The authorized capital of a joint-stock company reflects the valuation of shares. For accounting purposes, the share of each founder and the types of securities are of greatest importance. Based on these data, dividends are calculated and the rights of shareholders in managing the company are determined. Let's take a closer look at how the issue of shares is displayed in accounting (the entries that are used to account for corporate rights will not be ignored either).

Formation of the management company

The activities of joint-stock companies are regulated by Federal Law No. 208 of the same name. This law describes the procedure for creating and reorganizing companies, the rights and obligations of founders. According to Art. 7, in closed joint-stock companies shares are distributed only among participants. According to Art. 9, the founders enter into an agreement on the creation of a company, which specifies the procedure for carrying out activities, the amount of capital, types of shares, and the procedure for their payment. The first section of the liabilities side of the balance sheet is formed at the expense of the nominal value of the securities. It is the same for all ordinary shares. After state registration of a joint-stock company, 50% of the securities must be repaid within 3 months, and the rest within a year.

https://youtu.be/zuiOX5IUnDw

Reducing your own capital

The founders (participants) of a joint-stock company may decide to increase the authorized capital if its existing amount is fully paid. This will be reflected in accounting after registration:

- in the Federal Tax Service - the charter with a new value of the capital and, if necessary, with a new ratio of participation shares;

- in the Bank of Russia Service for Financial Markets - an additional issue (issue) if the par value of the shares does not change, or conversion of shares if the par value increases.

You can increase your capital by:

- Retained earnings of a legal entity or its additional capital. This will not require the founders (participants) to make additional payments and will be reflected in the correspondence of the management account with the source accounts of the increase:

Dt 83 (84) Kt 80.

- Participants' funds. Moreover, the number of those at whose expense the increase occurs may be different: one, if he is accepted additionally and the increase occurs only due to his contribution;

- single or several, if this is done with the aim of increasing the share of their participation;

- all if the shares increase in proportion to existing contributions.

Dt 75 Kt 80.

The amount of the minimum allowable capital for a joint-stock company is established by law. Until July 1, 2015, it depended on the minimum wage, and after this date it is (Article 26 of the Law of the Russian Federation dated December 26, 1995 No. 208-FZ):

- for public joint-stock companies - 100 thousand rubles;

- non-public joint-stock companies - 10 thousand rubles.

It cannot be lower than the figure established by law. But depending on the reasons for the decrease in the capital, you need to focus on different minimum values:

- when the initiative comes from the participants - to the one in force at the time of submitting documents for registration of changes in the meaning of the Criminal Code;

- if reduced in accordance with the requirements of the law - to the one that was in effect on the date of registration of the JSC.

The legal obligation to reduce the capital capital arises when the JSC:

- there are unpaid (unsold) shares of the primary issue or repurchased shares that could not be sold during the year;

- over the course of 2 years, at the end of the year, the capital turns out to be greater than the calculated value of net assets (NA).

Read more about the rules for calculating net assets in the article “How is the accounting value of net assets calculated?”

Before reducing the Criminal Code, you must:

- notify the Federal Tax Service about this;

- publish a message about these intentions in the media twice a month in order to notify creditors;

- register the conversion of shares or redemption of their quantity with the Bank of Russia Financial Markets Service;

- check that as a result of the reduction procedure on the initiative of the participants of the management company there is no more NA.

Reduction is possible in the following ways:

- Unsold shares (unpaid) shares are cancelled:

Dt 80 Kt 81.

- The joint-stock company buys back part of the shares and then cancels them:

Dt 81 Kt 75,

Dt 80 Kt 81;

- The nominal value of the shares is reduced in the required proportion. Postings using this method will depend on who is the recipient of the income from the difference in the amount of the capital: JSC with a mandatory reduction (when the existing loss is closed at the expense of the capital):

Dt 80 Kt 84.

- JSC in case of voluntary reduction:

Dt 80 Kt 91;

Dt 80 Kt 75.

In case of a voluntary reduction of the capital, the accrual of such income to the participant is equivalent to the accrual of dividends. But payment will be impossible when:

- The authorized capital has not been paid or has not been paid in full;

- the JSC has signs of bankruptcy;

- dividends already declared for payment have not been paid or have not been paid in full;

- shares for which there is a redemption requirement have not been repurchased.

Dt 75 Kt 91.

Read about the specifics of reducing capital in LLCs, business partnerships, state unitary enterprises and municipal unitary enterprises in the material “Accounting entries for reducing authorized capital.”

