What can and cannot be clarified

The law allows only minor data corrections.

For example, the payer made an error in the KBK or other details. It is also allowed, with the help of an application, to transfer paid contributions (for personal income tax, etc.) to another tax office.

This information can be changed by email.

But sending it to the Federal Tax Service does not allow you to change the following data:

- details of the recipient bank;

- Federal Treasury account number

If this information is provided incorrectly, then the transfer will not be carried out based on the letter. The payer needs to repeat the payment with possible payment of a penalty or fine.

https://youtu.be/4jD29OKIBgE

When it is impossible to clarify the tax payment

- If more than 3 (three) years have passed from the date of tax payment. This case can be called almost hopeless, because... a mistake made more than three years ago cannot be corrected. It is impossible to clarify, return, or offset such a payment by contacting the tax office (Clause 7, Article 78 of the Tax Code of the Russian Federation). There is a chance to defend your position in court if you can prove that 3 (three) years have not passed since the moment when you learned or could have learned about the overpayment resulting from an erroneous payment (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 25, 2009 No. 12882/08 ). In our opinion, the solution in this situation would be to prevent it: regularly (quarterly, and if necessary, more often) check the status of settlements with the budget. For example, you can request a certificate from the tax office about the status of payments for taxes, fees, insurance premiums, penalties, fines and interest for any date of interest. You can receive it for free both electronically and on paper;

- Specifying the tax payment will result in arrears . For example, an organization has a land tax debt of 1,000 rubles. She mistakenly pays transport tax of 5,000 rubles. to the KBK for land tax. In this case, before submitting an application to clarify the payment, you must pay off the arrears of 1,000 rubles. for land tax, otherwise the tax office will refuse clarification;

- The money did not reach the budget (as a rule, this is an error in the recipient’s bank number). Most likely the bank will not process such a payment, i.e. and there will be nothing to clarify. You will have to send a new payment order with the correct details. If the deadline for paying tax on such a payment has expired, penalties cannot be avoided, and fines are also possible.

You can clarify any tax payment that fell into the budget, i.e. The list of details that can be corrected is almost all fields of the payment order (see clause 7 of Article 45 of the Tax Code of the Russian Federation, Order of the Federal Tax Service of Russia dated December 29, 2016 No. ММВ-7-1 / [email protected] ). For example this:

- Federal Treasury account number (field 17). Until January 1, 2019, this detail could not be clarified; the tax had to be paid again, and the incorrect payment had to be returned. Federal Law No. 232-FZ of July 29, 2018 amended the Tax Code of the Russian Federation in favor of the taxpayer - from 2020, an error in the Treasury account can be clarified in a general manner;

- Reason for payment (field 106);

- KBK (field 104);

- OKTMO (field 105);

- Tax period (field 107);

- Payer status (field 101);

- TIN, checkpoint of both the recipient and the payer

- and other details.

Advice. To check yourself that you have correctly filled out a tax payment order (or prepare it for the bank), you can use the tax payment verification service on the tax service website.

Results Almost any operating organization needs to pay taxes. In payment orders for paying taxes, you need to fill in a lot of details, and no one is immune from errors in them. In most such cases, there is no need to panic, because there is a fairly simple and accessible way for everyone - clarifying the payment. Submit an application to the tax office, and the error will be gone: the tax will be considered paid on the day of payment, and the penalties will be recalculated.

Firmmaker, September 2020 Irina Bazyleva When using the material, a link is required

What happens if you don't submit a letter?

If the payer discovers an error, the tax service must be informed about it.

If the payment is made using incorrect details, it will take a long time to return it through the court.

And you need to pay the tax again until a penalty is charged on the amount owed.

If there is an error in the payment order

If incorrect data is indicated in a payment order, the standard procedure for contacting the tax service is used.

You can only change basic information, for example, change from KBK to KBK, which is correct. But you won’t be able to change your bank account details this way. You must first make the payment again and claim back the previously paid amount.

How to find your OKTMO

When filling out a payment slip, it may be difficult to determine the OKTMO code. The values of these codes are indicated in the All-Russian Classifier of Municipal Territories (OKTMO), approved by order of Rosstandart No. 159-st dated June 14, 2013. This classifier has replaced the Classifier of Administrative Territorial Divisions (OKATO), that is, if OKATO was previously indicated in the payment order, now the code OKTMO should be indicated. In the payment order, OKTMO is indicated in field 105.

Important! The company issues a payment order for taxes and duties, or to the address of its counterparty. Such a document must be drawn up correctly, without errors. Otherwise, the recipient of the funds simply will not receive them.

