How are production defects taken into account?

A manufacturing defect should be considered a product that was processed during the production process, but does not meet the established criteria. At the same time, products that, according to their characteristics, have higher values of the criteria provided for by the relevant documentation cannot be considered defective. This product will be considered better than standard.

Downgrading of products from a high grade to a lower grade is not considered a defect. For example, premium flour and 1st grade flour.

The decision to recognize a product as defective is made by the technical control department. At the same time, an act is drawn up. The technical control department identifies and determines whether the defect can be corrected, or whether it should be written off as an enterprise expense. Hence it is divided into correctable and incorrigible.

In this case, defects detected at the manufacturer are called internal. If it was found by consumers, then it should be classified as external.

If technical control recognizes the product as defective, its cost from account 20 should be written off to account 28 manufacturing defects.

After making a decision about the possibility of correcting the defect, the same account reflects information about all the costs incurred by the enterprise to correct it - the cost of materials, wages with deductions, services of third-party companies, etc. These costs are reduced by amounts reimbursed by the guilty parties.

Attention! When a defect is recognized as irreparable, its cost is written off to the appropriate accounts of other costs, minus the amounts of materials that can be used after disassembling the product, taking into account the reimbursement of costs by the guilty parties.

In this case, an act for writing off defective products is drawn up. Typically, those parts of the original product that have retained their usefulness come into stock and can be separated from the main product without loss of properties and reused in the production of new products. The cost of such materials is determined based on the price of their possible use.

If a company produces products for which it sets a strictly defined warranty period, then it is obliged to create a reserve for warranty repairs on account 96. In this situation, losses from external defects are compensated for by it.

The perpetrators of defects can be both internal (employees) and external (suppliers of low-quality material). If the supplier is to blame for the defect, then a claim is made to him, and the amount of compensation received is counted towards reducing the cost of correcting the defect.

Attention! If an employee is found guilty of committing marriage, then the amount of expenses that must be covered from his salary is established. The law establishes that it is allowed to withhold no more than 20% of the salary each month.

Manufacturing defect: a good thing won’t be called that

In the field of production, a defect is a product or its element (it can be a semi-finished product, part, assembly), the quality of which does not fit into the norms, standards, technical conditions adopted at the enterprise, and which is impossible to use for its intended purpose or is only permissible with additional adjustments that require costs. .

FOR YOUR INFORMATION! The definition of manufacturing defects, used in modern legal acts, repeats clause 38 of the Basic Provisions for Planning, Accounting and Calculation of Costs at Industrial Enterprises, approved by the State Planning Committee of the USSR, the State Committee for Prices of the USSR, the Ministry of Finance of the USSR and the Central Statistical Office of the USSR on July 20, 1970.

What is included in financial losses as a result of marriage:

- irreparable costs for the cost of a defective product (money for raw materials, salaries to employees, payment of energy for equipment operation, etc.);

- expenses for corrective actions to bring the product to acceptable quality (this includes remuneration for workers’ labor and funds for equipment maintenance);

- funds for identifying and formulating defects (for example, creating a list of typos);

- reimbursement to the consumer of low-quality products for the expenses incurred by him (these include the cost of replacing or correcting a product whose quality did not suit the consumer, including transportation costs for its delivery).

The following are not considered a manufacturing defect:

- products for which at a particular enterprise there are special requirements that differ from the standard ones for similar products, although the quality meets the standard requirements, but does not fit into the increased ones;

- losses associated with downward transition to another type of product.

The acceptable percentage of defects is the minimum acceptable level of non-compliance with quality. Depends on the nature of production and established quality criteria. At developed enterprises it should not exceed 2-3%, up to a maximum of 5%. Excess is a reason to worry about finding the causes and influencing the detected problems.

Characteristics of 28 accounts in accounting

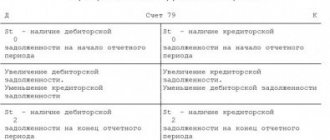

To account for defective production products in the Chart of Accounts, account 28 is used. It is active, as it reflects the cost of defective products and the cost of correcting them at the beginning of the period.

You might be interested in:

Account 02 in accounting: Depreciation of fixed assets

The debit of account 28 reflects the cost of defects identified in production, as well as all costs incurred by the company to bring products to the standards required by regulations.

The credit of the account reflects the cost of the corrected finished product, or the cost of defects written off as costs due to the impossibility of correction, as well as the cost of material assets that can be used, amounts attributed to the guilty parties, etc.

