New form 1-T (prof) 2016

In July, Rosstat Order No. 325 approved a new version of the 1-T (professional) statistics form . Officials need it in order to understand:

- how many people work for certain companies;

- which specialists are now most in demand (and vice versa), which ones are in short supply.

Based on the submitted forms 1-T (professional) statistics, Rosstat will select companies with a staff of five people (and separately their “isolations”) that it will study. Only small businesses will not enter into circulation. It is already known that approximately 68,000 enterprises will be targeted by Rostat.

If the enterprise has separate divisions, form 1-T (prof) must be filled out for each of them and the organization as a whole without them.

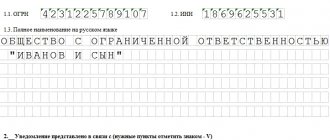

The current statistical form 1-T (prof) looks like this:

The deadlines for form 1-T (prof) are as follows: information must be reflected on October 31, 2016, and submitted accordingly - from November 1 to November 28, 2020 inclusive. This will be Monday (deadline date).

In addition, a specific frequency for submitting Form 1-T (professional) - once every two years. As you can see, 2020 did not fall under the exception.

You don’t have to go far to get forms 1-T (prof) for 2016 . It is already posted on our website. Form 1-T (prof) e.

Completing section 1

Let's consider filling out section 1. The column “Indicate the actual location of the legal entity (division) (regardless of the place of registration) - region, city, district, locality” is determined from the Organization’s

, tabular part

Contact information

by type

Actual address of the organization

.

The column “Territory code according to the Classifier of Administrative-Territorial Objects (KATO)” is determined according to the information register Address Classifier

.

The column “Indicate the name and code according to the Nomenclature of Types of Economic Activities (OKED 5-digit) of the actual main type of economic activity of the legal entity (division)” is determined from the Organization’s

tabular section

Codes

-

Type of activity

-

OKED code

.

https://youtu.be/ERth7-w9KyY

How to fill out form 1-T (professional)

From the organization’s data in Form 1-T (prof) you need to indicate:

- title (full and short);

- postal address (actual);

- OKPO.

Entering data into Form 1-T (prof) is quite simple. Essentially, you need to specify only two parameters for each type of profession/occupation in the organization:

| № | Count | Filling rules |

| 1 | Payroll number (for example, accountants, cleaners) as of 10/31/2016 | Contribute: • employees on labor agreements (permanently, temporarily, seasonally); • owners who received a salary. For part-time work - indicate as a whole unit. Internal part-time workers are included once at the main place. They do not enter data on: • external part-time workers; • who works according to the GAP; • women on maternity or childcare leave; • military. |

| 2 | How many corresponding work positions are not occupied as of 10/31/2016? | Half rates are indicated as a whole unit. Vacancies include positions: • vacant after layoffs; • free after going on maternity or childcare leave; • newly created positions for which people will be hired until November 30 inclusive. When vacancies are filled by internal part-time workers and the organization is not looking for employees to fill them, for form 1-T (professional) it means that there is no need for personnel. |

When assigning employees to groups and activities, use:

- All-Russian Classifier of Occupations (OKZ);

- A directory for the distribution of employees by subgroups and groups of OKZ.

The latest document can be found on the Rosstat website. Here is the exact link: www.gks.ru/form/Page28.html.

Sometimes in the 1-T (prof) form you will have to do simple mathematical manipulations. Namely: add specific lines to get the total number of people and vacancies for one profession or type of activity. For example, the total number of leadership positions.

Vote:

The article was published in the magazine “Personnel Solutions” No. 9 September 2020. All rights reserved. Reproduction, subsequent distribution, broadcast or cable communication, or bringing to the public attention of articles from the site is permitted by the copyright holder only with a mandatory link to the printed media indicating its name, number and year of issue.

You will learn:

- What is the updated reporting form?

- Who should fill it out?

- How does the updated report form differ from the previous one?

Order of the Federal State Statistics Service (Rosstat) dated 07/05/2016 No. 325 “On approval of statistical tools for organizing federal statistical monitoring of the number and need of organizations for workers by professional groups, composition of personnel of the state civil and municipal service” (hereinafter referred to as Order No. 325) the updated form of federal statistical observation No. 1-T (prof) “Information on the number and needs of organizations for workers by professional groups” (hereinafter referred to as Form No. 1-T (prof)) and instructions for filling it out were approved and put into effect.

Soon, organizations will have to report using this form, which will be used starting with the report as of 10/31/2016.

