“Northern” bonuses for employees of regional budgetary institutions under the age of 30 may be extended to residents of Karelia as early as April. Now young specialists from the Murmansk, Arkhangelsk and Amur regions, the Komi Republic, Primorsky Territory and other regions of the Far North and equivalent areas have the right to such payments from the first day of work. The first reading of the relevant bill will take place on February 20 in the Legislative Assembly of Karelia, the Federation Council Committee on Agricultural and Food Policy and Environmental Management told Izvestia. The total annual financing of such payments will cost the entity about 34 million rubles. Municipal authorities and business representatives are also working on appropriate measures. At the same time, trade unions are demanding that the age limit be removed from the bill.

Harmful working conditions

What factors are harmful to health for people staying in this region? The answer will not be original:

- It is constantly cold here; low temperatures can reach 50 degrees below zero.

- There are not enough vitamins that a person needs for normal life.

- Daylight hours are short compared to other regions of the country.

And in view of the above, the state compensates for harmful working and living conditions to all employees who are officially employed in the workplace with additional pay. Its size ranges from 10 to 100% of the salary.

https://youtu.be/CsPR1yBsv3w

How is the premium calculated?

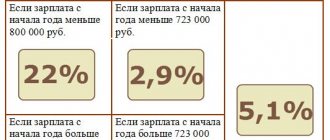

The so-called northern ones are calculated depending on the salary established for a particular employee. The rights of citizens and the rules for calculating surcharges are described in the Labor Code of the Russian Federation (Article 315 and 317).

There are several nuances that need to be taken into account. Everyone who wants to go to this region to earn money should know how northern bonuses are calculated.

The amount of the bonus for workers in the Far North depends on the employee’s length of service, the category of the region, the age of the employee and other factors. Let's consider the main nuances.

Regulatory framework

The main legislative act, according to which workers in the North and other territories with difficult conditions have the right to receive an additional payment to their salary, is the Labor Code (Chapter 50). Along with this, the procedure for calculating northern allowances, their size and other issues are reflected in the following regulatory and legislative acts (some of them were adopted during the existence of the Soviet Union, but have not yet been canceled and continue to be in effect):

- Law of the Russian Federation No. 4520-1 “On state guarantees and compensation for persons working and living in the RKS and equivalent areas” (02/19/1993);

- Decree of the Presidium of the USSR Armed Forces No. 1908-VII (09/26/1967);

- Order of the Ministry of Labor of the RSFSR No. 2 (11/22/1990);

- Resolution of the Central Committee of the CPSU, the Council of Ministers of the USSR and the All-Union Central Council of Trade Unions No. 255 (04/06/1972);

- Resolution of the Central Committee of the CPSU, the Council of Ministers of the USSR and the All-Union Central Council of Trade Unions No. 53 (01/09/1986).

- How to connect your phone to TV

- Red Riding Hood Salad with Pomegranate: Recipes

- Alcohol removal table for the driver

Some nuances of calculating allowances

There are four categories of regions in the Far North of the country. Depending on which of them the calculation occurs, the regional coefficient changes.

- Employees of the district, which belongs to the first category, do not receive any additional payments for the first six months of work. After this time, the increase will be 10% of the salary. And after six months it increases by another 10%. And thus, the bonus will change upward until it reaches 100% of the employee’s salary. After this, it will not change, provided the salary is stable. If the employee’s salary decreases or increases, then corresponding changes will be observed in the area of calculating northern allowances.

- If an employee works in a region that belongs to the second category, then he is entitled to northern additional payments after six months from the date of employment. They make up 10% of the salary. The increase in the bonus will initially occur every six months by 10%, until the level of 60% of the employee’s salary is reached. Then the increase is carried out once a year by 10% to a level of 80%.

- For employees who work in a region belonging to the third category, the first allowances are provided only after their work experience reaches 12 months. It will be 10% of the salary. The increase in the allowance will be carried out once a year. This will occur before the northern surcharge reaches 50%.

