondence with account 62 “Settlements with buyers and customers”.

Also see "".

The procedure for closing account 46 is as follows: upon completion of all work as a whole, the cost of the stages paid by the customer, recorded on account 46, is written off as a debit to account 62.

Accounting entries with account 46

The list of transactions using account 46 and accounts directly related to it within several stages of the project is as follows:

- Dt 51 – Kt 62 – receipt of an advance for a specific stage of work from the customer;

- Dt 20 – Kt 10 (69, 70) – reflection of the contractor’s costs for completing a specific stage;

- Dt 46 – Kt 90 – completion of the first stage;

- Dt 90 – Kt 20 – write-off of the cost of the first stage;

- Dt 90 – Kt 99 – reflection of the financial result of the completed stage;

- Dt 46 – Kt 90 – delivery of the next stage of completed work;

- Dt 20 – Kt 10 (69, 70) – reflection of the contractor’s costs for fulfilling the conditions under the drawn up contract;

- Dt 90 – Kt 20 – the fact of writing off the cost of all costs necessary to complete the second stage;

- Dt 90 – Kt 99 – reflection of the financial result of the second completed stage;

- Dt 62 – Kt 46 – actual write-off of the amount for all completed stages;

- Dt 51 – Kt 62 – receipt of final payment from the customer for the completed project.

Basic account transactions $46$

The debit of the account $46$ reflects the cost of the stages of work that were paid by customers and completed. The following works were also accepted:

- Dt $46$ – Ct $90$.

- Dt $90$ – Kt $20$ (simultaneously with the previous one) – for the amount of costs.

- Dt $50, 51$ – Kt $62$ – receipt of funds from the customer for accepted work, goods, services.

Upon completion of all work, the entire cost of the stages paid by the customer, which was collected on the account $46$, is written off as a debit to the account $62$.

- Dt $62$ – Ct $46$

The cost of fully completed work, which was invoiced at $62, is offset by previously received advances and the amount received in final payment from the customer.

Finished works on a similar topic

- Course work Features of product accounting when using an account 46,450 rubles.

- Abstract Features of product accounting when using the account 46,270 rubles.

- Test work Features of product accounting when using an account 46,210 rubles.

Receive completed work or specialist advice on your educational project Find out the cost

Analytical accounting is carried out by type of work.

The account is used to calculate intermediate stages of work performed. According to the accounting regulations, the contractor can use two methods for determining income from the delivery of construction work :

- Income based on the cost of the construction project

- Income based on the cost of work as it is completed.

In the first case, the financial result is determined after the complete completion of construction of the facility. Production costs are reflected in the debit of the account $20$, from the beginning of construction to its completion.

In the second case, the financial result is determined upon completion of individual works, according to the design stages provided for by the project, and the costs associated with them. The use of this method is used if the work performed and costs can be estimated. The costs of the work are taken into account by the contractor on an accrual basis. Same as work in progress.

Examples of accounting transactions on account 46

The use of this account is considered appropriate if organizations carry out activities and accept payment for them in stages.

The strictly negotiated price of the object is subject to reflection on the invoice. On the other hand, there are difficulties in the accounting process.

In the case of stage-by-stage delivery of the object, the transfer of ownership does not take place, so the company cannot say that all operations relate to direct sale.

The full amount of contractual terms reflected in the debit of account 46 is essentially revenue, but it is not presented to the customer. Therefore, these accruals relate to other assets and are recorded in line 1260.

Account 46 in accounting

In an economic sense, account 46 in accounting describes the progress of the production process and shows the implementation of work allocated under the contract to independent sections.

Conditions for reflecting transactions - the agreement is concluded for a long term and provides for phased execution of acts, preliminary step-by-step payment. A long period is characterized by activity in the scientific, cartographic, and construction industries. By long-term is meant a contract under which the completion of work occurs in a reporting period different from the beginning.

Count 46 – characteristic

The financial nature of the register is ambiguous. It refers to active, inventory accounts, that is, taking into account information about the organization’s property. But the company ceases to own the property after signing the acceptance certificate. It turns out that the account collects information about fulfilled obligations, and not about material objects.

A similar dispute is caused by the reflection in the balance sheet. Standard accounting programs generate line 520 “Other long-term liabilities” for the advance received. And the cost of work performed is included in line 213 “Costs in work in progress.” There is no separate column provided.

According to PBU 4/99, financial statements must be reliable (clause 6), indicators are expressed in a net estimate (clause 35). Consequently, the advance received from the customer must be reduced after partial delivery.

The conclusion is also confirmed by the fact that account 46 in accounting contains information about the cost of paid work (Chart of Accounts), that is, about revenue. Work in progress is formed from the expenses of the enterprise - this results in unreliable information.

Based on the above arguments, it is more correct to show 62 invoices minus completed stages in the balance sheet.

Account 46 – postings

Debit account assignments are compiled on the basis of acceptance certificates for work sites. Upon completion of the entire volume specified in the contract, credit transactions are formed. Analytical accounting is built for each contract.

