Legal advice > Entrepreneurial activity > How to employ an employee in an individual entrepreneur, step-by-step instructions and important nuances

Individual entrepreneurs mostly work independently, but some activities require staff. In this case, he needs to know how to officially employ all the staff, and what fees and reports will have to be submitted for each of them. Let us next consider how to employ an employee in an individual entrepreneur.

The legislative framework

The Labor Code allows all registered individual entrepreneurs to hire employees to work for themselves.

The process of registering employees differs little from the same procedure that is carried out by legal entities. All features of employment of citizens with individual entrepreneurs are enshrined in Chapter. 48 Labor Code. Formal employment is a mandatory requirement for the legal operation of all workers. In the next 3 days after the employee starts working, his employer must:

- Formalize their relationship by concluding an employment contract with the person (or a civil agreement).

- Make an appropriate entry in the employee’s work book.

Next, the employer must do the following:

- Prepare personnel documentation for a new employee.

- Register it with the FSS.

For failure to comply with this requirement, the violator may be held accountable:

- Administrative – payment in the amount of up to 50,000 rubles, or temporary suspension of the activities of the employer (entrepreneur) for up to 90 days.

- Tax – payment of a fine, the amount of which is established based on the severity of the offense committed (in this case, the duration of unofficial work, etc. is taken into account).

- Criminal - also involves a fine of up to 200,000 rubles, and in especially severe cases imprisonment for up to 2 years is imposed.

Attention! Regardless of the type of contract concluded with the employee, the employer is obliged, within the next 30 days after signing the first employee, to register him with the Pension Fund of the Russian Federation and the Social Insurance Fund.

What documents are required from the employee?

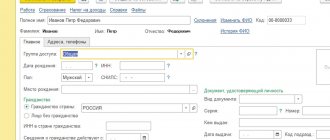

To be included in the staff, the employee submits the following documents to the employer:

- Passport.

- Labor card (if it is missing, he must get it himself).

- TIN.

- SNILS.

- For men - military ID.

- Medical book (required from minors, or those who get a job in trade, catering or the food industry).

- Certificate confirming the employee’s education.

Together with them, he submits an application for employment according to the established schedule of the state. The parties then sign an employment agreement. A total of 2 copies are prepared (according to Article 57 of the Labor Code):

- One remains with the entrepreneur.

- The second employee keeps it for himself.

The agreement itself contains a number of information:

- Full name of the applicant and the entrepreneur himself.

- Details of the person hiring him.

- Series and number of the employee's passport.

- Information about working conditions - work schedule, assigned salary, bonus and other factors influencing payment for work, job responsibilities.

- At the very bottom of the form is the signature of the applicant and the date of submission of the form.

Important! If a civil agreement is signed, the employment procedure for individual entrepreneurs is simplified. Then it acts precisely until a certain amount of work or task is completed, or specific services are provided. The contractor will not need to register with the Social Insurance Fund.

Step-by-step guide to making it official

In order to hire new individual entrepreneurs, you need to do the following step by step:

- Receive a package of personal documents from the applicant.

- Register him as an employee of your staff.

- Next, it is necessary to familiarize the worker with job responsibilities and acts regulating his activities - job description, etc. The entrepreneur himself draws up an order for admission to the staff (document form T-1).

- Afterwards, a personal card is opened for the employee.

- A corresponding entry on employment is made in the hired employee’s work record. This must be done within 7 days after signing the contract.

- This completes the design. All that remains is to submit the necessary certificates for it to the FSS and the Pension Fund.

To do this you need to do the following:

- If an individual entrepreneur has hired the first person, then he registers as an employer with the Social Insurance Fund and the Pension Fund of the Russian Federation, having submitted documents from the applicant.

- If he is not hiring for the first time, you only need to provide information about the new worker.

Hiring an employee under an employment contract

If you need the services of an accountant, but do not want to register him as your employee, then simply enter into a service agreement with him. An excellent solution would be if he, like you, is an individual entrepreneur, this will significantly simplify reporting and document flow. However, in the case of an employee, not everything is so simple; paperwork cannot be avoided, and the employer must be ready to answer the question of how to place an employee in an individual entrepreneur correctly.

- It is necessary to understand that concluding an employment contract with an employee, as expected - with a corresponding entry in the work book, automatically creates a situation where you must register as an employer. Also, from this moment, the individual entrepreneur, as an employer, is obliged to create a Book for recording the movement of labor books

- The first step is to visit the Pension Fund and register as an employer. If you choose a tax system based on a patent, the legislator allows you to hire no more than 5 employees.