- For residents of the Far North working in a region defined as category 4, the bonus is accrued upon expiration of 12 months of work experience. After this, it will increase once a year until the level of 30% of the salary is reached.

In order to understand how northern bonuses are calculated, you need to know that they are due to all employees who work in the regions of the Far North. This, as mentioned earlier, applies not only to those who live there on a permanent basis, but also to those working on a rotational basis.

How are northern bonuses calculated for shift workers? This happens regardless of whether the citizen works on a permanent or temporary basis, whether he has a part-time job, and so on. Only information about the employee is taken into account, namely length of service and class.

Northern supplement for young people under 30 years of age born in the Far North

Please note that the northern allowance has different calculation rules from the generally accepted ones. Until 2005, additional incentives were used for young professionals with specialized higher or secondary education who had not reached the age of 30. Since 2005, a new approach to calculating the increase has been in effect:

Duration of residence in the RKS until December 31, 2004

Increase amount from date of hire

The maximum amount of additional payment in accordance with the area group is from 30 to 100% of the salary or rate

Accelerated accrual procedure

Normal accrual procedure

Expedited payment procedure

According to Resolution No. 458, the northern allowance up to 30 years for citizens who began their working career in the RKS after 2004 and have lived in this region for at least 12 months have the right to apply for an accelerated assignment of the additional payment:

Maximum reward percentage

Work experience after which the right to additional payment arises, months

Initial increase amount

Increment step (% growth over a certain period)

Required work experience, months

Please note that for the first and second groups of regions, the length of service varies from six months to 12 months. This means that when the size of the supplement for those born in the RKS reaches 60%, the period required for a subsequent increase will no longer be six months, but a year.

Youth allowance calculations

For young people, special rules and procedures for calculating bonuses in the northern regions of the country have been determined. This is due to the fact that young people are reluctant to be involved in work in the regions of the Far North of the Russian Federation. Let's look at how northern bonuses are calculated for young people under 30 years of age.

- The area belongs to the first category.

Accrual occurs six months after employment, subject to successful work at the enterprise. The first increment is 20% of the salary. The next one will be charged in another six months and also at 20% - and so on until the level of 60% is reached. Then the increase will occur once a year up to 100% of the salary.

- An area belonging to the second category.

In order to answer the question of how northern bonuses are calculated for youth under 30 years of age in Khanty-Mansi Autonomous Okrug, it should be noted that this district belongs to the second category. In this area, the first accrual is made after six months from the start of work, it is 20% of the salary. It will then increase every six months by 20% until the level of 60% is reached. After this, after a year, the premium can be increased by another 20%.

- The area belongs to the third category.

In this region of the Far North, the bonus is 10% and increases every six months until it reaches 50% of the employee’s salary.

- The area belongs to the fourth category.

The bonus is 10% of the salary. Increases three times every six months.

Northern youth supplement up to 30 years of age

- Economic realities in the country have changed significantly since the very concept of northern allowances was introduced. Modern specialists evaluate their prospects differently than workers did in the USSR. Comfortable living conditions and a mild climate are becoming more preferable to people than high wages. Even a 100% premium cannot fully cover the needs of a young specialist of the 21st century or satisfy his ambitions.

- Private enterprise in the Far North is finding its own ways to benefit from allowances. Financiers calculate payments provided for by law and calculate wages based on these indicators. By understating wages in the region, private traders negotiate in advance with the applicant the conditions for a gradual increase in salary. Young people under 30 who are unfamiliar with the scheme may think they are benefiting from the benefits but are actually receiving an average salary even with all the bonuses. Low labor prices in the Far North only deter promising specialists. It is impossible to fight this.

This is important to know: Conditions for payment of benefits up to 3 years

Russians remember the northern bonus, which was calculated from the first day of work in the Far North. She was considered very attractive in the eyes of young people, especially university graduates who grew up in the northern part of Russia. Only specialists who had lived in areas with a harsh climate for at least five years were entitled to the bonus.