By virtue of the Chart of Accounts for accounting the financial and economic activities of organizations and the Instructions for its application (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n), account 81, entitled “Own shares (shares)”, is intended for accounting for own shares (redemption/cancellation). "

Note that accounting for own shares (shares) is active. That is, it can only be on the debit of account 81.

This account reflects information about the availability and movement of its shares, purchased by the joint-stock company from shareholders for their subsequent resale or cancellation.

Other business companies (LLC, etc.) and partnerships use it to account for the share of a participant acquired by the company/partnership itself for transfer to other participants or third parties.

Also see: When You Don't Have to Pay Tax on the Sale of Stocks.

Accounting for the issue of shares

According to PBU, account 80 “Authorized capital” displays information on the composition and movement of capital. The balance corresponds to the volume of the company's own funds. The amount of debt of the founders is reflected by posting KT 80 DT 75-1. The receipt of money to pay for corporate rights is reflected in KT 75-1. Analytics is carried out for each participant.

In order for transactions on shares to fully reflect the rights of all founders, stages of capital formation and types of securities, it makes sense to open sub-accounts for account 80 that contain information about the movement of different types of capital:

- 80-1 “Announced” - used to reflect the nominal value of securities intended for sale.

- 80-2 “Subscription” - used for accounting for securities with subscription.

- 80-2-1 “Corporate rights of the first founder.”

- 80-2-n “Central Bank of the nth founder.”

- 80-3 “Paid” – the cost of redeemed securities.

Accounting for shares + postings

You will later use this data when calculating your income.

Please note: your accounting policies must specify the disclosure procedure for investments and the unit of account (i.e. aggregate or unit shares). There is no need to pay VAT when selling shares.

Thus, in the tax return it is necessary to indicate the costs of the purchase and income from the sale of shares only when the securities are sold. However, it is necessary to record data on the purchase price in accounting in any case.

Accounting for income from shares

If shares bring dividends to the holding company, they also need to be reflected in accounting. They are taken into account in:

- K 91 (“Other income and expenses”)

- D 76 (“Settlements with various debtors and creditors”)

Taxes on dividends must also be paid. However, you don't have to do this yourself. In this case, the tax agent will be the issuer (source of dividends). The tax is calculated from the date of receipt of funds to the shareholder's account.

Let's sum it up

Individuals do not need to report income from shares and fill out declarations themselves. This will be done by the broker - according to personal income tax (13% for residents, 30% for non-residents). Legal entities reflect transactions with shares in accounting, and in the tax return these figures are recorded only upon sale. Dividends on shares are also recorded in accounting. Taxes on dividends are paid by the tax agent (issuer).

Denis Cherepkov Head of Customer Service Department Freedom24.ru

Example

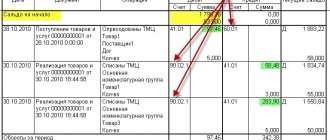

The three founders decided to found a joint stock company. Capital in the amount of 800 thousand rubles. divided into 800 shares. Nominal value of the Central Bank: 800,000: 800 = 1000 rubles. Shares are distributed among the founders in the following proportions: 40%, 35% and 25%. When placing, 50% of the securities were paid. The remaining amount should arrive in three months.

For NU purposes, income in the form of property received as a contribution to the capital of an organization is not taken into account when determining the basis for calculating the NPP (Article 1 of the Tax Code of the Russian Federation). Let's display the issue of shares in accounting. The postings are presented in the table below.

| Operations | DT | CT | Amount (thousand rubles) |

| Registration of JSC | |||

| The management company is reflected in accordance with the charter | 75-1 | 80-1 | 800 |

| Payment of 50% of shares from the share of each participant | |||

| first (800 x 40%) second (800 x 35%) third (800 x 25%) | 50 | 75-1 | 160 140 100 |

| The report on the issue of the Central Bank was approved | |||

| The value of the shares is reflected: first founder second founder third founder | 80-1 | 80-2-1 | 320 280 200 |

| The cost of securities paid is reflected: by the first participant second participant third party | 80-2-1 | 80-3-1 | 160 140 100 |

| Accounting records for the payment completion date | |||

| Funds were received on account of the remaining portion of the Central Bank: first founder (320 -160) second founder (280 – 140) third founder (200-100) | 50, 51 | 75-1 | 160 140 100 |

| The cost of paid securities is reflected (for each shareholder) | 80-2-1 | 80-3-1 | 160 140 100 |

The accounting entries reflecting the issue of uncertificated shares are no different from those presented above. Confirmation of a contribution to the company is a certificate or an extract from the register of owners of securities.

Accounting for shares in accounting entries

d.).