The new form is significantly different from the previous one, and in this article we will look in detail at what has changed in it compared to the form of the same name, approved by Rosstat Order No. 486 dated July 23, 2014 “On approval of statistical tools for organizing federal statistical monitoring of the number and needs of organizations in employees by professional groups” (hereinafter referred to as Order No. 486), which became invalid with the introduction of a new form.

WHAT REPORTING IS PREPARED IN FORM No. 1-T(PROF)

According to information published on the Rosstat website[1], the agency conducts a sample survey of organizations every 2 years in order to study the needs of organizations for workers to fill vacant jobs by professional groups.

Organizations (without small businesses) engaged in all types of economic activity are subject to examination, except for organizations whose main activity is financial activity; public administration and military security; social insurance; activities of public associations and extraterritorial organizations.

The results obtained as part of the sample survey allow us to analyze the professional and qualification structure of the number of employees and the current situation with the shortage of specialists and workers by professional groups, types of economic activity and forms of ownership of organizations (state and municipal, non-state), and constituent entities of the Russian Federation.

WHO SHOULD REPORT ON FORM No. 1-T(PROF)?

As before, legal entities (except for small businesses) engaged in all types of economic activities (except for financial activities, public administration and military security; activities of public associations and extraterritorial organizations) must report in Form No. 1-T (prof).

Note According to sub. 99.00 “OK 029-2014 (NACE Rev. 2). All-Russian Classifier of Types of Economic Activities”, approved. By Order of Rosstandart dated January 31, 2014 No. 14-st (as amended on April 14, 2016), the group “Activities of extraterritorial organizations and bodies” includes:

- activities of international organizations, such as the United Nations and its specialized agencies, regional bodies, etc., International Monetary Fund, World Bank, World Trade Organization, Organization for Economic Cooperation and Development, Organization of Petroleum Exporting Countries, European Community, European Association free trade, etc.

This grouping also includes the activities of diplomatic and consular missions if they are counted by the place where they are located rather than by the country they represent.

According to clause 1 of the Instructions for filling out the federal statistical observation form No. 1-T (prof) (hereinafter referred to as the Instructions), legal entities required to submit a report are determined by conducting a scientifically based sample of reporting units. Rospotrebnadzor also draws attention to this in letter No. 01/14444-14-27 dated December 8, 2014, focusing on the obligation to submit Form No. 1-T (prof) only upon an official request from the territorial bodies of Rosstat . At the same time, Rospotrebnadzor asks to inform it about the receipt of an official request from the territorial bodies of Rosstat.

The frequency of reporting has not changed - as before, it is compiled once every 2 years . The deadline for submitting the report has not changed - no later than November 28 .

Thus, a new report in form No. 1-T (prof) must be submitted by all legal entities specified in the header of the form that received a request from the territorial bodies of Rosstat by November 28, 2016.

Violation of the procedure for providing statistical information

At the top of form No. 1-T (prof) there is a warning that violation of the procedure for submitting statistical information, as well as the submission of unreliable statistical information, entails liability established by Art. 13.19 Code of Administrative Offenses of the Russian Federation dated December 30, 2001 No. 195-FZ, as well as Art. 3 of the Law of the Russian Federation of May 13, 1992 No. 2761-1 “On liability for violation of the procedure for submitting state statistical reports” (hereinafter referred to as the Law of the Russian Federation No. 2761-1).

Article 3 of Law of the Russian Federation No. 2761-1 establishes that enterprises, institutions, organizations and associations shall, in accordance with the established procedure, compensate statistical bodies for damages arising in connection with the need to correct the results of consolidated reporting when presenting distorted data or violating reporting deadlines. This norm has not changed since the adoption of the law, unlike Art. 13.19 Code of Administrative Offences—both the title of this article and its content have changed.

Firstly, the new wording of Art. 13.19 of the Code of Administrative Offenses has significantly increased the amount of the administrative fine that can be imposed on an official, and secondly, from December 30, 2015, not only an official, but also a legal entity can be held administratively liable in the form of a fine. In addition, liability has been introduced for both officials and legal entities for repeated violations:

CHANGES IN THE MAIN PART OF FORM No. 1-T(PROF)

The volume of Section 1[2] “Number and need of organizations for workers by professional groups as of October 31, 2020” has increased significantly due to greater detail in the data in the table and the introduction of a large number of significant changes and additions.