Example

The contract dated April 1 stipulates the construction of a woodworking shop on the site of a former dry cleaner. The due date is September 15. The hotel points highlight the stages - demolition of the building, installation of a heating system. The price of the agreement was 750 thousand rubles. An advance payment of 480 thousand rubles was transferred.

| Debit | Credit | Amount, thousand rubles | Name |

| 51 | 62 | 480 | Advance payment received |

| 76. AB | 68 | 73, 22 | Value added tax charged on advance payment |

| 68 | 51 | 73, 22 | VAT transferred |

| 46 | 90 | 80 | The old building was dismantled in May |

| 90 | 20 | 50 | Dismantling costs written off |

| 68 | 12, 20 | VAT according to the act | |

| 99 | 17,80 | The financial result for May is reflected | |

| 68 | 76. AB | 12, 20 | Part of the VAT calculated on the advance payment has been credited |

Balance as of June 1:

| Check | Amount, debit | Amount, credit | Explanation |

| 76.AB | 61,02 | Remaining VAT on advance payment | |

| 62 | 400 | Minus the indicator at 46 |

In July, the workshop was built, the construction of the building was estimated at 600 thousand rubles:

| Debit | Credit | Amount, thousand rubles | Name |

| 46 | 90 | 400 | The balance from the customer's advance payment |

| 62 | 90 | 200 | Reflection of the unpaid portion |

| 90 | 20 | 470 | Costs written off |

| 68 | 91,53 | VAT charged | |

| 99 | 38,47 | Profit for July reflected | |

| 68 | 76.AB | 61,02 | The balance of VAT calculated from the advance payment is credited |

Balance as of August 01:

| Check | Amount, debit | Amount, credit | Explanation |

| 76 | 0 | Remaining VAT on advance payment | |

| 62 | 200 | Minus the indicator at 46 |

In September, a certificate of completion of construction is signed:

| Debit | Credit | Amount, thousand rubles | Name |

| 62 | 90 | 70 | Reflection of unpaid stages |

| 90 | 20 | 40 | Costs written off |

| 68 | 10,68 | VAT charged | |

| 99 | 19,32 | Financial results | |

| 51 | 62 | 270 | Receivables transferred by the customer |

| 62 | 46 | 480 | Completion of the contract |

Attention! Account 46 “Completed stages of work in progress” is closed after final payment under the agreement. Signing the acceptance certificate is not the basis for generating a credit entry in accordance with the Chart of Accounts.

Source: https://spmag.ru/articles/schet-46-v-buhgalterskom-uchete

What is it used for?

The invoice is intended to provide information about work completed in accordance with the agreements drawn up, which have independent significance.

If necessary, it is used by firms carrying out long-term work, the beginning and completion of which usually relates to different reporting time intervals. That is, more often we are talking about the field of construction, science, geology. The debit of this direction records the cost of stages of work paid by the customer. This is done in the manner prescribed by law, in correspondence with account 90 “Sales”.

At the same time, the amount of costly areas for completed and accepted stages of work is written off from account 20 “Main production”. Amounts of money received from customers are reflected in the debit of the direction in question in correspondence with account 62 “Settlements with customers”.

When the work process comes to an end, the price paid by the customer for the stages, appearing on invoice 46, is written off to 62. The cost of measures that have been completed in full is subject to repayment through advances and other amounts that were previously received from the customer. As a result, the final calculation is obtained, correspondence with the debit of the accounting accounts is observed.

Analytical accounting activities are carried out in accordance with the types of work. Based on the description given, we can conclude that the 46 account is often used with the following accounts:

- 90 – when reflecting the cost indicator of the stages of work that were paid by the customer;

- 62 – write-off of the cost of work stages after their completion in general;

- 20 – upon completion and acceptance of work that has been fully completed.

In addition, the direction is of a calculation nature and is used to calculate the cost of products, goods, works, services that were produced during the reporting time period. In order to calculate the financial result for intermediate types of work, two key directions are used:

- For construction projects, the determination is made strictly after the completion of construction of the facility.

- Based on the type of work that was completed - based on the completion of individual areas of work, when they can be objectively and fully assessed.

Thus, the account has many features and accounting subtleties taken into account.

2.1. Features of accounting in construction using account 46.

According to accounting rules, revenue is always recognized on an accrual basis.

This is reflected in the credit of account 90.1 “Sales revenue”. And the moment of recognition of revenue for tax accounting may depend on the accounting policy adopted by the organization (accrual, cash basis, simplified tax system or UTII).

However, there is a very interesting and economical accounting in construction using account 46 “Completed stages for work in progress.” A peculiarity of using account 46 is the fact that revenue for both accounting and tax accounting is recognized not on an accrual basis, not on a cash basis, but somewhat differently.

1. Revenue for accounting and tax accounting is recognized at the time of completion of work under the act, but subject to payment for these works by the customer (under the contract, ownership begins at the time of payment for work performed under the act by the customer).

2. Revenue for accounting and tax accounting is recognized at the time of completion of all work under the contract, but subject to payment for these works by the customer (under the contract, ownership begins at the time of payment for work performed under the contract as a whole by the customer).

3. Revenue for accounting and tax purposes is recognized at the time of completion of the project as a whole, but subject to payment for all work by the customer (under the contract, ownership begins at the time of payment for work performed on the project as a whole by the customer). Revenue for accounting and tax purposes is recognized at the moment of transfer of ownership upon delivery of the object (according to the contract, ownership begins at the moment the object is put into operation to the customer).

Using all these options for recognizing revenue allows you to use account 46 “Completed stages for work in progress” in accounting. Until revenue is recognized in the first case, completed stages of work are reflected in the credit of account 46. After receipt of payment for work performed, i.e.