Before you start filling out the report, you must select the type of information form to be submitted.

So, SZV-KORR (cor.) - “corrective”

— replaces previously submitted data regarding the insured person with new ones.

SZV-KORR (about

— completely cancels the previously submitted information.

SZV-KORR (special) - “special”

— enters data about the insured person that was not indicated in the previously submitted reports.

Filling out the information begins with adding the employee for whom the information is being adjusted.

- SZV-KORR with “corrective” type

- SZV-KORR with “cancelling” type

- SZV-KORR with “special” type

The procedure for filling out sections of SZV-KORR depending on the type

Depending on the type of the SZV-KORR form, certain sections indicated in the table are filled out:

| Form type | Sections to fill out in the form |

| Form SZV-KORR with type " KORR " | Sections 1-3 and at least one of sections 4-6 of the form. Only the data specified in sections 3-6 of the form are corrected: Section 4, columns 1-6 - data on earnings (remuneration), income, amount of payments and other remunerations of the insured person REPLACE the data recorded on the ILS ZL Section 4, columns 7-13 - data on accrued and paid insurance premiums SUPPLEMENTS the data recorded on the ILS AP Sections 5 - 6 - REPLACE the data recorded on the ILS ZL |

| Form SZV-KORR with type “ OTMN ” | Section 1 and Section 2 must be completed - the data recorded on the ILS for the reporting period, which is being adjusted, is CANCELED |

| Form SZV-KORR with type “ OSOB ” | Sections 1-3 must be completed - data on “forgotten” employees is included |

Territorial conditions (code), Special working conditions (code), Calculation of the insurance period, Conditions for the early assignment of a labor pension - Filled out in accordance with the Classifier of parameters used when filling out information for maintaining individual (personalized) records (appendix to the Resolution of the Pension Fund of the Russian Federation Board dated 11 January 2017 No. 3p ).

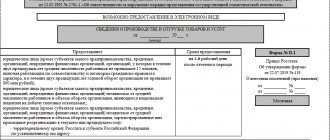

Form EDV-1: who submits it to the Pension Fund and when?

The rules for filling it out depend on which of these reports the inventory is compiled for.

Protect them from misuse - approve a local document on the rules for collecting, processing, transferring, and storing personal information.

Reporting can be:

- Initial - submitted upon initial submission complete with the main document.

- Cancellation - provided if you need to cancel the data specified in the original form in section 5.

- Corrective - provided if corrections need to be made to section 5 of the original form.

The type of form provided must be indicated by placing an “X” in the appropriate box.

Next, we will look at the EFA-1 report, how to fill it out, step by step. In any case, filling out a report begins with determining its type.

Sections 1, 2 and 3 are completed regardless of which main report the inventory is attached to.

Section 1 reflects information about the reporting organization or individual entrepreneur:

- TIN and checkpoint;

- registration number in the Pension Fund of Russia: has 12 characters and is assigned when registering a company with the Pension Fund of Russia;

- name of the insured.

Section 2 is intended to indicate the period for which reports are submitted. And a coded designation of the time period for which the report is provided:

- half year;

- year;

- another time interval for which reporting was to be submitted.

- quarter;

Currently, the SZV-STAZH report is submitted once a year, so the reporting period code in EFA-1 for this report will always be “0”.

It must indicate the year.

A complete list of reporting period codes for previous years can be found by contacting. Section 3 is intended to indicate the number of persons for whom information is filed in the main report. Opposite the name of the corresponding form indicated in column 1, we reflect the number of insured persons in column 2.

Thus, only one row will be filled in this tabular part.

We recommend reading: DIY cat bed

This part of the inventory is filled out only if it is submitted together with SZV-ISH or SZV-KORR reports with the “special” type. It contains information about the calculation and payment of insurance premiums for the reporting period.

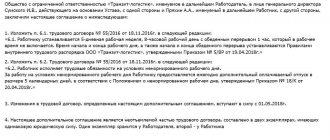

An example of filling out the SZV-KORR form for 2018

Instructions for filling out the SZV-KORR correction form, sections 1-3

Instructions for filling out the SZV-KORR correction form, section 4

Instructions for filling out the corrective form SZV-KORR, sections 5, 6

Calculation of insurance experience, additional information

In the “Type of information” column the code is indicated (clause 4.1 of Appendix 5):

- - “CORR” (corrective) – if you need to clarify previously submitted data, which are provided for in Section. 3 – 6 forms SZV-KORR;

- - “CANCEL” (cancelling) – if you need to cancel previously submitted data. In this case, only sections are filled in. 1 and 2 forms SZV-KORR;

- - “OSOB” (special) – when submitting information about the insured person, if there was no information about this person in the previously submitted reports.