Compared to the previous form, the distribution of workers into occupational groups, as well as the names of occupational groups, has changed; some occupational groups have reappeared, others have been excluded. For example:

- in the old report form there were three professional groups in the first section “Heads of institutions, organizations and enterprises and their structural divisions (services).” In the updated form, the first section is called “Managers” and includes 10 professional groups;

- in the old form, specialists in the field of biological, agricultural sciences and health were included in one professional group. In the new form, healthcare specialists are allocated to a separate professional group;

- from the trade union group of the old form “Journalists and literary workers”, journalists were allocated to a separate trade union group of the new form;

- in the previous form there was a professional group “Specialists of personnel services and employment institutions”, classified as mid-level personnel in the field of financial, economic, administrative and social activities. In the new form there is no such occupational group, but the occupational group “Employees for maintaining personnel records” has appeared in the category “Other office employees”;

- in the old form there was a subgroup “Stenographers and typists”, in the new form there are no stenographers, and typists are combined into one professional group with text editing equipment operators;

- assistant accountants and office managers are again included as separate lines in the professional group “Secondary specialized personnel for economic and administrative activities”;

- Chefs are included as a separate line in the new report form to the professional group “Secondary specialized personnel in the field of legal, social work, culture, sports and related activities.”

It is impossible to list all such changes, and there is no need.

Some trade union groups were not mentioned in previous versions of the reporting form and appeared only in the latest version of form No. 1-T (prof). For example:

- “Agents for labor contracts and hiring”, which are classified as mid-level specialized personnel for economic and administrative activities;

Note : Labor contract and recruiting agents select vacancies for job seekers, find workers for employers and draw up employment contracts for the implementation of specific projects at the request of enterprises and other organizations, including government agencies and institutions, or for employment on a commission basis.

Their responsibilities include selecting vacancies for job seekers; selection of workers for vacant positions on commission from an employer or employee, etc. (see section “Descriptions of main groups, subgroups, small and initial groups” of the All-Russian Classification of Occupations OK 010-2014 (MSKZ-08), adopted and put into effect by the Order of Rosstandart dated December 12, 2014 No. 2020-Art.

- “Employees of collection firms and workers in related occupations for the collection of debts and payments.” The developers of the form classified it as employees in the public service sector (along with employees conducting consumer surveys and employees in the reception area (general profile)), who in turn are included in the section “Employees involved in the preparation and execution of documentation, accounting and service”;

- in the section “Unskilled workers” in the new version of the report, the trade group “Street vendors and other unskilled workers providing various street services” appeared, etc., etc.

MAJOR CHANGES MADE TO THE INSTRUCTIONS

According to paragraph 1 of the Instructions, the rules for filling out the address part of form No. 1-T (prof) and the “Mail address” line have remained virtually unchanged.

According to paragraph 8 of clause 1 of the Instructions, the code of the All-Russian Classifier of Enterprises and Organizations (OKPO) is entered in the code part of the form, while the new edition of the Instructions clarifies that this code is entered on the basis of the Notification of assignment of the OKPO code sent (issued) to organizations by territorial bodies of the state statistics.

In the note to clause 1 of the Instructions , a link to clause 2 of Art. 11 of the Tax Code of the Russian Federation, according to which a workplace is considered stationary if it is created for a period of more than one month.

Paragraph 2 of the Instructions provides an updated list of employees who are not included in the list of employees of the organization. Thus, in addition to external part-time workers, executors under civil contracts and women on maternity leave and child care leave, the payroll now does not include military personnel in the performance of military service duties.

Paragraph 3 of the Instructions provides information about the new All-Russian Classification of Occupations (OKZ), which should now be used as a guide when distributing workers into professional groups (occupations). The new classifier was put into effect by Order of the Federal Agency for Technical Regulation and Metrology dated December 12, 2014 No. 2020-st instead of the previously used OKZ, approved by Decree of the State Standard of the Russian Federation dated December 30, 1993 No. 298.

If in the previous version a link to the directory for the distribution of employees by subgroups and groups of OKZ was located at the end of the Instructions for filling out the form, then in the new version information about the Directory and its location on the Internet is presented in the second paragraph of paragraph 3 of the Instructions:

Extract from the Guidelines

[…]

To correctly distribute employees of organizations into professional groups, you should use the Directory of distribution of employees into subgroups and groups of OKZ, which is posted on the Rosstat website on the Internet information and telecommunications network: www.gks.ru in the section Information for respondents/Federal state forms[3] statistical observation/Album of forms of federal statistical observation, the collection and processing of data on which is carried out in the system of the Federal State Statistics Service, for 2016/20. Labor market/form No. 1-T (professional) [4] [5] . The directory is developed in Excel format and contains 9 sheets, each of which corresponds to one of the main groups. In accordance with the survey program in main groups from 2 to 5, a list of occupations is provided for initial groups in 1, 6, 7 and 8 main groups - for small groups, and in main group 9 “Unskilled workers” - for subgroups. For each occupational group of OKZ, a list of professions included in this group is provided.