This procedure is established by paragraphs 26, 30 and 36 of PBU 19/02, as well as paragraphs 11 and 17–19 of PBU 10/99.

In this case, determine the expenses in the form of the cost of acquiring retiring financial investments depending on what is retiring:

— a share that is traded (quoted) or not traded (not quoted) on the organized securities market; - share.

Determine the value of listed shares taking into account the latest revaluation carried out by the organization based on market value.

Determine the value of unquoted shares in one of the following ways:

- at the original cost of the retiring unit; — at the average initial cost; - at the original cost of the first financial investments acquired (FIFO method).

Determine the cost of disposal of the share based on the initial cost of its acquisition.

The chosen method of evaluating a particular financial investment should be reflected in the organization’s accounting policies for accounting purposes.

This procedure is established by paragraphs 26 and 30 of PBU 19/02 and paragraphs 7 and 8 of PBU 1/2008.

For more information on the rules for determining the cost of disposal of shares and unquoted shares, see the appendix to PBU 19/02 (clause 33 of PBU 19/02).

An example of how to reflect in accounting and taxation the sale of shares traded on the organized securities market. The organization applies a general taxation system

On July 22, Alfa CJSC sold 2,000 shares of its shares in Master Manufacturing Company OJSC at a price of 5,800 rubles. for each share (purchased in the previous year). The purchase and sale took place outside the organized securities market. Shares are traded on the securities market. Their last revaluation was carried out by Alpha on June 30. According to the results of the revaluation, the cost of one share on this date was 6,000 rubles. The initial cost of purchasing shares in accounting and tax accounting is 6,500 rubles. per share.

The unit of accounting for financial investments is the share.

On July 22, the accountant made the following entries in Alpha’s accounting: Debit 76 Credit 91-1 – 11,600,000 rubles. (RUB 5,800/piece × 2,000 pieces) – income from the sale of one share is reflected; Debit 91-2 Credit 58-1 – 12,000,000 rubles. (6,000 rubles/piece × 2,000 pieces) – the cost of the sold share is written off.

At the same time, the analytical accounting of "Alpha" reflects the disposal of 2,000 accounting units - according to the number of shares of "Master" sold. Thus, the result from the sale of shares in the accounting is a loss in the amount of 400,000 rubles. (RUB 11,600,000 – RUB 12,000,000).

The organization calculates income tax on a monthly basis and uses the accrual method. The value of shares in tax accounting is determined by the unit cost.

As of the date of drawing up the purchase and sale agreement, the price range for Master shares was from 5,000 rubles. up to 5800 rub. for one share. Thus, the price of the purchase and sale transaction (RUB 5,800) exceeds the minimum price prevailing on the securities market on the date of the transaction. Therefore, Alpha’s accountant, when calculating income tax, took into account income based on the actual transaction price of 11,600,000 rubles. (RUB 5,800/piece × 2,000 pieces).

As part of expenses when calculating income tax, Alpha's accountant took into account the initial cost of acquiring Master's shares in the amount of 13,000,000 rubles. (RUB 6,500/piece × 2,000 pieces). Thus, the result from the sale of shares in tax accounting is a loss in the amount of 1,400,000 rubles. (RUB 11,600,000 – RUB 13,000,000).

Since in accounting the result from the disposal of shares is determined taking into account the revaluation of securities, but in tax accounting it is not, the Alpha accountant accrued a permanent tax asset: Debit 68 subaccount “Calculations for income tax” Credit 99 subaccount “Permanent tax assets” - 200 000 rub. ((6500 rub. – 6000 rub.) × 2000 pcs. × 20%) – a permanent tax asset is reflected.

The procedure for recording repo transactions with shares in accounting is similar to the procedure established for repo transactions with bonds.

Documenting

Confirm the fact of disposal of the financial investment (for any disposal option) with a primary document drawn up in the form approved by the head (Part 1, 4, Article 9 of the Law of December 6, 2011 No. 402-FZ). For example, this may be an act of acceptance and transfer of shares (shares), providing for all the required details, in accordance with Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

Change in capital amount

Article 28 of Federal Law No. 208 provides for an increase in the capital stock of a closed joint-stock company through additional issue of shares. The corresponding decision is made at a meeting of shareholders. The number of additional shares, their type, method of placement, price, form of payment are also determined at the meeting of shareholders. Securities can be paid for in cash or property rights. In the second case, an independent expert is hired to evaluate the transferred property. Resolution No. 19 of the FC Central Bank regulates the issue of additional shares. Accounting entries are entered on the basis of a report on the results of the issue: the value of shares, their number and categories.