How are military accruals made?

If you are interested in the question of how northern bonuses are calculated for military personnel, then you need to know that for citizens who perform military service in the Far North, there are several of them, and they are calculated depending on certain factors. These include rank and length of service, in other words, length of service. Allowances are calculated based on the size of the military personnel’s salary. An interesting fact is that when periodically living in the Far North, these gaps can add up to each other, even if some breaks were observed. This applies not only to military personnel, but also to persons who serve in internal affairs bodies.

In order to qualify for the bonus, you must first submit an application addressed to the commander. If the request is not satisfied, then you need to contact the prosecutor's office to resolve this dispute.

How to calculate the salary amount taking into account northern percentages?

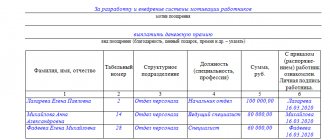

Here are some examples of calculating remuneration taking into account benefits.

A young employee under 30 years old works in Vorkuta. Salary – 50,000 rubles. After he has worked for 6 months, his salary increases by 20%. Then 50,000 rubles are added to the base amount, multiplied by 0.2, that is, the benefit will be in the amount of 10,000 rubles. – salary will increase to 60,000 rubles. When the rate increases to 80%, the final reward will be 90,000 rubles.

The worker is 42 years old, he works in the Koryak Autonomous Okrug. The salary is 60,000 rubles. Every six months it increases by 10%. After 5 years, the employee will earn 120,000 rubles. (the coefficient in this area is 100%).

Also, people who have worked in the Far North for 15-20 years are allowed to retire before reaching retirement age. Women can become pensioners at 50 years old. For men, old-age pension benefits are granted at age 55.

What is the northern surcharge coefficient

The northern bonus coefficient is an indicator that increases the established level of an employee’s salary by a certain amount. This is a percentage that depends on the region and other factors in the employee’s working conditions.

In order to answer the question of how to calculate northern allowances in the Yamal-Nenets Autonomous Okrug up to 30 years of age, it must be said that their coefficient is established by law. But local authorities have the right to increase the amount of the surcharge, subject to the availability of additional funds in the district budget. In the Yamal-Nenets Autonomous Okrug and Khanty-Mansi Autonomous Okrug currently this indicator varies in the range from 0.1 to 0.27. Specific numbers can only be obtained at the enterprise, for which you should contact the personnel department or accounting department.

And in order to understand how northern bonuses are calculated in the Komi Republic, we note that the regional coefficient here is 1.6.

Northern youth supplement up to 30 years of age

- Economic realities in the country have changed significantly since the very concept of northern allowances was introduced. Modern specialists evaluate their prospects differently than workers did in the USSR. Comfortable living conditions and a mild climate are becoming more preferable to people than high wages. Even a 100% premium cannot fully cover the needs of a young specialist of the 21st century or satisfy his ambitions.

- Private enterprise in the Far North is finding its own ways to benefit from allowances. Financiers calculate payments provided for by law and calculate wages based on these indicators. By understating wages in the region, private traders negotiate in advance with the applicant the conditions for a gradual increase in salary. Young people under 30 who are unfamiliar with the scheme may think they are benefiting from the benefits but are actually receiving an average salary even with all the bonuses. Low labor prices in the Far North only deter promising specialists. It is impossible to fight this.

Russians remember the northern bonus, which was calculated from the first day of work in the Far North. She was considered very attractive in the eyes of young people, especially university graduates who grew up in the northern part of Russia. Only specialists who had lived in areas with a harsh climate for at least five years were entitled to the bonus.

last information

Given the difficult economic situation in the country, there have been rumors that the northern surcharges could be abolished. But it is worth saying that to date such a decision has not been made at the state level. So no need to worry. Moreover, government authorities intend to further encourage the work of citizens who carry out their activities in the difficult conditions of the north of the country.