The OKTMO code consists of 8 or 11 digits. The last three digits of the eleven-digit code represent the designation of a specific small settlement. If a taxpayer has difficulties determining his OKTMO, then you can find out your code on the Federal Tax Service website (www.nalog.ru). The service presented on the tax website allows you to find out your code using the directory by entering the municipality. If OKTMO must be indicated in the payment slip for payments at customs, then the code must be taken from the territory that accumulates this payment (

Who draws up the document

According to general rules, drawing up a letter to the tax office is the responsibility of the person making the payment. This means that the payer has certain powers.

Most often, this is the accountant of the organization, who is obliged to make all money transfers.

The letter can be written by either an ordinary accounting employee or a chief accountant. This depends on the number of staff at the enterprise.

Before sending a document, it must be signed not only by the originator, but by the head of the company.

How to write correctly

The writer should not have any problems with formatting the letter. There is no single unified document form, so many enterprises create their own forms.

In this case, the accountant only has to fill out such a document. In case of its absence, the letter is drawn up in any form. possible on the Internet.

The only requirement of the law is that the letter be drawn up taking into account all the standard rules of office work:

| Field | Information |

| Document header | 1.Name of the addressee, address of the tax authority, details of the manager. 2.Name of the sending company, legal entity. address, manager's details. H. Document number and date of preparation. |

| a common part | Description of the problem. Incorrectly specified KBK or other code. Request to clarify the payment status and make the transfer taking into account the correct details. |

| Conclusion | List of documents, if they are attached to the letter. Date and signature. |

A request to change the BCC or other details must be supported by a reference to the relevant regulatory act (Tax Code of the Russian Federation, Article 45).

What to pay attention to when drawing up

Although in 2020 there are no special requirements for writing a letter for the tax service, it is necessary to ensure that it is formatted correctly.

- The document can be printed on a regular sheet of appropriate format (A4) or on company letterhead. It also does not have to be printed, but can be written by hand.

- The signature of the head of the organization remains an important condition. As for printing, there is no need to additionally certify the document. The exception is cases when this procedure is mandatory according to the rules of the enterprise.

- Such papers are always prepared in several copies, and a letter for the tax service is no exception.

Important to remember!

The second copy remains with the compiler, but only after the tax official leaves an acceptance mark on it. This is necessary to confirm that the document was transferred according to all the rules.

How to draw up an application for clarification of the KBK to the tax office: sample 2020

It is not difficult to draw up an application to the Federal Tax Service to clarify the BCC if you follow a certain procedure (see sample application 2020 below).

- You need to write two copies of the application. One remains at the tax office. And in another, tax authorities, after accepting the application, must make a note. A copy with a mark from the Federal Tax Service remains with you.

- There is no unified application form; it is drawn up in free form, but you must remember to enter the necessary data there (see table).

- The application can be completed both on paper and using electronic devices.

- If, in addition to the KBK, you made some other mistakes in the same payment order, for example, you wrote the TIN or KPP incorrectly (with the exception of the name of the recipient’s bank and current account), include them in the same statement.

Indicating several errors in one payment at the same time in one application is allowed.

- You cannot combine payments in one clarification letter. That is, if you made mistakes in the KBK in several payments at once, even for the same date, then a separate letter is written to the Federal Tax Service for each document.

- The signature of the manager or other person who has the right to draw up such documents must be made in pen. The only exceptions are companies that have issued an electronic signature according to the established standard.

Let's now look at what must be included in the application.

| Application section | Required details to fill out |

| Cap part |

|

| Document's name | Application for clarification of tax payment (error in KBK) |

| Main part | 1. We describe in which payment order what error was made:

For example: field 104 is incorrectly specified as KBK 182 1 0600 110 (see sample application 2019). 2. We note that we ask in this application:

For example: correct KBK 182 1 0600 110 |

| Final part | 1. Be sure to enter the word “Application”. Below we list copies of the attached documents, in our case it will be like this:

2. We enter the position, signature and transcript of the signature of the person who has the right to sign applications to the tax office (for example: director, chief accountant, etc.). 3. If the organization has not officially renounced the seal, then we put it on the application. |

Sample 2020

Download a sample application for clarification of payment to the tax office (completed). Download the application form for clarification of payment to the tax office (blank).

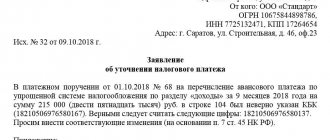

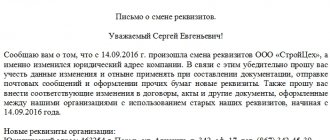

An example of a letter to clarify a payment to the tax service:

What to do if there is an error in a payment order?

Are you familiar with the situation when you hastily issued a payment order for tax transfer, the bank executed the order, and subsequently you discovered an error in the KBK - what to do in this situation?

The solution is simple: you need to file an application with the tax office to clarify the payment. The Ministry of Finance also speaks about this in letter dated January 19, 2017 No. 03-02-07/1/2145.