In the example discussed below, materials will be used to pay for securities. To account for them, the accounting system provides account 10 of the same name. If the placement price is higher than the nominal value of the securities, then the difference between the amounts received is charged to additional capital. Also in the example, the following postings for shares will be used:

- KT 80 DT 75-1 – increase in capital through the issue of shares.

- KT 83 DT 75-1 – creation of additional capital.

The nominal value of the issue is taxed at a rate of 0.8% (Federal Law No. 2023-1). The amount to be paid is determined by the enterprise independently and transferred to the federal budget along with documents for registration of the issue. In accounting, the accrual of tax on transactions with securities is reflected in the entry DT 91-2 “Other expenses”, CT 68 “Tax calculations”. State registration of the issue of additional shares is carried out if the number of subscribers exceeds 500.

How to reflect shares in accounting

Increasing the authorized capital of a joint stock company is possible in two ways: increasing the par value of shares or placing additional shares (Clause 1, Article 28 of the Law on Joint Stock Companies). Moreover, in accordance with paragraph 1 of Article 39 of this Law, the placement of additional shares can be carried out in one of three ways :

— subscription (open or closed);

— conversion;

— distribution among shareholders.

Let us consider the content of corporate events carried out during an additional issue of shares placed by private subscription, and in the case where the additional issue of shares is not accompanied by state registration of a securities prospectus.

Registration of a prospectus for the issue of securities is required if shares are placed by public subscription or by private subscription among a circle of persons whose number exceeds 500. In this case, more stringent requirements for disclosure of information are provided in order to ensure that possible investors in the securities market receive the necessary information.

Payment for shares of an additional issue can be made either in cash or in various property (under an exchange agreement), which must be preliminarily assessed by an independent appraiser. The article will discuss the first option for paying for shares.

The process of additional issue of shares includes 5 stages:

1. Making a decision on the placement of equity securities;

2. Approval of the decision on additional issue of equity securities;

3. State registration of an additional issue of equity securities;

4. Placement of issue-grade securities;

5. State registration of the report on the results of the additional issue of equity securities.

Each stage includes corporate activities that must be carried out consistently and in compliance with established deadlines.

1. Making a decision on the placement of equity securities

At this stage, a meeting of the Board of Directors is held, which determines the cost of one share, and the General Meeting of Shareholders, which decides to increase the authorized capital by issuing additional shares of the company.

If the company's charter does not contain provisions on authorized shares (that is, it does not provide for the possibility of an additional issue), it is necessary that at this stage the shareholders decide to make appropriate changes to the charter (on the number of authorized shares and the rights of shareholders provided by these shares after their placement) (clause 3 of article 28 of the Law on Joint Stock Companies). If such a decision was made at the General Meeting of Shareholders, the Joint Stock Company is obliged to register these changes with the Federal Tax Service.

2. Approval of the decision on additional issue of securities

The Board of Directors approves the decision on additional issue of shares. If the organization does not have a Board of Directors, the decision is approved by the management body performing the functions of the Board of Directors. Typically this body is the general meeting of shareholders. Documents for state registration of an additional issue of securities must be submitted no later than three months from the date of approval of the decision on their issue.

3. State registration of an additional issue of equity securities

According to Decree of the President of the Russian Federation dated July 25, 2013 N 645, the Federal Financial Markets Service of Russia was abolished. Its functions have been transferred to the Bank of Russia.

Thus, the Bank of Russia Service for Financial Markets carries out the functions of the abolished FSFM of Russia, including registering additional issues of shares.

For state registration of an additional issue of securities, the documents provided for by the Standards for the Issue of Securities (approved by the Bank of Russia on August 11, 2014 N 428-P) (hereinafter referred to as the Standards) are submitted to the registering authority.

1) application for state registration of an additional issue of securities;

2) issuer's questionnaire;

3) a copy of the document confirming the state registration of the issuer;

4) decision on additional issue of securities;

5) Minutes of the Board of Directors on determining the placement price of shares;

6) Minutes of the general meeting of shareholders on increasing the authorized capital;

7) Minutes of the meeting of the Board of Directors on approval of the decision on the additional issue of securities;

a copy of the charter (constituent documents) of the issuer in the current edition with all amendments and (or) additions made to them;

a copy of the charter (constituent documents) of the issuer in the current edition with all amendments and (or) additions made to them;

9) payment order (receipt of the established form in the case of cash payment), which confirms the fact of payment by the issuer of the state duty collected in accordance with the legislation of the Russian Federation on taxes and fees for state registration of an additional issue of securities;

10) inventory of submitted documents;

11) other documents provided for by the Standards.