The scope of the Instructions has been significantly reduced by eliminating clause 6, which provided the principles for distributing employees into larger groups. Accordingly, as stated in paragraph 5 of the Instructions in the new edition, the distribution of enterprises’ needs for workers by professional groups is made in the same way as the distribution of payroll in accordance with paragraph 3 of the Instructions (previously in accordance with paragraphs 5 and 6), in which we are referred to the All-Russian Classification of Occupations (OKZ) and the Directory of Distribution of Workers by Subgroups and Groups of OKZ.

In addition, in the new edition of the Instructions, clause 9, which set out the rules for filling out Certificate 1, is excluded, since it is not in the new form No. 1-T (prof). The certificate concerned workers engaged in activities in the production of goods and services related to the creation or use of nanotechnology.

According to paragraph 4 of the Instructions, column 5 contains a list of jobs that are classified as vacant. The content of this list has not changed compared to the Guidelines in the previous edition (where it was number 7):

Extract from the Guidelines (paragraph 2, paragraph 4)

[…]

Vacant jobs include those vacated in the event of employee dismissal, maternity leave or child care leave, as well as newly created jobs for which it is planned to hire employees within 30 days after the reporting period. If vacant positions are occupied by internal part-time workers and the organization does not take active steps to find workers, then this need for workers should not be reflected in Form No. 1-T (prof).

[1] https://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/publications/catalog/doc_1245749635312.

[2] Section 2 is not in either the previous or updated form of the report. For what reason the developers number the only section is unknown. — Approx. author.

[3] The word “state” is missing on the website in the “Information for Respondents” section. — Approx. author.

[4] Emphasis added in the extract.

[5] As of August 11, 2016, form No. 1-T (prof) is not included in the “Labor Market” section. — Approx. author.

Fines

Please note that failure to submit Form 1-T (prof) for 2016 entails serious administrative fines (Article 13.19 of the Code of Administrative Offenses of the Russian Federation).

| Act | Amount of fine, rub. |

| 1) failure to submit form 1-T (professional); 2) submitting form 1-T (professional) late - after November 28, 2020; 3) the data in form 1-T (prof) does not correspond to reality. | For officials: 10,000 – 20,000 For organization: 20,000 – 70,000 |

| Repeatedly | For officials: 30,000 – 50,000 For organizations: from 100,000 to 150,000 |

If you find an error, please select a piece of text and press Ctrl+Enter.

Report 1-T (working conditions)

The statistical form will contain information about the state of working conditions and compensation for work in harmful and dangerous conditions.

The report is prepared for the year, the deadline for submission is no later than January 20 of the following year. To correctly build a report, check the details of the “Electromechanical” staff unit card. On the “Working Conditions” tab, pay attention to the fields “Final class of assessment of working conditions”, “Assessment of working conditions by harmful factors”, “Code of class of working conditions”.

In addition, check that the organization card contains the full and short names, as well as the OKPO code.

In the menu Current work / Reports / Information, select form 1-T (working conditions), fill in the date the report was generated, indicate the organization or division. The program automatically prepares a printed form in word or uploads it in xml.

By default, the form creator is listed as the head of the HR department, but you can change this parameter in the organization card on the “Basic information” tab.

The first page of the report is the title page, it contains information about the company: name, legal and postal addresses, OKPO code, etc. The second page is the section “State of working conditions”, the third is the section “Guarantees and compensations provided to employees employed in work with harmful and (or) dangerous working conditions.” Particular attention should be paid to a few lines:

- in line 24 “Increased remuneration” only those employees will appear who have a hazard allowance indicated in their personal card on the “Types of accruals and deductions” tab;

- line 20 “Additional leave” includes employees who have this right also displayed in their personal card.

The correctness of the report can be checked in screen form; To ensure that employees who meet the criteria are included in it, look at setting up the application options. This is necessary because the options are pre-configured, and your organization can enter its own types of allowances and charges. For example, in the “Type of payment according to working conditions” option in the program there is “Harminess Allowance” with code 121, you can enter your type of accrual here.

You can also set up the necessary allowances in the employee’s personal card on the “Types of accruals and deductions” tab.