The same should be done if an error is made in other fields of the payment order, such as:

- basis of payment;

- TIN and KPP of the sender or recipient;

- taxpayer status;

- tax payment period;

- OKTMO;

- number or date of the basis document;

- purpose of payment;

- from 01/01/2019 - Federal Treasury account (provided that the money went to the budget).

IMPORTANT! An error in the name of the bank - the recipient of the payment is irreparable (clause 4 of article 45 of the Tax Code of the Russian Federation). In this case, there is only one way out - send a new payment with the correct details, pay a fine and write to the Federal Tax Service an application for the return of the payment paid with incorrect details.

You can find your tax office details on the Federal Tax Service website. See here for details.

Remember that payment can be clarified only if three conditions are met. Read more about them in the Ready-made solution from ConsultantPlus.

Let's look at the procedure for completing and a sample letter to clarify a payment to the tax office if the KBK is indicated incorrectly.

How to transfer

Once the letter has been drafted and signed by the appropriate officials, it must be submitted to the tax office.

There are several common ways to transfer documents to the Federal Tax Service:

- The payer personally contacts the tax authority at the place of registration of the legal entity and gives the documents to the employee.

- The transfer is carried out through a representative. The disadvantage of this method is that you need a corresponding power of attorney.

- Sending by registered mail. It is used if the compiler does not have the opportunity to send it to the Federal Tax Service in person.

- Sending an electronic version of a letter using any electronic means of communication (via VLSI, etc.) But the person must have a corresponding digital signature in advance.

The payer has the right to choose any suitable method of transmitting the letter to the tax service.

Action plan

A payer who learns that, after making an error in the order, the tax was not indicated on the personal account, must proceed as follows:

- contact the bank for confirmation of payment transfer provided in writing;

- send a letter to the tax office to clarify the payment (if necessary, you can immediately apply for a reconciliation of payments).

How to write a letter correctly

This document, intended to clarify the payment, does not have a specific form that must be used, so it can be written arbitrarily or in accordance with a template approved in the accounting policy of the organization.

There is a strict list of data that must be indicated in it:

- name of the company that sent the payment;

- legal address of the company;

- information about the addressee: company name, position, information about the boss;

- reference to the payment order in which the inaccuracy was found (order number, day of its preparation);

- the essence of the existing error;

- error correction option.

If there is inaccurate information in the document, each of them must be indicated in a separate paragraph. Each amount is written on the form both in numbers and in words.

When drafting this document, it is necessary to adhere to business writing style. The letter should be clear, clearly and correctly formed, and the general content should remain as brief as possible and relate only to the matter.

It is best to attach documentation confirming the payment to the letter. For example, you can print an electronic version from the Client-Bank service, which must be certified by the signature of the manager and the seal of the organization. Some tax offices may also require the bank to put its own mark on the payment receipt.

If you come across a very demanding tax officer, an extract from the current account is attached to the letter, reflecting the fact that the funds were written off.

If, due to an error, the payment was not reflected on time in a special payment card, the letter indicates a request to recalculate the penalty.

The letter is sent as needed - after discrepancies are discovered. There are no specific deadlines for this.

Design and sample

The letter can be written on a plain, blank white piece of paper or on company letterhead.

Both printed and handwritten versions of the document are acceptable. The only condition that must be met is that the director of the organization must sign this document; this can also be done by a person authorized to endorse documentation of this type.

The message does not necessarily have to be stamped, since legal entities are no longer required to do this (only if there is a situation in which this requirement is reflected in the regulatory documents of the organization).

The message must be compiled in at least four copies:

- the writer of the letter keeps one copy;

- the second copy is received by the counterparty;

- the third copy is transferred to the banking institution whose services the payer uses;

- the fourth copy is received by employees of the banking organization whose services are used by the payee.

All copies must be absolutely identical, in addition, they must be certified accordingly.

B____________(name of tax authority)

From___________

Phone number_____________

Letter to clarify the payment order for the transfer of funds

In the payment order dated August 15, 2018 No. 10, we identified a small error in the purpose of the payment. I ask you to consider the following payment purpose as correct: payment on invoice No. 67 dated 08/05/2018 for products in the amount of 20,000 (twenty thousand) rubles, including VAT 16% - 3,200 (three thousand two hundred) rubles.

Enclosure: payment order dated _____ number ______ for the amount of _______ rubles, bank statement for current account number _________________________ dated ________.

Sending a letter about payment clarification

The document can be sent in several ways:

- personal hand-to-hand delivery of a letter;

- delivery by courier service;

- dispatch by Russian Post in the form of a registered letter with acknowledgment of delivery;

- through the Internet.

When sending a letter via the Internet, it is necessary that the sending organization has an officially registered electronic digital signature, but this also does not guarantee 100% that the recipient will read the message.