The issuer must provide the registration authority with a set of documents on paper and electronic media. The decision on an additional issue and the issuer's questionnaire must be filled out in accordance with the Standards and compiled using a special program - an electronic questionnaire, which is freely available on the official websites of the SBR and recorded on electronic media in questionnaire format. Since at the moment the electronic questionnaire does not contain some provisions of the new Standards, the Decision on the additional issue and the issuer’s questionnaire in .doc or .rtf format with changes taking into account the new provisions must also be placed on the electronic medium.

Within 20 days from the date of receipt by the registering authority of documents and electronic media, it is obliged to carry out state registration of an additional issue of securities or make a reasoned decision to refuse its state registration

In the process of reviewing documents, the RBI may have comments on the documents. In this case, during the process of registering a decision on an additional issue of securities, a verification of the accuracy of the information contained in the provided documents may be ordered, or the state registration of the decision on an additional issue may be suspended. The period of suspension cannot be more than 30 days.

4. Placement of issue-grade securities

The placement of securities by the issuer begins with transactions (conclusion of agreements) aimed at the alienation (sale) of securities of an additional issue to their first owners, in accordance with the terms of the registered decision on the additional issue of securities. The issuer must send a transfer order to the registrar to make relevant entries in the register of shareholders.

The placement is carried out within the time limits provided for by the registered decision on the additional issue of shares. This period cannot exceed one year from the date of state registration of the additional issue of equity securities.

Also, during the placement process, changes may be made to the registered text of the decision on the additional issue of shares. Such changes are subject to mandatory registration with the SBR.

5. State registration of a report on the results of an additional issue of equity securities

No later than 30 days after the completion of the placement of issue-grade securities, the issuer is obliged to submit to the Bank of Russia a report on the results of the additional issue of issue-grade securities (Clause 1, Article 25 of the Law on the Securities Market).

For state registration of a report on the results of an additional issue of securities, the documents provided for by the Issue Standards are submitted to the registration authority:

1) application for state registration of a report on the results of an additional issue of securities;

2) report on the results of the additional issue of securities;

3) a copy (extract from) the minutes of the meeting (session) of the authorized management body of the issuer (order, instruction or other document of the authorized person), which made the decision to approve the report on the results of the issue (additional issue) of securities, indicating if this the decision was made by a collegial governing body, quorum and voting results for its adoption;

5) a certificate from the issuer regarding its compliance with information disclosure requirements at the stages of state registration of an additional issue of securities;

6) a document confirming the existence of a decision on the preliminary approval of transactions for the placement of securities of an issuer that is a business company of strategic importance for ensuring the defense of the country and the security of the state, if such transactions are permitted subject to the presence of the specified decision on their preliminary approval;

If the issuer refuses to place securities and submits a report on the results of their issue (additional issue), containing information that no securities have been placed, a copy (extract from) the minutes of the meeting (session) of the issuer's authorized management body ( order, instruction or other document of an authorized person) by which a decision was made to refuse to place securities, indicating, if this decision was made by a collegial management body, the quorum and the results of voting for its adoption;

If the issuer refuses to place securities and submits a report on the results of their issue (additional issue), containing information that no securities have been placed, a copy (extract from) the minutes of the meeting (session) of the issuer's authorized management body ( order, instruction or other document of an authorized person) by which a decision was made to refuse to place securities, indicating, if this decision was made by a collegial management body, the quorum and the results of voting for its adoption;

9) payment order (receipt of the established form in the case of cash payment), which confirms the fact of payment by the issuer of the state duty collected in accordance with the legislation of the Russian Federation on taxes and fees for state registration of a report on the results of an additional issue of securities;

10) inventory of submitted documents;

11) other documents provided for by these Standards.

The issuer submits to the registration authority the documents required in accordance with the Standards for state registration of the report on the results of an additional issue of securities, in one copy, with the exception of the report on the results of the issue (additional issue), submitted in three copies.

The text of the report on the results of the additional issue of securities is also submitted to the registration authority on electronic media and in a format that meets the requirements of the federal executive body for the securities market.

If, during the placement of securities, in the end, not a single security of an additional issue is placed, or the decision on an additional issue of securities placed by subscription establishes the share of securities, if not placed, the additional issue is considered failed, such additional issue of securities is recognized by the registration authority failed, and its state registration is cancelled.

Registration of a report on an additional issue of securities is carried out within 14 days from the date of submission of documents to the SBR.

In the process of reviewing documents, the RBI may have comments on the documents. In this case, during the process of registering a report on the results of an additional issue of securities, a verification of the accuracy of the information contained in the provided documents may be ordered, or the state registration of a report on the results of an additional issue of securities may be suspended. The period of suspension cannot be more than 30 days.