- The second step is registration with the Social Insurance Fund.

- The third step is signing a contractual relationship with the insurance company.

Attention! The legislator regulates the time frame when an individual entrepreneur as an employer must register with the relevant authorities. This period is 30 days from the date of conclusion of the employment contract for the Pension Fund and 10 days for the Social Insurance Fund.

Delay in registration, failure to properly formalize labor relations, or incorrect registration of them are fraught with troubles in the form of a fine. For an individual entrepreneur, the amount of penalties can be equal to 1-5 thousand rubles. Or a penalty may be applied in the form of administrative suspension of activities for up to 90 days.

Naturally, the individual entrepreneur must understand that after formalizing the employment relationship in this way, he is obliged to pay the employee “vacation pay” and “sick leave”. And he won’t be able to fire him just like that - the procedure is also clearly spelled out in the legislative framework. The employer must also be clearly aware of these circumstances before placing an employee in an individual entrepreneur.

Employee payments

According to Art. 136 of the Labor Code, an entrepreneur, like any other employer, must pay an employee every half month. The timing of receipt and procedure for transferring funds are determined in the agreement itself. But to confirm payroll, he will need to maintain:

- Personnel accounting.

- Working time sheet.

They are needed to know:

- Who worked and how much in a certain period of time.

- What should be the amount of payment taking into account the identified production?

Payments per employee

The responsibilities imposed on individual entrepreneurs are equal to those of other legal entities and the state acting as employers.

A private entrepreneur will also have to make mandatory contributions for all employees whom he hired to work for himself. Firstly, personal income tax will be withheld from the employee’s earnings. It is transferred to the tax office within 2 days after receiving the salary.

Then insurance premiums are transferred, which are also deducted from the employee’s salary. The deadline is the 15th of the new month. In total, all contributions will be 30%, of which:

- 22% are sent to the Pension Fund.

- 5.1% - in the Federal Compulsory Medical Insurance Fund.

- 2.9% - in the Social Insurance Fund.

In total, together with the income tax of 13%, 43% is withdrawn from the salary.

Important! A civil contract exempts the employer from transferring funds to the Social Insurance Fund. Payment in this case is allowed only upon request.

Employee reporting

It is also necessary not only to pay part of the funds to government agencies, but also to submit reports for each of the employees there. All regulatory services have their own deadlines for accepting documents, which are mandatory for all employers.

To the tax office

Tax authorities request information that can be conditionally divided according to the deadline for its submission.

Data on the average number of personnel is submitted once a year (they are taken from the state list). This information is required to correctly calculate the tax burden and determine the right to a special regime for paying taxes. Submission must be made by January 20th of the new year. Those. reporting for 2020 is due by January 20, 2020.

Then a certificate of form 2-NDFL is sent. It records information about the income received by the employee for the year, the deductions provided to him and the personal income tax withheld. It is also submitted once a year, but no later than April 1.

Important! If the individual entrepreneur’s staff consists of more than 25 people, this reporting can be submitted electronically. Otherwise, certificates for each employee are submitted in paper form.

It is also required to submit quarterly reports, namely certificate 6-NDFL. It is due until the 1st of the new quarter following the previous one for which the document is submitted. If there is a delay in sending money, tax authorities may temporarily block the entrepreneur’s current account.

Calculation of insurance premiums is also submitted quarterly - until the 30th of the new quarter.

To the pension fund

The following is submitted to the Pension Fund:

- Once a year - a certificate reflecting the accumulated insurance experience. They are provided until March 1 of the new year, and the document itself reflects the production for the past year.

- Monthly – SZV-M, transmitted before the 15th of the following month. The certificate itself reflects data about the employer and the persons working for him, namely their full name, SNILS and Taxpayer Identification Number.

In the FSS

Form 4 FSS document is submitted to the Social Insurance Fund. It is transferred by employers once a quarter, until the 25th of the new reporting period. On the basis of this certificate, contributions are made for accidents that occur at work.

The nuances of applying for a part-time job

It is also possible to hire staff on a part-time basis. The procedure itself is similar to a similar process in enterprises. To successfully pass you need:

- The submitted application for admission to the staff must indicate the desired position and the salary amount.

- The employee is also introduced to local regulations against signature.

- You will need to conclude an agreement, indicating in it information about the accepted hourly output and the amount of payment.

