The organization maintains tax records, calculates income tax, pays it and reflects it in the tax return in accordance with the norms of tax legislation. From an accounting point of view, the calculated amount of income tax is a fait accompli of economic life. About how calculated income tax is taken into account in accounting, how the application of the provisions of PBU 18/02 affects accounting entries when calculating tax, and how analytical accounting of calculations with the budget for income tax is organized in “1C: Accounting 8” edition 3.0 , say 1C experts.

Calculations with the budget for income tax

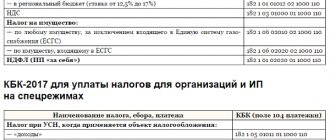

To summarize information about settlements with the budget for corporate income tax in “1C: Accounting 8”, account 68.04.1 “Settlements with the budget” is intended, subordinate to account 68.04 “Income Tax”.

The credit of account 68.04.1 reflects the accrual of income tax. The debit of account 68.04.1 reflects the amounts actually transferred to the budget (including advance tax payments).

Analytical accounting on account 68.04.1 is maintained:

- by types of payments (subconto Types of payments to the budget (funds)). To reflect transactions for the calculation and payment of tax (advance payments), the payment type Tax (contributions) is used: accrued / paid (we will consider other possible types of income tax payments below);

- by budgets to which tax is payable (subconto Budget Levels). For income tax, these are the Federal budget and the Regional budget.

Postings for calculating income tax in the program are generated automatically when performing the monthly routine operation Calculation of income tax, which is included in the Closing of the month processing.

The amounts of transactions for accrual of income tax are calculated as follows:

- According to tax accounting data, the taxable base is determined monthly on an accrual basis from the beginning of the year (regardless of the procedure for paying advance payments and the procedure for recognizing reporting periods in accordance with Articles 285 and 286 of the Tax Code of the Russian Federation).

- The income tax is calculated for each budget.

- The calculated amounts are compared with the tax amounts calculated in the last month of the current tax period (for each budget). If a positive difference is detected, then entries for “additional accrual” of tax are entered. If the difference turns out to be negative, then a decrease in previously accrued tax amounts is reflected.

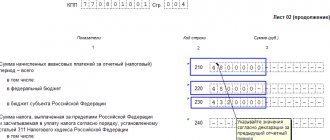

Thus, the amount of calculated tax indicated in line 180 of sheet 02 of the income tax return (approved by order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3 / [email protected] ) for the reporting (tax) period must coincide with credit turnover of account 68.04.1 by type of payment Tax (contributions): accrued/paid for the corresponding period.

The procedure for reflecting transactions for calculating corporate income tax in 1C: Accounting 8 depends on whether the organization applies the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02 (approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n).

Note

The Ministry of Finance of Russia, by order No. 236n dated November 20, 2018, approved the new edition of PBU 18/02. The changes approved by Order No. 236n should be applied starting with reporting for 2020. Organizations can keep records under the new rules earlier, for example, from 2020 or from 2020. Read more about PBU 18/02 as amended. Order No. 236n and about support in “1C: Accounting 8” (rev. 3.0), see the article “Application of PBU 18/02 in “1C: Accounting 8”.

What does the indicator consist of?

The profit formula shows three possible sources of its receipt. Let's look at them in more detail:

- Profit from sales of products (Pr). It is formed from revenue for goods, works, services, reduced by costs. These include production and sales costs, as well as tax deductions (VAT, excise taxes, export tariff payments, and other similar payments). In essence, this is the company’s net income, which can vary significantly and which can be effectively influenced by management decisions. The other two elements of the formula represent, as a rule, previously created income and their movement.

- Profit from the sale of property (Pim). As a rule, we are talking about the sale of fixed assets and property. Sales proceeds are reduced by sales expenses (transportation, payments to intermediaries, etc.) and by the residual value. In addition to fixed assets, the property sold may include any tangible assets belonging to the company, intangible assets (patents, trademarks). Profit from sales here will be determined by the difference between the selling price and the book value, adjusted for selling expenses.

- Non-operating income and expenses form the third component of balance sheet profit (Pvnro). This takes into account, summing or subtracting accordingly, income from financial investments in the capital of other companies, from bonds, income from rental premises; as well as expenses for fines, penalties, penalties for counterparties, losses, legal costs, etc.

Accounting entries when calculating income tax

If the organization applies PBU 18/02

The procedure for applying PBU 18/02 is configured in the Accounting Policy information register (Main section). If an organization applies the provisions of PBU 18/02, then the switch Accounting for deferred tax assets and liabilities (PBU 18 “Accounting for calculations of corporate income tax”) should be set to one of the positions:

- Maintained using the balance sheet method;

- It is carried out using the costly method (delay method). In the program, this method can be used after 2020, since PBU 18/02 does not contain restrictions on the use by an organization of any of these methods of its choice (Information message of the Ministry of Finance of Russia dated December 28, 2018 No. IS-accounting-13).

If the cost method is installed in the program, then the routine operation Calculation of income tax performs two functions at once: the calculation of tax for payment to the budget (according to tax accounting data), and calculations according to PBU 18/02 (according to accounting data).