After registering the report on the results of the additional issue, the issuer must make appropriate changes to its constituent documents in terms of increasing the size of the company’s authorized capital.

ATTENTION: Be sure to comply with the disclosure requirements for additional issuance of securities. For failure to comply with information disclosure requirements, the fine currently ranges from 700,000 to 1,000,000 rubles.

Our company will help you register an additional issue of securities. Services for registering an additional issue of securities include consulting at the stages of the issue, preparing a package of documents, submitting a package of documents to the registration authority and receiving documents on registration of an additional issue of securities.

The cost of services for additional issue of securities averages from 35,000 rubles. An additional fee for the issue (additional issue) of securities placed by subscription is paid at 0.2% of the nominal value of the issue of securities.

For questions regarding additional issue of shares, please call.

Example

The founders of the OJSC decided to increase the authorized capital by 0.5 million rubles by issuing 500 securities with a starting value of 1 thousand rubles. at a price of 1050 rubles. As a result of the issue, all shares were sold. Of these, 300 pieces were paid for in cash, and for the rest the JSC received materials worth 210 thousand rubles. We will display the issue of additional shares. Postings:

| Operation | DT | CT | Amount (thousand rubles) |

| Tax charged on transactions with the Central Bank (500 x 0.8%) | 90-2 | 68 | 4 |

| Money transferred to pay taxes | 68 | 51 | 4 |

| The money received from the founders in payment of the Central Bank was capitalized (300 x 1.05) | 50, 51 | 75-1 | 315 |

| Materials were capitalized to pay for shares | 10 | 75-1 | 210 |

| Increased capital | 75-1 | 80 | 500 |

| The amount of additional capital is reflected (300 x 1.05 + 210 – (500 x 1)) | 75-1 | 83 | 25 |

The contribution to the authorized capital can be paid using goods that have been previously assessed by an independent expert at market value. Let's look at how records are generated that reflect the accounting of finished products. Accounting entries:

DT 43 CT 20 – production of goods by the main (auxiliary, servicing) production.

Here's how an additional share issue is accounted for. The postings presented earlier can be used in case of payment of the contribution with other property, for example, OS.

Correspondence for postings

| By debit | By loan |

| 50 Cashier 51 Current accounts 52 Currency accounts 55 Special bank accounts 91 Other income and expenses | 73 Settlements with personnel for other operations 80 Authorized capital 91 Other income and expenses |

If you find an error, please highlight a piece of text and press Ctrl Enter.

Reduction of capital

The authorized capital can be reduced by changing the par value or repurchasing its own securities in order to reduce them. At the same time, the new amount of own funds should not be less than that provided by law. If the first method is used, then additional shares are issued, the transactions for which will be discussed further, of a lower value, which are converted into outstanding securities. Based on the issue report, changes are made to the charter. At the same time, the amount of the issue of the Central Bank, which is intended to reduce the capital, is not subject to taxation.

Accounting for transactions with shares of other enterprises

Ordinary organizations that are not professional participants in the securities market do not so often carry out transactions with securities in general and with shares in particular in the course of their activities. Therefore, many accountants, even those with extensive practical experience, experience certain difficulties in resolving issues related to the accounting of transactions with securities. An organization, when acquiring shares of other enterprises, may pursue various goals. Shares can be purchased for the purpose of generating income from their further resale or for the purpose of receiving income on them in the form of dividends. Sometimes the purpose of acquiring shares may be to form a controlling stake, allowing one to influence the activities of a particular company.

Example

By decision of the founders, the charter capital of the OJSC is reduced by 300 thousand rubles through the conversion of securities. The difference between the nominal and market values is paid to the founders upon issue. The transfer of money is carried out by an agent whose services cost 12 thousand rubles including VAT. We will display the issue of additional shares in the accounting system. Postings:

| Operation | DT | CT | Amount (thousand rubles) |

| Amount to be paid upon conversion of shares transferred to the agent | 76 | 51 | 300 |

| Disbursement to shareholders | 75-1 | 76 | 300 |

| Agent's remuneration (including VAT) | 91-2 | 76 | 12 |

| Payment for agent services has been transferred | 76 | 51 | 12 |

| Reflected decrease in capital | 80 | 75-1 | 300 |

Accounting entries when an organization acquires shares of another enterprise

To account for settlements with Matros LLC, the accountant of Parus LLC opened an account. 76 subaccount 5 “Settlements with intermediaries.” He reflected the purchase of shares as follows: Dt 58.1 Kt 76.5 82500 rub. (5500 * 15) - shares purchased; 2832 / (5500 * 15) * 100% = 3.4% - intermediary costs are insignificant;

Dt 91.2 Kt 76.5 2832 rub. — purchase costs are written off as other costs; Dt 76.5 Kt 51 85332 rub. (82500 + 2832) - money is transferred to the intermediary. The purchased shares are stored at the enterprise's cash desk or in a special storage facility (depositary).