- The order issued by the employer must contain clauses confirming that the worker is hired on a part-time basis.

- An entry about employment is made in the work book, but information about the rate is not entered.

The number of working hours is agreed upon at the stage of signing the employment contract, indicating specific output for a certain period, i.e. number of hours worked (per day, week, month, etc.). Based on these provisions, the subordinate’s salary will be calculated.

However, the scheme is usually such that the agreement specifies the salary accrued for a full working day. Only then does it specify that the employee is hired on a part-time basis, and therefore his salary will be less than indicated.

Such working conditions imply that the employee can receive a salary below the established minimum wage in the region. To avoid problems with regulatory authorities, it is necessary to clarify in the agreement why the salary is below the established minimum.

In the work report itself, a note about employment may not be included if this is already the second job for a person. In this case, the document is left in another organization, and information about the part-time job is not indicated.

The nuances of working for an individual entrepreneur

An individual entrepreneur, acting as an employer, has the following responsibilities:

- drawing up an employment contract with all of your employees;

- registration of insurance documents for pension insurance (applies to employees who got a job for the first time in their lives);

- timely payment of insurance premiums for its employees and making other payments required by law;

- provision of working conditions that do not contradict the norms of the Labor Code of the Russian Federation (payment for vacations, sick leave and lunch time).

If a person has not entered into an employment contract with an entrepreneur, then punishment for working without registering as an individual entrepreneur is provided for both parties. A businessman - for violating the Labor Code, and an employee - for conducting work activities without paying taxes.

When getting a job with an individual entrepreneur, a person may encounter some features that differ from working conditions in budgetary organizations:

- Working hours and rest periods are specified in the employment contract. At the same time, the total working time per week should not exceed the norms of the Labor Code of the Russian Federation. The amount of paid leave can be changed downwards and divided into small periods (for example, one week per quarter).

- Termination of an employment contract - the Labor Code of the Russian Federation provides for a specific list of reasons why an employment relationship may be terminated. An individual entrepreneur has the right to draw up an agreement at his own discretion and include certain clauses in it that may become reasons for dismissal.

- The Labor Code of the Russian Federation provides for the period within which the employer must notify the employee of dismissal (2 weeks). The amount of severance pay is also determined depending on the reason for dismissal. When working for an entrepreneur, an employee may not receive financial support if there were no such clauses in the contract. Giving notice of dismissal 2 weeks in advance is also not the responsibility of the employer, unless this is agreed upon in the contract.

An entrepreneur is not required to register employment contracts with local authorities.

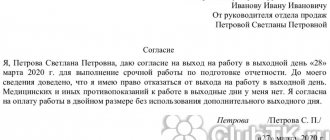

Temporary registration: with transfer of duties to another employee

If it is necessary to employ a person for a certain period of time (say, if the main employee occupying this position has gone on vacation or is on sick leave), the employer will have to transfer his responsibilities. If these functions will be temporarily performed by any of the previously employed employees, then an additional agreement to the employment contract is drawn up and attached to the contract already concluded with him, in which his duties are temporarily expanded and increased payment for their implementation is established.

Or there is the possibility of temporarily transferring a worker from one position to another. The maximum period for such a decision is 6 months. There is no need to sign up for employment. When the absent person returns, another employee temporarily replacing him will return to his place. To return it, you need to draw up an additional agreement again, attaching it to the main agreement.

For a one-time job

In this situation, an agreement is concluded that is limited in duration. It is drawn up in the same way as an open-ended one, but there is a clarification regarding the purpose of the hire. It indicates the replacement of an absent person, or the performance of time-limited duties. A specific expiration date for the agreement is set.

Subtleties of registration of employees

Having determined how many employees an individual entrepreneur can have, when concluding an agreement, you need to pay special attention to the preparation of documents.

The director needs:

- create an order confirming the employment of a citizen;

- fill out a personal card;

- make notes in the work book;

- familiarize staff with internal labor regulations and staffing schedules;

- enter data into vacation schedules;

- sign the job description.

Additionally, an agreement is concluded if the employee becomes a financially responsible person or when he does not have the right to disclose a trade secret. The employee is paid according to the tariff rate. It is indicated in the contract. The basis is a time sheet. The employer is obliged to pay for vacation and sick leave, pay severance pay, and provide decent working conditions.

On video: How to hire your first employee in the sales department

https://youtu.be/eR04H3XbY4Y