If the organization uses the balance sheet method, then the Month Closing processing includes two separate routine operations:

- Calculation of income tax - only calculates tax according to tax accounting data for payment to the budget;

- Calculation of deferred tax according to PBU 18/02 - performs only calculations according to PBU 18/02 according to accounting data (according to the new algorithm, that is, the balance sheet method) for financial statements.

In any case, the calculated amounts of income tax are accrued by posting:

Debit 68.04.2 Credit 68.04.1.

At the same time, tax amounts are distributed among budgets of various levels.

A decrease in amounts due for payment to the budget is reflected by a reversal entry with simultaneous distribution among budgets:

REVERSE Debit 68.04.2 Credit 68.04.1.

Account 68.04.2 “Calculation of income tax” is specifically used in the program to summarize information on the procedure for calculating income tax for organizations in accordance with the provisions of PBU 18/02. Analytical accounting for account 68.04.2 is not provided.

Calculations according to PBU 18/02 include the following operations:

- recognition (settlement) of deferred tax assets (DTA) and deferred tax liabilities (DTL). Accounts 09 “Deferred Tax Assets” and 77 “Deferred Tax Liabilities” are intended to summarize information about the presence and movement of IT and IT. Analytical accounting of IT and IT is carried out by type of assets or liabilities in the assessment of which a temporary difference has arisen;

- determination of conditional income tax expense (income). Conditional income tax expense (income) is calculated as the product of accounting profit for the reporting period and the income tax rate. To summarize information about the amounts of conditional income tax expense (income) in the program, accounts 99.02.1 “Conditional income tax expense” and 99.02.2 “Conditional income tax income” are intended;

- recognition of a constant tax expense (income) for income tax. The permanent tax expense (income) for income tax is calculated as the product of the permanent difference that arose in the reporting period and the income tax rate. To summarize information about the amount of recognized permanent tax expense (income), the program uses account 99.02.3 “Permanent tax liability”.

Note

About the advantages of the balance sheet method and how in “1C: Accounting 8” edition 3.0 this method is used when determining temporary differences, see the articles “PBU 18/02: how the balance sheet method is used in “1C: Accounting 8” and “Application PBU 18/02 and the balance sheet method in “1C: Accounting 8”.

Postings related to calculations according to PBU 18/02 using the balance sheet method are presented in the table.

Table

Postings generated in the program when performing the routine operation “Calculation of deferred tax according to PBU 18/02”

Please note that income tax is calculated in whole rubles, and the amounts of conditional income tax expense (income), SHE and IT, constant tax expense (income) are in rubles and kopecks. As a result, a difference may arise on account 68.04.2 (even if permanent and temporary differences are reflected correctly in accounting). The resulting balance is automatically written off to account 99.09 “Other profits and losses” by posting:

Debit 99.09 Credit 68.04.2 or Debit 68.04.2 Credit 99.09.

Thus, after performing the regulatory operations Calculation of income tax and Calculation of deferred tax according to PBU 18/02, account 68.04.2 is always closed.

Let's look at a specific example of how income tax calculations are performed when applying PBU 18/02 in “1C: Accounting 8” edition 3.0 and what transactions are generated in this case.

Example 1

| LLC "Trading House "Complex"" applies OSNO and the provisions of PBU 18/02 in accordance with the new edition, approved. Order No. 236n. The income tax rate is 20% (including 3% to the Federal budget, 17% to the regional budget). In January 2020, the organization’s accounting records reflected the following financial indicators:

The tax accounting registers reflect the following indicators:

The deductible temporary difference for the type of asset “Deferred income” is:

The taxable temporary difference for the type of asset “Fixed assets” is:

|

Let's calculate income tax for January 2020 according to tax accounting data:

- 700,000 rub. — tax base (RUB 1,000,000 - (RUB 72,000 + RUB 228,000)).

- 140,000 rub. — income tax (RUB 700,000 x 20%), including RUB 21,000. — to the Federal Budget (RUB 700,000 x 3%); 119,000 rub. — to the regional budget (RUB 700,000 x 17%).

When performing the routine operation Calculation of income tax, postings will be automatically generated (see Fig. 1).

Rice. 1. Calculation of income tax in correspondence with account 68.04.2

Let's perform calculations according to PBU 18/02 for January 2020 according to accounting data:

- 1,600 rub. — repayment of ONA ((112,000 rub. - 104,000 rub.) x 20%).

- 400 rub. — repayment of IT ((118,000 rub. - 116,000 rub.) x 20%).

- 706,000 rub. - profit according to accounting data ((RUB 1,000,000 + RUB 8,000) - (RUB 230,000 + RUB 72,000)).

- RUB 141,200 — conditional income tax expense (706,000 x 20%).

When performing the routine operation Calculation of deferred tax according to PBU 18/02, the following transactions will be automatically generated (see Fig. 2).

Rice. 2. Calculations using PBU 18/02

Figures 3 and 4 show Analyzes of accounts 68.04.1 and 68.04.2.