Decision to clarify payment

The law establishes a period of time during which the inspector is obliged to verify the information provided and provide a response. This is 10 days from the date of receipt of the application.

The tax authority may change:

- basis for payment (for example, TP on AP);

- ownership of the payment (if an error was made according to OKTMO or according to KBK);

- payer status;

- other data (TIN, etc.)

If after this period no response is given, the payer has the right to contact the Federal Tax Service with an official request.

What to do if the bank made a mistake

It is not always the payer's fault that a payment was made with an error. Sometimes the human factor plays a decisive role, so bank employees make mistakes. One, even the most insignificant error in the details can lead to negative consequences.

The payer learns about this at the stage when a fine begins to be charged on the unpaid amount.

To clarify the situation, you should:

- demand from the bank a written explanation of the problem;

- draw up a letter to the Federal Tax Service with a request to recalculate the accrued fine;

- attach to the letter documents from the bank, bank statement for that day, etc.

It is important for the payer to prove that the transaction was carried out with an error due to the carelessness of a bank employee.

Will there be penalties and offset of overpayments against arrears?

When paying taxes, you should be more careful when indicating the purpose and details of the payment. Otherwise, a penalty will be charged on the amount of the debt. If the payer has provided a letter confirming payment, penalties can be avoided.

The penalty is charged regardless of the payer’s request in the following situations:

- An error was made when specifying the recipient's bank account. Tax authorities do not have the right to change this information, so the date of tax payment will be considered the date of the second transfer of funds. And you will have to pay a penalty for this period, if it was accrued.

- The inspector may change the details, but the original payment was sent late. All accrued fines must still be paid.

Important to remember!

If the payer has an overpayment of taxes, it can be counted against the arrears. But this procedure is not carried out automatically, so you need to send the appropriate application.

The Federal Tax Service has 10 days to consider such an application, so it must be sent in advance. At least 10 days before the tax payment deadline. Then the overpayment will be counted.

What errors can be corrected?

The variety of fiscal taxes and fees often leads to the fact that the taxpayer makes typos in payment documents. If the error is not corrected, the payment may be lost, and the tax authorities will recognize the debt and apply penalties.

If an inaccuracy was identified before the payment document was executed by the bank or Federal Treasury authorities, the payment order can be recalled. But what to do if the payment order (PO) has already been posted and the funds have been debited from the current account in favor of the Federal Tax Service.

You can correct a payment order from 01/01/2019 due to any errors, but subject to three conditions:

- The statute of limitations has not expired, that is, three years have not yet passed since the transfers were made to the Federal Tax Service.

- The money was credited to the budget, that is, it went to the personal account of the Federal Treasury.

- When adjusting payment, no arrears are created for a specific tax liability.

In this case, you will have to prepare a sample: an application to the tax office to clarify the payment. However, not all errors can be corrected. Let's define the key conditions.

It is impossible to correct the PP for insurance contributions to the Federal Tax Service, as well as for contributions for injuries to the Social Insurance Fund, if:

- the money has not been received to the appropriate account of the Federal Treasury, that is, fields 13 and 17 (bank and beneficiary account) are filled in incorrectly in the payment order;

- an error was made in the KBK (the first three digits of the budget classification code are incorrectly indicated) in field 104;

- payment of the contribution to compulsory pension insurance was credited to the individual pension account of the employee (insured person), that is, the contributions already credited cannot be clarified (clause 9 of Article 45 of the Tax Code of the Russian Federation).

In other cases, the taxpayer can correct any errors and inaccuracies in the following fields of the PP:

| Field number | Name |

| Payer status | |

| Payer's TIN | |

| Payer checkpoint | |

| Recipient's TIN | |

| Recipient's checkpoint | |

| KBK, but only if the first three digits are correct | |

| OKTMO | |

| Basis of payment | |

| Payment period | |

| Base document number | |

| Document date | |

| Purpose of payment |

How to fill out a payment order in accounting programs

All modern accountants use special computer programs in their work that simplify accounting.

When paying taxes, all relevant information is entered into such programs. The choice depends on the taxation system - simplified tax system, UTII, etc.

Bukhsoft online

If an accounting employee uses Bukhsoft, then the algorithm of actions is as follows:

- You need to open the “Service/Our Accounts” tab.

- Click the “Change” button.

- In the window that opens, enter the required bank details.

- In the “Current Accounts” section , add a bank and set the status to “Main”.

- Open the “Accounting” section and go to the “Bank” tab.

- Select the institution to which the payment is sent.

- Select a period and click “Add”.

- Maintain other data.

The procedure is simple.

1C:Enterprise

In this program, a similar procedure is carried out as follows:

- “Bank and cash desk” section

- Click "Create".

- Select the “Pay tax” operation.

- Enter the required data.

- Click the “Record” button.

To print the document, click the “Payment order” button.

https://youtu.be/aJLXT9-h2ts