Despite the fact that various restrictions and sanctions have been applied to the Russian Federation, the authorities are striving to ensure that workers in the Far North do not lose their benefits and allowances.

Conditions for calculating additional payment

In order to receive a salary increase, an employee or employee must independently contact his superiors with a request to assign it. Without the direct participation of a citizen who claims an additional payment, nothing will happen by itself. If the request is not granted, you can always contact the local prosecutor’s office to resolve these issues.

To apply for an allowance, you will need to collect a package of documents that can certify your right to receive these additional payments and incentives. All conditions will have to be complied with. Before applying, you should carefully read the accrual conditions. Because if some of them are not met, a refusal will be received.

The important date for calculating additional payments for young people is December 31, 2004. For those who have lived in the northern regions for more than one year at the time of this date and began working after December 31, northern allowances will be accrued at an accelerated rate. Those who started working before the established date receive a bonus, which will be accrued as usual.

After 30 years...

How are northern bonuses calculated after 30 years in the RKS? For citizens who have worked for a long time in the Far North of the country, some incentives are provided in the form of the opportunity to retire a little earlier than others. To do this, certain conditions must be met.

Thus, women have the opportunity to receive a pension after reaching the age of 50, but at the same time their work experience in the northern regions must be more than 15 years, and their total work experience must be at least 20 years. By the way, when calculating a pension and additional payments to it, the length of service includes maternity periods before and after childbirth. As for northern men, they can receive a pension after 55 years, the northern length of service should be 20 years, and the total length of service should be 25 years.

If a citizen worked in the North less than the established norms, but more than 7.5, then, in order to retire earlier, some incentives are also provided for this category of citizens. For each subsequent year of work, the retirement date approaches 4 months.

About northern bonuses for employees under 30 years of age

The only benefit remaining for young people living in the northern regions was the procedure for calculating the bonus approved by Resolution of the Council of Ministers of the RSFSR dated October 22, 1990 No. 458 “On the streamlining of compensation for citizens living in the northern regions.” It establishes that young people who have lived in the Far North for more than 1 year receive a bonus for the first six months in the amount of 20% and subsequently 20% is accrued every 6 months until they reach 60%, then 20% for each year of work. For areas equated to the regions of the Far North - 10% for every 6 months until the maximum established by law is reached. This provides an accelerated option for increasing interest payments for young people in the Far North. If an employee has just moved to the north to perform work duties, then this procedure begins to apply for a young person under 30 years of age after a year of work. This point of view is confirmed by the letter of the Ministry of Health and Social Development dated January 20, 2005 No. 25-Pr and No. 97 - Pr, as well as the Resolution of the Presidium of the Supreme Court of the Russian Federation dated December 8, 2010.

Based on the Resolution of the Presidium of the Supreme Court of the Russian Federation dated December 8, 2010, persons under the age of 30 who entered into labor relations with organizations located in the Far North and equivalent areas during the period from January 1, 2005, even if they have lived in the specified places for at least five years, the salary supplement in question can only be paid in accordance with Art. 317 Labor Code and Art. 11 of the Law of the Russian Federation “On state guarantees and compensation for persons working and living in the regions of the Far North and equivalent areas” (as amended by Federal Law N 122-FZ), which provides for the establishment of the amount and procedure for its payment in the manner prescribed for establishing the size of the regional coefficient for the wages of employees of organizations located in the specified regions and localities, and the procedure for its application, that is, for organizations financed from the federal budget by the Government of the Russian Federation.”

As you can see, it links the calculation of the percentage premium in full to the start date of work.

Judicial practice also does not work out in favor of the employee in this regard:

According to the above, the employee must start working in the northern region before 01/01/2005 and live there for 5 years before that, only in this case can he count on the full bonus. In all other cases - on a general basis.

This is important to know: Non-State Pension Fund of Metallurgists: when will payments be made?