Rice. 3. Analysis of account 68.04.1

Rice. 4. Analysis of account 68.04.2

The presented entries and standard reports on income tax settlement accounts demonstrate that account 68.04.2 in the program plays a purely technical (auxiliary) role. For example, in recommendation R-102/2019-KpR “Procedure for accounting for income tax”, adopted by the Committee on the recommendations of the NRBU “BMC” fund on April 26, 2019, account 68.04.2 is not used at all.

If the organization does not apply PBU 18/02

If the organization does not apply the provisions of PBU 18/02, then the switch Accounting for deferred tax assets and liabilities (PBU 18 “Accounting for calculations of corporate income tax”) should be set to the Not maintained position.

In this case, when performing the regulatory operation Calculation of income tax, account 68.04.1 corresponds with account 99.01.1 “Profits and losses on activities with the main tax system” (with the value of the subconto type Income tax and similar payments). The accrual of current income tax amounts payable is reflected by posting with simultaneous distribution among budgets:

Debit 99.01.1 Credit 68.04.1.

Accordingly, the decrease in amounts due for payment is reflected by an entry with distribution by budget:

REVERSE Debit 99.01.1 Credit 68.04.1.

Let’s change the conditions of Example 1 and consider how “1C: Accounting 8” edition 3.0 reflects income tax calculations if the provisions of PBU 18/02 are not applied.

Example 2

| LLC "Trading House "Complex"" applies OSNO, but does not apply the provisions of PBU 18/02. Numerical indicators correspond to the conditions of Example 1. |

In this situation, when performing the routine operation Calculation of income tax, postings will be automatically generated (see Fig. 5).

Rice. 5. Calculation of income tax in correspondence with account 99.01.1

Regardless of the procedure for applying the provisions of PBU 18/02, the credit turnover of account 68.04.1 by type of payment Tax (contributions): accrued / paid for the reporting (tax) period coincides with:

- with the amount of calculated income tax indicated in line 180 of sheet 02 of the income tax return;

- with the amount of current income tax indicated in the statement of financial results (form approved by order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

On the calculation of income tax in “1C: Accounting 8” (rev. 3.0), see also the answer from 1C experts (+ video).

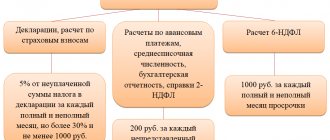

If the organization acts as a tax agent

An organization that pays dividends to a company participant (shareholder) - a legal entity, must fulfill the duties of a tax agent and withhold income tax when paying dividends.

To summarize information on settlements with the budget for income tax when paying dividends, a separate account 68.34 “Income tax when performing the duties of a tax agent” is intended. Tax on dividends is always paid to the Federal Budget, therefore analytical accounting in account 68.34 is carried out only by type of payments to the budget.

For limited liability companies, the accrual of dividends and withholding tax on the payment of participation income can be registered in the program automatically using the Accrual of Dividends document (Operations section).

For joint stock companies, the accrual of dividends on shares and tax withholding should be reflected in the Transaction document (section Transactions - Transactions entered manually).

In any case, the withholding of income tax when performing the duties of a tax agent when paying dividends should be reflected by posting:

Debit 75.02 Credit 68.34.

Account 75.02 “Calculations for the payment of income” is intended to summarize information on the payment of income to the founders (participants) of the organization (shareholders of a joint-stock company, participants of a general partnership, members of a cooperative, etc.).

Thus, the “agency” tax is taken into account separately and does not affect the turnover of account 68.04.1.

| 1C:ITS For more information about the procedure for taxation and accounting of corporate income tax, see the practical manual “Practical Annual Report 2018” edited by D.E. Sc., prof. S.A. Kharitonov in the section “Instructions for accounting in 1C programs”. |

Calculation of line 2410 “Statement of financial results”

The choice of method for forming the amount of consumer goods is recorded in the company’s accounting policy. In any case, the indicator in this line must coincide with the amount of NNP. The presence of PNO/PNA and ONO/ONA is reflected in the amount of consumer goods by the necessary corrections. To do this, in line 2421 of the report, information about PNO and PNA is indicated as reference information.

In accounting, PNO is indicated on the debit of the account. 99/PNO-PNA from credit account. 68/NNP, accordingly PNA is reflected on the credit account. 99/PNO-PNA.

Page 2421 = D/rev 99/PNO – K/rev 99/PNA

Exceeding the credit amount indicates the presence of PNA; it is written on page 2421 without brackets.

Transformations of IT are recorded on page 2430. This is the difference between the turnover on credit and debit of the account. 77, corresponding to the account. 68/NNP.

Page 2430 = K/rev 77 – D/rev 77

If the credit turnover is greater than the debit amount, then the excess amount is indicated in the line in parentheses.

Changes in ONA are calculated between debit and credit turnover on the account. 09.

Page 2450 = D/rev 09 – K/rev 09

An excess of debit turnover indicates the presence of ONA and in the report this amount is added to the conditional expense for NNP, and the excess of credit turnover is recorded in the line in brackets.

Let's consider how to reflect the value of consumer goods in the “Report on Financial Results” using the example of a company filling out a report based on the proposed initial accounting data.