Section 1

Section 1 indicates the short name of the policyholder, registration number in the Pension Fund of Russia, TIN, KPP. The data is presented in accordance with clause 2.1 of Appendix 5. You need to fill out both the subsection “In the reporting period” and the subsection “In the adjusted period” (clause 4.2 of Appendix 5).

Section 2

https://www.youtube.com/watch{q}v=upload

In section 2, you should record the last name, first name, patronymic in the nominative case and SNILS of the insured person. This information must correspond to the data of the insurance certificate (clauses 2.3.1, 4.3 of Appendix 5).

Section 3

In section 3 you need to provide data taking into account the adjustments (clauses 4.4.1 – 4.4.5 of Appendix 5):

- in column 1 – category code of the insured person;

- Column 2 – meaning “labor” or “civil” depending on the type of contract;

- other necessary data.

Contract number and date

The columns “Agreement number” and “Date of conclusion of the agreement” are filled in when adjusting data for periods up to and including 2001 (clause 4.4.4 of the Filling Out Procedure).

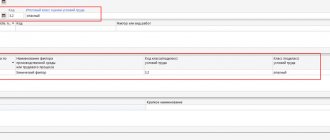

Section 4

Section 4 indicates (clauses 4.5.1 – 4.5.5 of Appendix 5):

- in column 1 - month code;

- columns 2 – 6 – adjusted payment amounts;

- columns 9, 10 – additional accrued insurance premiums for reporting periods from 2002 to 2013;

- column 11 – additional accrued insurance premiums for reporting periods since 2014;

- other necessary information.

Section 5

In section 5 you need to indicate (clauses 4.6.2 – 4.6.3 of Appendix 5):

- in column 1 - month code;

- Column 2 – code for special assessment of working conditions;

- columns 3, 4 – the corresponding amounts of payments, taking into account the adjustments.

Section 6

In Section 6, add (clauses 2.3, 4.7 of Appendix 5):

- in columns 1 and 2 – the adjusted start and end dates of the insured person’s work period;

- column 3 – code of territorial conditions;

- column 4 – code of special conditions;

- other necessary information.

In SZV-KORR, all sections do not always have to be filled out. The form consists of 6 blocks, but only the first two sections are mandatory for all cases. The header of the document contains:

- registration data of the policyholder;

- the period in which the error is corrected (the format of the codes is fixed in the Appendix to Resolution No. 3p);

- the period in which the inaccuracy was made;

- short form of the employer's name;

- information type.

The last parameter (information type) can be of three types:

- “KORR” is used if it is necessary to replace old data with new ones.

- “OTMN”, in this case the previously reflected information is canceled, new ones are not written in their place.

- “SPECIAL” is used to supplement the primary form if you initially forgot to show information on one or more employees.

When a sample for filling out the correction of length of service is drawn up according to SZV-KORR, it is necessary to enter data in sections 1, 2, 3 and 6. At the final stage, the date of compilation of the form is entered. All information is certified by the employer’s signature and seal. If the reason for making changes was inaccuracies in the amount of earnings or insurance premiums, the combination of completed blocks will consist of sections 1-4. For the canceling type SZV-KORR, sections 1-2 must be completed.

For example, in August 2020, an accountant identified an error in the SZV-STAZH report during the period of employment of A.M. Utina:

- it was necessary to enter the period of employment from 06/01/2017 to 12/28/2017;

- in the primary document it was indicated from 06/05/2017 to 12/28/2017.

In this situation, the report type will have the “CORR” attribute. The period when the error was detected and corrected is 0/2018. The period for which adjustments are made is 0/2017. Section 1 duplicates the employer's registration data from the header. Section 2 states your full name. and SNILS of an employee whose work experience was inaccurate. In section 3 you must enter the following information:

- Category code of a person insured in the pension insurance system. In the example we are talking about an employee, so he enters the NR code (a full list of codes can be found in Resolution No. 3p).