Its functions include the safety of BSO and their accounting. He receives a certain percentage and resells the securities on behalf of the owner.

Cancellation of the Central Bank

When an organization repurchases its own shares in bookkeeping, a difference may arise between the nominal price and the actual price paid. It is taken into account under article 80 (if the price is below the face value) or as part of own funds (if the price is above the face value), as well as under the article “Other monetary documents” (account 56). Most often, securities are purchased at a reduced value. Let's look at standard wiring:

- DT56 KT50(51) – the cost of the costs of repurchasing shares is taken into account.

- DT56 KT80 - excess of the nominal value over the redemption value.

- DT88 KT56 - excess of the redemption value over the nominal value.

If securities are purchased for the purpose of cancellation, then the following transactions are generated:

- DT80-3 KT80-1 – reduction in the cost of paid-in capital.

- DT80-1 KT56 - amount of canceled shares (entry is generated after amendments to the charter)

or:

- DT48 KT56 - reflects the par value of the securities sold.

- DT51(50) KT48 - cash was received as payment for the shares sold.

- DT48(80) KT80(48) – profit (loss) was received from transactions with the Central Bank.

Accounting for the sale of shares in accounting entries

If you are an individual, you do not have to worry about paying taxes on the sale of shares. The broker will independently calculate the amount and pay tax at a rate of 13% (or 30% if you are a non-resident of Russia). Individual entrepreneurs can also count on the same conditions. In this case, they act as individuals.

With legal entities everything is more complicated. The company must take care of its own accounting and tax reporting.

Shares in the accounting of a legal entity

According to accounting sources, the purchase of shares is reflected in the Chart of Accounts - with entries Debit 76 Credit 51, Debit 58 Credit 76.

The purchase of shares and the amount spent do not need to be recorded in the tax return. This will only be required when selling. In this case, you indicate the total cost of the purchase (in expenses) and sale.

So, how to reflect shares in accounting according to all the rules?

Please note:

- Expenses for the purchase of shares can reduce the tax base only if they were sold during a given reporting period.

- You can record expenses in the tax register. You will later use this data when calculating your income.

- Check whether the stock price at the time of purchase and sale corresponds to the market price. The rules for valuing securities depend on whether they are listed on a stock exchange or not. Study articles 313, 280, 272 (clause 7, subclause 7) of the Tax Code of the Russian Federation.

- In analytical accounting, you can consider each share or share, or a set (package, series) of shares of one issuer and purchased at the same price.

Please note: your accounting policies must specify the disclosure procedure for investments and the unit of account (i.e. aggregate or unit shares). There is no need to pay VAT when selling shares.

Thus, in the tax return it is necessary to indicate the costs of the purchase and income from the sale of shares only when the securities are sold. However, it is necessary to record data on the purchase price in accounting in any case.

Accounting for income from shares

If shares bring dividends to the holding company, they also need to be reflected in accounting. They are taken into account in:

- K 91 (“Other income and expenses”)

- D 76 (“Settlements with various debtors and creditors”)

Taxes on dividends must also be paid. However, you don't have to do this yourself. In this case, the tax agent will be the issuer (source of dividends). The tax is calculated from the date of receipt of funds to the shareholder's account.

Let's sum it up

Individuals do not need to report income from shares and fill out declarations themselves. This will be done by the broker - according to personal income tax (13% for residents, 30% for non-residents). Legal entities reflect transactions with shares in accounting, and in the tax return these figures are recorded only upon sale. Dividends on shares are also recorded in accounting. Taxes on dividends are paid by the tax agent (issuer).

Denis Cherepkov Head of Customer Service Department Freedom24.ru

Reorganization

Sometimes it may be necessary to change the par value of shares through splitting or consolidation. If the amount received clearly corresponds to the size of the capital account, no additional entries are generated in the accounting system. Changes are made only to the register of shareholders. If the size of the management company is not clearly divided by the number of new founders (for example, with a capital of 6 thousand rubles, the number of securities is reduced from 300 to 25), then changes are made to the charter documents and an additional issue of shares is formed. The wiring used is similar to that shown above.

Depreciation of financial investments.

Depreciation of financial investments is a steady decrease in the expected benefit from the Finn. investments for which the market value is not determined.