The debit balance of account 28 is determined by adding the initial balance to the debit turnover of the account and subtracting from it the loan amounts for the period under review. Subaccounts 28 accounts

Analytical accounting for account 28 is built in accordance with the characteristics of the activities carried out by the enterprise.

Subaccounts to this account can be opened:

- By structural divisions where product defects occurred.

- In types of defective products.

- According to cost items for correcting defective products.

- Due to the reasons for the occurrence of defects in production.

- For the guilty persons, as a result of whose activities or inaction a defect occurred in production.

Example of using count 28

At a plant producing various metal parts, the quality control service identified a defective product, which a specialist characterized as an irreparable defect. The acceptance committee conducted an inspection and determined that the defect arose through the fault of the employee. The following calculation was made:

- the cost of creating a part, including costs for casting, wages, experimental work and experimental work, amounted to 50 thousand rubles;

- It is possible to sell a defective part for scrap and receive 12 thousand rubles;

- 10 thousand rubles were collected from an employee of the enterprise;

- Uncompensated damage amounted to 28 thousand rubles.

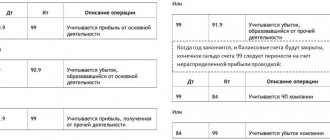

Which accounts does it correspond with?

Account 28 can correspond with the following accounts:

From the debit of account 28 to the credit of accounts:

- Account 10 - when writing off materials for repairing defects;

- Count 20 - when a defective product is detected in production;

- Account 21 - when writing off your own semi-finished products to correct defects;

- Account 23 - when correcting defects through auxiliary production;

- Account 25 - when writing off part of the overhead costs for correcting defects;

- Account 26 - when writing off part of the administrative expenses to correct the defect;

- Account 40 - when adjusting the cost of products by the amount of defects;

- Account 43 - when returning defective finished products from the warehouse;

- Account 60 - regarding the costs of suppliers attributed to correcting defects;

- Account 69 - in terms of accruals to social funds for wages attributed to the correction of marriage;

- Account 70 - regarding the amount of wages for employees involved in correcting marriages;

- Account 71 - when writing off the expenses of accountable persons to correct the defect;

- Account 76 - when writing off expenses for other work and services to correct defects (for example, utilities);

- Invoice 91 - when the buyer returns a defective product.

According to the credit of the account, it corresponds with the debit of the following accounts:

- Account 10 - when recording part of the defect as materials for further use;

- Account 20 - when writing off the costs of defects to the cost of production;

- Account 23 – when writing off the costs of defects as expenses of auxiliary production;

- Account 29 – when writing off the costs of defects as expenses of servicing production;

- Account 73 - regarding the write-off of expenses for eliminating defects to the guilty person;

- Account 76 - when writing off losses from defects due to insurance;

- Account 91 - when writing off the cost of defects for other expenses of the organization;

- Account 96 - when reimbursement of expenses for eliminating defects from the reserve (if it is formed);

- Account 99 - when writing off expenses for defects arising due to force majeure circumstances.

You might be interested in:

UIN in a payment order: what is it, where can I get it from 2020

Characteristics of defective products

According to the time of determination, marriage is divided into:

- internal - the product is recognized as non-compliant with standards at production, before being sent for sale or to the consumer;

- external - discovered by the consumer himself during operation or in the process of preparing for work.

If the manufacturer discovers a defect during the production process, depending on the nature of the quality discrepancies found, the following forms of defect can be distinguished:

- correctable - subject to adjustment, appropriate from the point of view of the invested funds;

- incorrigible – unsuitable for further use, a product that is irrevocably damaged.

IMPORTANT! The combination of these characteristics forms the final cost of defects made in production.

Financial losses from different types of marriage

- Internal incorrigible:

- the cost of wasted raw materials;

- labor remuneration of employees (including social charges);

- means for equipment maintenance;

- shop expenses.

- Internal fixable:

- the above expenses (direct expense items);

- direct costs for correcting defective products and bringing them up to standard.

- External incorrigible:

- cost of goods rejected by the buyer;

- reimbursement to the consumer of the amount he paid for the defective product;

- expenses for dismantling assembled products with detected defects;

- transportation costs associated with replacing the product or delivering it for repairs;

- selling expenses since the goods have already been sold.

- External fixable:

- all of the above financial losses from external defects (except for the costs of replacing goods);

- expenses for repairing defective goods from the consumer (raw materials, supplies, equipment, employee benefits, etc.).

NOTE! From the final amount of losses, you need to subtract funds that can be returned: the ability to reuse unusable products or their elements, funds collected from suppliers for substandard raw materials, monetary sanctions in the event of agreed liability for defective products.