- The type of contract is either labor or civil law. An employment agreement is always concluded with employees.

- Employment contract number.

- The date on which the employment contract was signed.

- Additional tariff code – filled in if additional tariffs are applied to the employee’s earnings.

When correcting employment periods, blocks 4 and 5 are skipped, and the correct data is indicated in section 6. There is no need to duplicate incorrect information. As a result, inaccurate information provided in the original report will be replaced with new parameters.

https://www.youtube.com/watch{q}v=ytdevru

The SZV-STAZH form requires the following codes to be indicated:

- territorial conditions (code) (column 8);

- special working conditions (code) (column 9);

- calculation of insurance period, basis (code) (column 10);

- calculation of insurance period, additional information (column 11);

- conditions for early assignment of an insurance pension, basis (code) (column 12).

Here is a breakdown of some of the codes indicated in these columns. The procedure for indicating certain codes in the SZV-STAZH form is determined by Resolution of the Pension Fund Board of December 6, 2018 No. 507p.

| Code | Full name |

| SEASON | Work for a full navigation period on water transport, a full season at enterprises and organizations in seasonal industries |

| DIVER | Divers and other underwater workers |

| Code | Full name |

| CHILDREN | Holiday to care for the child |

| DECREE | Maternity leave |

| AGREEMENT | Work under civil law contracts, including those beyond the reporting (calculation) period |

| DLOTPUT | Staying on paid leave |

| VRNETRUD | Period of temporary incapacity for work |

| QUALIFY | Off-the-job training |

| SOCIETY | Performance of state or public duties |

| SDKROV | Days for donating blood and its components and rest days provided in connection with this |

| SIMPLE | Downtime caused by the employer |

| ACCEPTANCE | Additional leave for employees combining work and study |

| NEOPLDOG | The period of work of the insured person under a civil contract |

| NEOPLAUT | The period of work of the insured person under the author's contract |

| Code | Full name |

| DLCHILDREN | Child care leave up to 3 years |

| Chernobyl Nuclear Power Plant | Additional leave for citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant |

| NEOPL | Vacation without pay, downtime due to the fault of the employee, unpaid periods of suspension from work (preclusion from work), unpaid leave of up to one year provided to teaching staff, one additional day off per month without pay provided to women working in rural areas localities, unpaid time for participating in a strike and other unpaid periods, except for periods with codes DLDETI and Chernobyl NPP. |

| CHILDREN | Parental leave until the age of three, granted to grandparents, other relatives or guardians actually caring for the child |

| Code | Full name |

| 27-11GR | Underground and open pit mining |

| 27-11VP | Leading professions in underground and open-pit mining |

| AIRPLANE | Work as a flight crew on civil aviation aircraft |

The full list of codes reflected in columns 8-12 of the SZV-STAZH form is given in Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 N 507p.

Penalties

By submitting the SZV-KORR pension form, the policyholder actually admits the presence of errors in previously submitted reports or failure to submit reports for one of the employees. Will the Pension Fund of Russia fine for this? It's possible! The fine may be 500 rubles for each insured person for whom incorrect information about the length of service was provided (Article 17 of the Federal Law of April 1, 1996 No. 27-FZ).

Together with the SZV-KORR , the EDV-1 type “initial” form must be submitted

Filling out the main form for length of service - in the material “SZV-STAZH: detailed information from Pension Fund specialists”

When is EDV-1 filled out?

The form is submitted when submitting personalized accounting reports to the Pension Fund. This document is not an independent report, but refers to accompanying forms containing information on the policyholder as a whole. Can contain the information type "Original", "Correcting" or "Cancelling". That is, it must be prepared only when submitting forms SZV-STAZH, SZV-KORR and SZV-ISKH. EFA-1 summarizes the data provided in the listed reports.

Since the form in question is not an independent report, the deadlines for its submission coincide with the deadlines for submitting the above documents. For example, the SZV-STAZH and EDV-1 set for 2019 must be submitted before 03/01/2020. Also, these documents are submitted, if necessary, during the year if the employee has applied for a pension. In this case, the report is provided within three days from the date of submission of the application.

We invite you to familiarize yourself with: Sample of a job description according to GOST

| Set of documents | Situation |

| ODV-1 SZV-STAZH |

|

| ODV-1 SZV-ISKH |

|

| ODV-1 SZV-KORR |

|