Here is how it is written in PBU 19/02:

A sustained significant decrease in the value of financial investments for which their current market value is not determined, below the amount of economic benefits that the organization expects to receive from these financial investments under normal conditions of its activities, is recognized as impairment of financial investments. In this case, based on the organization’s calculations, the estimated value of financial investments is determined, equal to the difference between their value at which they are reflected in accounting (accounting value) and the amount of such reduction

For Impairment of Financial Investments, the following conditions must be met simultaneously:

- At the reporting date and at the previous reporting date, the accounting value is significantly higher than their estimated value.

- During the reporting year, the estimated value of financial investments changed significantly only in the direction of its decrease;

- At the reporting date, there is no evidence that the estimated value of these assets will increase significantly in the future.

If an audit comes to the conclusion that the Finnish investments have become worthless, the organization creates a reserve for the depreciation of financial investments as the difference between the book value and the estimated value of such financial investments.

Financial investments are shown in the balance sheet net of provisions for impairment of financial assets. investments.

Depreciation of financial investments, I think, occurs in such cases when the issuer of securities (these securities are owned by the organization) has a borrower who goes bankrupt.

Accounting for contributions

A legal entity or individual entrepreneur can transfer the following types of funds to the authorized capital of other organizations:

- money (foreign currency and Russian rubles). At the same time, in accounting documents, reporting on which is submitted to the Federal Tax Service, currency funds cannot be shown, therefore their monetary value is converted into rubles at the Central Bank exchange rate;

- shares (their par value is also indicated in the reporting);

- property (office equipment, furniture, cars, production equipment, etc.). The issue of property valuation is regulated in Art. 15 Federal Law “On LLC”. If, in the opinion of the founder, the estimated value of the property that is transferred to the management company of the new organization he creates does not exceed 20,000 rubles, then the assessment process is carried out independently.

- If it is immediately clear that the object of transfer is worth more than 20,000 rubles, the law obliges to hire a special independent appraiser, who will determine the real value of the transferred property.

After the assessment, the nominal value of everything that is transferred is displayed by the founder’s accountant on accounting account 58 “Financial investments” using count 1 “Units and shares”. We'll talk about the postings on this account a little below.

Possible types of management companies

Russian legislation has approved the minimum size of the capital of a legal entity in the form of an LLC or other organizational and legal form in the amount of 10,000 rubles. The sources of formation of the management company in accordance with the norms of the Federal Law “On LLC” can be exclusively:

- money in Russian rubles (currency investments are converted at the exchange rate into rubles);

- securities purchased by the founders on the stock exchange or issued independently (shares, checks, bills, etc.);

- property rights;

- fixed assets (real estate, cars, etc.).

The process of transferring fixed assets to the management company of another organization is clearly regulated by the norms of the Federal Law “On JSC” (Article 34) and clause 2 of Art. 15 Federal Law “On LLC”, which stipulates the following points:

- mandatory involvement of an independent property appraiser, since fixed assets can be quite expensive;

- conducting an internal assessment of property;

- drawing up an assessment report. It is important to take into account that the value of the property established by an independent appraiser cannot be greater than that obtained as a result of an internal assessment;

- approval of the assessment results at the general meeting of shareholders;

- drawing up an act of acceptance and transfer of property.

The process of transferring shares and money is absolutely straightforward, so there is no need for a valuation process.

Securities accounting

Accounting for securities is maintained on account 58 “Financial investments” (Order of the Ministry of Finance dated October 31, 2000 No. 94n) in accordance with PBU 19/02.

In this case, analytical accounting on account 58 is maintained by type of financial investments and objects in which these investments are made (organizations that sell securities; other organizations in which the organization is a participant, etc.). In addition, in analytical accounting it is necessary to separate securities into short-term and long-term assets.

It must be borne in mind that financial investments of organizations do not include (clause 3 of PBU 19/02):

- own shares purchased by the joint-stock company from shareholders for subsequent resale or cancellation;

- bills issued by the organization-issuer of the bill to the organization-seller in settlements for goods sold, products, work performed, services rendered.

Consequently, accounting for these objects is carried out not on account 58, but on accounts 81 “Own shares (shares)” and on a separate sub-account to account 62 “Settlements with buyers and customers”, respectively.

Our consultation will focus on securities that are financial investments for an organization.

Securities are accepted for accounting at their original cost. The procedure for the initial and subsequent assessment of securities, the specifics of their depreciation, disposal, as well as accounting for income and expenses on them are disclosed in PBU 19/02, and in the accounting aspect - also in Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.